Analysis on Fraudulent Bank Account Data Detector Using Ensemble

Learning

Marvel Lemuel Junaidi, Farrell Marcello Lienardi, Nathan Setiawan and Hidayaturrahman

School of Computer Science, Bina Nusantara University, Jalur Sutera Road, Jakarta, Indonesia

Keywords: Fraud Detection, Ensemble Learning, Bank Account, RFNet, Logistic Regression.

Abstract: As the modern age has expanded in recent years, complications such as fraudulent data in the banks follow

as well. As one of the efforts for countermeasure, a study is conducted to analyze an ensemble learning method,

namely RFNet and compare it to two other models, namely XBNet and DevNet, using Logistic Regression to

stack the models. The study is conducted on a publicly available bank account dataset to evaluate the

performance of these models based on their respective accuracy, precision, recall, and ROC-AUC scores, as

well as their execution times. As for the statistical approach, we also measured the confidence interval with

95% confidence, along with the standard deviation to show model reliability, stability, and consistency. The

results of this study show that XBNet still outperforms the other methods in terms of overall performance,

consistency, and reliability. Even so, the RFNet model can be an applicable alternative for fraud detection in

certain scenarios and can compete in consistency in some metrics, while also outdoing a well-known DevNet

across several metrics. These results highlight the importance of model choice and tuning when conducting

tasks involving large amounts of data, especially when dealing with imbalanced data.

1 INTRODUCTION

Fraudulent bank data has escalated in recent years due

to the rise of digital banking and e-commerce

platforms and continues to be a critical threat to

businesses and economies worldwide, necessitating

advanced detection techniques (Adewumi et al.,

2024). This creates the need for modern fraud

detection systems to accurately identify fraud and

while being able to constantly adapt to this ever-

changing landscape.

The Suspicious Transaction Report or STR, which

enlists the statistics of suspicious transactions yearly,

from the state government in Indonesia displays a

significant increase in suspicious transactions for

both bank and non-bank transactions in 2 years from

2021, with around a 14% increase in STR from 2021

to 2022 and a huge 43% increase from 2022 to 2023.

In addition, the DKI Jakarta province had the most

STR numbers throughout these years, making up

approximately 97% of the data, and cases related to

gambling contributed about 50% of said data (Pusat

Pelaporan dan Analisis Transaksi Keuangan

[PPATK], 2024). Furthermore, suspicious bank data

have consistently increased over the years, suggesting

the need for improvement in countering the

development and implementation of financial attacks.

With that said, the scope of the research includes

providing a deep analysis on a proposed ensemble

learning model named RFNet, along with a

comparative analysis in detecting fraudulent bank

data, including XBNet and DevNet. The research

encompasses bank data that are indicative of fraud,

utilizing a reliable and validated dataset which was

mainly used for research on a new fraud detection

approach inspired by real-life human brain

mechanisms called Spiking Neural Network or SNN

(Perdigão et al., 2025). The research revealed

interesting breakthroughs that led to the use of said

dataset for this paper. Moreover, this study aims to

evaluate the effectiveness of each method in detecting

fraudulent data based on metrics such as accuracy,

precision, and recall while also highlighting the

challenges faced in fraud detection within the digital

era, contributing to the development of faster and

more reliable fraud detection methods that can be

applied by the banking industry in Indonesia.

One study highlights that credit card fraud is one

of the most common forms of fraud in the financial

industry, and although machine and deep learning

models have been widely used to predict this fraud,

196

Lemuel Junaidi, M., Marcello Lienardi, F., Setiawan, N. and Hidayaturrahman,

Analysis on Fraudulent Bank Account Data Detector Using Ensemble Learning.

DOI: 10.5220/0014268100004928

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Innovations in Information and Engineering Technology (RITECH 2025), pages 196-202

ISBN: 978-989-758-784-9

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

there are still several challenges to predict credit card

fraud transactions (Ekiye and Hewage, 2024). A

possible solution to this is ensemble learning, which

are methods that aim to integrate data fusion, data

modeling, and data mining into a unified framework

(Dong et al., 2020). One such method that fits into this

category is the XBNet (or XGNet) method, being a

framework that is known for its efficiency on tabular

datasets. Its ability to incorporate regularization and

handle missing values makes it a strong candidate for

fraud detection.

In relation to that, one of the methods this study

aims to compare is the XBNet, which combines

gradient boosted trees with a feed-forward neural

network architecture (Sarkar, 2022). The model is

trained using an optimization technique where the

weights of the neural network are updated using

traditional gradient descent, and feature importance is

used to adjust the weights in the intermediate layers

of the network, boosting performance by

incorporating insights from the tree-based model and

helping fine-tune the network.

Moreover, another possible approach is the

DevNet method, which is a method that excels at

identifying anomalies when learning features. One

study showed that DevNet achieves excellent results

in fraud detection, as it is more efficient and addresses

data imbalance issues better than the other methods

that were tested in the study. The framework uses a

Gaussian prior to generate reference scores and uses

a Z-score-based deviation loss function to push the

anomaly scores of normal objects close to the

reference score and anomalies far away, making it

excel in scenarios with high anomaly contamination

(Pang et al., 2019).

However, the proposed approach of this study

aims to implement ensemble learning on the random

forest method, which one study has been proven to be

potent at fraud detection tasks (Xuan et al., 2018),

with a neural network, that another study has proven

to be similarly potent at the task, albeit significantly

harder to train, to produce a method that can

complement each other and perform better at the task

overall (Asha et al., 2021).

2 RESEARCH METHODOLOGY

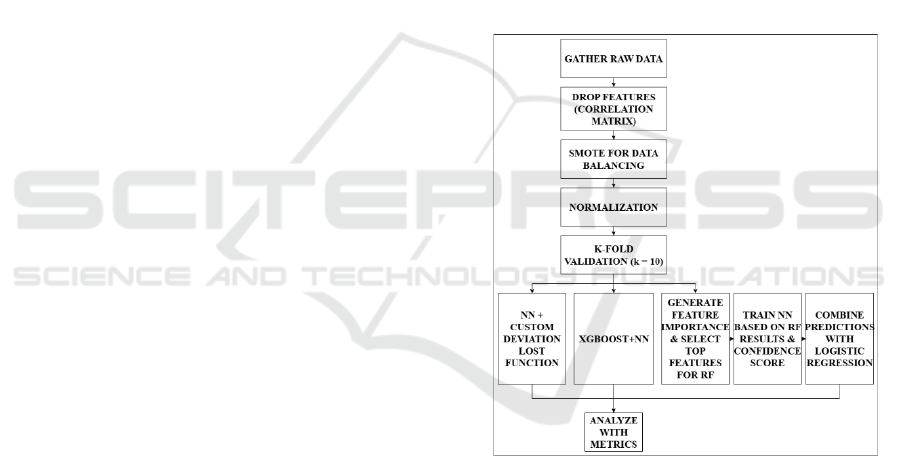

The research timeline is shown on Figure 1. Firstly,

the study begins by gathering the dataset,

preprocessing the data, training the individual

models, combining the models, and ends with

comparing the individual performances of the three

proposed ensemble models. The metrics used to

measure the performance of the XBNet, RFNet, and

DevNet approaches respectively are accuracy,

precision which evaluates the number of non-fraud

cases being labeled as fraud, recall for the ability to

determine fraud data as fraud, Receiver Operating

Characteristic Area Under Curve (ROC AUC), and

execution time to see which algorithm can make

predictions the fastest. Apart from that, the standard

deviation of both RFNet and XBNet are calculated to

measure model consistency. For the statistical

approach, we use confidence interval (CI) of 95% to

test model reliability or stability. The dataset used in

this research is acquired from Kaggle, with a total size

of one million rows and thirty-two columns and

comprises of information of fraud and non-fraud

data at a bank. As for data privacy protection, this

dataset has performed noise addition and feature

encoding, modifying the value to disguise the actual

content.

Figure 1: Flowchart of Research Methodology.

The data gathered goes through several data

preprocessing techniques to improve the quality of

data input for the models. The first step taken here

was to check for null values and remove them to

ensure the models will not break down during

training. Then, a correlation matrix is applied to every

feature, with the results being printed afterwards. The

results will be the basis of the decision when

performing feature selection. The columns are then

narrowed down to identify the ones needed to predict

fraudulent data. Subsequently, several features that

were deemed as irrelevant to the consideration of

Analysis on Fraudulent Bank Account Data Detector Using Ensemble Learning

197

determining whether a data is fraudulent or not were

dropped.

Since the data is imbalanced, Synthetic Minority

Oversampling Technique or SMOTE data

augmentation was employed to create synthetic

samples for the minority class, which in this case is

the fraud boolean label 1. This technique, also known

as data augmentation, adds random small changes

based on normal distribution. It helps to balance the

dataset and improve models’ performance.

Afterwards, data normalization was applied to ensure

every row of data contributes evenly to the prediction.

The algorithms used in this study are Neural

Networks, XGBoost, Random Forest, and Logistic

Regression. RFNet, as the focus machine learning

model, uses top features based on feature importance

value with k = 7, which then will be passed to the

Neural Network model with the chosen confidence

score value (based on multiple testings). This is what

makes the model unique, since each model influences

one another instead of being distinct models

combined into one. The Neural Network model uses

the parameters generated or used for the Random

Forest model, which are selected features based on

feature importance and confidence score, making NN

results reliant on the RF model performance for

model novelty.

For XBNet, Neural Network will be combined

with XGBoost to create a stacking model. Finally,

Logistic Regression will be the meta model of those

two stack ensemble models. Its job is to learn the

prediction output and produce final predictions.

Additionally, the models undergo cross validation,

which results in more robust models. For Devnet, the

Neural Network model uses a custom deviation loss

function due to its nature as an unsupervised model.

The process of RFNet model is shown in more detail

based on Figure 1 since it is the main model to be

analyzed, while the other model uses similar methods

in reference to previous works.

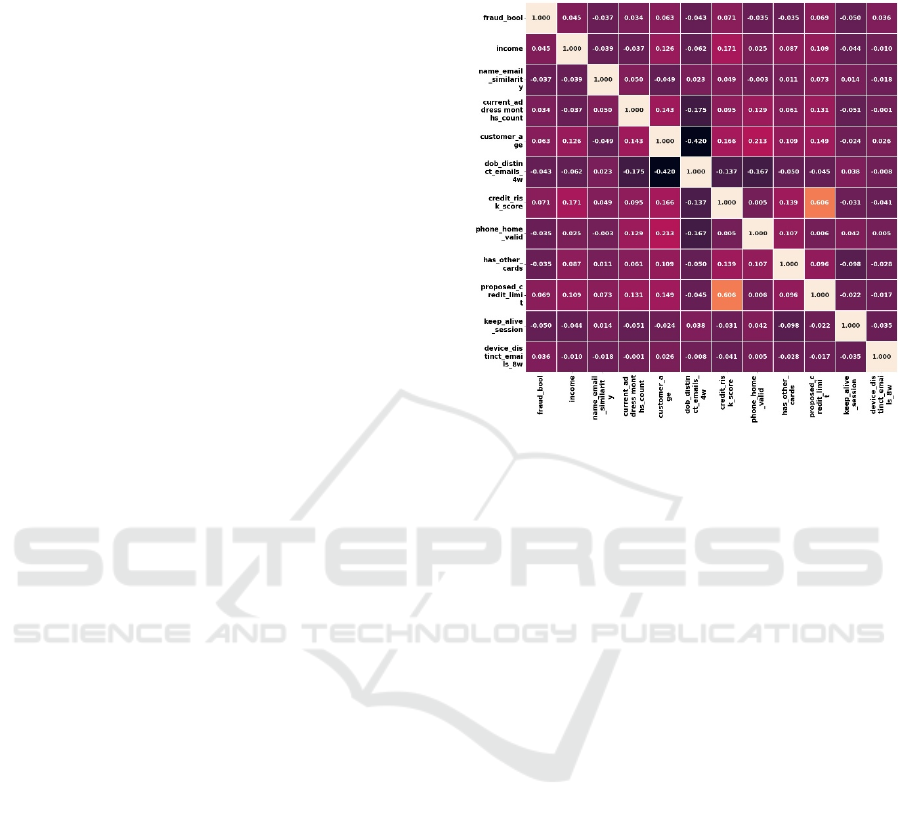

3 RESULTS AND DISCUSSION

The code execution was primarily done on a Jupyter

Notebook on Kaggle, as it has a 12-hour execution

time limit. Out of 32 features, 12 features were chosen

to be the criterion to identify fraud data, and the

features are selected based on the correlation matrix

shown in Figure 2, which only shows features with

the correlation value > 0.03 or < -0.03 with

fraud_bool (criteria), and such range is used to

minimize the number of features. For the data split,

the ratio for train and tests was 8 by 2 as it is known

as one of the standard ratios.

Figure 2: Correlation Matrix Heatmap.

One of the main considerations during the

selection of the respective model features was the

results of a heatmap of attribute correlations, or

correlation matrix in Figure 2. The previous selected

12 features will be measured their correlation with

one another. This method was used to select strongly

correlated features so that none of the selected

attributes are highly correlated to avoid overlapping

information and overfitting. The credit_ risk_score

attribute, for example, is selected over the proposed

credit_limit since both are highly correlated, and

because the former attribute seems to be more related

to the fraud bool than the latter attribute, so the latter

attribute is not used.

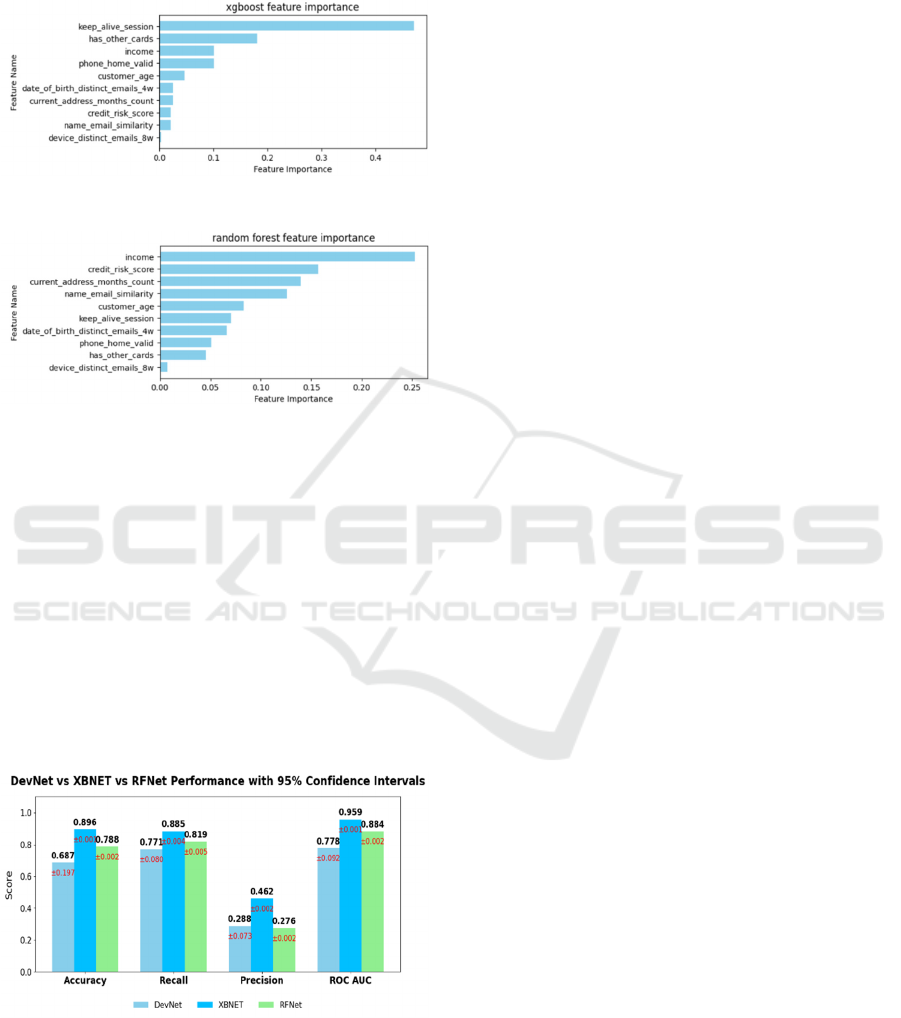

Several features have been shown in both figures,

and there seems to be some common ground in this

case along with several differences. Both XGBoost

and Random Forest use decision trees in learning the

data pattern. They have a built-in feature importance

calculator to determine which features contribute

highly to the prediction. In Figure 3 and Figure 4, it is

evident that the keep alive session has the highest

importance value for XGBoost, while the income

attribute seems to be more insightful for Random

Forest. On the other hand, device distinct email has

the lowest value for feature importance in both

models. In addition, other features rank differently

between both models, with Random Forest having

high importance value across multiple features, while

XGBoost focuses on fewer features. For the RFNet

RITECH 2025 - The International Conference on Research and Innovations in Information and Engineering Technology

198

model, the top 7 features from Figure 4 are passed to

the Neural Network model to be trained alongside the

confidence score, which we obtained the value as 0.5.

Figure 3: XGBoost Feature Importance.

Figure 4: Random Forest Feature Importance.

Based on the results in Figure 5, it can be

concluded that the recall of each approach in

classifying fraud data is of satisfactory value, with

each of them being above 75%. That means that the

models are capable of classifying fraud data among

the non-fraud ones. However, the presence of

imbalanced data (even after applying SMOTE) due to

fraud cases makes up one-tenth of the non-fraud

cases, while precision is also very sensitive towards

false positives that the models generate, the precision

values of each approach are significantly lower than

the recall.

Figure 5: Classification Result.

On the other hand, ROC-AUC values above 0.8

indicate that the models can separate both fraud and

non-fraud data, and the accuracy of the three models

also indicates the overall prediction being a reliable

method for fraud detection. Additionally, there seems

to be a high time and resource requirement to run such

models based on the amount of time needed for each

model, approximately 3364.2, 7247.9, and 16533.4

seconds for XBNet, RFNet, and DevNet respectively.

Furthermore, the value range with 95%

confidence of each comparison between XBNet and

RFNet based further that XBNet is still a more

reliable model, however RFNet can still follow due to

the small differences between both model CI values.

In terms of precision, both are in equal footing or have

similar values. With enough training and testing on

the model, it is possible that RFNet can roughly

compete with XBNet.

Overall, the XBNet prevails over the other two

models. It results in the highest accuracy, precision,

recall, and ROC-AUC values with the lowest

execution time. Not only is the model efficient, but

this also suggests that the model is effective in dealing

with imbalanced tabular fraud data. This is possibly

caused by the algorithm which utilizes corrective

trees, which helps identifying rare fraud cases that

RFNet and DevNet lacks. Nevertheless, the RFNet is

still a respectable alternative that may perform better

should the data be more balanced, while DevNet can

also be another model to be utilized but might be more

suitable for unlabeled data as an unsupervised

learning-based model.

In comparison with previous works, XBNet,

specifically, has been tested to have a higher recall

and precision, which are approximately 0.96 and 0.95

respectively with accuracy ranging from 85-100% on

different datasets, which are all template or baseline

(example: Iris, Breast Cancer, etc) (Sarkar, 2022).

Apart from that, other works on anomaly detection,

one being multi-class IoT attacks dettection which

resulted in above 90% accuracy on XBNet (Iman et

al., 2025), along with a different hybrid model of

XGBoost with LSTM application with similar results

as the IoT detection model (Yousef et al., 2025). This

could indicate that apart from different kind of

anomaly, although XBNet is a reliable model, other

hybrid methods can outperform the current ensemble

model. Further testing with a more similar dataset can

be done to compare both cases.

Regarding the DevNet model, as presented in a

previous work, it is shown to require significantly

fewer labelled anomalies than other methods to reach

a respectable level of performance, using 75%–88%

fewer labelled anomalies than other methods

depending on the dataset used (Pang et al., 2019).

Other related works dived deeper into specific use

case for DevNet, with one suggesting that DevNet’s

performance leaves room for improvement when

Analysis on Fraudulent Bank Account Data Detector Using Ensemble Learning

199

identifying fraud, which can be done by incorporating

a variational loss function and weighing the loss

accordingly (Piyush et al., 2024), and the other

pointing out that DevNet performs well in key

evaluation indicators such as AUC-ROC when used

to develop network security detection solutions with

its effective use of limited marked abnormal data

(Hao et al., 2025).

The proposed RFNet model, which is a novel

approach to the matter, may not have directly similar

previous works, but the concept of Random Forest

being used for similar use cases can be seen. One such

previous work that was done using on a dataset of

credit card transactions showed that although random

forest by itself obtains good results on small set data,

the results can be negatively impacted due to factors

such as imbalanced data (Xuan et al., 2018). Other

previous works proposed approaches that utilise

random forest by combining it with data processing

algorithms beforehand, such as one that first utilised

an autoencoder to extract features before using

random forest for classification to detect credit card

fraud that resulted in an AUC score of 0.962 (Tzu and

Jehn, 2021), further showing random forest’s

potential suitability for the task of credit card fraud

detection, and another previous work tackling

imbalanced data by using SMOTE, before using

random forest, resulting in a model that has reduced

undetected fraudulent transactions, particularly in

scenarios with imbalanced data (Sorin and Ștefania,

2025).

Table 1: Standard Deviation Values.

Metrics XBNet RFNet DevNet

Accurac

y

0.001 0.0025 0.302

Precision 0.0028 0.0023 0.1117

Recall 0.0054 0.0082 0.1225

ROC AUC 0.0015 0.0028 0.1403

To further validate each model, the variabbility or

range of values of each model is also measured.

XBNet, based on Table 1, has lower standard

deviation values in almost all metrics, which indicates

that the model still prevails in consistency in

comparison with RFNet since lower values of

variance and standard deviation equals fewer varying

results. Despite all that, RFNet can still compete

against XBNet in terms of consistency, such as the

precision, which matches the result of previous

comparison in consistency, as RFNet have higher

advantage in model precision. On the other hand,

DevNet model consistency is proven to be the least

reliable in this study case.

4 CONCLUSION

The proposed method, RFNet, has proven to be a

reliable model to detect fraudulent data, especially

compared to XBNet which is a well-tuned model that

still outperforms the proposed model. Even so,

XBNet is still the preferred model due to the low

resource cost and model quality based on the

precision, recall, value range, and model accuracy. Be

that as it may, RFNet is proven to be able to compete

with XBNet in fraud detection, specifically in bank

data. Moreover, RFNet also outperforms a well-

known fraud detection model, namely Devnet, with a

noticeable difference in results. Be that as it may, if

compared with several previous works, it is appearant

that model tuning and optimization across all tested

models are still needed for a more reliable result.

Research limitations include the data used in this

research which is limited to publicly available

historical bank data accessible to the researcher that

may not cover all types of fraud cases occurring in

recent times, which may affect the generalizability of

the findings to the entire banking industry.

Furthermore, the study compares a more in-depth

model with several tunings, RFNet, with pre-existing

models, XBNet and DevNet, with less parameter

changes, which makes the comparative analysis lacks

fairness, and it is one of the deployment challenges

faced in this research. Apart from that, the time

consumption for running machine learning models is

known to be abundant, which also occurs in this

research. Therefore, any changes made in the model,

including parameters or based model rework can be

challenging as well.

Future research can consider using RFNet if other

well-known and effective models do not perform as

expected or used for more in-depth comparative

analysis with more fairness in tuning, since further

model tuning can be done for better and more

accurate results. On top of that, a better version of

RFNet can be applied in real life banking systems in

the digital side, including mobile banking or financial

tracking applications or system changes in the ATM

machines to apply the machine learning logic.

ACKNOWLEDGEMENTS

The authors would like to give their heartfelt gratitude

and respect to all contributions provided by both

internal and external parties, including references and

sources which provide useful insights for this

research to be properly conducted, along with BINUS

RITECH 2025 - The International Conference on Research and Innovations in Information and Engineering Technology

200

University contribution in providing financial

support. Furthermore, feedback and critiques are also

appreciated for refining this paper. In addition, we

hope that this paper could provide valuable insights

for other researchers to gain more knowledge and

improvements for existing works related to this

research.

OPEN CONTRIBUTIONSHIP

All base concepts and models used for this research

are mainly sourced or referenced from multiple

respectable author works, with a paper titled "XBNet:

An extremely boosted neural network” by Tushar

Sarkar for developing the XBNet model, “Deep

anomaly detection with deviation networks” by

Guansong Pang for the Devnet design, and “Random

forest for credit card fraud detection” by Shiyang

Xuan as a reference for the base RF model, which

then we develop into RFNet as the ensemble learning

model. Apart from that, Hidayaturrahman has also

made a significant contribution in supervising and

providing guidance in paper refinement and ideas on

the model preprocessing method, along with several

other pieces of advice for paper submission.

OPEN DATA

This research fundamentally used a public dataset

from Kaggle, which can also be accessed using web

browser at

https://www.kaggle.com/datasets/sgpjesus/bank-

account-fraud-dataset-neurips-2022, which had also

been used for research published in NeurlIPS 2022.

Under the CC BY-NC-SA 4.0 license, this dataset is

freely available to access, share, and transform with

accreditation.

REFERENCES

Adewumi, A., Ewim, S. E., Sam-Bulya, N. J., & Ajani, O.

B. (2024). Enhancing financial fraud detection using

adaptive machine learning models and business

analytics. International Journal of Scientific Research

Updates, 8(2), 12–21.

https://doi.org/10.53430/ijsru.2024.8.2.0054

PPATK. (2024). Buletin Statistik APUPPT Vol. 11, No. 12

- Edisi Desember 2023.

https://www.ppatk.go.id/publikasi/read/213/buletin-

statistik-apuppt-vol-11-no-12---edisi-desember-

2023.html

Perdigão, D., Antunes, F., Silva, C., Ribeiro, B. (2025).

Exploring Neural Joint Activity in Spiking Neural

Networks for Fraud Detection. In: Hernández-García,

R., Barrientos, R.J., Velastin, S.A. (eds) Progress in

Pattern Recognition, Image Analysis, Computer

Vision, and Applications. CIARP 2024. Lecture Notes

in Computer Science, vol 15369. Springer, Cham.

https://doi.org/10.1007/978-3-031-76604-6_4

A. E. Ekiye and P. Hewage. (2024). Comparative Analysis

of Machine and Deep Learning Techniques for Credit

Card Fraud Prediction in The Financial Sector, 2024

OPJU International Technology Conference (OTCON)

on Smart Computing for Innovation and Advancement

in Industry 4.0, Raigarh, India, 2024, pp. 1-6, doi:

10.1109/OTCON60325.2024.10688293.

Dong, X., Yu, Z., Cao, W., Shi, Y., & Ma, Q. (2020). A

survey on ensemble learning. Frontiers of Computer

Science, 14(2), 241–258.

https://doi.org/10.1007/s11704-019-8208-z

Sarkar, T. (2022). XBNet: An extremely boosted neural

network. Intelligent Systems with Applications, 15,

200097. https://doi.org/10.48550/arXiv.2106.05239

Pang, G., Shen, C., & van den Hengel, A. (2019). Deep

anomaly detection with deviation networks.

Proceedings of the 25th ACM SIGKDD International

Conference on Knowledge Discovery & Data Mining,

353–362. https://doi.org/10.1145/3292500.3330871

Xuan, S., Liu, G., Li, Z., Zheng, L., Wang, S., & Jiang, C.

(2018). Random forest for credit card fraud detection.

2018 IEEE 15th International Conference on

Networking, Sensing and Control (ICNSC).

https://doi.org/10.1109/ICNSC.2018.8361343

RB, Asha., & KR, Suresh K. (2021). Credit card fraud

detection using artificial neural network. Global

Transitions Proceedings, 2(1), 35–41.

https://doi.org/10.1016/j.gltp.2021.01.006

Akour, I., Alauthman, M., Almomani, A., Raman, R., &

Arya, V. (2025). Comprehensive Evaluation of XBNet

for Multi-Class IoT Attack Detection. International

Journal of Cloud Applications and Computing

(IJCAC), 15(1), 1-26.

https://doi.org/10.4018/IJCAC.386134

Alraba'nah, Al Sharaeh, & Ghosoun-Yousef, Saleh Al

Hindi. (2025). Enhancing Intrusion Detection Using

Term Memory and XGBoost. -Hybrid Long Short

-, 6(1), 247Journal of Soft Computing and Data Mining

61. 2

https://publisher.uthm.edu.my/ojs/index.php/jscdm/arti

cle/view/20781

Nikam, P., Vijjali, R., Masihullah, S., Negi, M., & Mathew,

J. (2024). Utilizing DevNet with variational loss for

fraud detection in hyperlocal food delivery.

Proceedings of the 7th Joint International Conference

on Data Science & Management of Data (11th ACM

IKDD CODS and 29th COMAD) (CODS-COMAD '24),

459–463. Association for Computing Machinery.

https://doi.org/10.1145/3632410.3632460

Zheng, H., Sun, D., Han, X., Zhang, X., & Zhao, Y. (2025).

Research on network security intrusion detection based

on DevNet. Proceedings of the 3rd International

Analysis on Fraudulent Bank Account Data Detector Using Ensemble Learning

201

Conference on Signal Processing, Computer Networks

and Communications (SPCNC '24), 251–256.

Association for Computing Machinery.

https://doi.org/10.1145/3712335.3712379

Lin, T.-H., & Jiang, J.-R. (2021). Credit Card Fraud

Detection with Autoencoder and Probabilistic Random

Forest. Mathematics, 9(21), 2683.

https://doi.org/10.3390/math9212683

Mihali, S.-I., & Niță, Ș.-L. (2024). Credit card fraud

detection based on random forest model. 2024

International Conference on Development and

Application Systems (DAS), 111–114. IEEE.

https://doi.org/10.1109/DAS61944.2024.10541240

RITECH 2025 - The International Conference on Research and Innovations in Information and Engineering Technology

202