Managing and Optimizing Capital Structure for Profit Maximization:

A Comparative Analysis of Apple and Tesla

Zhihao Jiang

Shanghai Pudong Foreign Languages School, Shanghai, 201200, China

Keywords: Capital Structure, Capital Management, Profit Maximization, Apple, Tesla.

Abstract: This paper examines the capital structure optimization strategies of Apple and Tesla, two leading technology

companies, to understand how they maximize profits through strategic financial management. The study aims

to uncover the underlying principles that contribute to their financial success and market dominance. The

research finds that Apple’s low equity-debt ratio, high credit rating, and reliance on equity funding support

its stable financial position and innovation-driven growth. In contrast, Tesla’s journey from high-risk early-

stage financing to later-stage optimization through vertical integration and cost reduction highlights the

importance of strategic pivots in capital structure management. Both companies demonstrate the significance

of balancing debt and equity to achieve financial flexibility and sustainability. The study concludes that a

well-optimized capital structure is crucial for corporate profitability and resilience. It suggests that tailoring

firm’s capital structures to align with its growth stages and market conditions is crucial for the firm to

maximize profit. For investors, understanding these strategies can provide insights into evaluating company

financial health and potential returns. For corporate leaders, the findings emphasize the need for dynamic

capital structure management to support innovation and long-term growth.

1 INTRODUCTION

The capital structure of a firm, defined as the mix of

debt and equity used to finance its operations, is a

fundamental determinant of its financial performance

and strategic positioning. A well-optimized capital

structure can enhance profitability, reduce financial

risk, and maximize shareholder value. The seminal

work of Modigliani and Miller (1963) introduced the

concept of the tax shield, suggesting that debt

financing can provide tax advantages due to the

deductibility of interest expenses. However, this

benefit must be balanced against the potential for

increased financial distress costs. More recent

research, such as that by Zhang et al. (2008), has

highlighted the role of agency costs in shaping capital

structure decisions, emphasizing the need for a

delicate balance between debt and equity to minimize

these costs. This complex interplay of factors

underscores the importance of understanding how

firms can optimize their capital structure to achieve

sustainable growth and financial stability.

Given the critical role of capital structure in

corporate finance, this paper aims to provide a

comprehensive comparative analysis of how two

leading technology companies, Apple and Tesla, have

managed and optimized their capital structures to

maximize profits. By examining their strategies, we

seek to uncover the underlying principles and

practices that have contributed to their financial

success and market dominance. This analysis will

offer valuable insights for other firms seeking to

optimize their own capital structures in a highly

competitive and dynamic business environment.

The following parts of this paper are organized as

follows: Section 2 introduces the concept of financial

tolerance of enterprises and its relevance to capital

structure optimization. Section 3 provides a detailed

case study of Apple Inc., examining its market

expansions, supply chain management, low equity-

debt ratio, high credit rating, and reliance on equity

funding. Section 4 focuses on Tesla, analyzing its

growth stages, early and mature stage strategies, and

investment opportunities. Finally, Section 5

concludes the paper with a summary of key findings

and implications for corporate finance practice.

Jiang, Z.

Managing and Optimizing Capital Structure for Profit Maximization: A Comparative Analysis of Apple and Tesla.

DOI: 10.5220/0014351100004718

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2025), pages 283-288

ISBN: 978-989-758-792-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

283

2 FINANCIAL TOLERANCE OF

ENTERPRISE

2.1 Case Intro

Apple Inc. occupies a pivotal position in the global

technology industry, renowned for its leadership in

key segments such as smartphones, tablets, and

personal computers. Despite its dominance, Apple

operates in a highly competitive landscape, facing

intense rivalry from companies like Samsung, Xiaomi,

and Huawei. In the smartphone market, Apple held a

26.98% global market share in 2023, with Samsung

as its primary competitor at 27.38% (StatCounter,

2024). While Apple led the U.S. market with 55.85%,

Samsung and other competitors like Xiaomi, Oppo,

and Huawei have made significant inroads, especially

in emerging markets.

Apple’s product portfolio is meticulously

designed to create a seamless ecosystem. The iPhone,

accounting for 52% of its revenue, serves as the

cornerstone, driving customer acquisition and loyalty.

Services like the App Store, Apple Music, and iCloud

contribute 22% of revenue, enhancing ecosystem

lock-in through recurring income. The Mac lineup

(11% of revenue) targets professional users, while

wearables such as the Apple Watch (10% of revenue)

deepen the ecosystem and support Apple’s health

initiatives. The iPad, with a 5% revenue share, is

strong in the education market (Apple, 2024).

Apple’s competitive edge lies in its unparalleled

brand loyalty, driven by its reputation for innovation

and high-quality products. Its seamless integration of

hardware, software, and services creates a cohesive

user experience that is hard for competitors to

replicate. This ecosystem approach not only enhances

user satisfaction but also fosters long-term customer

relationships. While competitors offer diverse and

often more affordable options, Apple’s focus on

premium products and services ensures its continued

leadership in the technology industry, setting it apart

as a benchmark for innovation and excellence (Lins

et al., 2010).

2.2 Market Expansions

The launch of the iPhone and iPad serves as two of

the finest examples of Apple's revolutionary

influence on the tech industry, and it consistently

demonstrates that it can increase profits through

strategic market expansion. These products

demonstrated Apple's distinct approach to innovation

and customer engagement by not only capturing a

sizable market share but also opening up completely

new markets.

The 2007 release of the iPhone revolutionized the

smartphone market. Mobile phones were mostly

useful gadgets with restricted features at the time.

However, Apple's iPhone created an unmatched user

experience by fusing a powerful operating system, a

sleek design, and an easy-to-use touch interface into

a single device. A number of important factors

contributed to the success of the iPhone. First, Apple's

brand, already synonymous with quality and

innovation, provided instant credibility and consumer

trust (Myers, 1984). Second, the product itself was a

masterpiece of innovation, offering features like a

high-resolution display, app ecosystem, and seamless

integration with other Apple devices (Frank & Goyal,

2003). Third, Apple's marketing strategy, which

focused on simplicity and ease of use, resonated with

a wide range of consumers, from tech enthusiasts to

casual users (Fama & Frech, 2005). The iPhone's

launch not only captured market share but also

expanded the overall smartphone market, creating

new opportunities for growth.

Similarly, the iPad's debut in 2010 created a new

market segment altogether. Tablets had previously

struggled to find a foothold, but the iPad's intuitive

interface, portability, and versatility made it an instant

hit. The iPad's success was again rooted in Apple's

brand strength, which positioned the device as a

premium product. Its innovation lay in its ability to

bridge the gap between smartphones and laptops,

offering a device that was both powerful and easy to

use (Gromb & Scharfstein, 2002). Apple's marketing

campaigns highlighted the iPad's versatility,

promoting it as a tool for entertainment, education,

and productivity. The iPad's seamless integration

with the existing Apple ecosystem, including the

iPhone and Mac, further solidified its appeal and

encouraged cross-device purchases (Bancel & Mittoo,

2004).

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

284

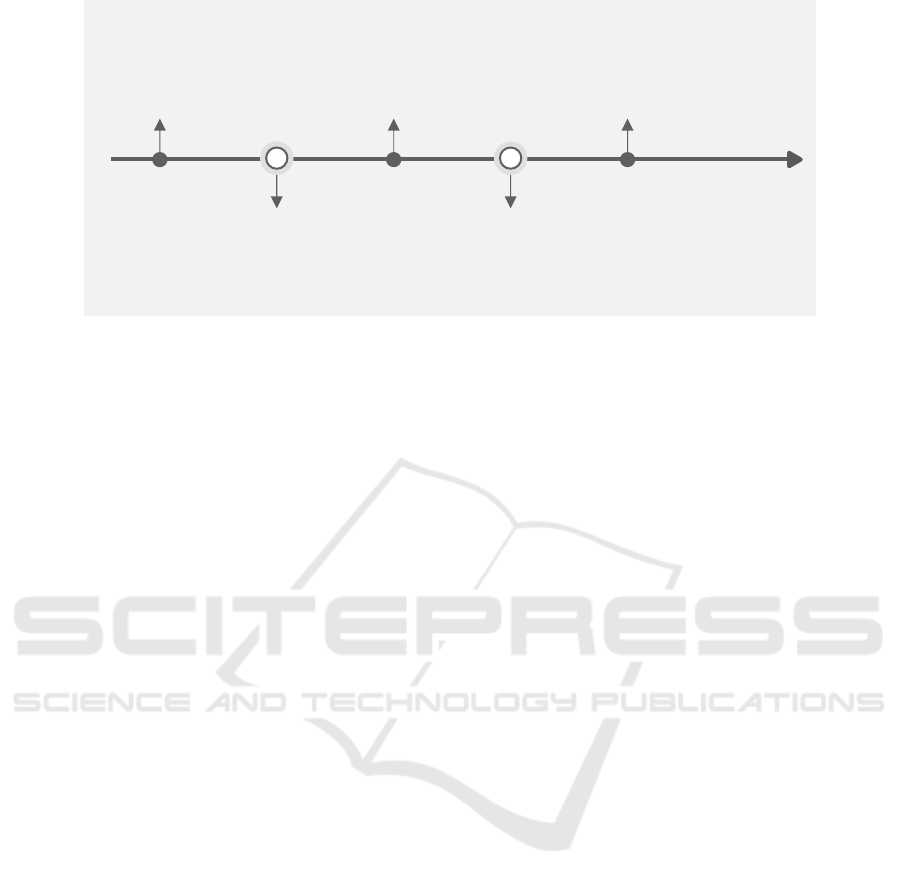

Figure 1 iPhone market share changes from 2003 to 2023 (Photo credit: Original).

In both cases, Apple's market expansion strategies

were underpinned by its brand advantage, product

innovation, and effective marketing (please see

Figure 1). The iPhone and iPad were not just products;

they were platforms that transformed user behavior

and expectations. By leveraging its brand to build

consumer trust, innovating to create unparalleled user

experiences, and marketing these products as

essential components of a seamless ecosystem, Apple

was able to capture significant market share and drive

substantial revenue growth. These strategies not only

maximized profits but also set new industry standards,

demonstrating Apple's unparalleled ability to shape

markets through strategic expansion.

2.3 Supply Chain Management

Apple’s supply chain management is a strategic asset

that drives profit maximization through efficient

operations and cost control. At its core, Apple’s

supply chain is characterized by close collaboration

with a select group of top-tier suppliers and the

implementation of a just-in-time (JIT) inventory

system. This approach ensures that components are

produced and delivered precisely when needed,

minimizing inventory holding costs and reducing

waste.

By maintaining tight relationships with suppliers,

Apple can exert significant influence over the quality

and cost of components. These partnerships enable

Apple to secure favorable pricing and ensure that

suppliers meet its stringent quality standards.

Additionally, the JIT system allows Apple to align

production schedules closely with market demand,

reducing the risk of overproduction and excess

inventory. This not only lowers storage costs but also

improves cash flow by freeing up capital that would

otherwise be tied up in inventory (Song, 2024).

Moreover, Apple’s supply chain management

supports its production and sales activities by

enabling rapid response to market changes. The

flexibility of the supply chain allows Apple to quickly

adjust production volumes and introduce new

products without significant disruptions. This agility

is crucial in the fast-paced technology industry, where

consumer preferences and technological

advancements can change rapidly (Tesla, 2024).

In summary, Apple’s supply chain management

achieves profit maximization by reducing costs

through efficient inventory management, ensuring

high-quality components through close supplier

collaboration, and maintaining operational flexibility

to support rapid innovation and market

responsiveness.

2.4 Low Equity-debt Ratio

The secret to Apple's optimal capital structure is its

low equity-debt ratio. Apple lowers the risk of high

interest costs and financial distress by relying more

on equity than debt, ensuring financial stability and

flexibility. It can tolerate market volatility because of

its cautious approach. In the meantime, Apple

strategically employs debt to finance capital return

initiatives such as dividends and share buybacks,

increasing shareholder value and reaping tax benefits.

Apple is able to invest in expansion and innovation

while maintaining a solid financial position thanks to

this balance. The secret to Apple's optimal capital

structure is its low equity-debt ratio.

This strategy has several advantages. First, a low

equity-debt ratio indicates that a company relies more

on equity than debt, which generally implies lower

financial risk. For Apple, this conservative approach

ensures financial stability and flexibility, allowing it

to better tolerate market volatility. Second, by

2003

3%

2013

15.3%

2023

26.98%

2010

18%

2016

18%

Managing and Optimizing Capital Structure for Profit Maximization: A Comparative Analysis of Apple and Tesla

285

strategically employing debt to finance capital return

initiatives such as dividends and share buybacks,

Apple can increase shareholder value and reap tax

benefits. This balance enables Apple to invest in

expansion and innovation while maintaining a solid

financial position.

However, there are also potential disadvantages to

consider. A very low equity-debt ratio might suggest

that the company is not fully leveraging the tax

benefits of debt financing, which could potentially

limit its ability to maximize returns. Additionally, if

the company has excess cash that it is not effectively

utilizing for growth opportunities, it could be seen as

a missed opportunity for further expansion. Overall,

Apple's strategy of maintaining a low equity-debt

ratio has proven effective in supporting its financial

stability and strategic initiatives (Tesla, 2024).

2.5 High Credit Rating

Apple’s high credit rating plays a crucial role in

optimizing its capital structure and maximizing

profits. A high credit rating signifies strong financial

health and low default risk, enabling Apple to access

capital at favorable terms. This rating reflects Apple’s

robust financial position, characterized by consistent

revenue growth, high profitability, and substantial

cash reserves. Apple’s ability to generate strong free

cash flow and maintain a conservative debt-to-equity

ratio further enhances its creditworthiness (Tesla,

2024).

The significance of a high credit rating lies in its

ability to reduce borrowing costs. With a top-tier

rating, Apple can issue bonds at lower interest rates,

minimizing the cost of debt financing. This is

particularly advantageous for large-scale capital

expenditures, such as R&D investments and strategic

acquisitions. For example, Apple has used debt

financing to fund its extensive R&D programs and

acquisitions like Beats Electronics, which have

expanded its product portfolio and technology

capabilities without significantly increasing financial

risk (Apple, 2024).

Moreover, a high credit rating provides Apple

with greater financial flexibility. It allows the

company to manage its capital structure more

effectively by balancing debt and equity financing.

Apple can take advantage of market conditions to

issue debt at optimal times, while also maintaining a

strong equity position. This flexibility ensures that

Apple can pursue strategic initiatives and respond to

market opportunities without compromising its

financial stability (Apple, 2024).

2.6 Equity Funding

Apple primarily relies on equity funding, which

reduces its dependence on debt and minimizes

financial risk. The company also returns capital to

shareholders through dividends and share buybacks,

balancing growth with shareholder value creation.

Apple effectively optimizes its capital structure and

maximizes profits through strategic use of equity

funding. By primarily relying on equity rather than

excessive debt, Apple maintains a strong financial

position with low financial risk. Equity funding,

sourced from shareholders and retained earnings,

provides a stable capital base that supports Apple’s

extensive R&D investments, which are crucial for

driving innovation and maintaining its competitive

edge. For instance, Apple’s significant spending on

R&D ($31.3 billion in 2024) is largely financed

through equity, enabling the development of

groundbreaking products like the iPhone, iPad, and

Vision Pro. These innovations not only boost revenue

but also enhance brand loyalty and market dominance

(Song, 2024).

Moreover, equity funding allows Apple to pursue

strategic acquisitions, such as Beats Electronics,

which expand its product portfolio and technology

capabilities without incurring substantial debt. This

approach ensures that Apple can integrate new

technologies seamlessly into its ecosystem, driving

long-term growth. Additionally, by maintaining a low

debt-to-equity ratio, Apple preserves financial

flexibility to respond to market changes and invest in

emerging opportunities, such as augmented reality

and virtual reality. This balanced capital structure

supports Apple’s ability to return capital to

shareholders through stock buybacks and dividends,

further enhancing shareholder value. Overall, equity

funding enables Apple to sustain high levels of

investment in innovation and strategic growth while

minimizing financial risk, thereby maximizing profits

and ensuring long-term financial stability (Apple,

2024).

2.7 Innovation & Integration

Continuous innovation and integration of products

and services are key to Apple's success. The company

invests heavily in research and development to create

innovative products and services, maintaining its

competitive edge in the market. Apple leverages

innovation and integration to optimize its capital

structure and maximize profits, creating a cohesive

ecosystem that drives both user loyalty and financial

success. Through continuous innovation, Apple

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

286

consistently introduces groundbreaking products like

the iPhone, iPad, and Apple Watch. These products

not only capture significant market share but also

command premium prices, contributing to high gross

margins. For example, the iPhone alone accounts for

over 50% of Apple’s revenue, highlighting the

profitability of its innovative flagship product (Song,

2024).

Moreover, Apple’s focus on integration ensures

that all its products and services work seamlessly

together. The seamless ecosystem of hardware,

software, and services enhances the user experience,

encouraging customers to purchase multiple Apple

products. This strategy not only increases individual

customer spending but also creates a barrier to entry

for competitors, further solidifying Apple’s market

position (Apple, 2024).

In addition, Apple’s investment in innovation and

integration supports its capital structure by reducing

dependency on external financing. By maintaining a

strong cash flow from its highly profitable products,

Apple can fund its R&D and strategic acquisitions

internally. This approach minimizes debt and interest

expenses while maximizing financial flexibility.

Apple’s ability to innovate and integrate its products

and services thus not only drives revenue growth but

also optimizes its capital structure, leading to

sustained profitability and long-term financial

stability (Apple, 2024).

3 GROWTH STAGE &

INVESTMENT

OPPORTUNITIES

3.1 Early Stage Strategy

In its early stages, Tesla faced significant financial

challenges and high investment demands. The

company focused on electric vehicle (EV) technology

research and development, production facility

construction, and brand promotion, all of which

required substantial funding. For example, the

development of Tesla's first model, the Roadster, saw

costs soar from an initial estimate of $25 million to

over $140 million. Additionally, during the 2008

global financial crisis, Tesla nearly went bankrupt,

relying on emergency funding from Elon Musk and

other investors to stay afloat (Apple, 2024).

Tesla's financial performance in the early years

was far from ideal. Despite the Roadster's success in

demonstrating the potential of electric vehicles, its

high development costs and limited market volume

made profitability elusive. Similarly, the

development and production of Model S required

massive investments. To support these high

expenditures, Tesla raised funds through its initial

public offering (IPO), equity financing, and

convertible bond issuances (Apple, 2024). While

these financing activities helped expand production

capacity, they also led to high financial risks and

rapid cash burn.

3.2 Mature Stage Strategy

In the later stages, Tesla implemented a series of

strategies to optimize its capital structure and

maximize profits. First, the construction of the

Gigafactory enabled vertical integration of battery

production, significantly reducing battery costs. For

example, the Gigafactory's operations led to a

substantial decrease in the cost per kilowatt-hour of

batteries, thereby improving the profit margins of

electric vehicles (Song, 2024). Additionally, Tesla

further enhanced production efficiency and reduced

unit production costs through automation and process

improvements.

Second, Tesla focused on optimizing capital

expenditure efficiency in the later stages. The

company improved production processes, adopted

innovative manufacturing technologies (such as

Gigacasting), and expanded its global production

network, further reducing production costs (Tesla,

2024). These measures not only increased production

efficiency but also strengthened Tesla's

competitiveness in the global market. At the same

time, Tesla implemented dynamic pricing strategies

and optimized its product lineup to further enhance

profitability.

Finally, Tesla continued to invest in technological

innovation and market expansion, further

consolidating its leading position in the electric

vehicle sector. For example, investments in

autonomous driving technology and renewable

energy solutions not only added value to the products

but also created new revenue streams (Tesla, 2024).

These strategic initiatives enabled Tesla to achieve

sustainable financial growth while maintaining

technological innovation.

4 CONCLUSION

This paper has explored the capital structure

optimization strategies of two leading technology

companies, Apple and Tesla, to understand how they

maximize profits through strategic financial

Managing and Optimizing Capital Structure for Profit Maximization: A Comparative Analysis of Apple and Tesla

287

management. Given the critical role of capital

structure in corporate finance, the study aimed to

uncover the underlying principles and practices that

have contributed to their financial success and market

dominance. The research found that both companies

have employed distinct strategies to optimize their

capital structures, aligning with their growth stages

and market conditions

Apple's low equity-debt ratio, high credit rating,

and reliance on equity funding have been key to its

stable financial position and innovation-driven

growth. Its strategic use of debt for capital return

initiatives, such as dividends and share buybacks, has

enhanced shareholder value while maintaining

financial flexibility. Apple's seamless ecosystem

integration and continuous innovation have further

solidified its market leadership, driving sustained

profitability and long-term financial stability.

Tesla, on the other hand, has transitioned from

high-risk early-stage financing to a more optimized

capital structure in its mature stage. The construction

of the Gigafactory and vertical integration of battery

production have significantly reduced costs,

improving profit margins. Tesla's focus on optimizing

capital expenditure efficiency and investing in

technological innovation and market expansion have

positioned it as a leader in the electric vehicle sector,

achieving sustainable financial growth while

maintaining technological innovation.

For corporate leaders, the findings emphasize the

need for dynamic capital structure management to

support innovation and long-term growth. Firms

should tailor their capital structures to align with their

growth stages and market conditions, balancing debt

and equity to achieve financial flexibility and

sustainability. For investors, understanding these

strategies can provide insights into evaluating

company financial health and potential returns.

While this paper provides a comprehensive

analysis of Apple and Tesla's capital structure

strategies, it is limited by the availability of data and

the specific focus on these two companies. The

findings may not be directly applicable to other

industries or companies with different market

dynamics and financial profiles.

Future research could explore the capital structure

strategies of other technology companies or industries

to identify common patterns and unique approaches.

Additionally, further studies could investigate the

impact of regulatory changes, technological

disruptions, and global economic conditions on

capital structure optimization. This would provide a

more comprehensive understanding of how

companies can adapt their financial strategies to

navigate evolving market landscapes.

REFERENCES

Apple Inc. (2024). Annual Report. Apple Inc.

Bancel, F., & Mittoo, U. R. (2004). Cross-country

determinants of capital structure choice: A survey of

European firms. Journal of Financial Research, 27(4),

485-507.

Fama, E. F., & French, K. R. (2005). Financing decisions:

Who issues stock? The Journal of Finance, 60(5), 2349-

2383.

Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking

order theory of capital structure. Journal of financial

economics, 67(2), 217-248.

Gromb, D., & Scharfstein, D. (2002). The role of debt in

corporate governance. The Journal of Finance, 57(5),

1979-2006.

Lins, K. V., Servaes, H., & Tufano, P. (2010). What drives

corporate cash holdings in the U.S.? The Journal of

Finance, 65(3), 793-833.

Modigliani, F., & Miller, M. H. (1963). Corporate income

taxes and the cost of capital: A correction. The

American Economic Review, 53(3), 433-443.

Myers, S. C. (1984). The capital structure puzzle. The

Journal of Finance, 39(3), 575-592.

Song, J. (2024). A company analysis of Apple Inc. based on

its internal and external environment. Highlights in

Business, Economics and Management FTMM,

40(2024), 912-918.

StatCounter. (2024). Global Smartphone Market Share.

Retrieved from https://www.statcounter.com/

Tesla Inc. (2024). Annual Report. Tesla Inc.

Zhang, L., et al. (2008). The role of agency costs in capital

structure decisions. Journal of Financial Economics,

89(2), 234-252.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

288