Political Risks Motivate Japan to Seek Ever More Global Trading

Partners

Tao Huang

Revelle College, University of California San Diego, La Jolla, U.S.A.

Keywords: Geopolitics, Trade Friction, International Strategy, Diplomcy.

Abstract: 2024 has become a historic turning point for Japan. Shigeru Ishiba dramatically became the country's 102nd

and 103rd prime minister in 43 days. Less than 2 months are left for the newborn Japanese government to be

prepared for the second Trump administration's strike after the trust crisis's chaos. The world is paying close

attention to how the Ishiba administration will deal with the Japan-U.S. relationship and its actions on other

international affairs. After world war Ⅱ, Japan made astonishing economic growth through foreign trade and

was known as a trade-oriented nation. Nowadays, foreign trade is increasingly correlated with politics. This

paper is researching whether international political risks would have either a positive or negative impact on

Japan’s foreign trade. With graphs, figures of quantitative indicators, case studies, and supportive opinions

from other researchers, the work is committed to providing a clearer vision of both the source of the risks and

the level of the influences in terms of foreign trade. At the moment, foreseeable political risks are threatening

on economic partnerships and the growth of trade scale.

1 INTRODUCTION

The last months of 2024 should be considered a

turning point for Japan when looking back on those

spotlighted events that occurred near the end of the

year. Donald John Trump won the 2024 presidential

election and would be back to his chair in the White

Palace on January 20, 2025. Previous Abe

administration has already experienced Trump’s

strong protectionism da-ting back to the period of the

first Trump administration. Unquestionably Trump’s

return will cast a shadow on Japan-US economic

partnership over the next four years. Shigeru Ishiba

was reelected as 103rd Prime Minister, 8 days after

the House of Representatives under his party was

dissolved and 43 days after he was elected as 102nd

Prime Minister. The next few months will be crucial

for the 2-term prime minister to prove his leadership

and reform a new well-served Japanese cabinet before

he moves his hands onto other challenges.

Fumio Kishida, the former prime minister,

emphasized that the time has come for “historic

economic and social transformations” in the World

Economic Forum’s virtual event, the Da-vos Agenda

2022. “There has been an overreliance on competition

and self-regulation to con-strain the excesses of

market forces,” he added. “This must change

(Oblaković, 2023).” During his comparatively short

tenure of 3 years and a half, efforts on reform of

liberal democratic capitalism were converted into

evident but temporary economic recoveries from

COVID-19 shock and reinforced bilateral

cooperation with the U.S., EU, and Indo-Pacific.

On 27 September 2024, a few days right before

the election victory, Ishiba Shigeru was in-troduced

as an advocate of the NATO Asian version with

hostility by Russian media. Whether he continues

with the economic policies of his predecessor or

attempts to deploy some varia-tions, the newborn

Japanese government must review cautiously on

international circum-stances before taking any action

that may have an impact on the international order.

And in today’s world, economic activity is highly

correlated with politics. Political consequences can

have either positive or negative influence on

economic activities. To avoid these risks of ten-sion,

economists strive to identify the source of the risks

and propose alternative solutions or countermeasures.

Huang, T.

Political Risks Motivate Japan to Seek Ever More Global Trading Partners.

DOI: 10.5220/0013985000004916

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on Public Relations and Media Communication (PRMC 2025), pages 5-12

ISBN: 978-989-758-778-8

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

5

2 ANALYSIS OF JAPAN’S

FOREIGN TRADE

2.1 The Current Status of Japan’s

Foreign Trade

In 2023, Japan is the fifth in total international trade,

following behind China, the U.S., Ger-many and

Netherlands (JETRO, 2024). Because of a shortage of

natural resources, Japan im-ports most of its fuel

resources, such as crude oil, and industrial raw

materials. On the other hand, its economic growth is

partially generated from processing and

manufacturing these materials for exports, fully

taking advantage of its high-tech industries.

The 21st century ushered in an era of economic

globalization. New categories of biotech-nology and

renewable energy such as wind-solar power

generation have emerged, causing rap-id innovations

in both industrial and business environments.

Competition with the rise of emerging countries such

as China leads to the promotion of free trade

agreements (FTAs) be-tween countries. Meanwhile,

with the task of getting rid of the economic downturn

due to COVID-19 shock, Japan’s trade structure has

undergone various changes to arrive at what it is

today.

Japan's main exports include automobiles,

semiconductors and other electronic parts, steel,

automobile parts, and semiconductor manufacturing

devices, and main imports include crude oil, LNG

(Liquefied Natural Gas), pharmaceuticals,

semiconductors and other electronic parts,

communication devices, clothing and accessories.

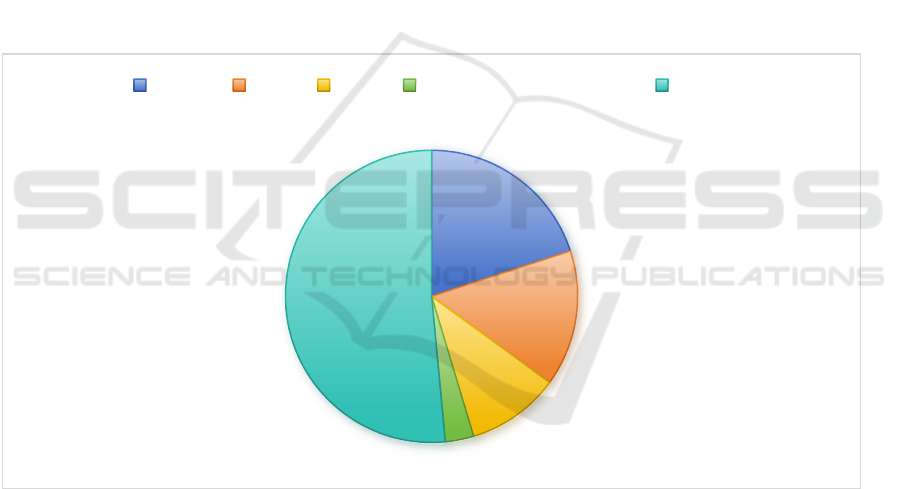

Figure 1 shows China, the U.S., and the European

Union (EU) took most of the share of Japan’s foreign

trade in 2023. Though exports to the U.S. were over

that of China, the largest sum of trade (sum of exports

and imports) was still from China because of high

dependencies on importing necessities from China.

Source: Trade Statistics of Japan

Alt Text for the figure: Figure 1 displays Japan’s major trading partners’ share of sum of foreign trade in 2023.

The figure shows China, the U.S., and the European Union (EU) took most of the share in 2023.

Figure 1. Share of sum of foreign trade in 2023

2.2 Tasks and Challenges

2.2.1 Trade Friction

Trade friction occurs between two countries due to an

imbalance between exports and im-ports. Japan has

had trade friction with the U.S., one of its major

trading partners, over beef, oranges, textiles, steel,

televisions, automobiles, and semiconductors. Each

time it has oc-curred, the two countries have resolved

it through negotiations and adjustments. Bilateral

trade talks on resolving trade frictions between Japan

and the U.S. are considered to occur more frequently

after Trump’s return.

Recently, in trade with resource-rich and

agricultural countries, there have been problems such

as export restrictions on mineral resources like rare

metals. Crops grown by Japanese farmers are

19.97%

15.06%

10.32%

3.15%

51.50%

China U.S. E.U. United Arab Emirates Others

PRMC 2025 - International Conference on Public Relations and Media Communication

6

becoming difficult to be sold in domestic due to the

influx of agricultural products with lower prices from

oversea.

2.2.2 Economic Partnership Agreement:

FTA/EPA/TPP

After world war Ⅱ , Japan made astonishing

economic growth through foreign trade and was

known as a trade-oriented nation. The government

must ensure the premise of trade liberaliza-tion to

continue its business partnerships in the long term

with countries and regions around the world.

World Trade Organization (WTO), the

international organization, is obliged to make rules

and regulations to promote trade liberalization.

However, the WTO, which has many members, has

not made any progress in creating new rules to

accommodate economic globalization. In recent years

there has been a trend to conclude free trade

agreements (FTAs) and economic partnership

agreements (EPAs), which determine rules through

agreements among the trade participants. Japan has

been actively promoting FTAs and EPAs through

bilateral trade con-versations since 2002.

In 2010, the U.S. began to promote negotiations

for an EPA in the Pacific Rim region, which is known

as the Trans-Pacific Partnership Agreement (TPP).

Like other EPAs, it deter-mines the rules necessary

for coordinating trade activities across borders. Japan

joined the TPP after discussions with the government.

However, Trump won the presidential election in

2017 and decided to withdraw from the TPP later.

Once paused by the withdrawal of America, TPP

eventually came into effect on December 30, 2018,

with the participation of 11 countries ex-cluding the

U.S..

Besides the TPP, Japan has concluded more

agreements such as the Japan-EU Economic

Partnership Agreement, the Japan-U.S. Trade

Agreement, the Japan-U.S. Digital Trade Agreement,

and the Japan-U.K. Comprehensive Economic

Partnership Agreement. On Janu-ary 1, 2022, the

Regional Comprehensive Economic Partnership

(RCEP) agreement, which in-cludes the 10 ASEAN

countries including China, South Korea, Australia,

and New Zealand, claimed a new era for newborn

Asian economic partnership.

2.2.3 Summary

Saori Katada, a professor of international relations

from the University of Southern California, states,

“Japan is actively pursuing new free trade agreements

to enhance its economic security and resilience

against a hostile global trade environment, having

already established major FTAs covering 80 percent

of its trade (Katada, 2024).” She accurately

summarizes Japan’s ef-forts to improve the

conditions of trade globalization. In other words,

Japan is attempting to reveal its leadership and taking

advantage through conducting a new international

order, which is also related to the reform of liberal

democratic capitalism advocated by the Kishida

administration and the theoretical basis of Asian

NATO advocated by Shigeru Ishiba.

3 POTENTIAL POLITICAL

RISKS ON JAPAN’S FOREIGN

TRADE IN 2024

3.1 International Political Incidents

Donald John Trump won the 2024 presidential

election and will be formally back to his chair in the

White Palace on January 20, 2025. The newborn

Japanese government led by Shigeru Ishiba is forced

to be prepared for foreseeable Japan-US trade

frictions once after getting rid of a temporary trust

crisis. It has come to a turning point for Japan not only

because of the up-coming Trump administration.

International affairs such as China issues, Russia-

Ukraine wars, Indo-Pacific affairs, and the G7

conference are all intensely involved in the future

inter-national trade environment for Japan. In this

section, potential political risks with 3 major trading

partners are analyzed with facts, figures of

quantitative indicators, graphs, and sup-portive

opinions from other researchers to forecast the

prospect of Japan's foreign trade.

3.2 Case Study

3.2.1 Trump’s Disdain for Multilateralism

In terms of trade policies, Japan has a deep concern

about the upcoming Trump administra-tion, which is

considered to be averse to multilateralism. During the

previous tenure of Trump, the former president

withdrew from the Trans-Pacific Partnership trade

agreement and expressed dissatisfaction with the

operation of the World Trade Organization.

Political Risks Motivate Japan to Seek Ever More Global Trading Partners

7

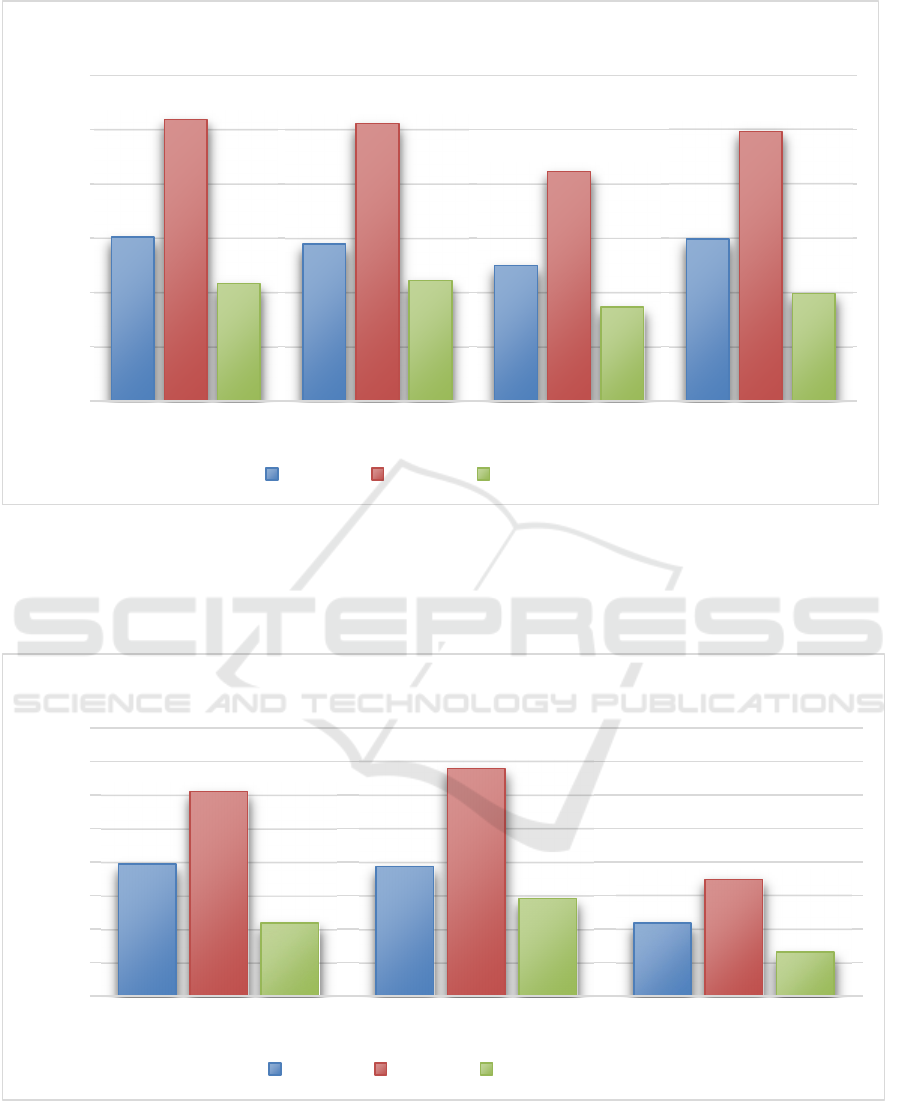

Source: Trade Statistics of Japan

Alt Text for the figure: Figure 2 displays the trade statistics (in billion dollars) between Japan and the U.S. under

the first Trump administration from 2017 to 2021. The figure consists of three indica-tors: statistics of import,

export and trade deficit.

Figure 2. Trade between Japan and the U.S. under first Trump administration

Source: Trade Statistics of Japan

Alt Text for the figure: Figure 3 displays the trade statistics (in billion dollars) between Japan and the U.S. under

Biden administration from 2021 to July 2024. The figure consists of three indicators: statistics of import, export

and trade deficit.

Figure 3. Trade between Japan and the U.S. under Biden administration

604

579

499

597

1037

1022

845

994

433

443

346

396

0

200

400

600

800

1000

1200

2017-2018 2018-2019 2019-2020 2020-2021

Unit: Billion Dollars

Import Export Trade Deficit

788

774

435

1223

1357

697

435

583

261

0

200

400

600

800

1000

1200

1400

1600

2021-2022 2022-2023 2024.01-2024.07

Unit:Billion Dollars

Import Export Trade Deficit

PRMC 2025 - International Conference on Public Relations and Media Communication

8

Figure 2 and Figure 3 incompletely describe the

difference in trade volume between the first Trump

administration and the Biden administration. The

trade deficit of 2024 could be rough-ly predicted as a

number around 500 billion and thus the average

annual trade deficit under the Biden Administration

would be a number over 500 billion accordingly.

Compared with the average annual trade deficit of

404.5 under the 1st Trump Administration, an

approximately 20 percent decline in trade deficit is

foreseeable to occur during the second Trump

administra-tion if “American First” doctrine revives.

Regarding bilateral trade talks, Trump has

suggested imposing additional tariffs on Japanese

cars. Not only additional direct tariff on Japanese

products is considered a negative factor on Japanese

exports to America, but it is also worried that exports

to China will be limited under the probable requests of

participation in anti-China actions by the Trump

administration.

Nor is Trump’s “America First” policy entirely a

bad thing for Japan. “A phase-two bilateral trade deal,

building on the one negotiated by Trump and Abe in

2019 (mainly to restore lost U.S. agriculture sales in

Japan as a result of Trump’s decision to pull out of the

Trans-Pacific Partnership) is possible (Goodman,

2024)”, mentioned by Matthew P. Goodman, the

senior vice president for economics. But then he also

adds, “IPEF is likely dead in the water, and other

forms of affirmative U.S.-Japan economic

cooperation in Southeast Asia do not appear to be on

the horizon. (Goodman, 2024)” No considerable

economic benefits is guaranteed through the alliance

of Trump’s anti-China strategy nor by the trade

partnership with the sec-ond Trump administration.

3.2.2 “China Risk” Matters

Though exports to China have no longer ranked at the

top since 2023, the solid business part-nership

between the two Asian powers continues to be studied

by economists from both coun-tries. Hideaki Kishida,

a researcher from MGSSI, claims that because of the

connection, China risk should be evaluated more

cautiously. In his report, “China risk is broken down

into three categories. First, as external risks to

Japanese companies’ China business (macro risks),

there are China dynamics and international

community dynamics, then as internal risks to China

business (micro risks) there are managerial and

operational risks (Kishida, 2022).” In brief, China

risk is categorized as either nation-perspective force

majeure or contradictions on com-mon values.

Source: Trade Statistics of Japan

Alt Text for the figure: Figure 4 displays how trade statistics of food exports to China is affected by the discharge

of treated wastewater from July 2023 to December 2023. The figure consists of two indicators: statistics of food

exports (in billion dollars) and calculated range (in percentage) of de-cline compared with data before the

discharge.

Figure 4. Declining food exports to China after the discharge

Jul. Aug. Sep Oct. Nov. Dec.

Food Exports

1.254173 0.922054 0.66129 0.67402 0.578545 0.704103

Range of Decline Compared

with Data before the discharge

0% 33% 59% 58% 68% 55%

0

0.2

0.4

0.6

0.8

1

1.2

1.4

Unit: Billion Dollars

Food Exports Range of Decline Compared with Data before the discharge

Political Risks Motivate Japan to Seek Ever More Global Trading Partners

9

On 24 August 2023, Japan formally began the

discharge of treated wastewater into the Pa-cific

Ocean, sparking protests in the region and China to

expand its ban on all aquatic imports from Japan.

Exports in the category of food, especially marine

products, were significantly re-duced accompanied

by voiced concerns from various governments.

Among the countries op-posed to the discharge, the

Chinese government is considered to overreact by the

Japanese side as China claims a complete prohibition

of all marine products imports.

3.2.3 European Union-Reliable Business

Partner in Response to Protectionism

Based on the EU-Japan Economic Partnership

Agreement (EPA) issued on 1 February 2019, the EU

has become one of the most reliable trading partners

of Japan. The largest trade agreement signed by the

two powers in the middle era of the first Trump

administration is considered a milestone, in response

to trade protectionism. The relevance of Japan-EU

rela-tions is precisely analyzed by PAULA

CISNEROS CRISTÓBAL from the form of bilateral

re-lation framework to the negotiation process of the

EU-Japan EPA. In conclusion, she com-ments, “It

represents a significant boost for trade exchanges on

both sides and will particularly affect the future of

important sectors such as the agri-food and

automobile sectors, liberalizing them (Pérez, 2021).”

Both Japan and the EU are dedicated to the

elimination of trade barriers and expansion of

cooperation beyond the field of economics.

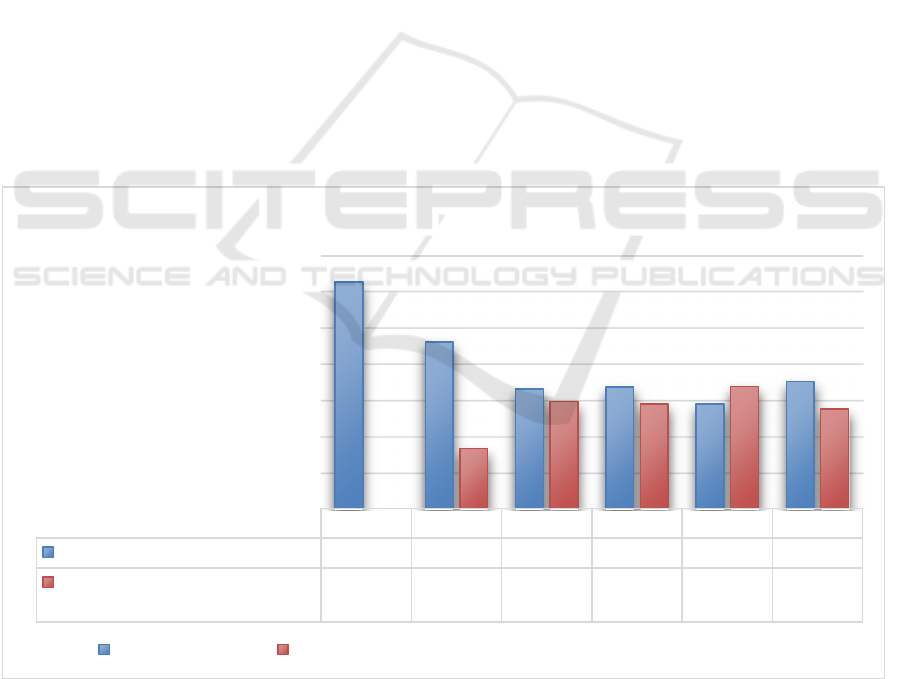

Source: Trade Statistic of Japan

Alt Text for the figure: Figure 5 displays the trade statistics (in billion dollars) between Japan and the EU. from

2019 to 2023. The figure consists of three indicators: statistics of import, export and trade deficit and records the

growth of trade partnership between the two powers after the EU-Japan EPA was issued.

Figure 5. Trade between Japan and EU since 2019

Figure 5 shows despite disastrous years of

experiencing COVID-19 shock, both exports and

imports between the two powers have been growing

steadily year by year since the launch of EPA. The

economic benefit is evident, and so is in other

perspectives. “The title ‘Econom-ic Partnership

Agreement’ rather intends to emphasise that the

cooperation goes beyond trade and should be viewed

as a strategic partnership including cooperation on

many levels (Frenkel, 2017),” commented by

Michael Frenkel and Benedikt Walter, German

researchers from WHU. The in-depth cooperation

also contributes on acceleration of the economic

recov-ery and innovation of medical support for the

two powers to combat the pandemic crisis.

However, despite the pandemic crisis, the Japan-

EU relationship is now facing new chal-lenges due to

the Russia-Ukraine war in 2022. Structural upheaval

2019 2020 2021 2022 2023

Import

651 525 633 767 766

Export

600 433 514 627 695

Trade Deficit

-51 -92 -120 -140 -71

-200

-100

0

100

200

300

400

500

600

700

800

900

Unit: Billion Dollars

Import Export Trade Deficit

PRMC 2025 - International Conference on Public Relations and Media Communication

10

occurred after the Kishida administration decided to

aid Ukraine with nonlethal military equipment.

Céline & Eva, both senior researchers on the Japan

program from CSDS, states, “As European and

Japanese firms withdraw from Russia, the importance

of ensuring resilient and ethical value chains and re-

ducing dependencies on China and Russia have

become key (Céline, 2022).” It is since 2023, China

no longer maintains the position of Japan’s largest

exporter. Trade between Japan and Russia is

shrinking as well because of the worsening

relationship. The unforeseeable end of the war, the

regime changes of Kishida onto Ishiba, Trump’s

attitudes, and reactions from Russia, China, and the

EU, any of these factors can carry out another storm

onto the Japan-EU relationship in near future.

4 CONCLUSION

At the moment, political risks from the U.S and China,

two major trading partners of Japan, are threatening

both economic partnerships and the growth of trade

scale. Japanese econo-mists have been concerned

about the complexity of global situation after the re-

appointment of Trump. On one hand, Japan-US trade

frictions are considered disastrous enough to let the

efforts of the Kishida administration to stabilize the

economic partnership with the Biden ad-ministration

be in vain. On the other hand, Trump is disruptive on

international order due to his advocacy of

protectionism. His return is also threatening the

economic partnerships be-tween Japan and China.

Though the level of impact depends on how Ishiba

administration is involved in Trump’s anti-China

actions, certain persecuted conflicts unavoidably cast

a shad-ow on the economic partnership between the

two Asian powers.

Hence, the rest of time before the formal return of

Trump is crucial for Ishiba administra-tion to

determine the standing position. The growing trade

scale of Japan and EU can not eliminate the huge

negative impact from a slump of trade with U.S. and

China. As men-tioned, no considerable economic

benefits is guaranteed through the alliance of Trump’s

anti-China strategy nor by a reinforced trade

partnership with the second Trump administration as

Trump has already suggested imposing additional

tariffs on Japanese cars.

In this perspective, “China risk” is not an

idiosyncratic troublemaker as many Japanese re-

searchers describe but a much milder conflict due to

contradictions on values. On the contra-ry, China

could become one of Japan’s reliable allies to combat

protectionism with its market scale and resources.

China's government’s promise to resume imports of

aquatic products from Japan implies China is not

willing to prohibit any foreign trade as well if

unnecessary. The global situation on international

trade policies motivates Japan to seek ever more

bilateral agreements with its largest trading partners,

and so does China.

Rome wasn’t built in a day. History of the

relevance of the Japan-EU relationship can be even

dated back to the 1991 Joint Declaration. The

successful Japan-EU partnership through a long

process of negotiation provides experience for future

diplomacy. To deepen international economic

integration in response to the rise of trade

protectionism, more strategic alliances are required to

create economic vitality for the island country.

REFERENCES

Céline, P., Eva, P. 2022. Rapprochement in times of crisis:

war in Ukraine and the EU-Japan partner-ship. CSDS

Policy Brief (9).

Cristóbal, P. C. 2021. The Economic Partnership

Agreement between Japan and the European Un-ion:

analysis of the first years of life and prospects for the

future. Australian and New Zealand Journal of

European Studies 13(2).

Frenkel, M., Walter, B. 2017. The EU-Japan economic

partnership agreement: relevance, content and policy

implications. Intereconomics 52, 358-363.

Hideaki, K. 2022. Changing China risks-perspectives and

attitudes needed to evaluate China risks properly and

view them with appropriate caution. Global Strategic

Studies Institute Monthly Re-port (12).

Japan External Trade Organization (JETRO) Research and

Analysis Department. 2024. Global trade. JETRO

global trade and investment report 2024. 1-39.

Jeremy Mark and Dexter Tiff Roberts. 2023, United States–

China Semiconductor Standoff: A Sup-ply Chain

Under Stress,” Atlantic Council,

https://www.atlanticcouncil.org/wp-

content/uploads/2023/03/US-China-Semiconductor-

Standoff.pdf

Matthew, P. Goodman, 2024. Japan Braces for Trump 2.0,

Council on Foreign Relations,

https://www.cfr.org/article/japan-braces-trump-20

Ministry of Foreign Affairs. 2024, China and Japan Reach

Agreement on Ocean Discharge of Fuku-shima

Nuclear-Contaminated Water, MFA News,

https://www.mfa.gov.cn/mfa_eng/xw/wjbxw/202409/t

20240920_11493511.html

Oblaković, G., Dogan, I.D., Njavro, M. 2023. World

economic forum (Davos) II. encyclopedia of

sustainable management. Springer, Cham. 1-5.

Political Risks Motivate Japan to Seek Ever More Global Trading Partners

11

Saori, K. 2024. Japan’s continuing zeal for free trade

agreements,

https://eastasiaforum.org/2024/09/03/japans-

continuing-zeal-for-free-trade-agreements/

Saul Rojas. 2022. Commerce Implements New Export

Controls on Advanced Computing and Semi-conductor

Manufacturing Items to the People’s Republic of

China(PRC), US Department of Commerce,

https://www.bis.doc.gov/index.php/documents/about-

bis/newsroom/press-releases/3158-2022-10-07-bis-

press-release-advanced-computing-and-

semiconductor-manufacturing-controls-final/file.

PRMC 2025 - International Conference on Public Relations and Media Communication

12