Optimizing Export Strategy of Photovoltaic Modules Under Trade

Policy Constraints: A Linear Programming Approach

Zhaoqi Jin

a

School of Intelligent Finance and Business, Xi’an Jiaotong-Liverpool University, Suzhou, 215000, China

Keywords: Photovoltaic Exports, Linear Programming, Trade Policy, Carbon Adjustment, Tariffs.

Abstract: The This paper develops a linear programming (LP) model to optimize the export strategy of Chinese

photovoltaic (PV) manufacturers under dynamic international trade conditions. Given increasing policy

complexities-such as tariffs, transportation costs, and carbon adjustment mechanisms-the study simulates

cross-border cost structures and identifies optimal production allocation to global markets. The model

incorporates key cost factors including unit production cost, destination-specific transportation fees, country-

level tariff rates, and carbon border adjustment charges. Using a self-constructed virtual dataset, the model

evaluates export allocation to four major markets: the United States, Germany, Japan, and Brazil. Cost

structure analysis shows that tariff-related costs are the most influential factor affecting export decisions,

followed by carbon adjustment charges. Sensitivity analysis reveals that a reduction in U.S. tariff rates

significantly alters the optimal allocation, making the U.S. a viable export destination. Results highlight the

importance of flexible planning tools in navigating policy uncertainty. The study provides a decision-support

framework for Chinese PV exporters to optimize cross-border logistics and minimize total export costs in a

policy-sensitive global environment. This model can be extended to other industries facing similar challenges

in global trade optimization.

1 INTRODUCTION

Building on this foundation, the present study

develops a linear programming (LP) model aimed at

minimizing total export costs for PV modules by

jointly optimizing production allocation and cross-

border distribution. The model integrates critical cost

elements such as manufacturing expenses,

transportation fees, tariffs, and carbon adjustment

levies. This research not only extends the application

of LP techniques to policy-sensitive, multi-node

global supply chains but also offers Chinese PV

exporters a data-driven tool to improve cost

efficiency and strategic adaptability in an

increasingly uncertain trade environment. In a similar

effort to integrate carbon policy into operational

models, a carbon-adjusted tariff evaluation

framework was developed, highlighting the role of

environmental regulations in export decision-making

(Zhu et al., 2021).

The global photovoltaic (PV) industry has

experienced substantial growth in recent years, driven

a

https://orcid.org/0009-0005-3670-192X

by the rising demand for sustainable and clean energy

solutions. According to the International Energy

Agency (IEA), the global installed capacity of solar

PV reached 1,047 Gigawatt by the end of 2022 and is

projected to exceed 2,400 GW by 2030. As the

world’s leading producer and exporter of PV

modules, China occupies a dominant position in the

global solar market. However, this upward trajectory

is increasingly threatened by a shifting international

trade landscape, characterized by escalating tariffs

and tightening regulatory measures.

The global trade environment has grown

increasingly volatile. The World Trade Organization

(WTO) has reported a surge in protectionist measures

and geopolitical tensions, particularly in key sectors

such as energy and electronics. Since 2018, the

United States has enacted multiple rounds of tariffs

on solar imports under trade remedy frameworks such

as Section 201 and anti-dumping policies. In

response, numerous Chinese manufacturers have

relocated production to Southeast Asia in an effort to

circumvent these restrictions. Concurrently, the

Jin, Z.

Optimizing Export Strategy of Photovoltaic Modules Under Trade Policy Constraints: A Linear Programming Approach.

DOI: 10.5220/0014324300004718

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2025), pages 169-174

ISBN: 978-989-758-792-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

169

European Union (EU) has implemented the Carbon

Border Adjustment Mechanism (CBAM) to mitigate

“carbon leakage,” which may significantly increase

the cost of PV exports from high-emission regions.

These developments present new operational

constraints for Chinese PV firms, necessitating

strategic reconfiguration of production and export

plans to maintain global competitiveness under

dynamic policy conditions. In response to these

challenges, a growing body of research has proposed

various modeling approaches to optimize global PV

supply chains. A mixed-integer programming model

was developed to coordinate production and

distribution under tariff-induced cost volatility

(Zhang et al., 2020). A dynamic production allocation

model was introduced to demonstrate how flexible

resource deployment can mitigate the risks associated

with tariff uncertainty (Liu and Wang, 2021). The

role of regional trade agreements was emphasized in

enabling strategic capacity realignment across

markets, highlighting the importance of geographic

diversification (Gong et al., 2023). It was further

argued that operational models should be coupled

with policy forecasting mechanisms to support real-

time decision-making amid regulatory shocks (Chen

and Xu, 2022).

In the context of supply chain resilience, recent

studies have investigated structural responses to

trade-related disruptions. A resilience-based

framework for PV supply chain design was proposed,

advocating for multi-country sourcing and distributed

manufacturing to mitigate political and policy risks

(Sun and Chen, 2022). This framework was expanded

by integrating transportation risk and infrastructure

capacity into optimization models, showing that

alternative routing can substantially reduce

vulnerability to bottlenecks (Huang et al., 2023).

Empirical evidence was provided that firms

optimizing both production and export routing under

an integrated cost-minimization framework achieved

greater profitability in policy-constrained

environments (Wang and Zhao, 2023).

Building on this foundation, the present study

develops a linear programming (LP) model aimed at

minimizing total export costs for PV modules by

jointly optimizing production allocation and cross-

border distribution. The model integrates critical cost

elements such as manufacturing expenses,

transportation fees, tariffs, and carbon adjustment

levies. This research not only extends the application

of LP techniques to policy-sensitive, multi-node

global supply chains but also offers Chinese PV

exporters a data-driven tool to improve cost

efficiency and strategic adaptability in an

increasingly uncertain trade environment.

2 METHODOLOGY

In this part, the data resources used in this study,

variables involved and specific methods will be

introduced.

2.1 Data Source and Description

LP is chosen for its ability to efficiently handle

continuous decision variables and cost minimization

under multiple restrictions. The objective is to

minimize the combined costs of production,

transportation, tariff, and carbon-related fees. The

decision variables represent the number of modules

exported to each destination. Constraints include total

production capacity and the demand of each country.

Due to the sensitivity and limited availability of

detailed cost data from real-world enterprises, this

study constructs a virtual dataset to simulate

representative international export scenarios in the

photovoltaic (PV) sector. The simulation reflects

typical contemporary policy settings and models the

production and policy-induced export costs faced by

Chinese PV manufacturers under realistic global

trade conditions.

The dataset covers five representative countries:

China (serving as the production base), and four

major export destinations — Germany, the United

States, Japan, and Brazil. These countries were

selected based on their strategic relevance, diversity

of trade regulations, geographic distribution, and

significance in the global PV market. This sample

captures typical configurations encountered by

export-oriented manufacturers across multiple policy

environments.

Cost-related parameters-including production

cost, transportation fee, tariff rate, and carbon

adjustment charges-are assigned using aggregated

estimates from recent industry reports, WTO tariff

schedules, and relevant academic literature. Demand

quantities in each destination are also preset to reflect

market scale. To ensure comparability, all cost

elements are standardized on a per-unit basis. The

dataset maintains internal consistency while

representing plausible trade constraints that affect

global solar supply chains.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

170

2.2 Indicator Selection and

Explanation

To capture the major cost drivers in cross-border PV

export, four key indicators are selected in this model:

unit production cost, transportation cost, tariff rate,

and carbon adjustment charge. These parameters

quantify the primary components of total export cost

under current trade and environmental policy

regimes.

Production cost reflects the baseline manufacturing

expense per unit in China and remains constant across

destinations.

Transportation cost varies by destination country

and reflects route-specific logistics expenses.

Tariff rate represents destination-imposed import

duties, applied as a percentage of product value.

Carbon adjustment charge accounts for

environmental policy costs such as the EU CBAM

and is estimated based on emission intensity and

country-specific rules.

These indicators are treated as fixed inputs in the

linear programming model and serve as cost

coefficients in the objective function. This

configuration helps simulate realistic variations in

policy and logistics conditions across export

destinations. The parameter values used in the

simulation are summarized in Table 1.

Table 1: Cost Parameters for PV Export Simulation.

Countr

y

Productio

n Cost

(USD/un

it)

Transpo

rtation

Cost

(USD/u

nit

)

Tariff

Rate

(%)

Carbon

Adjustme

nt

(USD/unit

)

China 100 - - -

Germa

n

y

- 25 10% 12

United

States

- 30 25% 10

Japan - 20 5% 15

Brazil - 35 20% 8

2.3 Model and Solution Approach

This study uses a linear programming (LP) model to

minimize the total cost of exporting photovoltaic

modules from China to multiple countries, subject to

trade-related constraints. LP is chosen for its ability

to efficiently handle continuous decision variables

and cost minimization under multiple restrictions.

The objective is to minimize the combined costs

of production, transportation, tariff, and carbon-

related fees. The decision variables represent the

number of modules exported to each destination.

Constraints include total production capacity and the

demand of each country.

The model is formulated as follows:

𝑓

(

𝑥

)

=𝑚𝑖𝑛

∑

(𝐶

+𝑇

+𝐷

+𝐸

)×𝑋

(1)

Subject to:

∑

𝑋

≤ 𝑇𝑜𝑡𝑎𝑙 𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛 𝐶𝑎𝑝𝑎𝑐𝑖𝑡𝑦 (2)

𝑋

≤ 𝐷𝑒𝑚𝑎𝑛𝑑 𝑖𝑛 𝑐𝑜𝑢𝑛𝑡𝑟𝑦 (3)

Where 𝑋

represents the quantity of modules

exported to country 𝑖 . 𝐶

represents the unit

production cost in China. 𝑇

represents the

transportation cost to country 𝑖 . 𝐷

represents the

tariff per unit imposed by country 𝑖. 𝐸

represents

the carbon adjustment cost per unit in country 𝑖.

3 RESULTS AND DISCUSSION

3.1 Model Output and Export

Allocation

The linear programming model was successfully

solved based on the defined parameters and

constraints. The optimal export allocation fully

utilizes the total production capacity of 2,500 units,

distributing them across three of the four target

markets. Specifically, 1000 units are allocated to

Germany, 900 units to Japan, and 600 units to Brazil.

The United States, despite its high demand of 800

units, receives no allocation. This allocation result is

summarized in Table 2.

This outcome reflects the influence of policy-

driven costs and demonstrates how the model

prioritizes destinations offering the most cost-

effective trade conditions. Export allocation,

therefore, is shaped not merely by market size but

also by trade and environmental policy burdens.

This outcome highlights that the model allocates

resources strictly based on cost efficiency, not on

perceived market importance. The fact that the United

States, a major PV importer, is excluded demonstrates

how even large markets can be deprioritized when

policy barriers distort cost structures. As shown in

Table 2, this reinforces the critical role of modeling

tools in revealing non-obvious but rational allocation

Optimizing Export Strategy of Photovoltaic Modules Under Trade Policy Constraints: A Linear Programming Approach

171

strategies under complex policy environments. Such

prioritization illustrates that trade policy variables can

override traditional market metrics, highlighting the

need for exporters to monitor geopolitical

developments in real-time.

Table 2: Optimal Export Allocation Summary.

Country Export

Quantity

(Units)

Demand

(Units)

Allocation

Ratio

German

y

1000 1000 100%

Ja

p

an 900 900 100%

Brazil 600 700 85.7%

USA 0 800 0%

3.2 Cost Structure and Sensitivity

Analysis

A detailed examination of the cost structure reveals

that tariff-related expenses are the most influential

factor affecting export decisions. While all countries

incur basic production and transportation costs,

variation in policy-induced components-particularly

tariffs and carbon adjustment charges-significantly

alters each destination’s effective unit export cost.

Logistics disruptions caused by trade barriers

significantly distort the overall cost-effectiveness of

cross-border PV delivery routes (Zhao and Zhang,

2023).

Their study emphasizes that route-specific risks

and regulatory bottlenecks can undermine cost

advantages even in low-tariff environments.

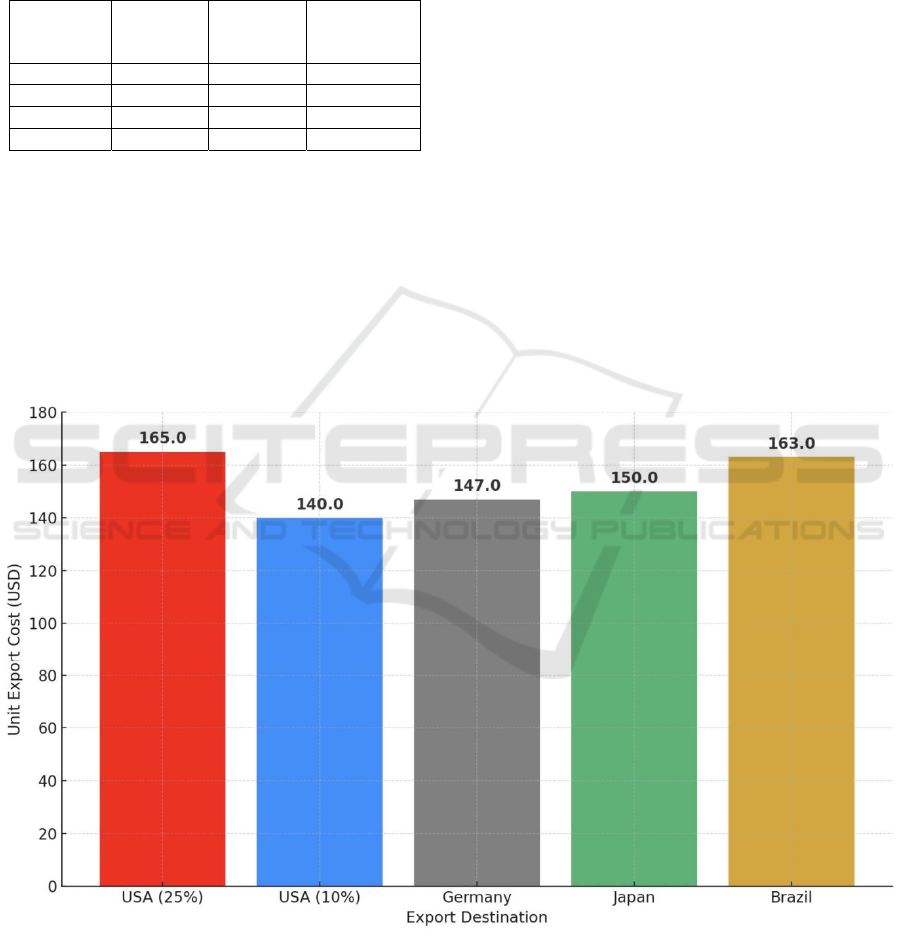

For instance, the effective unit export cost to the

United States is approximately USD 165, calculated

as:

𝐶𝑜𝑠𝑡_𝑈𝑆 = 100(𝑃𝑟𝑜𝑑𝑢𝑐𝑡𝑖𝑜𝑛) + 30(𝑇𝑟𝑎𝑛𝑠𝑝𝑜𝑟𝑡) +

25(𝑇𝑎𝑟𝑖𝑓𝑓) + 10(𝐶𝑎𝑟𝑏𝑜𝑛) (4)

This cost structure comparison is illustrated in Figure

1. In comparison, Germany’s total cost is around

USD 147, and Japan’s is approximately USD 150.

Although Japan faces a relatively high carbon

adjustment cost (USD 15), its low tariff (5%) offsets

the impact. Brazil, despite a high transportation cost

(USD 35), remains cost-effective due to moderate

tariffs (20%) and the lowest carbon adjustment (USD

8).

Figure 1: Comparison of Unit Export Costs Across Destinations (Picture credit: Original).

This chart compares the unit export costs to different

destinations under baseline and adjusted tariff

conditions. The United States becomes cost-

competitive only after tariff reduction. To further

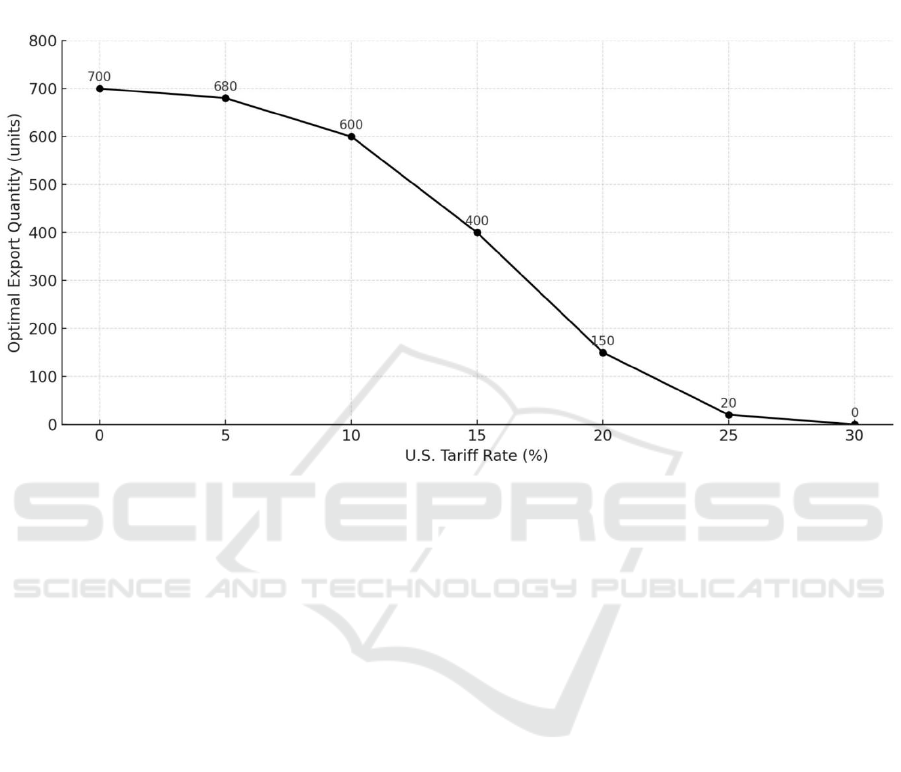

examine the influence of trade policy, a sensitivity

analysis was conducted by lowering the U.S. tariff

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

172

from 25% to 10%. This adjustment reduces the U.S.

unit cost to roughly USD 140, making it more

competitive than Brazil. In this scenario, the optimal

export allocation shifts: the United States would

receive up to 700 units, displacing Brazil. Figure 2

illustrates this shift in export allocation in response to

changes in the U.S. tariff rate.

Figure 2: Sensitivity of U.S. Export Allocation to Tariff Rate (Picture credit: Original).

This line graph illustrates how export allocation to the

U.S. fluctuates as the tariff rate increases (Figure 2).

When tariffs exceed 20%, the U.S. is excluded from

the optimal allocation. This finding highlights that

even minor tariff changes can lead to significant shifts

in export strategy. Sensitivity analysis is therefore

crucial for helping firms plan under policy

uncertainty and prepare for contingency scenarios.

3.3 Strategic Implications and Model

Limitations

From a managerial perspective, the model highlights

the critical importance of incorporating trade policy

environments-not merely demand levels-into global

supply chain planning. Germany and Japan emerge as

cost-efficient and policy-stable markets, suggesting

that exporters should prioritize long-term

infrastructure investment and strategic partnerships in

these regions.

Moreover, the model functions as a flexible

decision-support tool. It allows firms to simulate

“what-if” scenarios by adjusting key policy

parameters, thereby enabling them to anticipate and

adapt to evolving trade conditions. This predictive

capability is particularly valuable amid the rapidly

shifting regulatory landscape of the renewable energy

industry.

Despite offering actionable insights, the current

model has certain limitations. First, it assumes fixed

unit costs and excludes real-world uncertainties such

as currency exchange fluctuations, variable

transportation rates, and supply chain disruptions. In

addition, it does not account for demand elasticity-

namely, how market demand responds to price

changes-which can significantly influence actual

sales volumes.

Another simplification lies in the assumption of

perfect information and static policy environments. In

practice, tariffs and carbon regulations may change

rapidly, and firms often lack full visibility of future

policy shifts. Incorporating stochastic elements or

scenario-based modeling could enhance the model’s

realism and robustness.

Furthermore, the model focuses solely on cost

minimization, overlooking potential trade-offs

between cost, revenue, and profit. This narrow focus

may limit its applicability for firms pursuing market

share expansion or long-term brand positioning.

Future models may benefit from integrating multiple

objectives that more accurately reflect business

priorities.

Optimizing Export Strategy of Photovoltaic Modules Under Trade Policy Constraints: A Linear Programming Approach

173

Future research could expand this model by

incorporating multi-period decision frameworks or

carbon credit trading mechanisms. Additionally,

calibrating the model with empirical trade data would

enhance its external validity. Combining qualitative

scenario planning with quantitative optimization

techniques could further strengthen strategic export

planning for firms operating in volatile geopolitical

environments. This view aligns with previous

research emphasizing the necessity of infrastructure

resilience when planning export strategies in

politically unstable regions (Zhou and Huang, 2022).

These findings collectively underscore that cost-

effective export decisions in the PV industry require

data-driven models, sensitivity to policy dynamics,

and a long-term strategic outlook on market

prioritization.

4 CONCLUSION

This research presents a linear programming

framework tailored to optimize the global export

strategies of Chinese photovoltaic (PV)

manufacturers operating under increasingly complex

trade environments. By systematically incorporating

major cost components — namely production costs,

transportation fees, import tariffs, and carbon

adjustment levies — the model replicates realistic

cross-border decision-making scenarios across

multiple destinations.

The analysis demonstrates that tariff policies exert

the most profound influence on export

competitiveness, followed by carbon-related

regulatory costs. Sensitivity testing reveals that even

marginal changes in tariff rates can induce substantial

shifts in optimal export allocation, highlighting the

critical need for adaptive strategy planning under

policy uncertainty.

The proposed model offers a scalable and

transferable decision-support framework that enables

PV exporters to minimize total export costs while

maintaining strategic agility. Beyond the solar

industry, the methodology holds potential for broader

application in sectors navigating policy-sensitive

international logistics.

Future enhancements could include the

integration of stochastic parameters, dynamic market

demand profiles, or multi-objective optimization

layers, allowing firms to concurrently balance cost-

efficiency, risk exposure, and environmental

sustainability.

REFERENCES

Chen, K., Xu, L., (2022). Modeling real-time supply chain

adaptation under regulatory shock. Operations

Research Letters, 50 (2), 111-120.

Gong, S., Tan, Y., Liu, C., (2023). Trade agreements and

global manufacturing strategies in the PV sector.

Journal of International Business Studies, 54(1), 88-

102.

Huang, Y., Tang, F., Zhou, W., (2023). Multi-route

optimization under policy and infrastructure risk.

Transportation Research, 174, 103032.

Liu, H., Wang, M., (2021). Dynamic allocation strategies

for export-oriented manufacturers under tariff

uncertainty. Journal of Supply Chain Management,

57(3), 45-62.

Sun, Q., Chen, L., (2022). Resilient supply chain design in

the PV industry. Renewable Energy, 187, 847-859.

Wang, J., Zhao, Y., (2023). Joint optimization of export

cost and routing under trade disruptions. Computers &

Industrial Engineering, 179, 108106.

Zhang, Y., Zhao, X., Li, J., (2020). Optimal production and

distribution planning for solar panels under trade tariffs.

International Journal of Production Economics, 229,

107758.

Zhao, Y., Zhang, Y., (2023). Impact of trade barriers on

photovoltaic logistics. Renewable and Sustainable

Energy Reviews, 176, 112345.

Zhou, W., Huang, Y., (2022). Infrastructure disruption and

export resilience in Asia-Pacific. Journal of Operations

Management, 68, 23-39.

Zhu, L., Chen, L., Wang, M., (2021). Carbon-adjusted tariff

evaluation model for renewable exports. Energy Policy,

156, 113728.

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

174