Research on Vertical Synergy and Financial Contributions: A Case

Study on Tesla and Solar City

Heming Chen

Monsignor Kelly Catholic High School, Texas, 77707, U.S.A.

Keywords: Vertical Merger, Economies of Scale, Sales Synergy, Market Expansion, Financial Risks.

Abstract: To understand the synergy effect of vertical merger in positive and negative aspects, this paper takes the

vertical merger of Tesla and SolarCity as the case study example. More specifically, this research focuses on

the integration of electric vehicle manufacturer as well as solar energy production in aspects of cost reduction,

sales synergy and market expansion. Internal financial data and industry reports on the vertical merger

implicates that the vertical merger case can result in cost savings in differed operational aspects, in sales

bundling and synergy as well as in market expansion in renewable energy sector. Despite that, vertical merger

also leads to challenges in aspects of cultural clash, the surge in long-term debt as well as antitrust litigation

costs and risks. This research is meaningful as critical financial data in short and long term is analyzed to

understand synergy effects. Overall, this paper implicates that vertical integration can enhance

competitiveness given sales and market synergy and economies of scale, but needs to be managed carefully

in cultural, financial and regulatory aspect.

1 INTRODUCTION

Mergers and acquisitions have become significant

ways to improve market competitiveness and

maximise resource allocation given ongoing

globalisation and technological development (Rohra

& Anita, 2023). Among these, vertical mergers are

especially interesting since they can link the upstream

and downstream portions of the industry chain, hence

generating possible synergies.

The impact of vertical integration has been

explored by various scholars. Although there is no

conclusive evidence indicating M&A’s direct

contribution to value creation through focus-market

measures, accounting measures and mixed measures,

mergers and acquisitions have great contribution to

increased efficiency and profitability in the post

merger and acquisition stage (Rohra & Anita, 2023).

Vertical merger means combining two or more

companies within the industry, which operates in

different stages of the value chain production and

whose functions activities could be interdependent

(Glass & Gori, 2020). Used to enhance synergies,

vertical integration has been accredited for its role in

reducing costs as well as in increasing productivity

and efficiency (Eule – Rich, Kopp & Flügge, 2022).

In the empirical study, efficiency gains of vertical

integration, given the elimination of double

marginalization, improved coordination and

information flow, reduction of transaction cost,

specialization and economies of scale, chances of

innovation and quality control as well as increased

flexibility and responsiveness in the whole supply

chain is elaborated as outcomes of vertical synergy

(De Stefano & Salinger, 2024). Meanwhile, it is

emphasized that economies of scale of vertical

integration can help integrate homogeneous assets

such as production lines and technology to reduce

unit costs and minimize market transactions to cut

down market uncertainties (Lafontaine & Slade,

2007). Economies of scale in vertical integration can

also be represented as technology synergy, market

synergy and financial synergy among firms as well as

sharing of consumer resources (Song & Bin, 2016).

Case study on Yili and Ausnutria concluded that after

vertical integration, the diary giant can integrate both

upstream and downstream resources in the whole

supply chain, helping to assure raw materials supply

stability, improve production efficiency and elevate

product quality (Cao, 2024). In the meantime, it is

concluded that vertical integration has helped two

firms better respond to challenging and competitive

environment as well as market fluctuations to realize

130

Chen, H.

Research on Vertical Synergy and Financial Contributions: A Case Study on Tesla and Solar City.

DOI: 10.5220/0014322800004718

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Engineering Management, Information Technology and Intelligence (EMITI 2025), pages 130-137

ISBN: 978-989-758-792-4

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

sustainable growth of business (Cao, 2024). Through

analyzing data on routes, ticket prices and service

quality, case study in airline industry also implicated

that vertical integration can enhance efficiency and

increase market power (Calrton, Israel, MacSwain &

Orlov, 2019).

The industry and regulatory bodies have paid

great attention to Tesla and SolarCity’s vertical

merger. Founded in 2003 by Elon Musk and other

talented engineers, Tesla’s innovation in electric

vehicle has disrupted the market. With missions to

transit towards sustainable energy and to provide

electric vehicles with clean, efficient and high-

performance features, the company has focused on

synergy and integration in the value chain. Founded

in 2006 by Lyndon and Peter Rive, SolarCity

specialized in designing, installing and financing

solar energy systems for consumers across residential,

commercial and governmental fields. Solar City

became one leading solar panel installers in 2016 in

US with the goal to provide accessible and affordable

solar panels. The year of 2016 marked the decision of

Tesla to acquire SolarCity, with deal value at $2.6

billion. This vertical merger was completed in

November 2016, with SolarCity becoming a

subsidiary of Tesla.

This paper intends to investigate the economic

consequences of Tesla merger, hence investigating

whether the combination can produce the desired

positive outcomes and the negative concerns that

must be handled. By means of this case study, one

may acquire a thorough knowledge of the possible

advantages and obstacles big companies could face

when carrying out merger and acquisition plans.

This article is structured as follows: The second

section examines the favourable economic effects of

this merger—including cost synergies, sales

synergies, and market expansion; the third section

addresses possible negative economic effects, such as

cultural conflicts, financial risks, and antitrust

regulatory risks; finally, the conclusion presents the

research results and provides pertinent insights.

2 FAVORABLE ECONOMIC

RESULTS

2.1 Cost Synergy

The primary benefit of the vertical integration was

cost synergy. As Tesla has control over extensive

solar technology and facility of Solar City post the

vertical merger, Tesla’s reliance on solar components

and energy solutions externally has been cut down.

According to Table 1, the hardware procurement

cost was down by around $150 million within the first

year post the merger (Tesla, 2020). In Pre-merger

stage, Tesla purchased solar parts from third-party

players, which entails 15%-20% markups. However,

post merger, the California factory of Solar City

supplied Tesla directly, cutting down intermediate

cost by $920 million in 2017 alone. Aside from that,

the purchase volume post integration increased to 50

GWh by 2018, three times compared to pre-merger

stage, and the unit cost was down by 22%.

In addition, logistics costs were down after the

integration as the inventory turnover is rising from 4.2

to 6.8 cycles annually, thus making logistics down by

1.2 percent and saving $92 million (Tesla, 2020).

Besides, shared R&D facilities allowed cost on

R&D to be cut by 18% (Tesla, 2020). The

photovoltaic lab of Solar City is merged with R&D

centers of Tesla to share high-end facilities such as

spectral testers and climate simulation chambers.

Besides, the joint team focused on making Powerwall

compatible with vehicle energy management system

of Tesla, which helped reduce battery management

algorithm cycle. Furthermore, the joint team had

eliminated 200 redundant roles, cutting down $210

million annually.

According to Tesla’s investor presentations, long

term cost savings could be up to $250 million given

supply chains and operational process integration

(SolarCity, 2017).

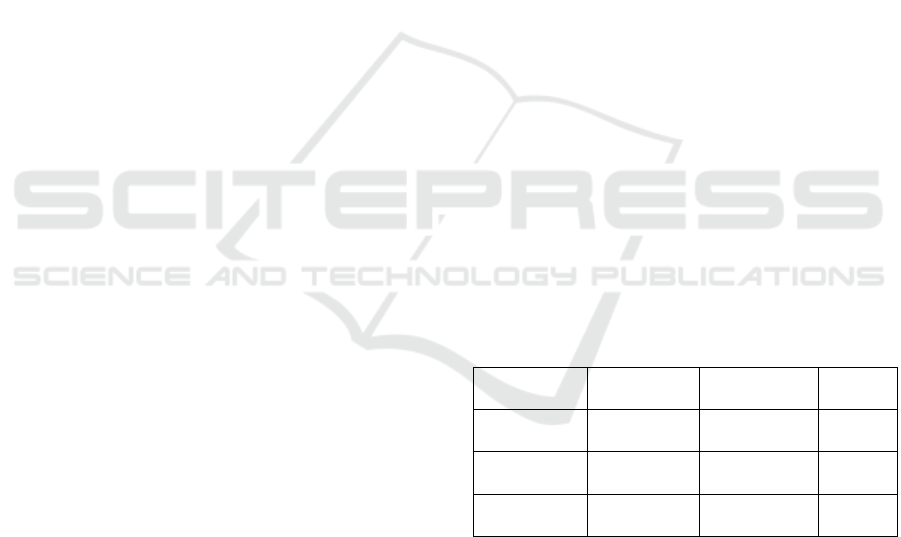

Table 1: Cost Synergy

Cost

Categor

y

2016 (Pre-

Merger)

2020 (Post-

Merger)

Savings

(%)

Hardware

Procurement

$800

million

$650 million 18.75%

R&D

Ex

p

enses

$450

million

$369 million 18.00%

Logistics $120

million

$92 million 23.33%

Data source: Tesla SEC filings 2016–2020 (Tesla,

2020).

2.2 Sales Synergy

Through leveraging Solar City’s energy solutions,

Tesla has implemented bundle sales strategies within

its own electric vehicle ecosystem. For instance,

integrated packages like Powerwall has been

introduced in the market, combining electric vehicles

with solar panels as well as energy storage system.

Those sales strategy enabled Tesla to improve

Research on Vertical Synergy and Financial Contributions: A Case Study on Tesla and Solar City

131

customer engagement, to increase consumer value

and to increase revenue streams, all adding to

increased competitiveness of Tesla in renewable

energy market. Additionally, sales synergy also

allowed Tesla to better acquire customers and

maintain quality relations.

Statistically speaking, there was a 20% drop in

consumer acquisition costs given the integration of

sales and marketing channels (Tesla, 2023). Actually,

the customer base of SolarCity provided Tesla with

150,000 pre-qualified leads in terms of electric

vehicle purchases whereas Tesla’s showroom

network enhanced solar panel installations of

SolarCity by 25% (SolarCity, 2017).

2.3 Increasing Market Share and

Economies of Scale

As Table 2 shows, the transaction overall has

enhanced and consolidated the position of Tesla in

both automotive sector and renewable energy sector.

As compared to competitors such as General Motors,

Tesla’s advantage in cost effectiveness as well as

quality products and services is enhanced. Besides

that, combined brand strengths allowed Tesla to

better expand into international market with better

global presence and market share. Statistically

speaking, Tesla’s EV market share has rose from 12%

to 18% in 2020 whereas its solar installation has

boosted from 3% to 8% (Electrek, 2020).

Table 2: Market Share of EVs in 2020

Pl. Brands Sept sales Year - to - Date sales Market share

1 Tesla 65,814 316,820 18%

2 Volkswagen 24,035 113,091 6%

3 BYD 18,631 104,176 6%

4 BMW 15,525 101,270 6%

5 Renault 13,300 68,928 4%

6 Mercedes - Benz 17,836 68,855 4%

7 Volvo 11,838 67,561 4%

8 Audi 12,385 67,304 4%

9 H

y

undai 11,510 63,679 4%

10 Kia 10,937 59,840 3%

Data Source: Electre

k

(2020)

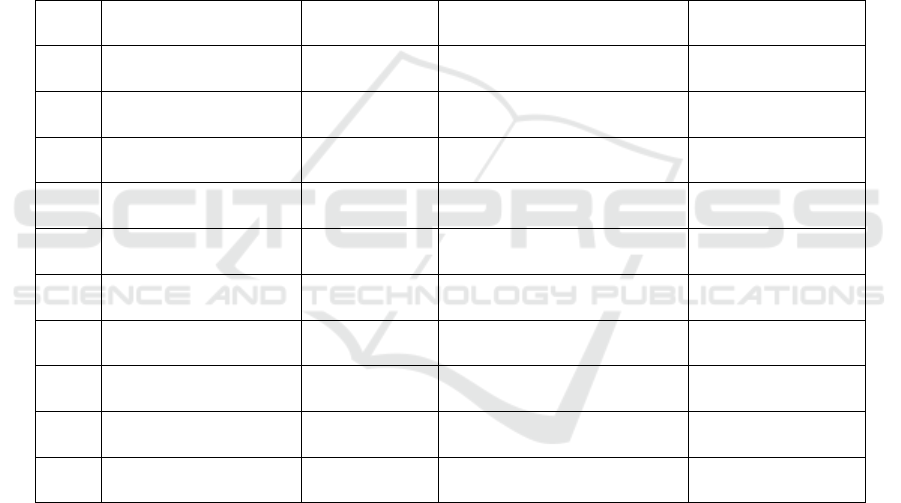

According to figure 1 and 2, concerning

economies of scale, the production and distribution

processes of both Tesla and Solar City have been

integrated to lower unit costs. For instance, 3 times

the increase in production efficiency in areas such as

battery production has been reported in internal

reports of Tesla. Statistically, the battery cost was

reduced from $1,100 in 2016 to $137 in 2023 given

the sharing of gigafactory resources with SolarCity

(Tesla, 2023).

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

132

Data Source: Electrek (2020)

Figure 1: Market Share of Tesla Vehicles by Region.

Data Source: Tesla Earnings Report 2023

Figure 2: Energy Storage Deployments.

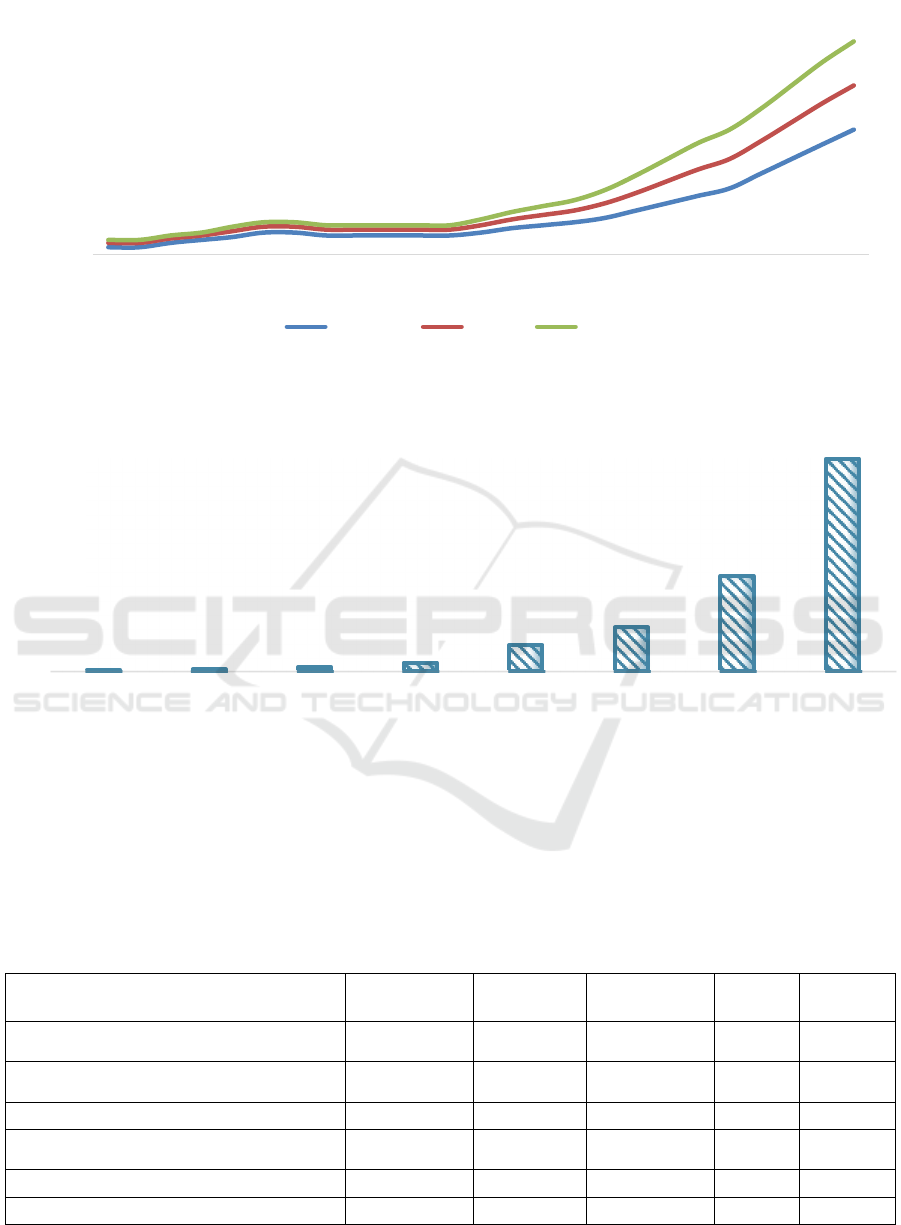

2.4 Positive Financial Results

As table 3 shows, total operating expenses increased

quarter on quarter under both Non-GAAP and GAAP

approach. Under it, R&D and SG&A increased to

varying degree, indicating Tesla’s expanding of

business or investment during the period (Tesla,

2016). This allowed Tesla to expand investment in

R&D, which is helpful for new technologies

development and application, fostering market

competitiveness and promoting revenue growth.

Table 3: Operating Expenses and Net Results

Dec 31, 2016

($000)

Sep 30, 2016

($000)

Dec 31, 2015

($000)

Change

QoQ

Change

YoY

Total operating expenses - GAAP $ 701,976 $ 551,113 $ 478,897 27% 47%

Total operating expenses - Non-GAAP $ 607,020 $ 470,509 $ 429,287 29% 41%

R&D ex

p

enses - GAAP $ 245,960 $ 214,302 $ 190,243 15% 29%

R&D expenses - Non-GAAP $ 204,656 $ 174,082 $ 164,791 18% 24%

SG&A ex

p

enses - GAAP $ 456,016 $ 336,811 $ 288,654 35% 58%

SG&A expenses - Non-GAAP $ 402,364 $ 296,427 $ 264,496 36% 52%

Data source:

Tesla Q4 Earnin

g

s Report (2016).

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

1.40%

1.60%

Q4

2017

Q1

2018

Q2

2018

Q3

2018

Q4

2018

Q1

2019

Q2

2019

Q3

2019

Q4

2019

Q1

2020

Q2

2020

Q3

2020

Q4

2020

Q1

2021

Q2

2021

Q3

2021

Q4

2021

Q1

2022

Q2

2022

Q3

2022

Q4

2022

Q1

2023

Q2

2023

Q3

2023

Q4

2023

US/Canada Europe China

0.1

0.15

0.3

0.6

1.8

3

6.5

14.5

2015 2016 2017 2018 2019 2020 2021 2022

Research on Vertical Synergy and Financial Contributions: A Case Study on Tesla and Solar City

133

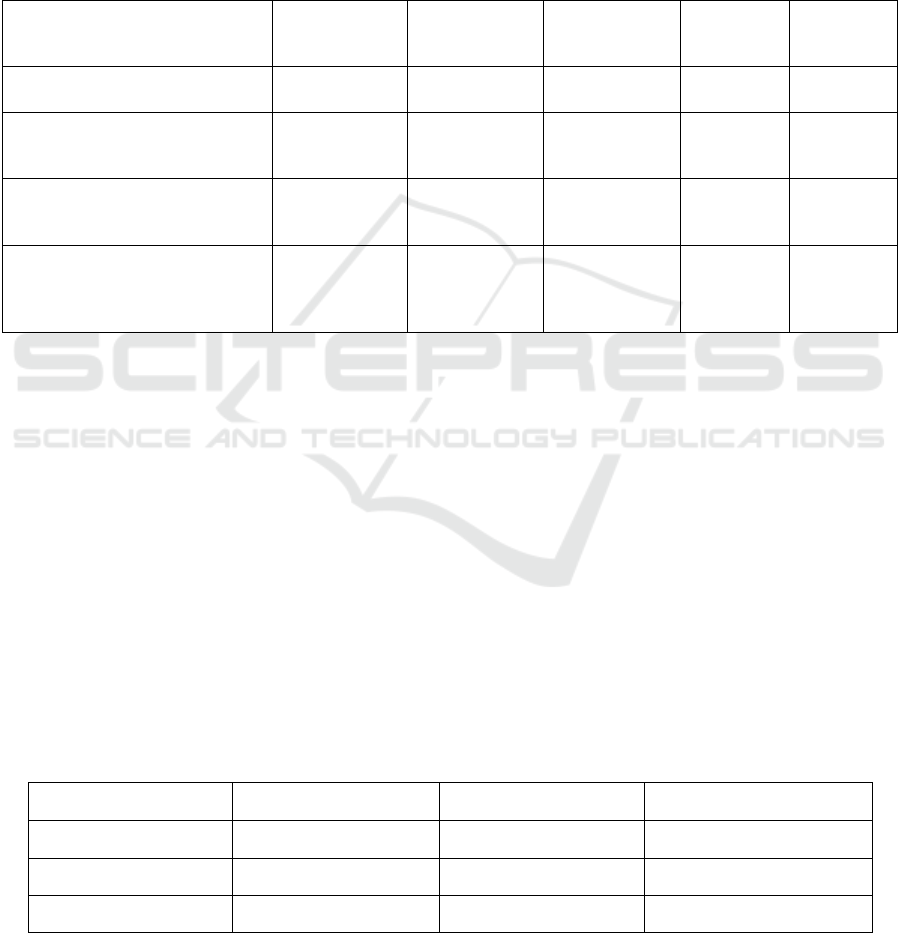

According to table 4, before the vertical

integration, SolarCity has a debt of around $1.5

billion whereas Tesla had around $2 billion in debt.

Positively, cash and cash equivalents increased 183%

year on year on December 2016, suggesting a surge

in funds reserve (Tesla, 2016). On top of that, Tesla

reported positive record with a GAAP profit of $22

million and a cash flow of $176 million post the

synergy (Tesla, 2016). Besides that, revenue of

renewable energy climbed from 3% in 2016 to 15%

in 2020, moving from EV market to comprehensive

solution provider and thus supporting its long-term

financial growth.

Despite that, cash flow registered negative as

compared to last quarter, indicating Tesla’s trouble of

recovering funds short term. Consequently, the

negative cash flow indicates Tesla’s problems with

long term financial sustainability.

Table 4: Cash Flow and Liquidity

Dec 31, 2016

($000)

Sep 30, 2016

($000)

Dec 31,

2015 ($000)

Change -

QoQ

Change -

YoY

Cash and cash equivalents $ 3,393,216 $ 3,084,257 $ 1,196,908 10% 183%

Cash flows provided (used in)

operating activities

($ 448,209) $ 423,650 ($ 29,849) -206% -1402%

Change in collateralized lease

b

orrowin

g

$ 212,040 $ 173,144 $ 208,793 22% 2%

Operating cash flows plus

change in collateralized lease

b

orrowin

g

($ 236,169) $ 596,794 $ 178,944 -140% -232%

Source: Tesla Q4 Earnings Report 2023

3 UNFAVOURABLE FINANCIAL

RESULTS

3.1 Cultural Conflict

Tesla's corporate culture is driven by innovation and

rapid problem-solving whereas Solar City

emphasizes on engineering culture and process

management. These cultural clashes weakened the

realization of synergies in the early stages of the

merger. In terms of decision making, Tesla’s quick

decision approach is in conflict with more cautious

approach in SolarCity, with the latter considered as

too bureaucratic. Furthermore, concerning internal

communication, Elon Musk’s hands-on and high-

intensity approach has created tension in hierarchical

and process-oriented management of Solar City.

Besides the above, zero-tolerance policy of Tesla and

somehow chaotic and flat organizational structure

had resulted in uncertainty and lack of clarity, which

further contributed to loss of some key talents. For

example, the exit of CFO, Treasurer and Head of

Engineering has delayed the integration process by 6

months.

Table 4 SolarCity Key Talents Turnover

Position Tenure at SolarCity Departure Timeline Reason Cited

CFO, Deepak Ahuja 5 years 2017 Q1 Cultural Misalignment

Head of Engineering 8 years 2017 Q2 Decision-Making Clash

Senior Data Scientist 3 years 2017 Q3 Organizational Chaos

Data source: LinkedIn alumni reports and media interviews)

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

134

3.2 Financial Dangers

As table 5 shows, Tesla acquired SolarCity for $2.6

billion to achieve vertical integration in order to

finish the purchase,. Till December 31, 2023, its debt

increased from $5.5 billion to $13.62 billion (Tesla,

2023). In other words, acquiring SolarCity has

amplified its financial risks.

Concerning long-term solvency, the long-term

debt of Tesla took up 78% of total liabilities, thus

adding to high solvency pressures (Tesla, 2023). As a

high portion of future cash flows may be earmarked

for debt servicing, critical business activities such as

R&D investment and market expansion may be

hindered. The surge in debt affects financial stability

of Tesla, implying greater financial leverage and

volatility of earnings, which could even push the

company into financial distress if sales declines or

cost increases.

Financing of Tesla was also affected post

integration. For Tesla, its interest rate on long-term

debt was 5.10% in 2024, nearly 1.5 time of industry

distress average while the interest expenses was high

as $149.6 million in Q1 2024. High interest rate or

decline in EBIT (earnings before interest and taxes)

could pose risks to financial health (SN&P, 2024).

Credit rating for Tesla was also lowered post the

acquisition, making it even costlier for Tesla to raise

new funds and adding to financial pressure.

Table 5 Liabilities and Equity

Current liabilities 15,255 15,904 15,273 13,937 14,431

Accounts payable and othe

r

8,205 8,378 8,684 8,530 9,080

Accrued liabilities 4,048 4,276 3,904 3,347 3,273

Current portion of debt and finance leases (I) 1,502 1,404 1,459 1,967 2,375

Total current liabilities 26,709 27,436 27,592 26,640 28,748

Debt and finance leases, net of current

p

ortion

(

I

)

1,597 1,272 872 4,226 2,857

Deferred revenue, net of current portion 2,804 2,911 3,021 3,059 3,251

Other liabilities 5,330 5,998 6,409 5,831 6,690

Total liabilities 36,440 37,598 38,409 39,446 43,009

Redeemable noncontrollin

g

interests in subsidiaries 409 407 288 277 242

Total stockholders' e

q

uit

y

47,704 48,054 51,130 53,466 62,634

Noncontrollin

g

interests in subsidiaries 785 774 764 752 733

Total liabilities and equit

y

82,338 86,833 90,591 93,941 106,618

(I) Breakdown of our debt is as follows:

Vehicle and ener

gy

p

roduct financin

g

(

non-recourse

)

2,001 1,708 1,475 3,660 4,613

Recourse debt excluding vehicle and energy product

financing

44 44 44 44 44

Total debt excluding vehicle and energy product

financin

g

44 44 44 44 44

Source: Tesla Q4 Earnings Report 2023

Research on Vertical Synergy and Financial Contributions: A Case Study on Tesla and Solar City

135

3.3 Risk of Antitrust Regulation

During the acquisition process, Tesla faced a lawsuit

from its shareholders. In 2016, Tesla owned a large

portion of SolarCity whereas two of his relatives were

co-founders, making the shareholders believe that the

integration was intended to address financial

struggles of SolarCity. During the lawsuit,

shareholders claimed Musk exerted dominance over

the board and breached fiduciary duty. The lawsuit

lasted for years, with the financial ruling of the

Supreme Court in 2023. This lawsuit has received

extensive media coverage, damaging market

reputation and raising doubts and concerns among

investors and public. What’s worse, the legal fees

exceeded $50 million and Tesla’s stock volatility

surged from 1.2 in 2016 to 1.5 in 2023 given loss of

investor confidence (AP New, 2025).

4 CONCLUSION

This research aims to explore the outcomes of vertical

merger through the case study of Tesla and SolarCity.

More specifically, as previous literature indicates that

vertical mergers can add to cost benefits, market and

sales synergy, as well as economies of scale, this

research have explored the case from the above

angles. Examining the Tesla acquisition of SolarCity

reveals that large-scale vertical mergers can actually

have beneficial consequences in terms of cost

optimization, revenue growth, and market expansion.

Thus, it is implicated that business can use vertical

integration as a way to reduce costs, enhance

competitiveness and realize sustainable growth.

On the other hand, this study has also examined

the possible challenges and risks to yield a more

balanced and fairer conclusion. In this case, cultural

clashes, financial strain, and regulatory scrutiny have

created challenges in both the financial, legal and

operational front. This it is implicated that ssuccessful

mergers and acquisitions not only need correct

evaluation of possible advantages but also demand

complete anticipation and response plans for possible

problems that can occur throughout the integration

process. Overall, businesses should aim for a sensible

balance between synergies and possible hazards

while developing merger and acquisition plans and

look for a sensible balance to produce lasting value.

This paper is limited as it focuses more on

financial and immediate operational aspects, whereas

long term effect of a merger on technological

development and product innovation is not fully

explored. Besides, other factors affecting the post-

acquisition performance of Tesla is not fully explored,

covering external factors such as governmental

policies and industry changes. Given the limitations

of the research, it is suggested that an indepth analysis

on Tesla’s innovation roadmap could be carried out.

Besides that, it is also relevant to take the variables of

external factors such as government policy in the

renewable energy field and automobile field, broad

economic contexts as well as industry dynamics into

consideration, to conclude if those factors can

promote or hinder post-acqusition performance of

Tesla.

REFERENCES

AP News. (2025, February 28). Delaware Supreme Court

upholds judge’s finding that Tesla acquisition of Solar

City was fair. https://apnews.com/article/tesla-elon-

musk-solar-city-shareholder-lawsuit-

362775d28666c40e66ca09117c31f93c

Cao, Z. (2024). Analysis of the risks and performance of

dairy company mergers and acquisitions. Dairy and

Human, (1), 53–58.

Carlton, D. W., Israel, M. A., MacSwain, I., & Orlov, E.

(2019). Are legacy airline mergers pro- or anti-

competitive? Evidence from recent U.S. airline mergers.

International Journal of Industrial Organization, *62*,

58–95.

De Stefano, M., & Salinger, M. A. (2024). The complicated

simple economics of vertical mergers. Working paper.

Lambert, F. (2020, October 30). Tesla increases lead as

world’s best-selling electric vehicle maker. Electrek.

https://electrek.co/2020/10/30/tesla-tsla-market-share-

global-ev-sales-change/

Eule-Rich, M., Kopp, R., & Flügge, B. (2022). Mergers and

acquisitions research—A bibliometric analysis.

European Management Journal, *40*(6), 832–846.

Glass, V., & Gori, S. (2020). Approaches to assessing

vertical mergers: A review and evaluation. In P. L.

Parcu, T. J. Brennan, & V. Glass (Eds.), The changing

postal environment (pp. 381–402). Springer.

Lafontaine, F., & Slade, M. (2007). Vertical integration and

firm boundaries: The evidence. Journal of Economic

Literature, *45*(3), 629–685.

Rohra, N., & Anita. (2023). Impact of mergers &

acquisitions—A critical review of literature. Academy

of Entrepreneurship Journal, *29*(3S), 1–14.

S&P Global Ratings. (2024). Industry credit outlook 2024:

Autos.

https://www.spglobal.com/ratings/en/research/pdf-

articles/240109-industry-credit-outlook-2024-autos-

101591897

SolarCity. (2017). Customer acquisition report.

http://www.solarcity.com/

Song, F., & Bin, Z. (2016). Market synergies in mergers and

acquisitions: Evidence from the Chinese

EMITI 2025 - International Conference on Engineering Management, Information Technology and Intelligence

136

pharmaceutical industry. Journal of Business Research,

*69*(10), 4485–4493.

Tesla. (2016). Tesla fourth quarter & full year 2016 update

[Earnings report]. https://www.teslarati.com/wp-

content/uploads/2017/02/TSLA_Update_Letter_2016-

4Q.pdf

Tesla. (2018). Tesla fourth quarter & full year 2018 update

[Earnings report]. https://cdn.arstechnica.net/wp-

content/uploads/2019/01/Tesla-2018-Q4-Update-

Letter1.pdf

Tesla. (2023). Tesla fourth quarter & full year 2023 update

[Earnings report]. https://digitalassets.tesla.com/tesla-

contents/image/upload/IR/TSLA-Q4-2023-Update.pdf

Tesla. (2023). 2023 annual shareholder meeting [Video].

YouTube.

https://www.youtube.com/watch?v=bZNL_8bUz6A

Tesla, Inc. (2016–2020). *Form 10-K annual reports*. U.S.

Securities and Exchange Commission.

https://www.sec.gov/Archives/edgar/data/1318605/00

0156459021004599/tsla-10k_20201231.htm

Research on Vertical Synergy and Financial Contributions: A Case Study on Tesla and Solar City

137