Internal Audit Effectiveness on Corporate Governance and Financial

Fraudulent Risk: Evidence from Kangmei Pharmaceutical

Yunjiao Wu

Rotman Commerce, University of Toronto, 27 King's College Circle, Toronto, Ontario, Canada

Keywords: Kangmei Pharmaceutical, Financial Fraud, Internal Audit Quality, Corporate Governance, Internal Control.

Abstract: Over the last decade, financial fraud has occurred more frequently as it has become increasingly complicated,

organized, and systematic, given the rapid growth of small and medium-sized enterprises. Due to the sudden

economic downturn post-pandemic, firms facing extensive financial pressure tend to act more aggressively,

eventually leading to the incentive to commit fraud. Thus, the research on financial fraud and its relationship

with firms’ corporate mechanisms is of great significance in helping the public better conduct control samples

for future fraud prevention. Applying Kangmei Pharmaceutical’s financial fraud case as a recent example,

given the current accounting system and theoretical framework of fraud, by analyzing its internal audit quality

and corporate governance, this article provides insight into how internal audit quality and corporate

governance will ultimately contribute to the overall fraud risk.

1 INTRODUCTION

With the development of the global economy and the

international market, growing attention from the

public has been focused on financial fraud associated

with financial statement misconduct and audit failure.

The U.S. Committee of Sponsoring Organizations of

the Treadway Commission’s financial statement

fraud study from 1897 to 1997 in U.S. public

companies revealed that approximately 40% of

financial fraud occurred in industries including

technology, healthcare, and financial services

(Beasley, Carcello, Hermanson, & Lapides, 2000).

This astonishing finding indicates a growing risk of

violations in selected industries. However, many

previous studies conducted in the last century did not

fairly present any fraud control samples, emphasizing

the effectiveness of the firm’s audit committee and

functions of its corporate governance mechanisms

(Beasley et al., 2000), which raised public concerns

about the validity and universality of their results.

Hence, further investigation should be conducted

among the selected industries to determine the degree

of the mentioned fraud control samples in mitigating

financial fraud in public companies, using the recent

fraud example of Kangmei Pharmaceutical as a case

study illustration.

A focus on Kangmei Pharmaceutical is

appropriate for many reasons. First, this incident

occurred after a series of financial frauds in Chinese

listed companies such as Lantian Corporation, Wanfu

Biotechnology, Green Earth, Zhangzi Island, Kangde

Xin, etc., which means the fraudulent behaviour

persists despite repeated bans as the Chinese capital

market has grown rapidly in recent years (Zhang,

2023). The disturbing trends warn public stakeholders

to pay more attention to the relevant industry.

Meanwhile, the repetitive occurrence of such

incidents also indicates a lack of enforcement of the

regulations, which is also a crucial factor beyond low

public awareness. Under such circumstances, the

revelation and analysis of Kangmei Pharmaceutical

fraud are critical to understanding the formulation of

financial fraud in enterprises and how fraud control

samples failed to prevent it.

Second, when examining Kangmei

Pharmaceutical’s detailed ownership structure, a

disturbing discovery is made: the company is solely

controlled by a single person, Ma Xingtian, with his

wife as an affiliated person (Li, 2024). As a result, the

imbalanced ownership structure contributed to

Kangmei Pharmaceutical’s vulnerable internal

control and offered opportunities for the Ma couple,

as the top management, to commit fraud.

Finally, according to the China Securities

Regulatory Commission (CSRC) release, the audit

partner, Zhengzhong the Pearl River, failed to detect

material misstatements presented in Kangmei

Pharmaceutical’s financial statements and issued

standard unqualified opinions on the 2016 and 2017

144

Wu, Y.

Internal Audit Effectiveness on Corporate Governance and Financial Fraudulent Risk: Evidence from Kangmei Pharmaceutical.

DOI: 10.5220/0013987500004916

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Public Relations and Media Communication (PRMC 2025), pages 144-150

ISBN: 978-989-758-778-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

annual reports, which led to the serious audit failure

and subsequent financial fraud (Ye, Bai, & Xue,

2022). Therefore, Kangmei Pharmaceutical’s

financial fraud is a typical example of a firm’s

misconduct due to weak corporate governance and

auditors’ misconduct. This paper will examine the

relationship between the internal audit quality and the

control effectiveness of Kangmei Pharmaceutical’s

corporate governance and potential enterprises’

fraudulent behaviours.

2 DEFINE INTERNAL AUDIT

AND FINANCIAL FRAUD

2.1 Internal Audit Quality and Audit

Committee Functions

With growing concern regarding a series of financial

frauds in the Chinese enterprise market within the

past decades, the role of internal audit (IA) has

evolved and expanded into massive activities

associated with corporate governance, as it provides

effective internal control systems, which makes a

strong corporate governance mechanism and enables

greater trust from the external auditors in internal

settings (Ferrari, Cunha, &Boff, 2023). Based on the

International Financial Reporting Standards (IFRS)

requirements, all listed companies should form an

Audit Committee involving key components that at

least three members presented in the committee, all

members are independent executives, and at least one

member obtains financial expertise (Krishnan, 2005).

Per IFRS, public companies must appoint an audit

committee to hire external auditors who obtain a

Certified Public Accountant (CPA) license to become

audit partners and conduct financial statement audits

to convince investors and stakeholders to trust the

firm's financial conditions.

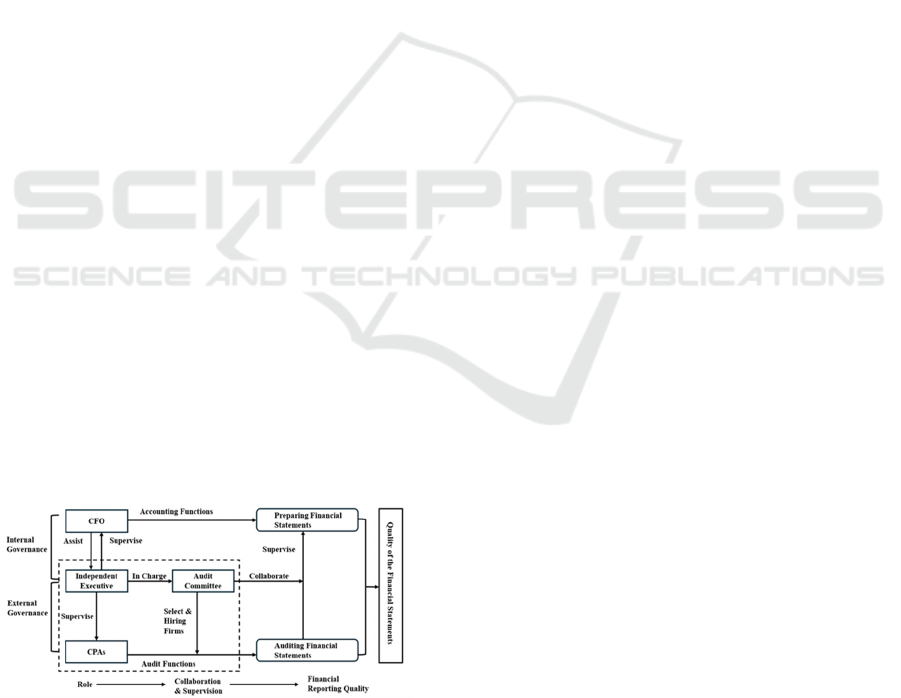

Alt Text for Graphical Figure: A diagram showing the

complete accounting system involving accounting and

auditing functions from the internal and external

governance angles.

Figure 1: Theoretical Framework of Firms’ Effective

Accounting System (Ye et al., 2022).

Figure 1 shows that firms can enhance financial

statement quality only when internal and external

governance cooperate well in the circled area. As a

key functional department involving internal and

external governance, the effectiveness of the audit

committee is critical.

2.2 Financial Fraud Theories

The theoretical approach mainly includes the Fraud

Triangle Theory and the GONE Theory. Of all three

factors contributing to potential fraud, pressure is the

majority cause due to firms’ need to meet the

financial forecasting, compensation and incentive

structures, external financing, or poor performance

(Hogan, Rezaee, Riley, & Velury, 2008), while weak

internal control will offer opportunities for top

management to manipulate revenues and earnings to

attract more investors. Besides, justification factors

allow some excuses to justify themselves as

“reasonable” when committing fraud. In contrast, the

GONE theory supposes individuals are profit-

seeking, and their behavior is rational; if there is an

opportunity and they believe it will be difficult to be

exposed in the future, they will inevitably engage in

fraudulent actions (Luo, 2020).

2.3 The Relationship Between IA

Quality and Financial Fraud

Compared to companies without fraud, companies

that commit fraud typically have either no audit

committee present or the members of the audit

committee are not entirely independent directors who

receive financial benefits such as stock options from

the company (Beasley et al., 2000). Furthermore, a

larger audit committee involving more independent

directors would have more expertise in terms of

diversity to provide more objected decision-making

and enhance accountability and oversight since more

independent members in the audit committee also

reflect more time, finances, and administrative

support (Pasko, Zhang, Pyzhikova, & Mykhailova,

2024). The hypothesis test shows that the two distinct

but important aspects of the internal audit function,

competence and independence, jointly strongly

improve financial reporting quality (Abbott,

Daugherty, Parker, & Peters, 2016), supporting the

above finding. Moreover, firms with a well-organized

audit committee typically have strong internal control

and IA quality, as mentioned above, which enhance

corporate governance to reduce the incentive for

fraud. For this reason, high IA quality greatly reduces

the opportunity fraud factors and helps organizations

construct a healthy corporate environment.

Internal Audit Effectiveness on Corporate Governance and Financial Fraudulent Risk: Evidence from Kangmei Pharmaceutical

145

3 EVIDENCE FROM KANGMEI

PHARMACEUTICAL

3.1 Company Background

Kangmei Pharmaceutical was founded in 1997 by Xu

Yanjun and Xu Dongjin. However, Xu’s spouse, Ma

Xingtian, physically controlled the company as the

sole director. In 2001, the company successfully went

public and was listed on the Shanghai Stock

Exchange. During the past two decades, Kangmei

Pharmaceutical has mainly produced and sold

traditional Chinese medicine, chemical drugs, health

food, purchased products, and Chinese medicinal

materials. As of 2018, 154 companies were included

in its consolidated financial statements, with 46

newly included, 33 newly formed and 13 newly

merged (Luo, 2020), making the company one of the

major operators in China’s pharmaceutical industry.

However, in October 2018, Kangmei was accused by

several financial analysts and journalists of

manipulating and falsifying its operating revenue,

stock inventories, cash and other current assets.

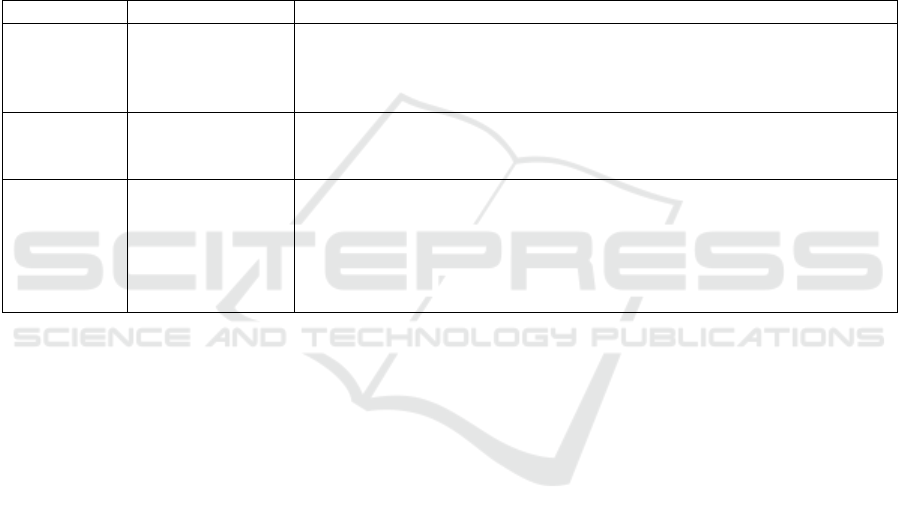

As shown in Table 1, a series of investigations

was launched, leading to a tremendous fraud

sequence.

Table 1: Timeline of Kangmei Pharmaceutical’s Fraud (Ye et al., 2022).

Sta

g

e Timeline Si

g

nificant Event

Stage I October 2018

– December 2018

The financial analysis article questioning Kangmei Pharmaceutical’s

fraud has been released, and the firm’s stock price has declined

significantly. On Dec 28

th

, 2018, the CSRC investigated Kangmei

Pharmaceutical’s violation of information disclosure regulations.

Stage II April 2019 Kangmei Pharmaceutical has released its 2018 annual report and

announcement on correcting accounting errors in the previous period,

with nearl

y

30 billion

y

uan of funds missin

g

.

Stage III May 2019

–

November 2021

The Shanghai Stock Exchange issued a letter of inquiry in May

2019, and the CSRC issued a notice of investigation to Zhengzhong

Pearl River. On May 14

th

, 2020, the CSRC issued the "Administrative

Penalty Decision" and "Market Ban Decision" to Kangmei

Pharmaceutical. On Nov 12

th

, 2021, the Guangzhou Intermediate

People’s Court made a firs

t

-trial

j

ud

g

ment on the class action lawsuit.

The audit partner of Kangmei Pharmaceutical

since 2001 is Zhengzhong Pearl River Accounting

Firm. Zhengzhong Pearl River, founded in 2000 and

registered in Guangzhou, is one of the earliest

accounting firms in China. In 2013, the firm switched

from a limited liability partnership (LLP) to a general

partnership (GPP). Since then, Zhengzhong Pearl

River has ranked 22nd in the "2018 Top 100

Accounting Firms by Business Revenue" released by

the China Association of Certified Public

Accountants (CACPA) and obtained 91 clients by the

end of 2018 (Luo, 2020). However, such a famous

CPA firm fails to detect the abnormal transactions in

Kangmei Pharmaceutical’s 2016-2018 annual report,

thus consequently being blamed by CSRC for the

other party responsible for Kangmei’s financial fraud.

Therefore, the following sections will analyze the

details of Kangmei Pharmaceutical’s fraud from both

IA and governance perspectives and follow the fraud

risk factors to determine the ultimate cause and the

aftermath of this incident.

3.2 Assessment of the IA Quality

First, since Zhengzhong Pearl River failed to detect

the falsified financial statement prepared by Kangmei

Pharmaceutical, the primary focus is on Kangmei’s

internal audit department to determine whether they

adequately oversee the board and monitor the external

audit. When examining the company’s board

structure and the audit committee, the first concerning

factor is the threat of independence. The three audit

committee members, Luo Jiaqian, Ma Huanzhou, and

Wen Shaoqian, all have management positions within

the company, which means they are not independent

executives, causing the audit committee to lose its

independence completely (Zhang, 2023).

Additionally, two of these executives are of senior

age (Zhang, 2023), making people question their

competence to adequately monitor the company’s

accounting department and provide sufficient

supervision to the IA. On the other hand, Zhengzhong

Pearl River has been Kangmei’s audit partner for 17

years, making the external auditors also face the

familiarity risk, in which auditors become too

familiar with the client’s transactions to detect any

PRMC 2025 - International Conference on Public Relations and Media Communication

146

material misstatements. The reason why Kangmei

Pharmaceutical was reluctant to switch partners may

be due to the consideration of lowering the audit fee

because auditors are risk-oriented; when companies

experience increasing risks, such as rapid growth,

organizational instability, and financial complexity,

the audit cost will increase due to the extra work

performed by the auditors (Bentley, Omer, & Sharp,

2013). Based on the information above, Kangmei

Pharmaceutical has the above characteristics since it

grew rapidly as of 2018, and in that single year, it also

had complex transactions such as consolidations.

Hence, the management had incentives to reduce the

audit cost for not switching audit partners for a long

time, even though the accounting industry

recommends that firms regularly switch audit

partners every five to ten years to avoid familiarity

risk. Since Zhengzhong Pearl River has been

Kangmei’s audit partners for almost twice the

recommended time frame, their audit failure is

foreseeable. Therefore, the external audit failure is

another vital evidence that the IA quality of Kangmei

Pharmaceutical is seriously inadequate, as the audit

committee should have monitored and prevented such

events by notifying the board beforehand.

3.3 Assessment of the Corporate

Governance and Internal Control

Subsequently, susceptors also point out that the

controller of Kangmei Pharmaceutical deliberately

selected those who were too old to maintain sufficient

supervision and empowerment to be the audit

committee members to undercut its function when

committing fraud, leading to questions about

Kangmei’s corporate governance and control. In

1999, The Blue Ribbon Commission (BRC) listed

various factors from the board’s characteristics that

could affect the audit committee’s effectiveness, such

as composition, independence, knowledge and

expertise, effectiveness, power, duties and

responsibilities, and the association between board

characteristics and earnings manipulation and fraud

(Cohen, Krishnamoorthy, & Wright, 2004). By

closely investigating Kangmei’s board structures,

there is a high functional overlap between the

controllers and the top management. The board

chairman, Ma Xingtian, also worked as the

company's CEO, with his wife, Xu Dongjin, the top

manager, meaning they monitored their own work.

Compared to the Ma couple, none of the other

shareholders own more than 5% of the company

shares, which means Ma has dominant control over

the decision-making and financial forecasting of the

entire company, and other executives cannot

counteract his irrational movements (Li, 2024).

Furthermore, the ownership structure has created

conditions for the Ma couple, as major shareholders,

to fully control the board decisions. Since they have

authority over the appointment, removal, and

compensation of members of the supervisory board

and audit committee through the shareholders’

meeting, the audit committee virtually have no

supervisory to effectively constrain the Ma couple as

they were not independent directors (Liang, 2021),

which led to serious internal control deficiencies and

a lack of corporate governance within the company.

Another indication is that the three audit committee

members held positions in Kangmei Pharmaceutical,

which significantly deteriorated the independence, a

crucial factor in the audit committee’s ability to

confront management and effectively collaborate

with external auditors (Cohen et al., 2004),

consequently minimizing control effectiveness.

3.4 Assessment of the Fraud Risk

Eventually, from the theoretical framework, these

control weaknesses provide board incentives and

opportunities for the Ma couple to manipulate the

company’s earnings and falsify the financial

statements over many years.

Applying the fraud triangle theory, the external

incentives mainly came from the financial pressure

since the company was rapidly growing. By the end

of the second quarter of 2018, Kangmei

Pharmaceutical had tripled its total assets compared

to five years ago through investment. As of December

31, 2018, the company had borrowed nearly 29.1

billion Chinese yuan (CNY), and the top ten

shareholders of Kangmei almost pledged all their

shares (Wang, 2021). As a result, pressures to obtain

more funds for its operating activities and debt

covenant is the Ma couple’s primary incentive for

financial fraud. On the other hand, the opportunity

factors are also displayed internally. According to the

previous analysis, a malfunctioned internal audit team

lacking effective corporate governance and control

opens the gate to misrepresentations in financial

statements since neither the internal supervision nor

the external audit detection was very effective in this

case. Finally, the Ma couple also had a fluke mind in

that they justified their misconduct to external factors

like the company’s rapid growth rather than their

incentives, while the executives from the audit

committee also had similar accuse as the extreme

ownership and equity structures did not provide them

enough motivation to perform their duties (Wang,

2021). Ultimately, all three factors contribute to a

series of Kangmei’s financial fraud.

Likewise, under the GONE theory, the Ma

couple’s excuses could be easily punctured since the

company's rapid growth is not a natural movement.

Internal Audit Effectiveness on Corporate Governance and Financial Fraudulent Risk: Evidence from Kangmei Pharmaceutical

147

Instead, as the controller, they made rapid expansion

and aggressive financial movements to satisfy greed

in their mind. Meanwhile, market opportunity factors

also played a role since managers have incentives to

misstate earnings to maintain a higher stock price

(Dechow, Ge, Larson, & Sloan, 2011), exactly what

the Ma couple did when engaging in fraud. In

addition, the pressure factors also explain the need for

them to conduct fraudulent activities because of their

urgent request for funds to fulfill the company’s cash

flow gaps. Lastly, internal opportunities, such as

insufficient supervision and regulatory enforcement,

increase the overall exposure to fraud risk from an

unsound system (Li, 2024).

4 REVELATIONS OF

KANGMEI’S FRAUD SCANDAL

In Kangmei’s financial fraud case, the Chief

Financial Officer (CFO), independent executives, and

the audit partners each committed dereliction of duty,

together proving that the entire enterprise mechanism

between all three was a total system failure. However,

this case also provides valuable lessons to the Chinese

and global enterprises market, especially high-risk

industries, to avoid the same mistake. Hence, several

recommendations and enforcement have been made

by the CSRC.

4.1 Improving the Corporate

Governance Structure

The primary reason for Kangmei’s fraud was that the

unbalanced ownership structure gave the Ma couple

too much authority as the board chairman. The

succession directors should allocate the equity

structure more reasonably and distribute the shares

evenly to all board members to avoid a single

shareholder dominating the entire board's decisions.

Moreover, the newly established board should ensure

that an odd number of directors are present on the

board, for instance, five executives before the fraud

incident. In that case, a majority vote should be

introduced to ensure the board decision is made in

favour of the majority shareholder groups so that their

decision.

4.2 Standardizing Financial Reporting

Procedures

During the CSRC’s investigation, there was a

sequence of financial misconduct in the CFO’s

representation and Kangmei Pharmaceutical’s

financial statement presentation, meaning that the

staff in its accounting department did not perform

their duties per IFRS requirements and under

accounting conceptual frameworks. Thus, the

company should also increase staff training to ensure

they have adequate financial expertise to follow the

required accounting procedures when preparing

financial statements. Ethical training should also be

introduced on a staff working basis to increase the

moral status of financial employees and reduce the

likelihood of fraud. At the same time, extra attention

should be paid to external auditors’ independence and

competence to avoid the case of Zhengzhong Pearl

River’s corruption with Kangmei’s top management

and violating the professional code of conduct as a

CPA.

4.3 Enhancing the Audit Committee’s

Functions to Improve IA Quality

While notable action was taken to improve the

external auditor’s expertise, the IA department should

be emphasized more when reconstructing the

corporate environment. Without internal audits’

unique efforts and expertise in companies’

organizational operations, the organization would

experience significantly more disclosures of material

weaknesses and revelations of financial

noncompliance (Holt & DeZoort, 2009), which

heavily reduces the effectiveness and efficiency of

external auditors. The U.S. Security Exchange

Commission (SEC) officials have repeatedly

emphasized the importance of the internal audit

function to the success of a company’s fraud

prevention and financial statement fair representation

(Holt & DeZoort, 2009). Kangmei Pharmaceutical’s

newly elected board should take subsequent actions

to reconstruct the audit committee by ensuring that at

least three members of the board’s independent

directors regularly perform their duties with at least

one obtained financial expertise.

4.4 Establishing a Comprehensive

System for Corporate Mechanisms

Cross-Monitoring One Another

Accordingly, the ultimate cause of Kangmei

Pharmaceutical’s fraud was a chain of reactions of

complex system failure when all three components

regarding the corporate governance, IA, and external

auditors simultaneously failed in the corporate

mechanism as a whole. The company should redesign

its corporate mechanisms to let all three pieces

function independently from each other but

collaborate well through cross-checking. Besides,

external effort should also help reduce the chances of

fraud and prompt companies to establish a more

PRMC 2025 - International Conference on Public Relations and Media Communication

148

functional and transparent corporate mechanism. Law

enforcement departments, such as the CSRC, should

tighten relevant regulations to eliminate any

loopholes for potential fraud and better direct

enforcement.

5 CONCLUSION

This article uses Kangmei Pharmaceutical’s financial

fraud as an illustrative example to conduct a detailed

analysis of its IA quality and corporate governance

and apply the fraud theories to determine how these

factors contribute to Kangmei’s significant financial

fraud. Based on extensive research and analysis, the

IA quality will positively influence the company’s

internal control and corporate governance since an

effective audit committee will monitor the company's

financial activities, enabling the management to act in

the shareholder’s interests. The audit committee can

also collaborate with the external auditors, as the

internal control is strong, and the external auditors

will perform less audit work. They can focus more on

the risky account to improve both the effectiveness

and efficiency of the overall audit work. At the same

time, since the audit committee members are

independent board executives, they also provide the

board oversight and help prevent financial fraud

internally by monitoring the external auditors’ work

and potential fraudulent behaviors conducted by top

management. Regarding the case study, Kangmei

Pharmaceutical demonstrated the exact opposite side

by showing its chaotic corporate governance, making

single shareholders dominate the entire board,

significantly weakening the effectiveness of IA

quality. Without the independent audit committee

member providing sufficient supervision, the top

management also corrupts its audit partner and leads

to serious misrepresentation in financial reporting and

subsequent audit failure, making all three parties

liable for committing fraud.

The revelation from Kangmei Pharmaceutical

also provides the industry with valuable insights to

help reduce the likelihood of financial fraud from

multiple perspectives. The internal approach should

focus on enhancing the staff qualifications (the CPA

competence and independence) and the function of

the IA Committee to improve internal control, which

helps eliminate the opportunity factors for

committing fraud. The board should also reinforce the

ethical code of conduct and corporate by-laws to its

management and employees. By improving their

moral status, the corporate environment is eventually

healthier. External enforcement should tighten the

regulations for industries obtaining a higher inherent

risk of fraud, for instance, introducing harsh

punishments and joint liabilities for all parties

engaging in fraud activities or negligent duties, as the

CRSC did for consequences made by Kangmei

Pharmaceutical’s directors and the in-charge external

auditors to reduce the top management’s incentives

for fraud.

Finally, this case study contains limitations in that

it is a single example from the Chinese capital market.

As the healthcare industry naturally involves a higher

inherent risk for financial fraud, the results generated

by Kangmei Pharmaceutical may not be fully

representative and generalized to all companies and

industries. In future research, more data should be

obtained from multinational-based firms to help

compare the fraud trend across countries. Equally

important, more case analyses through different

companies should be conducted cross-industries

when comparing the IA quality and corporate

governance to validate the study result.

REFERENCES

Abbott, L. J., Daugherty, B., Parker, S., & Peters, G. F.

2016. Internal audit and financial reporting quality: The

joint importance of independence and

competence. Journal of Accounting Research 54(1): 3-

40.

Beasley, M. S., Carcello, J. V., Hermanson, D. R., &

Lapides, P. D. 2000. Fraudulent financial reporting:

Consideration of industry traits and corporate

governance mechanisms. Accounting Horizons 14(4):

441-454.

Bentley, K. A., Omer, T. C., & Sharp, N. Y. 2013. Business

strategy, financial reporting irregularities, and audit

effort. Contemporary Accounting Research 30(2): 780-

817.

Cohen, J. R., Krishnamoorthy, G., & Wright, A. 2004. The

corporate governance mosaic and financial reporting

quality. Journal of Accounting Literature 87-152.

Dechow, P. M., Ge, W., Larson, C. R., & Sloan, R. G. 2011.

Predicting material accounting

misstatements. Contemporary Accounting

Research 28(1): 17-82.

Ferrari, A., Cunha, P. R. D., & Boff, M. 2023. Management

style in internal audit: influence between personal

factors and role conflict. Revista Contabilidade &

Finanças 34(92): e1710.

Hogan, C. E., Rezaee, Z., Riley Jr, R. A., & Velury, U. K.

(2008). Financial statement fraud: Insights from the

academic literature. Auditing: A Journal of Practice &

Theory, 27(2), 231-252.

Holt, T. P., & DeZoort, T. 2009. The effects of internal

audit report disclosure on investor confidence and

investment decisions. International Journal of

Auditing 13(1): 61-77.

Internal Audit Effectiveness on Corporate Governance and Financial Fraudulent Risk: Evidence from Kangmei Pharmaceutical

149

Krishnan, J. 2005. Audit committee quality and internal

control: An empirical analysis. The Accounting

Review 80(2): 649-675.

Li, S. 2024. A study on financial fraud at Kangmei

Pharmaceutical based on the GONE theory. Advances

in Economics, Management and Political Sciences 70:

231-240.

Liang, C. 2021. Analysis of financial fraud in Kangmei

Pharmaceutical: based on the perspective of internal

control. Marketing of Time-Honored Brands (10):83-

84.

Luo, L. 2020. Research on the identification and prevention

of financial fraud in Kangmei Pharmaceutical

Company. Zhongnan University of Economics and

Law.

Pasko, O., Zhang, L., Proskurina, N., Ryzhikova, N., &

Mykhailova, Y. (2024). Does internal audit matter?

Audit committee, its attributes, and corporate social

responsibility reporting quality. Investment

Management & Financial Innovations 21(2): 70.

Wang, H. 2021. Research on financial fraud of Kangmei

Pharmaceutical based on the fraud triangle theory.

China Storage and Transportation (12): 102-103.

Ye, X., Bai, X., & Xue, Y. 2022. Financial directors,

independent directors, and certified public accountants

improve the quality of financial reports: thoughts on the

financial fraud incident of Kangmei Pharmaceutical.

Finance Research (06): 14-23.

Zhang, R. 2023. Research on the corporate governance

system of Kangmei Pharmaceutical. Accounting for

Township Enterprises in China (03): 135-137

PRMC 2025 - International Conference on Public Relations and Media Communication

150