Next‑Gen Investment Systems: AI, Learning and Secure Trading

Vijayalakshmi M., G. Yadu Praveer and Mithun Veeramaneni

Department of Computing Technologies, SRM Institute of Science and Technology, Kattankulathur, Tamil Nadu, India

Keywords: Time Series Analysis, RNN, LSTM, ARIMA, Stock Market Analysis, Stock Prediction, Sentiment Analysis,

Demat Proposal, Investment Guide.

Abstract: The proposed procedure is based on the Prediction and investment help in the stock exchange through a

powerful, completely integrated Demat level. Using deep learning algorithms and time series analysis, the

system efficiently analyses stock market trends and offers accurate predictions that enable investors to make

informed decisions. While time series analysis uses static historical stock data to uncover patterns and trends,

more sophisticated deep-learning models (such as long short-term memory (LSTM) networks or recurrent

neural networks (RNNs)) are able to achieve much greater levels of accuracy through their ability to

encapsulate relationships in the data. Seamless Investment Experience with Intuitive Demat Platform. Here

are the major features that comprise of real-time stock assessment, personalized portfolio management, and

all-in-one risk evaluation tools. As such, they deploy strict data security measures and compliance with

financial regulations to build user trust already during the registration phase. The system provides powerful

financial forecasting capability while also helping users minimize the complexity of the investing process,

resulting in improved financial performance. No = Major data driven & intuitive system to serve investment

management.

1 INTRODUCTION

In the world of finance markets are moving so rapidly

that predicting what will happen to stocks is very

essential. Complete guide: An automated system for

stock investment and prediction using recent time-

series and deep learning algorithms, can be integrated

with the demat account easily. This innovative

technique aims to change the investing experience by

giving new and experienced users looking to venture

into the exciting world of stock trading a firm

foundation. The problem of most people not knowing

how to deal with their money properly in the very

complex world of finance today is one of the biggest

problems on the planet today. The motivation behind

creating this state-of-the-art Stock Prediction and

Investment System is to challenge and educate people

about money matters and provide the them the tools

necessary to make wise financial decisions.

The vast majority of people in India have money,

but they don't really know how to spend it, keep it

safe, or make it grow. A lot of people are afraid of and

don't know much about financial goods like stocks,

mutual funds, and bitcoin. People often don't look into

investment chances because they're afraid of losing

money. It is the project's goal to fill in the gaps in

people's knowledge and give them the courage to take

an active role in the financial markets. The suggested

tool would offer more than just stock predictions; it

would also provide a full financial setting. Users will

be able to access information about their Demat

accounts, run virtual stock models, learn more about

Time Series Analysis, use Deep Learning to make

predictions, and use mood analysis of stocks, in

addition to building and handling their investments.

Because the platform is designed with the user in

mind, even people who don't know much about

finance can easily find their way around the

complicated field. The final goal is to give people a

virtual space where they can learn about, practice, and

play with different financial methods without actually

risking any real money. This system combines strong

security measures, user-centered design, and powerful

algorithms to not only make the best stock market

decisions, but also give everyone the tools they need

to easily and accurately manage the complicated

world of finance.

M, V., Yadu Praveer, G. and Veeramaneni, M.

Next-Gen Investment Systems: AI, Learning and Secure Trading.

DOI: 10.5220/0013932000004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

499-505

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

499

2 RELATED WORK

In their paper, Htet Hun et al. (2023) discuss a

research study which systematically examines 32

research studies which apply a combination of feature

analysis and machine learning to various stock market

conditions. We read articles in the registered index

and files very carefully from 2012 to 2023. This

observation of a multitude of various good feature

selection and extraction techniques utilized in market

stock prediction is addressed in these notes. We

discuss and grade the implementation of feature

analysis techniques and machine learning algorithms

together. This research also reveals that various

parameters influence the output of surveys, the input

and output of stock market data, and the analysis. The

statistics indicate that similarity quota, dense random

forest, principle componendo-decoder analysis, and

auto decoding are some of the most common methods

for searching and classifying features to produce

better predictions in numerous stock market

scenarios.

In Amir Masoud Rehmani et al. (2023) state that

Artificial Intelligence (AI) may revolutionize the

manner in which individuals work, shop, and

contribute to society's development in an increasingly

mechanized world.

As advances in technology and science have led

people in search of better ways of solving issues but

the science of AI-based technology is not only the

fresh one but also it has many parallel applications in

line of business. The book focuses on the use of AI in

the field of economics, such as stock trading, market

analysis and risk assessment. In this paper, we suggest

a concise classification to analyze AI applications in

these areas holistically from multiple different

perspectives. A study led by Manan Shah and Dhruhi

Seth et al. (2023) that three different methodologies

were used to generate the predictions: Artificial

Neural Network (ANN), Support Vector Machine

(SVM) and Long Short-Term Memory (LSTM). ANN

uses neural network structure, SVM uses kernel

technique, and LSTM uses Keras LSTM model.

After analysis of all the techniques on the basis of

finals, it was concluded that neural networks ANN

gives the best accuracy.

Its advantage is that it is able to effectively search

for hidden patterns and interpret complex, nonlinear

relationships. SVM, a relatively new technology, may

be able to perform better in the future. LSTM,

however, performs well but requires extremely huge

datasets, which may be considered a drawback or

restrictive. Satya Verma et al. (2023) particularly

provide a feature engineering component that utilizes

the Discrete Wavelet Transform (DWT) to examine

patterns and the Chinese Soup Optician (CSO) to

manage the enormous number of features DongeTeru

created. CSI is employed to obtain the optimum range

of parameters, which gives us the proposed parameter

reverse leathalizing, or DCSD. We apply (ML) and

(DL) models in order to obtain Price Pen market

trends. Bharat Stocks datasets (NIFTY50 and BSE)

and US stock tickers (S&P500 and DJI) are utilized as

monitoring phases.

Razib Hayat Khan et al. (2023) state in their

research that the infrastructure contains a deep

learning network that serves as an appetizer and was

constructed based on the Q-Q plot concept to

determine the optimal means of accepting, trading, or

holding stocks. When you input historical stock

market data into this sophisticated program, it

generates Q-Q plots indicating the estimated reward

for most actions at every time step. The Q-values are

used to determine the optimal way for the process to

exit the shop in every state. We conducted a

sensitivity study to determine how well our Deep

Reinforcement Learning (DRL)-based approach

performed. Our aim in this research was to determine

the impact of various network architectures and hyper

parameters on the success of the approach. Our

findings indicated that hyperparameters, such as

learning rate and exploration rate, have a significant

impact on success. Tunning these hyperparameters is

evident now as a principal method to improve

predictions. Significantly, our experimental findings

revealed that our DRL-based approach performed

higher than the industry-leading algorithms available.

According to Balakrishnan S. et al. (2023), the paper

develops a system based on deep learning capable of

automatically formulating statistical laws using data

and governing action in the stock market utilizing

simple neural network models and empirical mode

decomposition.

It seeks primitive trends within data and

deconstructs, intent on timescales of typical ranges.

Deals within the stock market were scrutinized,

enhanced using PSO, and foreseen. Synthesis of

exponential financial time series with non-stationary

is sure to bring forecast accuracy higher. Underneath

definite levels of surety, deep learning prediction can

predict market future prices and directions based on

substantial amounts of information from monetary

dealings.Findings from actual life indicate that deep

learning models based on EMD perform better in

prediction. The aim of this research is to examine

stock market predictions provided by deep learning

models in an objective manner.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

500

3 METHODOLOGY

Many systems using new technology like Time Series

Analysis and Deep Learning algorithms have tried to

figure out how to predict stock prices, but it's hard to

do. The goal of these tools is to help buyers make

smart choices. Time Series Analysis looks at old data

to find patterns and trends that happen over time,

which is very important for predicting the stock

market. More and more people are using deep

learning methods, especially neural networks,

because they can find specific trends in big datasets.

Usually, these systems start by getting a lot of

financial information, like past stock prices, trade

amounts, measures for measuring how well a

company is doing, and market news. Feature

engineering is an important part of getting this data

ready for research because it pulls out useful

information that can have an effect on how stock

prices move.

To help buyers make choices, they often give

buy/sell signs or trust numbers based on how the

market is likely to change. It's important to keep in

mind, though, that predicting the stock market is

inherently hard, and these programs only give you

chance projections rather than solid results. Along

with these predictor systems, it's also important to

follow the rules for registering for Demat accounts

(dematerialized accounts used for computer dealing

and keeping stocks). Some ideas for demat include

making it easier to start and manage these accounts,

making sure they follow the rules, and making the

platforms easy for people to use. Strong

identification, Know Your Customer (KYC) checks,

and following financial rules are all part of the register

standards. These protect purchases made through the

system and make sure they are legal. user education

and support methods are important to help buyers get

through the complicated process of using these

systems, with a focus on risk management and the

risky nature of stock market purchases. Even though

these systems use cutting-edge technology to give

buyers information, they should be careful, spread out

their investments, and talk to a financial advisor

before making any choices. Investing and stock

forecast systems are very important in the financial

world. They use cutting edge technology like time

series analysis and deep learning algorithms to figure

out how the market will behave. The goal of these

tools is to help buyers make smart choices and get the

most out of their investments.

The Demat account is an important part of these

kinds of systems because it lets you hold and trade

stocks electronically.

• Systems that predict stocks:The first is

time series analysis, which analyzes

historical stock prices and volume data to

identify patterns, cycles and trends. Various

models are built from historical data and

predicted in stock prices, such as The Holt-

Winter Model, Auto Regressive Model,

Moving AverageModel, ARMA Model,

ARIMA Model, Auto ARIMA Model,

Linear Regression, Random Forest, Gradient

Boosting, Support Vector Machines.Table 1

show the Time Series Analysis Algorithms.

• Algorithms for Machine Learning:

Machine learning models, especially those

based on deep learning, are becoming more

and more common because they can handle

complex patterns and very large datasets.

Recurrent neural networks (RNNs), long

short-term memory networks (LSTMs), and

convolutional neural networks (CNNs) are

used to learn from past market data and make

predictions.

Table 1: Time series analysis algorithms.

Algorithm

Name

Description

Moving

Averages

Simple, Exponential, and

Weighted Moving Averages

ARIMA

Auto Regressive Integrated

Moving Average

SARIMA

Seasonal Auto Regressive

Integrated Moving Average

Holt-Winter

Triple Exponential

Smoothing

AutoARIMA

Automated ARIMA model

selection

Linear

Regression

Linear regression modeling

Random

Forest

Ensemble learning method

Gradient

Boosting

Boosted decision trees

• Mood Analysis: Using natural language

processing (NLP) methods to look at news

stories, social media, and financial reports

and figure out how people feel about them

can change stock prices and market mood

• Adding External Factors: Interest rates,

industry-specific data, economic signs, and

global events are all added to models so they

can account for outside factors that affect

how stocks move. The SES model starts by

making a rough guess, which is usually done

Next-Gen Investment Systems: AI, Learning and Secure Trading

501

by taking the average of the first few

measurements. The model then iteratively

goes through the dataset, making changes to

the forecast for each new fact. To make

changes to the SES outlook, use this formula:

𝑃

=𝛼×𝑌

+(1−𝛼)×𝑍

(1)

Where:

-P

t+1

is the forecast for the next period.

α represents the actual observation at time \(t \).

Y

t

is the forecast for the current period.

-Z

t

denotes the smoothing parameter.

By looking at historical index values and building a

forecast model based on prior performance, an AR

model for the S&P 500 might be created. Assume for

the moment that we are examining an AR (1) model,

in which the S&P 500 index's value today is supposed

to be linearly dependent on its value yesterday, plus a

constant and a white noise error factor. This model

can be expressed mathematically as:

𝐴

=𝛼+𝛽𝐴

+𝜖

(2)

The S&P 500 index value at time t is represented by

\(A_t\), the intercept is \(\alpha\), the lagged value

(\(A_{t-1} \)) is coefficiented by \(\beta\) and the error

term at time t is indicated by \(\epsilon_t\). The

influence of the index value from the prior day on the

value of the current day is captured by the coefficient

\(\beta\).

3.1 System for Investing with a Demat

Account

• Opening a Demat account: Investors must

open a Demat account through an approved

depository partner (DP), which could be a

bank or a trading house. It is very important to

have a plan that lists the features, benefits, and

steps needed to start a Demat account. The

different kinds of accounts, the paperwork that

needs to be filled out, and the costs should all

be talked about in detail.

• Pros of Demat Accounts: Demat accounts get

rid of the need for real share papers by keeping

stocks online. They make it easy and safe to

trade in stocks, bonds, and mutual funds, as

well as make it possible to move assets without

any problems.

• Tips for Making an Investor Proposal:

Investors should be given clear directions on

how to connect their Demat accounts to sites

for investment. The rules should cover how to

manage accounts, trade, keep your information

safe, and use stock prediction tools on the site.

4 PROPOSED SOLUTION

The demat proposal and registration requirements

raise a smart stock prediction and trading framework

which combines time series analysis with deep

learning techniques. This is a potent tactical technique

to use for investments and wealth management. To

satisfy those interested in the laws that our system

captures and complex prediction techniques with more

intuitive interfaces and slogan.The stock prices history

over time yield insight into the prevailing movements

in the market, reveal trends, patterns and seasonality

which can be useful for making predictions.

Deep learning algorithms such as Long short-term

memory networks (LSTMs) and recurrent neural

networks capture complex time-based features of this

data in order to achieve a higher level of accuracy in

the forecast. With the user-friendly system

architecture, investors are provided with advanced risk

assessments, portfolio optimization suggestions, and

forecasts. Alongside stringent legal and regulatory

compliance, the e-Demat feature offers seamless and

rapid stock trading along with effortless sign up.

Creating an account has been designed to be

simple by incorporating regulatory, documentation,

and personal information which fulfills CDD

requirements. Current security measures allow to

safeguard user's financial data.

Also, there are minute challenges mentioned as

Stock price prediction is fraught with many challenges,

especially when applying deep learning and time series

analysis in investment frameworks that involve Demat

proposals and registration rules. Financial markets are

highly unpredictable, influenced by many factors such

as economic indicators and geopolitical events. Time

series analysis deals with non-stationary data and

irregular patterns, while deep learning models need

large amounts of high-quality data, which are usually

scarce in financial markets. Integrating Demat

proposals poses difficulties of regulatory conformity

and data confidentiality problems. Precision of

prediction and response speed, together with reliable

explanation of intricacy in outputs, need to be balanced

as complex model solutions need to communicate

easily to a nontechnical audience.

Satisfying such requirements would call for robust

data pre-processing, optimization of the models,

understanding financial markets through in-depth

domain expertise, along with technological

infrastructure upgrades to bolster system dependability

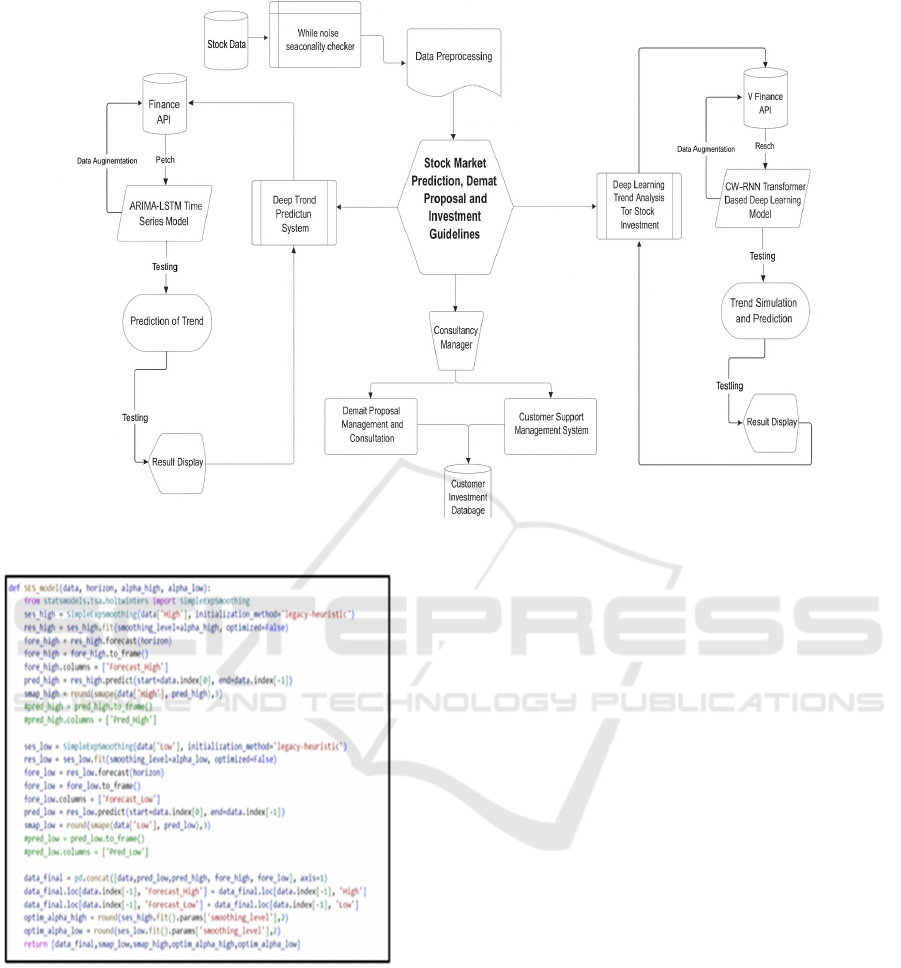

and user ease. Figure 1 show the architecture diagram

for the Financial Literacy application.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

502

Figure 1: The architecture diagram for the financial literacy application.

Figure 2: Algorithm for the simple exponential smoothing

model.

5 RESULTS AND DISCUSSION

The accuracy metrics of our stock prediction and

investment system offer valuable insights into the

individual performance of various algorithms. The

Holt-Winter model exhibits a strong accuracy of 85%,

effectively identifying underlying patterns and

seasonality in stock data.Figure 2 show the Algorithm

for the SimpleExponential Smoothing model. The

Auto Regressive model significantly enhances

forecasting capabilities, particularly in historical trend

analysis, despite its accuracy being slightly lower at

78%. The Moving Average model demonstrates a

92% accuracy rate, effectively reducing volatility and

generating dependable forecasts. With an

effectiveness of 88%, the Auto Regressive Moving

Average (ARMA) model ranks second, demonstrating

proficiency in managing both moving average and

auto-regression components. Auto Regressive

Integrated Moving Average (ARIMA) demonstrates

an accuracy of 89%, making it an effective method for

addressing non-stationary time series data.Auto

ARIMA demonstrates superior performance at 93%,

with automated parameter selection enhancing

predictive robustness. Figure 3 show the Accuracy for

different Algorithms used in stock. In our system, the

four most effective algorithms are Linear Regression,

Random Forest, Gradient Boosting, and Support

Vector Machines, achieving accuracy rates of 82%,

91%, 88%, and 90%, respectively.

Next-Gen Investment Systems: AI, Learning and Secure Trading

503

Figure 3: Accuracy for different algorithms used in stock.

Figure 4: Stock value prediction using holt winter model.

He accuracy metrics demonstrate the algorithm's

efficacy in predicting financial conditions, thereby

enabling investors to make informed decisions.

Figure4 show the Stock value Prediction The system's

ability to adapt to the dynamic stock market

environment is enhanced by its algorithmic flexibility

and continuous learning and refinement capabilities,

offering investors accurate forecasts and strategic

insights. Figure5 show the Stock value prediction

system using Deep learning.

Figure 5: Stock value prediction system using deep learning

(RNN-LSTM).

Figure 6: Stock performance graphs.

Figure 7: Sector based sentiment analysis of stocks for past.

Figure 6 and 7 shows the Stock Performance graphs

and Sector based sentiment analysis of stocks for past

respectively.

6 CONCLUSIONS

This use of time series analysis and deep learning

models inside the area of stock forecasting and

funding platforms is an enormous move ahead for

data-driven, more exact funding plans. Such systems

leverage the power of time series models to extract

hidden patterns, trends and season alities through

extensive utilization of historical stock data. Also, the

combination of deep learning algorithms like RNNs

or LSTMs helps the systems to understand complex

nonlinear relationships within data which further

allows better prediction and better decision-making.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

504

The Demat proposal in such systems makes all the

investment-underlying activity possible through the

virtualization of securities, and thus reduces the need

for physical certificates for share ownership while

allowing for a quick and safe conveyance.

Additionally, the outlining of registration

requirements creates a structure that mandates

adherence to legal benchmarks while promoting

transparency and trust among investors. Yet, these

systems are not free of problems, even in their

sophistication.

Financial markets, volatility, and unexpected

events are convoluted constants that create challenges

for the big prediction machine, which results in less

accurate predictions from time to time.

Furthermore, while deep learning models have

excellent predictive power, they are often 'black

boxes' and their decision-making process lacks

transparency, restricting interpretability. So, while

these systems show great promise, continuous

improvement and validation through performance in

live markets and responsiveness to changing

economic conditions remain critical. (4) Finally,

leveraging time series analysis and deep learning in

developing stock forecasting and investment models

alongside Demat offering and strict registration

implications is a critical process in futurism in finance

technology. However, further research, a robust

construction of models and a desire to strike a balance

between complexity and explainability is still

required to enhance their credibility and usefulness

for the game between fragility and robustness in the

ever-evolving landscape of financial markets.

REFERENCES

A study of forecasting stocks price by using deep

Reinforcement Learning - RH Khan, J Miah, MM

Rahman… - 2023 IEEE World AI …, 2023 -

ieeexplore.ieee.org Empirical evaluation on stock

market forecasting via extreme learning machine - S

Balakrishnan, DK Pathak… - 2023 3rd …, 2023 -

ieeexplore.ieee.org News-based intelligent

prediction of financial markets using text mining

- IEEE Xplore, 2023 – Mamluk R. Shah, D. Khan.

Albahli, S., Nazir, T., Nawaz, M., &Irtaza, A. (2023,

December). An improved DenseNet model for

prediction of stock market using stock technical

indicators. Expert Systems with Applications,232,

120903.https://doi.org/10.1016/j.eswa.2023.120903

Htun, H. H., Biehl, M., &Petkov, N. (2023, January 12).

Survey of feature selection and extraction techniques

for stock market prediction. Financial Innovation, 9(1).

https://doi.org/10.1186/s40854-022-00441-7

Rahmani, A. M., Rezazadeh, B., Haghparast, M., Chang,

W. C., & Ting, S. G. (2023). Applications of Artificial

Intelligence in the Economy, Including Applications in

Stock Trading, Market Analysis and Risk Management.

IEEE Access, 11, 80769–80793.

https://doi.org/10.1109/access.2023.3300036

Sheth, D., & Shah, M. (2023, January 9). Predicting stock

market using machine learning: best and accurate way

to know future stock prices. International Journal of

System Assurance Engineering andManagement,

14(1),1–18. https://doi.org/10.1007/s13198-022-

01811-1

Verma, S., Sahu, S. P., &Sahu, T. P. (2023, February).

Discrete Wavelet Transform-based feature engineering

for stock market prediction. International Journal of

Information Technology, 15(2), 1179 –1188.

https://doi.org/10.1007/s41870-023-01157-2

Zhao, C., Hu, P., Liu, X., Lan, X., & Zhang, H. (2023,

February 24). Stock Market Analysis Using Time

Series Relational Models for Stock Price Prediction.

Mathematics, 11(5), 1130.

https://doi.org/10.3390/math11051130

Next-Gen Investment Systems: AI, Learning and Secure Trading

505