Kite Connect, Uplink and Smart API: A Comprehensive Study of

Python API Libraries

Somnath Hase

1

and Vikas T. Humbe

2

1

Department of Computer Science, Smt. S. K. Gandhi Arts, Amolak Science and P. H. Gandhi Commerce College, Kada

414202, Maharashtra, India

2

School of Technology, SRTM University, Sub Center Latur, Maharashtra, India

Keywords: WebSocket, SmartAPI, Uplink, Kite Connect, API.

Abstract: The ability of machines to efficiently execute complicated and high-frequency trading strategies has made

algorithmic trading, or "algo trading," an essential part of the financial markets. With a focus on three well-

known platforms like SmartAPI, Uplink, and Kite Connect this research paper offers an in-depth study of

Python APIs in the context of the Indian financial markets. The basics of algorithm trading are covered in the

first section of the study, along with the value of Python as a programming language for creating algorithmic

techniques. The selection of Kite Connect, Uplink, and SmartAPI was driven by their notable positions in the

Indian financial scene, each providing traders and developers with special features and functionalities. Factors

including order execution speed, accuracy of market data, and the variety of supported financial instruments

are considered in this study. Case studies and real-world examples show how each API is used in algorithmic

trading scenarios. The study additionally looks at each API's WebSocket streaming capabilities, which are

essential for real-time data updates in the market.

1 INTRODUCTION

The financial system has shifted its paradigm in

recent years due to the use of technology into trading

activities. Algorithmic trading, or "algo trading," has

become an effective tool that is changing the way the

financial market function. This study explores the

complex world of algorithmic trading, with a

particular emphasis on its application utilizing Python

API inside the framework. Algo trading is the process

of automatically executing high-frequency trades

using mathematical models and pre-established

methods. Its ability to quickly assess market

conditions, identify trading opportunities, and carry

out orders at speeds faster than humans makes it

attractive. As the Indian share market keeps

developing and embracing new technology, algo

trading strategies especially those that use Python

APIs are becoming more and more popular. After

approving the Direct-Market-Access (DMA)

technology, the Securities Exchange Board of India

(SEBI) approved Algo Trading in 2008 (S. Acharya

and Dr. A. Ps 2022).

Artificial intelligence is a technology that can

think and act for itself. As such, it is ideal for

complicated trading applications where efficiency

and speed are critical. Its use can alter trading in a

variety of ways (Vignesh CK 2020), as is already

clear. Many factors are responsible for the daily

changes in the market, which makes it challenging for

businesses and stockbrokers to choose where to trade

(Bali 2021). Python's versatility, user-friendliness,

and availability of libraries and frameworks make it a

popular choice for algo trading. For traders and

engineers looking to build advanced algorithms in the

dynamic and complex environment of the Indian

stock market, Python is a great option due to its

readability and strong community involvement. With

a focus on Python API integration complexities, this

research study attempts to offer a thorough grasp of

API libraries. It looks at the main benefits and

characteristics of using Python for algorithmic

trading, as well as the difficulties encountered and

how they affect in trading procedures Algorithmic

trading is a method of order execution. Using

automated, pre-modified trading rules that represent

variables like volume, cost, and time (M. Mathur et

al., 2021). When compared to human brokers, this

type of trading aims to take advantage of the speed

and computational power of PCs.

814

Hase, S. and Humbe, V. T.

Kite Connect, Uplink and Smart API: A Comprehensive Study of Python API Libraries.

DOI: 10.5220/0013944200004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

814-819

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

This study explores the complex world of Python

API libraries, concentrating on the Python APIs

offered by three major platforms: Kite Connect,

Uplink, and SmartAPI. These APIs, which are

provided by top Indian financial institutions, are

essential in enabling algorithmic trading methods

because they give developers the resources and

connection they need to communicate

programmatically with financial markets.

2 PYTHON API

2.1 Kite Connect from Zerodha

One of the top stockbrokers in India, Zerodha, offers

Kite Connect, a well-liked trading API. Using Python

and other computer languages, it enables developers

to include stock trading capabilities into their own

apps. An interface for easy interaction with the Kite

Connects API is provided by the Kite Connect Python

library.

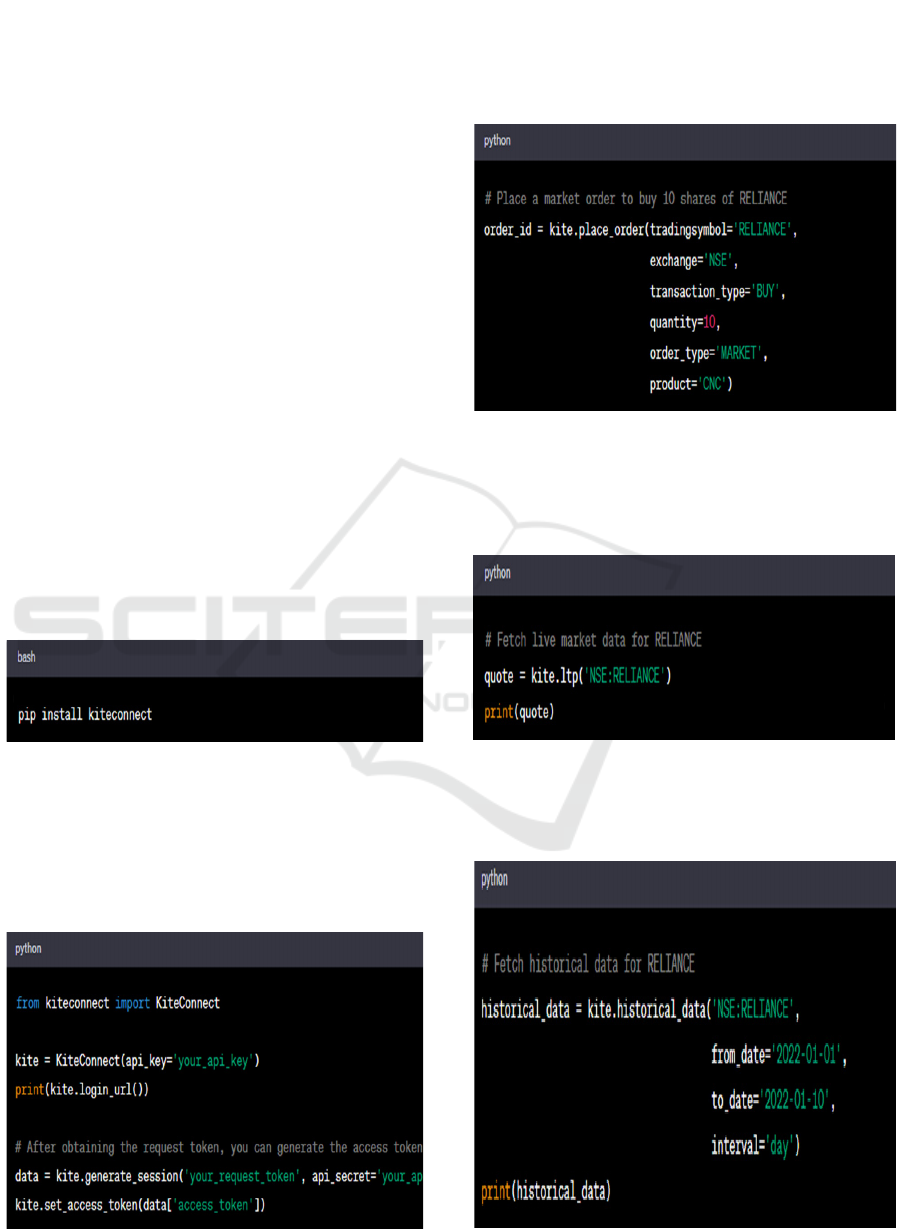

2.1.1 Installation

You can install the Kite Connect Python library using

pip:

2.1.2 Authentication

Your Zerodha API credentials are required in order to

utilize the Kite Connect API. An access token can be

generated to authenticate your API queries once you

have the API key and secret. Methods for managing

authentication are provided by the library.

2.1.3 Place Orders

You can place a variety of orders with the Kite

Connect Python library, such as market, limit, and

stop-loss orders.

2.1.4 Fetch Market Data

You can retrieve market data, including live market

quotes, historical data, and more, using the Kite

Connect API.

2.1.5 Historical Data

Access historical market data for a certain financial

instrument.

Kite Connect, Uplink and Smart API: A Comprehensive Study of Python API Libraries

815

2.1.6 WebSocket Streaming

WebSocket streaming is supported by Kite Connect

to provide real-time data updates.

2.1.7 Account Information

Retrieve details on the user's trading account.

2.2 Uplink from Upstox

Leading Indian stock brokerage Upstox has an

official API called Uplink. With the help of the

Uplink API, developers can incorporate Upstox

trading features into their apps, allowing users place

orders, get market data, and carry out a number of

other programmatic tasks. The basics of the Upstox

Uplink API is shown below:

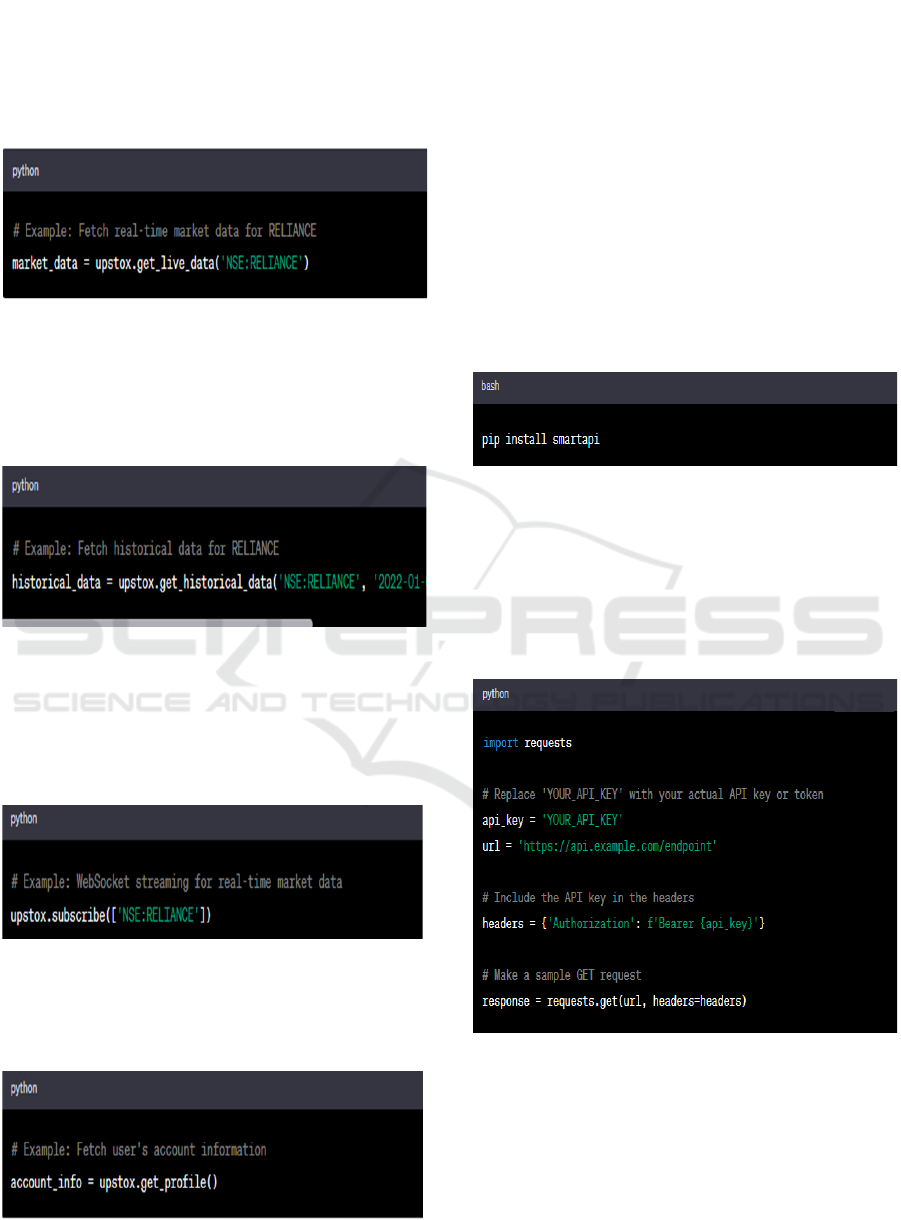

2.2.1 Installation

Upstox uplink API can be installed by using

following command.

2.2.2 Authentication

To use the Uplink API, developers need to obtain API

credentials (API key and secret) from Upstox. These

credentials are used to authenticate and authorize API

requests. Once authenticated, developers can access

various endpoints to interact with the Upstox

platform.

2.2.3 Order Placement

The Uplink API allows developers to make a variety

of orders, such as limit orders, stop-loss orders,

market orders, and more. Users may change attributes

including instrument, quantity, order type, and

validity details of order.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

816

2.2.4 Market Data

Developers can access historical data, live quotes, and

market depth in real-time via the Uplink API. Making

customized charts, examining patterns, and deciding

on trades with knowledge can all benefit from this.

2.2.5 Historical Data

Developers can use the API to fetch historical market

data for backtesting and analysis purposes. Historical

data can be retrieved in different time intervals, such

as daily, hourly, or minute-wise.

2.2.6 WebSocket Streaming

WebSocket streaming is enabled by Uplink API so

that real-time updates can be received. Through the

WebSocket connection, developers can subscribe to

specific tools and get real-time market data, order

updates, and more.

2.2.7 Account Information

Developers may obtain account-related data via the

API, such as positions, margin details, and user

profile details.

2.3 SmartAPI

One of the well-known stockbrokers in India, Angel

One (previously known as Angel Broking), offers an

official API (Application Programming Interface)

called SmartAPI. With the help of SmartAPI,

developers can integrate stock trading features into

their apps, allowing users place orders, get market

data, and carry out a number of other programmed

activities. The basics of Angel One's SmartAPI is

shown below.

2.3.1 Installation

The following command can be used to install

AngelOne's SmartAPI.

2.3.2 Authentication

Angel One provides developers with API credentials

(API key and secret) in order for them to use the

SmartAPI. These login credentials are required for

API request authorization and authentication. Once

developers have registered for API access, they can

generate API keys via the Angel One developer site.

2.3.3 Order Placement

Developers can place various orders using SmartAPI,

such as limit orders, stop-loss orders, market orders,

and more. Order attributes including symbol, amount,

order type, validity, and product type are configurable

by developers.

Kite Connect, Uplink and Smart API: A Comprehensive Study of Python API Libraries

817

2.3.4 Market Data

With SmartAPI, developers may obtain up-to-date

market data. This covers historical data, market

depth, and real-time quotes. For the purpose of

building personalized charts, identifying trends, and

making wise trading decisions, access to market data

is essential.

2.3.5 Historical Data

Developers can retrieve historical market data for

analysis and backtesting using SmartAPI. One can

obtain historical data at several time periods,

including hourly, minute, and daily.

2.3.6 WebSocket Streaming

For real-time updates, WebSocket streaming is

supported by SmartAPI. Through the WebSocket

connection, developers can subscribe to particular

instruments and get real-time market data, order

updates, and more.

2.3.7 Account Information

Developers can get details about accounts, such as

positions, margins, and user profiles, through the API.

3 CONCLUSIONS

The analysis presented in this research has shed light

on the distinctive features and functionalities offered

by each API, enabling a nuanced understanding of

their strengths and limitations.

SmartAPI, Uplink, and Kite Connect represent

key players in shaping the future of algorithmic

trading in the Indian financial markets. Their

distinctive attributes cater to a spectrum of trading

needs, providing traders and developers with the tools

necessary to navigate the complexities of algorithmic

strategies. As we stand at the intersection of

technology and finance, these APIs serve as catalysts

for innovation, empowering market participants to

unlock new possibilities and chart the course for a

future where algorithmic trading seamlessly

integrates with the heartbeat of Indian financial

markets.

REFERENCES

“Kite Connect 3 / API documentation.”

https://kite.trade/docs/connect/v3/

“SmartAPI.” https://smartapi.angelbroking.com/docs

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

818

“Trader API - Free Stock Market Trading API with

Documentation @Upstox,” Upstox - Online Stock and

Share Trading, Jul. 25, 2023.

https://upstox.com/uplink/trader-api/

A. Bali, “Development of Trading Bot for Stock Prediction

Using Evolution Strategy,” Sep. 30, 2021.

https://easychair.org/publications/preprint/Xrlc

E. P. Chan, Quantitative Trading. 2009. [Online].

Available:

http://books.google.ie/books?id=4kJ8tAEACAAJ&dq

=Quantitative+Trading&hl=&cd=1&source=gbs_api

M. Mathur, S. Mhadalekar, S. Mhatre, and V. Mane,

“Algorithmic Trading Bot,” ITM Web of Conferences,

vol. 40, p. 03041, 2021, doi:

10.1051/itmconf/20214003041.

S. Acharya and Dr. A. Ps, “Algorithmic Trading-Changing

The Paradigm of Stock Trading in The Indian Capital

Market,” ResearchGate, Nov. 26, 2022.

S. Hase and V. Humbe, “Python-Powered ETF Trading:

Unleashing Algorithmic Trading Strategies,” in 2024

3rd Edition of IEEE Delhi Section Flagship Conference

(DELCON), 2024, pp. 1–4. doi:

10.1109/DELCON64804.2024.10866662.

Vignesh CK, “APPLYING MACHINE LEARNING

MODELS IN STOCK MARKET PREDICTION,”

EPRA International Journal of Research &

Development (IJRD), pp. 395–398, Apr. 2020, doi:

10.36713/epra4361.

Y. Hilpisch, Python for Algorithmic Trading. O’Reilly

Media, 2020. [Online]. Available:

http://books.google.ie/books?id=g5IIEAAAQBAJ&pri

ntsec=frontcover&dq=trading+using+python&hl=&cd

=1&source=gbs_api MichaelL. Halls_Moore, Successf

ul Algorithmic Trading.

Kite Connect, Uplink and Smart API: A Comprehensive Study of Python API Libraries

819