Financial Analysis of Stocks Using AI Agents

Twinkle Vigneswari V. and Uma Maheswari Km

Department of Computing Technologies, SRM Institute of Science and Technology, Chennai, Tamil Nadu, India

Keywords: Artificial Intelligence, AI Agents, Agentic AI, Agentic Workflow, API, Phi Data, LLM, LLM Judge.

Abstract: This proposed work showcases a minimalistic yet impactful approach to financial analysis using AI agents.

Leveraging Python and open-source libraries, the system demonstrates the ability to autonomously gather,

process, and analyse stock market data. By utilizing tools such as phi data and Yahoo Finance, the work

highlights how AI-driven automation can streamline the analysis process for individual investors and small-

scale analysts.

1 INTRODUCTION

Analysing financial data has historically been

tedious and a laborious process, needing a significant

amount of manual wires in gathering, cleaning,

understanding trends and assessing performance. AI

agents are growing as disruptive forces in finance

powered by the developments made in AI and

machine learning (ML) over the past several years.

The agents use automation, natural language

processing (NLP), as well as deep and reinforcement

learning methods to simplify financial analysis,

reduce human errors, and make more efficient

decisions.

In this paper, we present a cloud-based AI-driven

financial analysis system built with Phi data an

advanced data pipeline automation framework. It

comprises of machine learning models, API-based

data extraction, and predictive analytics to

autonomously collect financial data, analyse stock

trends, and provide actionable insights. Utilizing AI-

based approaches, this fluency describes how

computational agents could change financial

decision-making process. Automated workflows,

scalable integration with the cloud, and AI-enhanced

visualization tools make financial analysis both more

accessible and more efficient.

In doing so, we hope to demonstrate the potential

of AI-powered automation to democratize access to

financial data and analytics, offering sophisticated

analytical insights to individual income earners,

analysts, and small businesses while serving as a

bridge between the worlds of traditional finance and

AI innovation

.

Motivation.

The financial landscape is changing rapidly, thanks to

a number of key trends: increased reliance on data-

driven decision making and machine learning

analytics. But the ability to apply sophisticated

financial analysis tools remains predominantly in the

hands of large institutions and hedge funds, which

can afford top-tier computing infrastructure and

proprietary AI models. Such advanced tools are

typically out of reach for retailer investors, small-

scale analysts and individual traders, negatively

affecting the individual traders and the day traders

decision-making process by depriving them of the

instantaneous market information and AI-enhanced

vision.

Our goal is to make this access gap smaller by

building an intuitive and lightweight financial

analysis system using AI agents and automation

frameworks like phi data. The system enables you to

use the system with no complex setups or high-cost

software as it uses open-source tools, external APIs

(Yahoo Finance API, for example), and pre-trained

AI models. It helps users (with or without tech

background) to easily monitor stock trends and

identify anomalies as well as analyse financial

sentiment from news articles and reports.

This work proposes a cheaper, real-time

alternative to traditional financial analysis systems by

streamlining the deployment steps and cutting down

on the computation expenses. As a mission, we aim

to democratise AI-based financial insights for

individual investors, students, and finance freedom

V., T. V. and K. M., U. M.

Financial Analysis of Stocks Using AI Agents.

DOI: 10.5220/0013941700004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

671-675

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

671

lovers to leverage the latest AI technologies without

needing particular expertise and capital.

2 LITERATURE REVIEW

AI in Financial Analysis: According to research, AI

is being increasingly used in sentiment analysis,

market prediction, risk management, and market

segmentation.

• Open-Source Tools: Frameworks like phi data

can simplify AI development, according to

research.

• Automation with AI Agents: The efficiency of

agent-based systems in terms of reducing

manual labour and increasing accuracy in

financial applications is discussed in the papers.

• Challenges in AI Adoption: Problems like data

quality, scalability, and user-friendliness

persist.

3 CHALLENGES IN EXISTING

SYSTEMS

The models like in faced with one of the main

challenges

• Limited Accessibility: Most high-end tools

come at a considerable cost which can prevent

smaller investors from using them.

• Complexity: Most are too sophisticated,

discouraging non-technical users.

• Data Gaps: Other tools may not pull in entire

data sets.

• It is also true that information used has its

stability and reliability depending on quality of

data.

4 OBJECTIVES OF THE WORK

• Build an accessible and straightforward AI agent

for financial data analysis.

• Automate data collection from reliable sources

like Yahoo Finance.

• Deliver clear, actionable insights with minimal

user input.

• Showcase the capabilities of AI agents in

simplifying financial decision-making.

Innovation of the work.

The great innovation is the simplicity and efficiency

of the work. Using Phidata, an AI-powered data

engineering framework, the regulator creates a

cohesive pipeline for extracting, processing, and

analysing data. Phidata streamlines the deployment

and monitoring of monetary knowledge analysing AI

agents. Moreover, this work makes use of Yahoo

Finance API to fetch real-time stock market data,

ensuring continuous access to the latest financial

information.

The system also utilizes machine learning models

to analyse trends and detect anomalies, as well as

NLP (Natural language processing) models for

sentiment analysis of financial reports and news

articles. Additionally, the summary generation

module leverages large language models (LLMs) to

translate raw data on stock performance into

digestible insights and patterns that users can

interpret.

While classical systems require significant

manual labour and computational effort, this work

focuses on simplicity, low-cost and fast turnaround

time. With lightweight and capable AI agents, it

removes the pain of a difficult configuration,

bringing financial analysis to the world of the

individual investor, small-scale analyst, and

educational user. This powerful AI enabled

automation also improves the accuracy of the analysis

work while driving down both the cost of doing the

work and the time it takes to deliver the analysis

thereby making the financial insights accessible to the

greater audience.

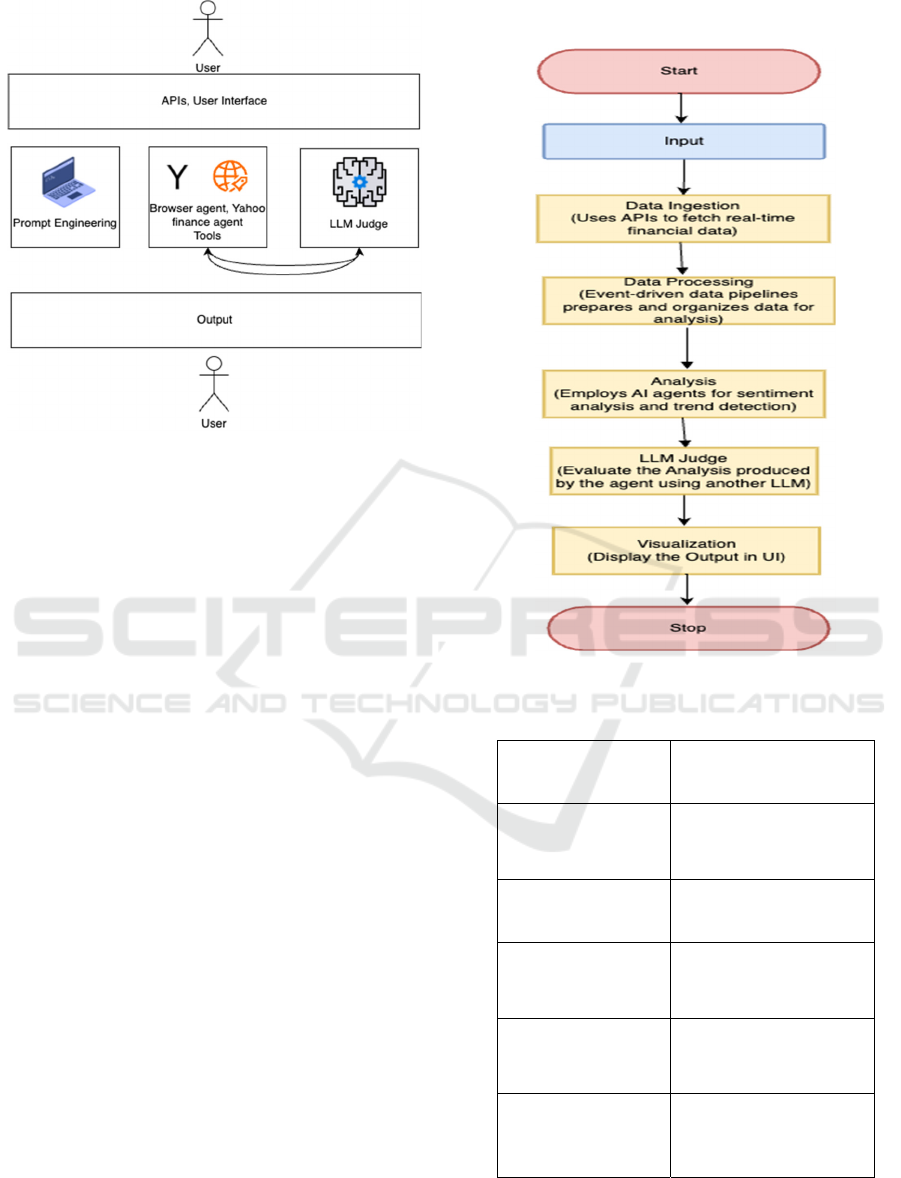

Figure 1 show the LLM Agent

System Architecture.

5 PROPOSED SYSTEM

In order to circumvent the limitations noticed in

previous research, our proposed system presented

several improvements to enable more efficient and

intelligent stock market analysis through AI Agents.

Our model empowers business analysis and

democratizes financial interpretation by utilizing

automated data collection, real-time querying, and

AI-driven financial intelligence.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

672

Figure 1: LLM agent system architecture.

5.1 Data Collection and Processing

Most existing financial analysis models depend on

static data, our system dynamically fetches live stock

market data using Yahoo Finance and other financial

APIs. The use of AI agents, where the system pre-

processes, normalizes, and stores this data for fast,

efficient analysis.

5.2 Real-Time Query Interface

Our system allows for ad-hoc, user-defined queries in

real-time a capability missing from many legacies

financial tools. Rather than manually sifting through

massive data, users key in stock symbols, time ranges,

and financial metrics, retrieving relevant insights

within seconds. Dynamic Stock Screening: Enables

user-based stock filtering based on PE ratio, EPS,

market trends and pricing power.

Trend Analysis Queries: to help investors to ask

questions like “show stocks with the growing NPS

score in the last quarter?”

Integration of Mind Trend to Conduct Sentiment

Analysis: Based on news articles, earnings reports,

financial announcements, and so forth to gauge

market sentiment. A second core technology is the

use of Generative AI for summarization in natural

language. Our system does not simply present

numerical data, as traditional models would, but

transposes that data in human-readable financial

insight.

Figure 2 show the LLM-Based Financial

Data Analysis Pipeline.

5.3 Algorithm Description

Figure 2: LLM-based financial data analysis pipeline.

Table 1: Input specifications:.

Input Type Description

Stock Symbol

The ticker symbol of the

stock (e.g., AAPL for

Apple, TSLA for Tesla).

Timeframe

User-specified period for

analysis (e.g., daily,

weekly, monthly).

Financial Reports &

News

Real-time news articles,

reports, and sentiment

data fetched from APIs.

User Query

Inputs related to specific

financial metrics (e.g.,

revenue, P/E ratio).

Market Trends Data

Historical and real-time

stock price data retrieved

using Yahoo Finance

API.

Financial Analysis of Stocks Using AI Agents

673

5.4 Data Collection Module

Utilizes Yahoo Finance API to collect real-time and

historical stock price data, financial reports, and key

performance indicators (KPIs). The Yahoo Finance

API automatically updates stock data at defined

intervals for continuous monitoring. Cleans raw

financial data by handling missing values, anomalies,

and noise. Transforms data into structured formats

(CSV, JSON, Pandas DataFrames) for faster

processing and analysis.

Table 1 show the Input

Specifications:

Phidata’s automation capabilities streamline the

data pipeline, ensuring real-time stock data updates

without manual intervention.

5.5 AI-Based Analysis Module

Utilizes NLP models for sentiment analysis from

financial reports and news articles:

Large Language Models (LLMs) (e.g., GPT-

based models, FinBERT) analyze financial news,

earnings reports, and social media sentiment.

Extracts positive, negative, or neutral sentiment

for stocks and industries.

Identifies market-moving news and predicts investor

sentiment shifts.

Implements machine learning models for trend

forecasting and anomaly detection:

Uses time series forecasting models (LSTMs,

ARIMA, and Transformer-based models) to predict

stock price movements.

Detects unusual price fluctuations and alerts users

about potential risks or investment opportunities.

Phidata facilitates efficient data pipelines, making it

easier to process large volumes of stock market data

quickly.

5.6 Query Interface Module

Accepts user-defined inputs (e.g., stock symbol,

timeframe, financial metric):

Users can enter stock symbols, date ranges, and

financial KPIs (e.g., P/E ratio, market cap, revenue

growth).

Allows for custom queries related to stock trends,

risk factors, and sector-specific performance.

Retrieves relevant stock trends, sentiment

analysis, and predictive insights:

Combines real-time data with AI predictions to

provide actionable investment insights.

Uses Phidata workflows to efficiently process and

return query results in a structured format.

Enables interactive exploration of stock trends

without requiring financial expertise.

5.7 Summary Generation Module

AI-powered engine for generating natural language

summaries based on analysed financial information:

LLM-based report generation from stock data,

sentiment analysis, and forecasts.

General impact of the financial news across stock

price movements of the typical stocks and the future

assessments of risk.

Instead of just stock data gives you intuitive insights:

Instead of showing complicated graphs and

numbers, the system gives plain-text summaries (for

example, “Stock X is seeing a good upward trend in

light of strong quarterly earnings”).

Allows investors lacking coding knowledge to

get a picture of financial trends without advanced

analytics capabilities.

5.8 LLM Judge Evaluation Module

Employs LLMs to review the output produced by the

summary generation module:

Uses reinforcement learning with another Judge

LLM to verify AI generated summaries are factually

accurate and in the right context.

Aims Open source LLMs Llama 3.1 70 b

versatile assume as true financial summaries through

comparing to live inventory piece of evidence.

Minimizes human intervention and evaluates the

accuracy of the output:

Conducts cross-check against the original data

and results of sentiment analysis.

Note: Potential hallucinations or misleading

information detected, providing reliable investment

insights.

Lowers manual verification overhead, enabling

automated, high-accuracy financial reporting.

6 CONCLUSIONS AND FUTURE

WORK

This paper uses AI agents to collect real-time data,

analyse sentiment, and query data based on user

preferences to address major issues in Financial

analysis. The system improves the decision-making

process for investors and analysts by automating

stock analysis and delivering AI-powered financial

insights.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

674

• Enhancing predictive analytics by incorporating

deep learning models for more accurate stock

price forecasting.

• Integrating multi-source financial data such as

earnings transcripts, social media sentiment, and

macroeconomic indicators for a more holistic

analysis.

• Expanding real-time query capabilities by

incorporating advanced NLP models for intuitive,

conversational financial queries.

• Optimizing computational efficiency for large-

scale financial datasets and real-time AI-driven

stock recommendations.

REFERENCES

A Systematic Survey of AI Models in Financial Market

Forecasting for Profitability Analysis," IEEE Access,

vol. 11, pp. 5359- 5378, 2023. doi:10.1109/ACCESS.2

023.3239357.

A Survey of Financial AI: Architectures, Advances and

Open Challenges," arXiv preprint arXiv:2411.12747,

2024. Available: https://arxiv.org/abs/2411.12747.

Artificial Intelligence Applied to Stock Market Trading: A

Review, IEEE Access, vol. 9, pp. 30898-30917, 2021.

doi:10.1109/ACCESS.2021.3058133.

Deep Reinforcement Learning for Quantitative Trading,"

arXiv preprint arXiv:2312.15730, 2023. Available:

https://arxiv.org/abs/2312.15730.

Financial Analysis of Stocks Using AI Agents

675