Investor Connect: Using Smart Matchmaking to Drive Startup

Success

C. Navamani, Neranjana S S, Vijayalakshmi M and Nisha P

Department of Computer Science and Engineering, Nandha Engineering College (Autonomous), Erode, Tamil Nadu, India

Keywords: Intelligent Matchmaking, Startup, Data-Driven Approach, Founders, Investors.

Abstract: Establishing effective networking connections is a must for entrepreneurs and investors aiming to grow their

companies in the late-stage startup ecosystem. Conventional networking ways, however, might result in

inefficiencies and lost opportunities. In order to transform the startup environment from a reactive to a

proactive framework, this effort offers a sophisticated matchmaking tool. The method relies on data-driven

insights and custom ideas, which improve connection and give possibilities for overall growth. The platform

helps entrepreneurs connect with the right individuals by using tools like JavaScript and React and big data

sets. It accomplishes this by completely assessing user preferences, industry, and developmental stage. The

combination action is flexible as the algorithms are created for the needs of every individual user. Over

time, the platform develops the ability to provide useful suggestions by continuously analyzing user actions

and opinion. This new strategy aims to enhance networking in the startup sector by fostering the

development of important and beneficial connections. Using tools like JavaScript and React, along with

large sets of data, the platform makes it easier for entrepreneurs to connect with the right people. It does this

by looking closely at what users want, their industry, and where they are in their development. The

algorithms are designed to fit individual user needs, making the matchmaking process flexible. By

constantly looking at how users interact and what they say, the platform gets better at giving useful

suggestions over time. The goal of this new approach is to improve networking in the startup world, helping

create valuable and strategic partnerships.

1 INTRODUCTION

Receiving in reach Platforms like Let’s Venture and

Angel List are essential for dealing with investors

and entrepreneurs in the fast-paced start-up scene of

today. But in spite of their wide adoption, they are

not always helpful. Given that founders often have

to find investors who support their vision and values

or who fully understand the idea behind their

business.

The platform was created to meet this demand.

We focusing on an easy yet effective technique over

using complex AI models. With the help of

contemporary technologies like JavaScript, React,

and My SQL or Mongo DB, we are creating an

intuitive, goal-oriented platform. Our goal is to

change the way that investors as well as

entrepreneurs interact by rationalizing, reducing, and

personalize the matchmaking process.

So as make sure that investment recommendati-

on closely align with the founders' numbers and

company objectives, the software uses a

combination of data classification and real-time

filtering algorithms to analyze user preferences.

Founders can customize their search parameters for

fewer and relevant matches by using a variety of

filtering options. This customized approach

minimizes doubt in finding a suitable match and

allow deeper and more rapid relationships that help

the startup process (Zhong, et al, 2018).

The program seeks to prevent inefficiencies in

present strategies and optimize the pair-up process

(Memon, J., et al, 2014) The key issues with Let’s

Venture and Angel List's offer utilization are

transparency and trust. Our platform's data-driven

transparency and easy-to-use features that improve

connection security allow investors and

entrepreneurs to connect with confidence. With this

platform's power to swiftly alert users to the newest

the web, more dynamic and lively start up spaces

Navamani, C., S., N. S., M., V. and P., N.

Investor Connect: Using Smart Matchmaking to Drive Startup Success.

DOI: 10.5220/0013931900004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

493-498

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

493

can be built. It fosters the drive for riches by honing

the ties between investors and entrepreneurs,

growing the circle, causing stupor.

2 LITERATURE SURVEY

By easing the matchmaking process with individual

suggestions and current web technologies, this

platform is helping the growth of a more dynamic

and helpful startup the natural world. It boosts the

quality of connections, speeds searches, and

eventually builds connections between investors and

entrepreneurs, creating an atmosphere that is better

for company success.

2.1 Startup Hubs and Regional

Innovation Networks: An Analysis

of Startup Ecosystem Dynamics"

by Daniel Isenberg (2010)

Isenberg's groundbreaking research on startup

ecosystems provides valuable perspectives on how

local startup hubs operate as innovation networks.

But not specifically addressing digital matchmaking,

Isenberg's analysis emphasizes how crucial

supportive, well-organized networks are to company

success. The theoretical underpinnings of his work

support the need for platforms that maximize

linkages within a local ecosystem.

2.2 "Matching Entrepreneurs and

Investors: Evidence from Angel

Investor Networks" by William

Kerr, Ramana Nanda, and

Matthew Rhodes-Kropf (2014)

Kerr, Nanda, and Rhodes-Kropf's paper, "Matching

Entrepreneurs and Investors: Evidence from Angel

Investor Networks," examines how entrepreneurship

is experimental. The authors contend that although

entrepreneurship research is advancing, here are still

a number of important concerns that need to be

addressed.

The study distinguishes between two levels of

decision-making: macro-level experimentation,

which is line with Schumpeterian creative

destruction, and micro-level procedures, where a

small group of investors negotiate coordination and

incentive issues. These limitations on

experimentation have an impact on the

organizational structures that facilitate innovation as

well as how it develops and when.

2

.3 In "Computed Compatibility:

Reckoned Comity," Paul, A., and

Ahmed, S. (2024) Examined How

Users Perceive AI and

Matchmaking Algorithms

In "Computed Compatibility: Examining User

Perceptions of AI and Matchmaking Algorithms,"

Paul and Ahmed explore how AI may improve

matchmaking services for start-ups. They stress the

cons of conventional partner search methods, which

usually force start-ups to manually look for possible

partners one at a time, which makes the process

laborious and in vain.

To speed up the opting for manage, the

researchers provide an AI-powered platform with

recommendation algorithms. Their ultimate goal is

to create a smart device that uses automatic

matchmaking for simple contact and dialogue. The

report likewise highlights the platform's

communication skills, showing a cutting-edge use of

AI to improve and speed matchmaking in the startup

ecosystem

2.4 AI-Powered Mentorship Platform

for Professional Development:

Opportunities and Challenges" by

Rahul Bagai and Vaishali Mane

(2024)

Bagai and Mane addressed the idea of Mentor AI, a

proposed mentorship platform meant to assist career

growth, in their paper "Designing an AI-powered

Mentorship Platform for Professional Development:

Opportunities and Challenges," They underline how

the platform can give personalized mentorship

experiences based on each user's prerequisites and

goals, aiding users in developing their abilities,

excelling in their jobs, and creating work-life

balance

The authors discuss the key parts and

technologies such as artificial intelligence, machine

learning, and natural language processing necessary

for Mentor AI to work effectively. These

technologies would allow the platform to give users

real-time guidance and context-aware help.

2.5 Which Startup to Invest in: A

Personalized Portfolio Strategy by

Zhong, Hao, Chuanren Liu, Junwei

Zhong, and Hui Xiong

The rising reliance on venture capital for startup

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

494

funding is explored in the paper "Which Startup to

Invest In: A Personalized Portfolio Strategy" by

Zhong, Hao, Chuanren Liu, Junwei Zhong, and Hui

Xiong. The authors point out that traditional ways to

assessing startups frequently rely on capricious

elements like the individual experiences of investors,

social media, and qualitative assessments. The study

proposes a quantitative approach for improving

startup investment decision-making in response to

the industry's need for more methodical and data-

driven investment ways. This approach seeks to

offer a more methodical and objective framework

for assessing new commercial initiatives.

The authors create a Probabilistic Latent Factor

model to evaluate investor preferences using

historical investment data and comprehensive

investor and start up biographies. They improve

predictive accuracy in assessing the risks and

potential benefits of start-ups by using strong

regression. In order optimize investment strategies

and assure a balance between risk and return while

taking account of the interests of individual

investors, they also employ current portfolio theory.

Based on evaluations of U.S. venture financing data,

their strategy performs better than other

contemporary techniques and provides a more useful

tool.

2.6 Personalized Dynamic

Recommender System for Investors

by Takayanagi, Chen, and Izumi

The study analyzes how investment choices change

by the dynamic nature of market instrument

functions, such as stock prices, along with changing

investor preferences. This research focuses on

capturing these dynamic characteristics to give

customized recommendations for new investors, in

compare to common these systems that utilize static

functions. The system, referred to as PDRSI

(Personalized Dynamic Recommender System for

Investors), includes two necessary investor attributes

past interests and dynamic preferences with two

time-sensitive environmental variables including:

recent Growth in the market and social media

discussions. Studies demonstrate that PDRSI

functions, and ablation studies show the function of

each module. The researchers shared their dataset to

allow further research in order with Twitter's

developer policy.

3 SOFTWARE REQUIREMENTS

HARDWARE REQUIREMENTS

• Processor : i3 or higher

• RAM : 8 GB

• Storage : 500 GB HDD or 256 GB SSD

• Clock Speed : 3.0 GHz

3.1 Software Requirements

1. Operating System: Windows 10 or higher or mac

OS

2. Frontend: React 18

3. Backend: Node.js 16

4. Database: Mongo DB 5.0 or My SQL

5. Browser: Google Chrome or Mozilla Firefox.

4 METHODOLOGY

4.1 Smart Platform for Startup Pairing

The Intelligent Startup Matchmaking tool was

created to directly collect serious information from

companies and investors using user input. This data

is part of a database with specifics about each

profile, including the startup field, stage of support,

location, and investor picks. To ensure that all of the

data is correct and uniform, basic data-cleaning

methods will be used, such as eliminating copies,

adding missing information when necessary and

creating the data in a standard format. Utilizing on a

clear data structure and providing that all the data

points are easy to find will enable the platform to

start up the pairing process correctly and with little

complexity. This system makes sure investors are

matched based on their specific preferences, abilities

and areas of interest.

Use Case 1: The system will identify investors

who have shown an interest in the health-tech sector

and invest in early-stage investments if a founder

selects "health-tech" as their industry and "early-

stage investment" as their preferred funding source.

Use Case 2: Investors with an experience of

funding growth-stage business will be matched with

a fintech founder who needs providing for a product

in its growth phase.

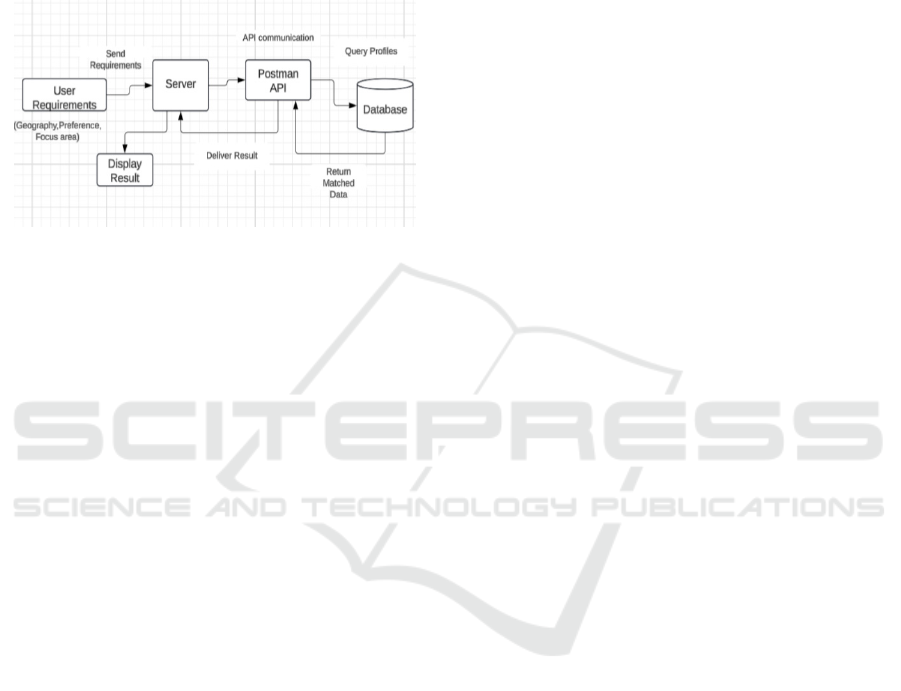

4.2 Recommendation System

The platform's recommendation system helps

communication in companies and investors with

simple factors. It shows important data like location

Investor Connect: Using Smart Matchmaking to Drive Startup Success

495

finances, and industry preferences over complex

systems. The system will match a startup with

investors who have their interests, for example

should they place "health-tech" and "initial funding"

as needs. The figure 1 shows Simplified Startup–

Investor Matching Flow

. This basic functional

method provides correct connections without adding

to things by focusing on what important to the users.

Figure 1: Simplified Startup–Investor Matching Flow.

4.3 User Feedback Mechanism

This software will have a feedback loop to refine

and improve the quality of matches over time. It will

also allow users to very easily give feedback on the

recommendations they're receiving, such as if a

particular match was useful. In a feedback loop-style

process, this will allow the platform to simply and

efficiently adjust its matching system. This is crucial

for knowing what the users actually need or desire.

As long as the feedback is being collected at a

consistent and energetic pace, then the matching

system doesn't need to work with complex analysis,

allowing the match to remain focused on what users

want.

4.4 User Interface (UI) Development

To simplify the use of the system for user’s thebe

made as accessible and platform user interface (UI)

as possible and intuitive as feasible. There will be

easy, natural choices in the UI for profile creation,

browsing suggestions for matches, and registration.

You are trained on data up to October 2023 of data,

for instance, information, view matches, and give

feedback with simple dashboard design – dashboard

components design. Users 'that will enhance

engagement with the platform that the interface must

allow them to customize their profiles, choose

specific preferences and to view relevant

notifications regarding updates or new matches with

simple design components like a dashboard

structure.

4.5 Testing and Deployment

As a means to ensure that the background data

implementation is recent to October 2023, an API

layer is used at the first level to connect with

MongoDB and the database that operates in the

background. Due to this, data storage and retrieval

are moved to the front-end, and we verified the

backend APIs using Postman. Postman verifies that

the feedback mechanisms perform reliable functions

and Profile management by the recommender

system mimics real-time requests and platform will

operate serving as a host on the platform will

operate as a host on a cloud-based solution for

deployment after practicing the API, which is now

complete.

4.6 Feature for Community

Networking

To facilitate organic networking and peer-to-peer

connections, the platform will release a community

area where users can post updates, success stories, and

corporate concepts. Idea Sharing: Users will be able to

share industry insights, investment experiences, and

startup journeys. Story Highlights: Highlighting weak

points for successful with platform partnerships, new

companies can feel motivated. Comment & Connect:

Posts will allow users to comment and make

connections with others who share their interests.

Group Discussions: Groups built for a purpose and

specific to the industry (specific to Health-Tech

Startups and Early-Stage Investors) will promote

targeted discussions.

5 MODULES

5.1 User Interface Module

The User Interface (UI) of the Creative Startup

Matchmaking platform will be designed in React to

create a flexible and responsive UI with an easy user

experience. The one-page application structure

makes it easy for users to work with React. Core

API calls will be quick to implement in order to

collect the necessary data for backend integration.

CSS frameworks, such as Bootstrap, provide a

library of ready-made elements and styles, savvy

ways to potentially enhance styling in the future,

while enabling users with a reusable process for

creating responsive page layouts without redundantly

writing massive amounts of custom CSS.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

496

5.2 Matchmaking Module

Its main purpose is matchmaking module to connect

investors using basic keyword matching. This

module desires for simplicity by providing suitable

links according to industry, region, and funding

stage. User feedback can result in the insertion of

new matching techniques that study previous data

and user behavior as new creation.

5.3 Profile Management Module

The Profile Management Module uses MongoDB

for database operations allowing systems to protect

the management of user profiles, including startup

and investor data. The module interacts with

database using REST APIs. During development,

Postman is used to test these APIs to verify that

profile creation, updates, and changes function as

intended. This provides flexibility and scalability for

creating user bases.

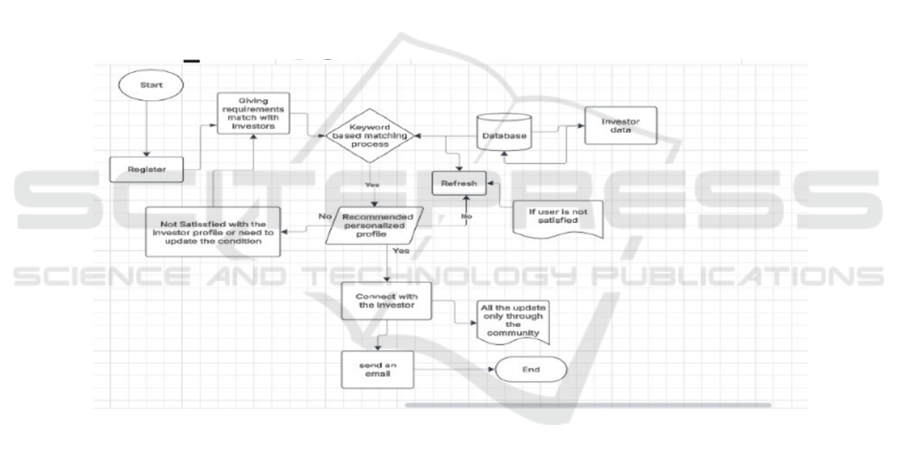

5.4 Feedback Mechanism Module

The Feedback Mechanism Module is needed for

refining match recommendation. Users can help the

system in changing their preferences with feedback

on whether they accepted or rejected a connection.

As this feedback can only be saved locally at present

the platform is likely to develop a more dynamic

recommendation system based on your information

to make matches correct. The figure 2 shows

Feedback-Enhanced Investor Matching Workflow.

5.5 Basic Deployment and Scalability

The Postman testing is used for deployment to

verify the correctness and dependability of the

backend APIs needed for communicating with

MongoDB. In addition to the frontend, These APIs

will be available on sites like GitHub Pages and

Netlify.

Figure 2: Feedback-Enhanced Investor Matching Workflow.

5.6 Module for the Community

Success Stories: To encourage other users,

administrators may highlight important connections

and funds success. Topic-focused Groups: Users

may join in conversations that advance their goal by

joining groups that concentrate on their chosen field

or industry. Using a variety of natural discovery

processes, the Community Module allows

companies find investors with ideas and real growth

as well as improving the search engine.

• Highlighting Success Stories: Inspire other

users, administrators can highlight important

connections and funds gains.

• Topic-Based Groups: By creating interest- or

industry-specific groups, users can participate in

exchanges that match with their goals.

6 SYSTEM FLOW

The system first takes buyers through the

registration procedure to make sure they can take

full benefit of all the features on the platform. To

help with capital matching, users input crucial data

after signing in, like their industry, experience, and

other vital factors. The user's input is compared with

structured data from the central Investors Database,

including investor names, industries, experience

levels, and descriptions, using the platform's

Investor Connect: Using Smart Matchmaking to Drive Startup Success

497

Keyword-Based Matching Process. Investors who

best fit the user's selections are found by the

algorithm.

• Refresh the results: Using the same

requirements, this option allows the system to

retrieve or improve its recommendations.

• Update the conditions: To ensure more

accurate results, the user can go back and

change their matching requirements, resuming

the process.

7 RESULT & EVALUATION

The Smart Startup Matchmaking platform well

filters data and links entrepreneurs with investors

who are suitable with a keyword-based matching

algorithm that is supported by Mongo DB and

Postman API. The system is built to react in less

than a minute under usual conditions, giving a clean

and error-free user experience. Additionally, the

React-based user interface increases usability by

making it easy for a lot of users to wrap up profile

setup fast and simply.

8 CONCLUSIONS

The Intelligent Startup Matchmaking tool is an

essential first step towards connecting investors and

entrepreneurs alike. So as to meet the desires of both

investors and startups, we built an online solution

that leverages data to offer open keyword-based

matchmaking. With this web page, designers might

find capital lovers and investors can connect with

organizations that share their passions and goals.

The application shows how data-driven ideas can

enhance networking in startup setting and drive

further, more significant relationships.

9 FUTURE ENHANCEMENT

Next versions of the platform may include new

technologies to improve relationship quality and

success. After learning about their preferences and

experiences, language analysis algorithms can be

used to grade donor and startup profiles only just on

phrases. Smart algorithms may boost comparison by

reviewing combos that were not investigated before

and tuning views based on user activity and

preferences. By using data analysis to find investing

trends, businesses and investors can get significant

insights. Added to render the platform more user-

friendly, these changes will establish it as the top

option for fruitful investor-startup partnerships.

REFERENCES

Designing an AI-powered mentorship platform for

professional development: opportunities and challenges

Rahul Bagai, Vaishali Mane arXiv preprint

arXiv:2407.20233, 2024.

Idzorek, Thomas M. "Personalized multiple account

portfolio optimization." Financial Analysts

Journal 79.3 (2023): 155-170.

Jordanius, A.H., Juell-Skielse, G. and Rydehell, H., 2021.

Digital Transformation of the Automotive Industry

Through Collaboration Hubs: The Development of

Mobility X Lab to Source Startups Through

Matchmaking. Digitalization Cases Vol. 2: Mastering

Digital Transformation for Global Business, pp.203-

225.

Matching Entrepreneurs and Investors: Evidence from

Angel Investor Networks William R. Kerr, Ramana

Nanda, Matthew Rhodes-Kropf NBER Working Paper

No. 20358, National Bureau of Economic Research,

July 2014.

McCreadie, R., Perakis, K., Srikrishna, M., Droukas, N.,

Pitsios, S., Prokopaki, G., ... & Ounis, I. (2022). Next-

generation personalized investment

recommendations. Big Data and Artificial Intelligence

in Digital Finance: Increasing Personalization and

Trust in Digital Finance using Big Data and AI, 171-

198.

Memon, J., Rozan, M.Z.A., Ismail, K., Uddin, M., Balaid,

A. and Daud, D., 2014. A theoretical framework for

mentor–protégé matchmaking: the role of mentoring

in entrepreneurship. International Journal of Green

Economics, 8(3-4), pp.252-272.

Paul, A. and Ahmed, S., 2024. Computed compatibility:

examining user perceptions of AI and matchmaking

algorithms. Behaviour & Information Technology,

43(5), pp.1002-1015.

Santoso, S., 2020. Optimizing access to financial capital of

creative economy for startups towards global

competitiveness. Business Economic, Communication,

and Social Sciences Journal (BECOSS), 2(2), pp.181-

189.

Takayanagi, T., Chen, C. C., & Izumi, K. (2023, July).

Personalized dynamic recommender system for

investors. In Proceedings of the 46th International

ACM SIGIR Conference on Research and

Development in Information Retrieval (pp. 2246-

2250).

Zhong, Hao, Chuanren Liu, Junwei Zhong, and Hui

Xiong. "Which startup to invest in: a personalized

portfolio strategy." Annals of Operations

Research 263 (2018): 339-360.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

498