Research on the Impact of Real Estate on China's Economy

Zheng Tan

QianWeiChang College, Shanghai University, Shanghai, 200444, China

Keywords: Real Estate, Economy, Economic Structure, Policy.

Abstract: During the past 3 decades of rapid economic progress in China, the real estate industry has played an important

role in advancing the Chinese economy. Real estate plays different roles in the economy at different times

and circumstances. This paper aims to explore the relationship between real estate and China's economy, and

what progress and risks real estate has brought to the economy over the decades of development. Through

data collection and analysis, this paper makes a detailed analysis and enumeration of the role of real estate in

promoting China's economy, such as the support of local finance, employment promotion, etc. At the same

time, it also notes a series of financial risks and foam caused by the excessive development of real estate, as

well as the living pressure of ordinary residents caused by excessive housing prices.This paper also calls on

residents and consumers to view real estate rationally and not to adopt irrational purchase behavior. So as not

to add too much life pressure and loan repayment risk to yourself.

1 INTRODUCTION

Reviewing the history of China’s real estate

development, it can generally be categorized into four

distinct phases. From 1949-1978, China's housing

system was still in the state allocated stage. From

1978-1998, the State Council promulgated many

reform policies on land use and housing system,

marking the beginning and establishment of the real

estate industry. From 1998 to 2008, surge in housing

demand and the deepening reform of the housing

system promoted the rapid development and real

estate’s marketization. Since 2019, due to the bubble

and risk of real estate, the real estate industry has

entered a stage of regulation and financialization.

Throughout the development of the real estate

industry, the relationship between real estate and

China's economy is very close. However, the question

that what advantages and related risks and problems

real estate industry brought to China’s economy and

what role it plays in is worth discussing and

researching.

2 THE POSITIVE IMPACT OF

REAL ESTATE

2.1 The Significance of Real Estate

Development Investment to Social

Fixed

Real estate development investment refers to the

investment of funds by enterprises or individuals in

real estate development for obtaining investment

benefits. The development process involves various

aspects and processes, such as land acquisition, house

design and planning, house facility construction,

construction and other links. Therefore, real estate

development requires a large amount of capital and

money to invest (Zhu, 2024). Social fixed asset

investment refers to the total amount of funds

invested in fixed asset construction in a country or

region in the form of currency over a certain period

of time. It covers multiple fields such as infrastructure

construction (transportation, energy,

communications, etc.), real estate development,

manufacturing, agriculture, etc. Social fixed asset

investment is also an important indicator for

measuring the economic growth of a country or

region.

Although investment in real estate development is

a

part of social fixed asset investment, it has an

606

Tan, Z.

Research on the Impact of Real Estate on China’s Economy.

DOI: 10.5220/0014369900004718

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2025), pages 606-612

ISBN: 978-989-758-792-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

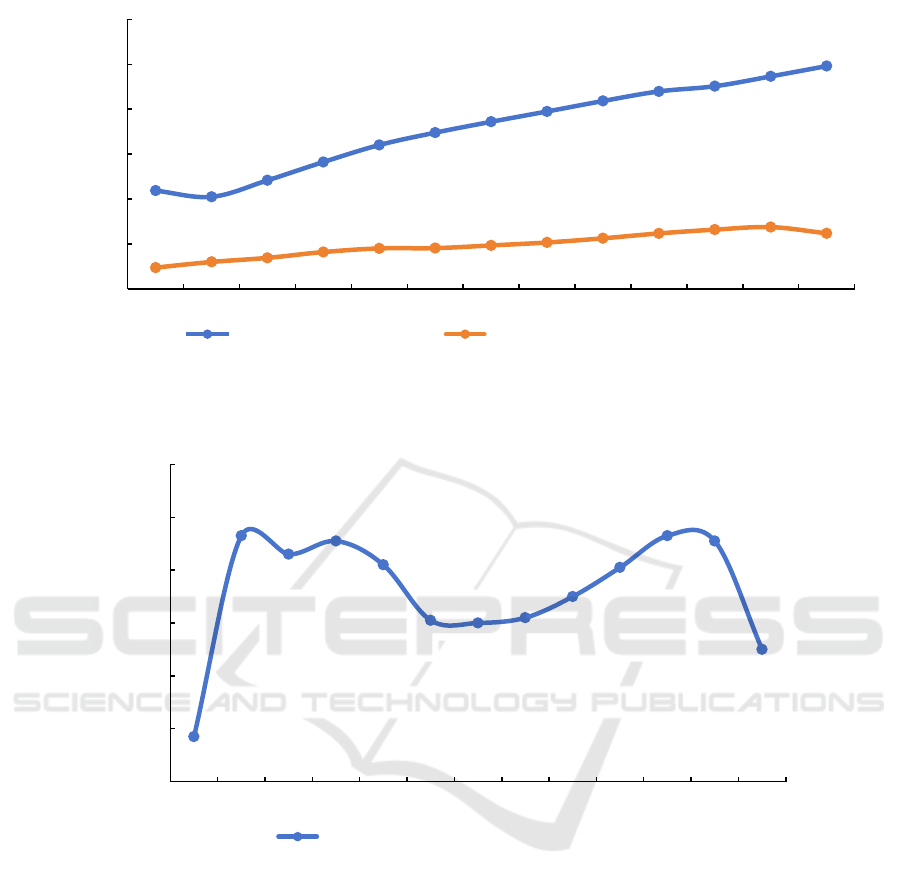

Data source: National Bureau of Statistics

Figure 1: Annual amount of social fixed assets and real estate development investment.

Data source: National Bureau of Statistics

Figure 2: Proportion of real estate development investment.

important impact and role on social fixed asset

investment. According to the related data from 2010

to 2022, the amount of real estate development

investment has steadily increased every year from

475.62 billion yuan in 2010. By 2022, the amount of

real estate development investment reached 1238.47

billion yuan, nearly three times. Correspondingly, the

amount of social fixed asset investment also increased

from 2188.33 billion yuan to 5209.16 billion yuan

(Figure 1). According to data calculations, the share

of real estate development investment within total

social fixed asset investment has largely maintained a

level above 25% between 2010 and 2022 and even

reached nearly 30% in some years (Figure 2). This

reflects that real estate development investment takes

a considerable proportion of social fixed asset

investment, and it plays a vital role in the entire social

fixed asset investment.

China has also issued many related favorable

policies like the "Continue to promote and expand

private enterprise bond financing support tools to

support private enterprise financing, including real

estate companies" issued in 2022. The increase in

financing tools for real estate companies allows them

to raise more funds for real estate development, and

indirectly promotes the growth of social asset

0

100000

200000

300000

400000

500000

600000

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

100 million yuan

Social fixed asset investment real estate development investment

21,7

29,3

28,6

29,1

28,2

26,1

26,0

26,2

27,0

28,1

29,3

29,1

25,0

20

22

24

26

28

30

32

2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

percentage %

Proportion of real estate development investment

Research on the Impact of Real Estate on China’s Economy

607

investment. The series of policies on lower loan

interest rates, tax incentives, and lower down

payment ratios issued in the policy year of 2024 also

stimulated people's enthusiasm for buying houses.

The expanded real estate demand has also increased

investment in real estate development, further

promoting consumption and the economic

environment at the time.

2.2 The Important Role of Real Estate

in Land Finance

Public ownership of land has always been one of the

basic principles of the Communist Party of China.

China's Constitution specifies that land in urban areas

is owned by the state, while land in rural regions is

collectively owned.. The development of the real

estate and land markets is actually closely related to

the handling of land use rights (Hu, 2012). The

development of land finance in China can be traced

back to the late 1980s. With the rapid development of

China's economy and the acceleration of

industrialization, local governments raised funds by

selling or leasing land use rights. In the tax-sharing

reform in 1994, the proportion of local and central

taxes was redistributed, and local government tax

revenue was reduced. However, the smaller land

revenue at that time was allocated to local

governments, which laid the foundation for land

finance. As an important part of China's current

economic system, land finance is only tied to real

estate, and the relationship between the two can be

said to be very close. Local governments obtain

income by selling the use rights of state-owned land

through auctions, bidding, etc., which is an important

part of land finance.

In the golden period of rapid real estate

development before, the booming real estate market

has promoted the increase in housing demand, which

in turn has strengthened the demand for land, and in

turn has caused the price of land transfer to rise,

which has directly increased local fiscal revenue. In

1999, the income from land transfer fees accounted

for only 9.3% of the total budget revenue of local

governments. But by 2011, this proportion had

increased to an astonishing 60.7%. Even in some

years when the real estate industry was booming, the

land transfer income of some regions such as Tianjin

and Hangzhou has exceeded the local total budget

revenue (Wang & Ye, 2016). These data and cases are

enough to show that the development of real estate

has driven the growth of income in various parts of

China and provided a good guarantee for the

urbanization and industrialization of various regions.

In addition, the land whose value has increased due to

real estate development can also be used as high-

quality collateral to borrow from banks and other

financial institutions or issue bonds. The funds raised

can help some local governments alleviate the

shortage of funds in the short term, or be used for

investment in public infrastructure construction and

other public service projects, which also indirectly

confirms that land finance has been positively

affected by real estate.

2.3 The Promotion on Employment

The real estate industry has a significant impact on

employment. It not only directly creates a large

number of jobs, but also indirectly creates and

promotes many employment opportunities in its

upstream and downstream industrial chains. In terms

of direct employment: In the early stage of real estate

development, from project planning, design

drawings, on-site construction, house sales and other

processes and links, human resources are required.

The positions involved include engineers, designers,

construction workers, house salesmen... Take the

construction industry, which is most strongly

associated with the real estate industry as an example:

the number of relevant workers required for every

10,000 square meters of house construction area is

about 170 (Chen, 2014). The growing prosperity of

the real estate industry represents an increase in the

number of house purchases, and the increase in

housing demand means an increase in the

construction area of houses, so the number of workers

required will also increase rapidly (Chen, 2014). The

increase in residential houses and houses also means

an increase in the demand for property management

personnel. At the same time, the intermediary

consultation in the house transaction process also

requires a large number of corresponding

professionals. In terms of indirect employment: the

increase in housing demand has caused an increase in

the demand for raw materials required for upstream

houses, such as steel, cement, glass, wood, etc., which

has increased the demand for personnel in these

corresponding industries. When the house purchase is

completed, the house decoration, home appliances

and furniture purchase and other links involved

require the employment of labor. Mortgage loan

services provided by banks and other financial

institutions also benefit from the active housing

market, increasing demand for employment related to

credit business.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

608

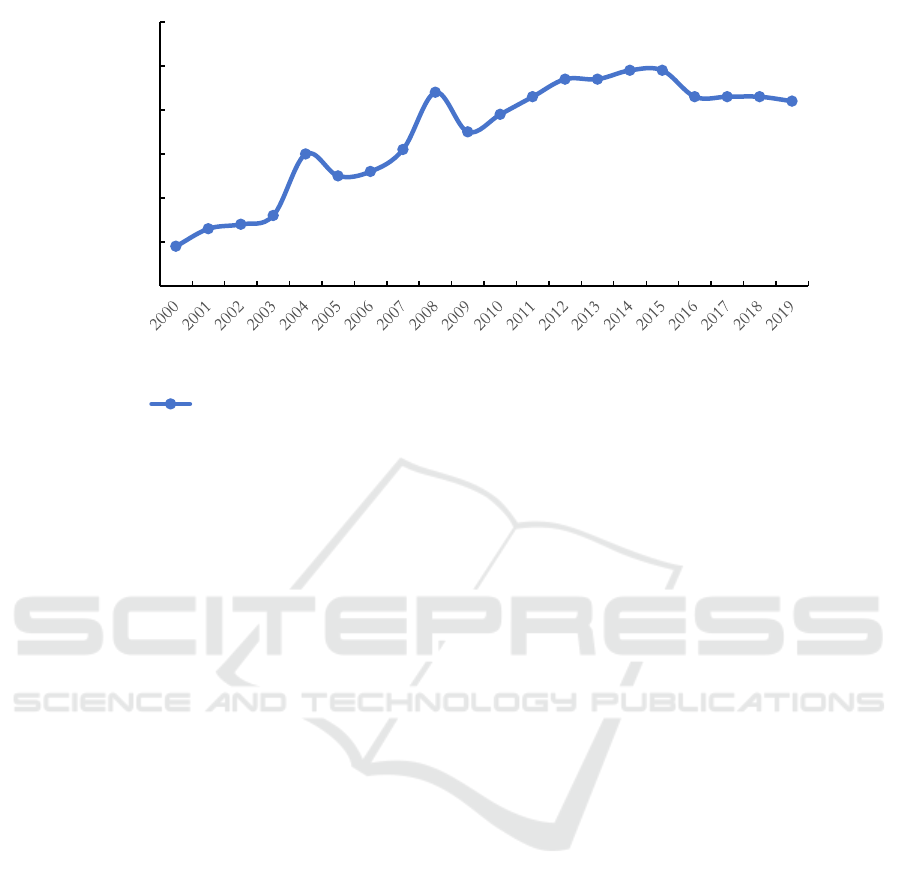

Data source: National Bureau of Statistics

Figure 3: The proportion of direct real estate employment to tertiary industry employment.

According to the relevant data in Figure 3, the

number of direct employment in the reality industry

was only about 930,000 in 2000, accounting for about

0.49% of the total employment in the tertiary service

industry. However, with the rapid development of the

reality industry, the number of direct employment

provided by the real estate industry is also rising

rapidly. By 2018, the number of direct employment

in real estate reached a peak of 2.94 million, nearly

three times the number in 2000. From these data, it

can also be seen that the real estate industry has

created many jobs and employment opportunities in

the process of development. At the same time, it can

be found that the proportion of direct employment in

real estate to employment in the service industry has

shown an overall upward trend. Although the

proportion is not large, less than one percent, the

proportion has also increased significantly. By 2014,

it has reached about 0.89%, an increase of about 82%

compared to 2000. And this is only the direct

employment created by the real estate industry, and

does not include the increase in employment in

upstream and downstream raw material supply,

construction industry, etc. due to the influence of the

real estate industry. Therefore, real estate

undoubtedly has a boosting effect on China's

employment situation.

3 NEGATIVE IMPACT OF REAL

ESTATE

3.1 The Debt Crisis

Over the last two decades, the fast-paced economic

growth of China ,steady GDP growth and stable

employment market are inseparable from the

promotion and help of the real estate industry.

However, even though the real estate industry has

brought many positive effects to China's economy,

there are also many problems and huge risks behind

it. The real estate industry is a capital-intensive

industry. The land purchase cost, construction cost,

design planning and other links in real estate

development require a large amount of capital

investment. A real estate development project is

usually accompanied by high investment and long

cycle characteristics, so real estate companies have a

high demand and dependence on capital. The high

dependence on funds means that real estate

companies need to raise a lot of funds to make the

project go smoothly, and companies usually adopt

high-leverage debt financing methods. Although the

high-leverage financing strategy will enable the

company's business and scale to expand rapidly, it

will also cause the company to bear huge financial

risks and debt pressure (Bai & Zhou, 2025). Because

most of the assets of real estate companies are fixed

assets such as land and houses, the ability to convert

0,4

0,5

0,6

0,7

0,8

0,9

1

percentage %

year

The proportion of direct real estate employment to tertiary industry employment

Research on the Impact of Real Estate on China’s Economy

609

them into cash flow is poor. In addition, the long cycle

of real estate development, these factors further test

the capital operation and management capabilities of

real estate companies that adopt high-leverage

financing. The real estate industry is also extremely

susceptible to the influence and regulation of national

policies. The real estate market’s direction is heavily

impacted by each specific policy enacted by the

authorities. The constant changes also make real

estate companies vulnerable to fluctuations but

difficult to adjust and respond in time (Liu, 2018).

The above internal and external factors show that the

risk and possibility of debt crisis in real estate

companies are much higher than other industries.

In recent years, there have been many cases of real

estate companies going bankrupt due to debt defaults,

among which the famous companies are: Country

Garden, Evergrande Group, etc. The bankruptcy of

these real estate giants has brought a series of

financial problems, causing very bad impacts and

losses to the society. Take the bankruptcy of

Evergrande Group as an example: Evergrande Group

entered a state of crazy expansion between 2016 and

2020, and the company's asset scale also reached a

historical high of 2.3 trillion yuan in 2020.

Correspondingly, such a radical expansion is

inevitably accompanied by high financing loans. In

2020, Evergrande Group's liabilities reached 1.95

trillion yuan, and its asset-liability ratio was as high

as 84.8%. Such an astonishing debt ratio has shown

that Evergrande's financial risks are in an extremely

dangerous situation, and the high debt has put great

pressure on its cash flow. What is more fatal is that

the country began to implement stricter controls on

the real estate sector in 2020, promulgated the "three

red lines" policy, and imposed relevant restrictions

and supervision on the high-leverage financing

behavior of real estate companies. This series of

measures made it even more difficult for Evergrande,

which was already in a debt crisis, to maintain normal

operations through refinancing. Coupled with

Evergrande's failed investments in other fields such

as medicine, new energy, and health, it eventually led

to the bankruptcy of Evergrande, a former leading

real estate company. Evergrande's bankruptcy caused

huge losses to upstream raw material merchants,

depreciation of the wealth of Evergrande bond

holders, and the loss of money for Evergrande's pre-

sale buyers, among other social harms and losses.

This case also fully reflects that real estate not only

represents high returns, but also contains crises and

risks.

3.2 Increased Living Pressure on

Residents

The fast-paced expansion of estate sector and the

rapid rise in property values have brought

considerable income and wealth to those who invest

in this industry. However, the high property prices

have brought considerable living pressure to many

people who want to buy properties. The property

value is usually affected by the development costs,

expected income and housing supply and demand of

real estate developers. The price of real estate should

fully reflect the value of real estate. However, in

property market in China, the price of property

deviates from its corresponding value. This

phenomenon also exposes the bubbles and risks

contained in real estate prices (Li, Li & Nuttapong,

2022). According to relevant data from National

Bureau of Statistics: in 2005, the price of commercial

residential housing was about 2,937 yuan per square

meter. In the following 20 years, due to the rapid

advancement within the property industry and social

economy, the price of property has been rising

accordingly every year. By 2023, the value of

commercial residential homes per square meter has

risen to 10,864 yuan, nearly 3.7 times that of 2005.

The sharp increase in housing prices also shows that

the financial pressure faced by ordinary residents

when they want to buy houses will also increase

accordingly. The ratio of housing prices to household

income is an important indicator for measuring the

housing prices in a region and the purchasing power

of residents. It has a good reference value. The World

Bank indicates that in developed countries, a standard

housing price-to-income ratio usually lies within the

range of 1.8 to 5.5, whereas in developing countries,

the acceptable level ranges from 3 to 6.However, in

2016, the housing price-to-income ratio in first-tier

cities such as Beijing and Shanghai reached an

astonishing 25 times (Glaeser, Huang & Shleifer,

2017). In 2010, the housing price-to-income ratio in

Shenzhen reached about 22 times. Although it briefly

dropped to about 17 times in 2015, it reached a peak

of about 40 times in 2020 after another round of

housing price increases. The extremely high housing

price-to-income ratio in the above-mentioned first-

tier cities in China has far exceeded the reasonable

housing price-to-income ratio range proposed by the

World Bank. When a family in a first-tier city needs

to spend more than 25 years of annual income without

food or drink to buy a house to live in, it is foreseeable

that most families may be under a series of pressures

and influences such as high housing prices and

mortgage repayments for a long time. According to

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

610

CHFS data in 2017, the total asset change index of

urban households without housing was 96.3,

indicating that wealth is shrinking. The index of

households with houses is 110.3, indicating that their

wealth continues to grow. This shows that due to the

rise in housing prices, wealth has begun to transfer

from households without houses to households with

houses. The faster the housing prices rise, the greater

the gap between the rich and the poor between the

people with houses and the people without houses.

This phenomenon also stimulates the public to choose

to work hard to buy houses in order to avoid losing

wealth, which in turn stimulates the housing prices to

continue to rise due to the increase in demand,

forming a vicious circle.

3.3 Challenges of Economic

Restructuring

China's long-term rapid economic advancement has

relied on the real estate industry as the engine of

economic growth. The over-reliance on the real estate

industry has led to obstacles and challenges in China's

economic structural transformation. In the previous

article, the relationship between land finance and the

real estate industry was analyzed in detail. Although

real estate has brought a lot of benefits to the finances

of various regions, the corresponding data show that

the land transfer income related to real estate has

occupied too large a proportion of the local

government's budget revenue. Local government debt

funds have poured into real estate-related industries.

The over-reliance on real estate has caused the funds

that should have been invested in other fixed assets to

flow into real estate, thereby limiting the

government's ability to invest in other areas and

distorting the ability to adjust fund allocation

accordingly (Yang, n.d.). According to data surveys,

since 2018, the land transfer income of real estate

companies has begun to decline continuously, from

120.7 billion yuan in 2018 to 67.4 billion yuan in

2023. The continuous decline in land transfer income

shows the unsustainability of land finance. Today, the

Chinese government has promulgated a series of

relevant laws to suppress and regulate real estate, and

gradually transfer the long-term, high-investment,

and high-leverage characteristics of real estate to the

real economy model (Chen, 2025). Therefore, local

governments cannot continue to develop the real

estate industry as the mainstay of local finances. The

adjustment and transformation of the industrial

structure is a big challenge for them. It is difficult to

transform from the land finance model to other

models quickly.

4 CONCLUSION

This paper takes the real estate’s influence on China's

economy as the survey background, and discusses in

detail the positive and negative impacts of the

property industry on China's economic growth

through data analysis and case analysis. It is found

that real estate sector has significantly contributed to

the swift growth of local financial systems in China ,

employment, and economic level, but the

phenomenon of China's economy over-relying on

property also contains corresponding financial risks

and social harm. The analysis of real estate, a key

driving force in China’s economic structure , has very

important social significance. A deeper

understanding of the two sides of the real estate

industry will help people have a more rational view

and understanding of it. For the current problems of

high house prices and financial bubbles, the

government should strengthen the monitoring of the

corresponding real estate loan situation. Increase the

supply of land to build more public rental housing and

affordable rental housing, in order to cope with the

current phenomenon that house prices are generally

too high and low - and middle-income people can not

afford house prices. At the same time, government

should continue to emphasize the residential

attributes of the house and limit its financial attributes

to avoid another irrational rise in house prices.

Although this article provides a specific analysis

of the dual nature of real estate, most of it focuses on

existing data analysis and does not involve relevant

data calculations or predict and analyze future

development trends in the real estate industry. This is

one of the shortcomings of this article. After that, this

paper can focus on predicting and exploring the

adjustment and future prospects of the real estate

industry based on the relevant policies issued by

China.

REFERENCES

Zhu, Y. (2024). Analysis of the Contribution and Impact of

Real Estate Investment on Urban Economic Growth.

Shang Xun(14),1-4.

Hu, R. (2012). Understanding Chinese real estate: The

property boom in perspective. In Law and Policy for

China's Market Socialism. Routledge, 87-100.

Wang, W. & Ye, F. (2016). The political economy of land

finance in China. Public Budgeting & Finance, 36(2),

91-110.

Chen, B, D. (2014) Quantitative Research on Real Estate

Industry Development Driven Social Employment.

Wuhan University of Science and Technology, 2-12.

Research on the Impact of Real Estate on China’s Economy

611

Bai, Y, Zhou, L, J.(2025). The Impact of Real Estate

Industry Characteristics on Financial Management: A

Case Study of Evergrande Group . Science Technology

and Industry, 237-242.

Liu, C., & Xiong, W. (2018). China's real estate market.

Li, N., Li, R. Y. M., & Nuttapong, J. (2022). Factors affect

the housing prices in China: a systematic review of

papers indexed in Chinese Science Citation Database.

Property Management, 40(5), 780-796.

Glaeser, E., Huang, W., Ma, Y., & Shleifer, A. (2017). A

real estate boom with Chinese characteristics. Journal

of Economic Perspectives, 31(1), 93-116.

Yang, F, D. Real Estate Investment, Local Government

Debt, and Credit Risk in the Commercial Banking

System. Inner Mongolia University of Finance and

Economics, 1-3

Chen, Y, J. (2025) Research on the Impact of Real Estate

Downgrading on Economic Development and Urban

Renewal Strategy.Market Outlook, 7-9.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

612