Research on the Compliance of Green Subsidy Policy in International

Trade-Based on WTO Rules

Yuru Lai

Business School, International Economics and Trade, Beijing Language and Culture University, Beijing, China

Keywords: Green Subsidy Policy, WTO Reform, Compliance Challenge, International Trade.

Abstract: The green subsidies have become important policy tools for economic green transition in the context of the

severity of global climate governance and the increasing trade protectionism. This article analyses the

compliance challenges of the green subsidy policy. After a comparison between different nations through case

analysis and literary review of the WTO jurisprudence, the research discovers that differentiated strategies of

various countries are easier to cause trade distortions because of the uncertainty in the rules of WTO judicial

interpretation and scope of application. Considering the results, this article presents three paths. compliance

strategies should be made at the enterprise level. The state-level should design policies rationally. As for the

international part, it’s necessary to promote WTO mechanism reform. The research provides theoretical

support and practical reference in optimization of green subsidy policy, attaching great importance to

balancing the environmental objectives and trade rules under the multilateral trading system.

1 INTRODUCTION

With the increasing awareness of environmental

protection and sustainable development in the world,

more and more countries are altering their goals to

develop new energy industries, curb climate change

and promote sustainable production and

consumption. Take China as an example, its

competitiveness in the global market has realized

remarkable change recently by granting large

amounts of subsidies for new energy vehicles (NEVs)

industry in the links among upstream, midstream and

downstream, which is beneficial to low-carbon

energy transformation (LCE) (Fang, & Zhou, 2022).

The United States provides $400 billion within a

decade through Inflation Reduction Act of 2022

(IRA) in order to fuel the development of clean

energy and green technology (Buccella et al., 2024).

The European Union released the Foreign Subsidies

Regulation (FSR) to make sure that fair competition

and energy transformation go smoothly (Gam &

Papaefthymiou, 2023).

Green subsidy policy refers to the economic

incentives measures provided by the government or

public institutions for enterprises, industry and

customers, whose objective is to protect the

environment, reduce pollution, support the

application of low-carbon technologies and advocate

sustainable development with financial instruments.

While its core aim lies in the initiative of correcting

the market failure in environmental governance and

guiding the flow of resources to the low-carbon field

(Eurostat, 2023). With the trend of green

transformation and globalization, Governments have

adopted green subsidy policies one after another to

accelerate the development of clean energy,

renewable energy and environmental-friendly

industries (Charnovitz, 2014). However, these

policies may lead to international trade disputes.

GATT was formally incorporated into the WTO

system in 1995. In 1994, SCM was concluded in

Uruguay Round Negotiations to provide a mechanism

to settle down subsidy disputes without distorting

international trade (Cim & Esty, 2024). WTO has

been performing constraints on the subsidy policies

all the time from GATT to SCM, but there are still

certain limitations in terms of green subsidies.

Moreover, it is easy to generate compatibility

problems in practical terms.

Nowadays, research on green subsidy policy is

ubiquitous. Academic circles commonly believe that

from the perspective of economic advisability, green

subsidies can foster public interest, produce positive

externality (Charnovitz, 2014) and to a certain extent

help to increase social benefits (Nagy et al., 2021). As

488

Lai, Y.

Research on the Compliance of Green Subsidy Policy in International Trade-Based on WTO Rules.

DOI: 10.5220/0014385100004859

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Politics, Law, and Social Science (ICPLSS 2025), pages 488-493

ISBN: 978-989-758-785-6

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

for the topic of what effects green subsidies have on

international trade, one research points out that the

lack of clarity in green subsidies usually triggers

irrational subsidy competition, then results in trade

disputes (Sun & Peng, 2023). However, the

systematic analysis and comparison of subsidy

policies or concrete cases are still lacking.

This research aims to fill the above-mentioned

blanks by applying such methods as literature review,

case analysis, comparative analysis and so on.

Through systematic analysis of specific cases of

major economies, this article better understands the

similarities and differences of green subsidy policies

in different countries. Then it investigates potential

issues and how these policies influence international

trade under the WTO rules. Finally, the article figures

out the contribution that different districts account for

the international trade, as well as how these policies

interact, and provides a reference for the

improvement of WTO subsidy rules.

2 LITERATURE REVIEW

Centering around the economic advisability of green

subsidy policy, one of the researchers proposes that

not only can it reduce the costs of clean energy

technology, gaining a strong competitiveness in

market, but it allows social resources to follow the

direction of high-efficiency industry so that the global

energy structure successfully transforms (Charnovitz,

2014). Such interpretation provides an important

reference to further understanding green subsidy

policy and a different angle for subsequent research.

Some researchers analyzed how carbon emission

reduction policies can become a potential strategic

trade policy tool by constructing a model that

includes two exporting countries adopting

environmental policies such as taxes and subsidies in

third-country markets, discovering that reducing

pollution through subsidies benefits all the

stakeholders under certain conditions (Buccella et al.,

2024). Moreover, other scholars have noted that in

most cases, the market fails to reflect the true value of

the environmental resources because of existing

public attributes, but the green subsidies guide

enterprises and individuals to make proper use of

environmental resources through economic

incentives (Nagy et al., 2021).

Regarding the effects derived from international

trade, one research has mentioned that WTO rules

lack clarity in some clean energy subsidies. Hence,

the government would unconsciously break the rules

as they cannot access the compliance of those

policies, resulting in unfair competition (Charnovitz,

2014). Some scholars have claimed that under WTO

rules, countries had better weigh the relationship

between compliance and economic objectives when

implementing green subsidy policies to ensure that

policies are consistent with international trade rules

and green development (Fang & Zhou, 2022).

Additionally, some scholars suggested international

communication and cooperation are important to

promote the transparency, fairness and sustainability

of green subsidy policy making and implementation,

thereby reducing trade friction and promoting the

healthy development of global trade.

3 COMPLIANCE ANALYSIS OF

GREEN SUBSIDY POLICY

UNDER WTO FRAMEWORK

3.1 Definition of Green Subsidy Policy

Under the GATT, there are definitions of

transparency requirements and additional

requirements for the export and periodic check of

primary products in Article 16. It emphasizes that fair

competition requires the government to disclose the

subsidy policies and countries should negotiate

whether to limit them when there is a conflict with the

interests of the contracting states. Meanwhile, the

general exception part of Article 20 makes strict

provisions on special areas such as environmental

protection and public health, resource preservation,

and non-discrimination principles. According to the

SCM, the types and implementation conditions of

subsidies include prohibited subsidies directly linked

to export performance or import substitution, and

actionable subsidies that have specificity and would

cause damage to the interests of other countries.

According to the domestic and foreign literatures,

this article summarizes that green subsidy policy is a

key mechanism to coordinately promote

environmental goals and economic development in

order to balance environmental legitimacy and trade

fairness, which financial intervention is carried out in

many fields such as renewable hydrogen energy, new

energy vehicles, and lithium battery with the aim of

correcting the excessive waste of resources in

traditional markets, promoting green technology

research within enterprises, and alleviating the lower

effect of low-carbon transformation on vulnerable

industries or groups.

Green subsidy policies such as research and

development (R&D) support, production-side

Research on the Compliance of Green Subsidy Policy in International Trade-Based on WTO Rules

489

stimulation, consumption incentives, and

environmental protection goals are widely used all

around the world. For example, in Shanghai Lingang

New Area, China, the government provides R & D

support at a ratio of 10% ~ 30% of investment to

encourage some breakthroughs in new energy storage

technology projects. The Chinese government has

introduced a policy called “Two New” to promote the

penetration rate of new energy vehicles to exceed

50% (Zhu, 2024). The Inflation Reduction Act (IRA)

and the Chip and Science Act of the United States

plan to subsidize the green energy and semiconductor

industry by $700 billion within ten years, mentioning

that 40% of the key minerals in electric vehicle

batteries should come from North America, and the

local manufacturing can enjoy tax credit once they

reach the standard. The EU provides full funding of

7.81 million euros for all-solid-state lithium battery R

& D projects through the 'Horizon Europe' fund. In

2022, photovoltaic subsidies will reach 25 billion

euros, supporting the research and development of

ultra-thin film technology and perovskite facilities.

Through the 'Recovery and Resilience Fund' (RRF),

it provides up to 87.9 billion euro for industrial chains

such as electric vehicle R & D, manufacturing, and

charging facilities. The EU Carbon Border

Adjustment Mechanism (CBAM) imposes carbon

tariffs on imported high-carbon products such as steel

and cement. France provides an 'ecological subsidy'

of 27% for the purchase price of electric vehicles.

(WTO Law Research Society of China Law Society

Center for WTO Legal Studies,2024) Spain 's

'MOVES III' plan allocates 150 million euros to

support the installation of charging facilities. Brazil

implements the Low Carbon Agriculture Program

plus (ABC+), which provides low-interest loans to

farms that adopt no-till farming and agroforestry

systems (United States Development of Agriculture,

2024).

The implementation of these subsidies has played

an active role in green technology development,

industrial upgrades and market demand stimulation.

However, some policies may lead to problems like

technology monopoly, overcapacity, price

competition and trade disputes, which need to be

balanced and coordinated in the process of policy

formulation and implementation.

3.2 Case Analysis of Subsidy Policy

Practice Among Countries

In the Sino-US Wind Energy Subsidy case (Canada-

Renewable Energy/Canada-FIT, 2023), the

compliance debate focused on import substitution

subsidies and the applicability of Article 20 of GATT

1994. Based on WTO rules, the United States accus

that China 's subsidies, funding or incentives to

enterprises with domestic products violate the

provisions under the SCM agreement, while China

tries to invoke Article 20 of GATT 1994 to defend

itself, arguing that it’s in line with the exceptions to

environmental protection in this article because its

subsidy measures are aimed at protecting the

environment. The case not only affects the trade

pattern between China and the United States but also

impact the trade order of the global renewable energy

industry and hinder the efforts of international

cooperation to cope with climate change and energy

crisis.

In the EU 's Anti-Subsidy Investigation of Electric

Vehicles against China (European Comittion, 2023)

the compliance disputes mainly focus on whether the

local component requirements constitute import

substitution subsidies. The European Commission

believes that China 's subsidies to BYD and Weilai at

the production end and export section seriously

distort the market competition and cause 'serious

damage' to the EU industry, which violates the

'specificity' in Article 2 of SCM and the provisions of

Article 5. China advocates that the subsidy is in line

with the public goal of 'carbon neutrality', and the EU

cannot clearly prove that the subsidy causes industrial

damage. On the one hand, China has higher cost when

entering the European market, while on the other

hand, the EU also faces China 's anti-dumping

investigation response.

In addition, it’s obvious that there is a particularity

among the cases. For example, China 's new energy

products are blamed for domestic overcapacity with

the reason that the 'New Three' exports are using 'low-

price dumping' to transfer excess capacity. The EU

level is superimposed on the subsidies of member

states, but due to coordination problems, it is easy to

generate double subsidy mechanism risks and green

barrier adversity. The localization requirements of the

US green subsidy policy are greatly affected by the

political cycle, and fluctuate with the change of

government, resulting in long-term investment

uncertainty of enterprises.

3.3 Analysis on the Compliance and

Limitations of Green Subsidy

Policy

Based on the above research and analysis of green

subsidy policies, it is obvious that there are certain

uncertainties in the interpretation and application of

WTO rules. Firstly, the WTO rules have an

ICPLSS 2025 - International Conference on Politics, Law, and Social Science

490

ambiguous definition of subsidies, and both the

implementation mechanism and judicial

interpretation are often uncertain. The decisions of

the dispute settlement body (DSB) are often

subjective, which makes it difficult for member states

to determine whether they are in compliance with the

rules when implementing policies. Moreover, the

appellate body is prone to suspension, but the interim

appeal arbitration (MPIA) lacks coercive force,

fragmentating the adjudication standards. Secondly,

there is a conflict between the specificity

identification standard and the green subsidy target in

the structure of WTO rules. According to the SCM

agreement, subsidies need to meet the 'specificity'

standard before they can be sued. However, green

subsidies often cover multiple industries with

environmental protection goals while their actual

beneficiaries may be concentrated in specific areas,

resulting in being identified as 'factual specificity'.

Third, the current SCM agreement does not make a

distinction between environmental protection

subsidies and traditional industrial subsidies,

resulting in green policies often classified as

"actionable subsidies" and corresponding green

subsidies "exception clauses". The application

threshold of environmental protection exceptions in

Article 20 of the GATT is at a high level. It is

necessary to pass the "necessity test" and prove that

the measures are non-discriminatory, but green

subsidies are often questioned and discriminated

against for the choice of policy tools.

Green subsidy policy will certainly reshape the

global trade pattern. In terms of market access, some

countries increase green trade barriers by setting strict

environmental protection standards and certification

procedures, limiting the entry of products from other

countries, which may lead to higher market access

costs. In terms of trade, countries reduce the cost of

their products through subsidies to make them more

price competitive in the international market, thus

putting pressure on similar products in other

countries, but this pressure will be passed on to

consumers and increase their burden. In terms of

international investment, some countries attract

investment in green industries by providing subsidies

to promote the development of their own green

industries, but this may also lead to the outflow of

investment from other countries and aggravate the

tendency of capital hedging.

4 THE OPTIMIZATION PATH OF

GREEN SUBSIDY POLICY

COMPLIANCE

4.1 Compliance Coping Strategies at

the Enterprise Level

As the direct beneficiaries of green subsidy policies,

enterprises need to actively participate in the

formulation of international standards and

compliance review mechanisms to anticipate policy

risks and ensure their competitiveness in international

trade. For example, enterprises can influence the

formulation of international standards through

industry associations or direct participation under the

WTO frame framework. When faced with unfair

trade barriers or subsidy disputes, Amicus Curiae

Briefs are suggested because that makes full use of

the WTO dispute settlement mechanism to safeguard

their own interests (McDaniel & Matthews, 2024).

4.2 Policy Design and Risk Aversion at

the National Level

Governments should give priority to supporting basic

R & D and non-specific subsidies when designing

green subsidy policies. For example, policies such as

carbon tax returns can encourage technological

innovation, avoid excessive support for specific

enterprises, and reduce the risk of trade disputes

(McDaniel & Matthews, 2024). In addition, the green

subsidy policy is designed to avoid the terms directly

linked to exports as much as possible, while

strengthening the quantitative assessment of the

environmental benefits of subsidies to ensure that the

subsidy policy can not only promote green

development but also conform to WTO rules and

reduce trade risks. In the process of policy

implementation, the state needs to strengthen the

quantitative assessment of environmental benefits to

ensure that subsidy policies can truly bring about

environmental improvement and can prove their

compliance through scientific data support.

4.3 Promote WTO Rules Reform at the

International Level

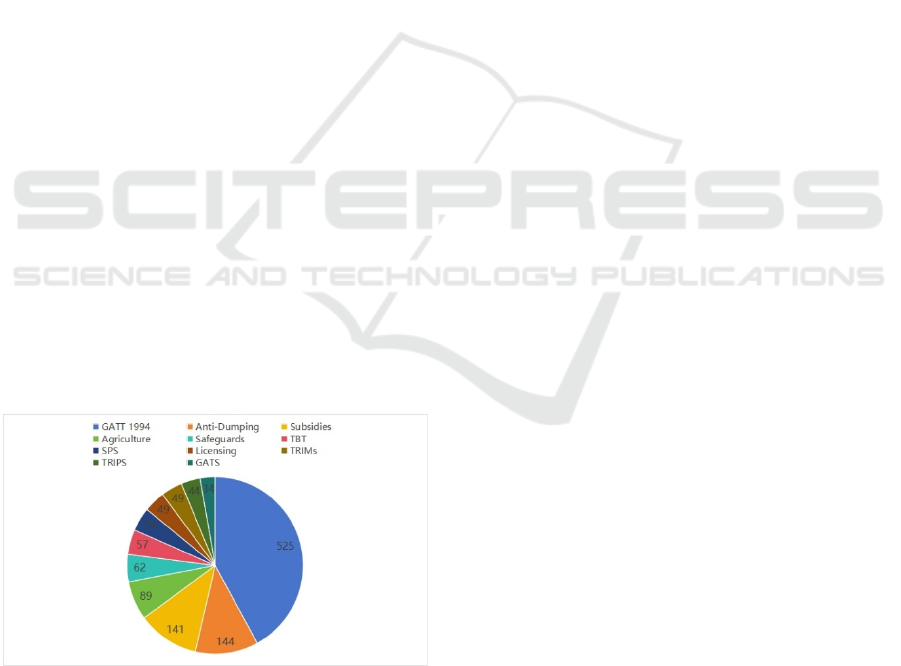

According to World Trade Organization data, as of

December 31, 2024, a total of 631 consultation

requests had been circulated to WTO members, of

which 141 disputes were related to subsidy claims

under WTO agreements. The data in Figure 1 shows

that, in general, the application of various agreements

Research on the Compliance of Green Subsidy Policy in International Trade-Based on WTO Rules

491

under the WTO dispute settlement platform reflects

the hot and difficult issues in different fields of

international trade. GATT 1994 accounts for the

largest number of related disputes, reaching 525 due

to its involvement in basic trade rules and industrial

policies. Agreements such as Agriculture and

Safeguards have also caused more disputes due to the

sensitivity and complexity of specific areas. It can be

seen that promoting the reform of WTO rules is the

key to ensuring the compliance of green subsidy

policies.

In view of the limitations of WTO rules, first of all,

revise the SCM agreement and add the green subsidy

exception clause to provide a clear legal basis for

green subsidies to reduce disputes caused by vague

rules. Secondly, seeking cooperation with

international institutions such as OECD, IMF and the

World Bank to promote transparency and information

sharing of subsidy issues, establish a multilateral

environmental subsidy transparency mechanism,

promote communication and coordination among

countries on subsidy policies, and reduce trade

frictions caused by information asymmetry

(Organization for Economic Co-operation and

Development, 2023). Finally, establishing a complete

framework or agreement to deal with climate change

as soon as possible and incorporating green subsidies

into the framework of global climate governance can

provide broader support and recognition for green

subsidy policies. The Annex 2 of the Agreement on

Agriculture policy serves as a reference which allows

green subsidy exemption litigation that meets the

conditions of carbon emission reduction intensity as

the benchmark, covering the whole industry, and

regularly accepting third-party environmental benefit

audits (Wang et al., 2021)

Data source: WTO

Alt Text for the figure: The figure reflects the number of cases

of various disputes under the WTO.

Figure 1. Agreements raised in WTO disputes (1995-2024).

5 CONCLUSION

Through analyzing the practical situations of green

subsidy policy in international trade and combining

with the interpretations under the WTO rules, this

article on the one hand finds that the policies which

have both similarities and differences are widespread

used. However, the existing rules still have

limitations and ambiguities and pose challenges to

determine the compliance of green subsidy policy. On

the other hand, by comparing the related cases

happened in China, the United States and the

European Union, it is concluded that green subsidy

policy generally face compliance risks and is prone to

trade disputes. The optimization path for the

compliance of green subsidy policies requires the

joint efforts of enterprises, countries, and the

international community. Enterprises need to actively

participate in making international standards and

making use of the dispute settlement mechanism.

Countries need to design reasonable subsidy policies

to avoid triggering trade disputes. The international

community should promote the reform of WTO rules,

providing legal foundation and transparency

mechanisms for green subsidies.

REFERENCES

Buccella, D., Fanti, L., & Gori, L. 2024. Green subsidies as

strategic trade policy tools. Environmental Economics

and Policy Studies 26: 741–757.

Carbon Border Adjustment Mechanism. [n.d.]. Taxation

and Customs Union. https://taxation-

customs.ec.europa.eu/carbon-border-adjustment-

mechanism_en.

Charnovitz, S. 2014. Green subsidies and the WTO. World

Bank Policy Research Working Paper No. 7060.

doi:10.1596/1813-9450-7060.

Cima, E. & Esty, D.C. 2024. Making international trade

work for sustainable development: Toward a new WTO

framework for subsidies. Journal of International

Economic Law 27(1): 1–17.

Eurostat. 2023. Environmental statistics and accounts in

Europe. Eurostat Statistics Explained. Available:

Environmental subsidies and similar transfers statistics

| System of Environmental Economic Accounting.

Fang, M.M. & Zhou, W. 2022. Greening the road: China’s

low-carbon energy transition and international trade

regulation. Leiden Journal of International Law 35(2):

357–378.

Gam, L. & Papaefthymiou, A. 2023. The EU foreign

subsidies regulation: Green subsidies treading the line

between the FSR, state aid, and WTO law. Competition

Policy International. Available:

https://www.competitionpolicyinternational.com/wp-

ICPLSS 2025 - International Conference on Politics, Law, and Social Science

492

content/uploads/2023/05/5-THE-EU-FOREIGN-

SUBSIDIES-REGULATION-GREEN-SUBSIDIES-

TREADING-THE-LINE-BETWEEN-THE-FSR-

STATE-AID-AND-WTO-LAW-Liliane-Gam-

Argyrios-Papaefthymiou.pdf.

Nagy, R.L. et al. 2021. Green capacity investment under

subsidy withdrawal risk. Energy Economics 98:

105259.

Natural Resources Conservation Service. 2025.

Environmental Quality Incentives Program.

Shi, X. et al. 2024. The EU's industrial subsidy policy for

lithium batteries, photovoltaic products, and electric

vehicles in the name of green transition. WTO Legal

Studies Blue Book.

Sun, A. & Peng, D. 2023. Revisiting WTO subsidy rules in

a changing global landscape: Problems and prospects.

Journal of WTO and China 13(3): 23–44.

United States Department of Agriculture. 2021. ABC Plus:

Brazil's new climate change adaptation and low carbon

emission in agriculture plan.

Zhu, Y. [n.d.]. The "two new" support policies are fully

launched: Policy Interpretation. China Government

Network.

https://www.gov.cn/zhengce/202409/content_6976037

.htm.

Research on the Compliance of Green Subsidy Policy in International Trade-Based on WTO Rules

493