Relation Between Loss Aversion and Human Behavior

Mengyadi Liang

Liberal Arts College, Macau University of Science and Technology, Macau, 99078, China

Keywords: Loss Aversion, Investment Strategy, Emotional Trap.

Abstract: A cognitive bias known as loss aversion occurs when people would rather avoid losses than experience

comparable gains; in other words, the psychological pain of losing is greater than the psychological pleasure

of winning. This fundamental idea of prospect theory aids in the explanation of risk-averse decision-making

behaviour. In general, loss aversion is a psychological phenomenon that refers to people's aversion to losses

greater than their preference for gains of equal value. This paper reviews the conceptual history of loss

aversion and discusses the existence of loss aversion and its significant impact on human investment behavior.

Through experiments and case studies, it is revealed that individuals show different levels of disgust in

different decision-making environments. The study also investigated the effects of self-protection

mechanisms, gender, and age on loss aversion. Through the experiment of three experiments and

measurement scale, it is proved that they do have a correlation effect on people's attitude of loss aversion. At

last, it deals with the future research direction of the concept of loss aversion, hoping to provide better

investment decision support for investors and not fall into the emotional trap of loss aversion.

1 INTRODUCTION

Loss aversion describes a psychological phenomenon

in which an individual feels negative emotions when

faced with a situation in which they may suffer a loss.

These negative emotions outweighed the positive

emotions they felt when faced with potential gains of

equal value.

This concept plays an important role in the field

of behavioral economics and decision theory,

explaining why people tend to be cautious and risk-

averse in the face of potential losses. This suggests

that people tend to weigh losses more strongly than

they do objectively equivalent gains. Given a $100

loss versus a $100 gain, people may value a $100 loss

more than a $100 gain. In consumer behavior, they

are sensitive to subtle changes in price, especially

when the price rises, they will look for substitutes or

reduce the amount of purchases. In investment

activities, they are more inclined to choose low-risk

investment products, even if the expected return of

these products is not high. They are often reluctant to

sell losing assets, but hold them in the hope that they

will recover to their original purchase price to avoid

real money losses. Their behavior tends to be overly

conservative. So loss aversion has a significant effect

on people's behavior.

Therefore, in-depth research on the causes and

manifestations of loss aversion and its impact on

investment decisions is of great significance for

understanding market behavior and formulating

effective investment strategies. The purpose of this

study is to explore the specific impact of loss aversion

on investment decisions, including the performance

of people in different decisions, the impact of others

on their decisions, and the impact of gender, age and

other factors on loss aversion. Through these studies,

this paper will reveal how loss aversion affects

investors' risk appetite and investment strategy

selection.

This study adopts the methods of questionnaire

survey and data analysis interview. Firstly, the

conceptual framework of loss aversion is sorted out

through the review of relevant literature. Secondly,

through questionnaire survey and analysis of previous

experiments, including the experiment of measuring

loss aversion, the experiment of the impact of loss

aversion under the self-protection mechanism, and

the case study of the Indian stock market. Through the

above methods, the influence of loss aversion on

investment decision is revealed, and corresponding

suggestions and future research directions are put

forward.

Liang, M.

Relation Between Loss Aversion and Human Behavior.

DOI: 10.5220/0014151200004942

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Applied Psychology and Marketing Management (APMM 2025), pages 697-702

ISBN: 978-989-758-791-7

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

697

2 THE HISTORY AND

INFLUENCING FACTORS OF

LOSS AVERSION

Since Thaler introduced it to decision theory in 1980,

loss aversion has gradually become key to

understanding human behavior. Kahneman's,

Knetsch's, and Thaler's cup experiments, as well as

Tversky's and Kahneman's in-depth studies, have

confirmed the existence and impact of this

phenomenon. It shows up not only in transactions, but

also in consumers' sensitive reactions to price

fluctuations, especially strong reactions to price

increases. So what factors shape the loss aversion?

Let's take a closer look at how reference dependency,

emotional influence, and risk attitudes work together

to shape the decision-making process.

2.1 A Brief History of Loss Aversion

Thaler was the first to extend the concept of loss

aversion to risk-free decision-making, arguing that

the valuation of gaining an item is much smaller than

the valuation of losing the same item. Loss aversion

is also used to explain the endowment effect.

Kahneman, Knetsch, and Thaler's (1990) cup study

provided more evidence for their research and linked

it to loss aversion. Tversky and Kahneman (1991)

reviewed the evidence and formally dealt with loss

aversion. Since then, many studies have found loss

aversion in trading (

Kahneman & Tversky, 2013). In

addition, loss aversion is also reflected in consumers'

sensitivity to price changes. They react more strongly

to rising prices than to falling prices. This effect

applies even when people have never owned goods,

such as choices in decision-making.

2.2 Influencing Factor

The influencing factors of loss aversion mainly

involve the following three aspects:

Reference dependence: Loss aversion is closely

related to an individual's reference point. Reference

points are benchmarks against which individuals

assess their gains and losses, most commonly their

current state or desired state. When people face the

phenomenon of "loss aversion", they are more

inclined to give more weight to their losses, even if

the losses and gains are objectively equivalent. At the

same time, the evaluation of the decision will

overemphasize the loss caused by the decision. If the

reference point is identified as the current state of the

individual, then any loss can cause the state to drop,

triggering a stronger negative response. But if the

reference point is taken as an individual's desired

state, then the loss can be seen as a defeat for not

meeting expectations and can also cause strong

negative emotions. Loss aversion is therefore easily

influenced by an individual's choice of reference

point (

Kahneman & Tversky, 1979).

Emotional impact: Losses often elicit strong

negative emotional responses, such as fear and upset.

Gains, on the other hand, cause less emotional

upheaval. Regret is a negative, cognitively

determined emotion that people experience when

realizing or imagining that the present situation would

have been better, had they acted differently

(Zeelenberg 1996, p. 6) This emotional asymmetry

is an important factor in loss aversion. It is

psychological phenomenon where people would

rather avoid a loss than gain an equal amount. When

it comes to decision-making, people's strong

emotional reactions to potential losses can lead

individuals to make risk-averse decisions, potentially

missing out on opportunities to gain. People who

repeatedly experience loss can lead to changes in

behavior, may become more conservative, and even

begin to avoid situations where loss might occur

(

Loewenstein, 1996).

Risk attitude: Loss aversion affects an individual's

attitude towards risk. In the face of losses, people tend

to show higher risk aversion,fearing of losing money

or other resources can lead people to make more

conservative decisions. Therefore, they are reluctant

to engage in activities that may lead to loss. In the face

of returns, people may show a higher appetite for risk.

The prospect of profit makes them more willing to

take on additional risk, because the likelihood of a

positive outcome may outweigh the fear of a negative

outcome. This could lead to more risky and

aggressive investment strategies. For example, when

it comes to decision making, a loss-averse investor

may avoid investments with larger moves, preferring

safer and more stable investments. In terms of

strategy, entrepreneurs may be more cautious when

pursuing new ventures (

Tversky & Kahneman, 1991).

APMM 2025 - International Conference on Applied Psychology and Marketing Management

698

3 THE INFLUENCE OF LOSS

AVERSION ON INVESTMENT

DECISION: A

MULTIDIMENSIONAL

ANALYSIS

Based on previous studies, how does loss aversion

affect investors' risk appetite and how does this

psychological tendency affect their investment

decisions. Through literature review and empirical

analysis by different experts, this paper attempts to

reveal the specific impact of loss aversion on

investment strategy selection. here are three aspects

involved: (1)Analyze the performance of loss

aversion in different decision-making environments

by using different measurement methods, and analyze

people's reaction to loss aversion in investment

activities (Xing, 2023).

(2)Whether decision makers' risk appetite changes

when others make decisions for them (Mengarelli et

al., 2014).

(3)Take the Indian stock market as an example to

study the impact of loss aversion on investment

decisions (

Kumar & Babu, 2018).

3.1 Behavioral Patterns of Loss

Aversion and Their Impact on

Investment Decisions

Schmidt et al. designed an experiment to measure loss

aversion in a new dimension. The survey found that

51 percent of respondents showed strong loss

aversion, which indicated that they had a positive

view of loss. Emotions in this environment could

cause them to be more inclined to avoid losses when

making decisions, even if this might forego gains.

Meanwhile, in 2005, Book and other organizations

recruited 49 students to participate in an experiment

to explore their behavior patterns in a real gambling

game.Finally, the subjects' behavior reflected a clear

preference for loss (Xing, 2023). This shows that loss

aversion behaves differently in different decision-

making environments, and people may exhibit

stronger risk aversion behaviors when facing losses,

which may affect their future investment decisions.

From the perspective of investors' participation in

loss reaction : Thaler and other researchers first

discovered the existence of Myopia Loss Aversion

(MLA) in 1997 (Xing, 2023). The results of this

experiment showed that when the evaluation period

was short, the proportion of participants' investment

in risky assets was lower, indicating that their

aversion to short-term losses was higher. This study

reveals that under certain conditions, people are more

inclined to avoid short-term losses, and this behavior

may have a profound impact on investment decisions,

because they pay more attention to short-term losses

and ignore the potential for long-term gains.

3.2 The Role of Moral Hazard and

Loss Aversion in Decision Making

Earlier, an economist had proposed the concept of

moral hazard. In a broad sense, moral hazard was

described as a situation involving two parties, in

which one party's interests were the responsibility of

the other party, but the other party had an incentive to

pursue its own interests (Mengarelli et al., 2014).

While most people focused on their own choices and

interests, in the real world, people often delegated

their choices to others. So, what happened when

someone else made the decision for the decision

maker?

This experiment had two tasks: (1) The "self"

condition: Subjects had to make choices for

themselves, and their choices only affected their own

payoffs. (2) The "other" condition: Subjects asked

another unknown person to make a choice, and that

person's choice only affected the outcome for that

individual. The results of the experiment show that

when the probability of high risk is high, there is a

significant difference in the proportion of high risk

choices in the "self" and "others" conditions. At low

probability, there is no significant difference between

the two conditions. This suggests that when subjects

ask others to make economic decisions, they show a

higher risk seeking tendency than when they make

their own choices, and they are more willing to take

risks in this situation (Mengarelli et al., 2014).

When the economic consequences of a decision

involve others, it is perceived as less risky and loss

aversion is minimized. Self-selected individuals

(Self-selection is the process by which individuals

make decisions based on their own judgment and

preferences in the face of potential losses and gains.)

have higher levels of loss aversion than others,

perhaps they feel more remorse for their own choices

than for the choices made by the other person.

Therefore, the decisions of others are more rational

than the risk assessment of individual decisions.

3.3 The Influence of Loss Aversion on

Investment Decision and Market

Stability Analysis

Thaler and Johnson (1990) pointed out that when

people had experienced losses, they would become

Relation Between Loss Aversion and Human Behavior

699

more averse to future losses, and this attitude could

lead to a state of paralysis in investment decisions

(Kumar & Babu, 2018). This phenomenon became

even more apparent during the financial crisis of

2008. The research results of Soosunghwang and

Steve E. Satchel (2010) showed that investors

participating in the financial market were seriously

affected by loss aversion behavior, and the sensitivity

of investment to loss aversion behavior varied across

different periods (Kumar & Babu, 2018). It could be

seen that investors were influenced by loss aversion

when making decisions. Therefore, researcher

collected data based on questionnaires and adopted

sampling techniques to investigate Indian companies.

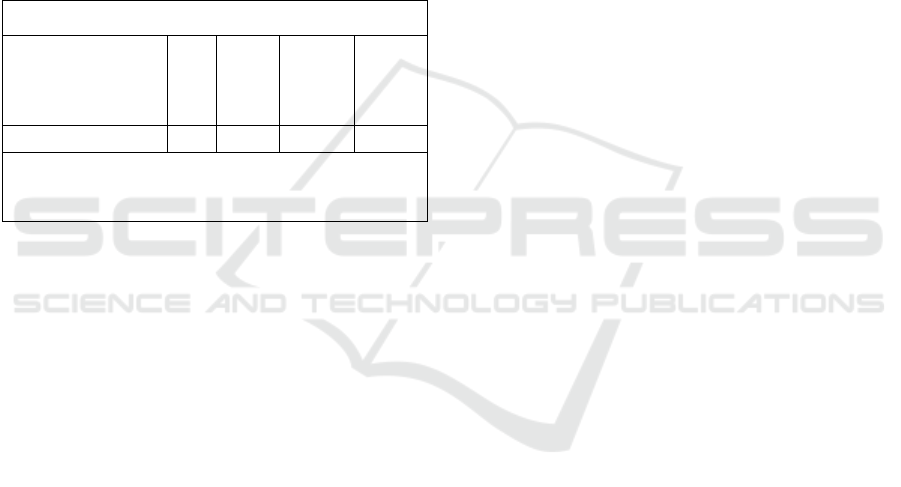

Table 1. Results of regression model fitness for loss

aversion bias and investor risk perception.

Model Summary

Model R R

Square

Adjusted

R Square

Std.

Error

Of the

Estimate

1 .581 .338 .332 .51366

a,

Predictors:(Constant),

LA

The research treats investor decisions as

dependent variables and loss aversion bias as

independent variables. It is concluded that there is a

positive correlation between loss aversion and

investment behavior (Kumar & Babu, 2018) (See

Table 1.).

Therefore, through the above three aspects of

research, it can be confirmed that loss aversion is a

key factor affecting investors' decision-making

behavior. It not only affects the investment choices of

individuals, but can also have a profound impact on

the stability of financial markets.

4 GENDER, AGE, AND LOSS

AVERSION: EXPERIMENTAL

RESEARCH AND

INVESTMENT APPLICATIONS

4.1 Self-Protection Mechanism and

Loss Aversion

It is well-known that loss aversion is a cognitive bias

that is well suited to solving problems related to

survival, specifically protecting oneself from physical

danger, the self-protection mechanism. So

experimentally, how does self-protection affect gains

and losses? What effect will this have on loss

aversion?

Researcher set up three experiments to examine

how loss aversion was affected by courtship and self-

protection mechanisms. In experiments 1 and 2, the

degree of loss aversion of male subjects was reduced

under the stimulation of courtship motivation, while

the degree of loss aversion of female subjects was not

significantly affected. In experiment 3, the use of

guided imagination exercises to motivate self-

preservation, unlike the previous two experiments,

resulted in both men and women becoming more loss-

averse (Li et al., 2012).

This suggests that people are more inclined to

value potential losses in the face of threats, and this

behavior may have a profound impact on investment

decisions, because it makes people pay more attention

to short-term losses and ignore long-term gains.

Through these experiments, it can be concluded

that there are gender differences in loss aversion in

specific situations. In courtship situations, the degree

of loss aversion may decrease in men, while the

degree of loss aversion is relatively stable in women.

However, both men and women become more loss-

averse when faced with a threat. This gender

difference has important implications for investment

decisions, as it can lead people to be more

conservative in the face of potential losses, thus

missing out on opportunities for long-term gains.

4.2 Age and Sex and Loss Aversion

Hallahan, Faff and McKenzie (1999) found that

gender and age can affect people's risk tolerance,

which shows that age and gender variables are

important reasons to explain investors' loss aversion

tendency. It could be seen that age and gender

variables were important factors in explaining

investors' loss aversion tendency. Therefore,

researcher used age and gender as exogenous

variables and loss aversion and risk tolerance as

endogenous variables. In the measurement,

participants were asked to choose between lottery

tickets that were uncertain of whether they would win

or lose, so that accurate measurements could be

achieved under controlled conditions (Arora &

Kumari, 2015). Other researchers also examined the

impact of age on loss aversion (Albert & Duffy,

2012).

It can be concluded that older participants show

higher loss aversion than younger investors, and

APMM 2025 - International Conference on Applied Psychology and Marketing Management

700

women show higher loss aversion than men. So age

and gender have an effect on loss aversion.

5 DISCUSSION

5.1 The Overall Conclusion of the

Study

This paper defined the meaning and influence of loss

aversion, and make it clear that loss aversion, as a

psychological phenomenon, plays an important role

in economics and decision theory. It explains why

people tend to behave cautiously in the face of

potential losses. Moreover, the influential factors of

loss aversion mainly include reference dependence,

emotional influence and risk attitude.

Through literature review by different experts and

empirical analysis, this study reveals the specific

impact of loss aversion on investment strategy

selection, including the performance under different

decision-making environments, the impact of others

on decision making for decision makers and case

studies of specific markets, as well as the relationship

between gender and age and loss aversion.

5.2 Suggestion

Therefore, from the perspective of them should be

aware of the impact of loss aversion on decision-

making and understand the irrational psychological

behaviors that may be caused by loss

aversion.Through self-education and training,

investors are helped to identify and overcome this

psychological bias, laying the foundation for being

able to make more rational decisions in the future.It

also encourages investors to focus on long-term gains

rather than short-term losses.Educate investors to

understand the importance of long-term investment

and reduce the excessive trading and frequent

adjustment of decisions caused by loss aversion.

Financial institutions should design products with

different risk levels to meet the needs of investors

with different risk preferences. At the same time, the

psychological support mechanism should be added to

the product design to help investors better cope with

the psychological pressure brought by market

fluctuations.

Market policymakers should consider the impact

of loss aversion on market stability and reduce the

negative impact of market volatility on investor

sentiment by strengthening regulation and guiding

investment through policies.

5.3 Future Research Direction of Loss

Aversion

In the context of emerging technologies, it is possible

to explore how to use big data and artificial

intelligence techniques to identify and manage loss

aversion. Through technical data analysis, loss

aversion related technologies are created to provide

investors with personalized investment advice and

emotion management tools.

In virtual reality technology, the simulation of

investment environment and market fluctuation

environment can study the loss aversion behavior of

investors in the virtual investment environment, and

provide a new method for investment education.

6 CONCLUSION

This paper explores the phenomenon of loss aversion

in depth and reveals its profound influence on human

behavior, especially investment decisions. As an

important cognitive bias, loss aversion affects an

individual's perception and response to potential

losses and gains, often leading to risk aversion and

over-conservative behavior.

Through multi-dimensional analysis, this study

confirms that loss aversion has a significant impact

on investment strategy. Investors show different

levels of loss aversion in different decision-making

environments, and short-term assessment often leads

to higher loss aversion. In addition, the study found

that individuals might show a different risk appetite

when decisions are made on behalf of others, and are

generally more willing to take risks in such situations.

Moreover, case studies of the Indian stock market

provide empirical evidence of the impact of loss

aversion on investment decisions. Therefore, it is

concluded that loss aversion is a key factor affecting

economic and investment decisions. By recognizing

the factors that influence loss aversion and exploring

innovative solutions, investors and financial

institutions can better navigate the complexity of the

market and achieve more rational and profitable

outcomes.

REFERENCES

D. Kahneman & A. Tversky Prospect theory: An analysis

of decision under risk In Handb Fundam Financ Decis

Mak Part I (pp. 99-127) (2013)

Relation Between Loss Aversion and Human Behavior

701

D. Kahneman & A. Tversky Prospect theory: An analysis

of decision under risk Econometrica 47(2), 263-291

(1979)

G. Loewenstein Out of control: Visceral influences on

behavior Organ Behav Hum Decis Process 65(3), 272-

292 (1996)

A. Tversky & D. Kahneman Loss aversion in riskless

choice: A reference-dependent model Q J Econ 106(4),

1039-106 (1991)

T. Y. Xing Experimental analysis of loss aversion and risk-

taking Ind Innov Res (21), 130-132 (2023)

F. Mengarelli, L. Moretti, V. Faralla, P. Vindras & A. Sirigu

Economic decisions for others: An exception to loss

aversion law PLoS One 9(1), e85042 (2014)

A. A. Kumar & M. Babu Effect of loss aversion bias on

investment decision: A study J Emerg Technol Innov

Res 5(11), 71-76 (2018)

Y. J. Li, D. T. Kenrick, V. Griskevicius & S. L. Neuberg

Economic decision biases and fundamental motivations:

How mating and self-protection alter loss aversion J

Pers Soc Psychol 102(3), 550 (2012)

M. Arora & S. Kumari Risk-taking in financial decisions as

a function of age, gender: Mediating role of loss

aversion and regret Int J Appl Psychol 5(4), 83-89

(2015)

S. M. Albert & J. Duffy Differences in risk aversion

between young and older adults Neurosci Neuroecon,

3-9 (2012)

APMM 2025 - International Conference on Applied Psychology and Marketing Management

702