Globalization and Corporate Financial Decision-Making: A Multi

Dimension of Industry, Market and Institutional Influence

Zhixuan Sun

Shanghai International Studies University, Songjiang District, Shanghai, China

Keywords: Globalization, Corporate Financial Decision-Making, Reciprocal Tariff Policies, Manufacturing, Retailing,

Service Industries.

Abstract: This study investigates how industries in China, Japan, and the United States respond to the U.S. reciprocal

tariff policies, focusing on manufacturing, retailing, and services. Using a comparative case study method, it

explores financial decision-making through the lenses of Pecking Order Theory, Trade-Off Theory, Net

Present Value (NPV) Method, and Real Options Theory. The findings show that Chinese manufacturers are

shifting operations abroad and adopting flexible investments, while retailers emphasize internal financing and

national branding. In services, firms like Aliyun balance debt to maintain financial stability amid geopolitical

risks. Japan, though less directly impacted, is relocating production, diversifying supply chains, and

leveraging third-country trade agreements to maintain U.S. market access. The U.S. aims to restore industrial

strength but faces inflation and retaliation. Government responses, including subsidies and regional trade

negotiations, play vital roles. The study concludes that financial strategy under globalization is deeply shaped

by industry characteristics and national policy and offers theoretical insights for managing uncertainty. Future

research is encouraged to explore firm-level case studies for greater depth.

1 INTRODUCTION

Eric C.E. et al. (2025) report that in 2025, global trade

entered a new period of tension and realignment as

the United States issued aggressive tariff measures

under the “reciprocal tariff” policy proposed by

President Donald Trump (Accountancy, 2025). In this

policy shift, the U.S. imposed a flat 10% tariff on all

imported goods and significantly higher rates,

ranging from 25% to 125%, on imports from

countries that, according to U.S. trade officials, did

not offer reciprocal market access or fair-trade

practices. This marked a sharp turn away from

decades of liberalized trade policies that had

underpinned globalization.

China, as the U.S.’s largest trading rival, faced a

steep 125% tariff on its exports to the U.S., prompting

Beijing to retaliate with up to 34% tariff on American

goods such as agricultural products and consumer

goods and impose export restrictions on vital

materials like rare earth elements. These actions have

disrupted global supply chains and intensified

tensions between the two largest economies.

Meanwhile, Japan, subjected to a 24% tariff, was

seeking exemptions through diplomatic channels.

Prime Minister Shigeru Ishiba advocated for the

removal of tariffs, especially the 25% levy on auto

imports, which is a core pillar of Japan’s export

economy, during the talk with President Trump.

Despite these efforts, the Japanese government

allocated a sum of ¥980 billion (approx. $6.3 billion)

as assistance funds to support the affected industries

and small businesses. (Christopher, 2025) Besides,

Japan has intensified negotiation with regional

partners to stabilize its trade outlook.

In response to escalating trade barriers, China,

Japan, and South Korea have agreed to resume

negotiations for a trilateral free trade agreement,

aiming to strengthen regional economic cooperation

and defused the impact of U.S. protectionist policies.

These developments highlight a shift towards

regional alliances and a revaluation of global trade

strategies, as nations navigate the complexities

introduced by the U.S.’s reciprocal tariff policy.

The broader implications of these changes are

significant. First, Eiteman et al. (2016) suggest that

multinational corporations are reassessing their

production and sourcing strategies, increasingly

looking to Southeast Asia, Mexico, and Eastern

Europe to hedge against geopolitical risks (Moffett et

al., 2021). Second, the rise in tariffs and trade barriers

is contributing to inflationary pressures worldwide,

Sun, Z.

Globalization and Corporate Financial Decision-Making: A Multi Dimension of Industry, Market and Institutional Influence.

DOI: 10.5220/0014353600004718

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2025), pages 321-327

ISBN: 978-989-758-792-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

321

with consumers in all three countries—especially in

the U.S.—facing higher prices for imported goods.

Therefore, this study will focus on identifying the

characteristics of the manufacturing, retailing and

service in China, Japan, and the United States. And

analysing what strategies these three industries took

to cope with the reciprocal tariff policies issued by the

United States. In the study, a comparative case study

approach will be applied to analyse financial data

from manufacturing, retailing, and service companies

in China, Japan, and America to validate the

theoretical frameworks.

2 RESEARCH QUESTIONS

What are the characteristics of manufacturing,

retailing and service in China, Japan and America and

what strategies do they adopt in response to the

reciprocal tariffs imposed by the USA.

3 THEORETICAL BASIS

To better illustrate the characteristics of

manufacturing, retailing and service in China, Japan

and America and to analysis their response

respectively to the tariffs imposed by USA, some

relevant theories will be introduced below.

3.1 Financing Decision Theories

3.1.1 Pecking Order Theory

The Pecking Order Theory explains how companies

prioritize financing options, which may affect their

strategies in response to tariffs. For instance, during

the U.S.-China trade war, many Chinese

manufacturers prioritized internal financing to avoid

the signalling risk associated with external equity

financing. (Brealey et al., 2022) Proposed by Stewart

Myers and Nicolas Majluf in 1984, it elucidates that

when financing new projects, the company will

prioritize using internal profits, which is equal to net

profit plus depreciation minus dividends, because

internal financing does not require signing contracts

with investors or paying various fees, which means

fewer restrictions. When stock prices are overvalued,

managers will issue new shares based on internal

information, making investors discover the

information asymmetry, resulting in investors

lowering the valuation of existing and newly issued

stocks, which leads to a decrease in stock prices and

the market value. But if issuing bonds unrelated to

asymmetric information, the value of the company

will not decrease. Therefore, bond financing is

preferred over equity financing.

3.1.2 Trade-Off Theory

The Trade-Off Theory explains how companies

balance debt and equity to maximize firm value. It is

crucial for understanding how companies manage

financial risks under tariff pressures (Ross et al.,

2021). When industries, specially manufacturing and

retailing, are facing high tariffs, the cost of imported

inputs will increase, resulting in lower revenue or

profit margins. Managers need to use this theory to

pull off the appropriate balance in capital weights to

maximize their firm value and create positive

shareholder value. When the debt-to-equity ratio is

low, the tax shield benefits of debt enhance the

company's value. Until the debt ratio reaches a certain

extent, the tax shield benefits of debt begin to be

offset by the cost of financial distress. When the

marginal tax shield benefits are exactly equal to the

marginal financial distress costs, the company's value

is maximized, and the debt ratio range that time is the

optimal capital structure of the company.

Together, the Pecking Order Theory and the

Trade-Off Theory provide a comprehensive

framework for understanding how companies balance

financing options and manage financial risks, which

is crucial for formulating strategies in response to

tariffs. By understanding the principles of these two

theories, companies can optimize their financing

decisions and minimize financial risks, thereby

enhancing their resilience to tariff changes under

globalization.

3.2 Investment Decision Theories

3.2.1 NPV Method

Net Present Value refers to the shortfall between the

present value of future cash inflows and the present

value of future cash outflows.

NPV=

∑

()

()

−𝐼

*

(1

)

The NPV Method is used to evaluate investment

projects by comparing the present value of future cash

inflows and outflows. It helps managers decide

whether to proceed with projects under current tariff

rates (Damodaran, 2012). It converts the net cash

flows of an investment over its entire life into the sum

of equivalent present values based on a predetermined

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

322

target rate of return. Assuming that the expected cash

inflow can be realized at the end of the year, and

considering the initial investment as borrowed at a

predetermined discount rate, when the net present

value is positive, the project still has spare income

after repaying the principal and interest. When the net

present value is zero, there is no profit left. When the

net present value is negative, the project's income is

insufficient to repay the principal and interest. For

example, when a transnational company needs to

evaluate an investment project, it needs to estimate

cash flows in local currency first, and then, convert

projected local cash flows into the parent company’s

currency. Thirdly, it uses the cost of capital, adjusted

for country risk premium, exchange rate risk and

inflation differences to determine the discount rate,

which will be applied calculating the present values.

Adjustments for transfer pricing, tariffs, and capital

controls that affect repatriation should be put into

consideration. Finally, it subtracts the initial

investment from the total present value of future cash

flows and decides whether the project is feasible.

*NFC (t) refers to the net cash flow in year t; K refers to the

discount rate; I refers to the initial investment amount; n

refers to the expected service life of the project

3.2.2 Real Options Theory

Real Options Theory provides a framework for

making flexible investment decisions under

uncertainty. This theory helps companies adapt to

changing tariff environments by allowing them to

delay or modify investment decisions(Trigeorgis,

1996) (Copeland & Antikarov, 2001). In theory, a real

option is an economically valuable right (without an

obligation) to gain real assets whose expected future

cash flows are linked to the development of a new

product through R&D investments, patent

exploitation, expansion of production scale and so on.

Under globalization, companies can use real options

to delay investment decisions until more information

is available about tariff changes, thereby minimizing

potential losses. It helps firms reframe reciprocal

tariffs not just as threats, but as triggers for strategic

flexibility. Instead of locking into rigid plans,

companies can design adaptive strategies that treat

investment decisions as options—waiting, switching,

abandoning, or expanding—as conditions evolve.

This dynamic approach enhances competitiveness in

an uncertain and protectionist global trade

environment.

In short, the NPV method helps managers decide

whether a project is profitable or not under the current

tariff rates while The Real Option Theory values the

flexibility to adapt decisions over time in uncertain

environments, which helps companies to respond

dynamically to changing tariffs. However, NPV

method may have some limitations when tariffs keep

changing because it assumes fixed conditions.

4 CROSS-INDUSTRY ANALYSIS:

TAKE CHINA AS AN

EXAMPLE

The reciprocal tariff policy has sent ripples across

China’s economic landscape, particularly affecting its

key industries: manufacturing, retailing and services.

Each sector has experienced distinct challenges while

also adopting innovative strategies to adapt and

remain competitive in a changing global trade

environment.

In Cross-industry analysis, the study is going to

introduce the characteristics of manufacturing,

retailing and service industries in China and analyse

what strategies do they adopt in response to the

reciprocal tariffs imposed by the USA.

4.1 Manufacturing

The manufacturing industry in China is characterized

by high output volume and cost efficiency. It has

become the global leader in manufacturing through its

extensive industrial infrastructure, low labour costs,

and government support for export-driven growth.

The industry focuses on electronics, textiles,

machinery, and more recently, electric vehicles and

green energy technologies. Recently, it was

showcasing China's national strength to the world

with its remarkable rapid development.

When it comes to problems, however, the sector

has borne the brunt of U.S. tariffs. Key exports, such

as electronics, machinery, automotive components

and consumer goods, are facing increased costs and

reduced competitiveness in the U.S. market due to

high import duties. The 125% tariff on critical

businesses like electric vehicles and solar panels has

sharply curtailed Chinese manufacturers’ access to

one of their largest export markets (Hong Zhu et al.,

2025). This has led to decreased factory orders,

margin compression, and concerns about

overcapacity in domestic production.

To alleviate the economic losses caused by tariff

pressure, many manufacturers are seeking alternative

solutions. By calculating the net present value of

continuing versus shifting operations, managers make

decisions on whether to retain the US market or not.

Globalization and Corporate Financial Decision-Making: A Multi Dimension of Industry, Market and Institutional Influence

323

With declining NPV of U.S (Moffett et al., 2021).

market-oriented production due to tariffs, firms are

instead investing in South Asia, Mexico, and Africa

where markets contain a higher future cash flow

potential and lower trade barriers. Besides, firms are

adopting “option-based” flexibility. For example,

keeping idle capacity in China while building

modular plants in Vietnam or India creates

operational flexibility, allowing them to observe the

change of trade climate. Since this approach treats

international expansion as a series of real options,

which minimizes risk in uncertain global conditions.

4.2 Retailing

As one of the most dynamic and tech-driven sectors

in the world, the retailing industry in China is

prosperously developing. There’s an obvious

characteristic of the industry in China, which is called

“E-Commerce Dominance”. Many platforms like

Alibaba, JD.com and Pinduoduo dominate retail, with

online sales making up a large portion of total retail

revenue. These sales are promoted by the emergence

of a new promotion mean called real-time livestream

selling.

While not directly subject to tariffs, Chinese

retailers are facing downstream effects from higher

input costs and disrupted supply chains for imported

goods. Additionally, reduced household confidence

because of macroeconomic uncertainty affects

consumption.

Continuously meeting consumer demands while

maintaining industry stability have become the top

priorities for Chinese retailers. Firstly, they are trying

to leverage national pride and consumers’

nationalism, strategically promoting local brands.

This sentiment-driven strategy, while not grounded in

traditional finance theory, complements real options

logic: it provides a low-risk, high-upside branding

shift without major capital expenditure. Secondly,

large retailers are prioritizing retained earnings and

internal cash flows to finance supply chain

optimizations, smart inventory systems and AI-based

customer analytics. Here’s a classic case: JD.com.

Rather than relying heavily on external equity

markets, especially during periods of macroeconomic

instability and investor scepticism. Moffett et al.

(2021) highlight that rather than relying heavily on

external equity markets, JD has prioritized internal

cash flows and retained earnings to fund its supply

chain restructuring and AI-driven retail technology

(Brealey et al., 2022). For instance, JD reinvested a

significant portion of its net income into expanding

its proprietary warehousing and logistics

infrastructure, rather than issuing new equity. This

aligns with the logic of the Pecking Order Theory:

Firms prefer internal financing to minimize

information asymmetry and avoid signalling risk to

the market.

4.3 Service

Since China is the second most populous country

in the world, its service sector is highly developed,

and it is still growing. The industry has provided 331

million people with job opportunities. What’s more,

it now accounts for over 50% of China’s GDP, which

signals a shift from manufacturing-led growth. The

integration of the service industry with emerging

technologies has also brought new vitality to this

sector. For example, digital services like fintech,

online entertainment, education platforms and cloud

computing are expanding rapidly, too. However, they

are undergoing significantly indirect consequences

due to slowing trade, rising operational costs and

weakened investor confidence. Meanwhile, cross-

border financial services and logistics firms have

experienced reduced volumes and higher geopolitical

risk premiums.

The study will take Aliyun as an example to

explain how a cloud computing company responds to

reciprocal tariffs and how it copes with the risks.

According to the FY 2022 Annual Report and the FY

2024 Annual Report of Alibaba Groups Investor

Relations website, the total debt of the firm rose from

154.5 billion RMB to 180.8 billion RMB, while its

EBITDA increased from 186.2 to 210.3 billion RMB.

This resulted in a stable Debt/EBITDA ratio hovering

around 0.86, well within safe limits. During the same

period, Aliyun ’ s revenue surged from 100.2 to

137.6 billion RMB, reflecting successful capital

deployment into high-growth digital infrastructure

(Alibaba Group, 2022; Alibaba Group, 2023; Alibaba

Group, 2025). Data mentioned above can be seen in

figure 1.

Figure 1: Alibaba Cloud: Debt/EBITDA Ratio vs Cloud

Revenue (2022-2024). Picture credit: Original

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

324

This financing decision exemplifies a balanced

risk-return approach. By maintaining moderate

leverage, Alibaba maximizes tax benefits and avoids

the dilution of control associated with equity

financing, especially critical in a volatile geopolitical

landscape. It can be concluded that a firm should

borrow just enough to fund growth efficiently, while

safeguarding its financial stability. As U.S. reciprocal

tariffs continue to strike global markets, such theory-

based decision-making offers a blueprint for resilient

corporate finance in China ’ s evolving service

sector.

4.4 Government Response

In all three sectors, China’s governments have played

a practice role. For examples, a large amount of

subsidies and tax relief have been provided as support

to export-heavy manufacturers and logistics

providers. Besides, billions have been allocated to AI,

green energy and industrial automation to help

industries move up the value chain. In the field of

diplomacy, China is actively engaging in regional and

global trade forums to open alternative markets and

reduce dependency on the U.S.

5 CROSS-MARKET ANALYSES:

TAKE JAPAN AS AN

EXAMPLE

While China has been the primary target of the United

States’s reciprocal tariff policy, Japan’s deeply

export-oriented economy has not been immune to the

indirect effects.

In cross-market analysis, the study aims to explore

how Japan’s labour market, merchandise market and

financial market are responding to an evolving under

these new global trade conditions.

5.1 Labor Market

Japan’s labour market has shown notable resilience

largely due to its diversified export portfolio and

stable domestic service industry. Although it was not

directly targeted by the tariffs, industries linked to

U.S.-China supply chains, such as automobiles,

semiconductors and precision machinery, have seen

slower growth. Among the huge market, Toyota is a

good example illustrating automotive sector

adjustment amid global shocks.

In a strategic move, it announced plans to relocate

a portion of its GR Corolla production from Japan to

its Burnaston plant in Derbyshire, UK. This decision

is influenced by a recent UK-U.S. trade agreement

that reduces tariffs on UK-manufactured vehicles

exported to the U.S. from 25% to 10% for up to

100,000 vehicles annually. (Karim C., 2025)

The Burnaston facility, currently operating below

capacity, will receive an investment of approximately

¥8 billion to establish a new assembly line capable of

producing 10,000 units annually, primarily for the

North American market.

To facilitate the production transition, it plans to

dispatch Japanese engineers to the UK to assist in

setting up the new assembly line. This temporary

redeployment underscores the need for workforce

flexibility and may influence future training and

development programs within Japan to support

internationalization operations. Data mentioned

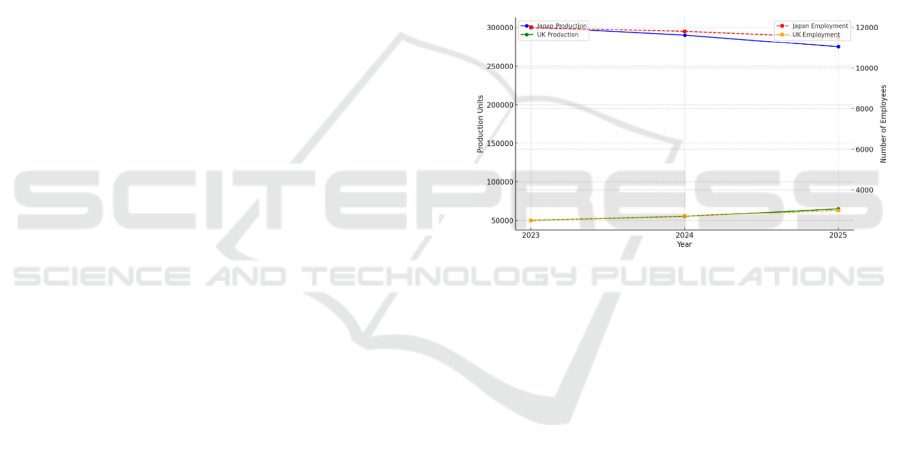

above can be seen in figure 2.

Figure2: Toyota Global Production and Employment

Impact (2023-2035) Picture credit: Original.

5.2 Merchandise Market

As the U.S. shifts its tariff posture, Japan is facing

dual challenges such as reduced cost-efficiency in

regional supply chains, especially those involving

China, and increased pressure to prove reciprocal

trade fairness.

To save themselves, Japanese importers are

actively diversifying sourcing strategies. Many firms

have increasingly localized workshops in the United

States and Southeast Asia to bypass tariff-related

costs. For example, Panasonic has expanded its

battery production facilities in Nevada, while

companies like Denso are investing in North

American R&D hubs. These moves support U.S.

operations but reduce the volume of finished goods

exported directly from Japan. Data mentioned above

can be seen in figure 3.

Globalization and Corporate Financial Decision-Making: A Multi Dimension of Industry, Market and Institutional Influence

325

Figure3: Pre&Post-Tariff Production Localization Picture

credit: Original.

With the reciprocal tariffs raising the cost of

Chinese components, Japan is deepening its

economic partnerships with Vietnam, Thailand and

India to build more resilient and cost-effective supply

chains. This strategy not only mitigates immediate

tariff risks but also aligns with Tokyo’s long-term

economic diplomacy goals under its Indo-Pacific

strategy

5.3 Financial Market

Japan’s financial market can be seen as a safe haven

in a volatile landscape. The yen has maintained its

role as a safe-haven currency, appreciating during

periods of global uncertainty driven by tariff

escalations. Although this strengthens investor

confidence, it also poses challenges for exporters by

making Japanese goods more expensive abroad.

The financial market is always inseparable from

equities and dividends. Japanese equity markets have

reflected sectoral divergence. Export-heavy firms in

the automotive and electronics sectors have

experienced volatility in response to tariff

developments, while domestically focused industries,

such as retail, healthcare and financial services, have

remained stable or developed. Institutional investors

and corporate treasuries have responded by

diversifying asset allocations, with increased

investment in non-U.S. markets and local innovation.

At the policy level, the Bank of Japan has

continued its accommodative stance, which provides

liquidity and maintaining low interest rates to support

capital flows and ensure credit stability. Government-

backed agencies have also extended credit and

insurance to exporting SMEs facing demand

uncertainty.

By spreading production risk, investing in new

markets, and preserving employment stability, Japan

offers a blueprint for how advanced economies can

navigate the uncertainties of modern trade while

sustaining long-term growth.

6 CROSS-COUNTRY ANALYSES

The United States’ policy of reciprocal tariffs, where

taxes match or exceed those imposed by trade

partners, has reshaped the dynamics of international

commerce. While originally aimed at correcting long-

term trade imbalances and advocating for more

equitable market access, the ripple effects of these

tariffs have significantly impacted major economies

such as China and Japan. This analysis explores how

each of these three countries, China, Japan and the

United States, has been influenced by and responded

to these reciprocal tariffs across trade, production,

and economic strategy.

6.1 China

China, as the primary target of the United States'

tariffs in this trade war, has undergone a burden over

$300 billion worth of goods, including electronics,

machinery and consumer products, disrupted export

volumes and pressured manufacturers to reassess

their global positioning.

In response, China has pursued a dual strategy.

Firstly, it accelerated the diversification of its export

markets under the Belt and Road Initiative and

deepened trade ties with ASEAN nations, the Middle

East and Africa. Secondly, Chinese firms have

increasingly “decoupled” sensitive supply chains,

especially in the tech sector, by localizing plants or

investing in third countries such as Vietnam and

Indonesia.

Moreover, the government has provided subsidies

and tax relief for affected export enterprises while

promoting domestic consumption to counterbalance

weakening external demand. However, these

strategies haven’t fully offset losses because foreign

investment inflows to China have slowed, and

manufacturers face rising costs due to the need to

“tariff-proof” supply chains.

6.2 Japan

Although not being directly affected, the imposition

of a 25% tariff on Japanese car imports by the U.S. in

2025 marked a turning point, prompting major

manufacturers to adapt. Toyota’s decision to shift

production of the GR Corolla from Japan to the UK

exemplifies how Japanese firms are leveraging third-

country trade agreements to bypass U.S. tariffs. By

exploiting the UK-U.S. trade deal that offers

preferential tariff treatment, Japanese firms are

maintaining U.S. market access without escalating

costs.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

326

Japanese companies are also expanding

workshops in North America and Southeast Asia,

thereby isolating themselves from tariff exposure.

Meanwhile, Tokyo has responded diplomatically by

strengthening bilateral and multilateral trade

frameworks, such as the CPTPP and the Japan-EU

Economic Partnership Agreement, to reduce

dependence on any single trade corridor.

Japan’s economic resilience is also supported by

a stable financial market and a robust monetary

policy, although these come at the cost of reduced

export competitiveness. Labor markets remain stable

due to domestic redeployment strategies and the

country’s long-standing tradition of lifetime

employment in major firms.

6.3 The United States

For the United States, the reciprocal tariff policy is a

part of a broader industrial policy aimed at restoring

manufacturing, protecting intellectual property, and

correcting structural trade deficits. While these

measures have achieved some near-term gains, for

example, a rebound in U.S. steel and semiconductor

investments. They have also raised import costs,

contributing to inflationary pressures and supply

chain distortions. The reason why side-effects exist is

that U.S. consumers and businesses have faced higher

prices for imported goods, especially electronics and

textiles. What’s more, retaliation from China and

other trading partners has hurt U.S. agricultural

exports and high-end manufacturing industries like

aerospace.

However, the U.S. has encouraged domestic

investment through legislative tools like the Inflation

Reduction Act and CHIPS Act. These policies aim to

create high-value jobs and rebuild industrial capacity

in strategic sectors. Still, the full economic benefits of

these policies are long-term, while the short-term

disruptions of tariff wars continue to ripple through

the economy.

7 CONCLUSIONS

The study finds that companies in China, Japan, and

the United States adopt different strategies to cope

with reciprocal tariff policies, influenced by industry

characteristics, market conditions, and institutional

factors, which provide valuable insights for

policymakers and business leaders on how to navigate

the complexities of global trade and tariff policies.

However, this study is limited by the availability of

data on specific companies’ financial decisions.

Future research could explore case studies of

individual companies to provide more detailed

insights.

REFERENCES

Accountancy. (2025, April 6). Forecasting the Impact of

Trump ’ s 2025 Reciprocal Tariffs. Auditing

Accounting. Retrieved June 14, 2025, from

https://auditingaccounting.com

Alibaba Group. Fiscal Year 2022 Annual Report, February

20, 2025 [June 14, 2025],

https://www.alibabagroup.com/en-US/ir-financial-

reports-financial-results

Alibaba Group. Fiscal Year 2022 Annual Report, July 21,

2023 [June 14, 2025],

https://www.alibabagroup.com/en-US/ir-financial-

reports-financial-results

Alibaba Group. Fiscal Year 2022 Annual Report, July 26,

2022 [June 14, 2025],

https://www.alibabagroup.com/en-US/ir-financial-

reports-financial-results

Brealey, R. A., Myers, S. C., & Allen, F. (2022). Principles

of Corporate Finance (14th Edition). McGraw-Hill.

Christopher C. (2025, May 26). Japan to spend 6.3 billion

for tariff relief package, Kyodo reports. Reuters.

Retrieved June 14, 2025, from https://www.reuters.com

Copeland, T., & Antikarov, V. (2001)., Real Options: A

Practitioner’s Guide. Texere.

Damodaran, A. (2012). Investment Valuation: Tools and

Techniques for Determining the Value of Any Asset

(3rd Edition). Wiley.

Eiteman, D. K., Stonehill, A. I., & Moffett, M. H. (2016).

Multinational Business Finance (14th Edition). Pearson.

Eric C.E., Kevin G., Zhu Wang, Jeffrey G.W., Christopher

F., Santiago G.C., Meghan P. (2025, April 17).

Important Updates to President Trump’s Reciprocal

Tariffs. Steptoe. Retrieved June 14, 2025, from

https://www.steptoe.com

Hong Zhu, Wenxin Chen, Sheng Tang. (2025, April 22).

Analysis of the Impact of the U.S. “Reciprocal Tariff”

Policy on Global Supply Chains and China’ s Co.

Chambers. Retrieved June 14, 2025, from

https://www.chambers.com

Karim C. (2025, May 29). Wheely Moving World ’ s

Largest Car Maker Hatching Plans to Invest £ 40

million in a New Assembly Line in UK. The Scottish

Sun. Retrieved June 14, 2025, from

https://www.thescottishsun.co.uk

Moffett, M. H., Stonehill, A. I., & Eiteman, D. K. (2021).

Fundamentals of Multinational Finance (6th Edition).

Pearson.

Ross, S. A., Westerfield, R. W., & Jaffe, J. (2021).

Corporate Finance (13th Edition). McGraw-Hill.

Trigeorgis, L. (1996). Real Options: Managerial Flexibility

and Strategy in Resource Allocation. MIT Press.

Globalization and Corporate Financial Decision-Making: A Multi Dimension of Industry, Market and Institutional Influence

327