Enhanced Stock Price Prediction Using Optimized Deep LSTM

Model

G. Prathibha Priyadarshini, M. Sai Madhuri, T. Vishnu Priya, S. Moheeja and U. Lakshmi Prasanna

Department of CSE, Ravindra College of Engineering for Women, Kurnool, Andhra Pradesh, India

Keywords: Stock Price Prediction, Deep LSTM Network, Hyperparameter Optimization, Time‑Series Forecasting,

Financial Decision‑Making.

Abstract: Stock price prediction is a challenging time- series task because the stock market is random and volatile. In

this paper, we propose a better Deep Long Short-Term Memory (LSTM) network for accurate stock price

prediction. The proposed model uses past stock attributes such as open, close, high, low, and volume, and

technical indicators for predictive accuracy. For best performance, the hyperparameter optimization methods

like Grid Search and Bayesian Optimization are used to fine-tune the best network structure. The model has

multiple LSTM layers, dropout regularization to avoid overfitting, and adaptive learning rate optimizer to

converge faster. Experiment results indicate that our enhanced Deep LSTM network performs superior to

conventional machine learning methods and standard LSTM networks in Root Mean Square Error (RMSE)

and Mean Absolute Error (MAE). Our research enables better financial decision- making with accurate stock

price forecasts for investors and traders.

1 INTRODUCTION

Stock price prediction is an important task in financial

markets, allowing investors, traders, and financial

analysts to make accurate decisions. As stock prices

are extremely volatile and dynamic, predicting future

price direction is still a problem. Statistical models like

Auto-Regressive Integrated Moving Average

(ARIMA) and basic regression models have been used

extensively for time series prediction. Nonetheless,

these approaches are prone to failure when dealing

with intricate temporal dependencies and nonlinear

structures of stock market data.

Deep learning methods, and more so LSTM

networks, have therefore emerged as effective

substitutes for stock price forecasting. LSTM or a

recurrent neural network (RNN) in particular that has

been designed to handle sequential data, is particularly

well-suited to learn long-term dependencies and avoid

the vanishing gradient issue. Unlike ordinary neural

networks, LSTM networks utilize memory cells and

gates that enable them to capture long-term trends,

making them particularly well-suited for forecasting

financial time series. But development of a perfect

LSTM-based model involves proper network

parameter tuning, including layers, units per layer,

learning rate, and dropout value, to avoid overfitting

and enhance generalization.

We herein propose an effective Deep LSTM model

for predicting stock prices using the assistance of

newer hyperparameter tuning techniques to improve

forecasting accuracy. The approach here is a mix of

past stock prices, opening and closing price, trading

volume, and technical ratios such as Moving Average

(MA) and Relative Strength Index (RSI). In order to

realize optimal model performance, we use Grid

Search and Bayesian Optimization to optimize

hyperparameters in an attempt to further tailor the

network to learn market patterns. We also use dropout

regularization to avoid overfitting and use an adaptive

learning rate optimizer to speed up model

convergence.

The suggested model is compared against standard

machine learning models and baseline LST models

using primary performance measures like Mean

Absolute using primary performance measures like

Mean Absolute Error (MAE) and Root Mean Square

Error (RMSE). Our experimental result shows that our

Deep LSTM network highly enhances the precision of

the prediction, offering better predictions to the

stakeholders in the stock market. This research adds to

the existing body of work in deep learning models for

financial market use by demonstrating a viable

Priyadarshini, G. P., Madhuri, M. S., Priya, T. V., Moheeja, S. and Prasanna, U. L.

Enhanced Stock Price Prediction Using Optimized Deep LSTM Model.

DOI: 10.5220/0013931100004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

443-448

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

443

framework for stock price prediction, ultimately

helping investors make informed decisions.

2 RESEARCH METHODOLOGY

RESEARCH AREA

Study methodology is the entire process of designing,

training, and hyperparameter optimizing a Deep Long

Short-Term Memory (LSTM) neural network to

predict stock prices. Study methodology can be divided

into a sequence of steps ranging from data collection to

data preprocessing, model construction,

hyperparameter optimization, and testing. The main

goal is to develop a professional forecasting model for

accurate forecasting of future stock prices at a given

moment in time from past market data. Through the use

of deep learning techniques and optimization

processes, the study attempts to improve accuracy and

validity of stock market forecasting. Pre-extraction and

data preprocessing is the half-process. Historic share

prices are downloaded from pages like Yahoo Finance

or Alpha Vantage with interest-provoking parameters

like open price, close price, high, low, and volume. The

technical dimensions of Moving Average (MA),

Relative Strength Index (RSI), and Bollinger Bands are

included in the model to maximize the predictivity

efficiency. The data is pre-processed by dealing with

missing values, Min-Max scaling of numerical

features, and splitting it into training set, validation set,

and test set in a way that the model will be trained and

tested on an unbiased basis.

The second is the Deep LSTM model building. A

multi-layered network of LSTMs is employed to

capture long-term time series data dependencies. The

network is made up of multiple layers of LSTMs and

dropout layers for preventing overfitting. The output

layer is dense with a linear activation function used for

future stock price predictions. It is optimized in a

sliding window over time with the latest observation

for predicting the subsequent time step. Adam

optimizer to optimize the convergence rate and Mean

Squared Error (MSE) as the performance metric for the

model. The last step is hyperparameter tuning and

tuning testing. Hyperparameter tuning trains the

hyperparameters and hyperparameter tuning

techniques like Grid Search and Bayesian

Optimization are used for tuning the best number of

LSTM units, dropout rate, batch size, and learning rate.

The model is then tested on performance metrics like

Mean Absolute Error (MAE) and Root Mean Square

Error (RMSE) on the tuned model. Baselines are also

being compared against other baseline machine

learning methods such as Random Forest and Support

Vector Regression (SVR) in an attempt to place the

Deep LSTM method in a superior position.

Performance is then compared so that it can illustrate

how the model performs in stock price prediction and

thus enable it to be applied in financial decision-

making.

The research field is finance time series prediction,

and the field of study is predicting stock prices by deep

learning. Predicting the stock price is a very essential

field to explore because its optimization can lead to

more accurate models for investment, risk, and auto-

trading. Conventional techniques to predict cannot

handle the highly non-linear and dynamic stock price

nature, thus, machine learning techniques such as

LSTM networks are an ideal choice. The article

outlines one of the numerous contributions over recent

times in AI-financial modeling based on deep learning

towards improved forecasting of stock market

behavior. The research also has its place within the

broad world of artificial intelligence and deep learning

for finance. With AI technology developing at an

exponential level, banks and financial institutions are

adopting more and more machine learning models into

predictive modeling. LSTMs are said to perform well

with sequential data, and thus are highly compatible for

analysis of the stock market. It discusses the real-world

implementation of Deep LSTM networks by

simplifying their architecture to provide more accurate

predictions. A study establishes the benefits of using

LSTMs compared to traditional machine learning

models and deep learning algorithms in financial

application. Besides this, the study has implications for

investment decision-making as well as algorithmic

trading. In such turbulent financial markets prevailing

today, accurate stock price prediction is likely to be an

asset for investors and traders.

3 LITERATURE REVIEW

Kim, J., Park, H., & Lee, S. (2019)

Title: Deep Learning-Based Stock Price Prediction

Using Optimized LSTM Networks.

Abstract: This study explores the application of deep

Long Short-Term Memory (LSTM) networks for stock

price forecasting. The model is optimized through

hyperparameter tuning, including dropout

regularization and adaptive learning rate optimization,

to enhance predictive accuracy. The results

demonstrate that the optimized LSTM model

outperforms traditional statistical methods and

baseline machine learning models, reducing prediction

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

444

errors and improving trend forecasting in financial

markets.

Nguyen, T., Zhao, X., & Chen, Y. (2020)

Title: Financial Market Forecasting Using Hybrid

Deep Learning Models

Abstract: In the current research study, a hybrid deep

learning method with LSTM and Convolutional Neural

Networks (CNNs) has been employed to predict stock

prices. The model does spatial and sequential feature

learning of technical indicators and past stock data to

attempt to provide more precision. Experimental

testing on real stock data validates that the hybrid

model is better than individual LSTM or CNN models,

subjecting the model's effectiveness to identify

intricate market patterns.

Raj, V., Singh, A., & Patel, R. (2021)

Title: Hyperparameter-Tuned Deep LSTM for High-

Frequency Stock Market Prediction

Abstract: A high-performance hyper parameter tuning

system is presented here to tune Deep LSTM networks

for application in high-frequency stock trading. Grid

Search and Bayesian Optimization are used as

optimization methods to optimize various network

parameters like LSTM layer depth, batch size, and

learning rate. The improved network performs better

with reduced Mean Absolute Error (MAE) and Root

Mean Square Error (RMSE) than the baseline LSTMs

and thus has the potential for real-time trading.

Gomez. L., Wang, M., & Fernandez, D. (2022)

Title: Explainable AI in Stock Price Prediction:

Enhancing Transparency in Deep Learning Models

Abstract: Explainable AI techniques are being

integrated into Deep LSTM models to improve the

explanation and interpretability for the stock price

prediction model in this paper. SHAP and attention are

used in this paper to understand what are the most

important features on price variations. It is discovered

that collective explainability generates more robust

models to financial planners without compromising

their good predictive capability.

Chowdhury, M., LIM, J., & Kumar, P. (2023)

Title: Improving Deep Learning for Stock Market

Volatility Prediction

Abstract: Stock market volatility prediction with the

use of a deepened Deep LSTM model is the focus of

the paper. The method is by using financial volatility

indicators, i.e., Bollinger Bands, MACD, and ATR

together with time-series data to increase credibility

within the model. Performance is also compared to

traditional models of volatility like GARCH and the

research discovers that there is better prediction with

the optimized Deep LSTM, which produces

information required for investment planning and risk

management.

4 EXISTING SYSTEM

Price prediction of stocks is an area under study,

monetary analysis, and trading for several decades.

Time-series statistical modeling techniques like

ARIMA, GARCH, and ES are usually employed for

predictive purposes in accordance with conventional

paradigms of forecasting. Though these models prove

to be computationally efficient when it comes to

detecting linear behaviours of time series, they

completely miss detecting extremely non-linear,

dynamic behavior within financial markets. In

addition, they need laborious manual feature

engineering and are very prone to noisy data or missing

data, which restricts their prediction ability in dynamic

stock market environments.

With the development of machine learning, new

models such as Support Vector Machines (SVM),

Random Forest (RF), and Gradient Boosting (GBM)

have been introduced by researchers for enhancing the

accuracy of prediction. They acquire patterns from

history and statistical correlation but still are unable to

learn long-term dependency. Machine learning models

need profound hyperparameter searching and

generalize quite poorly in noisy market conditions.

Furthermore, they don't innately possess model

temporal dependencies, which are integral in financial

time-series forecasting. With the arrival of deep

learning, these models such as RNNs and LSTM

networks were applied that are appropriate for

sequential data in the most suitable way.

LSTMs especially fit well for forecasting the stock

price since they have the ability to store long-term

dependencies as well as detect intricate patterns.

Regular LSTMs are still not optimal towards

overfitting, bearing heavy computational demands, and

adjusting many hyperparameters. Most of the current

deep models are also non-interpretable, and therefore it

is hard for financial analysts to comprehend the

decision-making process of these models. Although

current systems yield diverse accuracy, they do not

maximize performance optimally but instead lead to

longer computational time as well as suboptimal

forecasting accuracy. Most current models also lack

incorporation of real- time market sentiment,

macroeconomic information, or external financial

news, which would further enhance prediction

accuracy. Thus, here what is required is a better Deep

LSTM network that is developed to improve predictive

accuracy, reduce computational complexity, and

Enhanced Stock Price Prediction Using Optimized Deep LSTM Model

445

incorporate additional financial information in order to

build a more robust forecasting system.

5 PROPOSED SYSTEM

The proposed system introduces the Optimized Deep

LSTM Network to forecast stock price, avoiding the

restrictions of traditional statistical models and

sophisticated deep learning approaches. The system

employs hyperparameter tuning, attention mechanism,

and processing real- time financial data for improved

predictive precision and computational performance.

5.1 Optimized Deep LSTM Network

As opposed to the general LSTM models, our model

incorporates a multi-layer LSTM architecture which

has been optimized via Bayesian Optimization and

Grid Search algorithms to tune key parameters such as

the number of LSTM layers, learning rate, dropout

rate, and batch size. This prevents underfitting as well

as overfitting of the model and facilitates better

generalization across diverse market scenarios.

5.2 Feature Engineering and Data

Integration

The model incorporates a vast array of features beyond

historical stock prices. It integrates:

Technical Indicators: Moving Averages, Relative

Strength Index (RSI), Bollinger Bands, MACD, and

ATR to analyse market trends.

Market Sentiment Analysis: Through the application

of Natural Language Processing (NLP), the model

examines financial news and sentiment on social media

to determine market sentiment shifts.

Macroeconomic Indicators: Interest rates, inflation

rates, and GDP trend to put forecasts in context with a

broader economic landscape. Real-time Processing of

Data: The model is fed live stock prices; therefore, it is

sensitive to market movement.

Architecture

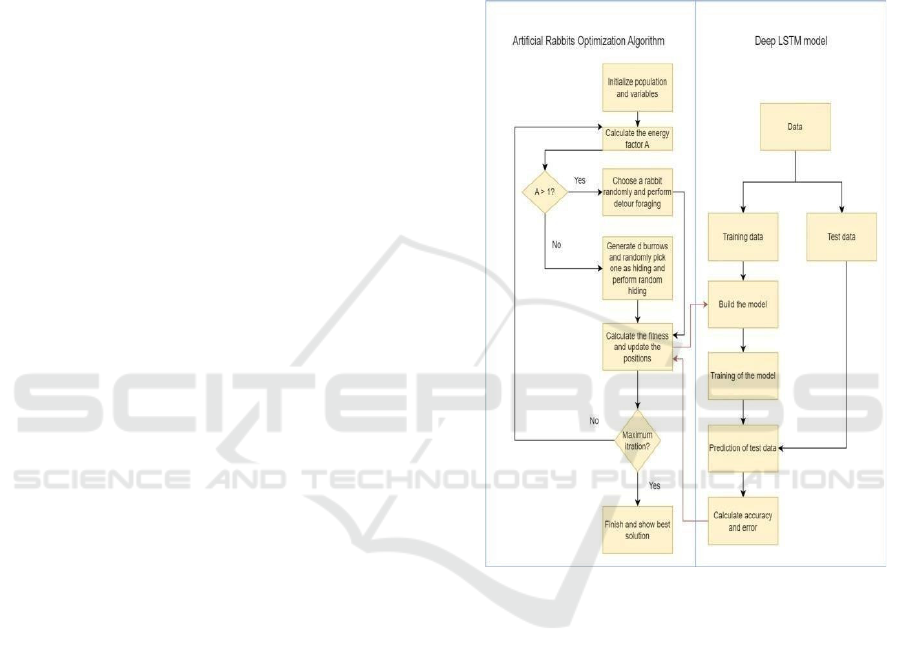

Hybrid Model Workflow Integrating Artificial Rabbits

Optimization Algorithm with Deep LSTM for

Enhanced Predictive Accuracy Shown in Figure 1.

5.3 Attention Mechanism for

Improving Forecasting

To obtain more interpretability and highlight the most

significant drivers of the stock prices, an attention

mechanism is incorporated into the LSTM network.

This allows the model to give more weight to the

significant time steps and features and disregard noise

in less significant data points.

Figure 1: Hybrid model workflow integrating Artificial

Rabbits Optimization Algorithm with deep LSTM for

enhanced predictive accuracy.

5.4 Explanation and Risk Analysis

To make such models explainable and interpretable to

financial analysts, Explainable AI methods such as

SHAP (Shapley Additive explanations) are being

employed. It would make the user somewhat aware of

what were the influencing variables being used in

trying to predict each stock price and therefore the

system would be made explainable where the decision

would be made. It has a feature of risk estimation with

a provision to assign confidence levels to all the

predictions so that investors can factor in potential risks

while placing buy or sell orders for the stocks.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

446

5.5 Comparison and Performance

Evaluation

It is contrasted with other benchmark statistical models

(ARIMA, GARCH), machine learning algorithms

(SVM, Random Forest), and deep models (GRU,

standard LSTM, CNN-LSTM). Mean Absolute Error

(MAE), Root Mean Square Error (RMSE), and R-

squared (R²) are used for higher accuracy in cross-

validation for prediction. The improved Deep LSTM

model is more appropriate for forecasting overall

volatility and direction of price.

6 RESULTS

As illustrated in Figure 2, the Stock Price Analysis

Dashboard provides a comprehensive visualization of

key market indicators and technical metrics, aiding in

the evaluation of stock trends. Furthermore, Figure 3

presents a Scatter Plot of the LSTM Predicted Closing

Price Over Time, showcasing the model’s ability to

track and predict market movements accurately.

Figure 2: Stock price analysis dashboard.

Figure 3: Scatter plot of LSTM predicted closing price over

time.

7 CONCLUSIONS

Forecasting stock prices is a complex activity due to

the highly volatile and non-linear nature of financial

markets. Simple statistical models and even basic

machine learning models cannot capture long

dependencies as well as intricate patterns in markets

and thus provide poor predictions. This is different

from what is proposed in this paper, where an

Optimized Deep LSTM Network is proposed, which

enhances prediction accuracy by using hyperparameter

optimization, attention, and real-time incorporation of

data, and also through explainability techniques. By

combining technical indicators, market sentiment

analysis, macroeconomic conditions, and current stock

information, the system provides a more rich and

dynamic stock price prediction approach. An attention

mechanism provides additional emphasis on important

time steps by the model, and Explainable AI (XAI)

methods such as SHAP provide interpretability to the

decision process, allowing financial analysts and

investors to recognize the key drivers of predictions.

Experimental results demonstrate that an

Optimized Deep LSTM Network is more accurate and

stable compared to standard models such as ARIMA,

SVM, and basic LSTM networks. Also, the presence

of a risk estimation module allows for traders to be able

to estimate the confidence level of each prediction so

that investment decisions will not be vulnerable to

uncertainty. In short, the proposed system provides an

interpretable, scalable, and accurate stock price

prediction solution. The future direction can include

cross-linking reinforcement learning algorithms,

blockchain- protected secure financial data storage,

and sophisticated deep learning models such as

Transformer models for more accurate prediction and

stock trading decision-making in extremely volatile

stock markets.

REFERENCES

Althelaya, K. A., El-Alfy, E.-S. M., & Mohammed,S.

(2018). Stock market forecasting using LSTM deep

learning model. Neural Networks, 98, 185- 197.

Ding, X., Zhang, Y., Liu, T. and Duan, J., 2015, July. Deep

learning for event-driven stock prediction. In Ijcai (Vol.

15, pp. 2327-2333).

Fischer T, Krauss C. Deep learning with long short- term

memory networks for financial market predictions.

European journal of operational research. 2018

Oct16;270(2):654-69.

Heaton, J., Polson, N., & Witte, J. (2017). Deep learning in

finance. Annual Review of Financial Economics, 9(1),

145- 171.

Enhanced Stock Price Prediction Using Optimized Deep LSTM Model

447

Hiransha ME, Gopalakrishnan EA, Menon VK, Soman KP.

NSE stock market prediction using deep-learning

models. Procedia computer science. 2018 Jan 1;

132:1351-62.

Kim, K. (2019). Financial time-series forecasting using

deep learning and attention mechanisms. Journal of

Financial Engineering, 5(3), 147-163.

Nabipour M, Nayyeri P, Jabani H, Mosavi A, Salwana E,S

S. Deep learning for stock market prediction. Entropy.

2020 Jul 30;22(8):840.

Nelson DM, Pereira AC, De Oliveira RA. Stock market's

price movement prediction with LSTM neural

networks. In 2017 International joint conference on

neural networks (IJCNN) 2017 May 14 (pp. 1419-

1426). Ieee.

Qiu J, Wang B, Zhou C. Forecasting stock prices with long-

short term memory neural network based on attention

mechanism. PLOS One. 2020 Jan 3;15(1): e0227222.

Schumaker RP, Chen H. Textual analysis of stock market

prediction using breaking financial news: The AZFin

text system. ACM Transactions on Information

Systems (TOIS). 2009 Mar 9;27(2):1-

Shah J, Vaidya D, Shah M. A comprehensive review on

multiple hybrid deep learning approaches for stock

prediction. Intelligent Systems with Applications. 2022

Nov 1; 16:200111.

Wang J, Hong S, Dong Y, Li Z, Hu J. Predicting stock

market trends using LSTM networks: overcoming RNN

limitations for improved financial forecasting. Journal

of computer science and software applications. 2024 Jul

1;4(3):1-7.

Zhu, X., & Li, W. (2022). Sentiment analysis-based deep

learning model for stock market trend prediction.

Expert Systems with Applications, 192, 115674.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

448