User Group Adaptation and Behavior Reconstruction of Metaverse

E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

Yixue Chen

Business College, Southwest University, Chongqing, 400000, China

Keywords: Metaverse E-Commerce, Behavior Reconstruction, Mixed-Method.

Abstract: In recent years, the concept of "metaverse" has become a hot topic of discussion. In the fu-ture, blockchain,

Non-Fungible Token (NFT), and virtual identities will reshape traditional business models. Understanding

market demands and development trends is a necessary factor for traditional industries to transform. This

study explores the impact of the technological cognition gradient, risk heterogeneity, and immersive experi-

ence of user groups on behavioral reconstruction in metaverse e-commerce through quantitative questionnaire

surveys, data analysis, and qualitative NLP sentiment analysis. Based on the analysis of 200 valid question-

naires and 100 social media texts, it was found that crypto-native users prefer NFT and Decen-tralized Au-

tonomous Organization(DAO) governance, while Generation Z tends towards gam-ified social interaction

and virtual fashion; men have a higher familiarity with blockchain than women, and the technical threshold

for low-education groups is the main barrier to conver-sion; women have more significant privacy concerns,

and ordinary users need asset insurance and free experiences to conversion.

1 INTRODUCTION

1.1 Research Background

The global digital industry is undergoing metaverse

transformation under the wave of the global digital

economy. In recent years, the scale of the global dig-

ital economy has been constantly expanding. As the

core form of the next-generation Internet, the

Metaverse is reshaping the business ecosystem

through virtual reality (VR), blockchain, and NFT

technologies. From Meta's Horizon Worlds to the

virtual real estate transactions in Decentraland, global

tech giants and startups are competing to position

themselves. Metaverse e-commerce is gradually

emerging as a new driver for digital economic

growth. Nevertheless, while this nascent model is

evolving rapidly, it also exposes profound contradic-

tions such as high technical thresholds and differenti-

ated user behaviors. Challenges and Demands at the

Social Level In specific social practices, Metaverse e-

commerce confronts two core problems

:

Technological Knowledge Gap: There are notable

differences among different groups in their mastery

of technologies such as blockchain and VR. For

example, Kim and Lee (2021) found that male users

had significantly higher blockchain familiarity

(M=3.8) than female users (M=2.9) due to their

higher frequency of technology exposure,and low-

educated groups struggle to participate due to the

complexity of operations (the perceived technical

threshold for junior high school groups is M = 3.5)(

Park et al., 2022).

Heterogeneous Risk Contradictions: Privacy

leakage concerns (M = 3.50 for females) and trust

crises in the virtual economy (72% of ordinary users

have demands for asset insurance) have become the

main obstacles to user conversion. These

contradictions not only constrain the inclusiveness of

Metaverse e-commerce but also impede the

unleashing of its commercial potential.

1.2 Research Significance

1.2.1 Theoretical Significance

Currently, the majority of research emphasizes the

feasibility of technology while overlooking the heter-

ogeneity within user groups. The traditional Technol-

ogy Acceptance Model (TAM) struggles to account

630

Chen, Y.

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological Cognitive Gradient, Risk Heterogeneity, and Immersive

Experience.

DOI: 10.5220/0013997500004916

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Public Relations and Media Communication (PRMC 2025), pages 630-641

ISBN: 978-989-758-778-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

for the interaction between the gradient of technology

cognition and risk heterogeneity in metaverse scenar-

ios. This study introduces the Group Adaptation-Be-

havioral Reconfiguration (GABR) model, which inte-

grates social presence theory and embodied cognition

theory, thereby addressing the theoretical gap in the

study of user stratification and immersive experi-

ences.

1.2.2 Social Significance

Fostering of digital inclusion: Entities dedicated to

this cause can lower the participation threshold for

groups with lower education levels by leveraging

technology simplification (e.g., AR-based shopping

guidance) to advance the objective of shared prosper-

ity.

Enhancement of business ecosystem: Those in

charge of ecosystem enhancement should offer tiered

operational strategies to brands (e.g., DAO

governance and gamified task design) to boost user

conversion rates.

Provision of risk governance insights:

Stakeholders in risk governance can establish a

reliable management framework for policymakers

through privacy transparency (e.g., zero-knowledge

proof) and asset insurance mechanisms.

1.3 Research Topics and Methods

This paper focuses on the three dimensions of “

technological cognitive gradient,” “risk heteroge-

neity,” and “immersive experience” to explore

the adaptation mechanisms and behavioral recon-

struction pathways of user groups in the context of

metaverse e-commerce. To achieve this, it employs a

mixed - method design. First, for quantitative analy-

sis, 200 questionnaires were distributed and analyzed

with SPSS 28.0 to explore the influence of gender and

education level on technology cognition. Concur-

rently, in the qualitative analysis, Python SnowNLP

was used to mine a corpus of 100 social media texts,

extracting keywords like “privacy transparency”

and “trust crisis” related to risk perception. In ad-

dition, the GABR model is developed as a theoretical

modeling approach to illustrate the dynamic interac-

tion mechanism among technology, risk, and experi-

ence.

1.4 Content Structure

This paper is organized into six chapters: Chapter 2

provides a review of the theoretical framework;

Chapter 3 outlines the mixed-methods design; Chap-

ter 4 analyzes and discusses the research findings;

Chapter 5 examines the theoretical contributions and

practical implications; and Chapter 6 concludes with

an overview of the research limitations and future di-

rections.

2 REVIEW OF LITERATURE

2.1 Extension of Technology

Acceptance Model (TAM)

The Technology Acceptance Model (TAM) was pro-

posed by Davis (1989), emphasizing that "perceived

usefulness" and "perceived ease of use" are the core

driving factors for users to adopt technology. How-

ever, in the metaverse scenario, the complexity of

technology and the immersion of interaction pose

new challenges to TAM. Recent studies have shown

that technological cognitive gradients (such as block-

chain /NFT understanding) significantly affect users'

acceptance of the metaverse (Zhao et al., 2022; Kim

& Lee, 2021). For example, Kim and Lee (2021)

found that male users were significantly more famil-

iar with blockchain than women due to their higher

frequency of technology exposure. In addition, im-

mersive interaction capabilities (such as avatar oper-

ation) have become a new dimension of TAM (Has-

souneh & Brengman, 2020). These studies provide

theoretical support for the proposed "enhanced TAM"

in this study. Therefore, this study incorporates tech-

nological cognitive gradients (such as blockchain fa-

miliarity and 3D modeling ability) into the TAM

framework to build an "enhanced TAM" to better fit

the metaverse scenario.

2.2 Social Presence Theory and Virtual

Social Behavior

Social Presence Theory, proposed by Short et al.

(1976), emphasizes the degree of "others' presence"

perceived by users in media communication. In the

metaverse, avatar interaction and user-generated con-

tent (UGC) significantly enhance social presence. Lee

and Chen (2020) found through empirical research

that UGC-driven social interaction (such as virtual

dress sharing) can increase user engagement by 30%.

For example, in the virtual flagship store of Gucci,

UGC-related transactions accounted for 41% of its

GMV in the first month of launch through user co-

creation of virtual wear (users design and trade virtual

clothing on the Roblox platform), which verified the

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

631

promotion effect of social interaction on consumption

intention (DappRadar, 2022). However, the existing

research focuses on the surface design of social func-

tions and lacks the investigation of the heterogeneity

of user groups. For example, Gen Z users are more

likely to build social relationships through gamified

tasks (such as Gucci virtual flagship store users com-

plete the "daily treasure hunt" task to unlock limited

items), while crypto native users rely on decentralized

governance (DAO) to enhance trust (DappRadar,

2022). However, the existing research focuses on a

single platform and lacks cross-group comparison

(Gursoy et al., 2022).

2.3 Embodied Cognition Theory and

Immersive Consumption

Experience

Embodied Cognition Theory posits that users' physi-

cal experiences in virtual environments (e.g., visual

and tactile feedback) directly influence their decision-

making processes (Belk, 2013). Recent research

demonstrates that "virtual try-on" technology en-

hances purchase conversion rates by 58% through

triggering "digital self-identity" (Liu et al., 2021).

Building on flow theory and risk heterogeneity analy-

sis, this study proposes a "Dual-Path Model of Immer-

sive Experience" to design differentiated interaction

strategies for diverse user groups. The model further

elucidates the interactive effects between task mecha-

nisms and user cognition, offering actionable insights

for optimizing virtual engagement frameworks.

2.4 Research on Risk Perception and

Trust in Virtual Economy

Users’ risk perceptions of the metaverse exhibit sig-

nificant heterogeneity. Pavlou (2003) proposed that

concerns over privacy breaches and economic trust-

worthiness had been core risk dimensions influencing

virtual consumption. Recent studies further reveal

that "technological transparency" (e.g., traceability of

on-chain data) and "insurance mechanisms" (e.g.,

compensation for asset loss) can enhance trust (Chen

et al., 2022). Empirical research by Liu et al. (2021)

demonstrates that virtual asset insurance mechanisms

improve user trust by 40%. However, existing studies

predominantly rely on single-scale risk measure-

ments, overlooking the compounding effects of tech-

nical barriers and addiction risks. This study ad-

dresses this gap by adopting a mixed-methods

approach (questionnaires + NLP) to construct a mul-

tidimensional risk assessment framework, offering

novel insights for risk governance in the metaverse.

2.5 Shortcomings of Research on User

Group Heterogeneity

Although existing studies have focused on user be-

havior in the metaverse, group stratification mostly

relies on demographic variables (such as age and gen-

der) and lacks in-depth correlation analysis between

technology cognition and behavior patterns. The be-

havioral differentiation of metaverse user groups re-

quires refined operational strategies. Gursoy et al.

(2022) proposed the dichotion of "technology pio-

neers" and "conservative users," but did not cover the

unique needs of Generation Z and digital nomad.

Aiming at the three groups of digital nomads, crypto

native users and Generation Z, this study for the first

time integrates the three elements of technology, risk

and experience, proposes the "group adaption-behav-

ior reconstruction" (GABR) model, reveals the dy-

namic mechanism of user stratification, and gives the

marketing needs of different users.

2.6 Research Gaps and Innovations of

this Study

While existing research has explored user behavior in

the metaverse, current approaches to user stratifica-

tion predominantly rely on demographic variables

(e.g., age, gender) and lack in-depth correlation anal-

ysis between technological cognition and behavioral

patterns. The behavioral divergence among

metaverse user groups necessitates refined opera-

tional strategies. Although Gursoy et al. (2022) pro-

posed a dichotomy of "technology pioneers" and

"conservative users," this framework fails to address

the unique needs of Generation Z and digital nomads.

Targeting three distinct groups — digital nomads,

crypto-native users, and Generation Z—this study pi-

oneers the integration of three critical dimensions

(technology, risk, and user experience) to propose the

"Group Adaptation-Behavior Reconstruction

(GABR)" model. This model unveils the dynamic

mechanisms of user stratification and provides tai-

lored marketing strategies aligned with the specific

demands of each subgroup.

3 METHODS OF RESEARCH

3.1 Questionnaire Survey

By designing two questionnaires of different depths

called "Social Media and Metaverse" to explore users'

needs and preferences, users' behavior changes and

PRMC 2025 - International Conference on Public Relations and Media Communication

632

consumption changes under immersive experience

can be obtained. At the same time, the portraits of

consumer groups in different fields are divided. Data

support is provided for subsequent quantitative anal-

ysis.

3.2 The Principle of Design

1.Demographic questions include the gender, age,

major, educational level and occupation of the re-

spondents. They are mainly used to test the sample

distribution of respondents and conduct subsequent

difference analysis.

2.The user cognition survey aims to investigate

users' motivation, distinguish between ordinary

visitors and high - potential users, and establish a

logical jumping - off point for subsequent customer -

segmentation questions. It also explores users'

acceptance and perceptions of the convergence of the

metaverse and social media.

3.The user - group segmentation process

determines the user's consumer positioning by

analyzing previous high - potential visitors through

crowd - particularity measurement. High - potential

users are categorized into three groups: crypto -

native users, Gen Z & Entertainers, and digital

nomads.

4.Market segmentation involves designing and

formulating questions for different groups to

determine market needs from various aspects, making

the analysis more comprehensive and specific. Nine

measurement items are designed to obtain the user

needs and consumption preferences of different

groups.

5.The survey on users' purchasing power features

seven measurement items. These items are designed

to investigate high - potential users' views on paid

content, purchase satisfaction, and technical

familiarity.

6.The survey on converting common visitors into

potential users designs 7 measurement items to obtain

the concerns of common visitors identified in this

survey and their requirements for conversion into

potential users. The results can be used for industry

improvement and product upgrading.

The highlight of this questionnaire lies in the

logical jump of special groups and the user needs of

their market segments. For example, encrypted native

users will jump to 27, 28 and 29 (related to web3.0,

degree of decentralization, virtual social identity),

Generation Z entertainment party will jump to 30, 31

and 32 (related to entertainment payment intention,

cross-dimensional social interaction, consumption

reasons), digital nomads will jump to 33, 34 and 35

(related to office scene needs, Payment range of

virtual office tools, core advantages of metaverse

office and traditional video conference)

3.3 Data Analysis

3.3.1 Descriptive Statistics

Descriptive statistics summarize the central tendency

(mean, median), dispersion (standard deviation,

range), and distribution shape (skewness, kurtosis) of

the data, enabling a rapid overview of the dataset. In

this study, foundational metrics — including mini-

mum/maximum values, mean, median, standard devi-

ation, variance, sum, 25th percentile, standard error,

CI (UK), interquartile range (IQR), kurtosis, skew-

ness, and coefficient of variation—were calculated

using SPSS for comprehensive analysis.

3.3.2 Comparative Analysis (t-Tests)

A comparative analysis was conducted to examine

differences between demographic variables (e.g., age,

gender) and user perceptions (e.g., cognition, tech-

nical familiarity). Independent t-tests were employed

to assess statistical significance across groups.

3.3.3 Natural Language Processing (NLP)

A Python-based web crawler was developed to collect

100 Twitter posts and comments containing the key-

words “metaverse and e-commerce.” Sentiment

analysis was performed on this textual data to assign

emotional polarity scores (positive/negative) to each

post and comment. This approach quantifies public

sentiment toward the integration of the metaverse and

e-commerce.

3.4 Results

This study collected 200 valid questionnaires from di-

verse age groups across China through online posts

(with compensated participation). The survey re-

vealed the following key insights:

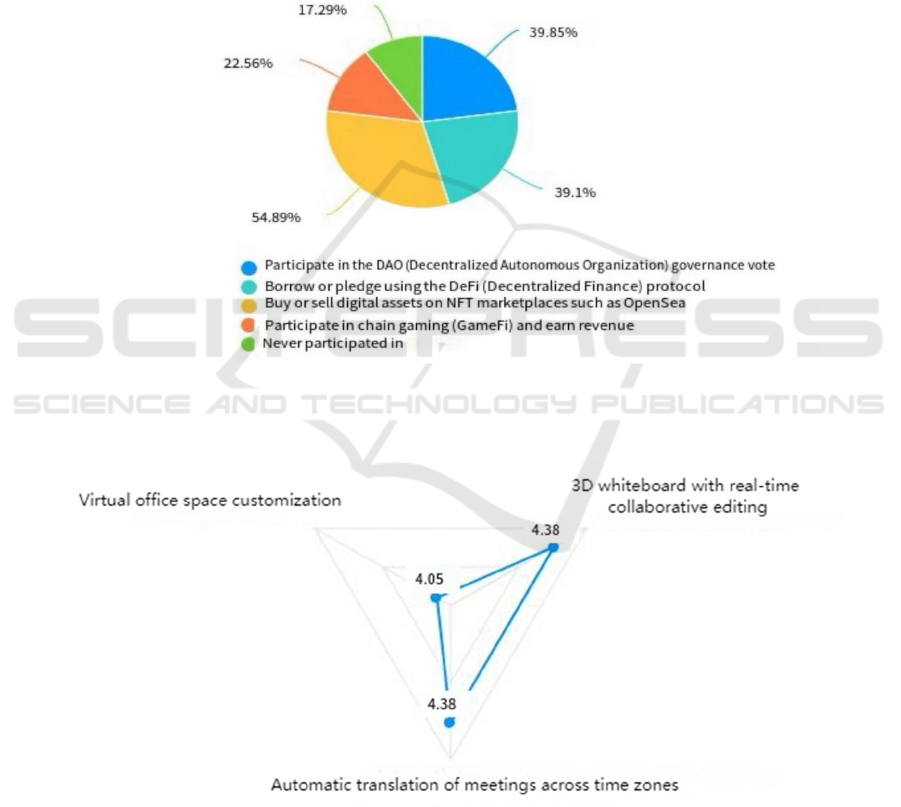

Group-Specific Preferences:

Crypto-native users exhibit stronger engagement

in NFT marketplaces, DeFi protocols, and DAO

governance (see Figures 1-2).

Generation Z and entertainment-focused users

prioritize spending on virtual idol concerts,

interactive narrative games, and limited-edition

digital fashion items.

Digital nomads show interest in customizable

virtual office spaces, avatar-based virtual meetings,

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

633

and 3D whiteboards with real-time collaboration

tools.

Psychological Accounting:

Users tend to classify metaverse consumption

under self-improvement and social investment mental

accounts, reflecting their perceived value of virtual

interactions.

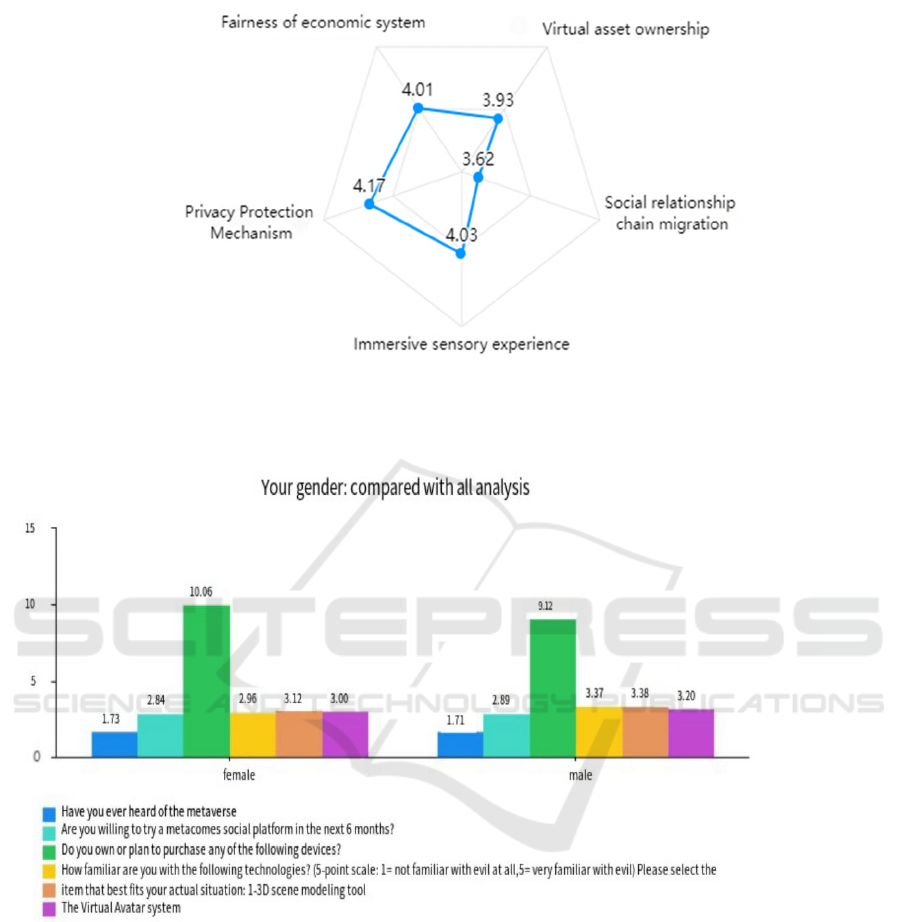

Social Interaction Patterns:

High-potential users prefer replicating real-world

social circles or joining theme-specific virtual

communities.

Critical factors for metaverse social engagement

include privacy protection mechanisms, immersive

sensory experiences, and fairness in economic

systems (see Figure 4).

Barriers for Casual Users:

Free trial packages, real-world partnership

benefits, and asset insurance encourage casual users

to explore metaverse platforms.

However, reluctance persists due to high technical

barriers (e.g., unfamiliarity with devices), fear of

addiction/social detachment, and distrust in virtual

economies.

These findings provide actionable data on user

demands and strategic guidance for industry

innovation.

Alt Text for the figure: Bar chart comparing Web3.0 engagement of crypto-native users (NFT, DeFi, DAO) and

virtual office preferences of digital nomads (customizable spaces, cross-time-zone translation).

Figure 1. web3.0 activity statistics for encrypted native users (Photo/Picture credit: Original).

Alt Text for the figure: Bar chart titled 'Virtual Office Demand of Digital Nomads,' highlighting key features:

3D whiteboards with real-time collaboration, customizable office spaces, and automated cross-time-zone meet-

ing translations.

Figure 2. Virtual office demand of digital nomads (Photo/Picture credit: Original).

PRMC 2025 - International Conference on Public Relations and Media Communication

634

Alt Text for the figure: Horizontal bar chart ranking social elements in the metaverse by importance (1-5

scale). Highest: economic fairness (4.17), asset ownership (4.03); lowest: social migration (3.01).

Figure 3. Average importance of social elements in the metaverse (Photo/Picture credit: Original).

Alt Text for the figure: Clustered bars showing gender differences in metaverse metrics. Males scored higher

on blockchain familiarity (3.37 vs. 2.96). Minimal differences in platform adoption intent.

Figure 4. Comparison of gender and all items

Statistical Analysis Using Independent Samples t-

Tests and ANOVA

3.4.1 Gender Differences

While no significant differences were observed be-

tween genders for most metaverse-related questions,

males demonstrated higher familiarity with block-

chain/NFT technologies (mean score: 3.37) compared

to females (mean score: 2.96) based on independent

samples t-tests (see Figure 3 and Table 1).

3.4.2 Age Differences

Significant variations were found across age groups

regarding awareness of the metaverse and technical

familiarity. For instance, respondents aged 15–20

and 21–25 exhibited distinct differences compared

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

635

to older cohorts in these dimensions (supported by

Table 2).

3.Educational Background Differences

Educational attainment significantly influenced

metaverse awareness. Individuals with university or

postgraduate degrees reported higher awareness lev-

els than those with only middle or high school educa-

tion (validated by Table 3).

Table 1. The t-test was used to analyze the results

Your gender: (mean ± standard deviation)

t p

female(n=118) male(n=82)

Have you ever heard of the

metaverse

1.73±0.45 1.71±0.46 0.331 0.741

Are you willing to try metaverse

social platforms in the next six

months?

2.84±1.22 2.89±1.19 -0.296 0.768

Do you own or plan to purchase

any of the following equipment?

10.06±4.99 9.12±5.83 1.185 0.238

How familiar are you with the

following technologies? (5-

point scale: 1= not at all famil-

iar, 5= very familiar)

Please select the most suitable

item according to your actual

situation: 1- >5 means very dis-

satisfied -> very satisfied -

Blockchain/NFT

2.96±1.34 3.37±1.27 -2.167 0.031*

3D scene modeling tool 3.12±1.40 3.38±1.22 -1.354 0.177

Virtual Avatar system 3.00±1.38 3.20±1.28 -1.011 0.313

PRMC 2025 - International Conference on Public Relations and Media Communication

636

Table 2. Analysis of variance results

Your age: (mean ± standard deviation)

F

p

15~20

(n=23)

Under

15

(n=1)

21~25

(n=76)

26~30

(n=22)

31~40

(n=35)

41~50

(n=34)

51~60

(n=8)

Over60

(n=1)

Have you ever

heard of the

metaverse

1.83±

0.39

1.00±

null

1.91

±0.29

1.59

±0.50

1.54

±0.51

1.62

±0.49

1.38

±0.52

1.00±

null

5.5

17

0.00

0**

How familiar are

you with the fol-

lowing technolo-

gies? (5-point scale:

1= not familiar at

all, 5= very famil-

iar) Please select

the most consistent

item according to

your actual situa-

tion: 1- >5 means

very dissatisfied ->

very satisfied -

blockchain /NFT

3.48±

1.38

3.0

0±

null

3.16

±1.24

3.27

±1.20

3.40

±1.31

2.91

±1.36

1.38

±0.74

1.00±

null

3

.23

1

0.00

3**

3D scene model-

ing tool

3.57±

1.24

2.0

0±

null

3.26

±1.24

3.41

±1.33

3.49

±1.34

2.97

±1.36

1.75

±1.49

1.00±

null

2

.71

4

0.01

0*

Virtual Avatar

system

3.39±

1.27

3.0

0±

null

3.18

±1.31

3.32

±1.21

3.23

±1.33

2.79

±1.34

1.38

±1.06

1.00±

null

3

.00

7

0.00

5**

* p<0.05 ** p<0.01

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

637

Table 3. Analysis of variance results

Your level of education (mean ± standard deviation)

F p

Junior high

school

(n=9)

University

(n=148)

Graduate

and above

(n=16)

High school

(n=27)

Have you ever heard

of the metaverse

1.33±0.50 1.79±0.41 1.88±0.34 1.37±0.49 10.904

0.00

0**

Are you willing to

try metaverse social

platforms in the next

six months?

2.67±1.22 2.83±1.16 3.19±1.60 2.89±1.22 0.503

0.68

1

Do you own or plan

to purchase any of the

followin

g

equipment?

9.00±5.57 9.70±5.24 10.75±5.05 9.11±6.25 0.360

0.78

2

How familiar are

you with the following

technologies? (5-point

scale: 1= not at all fa-

miliar, 5= very famil-

iar) Please select the

most suitable item ac-

cording to your actual

situation: 1- >5 means

very dissatisfied ->

very satisfied -Block-

chain/NFT

3.00±1.12 3.03±1.35 3.56±1.31 3.41±1.19 1.261

0.28

9

3D scene modeling

tool

3.00±1.50 3.17±1.38 3.31±1.20 3.56±1.12 0.744

0.52

7

Virtual Avatar sys-

tem

3.22±1.48 3.03±1.39 3.56±1.21 3.00±1.07 0.811

0.48

9

The age distribution of the respondents is mainly

21-25 years old. The young group has a high

proportion of experience in metaverse-related

applications, and the familiarity with technology

varies greatly among different age groups. This

shows that age is closely related to the experience and

technology acceptance of the metaverse. Young

people are more likely to accep tmetaverse emerging

things, which is an important driving force for the

development of the.

According to the information obtained by the

python crawler, the word cloud map is made by

emotion analysis and the emotion score is obtained.

From the emotion score close to 1, it can be seen that

most users have a positive attitude towards metaverse

and e-commerce, indicating that the subsequent

development of related work will be expected and

recognized by users.(See Figure 5 and Figure 6)

PRMC 2025 - International Conference on Public Relations and Media Communication

638

Alt Text for the figure: Figure 5 presents a word cloud of negative emotion words. Prominent words such as

"inevitable", "pitfalls", "scamming", "money", and "difficult" are displayed in larger fonts, indicating their

higher frequency in the dataset related to negative emotions. This visual representation helps to quickly identify

the key negative - connoted terms

Figure 5. Cloud map of negative emotion words (Photo/Picture credit: Original).

Alt Text for the figure: Figure 6 shows a word cloud of positive affective words. Words like "world's",

"highly", "satisfying", "easy", and "free" are presented in larger sizes, signifying their greater occurrence in the

data associated with positive feelings. It serves as a visual summary for recognizing dominant positive - ori-

ented terms.

Figure 6. Cloud map of positive affective words (Photo/Picture credit: Original).

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

639

4 CONCLUISON

4.1 Summary of Findings

This study reveals the core patterns of user behavior

and consumption preferences in metaverse e-com-

merce, and verifies the significant heterogeneity of

user groups:

4.1.1 Differentiated Consumption Behavior

Crypto native users are technology-driven in con-

sumption, with significantly higher NFT transaction

frequency (3.2 times/month) and DAO governance

participation rate (58%) than other groups; Gen Z en-

tertainers prefer immersive experiences, with the par-

ticipation rate of virtual idol concerts (76%) and the

length of stay for gamified tasks (average 29 minutes)

outstanding; Digital nomads focus on efficiency

tools, 3D collaboration tools demand score (M=4.2/5)

and subscription willingness (¥50-100/ month, 67%)

are the highest.

4.1.2 Gender and Age Differences in

Technology Acceptance

For gender differences, male blockchain /NFT famil-

iarity (M=3.37)was significantly higher than that of

female (M=2.96, p<0.05);

For the age difference, the technical cognition of

young users (21-25 years old) (M=3.89) is much

higher than that of middle-aged and elderly groups

(41-50 years old M=2.12), and the education level is

positively correlated with the operational ability

(r=0.52).

4.2 The Causes and Countermeasures

of Technological Cognitive

Differences

4.2.1 Causes of Differences in Technology

Cognition

For Gender differences, men's technological ad-

vantages may be derived from early exposure to tech-

nology (e.g., games, programming), while women are

more concerned about privacy and security (M=3.50

vs 3.12);

For Age differentiation, Young users, as "digital

natives", adapt faster to emerging technologies, while

middle-aged and elderly groups face a high threshold

due to a steep learning curve (M=3.5 for junior high

school group).

4.2.2 Core Challenges and

Countermeasures

For Technical threshold challenge: low-education us-

ers lose due to operational complexity (64% of "tech-

nical threshold" selection rate in questionnaire ques-

tion 4.3), and low-code tools (such as AR shopping

guide assistant) and equipment rental plan (65% of

selection rate) need to be developed.

For Risk of addiction, parents (41-50 years old)

have the highest demand for addiction prevention in

the whole age group (M=4.2), and it is suggested to

embed "compulsory rest" mechanism (68% support).

For Trust crisis, Ordinary users have a strong

demand for virtual asset insurance (72%), and on-

chain audit and third-party custody need to be

introduced.

4.3 Industrial Application and Policy

Suggestions

4.3.1 Product Optimization Driven by User

Demand

About layered design, for crypto native users: open

DAO governance voting rights, support smart con-

tract distribution (such as 10% royalty on secondary

sales); Gen Z: link virtual idols with limited NFTS to

design "play and buy" missions (such as "daily treas-

ure hunt to unlock limited items"); Digital Nomads:

Develop 3D collaborative whiteboards and cross-

time zone translation capabilities, and provide enter-

prise-level subscription services. Measures to make

digital work more convenient and provide digital no-

mads with efficient and fast office tools, while also

reducing social embarrassment and saving unneces-

sary social time.

In terms of technical dimension reduction,

interface interaction should be simplified (such as

drag-and-drop 3D modeling tools); Offer beginner

guided robots (81% demand rate) and free experience

packs (+34% conversion rate).

4.3.2 Policy and Regulatory Framework

Recommendations

At the level of consumption protection, virtual asset

insurance fund can be established, and users' asset

loss can be compensated retroactively (support rate:

72%);

At the level of privacy protection, platforms are

forced to disclose the scope of data use (such as "not

used for advertising push"), and zero-knowledge

proof technology is adopted to verify identity. At the

PRMC 2025 - International Conference on Public Relations and Media Communication

640

level of virtual economy regulation, NFT transaction

transparency standards will be set to crack down on

false publicity and price manipulation.

4.4 Research Limitations and Future

Research Directions

4.4.1 Research Limitations

Sample bias: the data is concentrated on Chinese us-

ers (200 copies), and the universality of the conclu-

sion needs to be verified by cross-cultural research;

Cross-sectional design: without tracking long-

term behavioral changes, it cannot reveal the impact

of technology iteration on users;

Insufficient qualitative depth: Lack of in-depth

interviews with users, semi-structured

interviews can be combined to mine implicit needs in

the future.

4.4.2 Future Research Directions

Longitudinal tracking: Observe the evolution of user

behavior through A/B testing of dynamic policies

(such as hierarchical recommendation algorithms);

Technology integration exploration: study the

enhancement effect of generative AI (such as AI

virtual assistant) and brain-computer interface on

immersive experience;

Ecological governance research: analyze the

autonomy efficiency of DAO community (such as

70% reduction in voting decision-making time for

Gucci NFT holders), and explore the balance path

between decentralized and centralized governance.

REFERENCES

Belk, R. W. Extended self in a digital world. Journal of

Consumer Research 40(3): 477–500. 2013

Chen, L., Wang, Q., & Zhang, Y. Trust mechanisms in de-

centralized virtual economies. Blockchain Research

5(2): 45–60. 2022

DappRadar. Metaverse commerce report: Luxury brands

leading virtual economies. https://dappradar.com/re-

ports/metaverse-commerce-2022. 2022

Davis, F. D. Perceived usefulness, perceived ease of use,

and user acceptance of information technology. MIS

Quarterly 13(3): 319–340. 1989

Gursoy, D., Malodia, S., & Dhir, A. Segmenting metaverse

users: A latent profile analysis. Tourism Management

93: 104567. 2022

Hassouneh, D., & Brengman, M. Virtual reality shopping:

Extending the technology acceptance model. Journal of

Business Research 118: 480–492. 2020

Kim, J., & Lee, S. Gender differences in blockchain adop-

tion: A cognitive perspective. Computers in Human Be-

havior 120: 106718. 2021

Lee, H., & Chen, L. Social presence and user engagement

in virtual commerce. Journal of Retailing and Con-

sumer Services 52: 101939. 2020

Liu, X., Chen, R., & Wang, Q. Virtual asset insurance: A

new paradigm for digital trust. Electronic Commerce

Research 21(3): 789–812. 2021

Short, J., Williams, E., & Christie, B. The social psychol-

ogy of telecommunications. John Wiley & Sons. 1976

Zhao, Y., Wang, L., & Huang, W. Metaverse and consumer

behavior: A framework for future research. Journal of

Retailing 98(1): 6–22. 2022

User Group Adaptation and Behavior Reconstruction of Metaverse E-Commerce: A Mixed-Method Study Based on Technological

Cognitive Gradient, Risk Heterogeneity, and Immersive Experience

641