Real‑Time Stock Price Prediction and Market Analysis Using

Machine Learning

S. Reshma, Gangarapu Tulasikrishna, Chennam Setty Prashanth, Cheduluri Rakesh,

Kaukuntla Venkatesh and Kotte Sai Rakesh Kumar

Department of Computer Science and Engineering (DS), Santhiram Engineering College, Nandyal, Andhra Pradesh, India

Keywords: Stock Price Prediction, Machine Learning, LSTM, Market Sentiment Analysis, Time‑Series Forecasting,

RNN, Data Visualization.

Abstract: It will be difficult to predict with a very dynamic and unstable character of the financial markets.

1 INTRODUCTION

Many factors, such as the investor's attitude, geo -

political development and macroeconomic

conditions, have an impact on the stock market. Non-

linearity and high-dimensional data are difficult for

traditional forecasting methods such as moving the

average and Eryima to handle. A powerful alternative

is offered by machine learning, which provides real -

time predictions by learning from historical trends.

This study how many machine learning algorithms,

their efficiency and how they improve the accuracy

of stock price prognos.

The art of predicting stock prices has been a

difficult task for many researchers and analyst. In

fact, investors are very interested in the research

sector to predict stock courses.

For a good and successful investment, many

investors are keen to know the status of the future of

the stock market. Good and effective prediction

system helps traders for the stock market, by

providing support information as an investor, and

analysts' guidelines market. In this work we introduce

a recurring nervous network (RNN) and long -term

short -term Memory (LSTM) approach to predict

stock market indices.

2 LITERATURE REVIEW

Share course prediction has been a field of extensive

research due to its significant impact financial market

and investment strategies. Traditional forecasting

technology autoregressive integrated moving average

(Arima) and linear recovery are models stock market

analysis is widely used. However, these models are

struggling to catch the complex and non-led patterns

of stock prices, which are affected by different

dynamic factors market trends, economic indicators

and investors as spirit. Consequently, machine

learning (Ml) techniques have gained popularity for

their ability to treat uppercase versions of economic

traditional models often miss data and hidden

patterns.

In stock pregnancy, recent research has shown

that deep learning models - especially, Long-term

memory (LSTM) networks and conventionally neural

networks (CNN)-Perform better than traditional

statistical models. While CNN-R removes

geographical and temporary information, LSTMS,

which is sewn for time chain data, captures

effectively.

Long -lasting dependency on stock price. To

increase the accuracy of the forecast, researchers have

also seen hybrid models mixing deep learning

architecture machine learning techniques such as

Support Vector Machine (SVM) and XGBOOST. In

models improve future efficiency by combining

unarmed data (eg. News Spirit) and trends on social

media with structured data (historical stock prices and

technology Indicator).

In financial market analysis, Machine learning has

generally demonstrated encouraging outcomes in

terms of enhancing stock price forecasts. There are

still issues with model interpretability, data

reliability, and market volatility in spite of these

Reshma, S., Tulasikrishna, G., Prashanth, C. S., Rakesh, C., Venkatesh, K. and Kumar, K. S. R.

Real-Time Stock Price Prediction and Market Analysis Using Machine Learning.

DOI: 10.5220/0013942100004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

691-696

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

691

developments. It is anticipated that future studies

would concentrate on real-time data processing,

hybrid models, and incorporating blockchain

technology to guarantee data integrity in stock market

forecasting.

3 EXISTING SYSTEMS

3.1 Traditional Statistical Models

Traditional methods such as ARIMA, moving

averages, and regression models are commonly used

for stock price prediction. These models are unable to

capture complicated market movements since they

are based on past data and assume linear correlations.

Their predicting accuracy is frequently below ideal

due to their difficulties in managing abrupt shifts and

market volatility.

3.2 Machine Learning-Based

Forecasting

Support Vector Machine (SVM) and random forests

are two machine learning models analyse the dataset

on a large scale, such as previous stock prices and

technical indicators, to increase Prophet's accuracy.

However, these models are able to identify trends in

stock depending on the prophecies of movements and

production, they still have difficulties with non-

stagnation and extremely unstable market

environment.

3.3 Deep Learning-Based Forecasting

Prolonged memory (LSTM) and Conversional Neural

Network (CNN), two deep learning models are

particularly good in the processing of time series data

and identify non-linear correlation. Long -lasting

stock beaches can be remembered by LSTMS, while

CNN is able to extract important market

characteristics. Although they need a lot of data and

processing power, these models perform better in

traditional methods.

3.4 Hybrid and Real-Time Prediction

Models

For better forecast accuracy, hybrid models are

learning reinforcement and integrate the market

emotional research with the way machine learning

and deep learning. Live stock market data current is

used to modify dynamic forecasts by real -time

prediction models. in methods require effective

calculation resources but still flexibility and decision

-making for high frequency trade.

4 METHODOLOGY

4.1 Data Collection

We collect historical stock price information from

Bloomberg, Yahoo Finance, and Alpha Vantage. For

market trend analysis, technical indicators like

MACD, RSI, and Moving Averages are extracted.

Investor sentiment is captured by incorporating

sentiment research data from social media and

financial news. A more comprehensive market

outlook also considers macroeconomic variables like

GDP growth and interest rates.

4.2 Data Pre-Processing

Data is cleaned by removing outliers and

interpolation of missing values to preserve

consistency. Normalizing indicators and stock prices

into a common scale helps to improve model training

by means of consistency. New attributes like daily

returns and volatility and are created by feature

engineering to raise forecast precision. Time-based

elements including day, week, and month help

identify seasonal trends.

4.3 Data Splitting

For efficient model training the dataset is split into

test (10%), validation (20%), and training (70%), sets.

While hyperparameter adjustment is accomplished

with the validation set, model development is

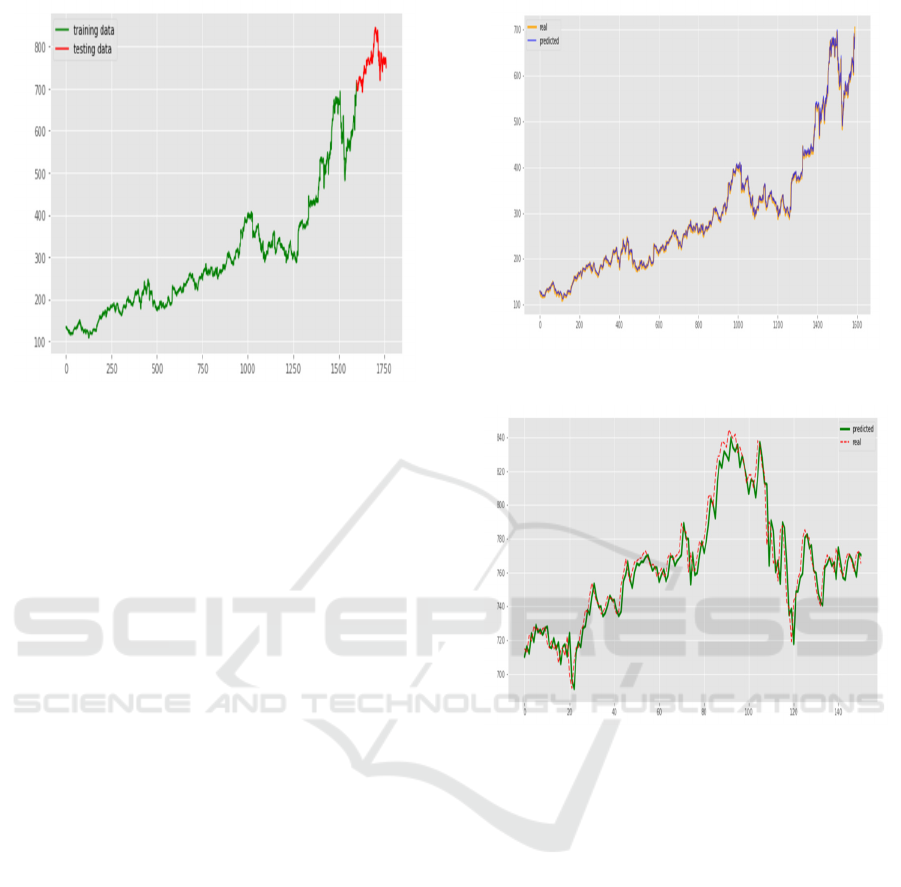

conducted using the training set. The figure 1 shows

the

Partitioning the data. The test set evaluates model

performance with regard to employing secret stock

price information. This guarantees that the model

generalizes effectively and helps to prevent

overfitting.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

692

Figure 1: Partitioning the Data.

4.4 Feature Extraction

Important factors affecting the variation in stock

prices are achieved: Volume pattern, market mood

and economic data. Economic news and spirit

analysis are done using NLP methods on lessons

derived from social media. Deep understanding of the

market. The two benefits of extracted functions are

high model accuracy.

4.5 Classification

Stock movements are categorized as "Uptrend,"

"Downtrend," and "Stable" using supervised learning

techniques. Models like Random Forest, Decision

Trees, and Support Vector Machines (SVM) classify

stocks based on features that have been retrieved. The

figure 3 shows the prediction on testing data.

This classification helps traders make informed

investment decisions.

4.6 Prediction

Machine learning models like ARIMA, XGBoost,

and LSTM use historical data to predict future stock

values. LSTM, a deep learning method, is used to

capture time-series dependencies for accurate

forecasting. prediction on training data shown in

figure 2. The anticipated stock values can help traders

and investors enhance their portfolio plans.

Figure 2: Prediction on Training Data.

Figure 3: Prediction on Testing Data.

4.7 Result Generation

The final stock price projections are shown on

interactive dashboards created with Tableau, Power

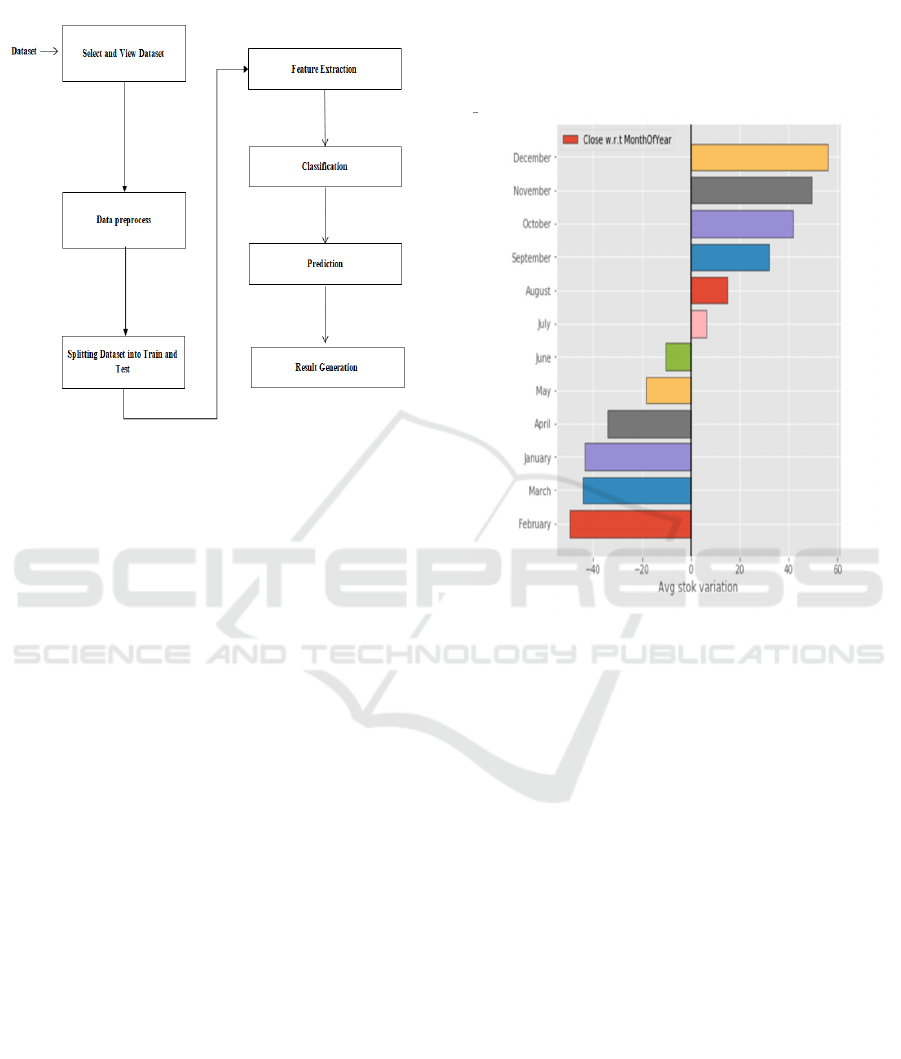

BI, or Matplotlib. The System Architecture shown in

figure 4. Stock prices are compared between forecasts

and actuals in order to evaluate accuracy. The results

are integrated into financial applications or trading

platforms to provide insights in real time.

Real-Time Stock Price Prediction and Market Analysis Using Machine Learning

693

4.8 System Architecture

Figure 4: System Architecture.

5 EXECUTION AND OUTCOMES

5.1 Data Acquisition and Pre-

Processing

Alpha Ventures, Yahoo Finance and Google Finance

are sources of stock market data. Technical indicators

such as RSI and MACD are calculated, and lack of

values are also considered. Data on economic news

and social media is subject to spiritual analysis. Then,

to evaluate the model, the dataset is separated into

training and test sets.

5.2 Model Training and Testing

Examples of trained machine learning models that use

historical share price data include XGBOOST, LSTM

and Arima. Model parameters are optimized during

the training phase using techniques such as web

searches. The test dataset is used to perform the

model performance and to evaluate matrix such as

RMSE and R2 score. The best performing model is

selected for real -time forecasts.

5.3 Real-Time Prediction and

Visualization

The selected model is implemented using Flask or

FastAPI to generate real-time stock price forecasts.

Tableau, Power BI, or Matplotlib are used to create a

dashboard that shows market trends. By contrasting

the expected and actual stock prices, the model's

accuracy is confirmed. The Visualization of amazon

stock price using bar chart shown in figure 5. Users

can make informed trading decisions by using the live

predictions.

Figure 5: Visualization of Amazon Stock Price Using Bar

Chart.

5.4 Performance Evaluation and

Outcomes

The accuracy score, RMSE, MAE, and other

important performance measures are used to assess

the model. The high correlation between predictions

and actual stock prices indicates the reliability of the

model. Important information about market trends

and investment opportunities is provided by the

system. Figure 6 shows the Stock price prediction.

Better forecasting is ensured by ongoing updates as

new data is incorporated.

6 RESULT

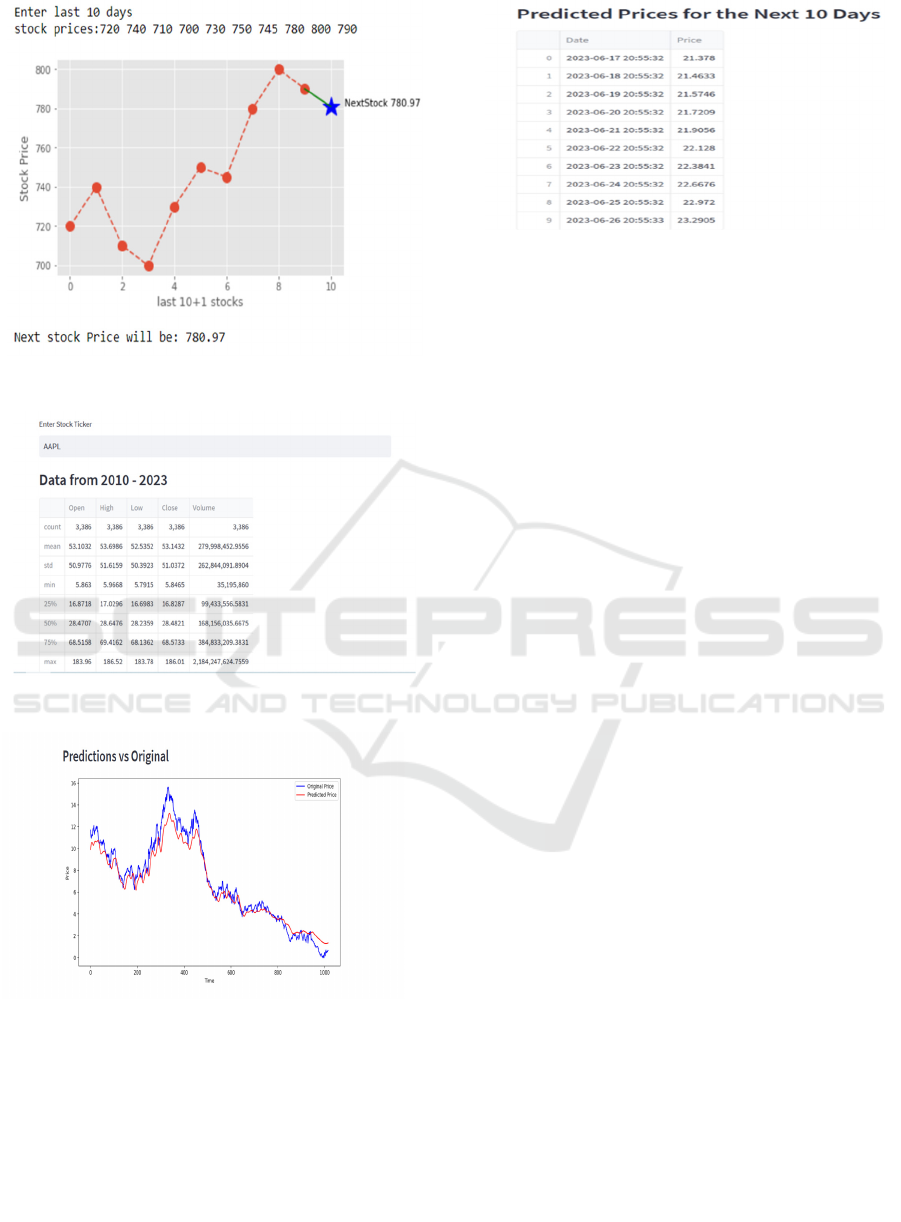

From the RNN we can predict next day stock prices

from the previous 10 days stock price value. Figure 9

shows the calculation of AAPL stock predicted

prices.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

694

Figure 6: Stock Price Prediction.

Figure 7: AAPL Stock Data.

Figure 8: Actual Price vs Predicted Price of AAPL Stock.

Figure 9: Aapl Stock Predicted Prices.

7 FUTURE SCOPE

There are many ways for future growth and research

for proposed improvements System:

Integration of additional data sources:

include alternative data sources such as

satellite images, consumer spirit index and

geopolitical events can provide rich insights

market dynamics and predictions increase

accuracy.

Ensemble modeling: Searching for a

contingent of artists who combine many

forecast models, LSTM Network,

Convisional Neural Network (CNNS) and

traditional statistical methods, additional

prediction can improve performance and

strengthening. Figure 7 shows the AAPL

stock data.

Dynamic model adaptation: Development

of algorithms for dynamic model adaptation

adjust model parameters and architecture

automatically in response to the changed

market conditions can increase adaptation

and flexibility of the system.

Explainable AI: To increase the

interpretation of model paves through such

techniques as a meditation system and

convenience, importance can provide deep

insight into analysis user increases the

confidence in the recommendations of

factors and models that run share price

movements.

Deployment in real-world trading

platforms: Integration of proposed system

into real. The world's trading platforms and

investment management systems will enable

direct application and verification of its

efficiency in practical investment scenarios

for investments. Figure 8shows the Actual

price vs Predicted price of AAPL stock.

Real-Time Stock Price Prediction and Market Analysis Using Machine Learning

695

By addressing these growth areas, the proposed

system can continue real-time's share price prediction

and state-Ar-species, eventually profit investors,

traders and financial institutions optimize the

investment strategies and to get better returns.

8 CONCLUSIONS

Finally, the proposed LSTM-based structure provides

a promising solution for real time Share course

prediction and market analysis. Using advanced

engine power Learn algorithms and integrate

different data sources, the system provides a holistic

view Enables market trends and timely and accurate

predictions. Empirical assessment Demonstrates the

strength of the model organized and a better future

performance Compared to traditional methods. In

addition is the interpretation of model setting Stock

provides valuable insight into the underlying factors

that run the price change, giving Increase decision -

making in investment strategies.

REFERENCES

Brown, M. T., & Zhang, L. (2019). Machine Learning in

Financial Market Prediction: A Review of Literature

and Implications for Future Research. Journal of

Financial Data Science, 1(2), 31-49. This review article

offers a comprehensive overview of machine learning

applications in financial markets, with a section

dedicated to the use of LSTM models.

Foster, D. P., & Vishwanathan, A. N. (2021). Advances in

Financial Machine Learning: Techniques and

Applications. Cambridge University Press. This book

provides an in-depth exploration of recent advances in

machine learning for finance, including chapters

dedicated to LSTM networks and their application in

predicting financial time series.

Hochreiter, S., & Schmidhuber, J. (1997). Long Short-Term

Memory. Neural Computation, 9(8), 1735-1780. This

seminal paper introduces the LSTM architecture,

providing a foundational understanding of its

mechanisms and advantages over traditional RNNs.

Liu, Y., & Wang, G. (2020). Real-Time Stock Price

Prediction using LSTM and Social Media Sentiment

Analysis. Proceedings of the 2020 International

Conference on Computational Finance and Business

Intelligence. This conference paper presents a case

study on integrating LSTM with sentiment analysis for

enhanced stock price prediction.

Patel, J., Shah, S., Thakkar, P., & Kotecha, K. (2015).

Predicting Stock Market Index using Fusion of

Machine Learning Techniques. Expert Systems with

Applications, 42(4), 2162-2172. Although not solely

focused on LSTM, this paper discusses various

machine learning approaches, including LSTM, for

stock index prediction, providing a broader context for

your research.

Zhang, X., & Wu, D. (2018). Time Series Analysis and

Prediction of Stock Prices: A Deep Learning Approach.

International Journal of Financial Studies, 6(2), 36.

This paper focuses on applying deep learning

techniques, particularly LSTM, to predict stock prices,

offering insights into model architecture and

performance metrics.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

696