Stock Market Forecasting with Machine Learning

P. Jacob Vijaya Kumar

1

, Shaik Fayaz

2

, Moghal Rasool Baig

2

, Shaik Mohammad Ershad

2

and Vadla Uday Kiran

2

1

Department of Computer Science and Engineering (AI-ML), Santhiram Engineering College,

Nandyal, Andhra Pradesh, India

2

Department of Computer Science and Design, Santhiram Engineering College, Nandyal, Andhra Pradesh, India

Keywords: Stock Prediction, Machine Learning, Deep Learning, Bayesian Optimization, Streamlit.

Abstract: Stock prices shift each day. People look for ways to predict where they might move next. Computers learn

from past trends and patterns to make smart guesses about future changes. Some methods focus on recognizing

trends. XGBoost, Random Forest, and Support Vector Regression study past stock behavior to predict

upcoming movements. Others focus on time-based patterns. LSTM and GRU observe how prices change over

time, adapting as they learn. Accuracy matters. Randomized Search CV helps adjust machine learning models

for better results. Bayesian optimization refines deep learning models, improving their performance step by

step. No single approach is enough. Machine learning and deep learning predictions are blended together,

reducing errors and increasing reliability. Users need simple access. A web tool built with Streamlit presents

forecasts in a clear way. Data comes from Yahoo Finance will ensure up-to-date stock information is used. By

combining these methods stock predictions become sharper. This approach offers a better way to understand

future market trends.

1 INTRODUCTION

Forecasting prices of stocks has always been a

stochastic process. It was high time for the contract

market to adjust the numbers. A number of elements

determine its course. Traditional methods have

difficulty with sudden changes or floods of new data.

Machine learning introduces an element of

intelligence. It learns from past trends. It predicts

based on patterns. But even the cleverest models

stumble when the market acts in ways they have never

encountered. That’s where deep learning comes into

play. It does not dumb like picture models, it adjusts.

It develops as the market changes. It does not simply

refer to past trends. It learns from what is changing,

at the moment. Over the years, its predictions become

increasingly sharp. It learns new patterns and

modifies its internal model. Machine learning + Deep

Learning: This is a great combination One analyzes

past trends. The other adapts to new ones. Pass

combined makes stock predictions more trustworthy

by giving investors better insights into an

unpredictable use.

2 LITERATURE REVIEW

2.1 How Machine Learning Assists

Stock Market Predictions

The automatic trading of stocks uses machine

learning that analyzes historical prices and identifies

patterns. People prefer it because it:

• Can quickly go through large amounts of

data

• Finds connections that humans might miss

• Adjusts to market changes over time

But standard stock prediction models have some

issues:

• They don’t always handle sudden price

jumps well

• They might focus too much on past trends

and make wrong guesses

• Their decisions are sometimes too complex

to explain

By adding deep learning and better data processing

this system makes predictions more accurate and

flexible by helping investors make better choices.

Kumar, P. J. V., Fayaz, S., Baig, M. R., Ershad, S. M. and Kiran, V. U.

Stock Market Forecasting with Machine Learning.

DOI: 10.5220/0013942400004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

697-703

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

697

2.2 How Does Machine Learning Play

a Role in Stock Market Predictions

It is utilised to predict prices more cleverly and

swiftly by stock specialists.

• Detecting Hidden Patterns: It analyses

previous stock prices and really identifies

trends that humans tend to ignore.

• Critical processing: It doesn’t make

decisions influenced by feelings unlike

humans it only looks in numbers.

• More Intelligent Predictions: By studying

past movements, it gives better estimates of

where stocks may head in the future.

2.3 Big Improvements in Stock Market

ML

• Mixing Different ML Methods: Some

models now use both deep learning and

traditional techniques to improve

predictions.

• Tracking News Instantly: ML tools can

scan news and social media in real time to

predict market changes.

• Noticing Odd Moves: Some ML systems

catch unusual trading behaviors that might

signal fraud or market tricks.

2.4 Challenges and Future Possibilities

ML is beneficial but certain issues persist.

• Messy Data: Stock market data can be full

of errors by making it hard for ML to learn

correctly.

• Unexpected Market Crashes: If something

big happens like a sudden crisis then ML

predictions can fail.

• Expensive Technology: Training ML

models needs powerful computers which

everyone cannot afford.

2.5 What Researchers Are Working On

• Making the ML Models Lighter: Experts

are working on models that do not need

heavy computing making stock predictions

faster and more efficient.

• Keeps Data Secure: New methods help to

protect user privacy while improving

prediction accuracy.

• Mixing of More Data Sources: Future

models may combine stock trends with real-

time news and economic events for smarter

predictions.

3 EXISTING SYSTEMS

3.1 Problems from Old Stock

Prediction Methods

• Not Enough Data is Considered:

Traditional systems mostly use past stock

prices by ignoring real-time market

influences.

• Struggle with the Sudden Market Shifts:

Big changes like economic crashes will

often make old methods unreliable for

prediction.

• Can not Recognize Fraud: Old models

struggle to find strange trading activities and

market tricks.

3.2 ML That Reads the Market’s Mood

How This Model Works: This system tracks stock

prices and market trends in real-time. It uses machine

learning to study past data and find patterns. By doing

this it predicts how the market might move. The

model adapts to the latest market changes and helps

investors understand where prices are headed.

Uncommon Merits:

• Uses smart machine learning to find hidden

patterns.

• Harder for fake news or sudden hype to trick

the system.

Drawbacks:

• Needs strong computers to work fast.

• Struggles with totally random events like

global crises. `

3.3 Blazing-Fast Stock Movement

Detection

How it works: Using models like LSTM and

Transformer, this system predicts where stock prices

might go next. It looks at historical stock data and

tries to find patterns that show up over time. Even

when the market is changing quickly the model keeps

up and gives predictions about stock movements.

Cool features:

• Can track many stocks at once.

• Works even when the market is moving

wildly.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

698

Drawbacks:

• Needs powerful graphics cards to run well.

• Still has trouble with stocks that move

unpredictably.

3.4 Fake Stock Hype Buster

How it works: This system watches for both real and

fake stock movements. It compares stock changes

with news and social media. The model looks for fake

trends and warns investors before they are tricked. It

helps make sure that stock predictions are not affected

by misleading information.

Cool features:

• Catches misleading trends before they trick

investors.

• Helps make stock predictions more reliable.

Drawbacks:

• Needs a huge amount of data to learn

properly.

• Uses a lot of computer power.

3.5 Smart Market Tracking in Real

Time

How it works: This model combines live stock prices

with news and social media to track changes as they

happen. It looks for important trends and sudden

stock movements. By analyzing live data the system

helps spot which stocks are rising or falling fast by

keeping predictions up-to-date.

Cool features:

• Updates instantly with the latest stock

changes.

• Can show which stocks are rising fast or

falling hard.

Drawbacks:

• Needs a steady internet connection.

• Costs more to run because it pulls in live

data.

3.6 Super-Secure Stock Predictions

How it works: This model uses different machine

learning methods together. Each model checks the

others so the predictions are more accurate. The

system reduces mistakes by comparing data from

different sources. This makes stock predictions safer

for investors who want more reliable information.

Cool features:

• Makes predictions more accurate by cross-

checking data.

• Good for people who want safer investment

decisions.

Drawbacks:

• Harder to build and connect all the models.

• Costs more to set up and keep running.

3.7 Comparing Different Stock

Prediction Methods

Table 1 gives the information about the Stock

Prediction.

Table 1: Comparison of Stock Prediction.

Method How It

Works

Why It’s

Useful

What’s Tricky

News &

Social

Media

Analysis

Reads

financial

news and

social

media to

sense

market

mood.

Spots

trends

early,

warns

about hype

or panic.

Can

misunderstand

sarcasm or

fake news.

Smart AI

Stock

Predictions

Uses deep

learning to

study past

stock

prices and

guess

future

trends.

Learns

patterns

well,

adapts to

new trends.

Needs strong

computers,

struggles with

sudden market

crashes.

Detecting

Odd

Market

Moves

Finds

unusual

stock price

jumps or

drops that

seem

suspicious.

Helps

avoid risky

trades,

catches

fraud early.

Can raise false

alarms, needs

lots of past

data.

AI

Learning

to Trade

AI tests

different

trading

strategies

and keeps

improving

over time.

Adapts on

its own,

can make

better

choices.

Takes time to

learn and risky

if trained on

bad data.

Mixing AI

with Old-

School

Indicators

Combines

machine

learning

with charts

traders

already

use (like

RSI,

MACD).

Gets the

best of

both

worlds,

balances

AI with

human

experience.

Harder to set

up, needs

expert fine-

tuning.

Stock Market Forecasting with Machine Learning

699

4 METHODOLOGY

4.1 Problem Definition

The structure in which we do our project in steps to

attain our project goals. The ultimate goal is to create

a smart system that employs machine learning (ML)

methods to forecast stock prices.

• Developing a

Stock Prediction System: The system

will gather historical stock prices, observe price

movements, and analyze the significant leading

indicators that influence stocks. It will seek

to

observe trends in the rise and fall of stock prices.

• Deep Learning Model:

The system will work with

models that are based on RNN like LSTM· GRU

They will review historical prices, remember long-

term trends and will predict stock prices in the future

on the basis of how stocks have behaved

in the past.

• Introducing Classic ML Models to Achieve

Accuracy: To improve predictions, models such as

XGBoost, random forest and SVR will be added.

These models utilize diverse approaches to

unveil

concealed patterns and lessen errors in forecasting.

4.2 Software Requirements

To develop the stock prediction system, we need the

following software tools:

• Development Tools:

o Streamlit (for creating an interactive web

interface)

o TensorFlow & Keras (to train the deep

learning models)

o Scikit-Learn (data preparation and

evaluation)

o XGBoost (boosting accuracy)

o Pandas & NumPy (handling data)

o Matplotlib (making charts and graphs)

4.3 Hardware Requirements

For smooth operation, the system requires:

• At least 8GB RAM to process stock data

efficiently

• A GPU to speed up deep learning model

training

• Fast internet to fetch real-time stock data

4.4 Inputs & Outputs

• Inputs: Stock history data, technical

indicators

• Outputs: Future stock price predictions,

performance graphs, accuracy reports

4.5 Use Case

The system is designed for different users, each with

specific roles:

• User:

o It receives stock-related information from

the user such as the company ticker

symbol, the date range for analysis, and the

prediction period.

o This creates stock predictions which the

user views and interprets alongside their

own analysis to make their decisions.

• System:

o Stock market data, including live and

historical prices, are retrieved by the

system for accurate analysis.

o The data is then cleaned, and a

MinMaxScaler is applied to better

normalize the data points to improve the

model streamline.

o The next step for the system is to build

machine learning models or a deep

learning model to understand the stock

market trends and predict future moves.

o Ultimately system shows the predicted

stock valus as well as trend on

visualization which makes it easy for the

user to perceive stock market movement.

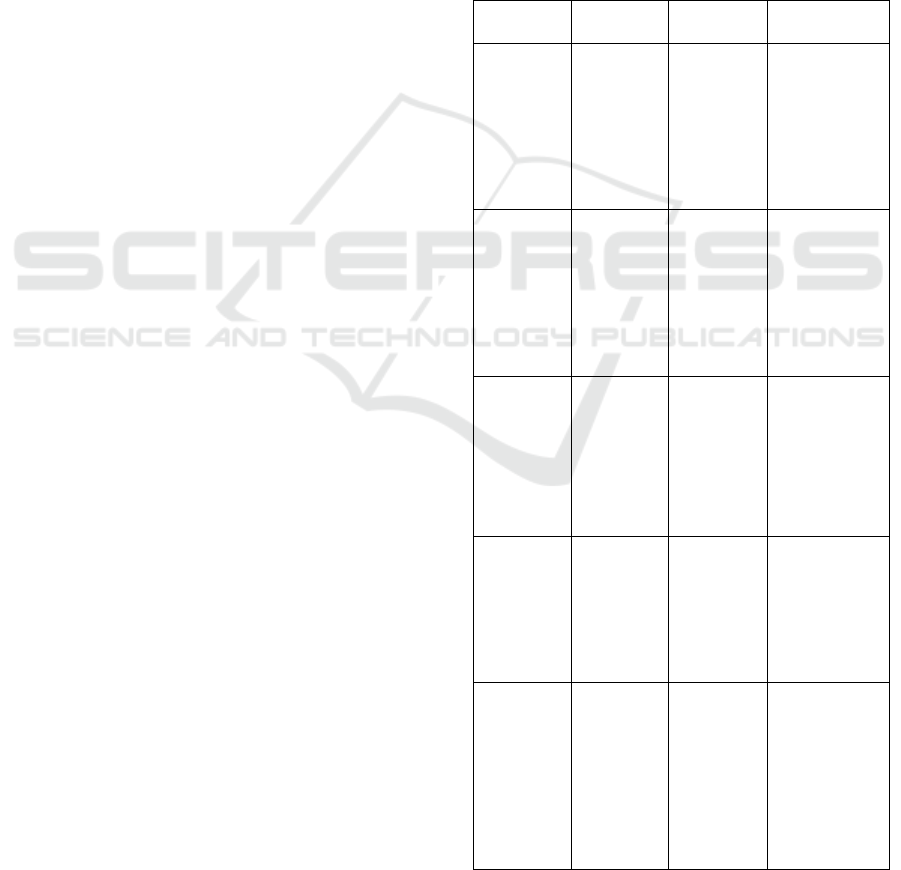

4.6 Data Flow Diagram (DFD)

The Data Flow Diagram (DFD) presents how

information moves through the system. Figure 1

covers:

• The user enters stock-related details such as

the company ticker, time range and

prediction period.

• The system collects stock market data

including past and real-time prices from

reliable sources.

• The collected data is preprocessed, cleaned

and scaled to prepare it for analysis.

• Machine learning and deep learning models

are trained using the processed data to

generate predictions.

• The system then displays the predicted stock

values in a user-friendly format often with

graphs and visual trends to help the user

interpret the results easily.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

700

Figure 1: Data Flow Diagram of the Stock Prediction

System.

4.7 Database

The system does not store data in a traditional

database. Instead, it uses caching and storage

techniques to improve efficiency. It manages:

• Stock ticker symbols and details

• Past stock prices

• Preprocessed data

• Saved models for reuse

• Prediction outcomes and accuracy reports

4.8 Sequence Diagram

The Figure 2 Sequence Diagram shows the system's

flow step by step:

1. User enters stock details.

2. System collects and processes stock data.

3. ML & DL models predict future prices.

4. Predictions and metrics are displayed to the

user.

Figure 2: Sequence Diagram of the Stock Prediction

System.

4.9 Flowchart

The Flowchart visually represents how the stock

prediction system operates. Figure 3 illustrates:

• User input and data collection

• Data preprocessing and feature selection

• Model training and evaluation

• Generating and displaying predictions

Figure 3: Flowchart of the Stock Prediction System.

5 EXECUTION AND OUTCOMES

5.1 Overview of the Model

The model combines two major approaches

traditional machine learning and deep learning to

predict stock prices. By merging these methods, it

aims to boost prediction accuracy. Deep learning is

handled through LSTM (Long Short-Term Memory)

and GRU (Gated Recurrent Unit) models, which are

designed to find complex patterns in stock price data.

On the other hand traditional models like XGBoost,

Random Forest, and Support Vector Regression

(SVR) bring in extra insights based on structured

features.

Stock Market Forecasting with Machine Learning

701

5.2 Data Preparation Process

Data collection starts with retrieving stock prices

from Yahoo Finance using the yfinance API. The

'Close' prices are then scaled using MinMaxScaler

which converts them into a range between 0 and 1.

The time series data is structured into windows by

using 60 past days to predict the price for the next day.

This data is split into training and testing sets to

ensure proper evaluation.

5.3 Deep Learning Model Structure

The deep learning part of the model uses a mix of

LSTM and GRU layers, perfect for handling time-

sequenced data like stock prices. These layers are

bidirectional means they process the data both

forward and backward to understand dependencies

from the past and the future. Dropout layers are

included to prevent overfitting by randomly dropping

some weights during training. Training is done using

the Adam optimizer with the learning rate fine-tuned

through Bayesian Optimization.

5.4 Traditional Machine Learning

Models

The traditional machine learning models including

XGBoost, Random Forest and SVR are applied to the

prepared data. Hyperparameter tuning for these

models is carried out using randomized search

techniques to find the best setup for stock price

prediction.

5.5 Model Prediction

At the end of the process the model provides

predictions for the next 30 days of stock prices. The

final output is a combination of predictions from both

the deep learning and machine learning models by

producing a more accurate result through ensemble

methods.

5.6 Checking Model Performance

We tried different machine learning and deep learning

models to predict stock prices. Each model had a

different way of understanding patterns in stock data:

• LSTM – This model remembers past trends

and uses them to predict future stock prices.

• GRU – Works like LSTM but is faster and

needs less memory.

• XGBoost – A smart decision-making model

that finds patterns in stock prices.

• Random Forest – A group of decision trees

that work together to give better results.

• SVR – A model that focuses on predicting

stock prices using advanced math formulas.

To check how well these models work we

measured their accuracy using Mean Squared Error,

Root Mean Squared Error and R² Score. Lower errors

meant the model was predicting better.

5.7 Overall Model Performance

The ensemble model combining deep learning (DL)

and machine learning (ML) which delivers strong

results shown in table 2.

• MAE (Mean Absolute Error): The model’s

predictions are generally close to the actual

stock prices, with only small deviations on

average.

• MSE (Mean Squared Error): While the

model shows some larger errors at times it

remains effective in predicting overall trends

with the larger mistakes helping guide

improvements.

• RMSE (Root Mean Squared Error):

Considering all the errors the model's

predictions are accurate enough by

reflecting the true stock price changes

without large discrepancies.

• R² Score: The model explains almost all of

the variations in stock prices by indicating

that it closely follows the price movements

and can predict them effectively.

Table 2: Ensemble Model Performance Evaluation

(Blended Deep Learning & Tuned Machine Learning).

Metric Value

Mean Absolute Error (MAE) 13.8200

Mean Squared Error (MSE) 234.0953

Root Mean Squared Error (RMSE) 18.2783

R² Score 0.9803

5.8 Saving Predictions in CSV or Excel

To make things easy the system lets users download

stock predictions in CSV or Excel format. Users just

need to choose a stock and a date range and the

system creates a neat file with:

• Date – The day for which the prediction is

made.

• Actual Price – The real stock price, if

available.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

702

• Predicted Price – This model is the best

guess for the stock price.

• Errors – The gap between the real price and

the prediction.

This helps investors check forecasts compare them

with actual prices and plan wisely.

6 CONCLUSIONS

This project uses machine learning to predict stock

prices. It helps investors make better decisions by

showing potential future prices. Instead of guessing it

looks at past stock data and trends to find patterns.

These patterns are used to predict future prices more

accurately.

This helps the system make smart predictions.

Machine learning is great for finding patterns in large

sets of data that are hard for humans to see. By using

this technology, the project gives investors a tool to

predict prices based on real data not just assumptions.

In the end it helps investors plan their actions with

more confidence by making stock predictions clearer

and more reliable.

7 FUTURE SCOPE

In the future we plan to improve the stock prediction

system by integrating live stock data to ensure

predictions are based on up-to-date market

information. By incorporating more financial details

such as earnings reports and economic indicators we

can enhance the accuracy of the forecasts. We also

aim to combine deep learning with other advanced

techniques to make the predictions more adaptive to

market changes by allowing the system to improve

over time. Enhancing the user interface with

interactive charts and graphs will make the system

easier to use and understand. These improvements

will make the system more accurate, efficient and

user-friendly.

REFERENCES

M. S. Sonani, A. Badii, and A. Moin, “LSTM with Graph

Neural Network for Stock Prediction,” arXiv preprint,

2025.

W. Gu, Y. Zhong, S. Li, et al., “Stock Price Prediction Using

LSTM and News Sentiment Analysis,” arXiv preprint,

2024.

C. Fjellström, “Ensemble LSTM Models for Stock Market

Prediction,” arXiv preprint, 2022.

P. Tran, T. K. A. Pham, et al., “Deep Learning for Stock

Trends: A Case Study on Vietnam’s Market,” Nature

Scientific Reports, 2024.

X. Zhang and D. Wu, “Time Series Analysis and Stock

Price Prediction Using Deep Learning,” International

Journal of Financial Studies, vol. 6, no. 2, p. 36, 2018.

J. Patel, S. Shah, P. Thakkar, and K. Kotecha, “Predicting

Stock Market Index Using Fusion of Machine Learning

Techniques,” Expert Systems with Applications, vol. 42,

no. 4, pp. 2162–2172, 2015.

D. S. Kumar, M. V. Subramanyam, and A. P. S. Kumar, “A

hybrid spotted hyena and whale optimization

algorithm-based load-balanced clustering technique in

WSNs,” Proceedings of International Conference on

Recent Trends in Computing: ICRTC 2022, Singapore:

Springer Nature Singapore, 2023.

J. D. S. Kumar, M. V. Subramanyam, and A. P. S. Kumar,

“Hybrid Sand Cat Swarm Optimization Algorithm-

based reliable coverage optimization strategy for

heterogeneous wireless sensor networks,” International

Journal of Information Technology, 2024. Available:

https://doi.org/10.1007/s41870-024-02163-8.

J. D. S. Kumar, M. V. Subramanyam, and A. P. S. Kumar,

“Hybrid Chameleon Search and Remora Optimization

Algorithm‐based Dynamic Heterogeneous load

balancing clustering protocol for extending the lifetime

of wireless sensor networks,” International Journal of

Communication Systems, vol. 36, 2023. DOI:

10.1002/dac.5609.

Stock Market Forecasting with Machine Learning

703