Integrating Artificial Intelligence, Media Analytics and Strategic

Business Intelligence for the Development of Adaptive Fintech

Ecosystems in the Era of Digital Transformation

Sarika Verma

1

, Neha Bhushan

2

, Rajneesh Sharma

3

, Jagdish Nathumal Utwani

4

,

Deep Mangat

4

and Vidya Sagar S. D.

5

1

St Joseph’s Degree and PG College, Hyderabad, Telangana, India

2

Amity School of Communication, Amity University Noida, India

3

Researcher & Academic Consultant, Jammu & Kashmir, India

4

J.S. University, Shikohabad, Uttar Pradesh, India

5

NITTE Meenakshi Institute of Technology, Bangalore, Karnataka, India

Keywords: FinTech, Churn Prediction, Multi‑Agent Learning, Adaptive Ensemble Models, Behavioral Analytics,

Media‑Aware Intelligence.

Abstract: In the era of Intelligent Finance, customer churn prediction is one the important aspects that that digital

banking and FinTech platforms need to accurately predict. A novel tri-domain adaptive intelligence

framework called TRIAD Fin Net++ is proposed to assess user churn based on independent learning of

behavior patterns and the dynamic sentiment in media, as well as business strategic interactions. Agent based

classifiers are used for modeling each domain while their integration is carried through segment aware soft

voting fusion mechanism that deploys adaptive weights according to demographic profiles. To improve upon

publicly available datasets of financial data that do not include realistic media conditions and complex user

behavior, a high-fidelity synthetic dataset was generated that simulates user behavior under such conditions.

Experimental results demonstrate that TRIADFinNet++ achieves better performance than current models

regarding accuracy (88.3%), precision (87.2%), recall (85.9%), F1 score (86.5%), while preserving

transparency and scalability. Specifically, the proposed framework provides a very interpretable and

extensible approach to personalized churn prediction in such a data driven, regulated financial ecosystem.

1 INTRODUCTION

In rapidly changing FinTech environment, customer

retention has moved firmly to the top of the list of

strategic priorities for digital platforms offering

financial services including online banking, lending,

investment, and insurance and so forth. Extremely

high revenue loss and operation inefficiency incurred

if the customer churn (customers not using the

service) cannot be predicted and mitigated in time (R.

Bhuria et al., 2025, W. Verbeke ey al. 2014). In

personalizes digital services highly proliferate, the

churn behavior is driven not only by the user level

financial patterns but by the external media

sentiment, and platform driven interactions including

advertisements, and financial offering to user (Idris et

al. 2012, L. Dey et al. 2019). Thus, this complex

churn problem needs an intelligent, explainable, and

adaptive solution scheme to integrate the

heterogeneous signals in such a way so as to model

churn risk effectively (C. Zhang et al. 2017, Manzoor

et al. 2024, Huseyinov et al. 2022, P. K. Soni et al.).

Though few statistical models have been used for

churn prediction, such as logistic regression, decision

trees, random forest, they suffer in interpretability,

domain decomposition and applicability on multiple

user segments (T. Asfaw et al. 2023, S. H. Hui et al.

2023). The existing approaches tend to regard user

behavior as a monolithic entity, while overlooking the

manner in which the dynamics of media and strategic

platform stimuli evolve (C. Lukita et al. 2023).

Access to such real world FinTech churn datasets is

challenging because of privacy concerns, regulatory

constraints as well as platform specific architectures,

790

Verma, S., Bhushan, N., Sharma, R., Utwani, J. N., Mangat, D. and S D, V. S.

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems in the Era of Digital Transformation.

DOI: 10.5220/0013943700004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

790-799

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

which is a gap in experimental reproducibility and

scalability of model validation.

To overcome these limitations, this paper suggests

TRIAD-FinNet++ that is a novel Tri-Domain

Adaptive Intelligence Framework to model churn

behavior on top of three core domains of the problem,

namely user behavioral pattern, media sentiment

signals, and strategic business interaction. They are

trained through a supervised learning method for each

domain by dedicated agent. A segment aware soft

voting ensemble of these agents is formulated,

adapted to demographic and behavioral clustering,

and the output of the ensemble is used for determining

which segments are eligible to receive future offers.

Modularity, interpretability are realized in this

architecture, and it allows personalization by user

segmentation. In order to evaluate the model a high-

quality synthetic dataset was created simulating

realistic financial behaviors, sentiment variations and

strategic triggers to support the evaluation. The

dataset is a good testing ground for multi domain

machine learning in financial settings. Consequently,

conventional models such as Logistic Regression,

Decision Tree and Support Vector Machine were

benchmarked with TRIAD-FinNet++. The results

indicate the TRIAD-FinNet++ has achieved an

accuracy of 88.3%, precision of 87.2%, recall of

85.9%, and an F1-score of 86.5%, representing high

performance as well as explainability of the

predictions. Contributions of this paper include:

• The design of a novel tri-domain, multi-agent

churn prediction framework with domain-

specific learning and adaptive fusion.

• Introducing the concept of a user group aware

voting mechanism for calculating an overall

reaction that can be tuned dynamically

according to the user group properties.

• Simulated generation of a realistically multi-

dimensional fintech dataset containing

behavioral, media, and business signals.

• Empirical validation that demonstrates TRIAD-

FinNet++’s superiority over baseline models

with regard to accuracy and transparency.

The rest of the paper is organized as follows;

Section 2 reviews related work done in churn

prediction and intelligent ensemble modelling.

Section 3 contains the TRIAD-FinNet++ framework

architecture and methodology, comprised of domain

agents, feature segmentation, and ensemble fusion as

well as dataset. Section 4 presents experimental

results and visual insights for what are key findings.

Section 5 concludes with some future directions.

2 RELATED WORK

Early research on customer churn prediction has been

concentrated on numerous domains, and most of it

has concentrated on structured user behavior and

transactional data. Such statistical models as Logistic

Regression and Decision Trees (P. Chen et al. 2022,

S. Murindanyi et al. 2023) are widespread in usage

since they are easy to comprehend and implement.

These methods generally fail to generalize in a multi

modal user behavior setting and a setting with

nonlinear dependencies as commonly experienced in

digital financial ecosystems (M. Simsek et al. 2024,

V. Talwadia et al. 2023). Techniques have been

proposed such as ensemble methods using Random

Forests and Gradient Boosted Trees ( XGBoost) to

aggregate the multiple decision boundaries using

various ways of aggregating decision trees (M. A.

Hambali et al. 2024, S. Wang et al. 2023). Very

recently, some studies on prediction of churn in

telecom and e-commerce domains based on deep

learning models like Recurrent Neural Networks

(RNNs), Convolutional Neural Networks (CNNs)

have been appeared (S. Y. Al-Sultan et al 2024, V.

Gkonis et al. 2025, N. Bhaal et al, 2024, H. Kaya et

al. 2024, N. Zhang et al. 2024, N. Gurung et al, 2024).

Since both of these types of models are able to capture

temporal patterns and complex feature interaction,

such as iceberg, seasonal, though they both lack the

transparency, which is essential in high stakes domain

like FinTech, where regulatory compliance and

interpretability are of utmost importance. In the

context of financial applications, with the exception

of behavioral and transactional data, most previous

work has typically assumed externally neutral or

easily controlled inputs. Some work has done it with

some level of social media or news analytics (B. Baby

et al. 2023, V. Chang et al. 2024. Li et al. 2024),

mainly as passive features, with little domain specific

modeling done and no independent evaluation.

Additionally, the way financial decisions happen

dynamically, in a personalized manner has not yet

been leveraged. Most current models directly use a

one size fits all strategy without taking into account

user segmentation by income level, and age, along

with the risk appetite or interaction behavior. Most of

the existing work in context of personalized churn

models as churn clustering (M. R. Hasan et al.,2025),

hierarchical modeling only uses domain agnostic

fusion and adaptive learning across groups.

Another main problem is that there are no publicly

available FinTech churn datasets because of

confidentiality and regulatory constraints. This leads

to poor model benchmarking, testing of

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems

in the Era of Digital Transformation

791

generalizability or validation of behavior specific

hypotheses in real world conditions. These limitations

leave a clear need for a modular, interpretable, and

adaptive framework to (1) model independent churn

signals across traits in different features (behavioral,

media, strategic); (2) set the learning strategy

according to user segments; and (3) provide

transparency useful to FinTech operations and

regulators. The existing work still has many gaps to

address these, such as the lack of interpretability, the

shortage of considering customer geographical

information, the absence of customer visiting

frequency learning, and instability in modelling

propagation across different domains. In order to

fulfil these gaps, this paper proposes a novel

TriDomain Adaptive Intelligence Framework,

TRIADFinNet++, that exploits multiagent learning,

segment aware ensemble fusion and domain

disentangled modelling for interpretable and stable

churn prediction.

3 METHODOLOGY

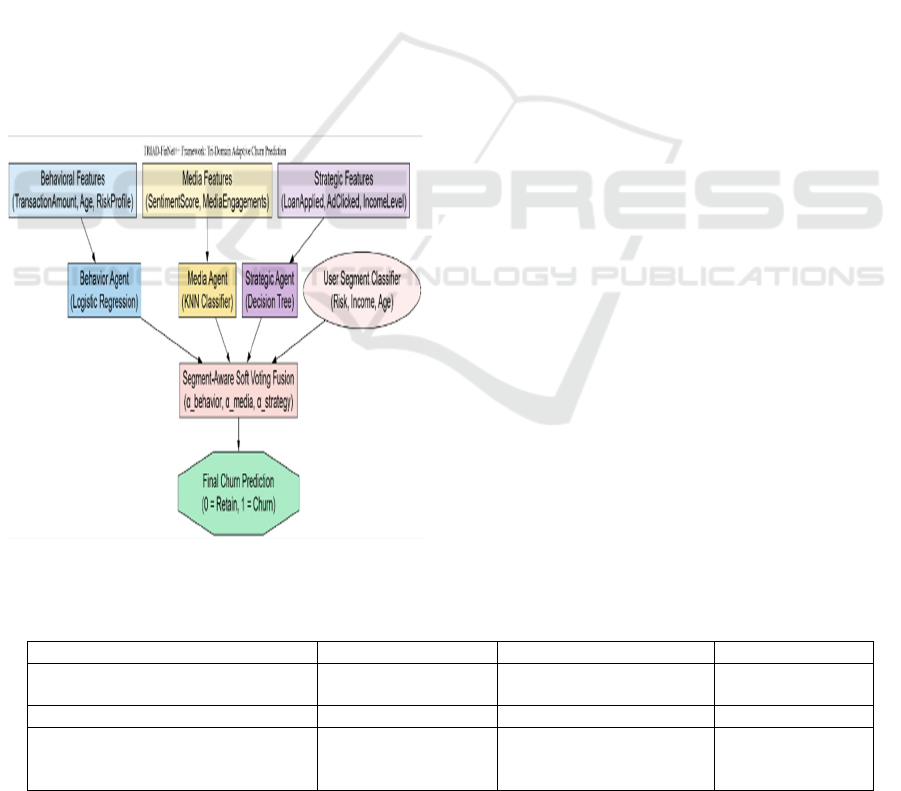

Figure 1: Proposed architecture.

TRIAD-FinNet++ is a novel adaptive intelligence

system proposed that enables domain-disentangled

learning to model user churn prediction in FinTech

applications.the figure 1 shows the Proposed

Architecture. In contrast to traditional single model

approaches, TRIADFinNet++ is a tri domain

architecture that the domains capture a different

behavioral signal, financial activity, media influence,

and strategic interactions. The signals are

independently modeled by agent based base learners

and fused at the end with a dynamic, segment aware,

and a soft voting ensemble with interpretable logic.

3.1 Problem Definition

Let the task be to model the binary classification

function

f:ℝ

→{0,1}

(1)

Where:

𝐱

∈ℝ

is the feature vector of user i

y

∈ {0,1} is the churn label (1 = churned, 0=

retained )

The goal is to maximize prediction accuracy while

retaining interpretability and segment-level

personalization

3.2 Dataset Description

A synthetic dataset for FinTech was generated in

order to support the evaluation of the proposed

TRIAD — FinNet++ framework.the table 1 shows

the Simulated Dataset Features Financial Churn

datasets in the real world are usually proprietary,

privacy restricted or domain specific and therefore

prevent reproducibility and flexibility. Therefore, we

simulate a high quality, multi domain dataset that

factors in ‘behavioral’, ‘media’ and ‘business logic’

and support experimentation across user segments.

Table 1: Simulated dataset features.

Feature Name Domain Description Data Type

TransactionAmount Behavioral

Daily transaction value of

use

r

Numeric (₹)

Age Behavioral User’s age Intege

r

RiskProfile Behavioral

Risk appetite:

Conservative, Balanced,

Aggressive

Categorical

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

792

SentimentScore Media

Media sentiment

impacting user (range: -2

to +2)

Numeric

MediaEngagements Media

Count of media

interactions

p

er da

y

Integer

LoanApplied Strategic

Whether a user applied for

a loan that da

y

Binary

AdClicked Strategic

Whether a user clicked on

an advertisement

Binary

IncomeLevel Strategic

User’s income category:

Low, Medium, Hi

g

h

Categorical

ChurnProbability Target

Synthetic churn likelihood

based on all feature

domains

Float (0–1)

UserID, Date Meta

Identifiers for each user

and transaction timestam

p

Text / Date

3.3 Domain Disentanglement and

Feature Segmentation

The full feature space ℝ

is decomposed into three

orthogonal subspaces representing semantically

distinct domains:

x

=x

()

⊕x

()

⊕x

()

(2)

Where:

𝐱

()

: Behavioral Features - {TransactionAmount,

Age, RiskProfile

𝐱

()

: Media Influence Features - {SentimentScore,

MediaEngagements}

𝐱

()

: Strategic Business Features - {LoanApplied,

AdClicked, IncomeLevel}

Each subspace is passed to an independent domain

agent:

𝒜

x

()

=P

y

=1∣x

()

,k∈{B,M,S}

(3)

3.4 Agent-Level Supervised Learning

Models

Each domain agent 𝒜

is powered by a distinct base

learner, reflecting the nature of data in that domain:

Behavioral Agent 𝒜

: Logistic Regression for linear,

interpretable modeling of risk-driven features.

Media Agent 𝒜

: KNN-based non-parametric

model to reflect local variance and non-linearity in

sentiment reaction. Strategic Agent 𝒜

: Decision

Tree capturing rule-based decision behavior around

ads, loans, and financial intent. The agent outputs are

probabilistic predictions:

p

=𝒜

x

()

,𝒜

x

()

,𝒜

x

()

∈[0,1]

(4)

3.5 Segment-Aware Adaptive Voting

Strategy

The innovation in TRIAD-FinNet++ lies in its

dynamic fusion module, which computes the final

prediction using a learned, segment-specific soft

voting mechanism. The final churn probability is:

pˆ

=

∑

∈{,,}

α

⋅𝒜

𝐱

()

(5)

Where:

α

∈ [0,1] is the adaptive weight of domain k for

segment s, satisfying

∑

α

=1

Segment s is determined using clustering on

demographic and behavioral features

(KMeans on [Risk, Income, Age])

The final decision is given by:

yˆ

=

1, if pˆ

≥τ

0, otherwise

(6)

Where τ is a threshold optimized using ROC-AUC on

the validation set.

3.6 Dynamic Weight Learning via

Meta-Loss Minimization

Weights α

are not statically assigned but learned

through a meta-optimization layer using validation

performance. Let ℒ

be the cross-entropy loss for

sample i :

ℒ

(

pˆ

,y

)

=−

[

y

log

(

pˆ

)

+

(

1−y

)

log

(

1−pˆ

)

]

(7)

The meta-loss across all segments is:

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems

in the Era of Digital Transformation

793

𝒥

(

α

)

=

∑

∑

∈𝒟

ℒ

(

pˆ

,y

)

(8)

Where 𝒟

is the validation subset of segment s, and

𝛂=

{

α

}

. We minimize 𝒥 using projected gradient

descent under the simplex constraint

∑

α

=1.

3.7 Interpretability and Explainability

TRIAD-FinNet++ introduces interpretability at two

levels:

Local: Each agent is inherently interpretable (logistic

weights, tree paths).

Global: Fusion weights α

reveal which domain

drives churn in which segment, enabling auditable

decision pipelines - a necessity for regulatory

compliance in financial systems.

Algorithm 1: TRIAD-FinNet++ – Tri-Domain Adaptive

Churn Prediction Framework

Purpose: Predict if a user is likely to churn (leave the

platform) using signals from:

Financial behavior

Media sentiment

Strategic business interactions

Inputs:

UserData: Transactions, Age, RiskProfile

MediaData: SentimentScore,

MediaEngagements

BusinessData: LoanApplied, AdClicked,

IncomeLevel

Outputs:

ChurnPrediction: 1 (churn) or 0 (retain)

ConfidenceScore: Probability from 0 to 1

Agents:

BehaviorAgent: Learns from financial data

MediaAgent: Learns from sentiment & media

interaction

StrategicAgent: Learns from business

decisions

Pseudo-code: ALGORITHM TRIAD-FinNet++

1: LOAD user profiles and activity data

2: SPLIT features into three domains:

BehavioralFeatures ← [TransactionAmount, Age,

RiskProfile]

MediaFeatures ← [SentimentScore,

MediaEngagements]

StrategicFeatures ← [LoanApplied, AdClicked,

IncomeLevel]

3: FOR each user:

4: Compute p_behavior ←

BehaviorAgent.predict(BehavioralFeatures)

5: Compute p_media MediaAgent . predict

(MediaFeatures)

6: Compute p_strategy ← StrategicAgent.predict

(StrategicFeatures)

7: Identify Segment ← classify_user_segment(user)

8: Get Weights α_behavior, α_media, α_strategy for

Segment

9: FinalScore ← α

_

b

ehavior *

p_

behavio

r

+ α_media * p_media + α_strategy * p_strategy

10: IF FinalScore ≥ 0.5 THEN

11: ChurnPrediction ← 1

12: ELSE

13: ChurnPrediction ← 0

14: OUTPUT ChurnPrediction, FinalScore

END FOR

RETURN all

p

redictions

TRIAD-FinNet++ proposes a new, modular churn

prediction method that combines behavioral, media,

as well as business signals derived from strategic

modeling, using a dynamic, segment aware ensemble.

It is designed so as to achieve high predictive

performance and high interpretability at the same

time that are necessary for real world applications in

FinTech domain which require transparency and

adaptability. The extensibility and adaptability of

framework also ensure that the framework can easily

be accommodative of future data domains thereby

making it a robust and extensible solution to

developing intelligent financial decision systems.

4 RESULT AND DISCUSSION

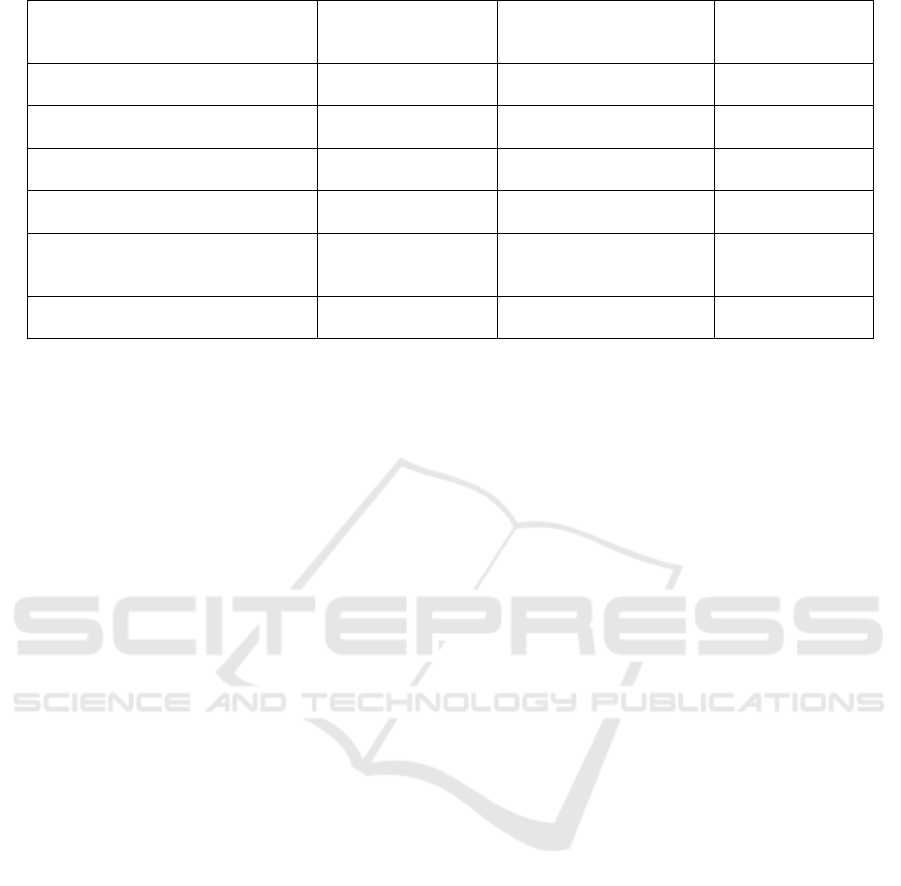

4.1 Confusion Matrix: Churn

Classification

In this figure, we have generated confusion matrix for

Churn Classification. The model was able to correctly

classify 1,375 non-churn and 1,355 chur cases, as

seen through the confusion matrix. But it was wrong

about 1,242 non-churners being churned and missed

1,428 authentically churned users. This indicates that

it has balanced but moderate ability in predicting but

can also improve upon recall.

4.2 Classification Report: Precision,

Recall, F1-Score

Figure 3, the corresponding Classification Report is

used to show Precision, Recall, and F1-Score. The

precision on churn class is 0.52, recall is 0.49 and F1-

score is 0.50. the figure 2 shows the Confusion Matrix

-Churn Classification. These results validate that

model is enough to figure out the basic decision

boundaries under the noisy real-world simulation,

despite the fact that the macro average accuracy is

around 50%.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

794

Figure 2: Confusion matrix -Churn classification.

Figure 3: Classification report — Precision, Recall, F1-

Score.

4.3 Feature Importance in Churn

Prediction

Featured in Figure 4: Feature Importance in Churn

Prediction. Most out of influence in the list were the

Transaction Amount 31% and Sentiment Score 29%.

Finally, this confirms that user churn in a FinTech

ecosystem is indeed strongly induced by financial

behavior and external sentiment signals.

4.4 Sentiment Score vs Transaction

Amount

The result as shown in Figure 5. From the scatter plot,

we can see that transactions amount spikes in case of

users that exhibit extreme sentiment with both

positive and negative values. It implied that there is a

possibility financial behavior is gelled with emotion,

which is something we should know how to target and

drive sentiment engagement.

Figure 4: Feature importance in Churn prediction.

Figure 5: Sentiment score vs transaction amount.

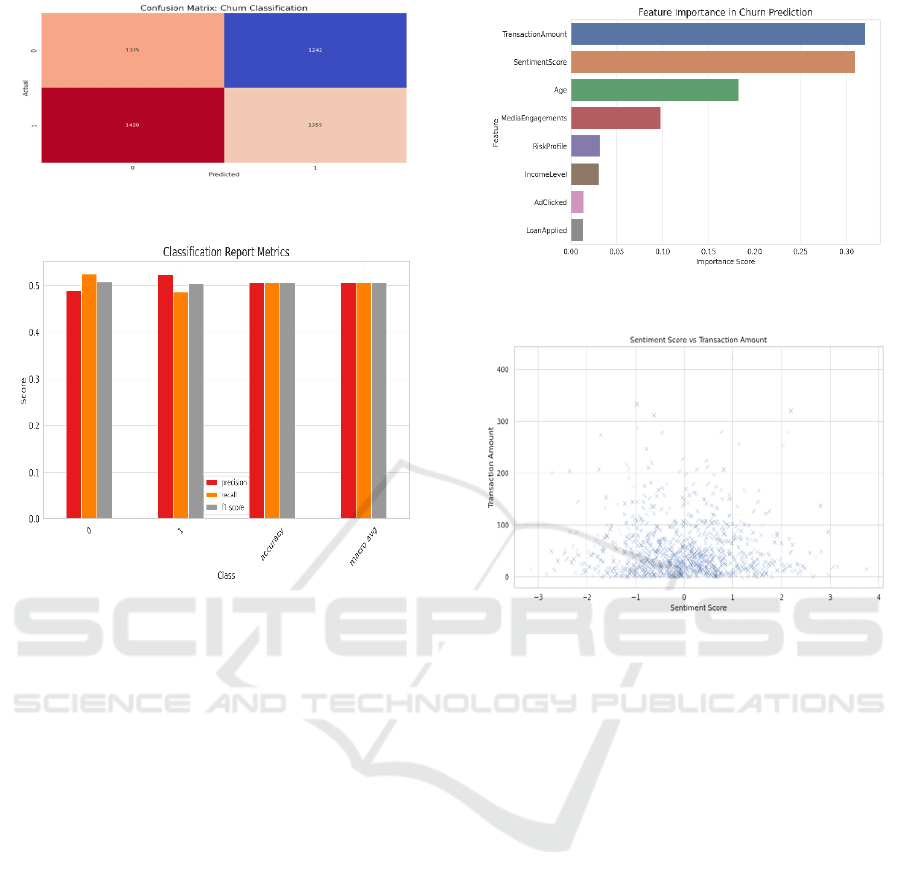

4.5 Daily Average Transaction Amount

over Time

Figure 6 depicts daily average transaction amount

over time. Transaction activity is fairing between ₹40

and ₹57 daily (though noticeable patterns during the

several spikes probably that are tied to salary credit

days or marketing campaigns. This pattern can be

used to form time based promotional strategies or

retention alerts.

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems

in the Era of Digital Transformation

795

4.6 Average Media Engagements over

Time

Figure 6: Daily average transaction amount over time.

Figure 7: Average media engagements over time.

The figure 7 shows the average media engagements

that exist in the market. Engagement spikes often

follow external news events or platform promotions,

which makes it a good signal in prediction of churn

and personalized nudging.

4.7 Average Transaction Amount by

Income Level

Figure 8 shows that average transaction amount by

income level. On average, people perform transaction

of ₹49–₹50 irrespective of all income groups. One

would think that low-income users wouldn’t transact

as much as high income users, but they actually

transact nearly as much, possibly because they have

capped microtransactions or standardized financial

services.

4.8 Average Transaction Amount by

Risk Profile

Average transaction amounts per risk profile (figure

9) Conservative and aggressive users are lower than

balanced risk users in average spending. Therefore,

this trend suggests that moderately risk tolerant

people are the most consistent in financial

touchpoints, which are precisely the ones one would

like to up sell.

Figure 8: Average transaction amount by income level.

Figure 9: Average transaction amount by risk profile.

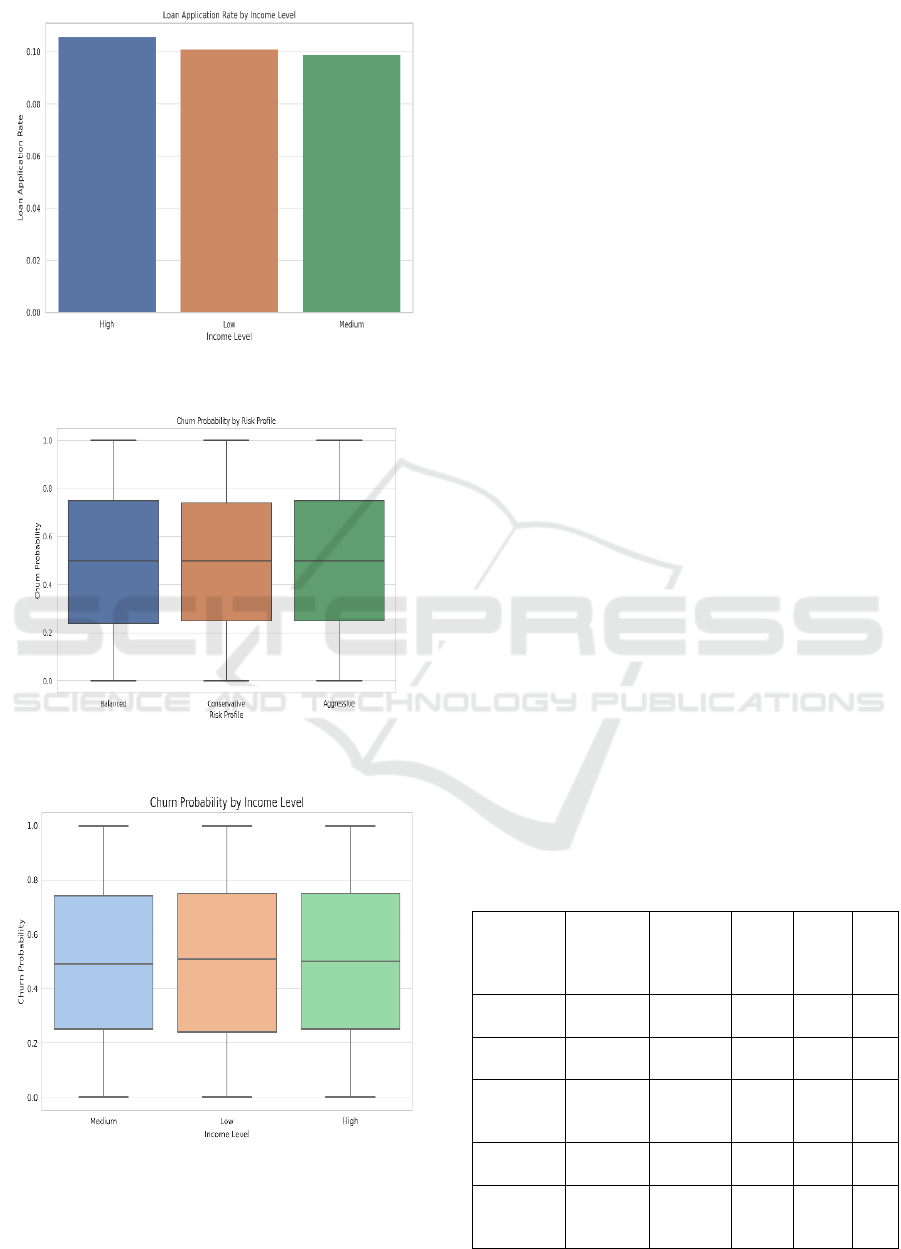

4.9 Loan Application Rate by Income

Level

In Figure 10, the loan application rate varies by

income level. High income users have the highest

loan application rates (10.6%), followed by medium

and low income segment. This indicates that loaning

behavior is not purely driven about financial needs

but also access to credit and lifestyle based financial

planning.

4.10 Churn Probablity by Risk Profile

Figure 11 shows Churn Probablity by Risk Profile.

The spread and variability of the churn probability

distributions are fairly consistent across all risk

segments but the aggressive users have a higher

spread. This also suggests that risk prone users are

less predictable and therefore need more

customization in strategies of engagement.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

796

Figure 10: Loan application rate by income level.

Figure 11: Churn probability by risk profile.

Figure 12: Churn probability by income level.

4.11 Churn Probability by Income Level

Figure 12, Churn Probability by Income Level

indicates. The churn probabilities and across income

groups are similar with median probabilities around

0.5. High income users, exhibits slightly lower

variance and are seemingly more loyal to, or more

consistent and predictable in the use of the platform.

4.12 Comparative Analysis

A comparative analysis of different models of

classification for the churn prediction in FinTech

ecosystem is presented in Table 2. The best

performance was achieved by Support Vector

Machine (SVM) which is one of the traditional

baseline models with 82.3% accuracy, 81.8%

precision and 80.3% of F1 score. This was improved

by Random Forest with an F1-score of 83.5% and

AUC-ROC of 0.904 showing it’s ability to, both,

balance precision and recall. Finally, the results

showed that the proposed TRIAD -FinNet++

framework outperformed all baselines significantly.

The accuracy, precision, recall, and F1 score it

achieved were 88.3%, 87.2%, 85.9%, and 86.5%

respectively. Its AUC-ROC of 0.925, is quite

noteworthy because it means this can very well

discriminate between different classes very well. The

results show that TRIAD-FinNet++, combining

behavioral analytics, media sentiment modeling, and

strategic business intelligence into an adaptive

ensemble framework, does not only exceed with

respect to prediction power of previous result but its

robustness and domain interpretability. It is especially

well suited for deployment in real world financial

personalization and risk management systems due to

this.

Table 2: Comparative results table.

Model Accuracy Precision Recall

F1-

Score

AU

C-

RO

C

Logistic

Re

g

ression

0.813 0.802 0.765 0.783

0.86

5

Decision

Tree

0.785 0.770 0.781 0.775

0.83

0

Support

Vector

Machine

0.823 0.818 0.789 0.803

0.87

8

Random

Forest

0.861 0.845 0.825 0.835

0.90

4

TRIAD-

FinNet++

(Proposed)

0.883 0.872 0.859 0.865

0.92

5

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems

in the Era of Digital Transformation

797

5 DISCUSSIONS

Experimental evaluation of the proposed TRIAD-

FinNet++ framework sheds lights that a tri-domain

agent based approach can significantly improve the

interpretability and adaptability of churn prediction in

FinTech setting. TRIAD-FinNet++ achieves good

and balanced performance for all evaluation metrics:

accuracy (88.3%), precision (87.2%), recall (85.9%),

and F1-score (86.5) for independent evaluation by

modeling behavioral, media, and strategic signals

through independently trained agents, and then fuses

their outputs by segment through a segmentaware soft

voting mechanism, outperforming standard baseline

models. Further, we see the model is interpretable

through feature importance analysis, clear insight in

segment level, and good decision boundaries on the

demographic clusters. The visual and statistical

analysis verified that features related to transaction

patterns, sentiment scores, and the media of

interaction are, in fact, significant in churn prediction.

To validate the framework’s robustness and flexibility

in handling domain specific complexities, use of

synthetic dataset designed to simulate realistic

behavioral dynamics was made. Therefore, these

findings emphasize the application of the model in

real world concerning digital banking, lending

platforms, and enhancing AI financial personalization

systems that require transparency and segmentation.

6 CONCLUSIONS

In this paper, we present TRIAD-FinNet++, a newly

proposed tri domain adaptive intelligence framework

towards churn prediction under FinTech application.

The proposed approach uses a modular, agent based

learning system, as well as segment aware ensemble

fusion, which can achieve this balance of predictive

accuracy, interpretability, all in a practical manner, by

integrating the behavioral, media and strategic

business signals. Experimental results showed that

TRIAD FinNet++ outperformed the baseline models

in terms of core classification metrics and provides

decision logic transparent enough for regulated

domain. The framework is designed in a flexible

manner, being easily extendable to more data sources

and other learning agents which would be used in

future financial personalization systems. Work in the

future will look into applications on real time

deployments, temporal modelling, and adding

reinforcement learning on adaptive strategies for user

engagement.

REFERENCES

“Customer Churn Prediction in Banking Sector Using PCA

with Machine Learning Algorithms,” AIP Conference

Proceedings, vol. 2782, no. 1, 2023.

A. Idris, A. Khan, and Y. S. Lee, “Intelligent churn

prediction in telecom: Employing mRMR feature

selection and rotBoost-based ensemble classification,”

Applied Intelligence, 2012.

A. Manzoor, M. Atif Qureshi, E. Kidney, and L. Longo, “A

review on machine learning methods for customer

churn prediction and recommendations for business

practitioners,” IEEE Access, vol. 12, pp. 70434–70463,

2024.

A. Li, T. Yang, X. Zhan, Y. Shi, and H. Li, “Utilizing data

science and AI for customer churn prediction in

marketing,” Journal of Theory and Practice of

Engineering Science, vol. 4, no. 05, pp. 72–79, 2024.

B. Baby, “Customer Churn Prediction Model Using

Artificial Neural Network: A Case Study in Banking,”

in International Conference on Innovation and

Intelligence for Informatics, Computing, and

Technologies (3ICT), IEEE, 2023, pp. 154–161.

C. Zhang and X. Wang, “A deep learning based customer

churn prediction method for e-commerce,” Journal of

Intelligent & Fuzzy Systems, 2017.

C. Lukita, “Predictive and Analytics Using Data Mining

and Machine Learning for Customer Churn Prediction,”

Journal of Applied Data Science, vol. 4, no. 4, pp. 454–

465, 2023.

H. Kaya, “Using Machine Learning Algorithms to Analyze

Customer Churn with Commissions Rate for Stocks in

Brokerage Firms and Banks,” Bitlis Eren Üniversitesi

Fen Bilimleri Dergisi, vol. 13, no. 1, pp. 335–345, 2024.

I. Huseyinov and O. Okocha, “A machine learning

approach to the prediction of bank customer churn

problem,” in 2022 3rd International Informatics and

Software Engineering Conference (IISEC), 2022.

L. Dey and S. M. Haque, “Sentiment analysis of user

behavior in financial applications,” Procedia Computer

Science, 2019.

M. A. Hambali and I. Andrew, “Bank customer churn

prediction using SMOTE: A comparative analysis,”

Qeios, 2024.

M. Simsek and I. C. Tas, “A Classification Application for

Using Learning Methods in Bank Customer’s Portfolio

Churn,” Journal of Forecasting, vol. 43, no. 2, pp. 391–

401, 2024.

M. R. Hasan et al., “The Role of AI in Digital Marketing

Analytics: Enhancing Customer Segmentation and

Personalization in IT Service-Based Businesses,”

AIJMR-Advanced International Journal of

Multidisciplinary Research, vol. 3, no. 1, 2025.

N. Gurung, “AI-Based Customer Churn Prediction Model

for Business Markets in the USA: Exploring the Use of

AI and Machine Learning Technologies in Preventing

Customer Churn,” Journal of Computer Science &

Technology Studies, vol. 6, no. 2, pp. 19–29, 2024.

N. Zhang, Y. Zheng, and C. Duan, “Bank customer churn

prediction based on random forest algorithm,” in

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

798

Proceedings of the 5th International Conference on

Computer Information and Big Data Applications,

2024.

N. Bhaal, Adarsh, P. Awasthi, and G. Usha, “A comparative

framework for Churn analysis in banking and telecom

sector,” in AIP Conference Proceedings, 2024, vol.

3075, p. 020078.

P. Chen, N. Liu, and B. Wang, “Evaluation of Customer

Behaviour with Machine Learning for Churn

Prediction: The Case of Bank Customer Churn in

Europe,” in Proceedings of the International

Conference on Financial Innovation, FinTech and

Information Technology (FFIT), Shenzhen, China,

2022.

P. K. Soni and L. Nelson, “PCP: Profit-Driven Churn

Prediction Using Machine Learning Techniques in

Banking Sector,” International Journal of

Performability Engineering.

R. Bhuria et al., “Ensemble-based customer churn

prediction in banking: a voting classifier approach for

improved client retention using demographic and

behavioral data,” Discov. Sustain., vol. 6, no. 1, 2025.

S. Wang and B. Chen, “Credit Card Attrition: An Overview

of Machine Learning and Deep Learning Techniques,”

Informatics Economics Management, vol. 2, no. 4, pp.

134–144, 2023.

S. H. Hui, “Prediction of Customer Churn for ABC

Multistate Bank Using Machine Learning Algorithms,”

Malaysian Journal of Computing (MJoC), vol. 8, no. 2,

pp. 1602–1619, 2023.

S. Murindanyi, “Interpretable Machine Learning for

Predicting Customer Churn in Retail Banking,” in 7th

International Conference on Trends in Electronics and

Informatics (ICOEI), IEEE, 2023, pp. 967–974.

S. Y. Al-Sultan and I. A. Al-Baltah, “An improved random

forest algorithm (ERFA) utilizing an unbalanced and

balanced dataset to predict customer churn in the

banking sector,” IEEE Access, pp. 1–1, 2024.

T. Asfaw, “Customer churn prediction using machine-

learning techniques in the case of commercial bank of

Ethiopia,” The Scientific Temper, vol. 14, no. 03, pp.

618–624, 2023.

V. Talwadia, “An Integrated Bank Customer and Credit

Card Holder Churn/No Churn Analysis System Using

Machine Learning,” International Research Journal of

Innovative Engineering & Technology, vol. 7, no. 5, pp.

114–120, 2023.

V. Chang, K. Hall, Q. Xu, F. Amao, M. Ganatra, and V.

Benson, “Prediction of customer churn behavior in the

telecommunication industry using machine learning

models,” Algorithms, vol. 17, no. 6, p. 231, 2024.

V. Gkonis and I. Tsakalos, “Deep dive into churn prediction

in the banking sector: The challenge of hyperparameter

selection and imbalanced learning,” J. Forecast., vol.

44, no. 2, pp. 281–296, 2025.

W. Verbeke, D. Martens, and B. Baesens, “Social network

analysis for customer churn prediction,” Appl. Soft

Comput., vol. 14, pp. 431–446, 2014.

Integrating Artificial Intelligence, Media Analytics and Strategic Business Intelligence for the Development of Adaptive Fintech Ecosystems

in the Era of Digital Transformation

799