Unified Payments Interface Fraud Detection Using Machine Learning

P. Sirisha

1

, S. Jaheda

2

, G. Afra Tahaseen

2

, K. Divya Madhuri

2

and P. Mohammad Arshad

2

1

Department of CSE, Srinivasa Ramanujan Institute of Technologv, Anantapur, Andhra Pradesh, India

2

Department of CSE (Data Science), Srinivasa Ramanujan Institute of Technology,

Anantapur, Andhra Pradesh, India

Keyword: Machine Learning, XGB-Classifier, Decision Tree, Random Forest, UPI Digital Payments, Fraud Detection.

Abstract: Digital transaction fraud has become more common due to the widespread use of the Unified Payments

Interface (UPI). Our proposed fraud detection system employs six machine learning algorithms to address

this issue: XGBClassifier, Decision Tree, Random Forest, and Gradient Boosting Machines (GBMs). A

logical framework for classifying transactions is provided by the Decision Tree algorithm. By enhancing

accuracy and resilience, Random Forest successfully detects fraud. By combining weak learners, GBMs are

able to identify changing fraud trends over time and capture intricate fraud patterns. training the model to

converge efficiently. When it comes to classification jobs, XGBClassifier is a formidable gradient boosting

method. Quick, it deals with missing values, and it stops overfitting. Enhancing UPI security, this multi-

algorithm technique processes UPI transactions securely and accurately, differentiating between fraudulent

and authentic ones. We are on the cusp of seeing this paradigm implemented in actual financial systems.

1 INTRODUCTION

The Unified Payments Interface (UPI) has

transformed the digital payment landscape, enabling

instant and seamless financial transactions. UPI

allows users to send and receive money using their

mobile devices without requiring traditional banking

details such as account numbers and IFSC codes. Its

convenience and accessibility have led to rapid

adoption across individuals, businesses, and financial

institutions. However, as digital transactions increase,

so do the risks associated with fraudulent activities.

Cybercriminals exploit vulnerabilities in the system

using tactics like phishing, fake payment requests,

identity theft, and transaction manipulation. These

frauds pose a serious threat to both users and financial

institutions, leading to monetary losses and decreased

trust in digital payments.

Traditional fraud detection methods rely on rule-

based approaches, where predefined conditions flag

potentially fraudulent transactions. However, these

static rules often fail to detect new and sophisticated

fraud patterns. Fraudsters continuously evolve their

tactics, making it essential to implement intelligent

and adaptive fraud detection systems. This is where

machine learning (ML) comes into play. ML-based

fraud detection systems can analyze vast amounts of

transaction data, learn from historical fraud patterns,

and automatically identify suspicious activities. By

leveraging advanced ML algorithms, we can enhance

fraud detection accuracy, reduce false positives, and

improve real-time security measures in UPI

transactions.

In this study, we propose a machine learning-driven

UPI fraud detection system that utilizes six powerful

algorithms: Decision Tree, Random Forest, Gradient

Boosting Machines (GBMs), and XGBClassifier.

These models help in detecting fraudulent transactions

with high precision. Decision Tree provides a clear

decision-making process for transaction classification.

Random Forest enhances detection accuracy by

combining multiple decision trees, making it robust

against fraudulent anomalies. Gradient Boosting

Machines (GBMs) use weak learners to identify

evolving fraud patterns, while XGBClassifier, a fast

and efficient gradient boosting algorithm, prevents

overfitting and handles missing values effectively.

By implementing this multi-algorithm approach, our

system ensures secure, accurate, and real-time fraud

detection in UPI transactions. Financial institutions

can integrate this model into their existing security

infrastructure to prevent fraudulent activities and

protect users. The proposed system not only improves

fraud detection efficiency but also contributes to a

420

Sirisha, P., Jaheda, S., Tahaseen, G. A., Madhuri, K. D. and Arshad, P. M.

Unified Payments Interface Fraud Detection Using Machine Learning.

DOI: 10.5220/0013930800004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

420-426

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

safer digital payment ecosystem, enhancing user

confidence in UPI transactions.

2 LITERATURE SURVEY

i) CARDWATCH: a neural network based database

mining system for credit card fraud detection

https://ieeexplore.ieee.org/document/618940

Here we introduce CARDWATCH, a database mining

method that can identify credit card fraud. An intuitive

graphical user interface, connectivity to several

commercial databases, and a neural network learning

module form the basis of the system. Very high

success rates in detecting fraud were found in tests

using autoassociative neural network models and

synthetically created credit card data.

ii) Understanding telephony fraud as an essential step

to better fight it

https://www.semanticscholar.org/paper/Understandi

ng-telephony-fraud-as-an-essential-step-

Sahin/4f88de8f9ffb34aa147b2c10d4bf08b350ae917

b

The first large-scale network, which reached around

7 billion people over a century ago, was the telephone

network. The complex nature of telecommunications

and the possibility of monetising several services

make it an attractive target for fraudsters. Academic

studies on these networks are few because of their

complexity and closed nature. A comprehensive

examination of fraud in telecommunication networks

is the first part of this thesis. We present a taxonomy

that differentiates between basic reasons,

weaknesses, ways of exploitation, types of fraud, and

benefits to fraudsters. We break it down for you and

show how our taxonomy sheds light on CAller NAMe

(CNAM) revenue sharing fraud. We look at two types

of wholesale billing fraud that operators face head-on

in the second part of the article. New forms of

interconnect telecom fraud include Over-The-Top

(OTT) bypass fraud. Directed via IP to a voice chat

app on a smartphone, rather than terminating it over

the telco infrastructure, is how OTT bypass works.

We analyse the effects of this fraud on a small

European country and how to identify it using more

than 15,000 test calls and a thorough user survey. A

big wholesale scam, the International Revenue Share

fraud (IRSF), will be discussed later. Calls from IRSF

numbers are being diverted to "international premium

rate services" by con artists. In order to gain a deeper

understanding of the IRSF ecosystem, we examine

data from several third-party premiu rate service

providers' worldwide premium rate tests. Using this

data, we suggest characteristics for IRSF-detection

for both the source and destination numbers of calls.

The latter section of the thesis delves into consumer-

side telephonic fraud, namely voice spam. A recent

approach to stop unsolicited phone calls includes

linking the spammer with a phone bot (“robocallee”)

that impersonates a genuine person. Lenny, a bot,

plays pre-recorded audio messages to communicate

with the user.

iii) Fraud detection system: A survey

https://www.sciencedirect.com/science/article/abs/pi

i/S1084804516300571

Credit card, telecommunication, and healthcare

insurance systems are just a few examples of the

many forms of electronic commerce that have

emerged as a result of the proliferation of both

personal computers and large corporations. There are

legitimate and dishonest individuals on these

networks, unfortunately. There were a number of

methods in which fraudsters gained access to e-

commerce platforms. Fraud prevention systems

(FPSs) do not adequately safeguard e-commerce

networks. Electronic commerce systems may be

protected, nevertheless, through FDS-FPS

cooperation. Several challenges, including as concept

drift, real-time detection, skewed distribution, and

huge data, impede the performance of FDS. In a

systematic fashion, this survey study examines these

worries and roadblocks that impede FDS operation.

Our five e-commerce platforms include online

auctions, credit card processing, telecommunications,

healthcare insurance, and auto insurance. We will go

over the two main categories of online shopping

fraud. Additionally, selected E-commerce sites'

modern FDSs approaches are showcased. Here is a

concise synopsis of the patterns and conclusions that

will shape future study.

iv) Network Analysis (From Criminal Intelligence

Analysis, P 67-84, 1990, Paul P Andrews, Jr and

Marilyn B Peterson, ed. -- See NCJ-125011)

https://www.ojp.gov/ncjrs/virtual-

library/abstracts/network-analysis-criminal-

intelligence-analysis-p-67-84-1990-paul-p

Relational matrices and maps of relationships are

described together since they both provide the same

information. You may find the frequency, intensity,

and strength of the relational linkages between the

subjects of investigation using the diagrams and

matrices. The presentation of mathematical models

serves to demonstrate how conclusions may be

derived from network models. We take a look at a

sophisticated use of network analysis by the police.

twelve figures and fourteen references.

Unified Payments Interface Fraud Detection Using Machine Learning

421

v) Modelling different types of automobile insurance

fraud behaviour in the Spanish market

https://www.sciencedirect.com/science/article/abs/pi

i/S0167668798000389

Controlling insurance fraud necessitates in-depth

understanding of insureds' conduct, according to

microeconomic theory. We quantify the impact of

insured and claim variables on the risk of fraud using

discrete-choice models that we propose in this

research. The data is based on a sample from Spain.

Oversampling of fraud claims necessitates correction

for choice-based sampling in the estimation. Also

covered is the organisation of the Spanish vehicle

insurance sector. Our findings vary depending on the

specific form of fraudulent activity being examined.

3 METHODOLOGY

3.1 Proposed Undertaking

The proposed system enhances UPI fraud detection by

integrating multiple machine learning algorithms,

including Random Forest, Decision Tree, Gradient

Boosting Machines (GBMs), and XGBClassifier. This

multi-algorithm approach leverages the strengths of

each model to improve accuracy, robustness, and real-

time fraud detection. Random Forest, an ensemble

method, builds multiple decision trees and aggregates

their predictions, making it effective in handling noisy

and imbalanced data while capturing intricate feature

relationships. Decision Tree, a simple yet interpretable

model, provides clear decision paths but is prone to

overfitting on complex datasets. However, it serves as

a foundational component for advanced ensemble

methods. GBMs enhance performance by refining

predictions iteratively, making them adept at detecting

non-linear fraud patterns within large datasets.

XGBClassifier, an optimized version of GBMs, offers

high speed, scalability, and regularization techniques

to prevent overfitting while handling missing values

efficiently. This system ensures enhanced accuracy,

robustness against overfitting, real-time detection

capabilities, and adaptability to evolving fraud

patterns. By leveraging these machine learning

techniques, the proposed model significantly

strengthens UPI security, ensuring faster, more

reliable fraud detection and protecting users from

financial risks.

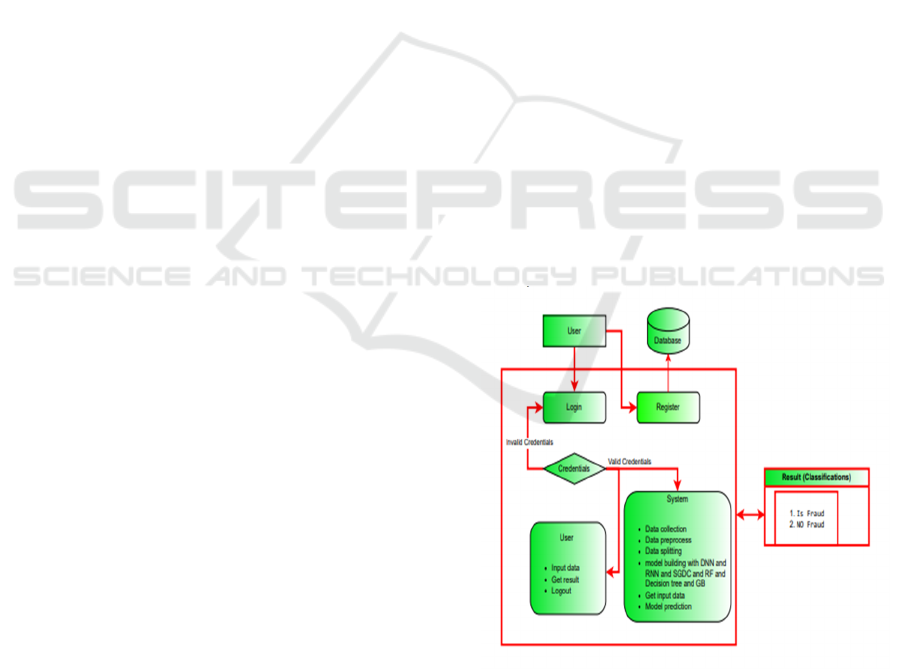

3.2 Design of the System

The architecture of the proposed UPI fraud detection

system is designed to efficiently analyze transaction

data, identify fraudulent patterns, and provide real-

time security measures. The system follows a

structured approach, starting with data collection and

preprocessing, where transaction data, including

amount, sender and receiver details, timestamps, and

transaction types, are gathered and cleaned to remove

inconsistencies. Feature engineering is then applied to

extract relevant attributes that contribute to fraud

detection.

Once the data is prepared, it is fed into multiple

ML models, including RF, DT, GBMs, and

XGBClassifier. Each model processes the input data

to identify anomalies and patterns indicative of

fraudulent activities. Random Forest, with its

ensemble of decision trees, enhances detection

accuracy by reducing overfitting, while Decision Tree

provides an interpretable decision-making

framework. GBMs and XGBClassifier further refine

predictions, capturing complex relationships and

improving classification precision.

The system integrates a real-time detection

module, which continuously monitors transactions

and flags suspicious activities. When a potentially

fraudulent transaction is detected, an alert mechanism

is triggered, notifying users and financial institutions

for further action. Additionally, the model undergoes

continuous training and updating to adapt to emerging

fraud techniques, ensuring long-term effectiveness.

Figure 1 architecture ensures a robust, scalable, and

adaptive fraud detection system, providing enhanced

security for UPI transactions.

Figure 1. Proposed architecture.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

422

4 IMPLEMENTATIONS

4.1 Modules

The UPI Fraud Detection System is able to identify

and stop fraudulent transactions because to its many

key components. System primary components:

a) Data Collection and Preprocessing: This

module gathers transaction data, including

sender and receiver details, transaction

amount, timestamps, and payment methods.

The data is then cleaned, removing

duplicates and handling missing values to

ensure accurate model training.

b) Feature Engineering: In this module,

relevant features are extracted and

transformed to improve fraud detection

accuracy. Key features include transaction

frequency, average transaction amount, and

user behavior patterns, which help in

distinguishing fraudulent activities from

legitimate ones.

c) Machine Learning Model Training: The

system trains multiple ML models RF, DT,

GBMs, and XGBClassifier on historical

transaction data. These models learn fraud

patterns and classify transactions based on

their likelihood of being fraudulent.

d) Real-Time Fraud Detection: This module

applies trained models to live transactions,

analyzing them in real-time. If a transaction

is flagged as suspicious, an alert is triggered

for further verification.

e) Alert and Notification System: When

fraudulent activity is detected, the system

sends alerts to the user and financial

institutions, enabling immediate action to

prevent losses.

f) Model Update and Continuous Learning:

Fraud patterns evolve over time, so this

module updates the machine learning

models with new transaction data, ensuring

they remain effective against emerging fraud

techniques.

4.2 Algorithms

The UPI Fraud Detection System utilizes multiple

machine learning algorithms to enhance fraud

detection accuracy and efficiency. The key

algorithms used in the system are:

a) Decision Tree: This algorithm classifies

transactions based on feature importance by

creating a tree-like structure of decisions. It

is easy to interpret but may overfit on

complex datasets.

An algorithm that uses decision trees is

called a random forest. As a decision-

support tool, a decision tree resembles a tree.

Gaining familiarity with decision trees can

facilitate comprehension of random forest

techniques.

Nodes at the decision, leaf, and root levels

make up decision trees. The training dataset

is partitioned into additional branches using

a decision tree approach. At a leaf node, the

series terminates. There is no differentiation

at the leaf node.

Nodes in a decision tree represent

characteristics that are utilised to make

predictions. Decided nodes link leaves. The

following diagram shows the three types of

nodes in a decision tree.

b) Random Forest: When it comes to

regression and classification problems,

machine learning employs random forests.

In ensemble learning, many classifiers are

used to tackle complex problems as shown

in figure 2.

An array of decision trees is employed by a

random forest approach. The 'forest' that the

random forest approach uses to train is

accomplished by bagging or bootstrap

aggregation. Machine learning accuracy is

improved by using the ensemble meta-

algorithm bag.

The outcome is determined by the decision

tree projections using the random forest

approach. It averages the output of trees to

make predictions. When there are more

trees, the results are more accurate.

Decision trees are limited, whereas random

forests are not. This lessens the likelihood of

dataset overfitting and increases accuracy.

Like Scikit-learn, it generates predictions

without requiring a plethora of package

options.

Features of a Random Forest Algorithm:

Better at managing missing data and

more accurate than decision tree

algorithms.

It is possible to make accurate

predictions without adjusting the

hyperparameters.

Addresses problems with decision tree

overfitting.

Unified Payments Interface Fraud Detection Using Machine Learning

423

The splitting point of each node in a

random forest tree is used to randomly

choose a subset of attributes.

Figure 2: Random forest process.

c) Gradient Boosting Machines (GBMs): A

boosting technique that improves prediction

performance by combining weak learners

sequentially. It captures complex, non-linear

fraud patterns and enhances classification

precision.

d) XGBClassifier (Extreme Gradient

Boosting): Improving GBM performance on

massive datasets in terms of speed,

scalability, and efficiency. For real-time

fraud detection, regularisation is ideal since

it manages missing data and reduces

overfitting.

XGBoost is a scalable machine learning

system that uses distributed gradient-

boosted decision trees (GBDTs). With

parallel tree boosting, it is the best machine

learning software for ranking, classification,

and regression.

A solid grasp of supervised ML, decision

trees, ensemble ML, and gradient boosting is

necessary for fully grasping XGBoost.

Through the use of algorithms, supervised

machine learning trains a model to recognise

patterns in a dataset that already contains

labels and features, and then uses that model

to predict labels for new features as shown

in figure 3.

Figure 3. XGoost.

5 EXPERIMENTAL RESULTS

The UPI Fraud Detection System was tested on a

dataset containing real and fraudulent transactions to

evaluate its effectiveness. The system was trained

using Decision Tree, Random Forest, GBMs, and

XGBClassifier, and performance metrics such as

accuracy, precision, recall, and F1-score were

analyzed. Among the models, XGBClassifier

demonstrated the highest accuracy due to its efficient

handling of missing values and overfitting prevention

techniques. Random Forest provided robust fraud

detection with reduced false positives, while GBMs

effectively captured complex fraud patterns. The

system successfully detected fraudulent transactions

with high precision and recall, minimizing false

alarms while ensuring security. These results confirm

that the proposed multi-algorithm approach

significantly enhances fraud detection accuracy, real-

time processing, and adaptability to emerging fraud

trends in UPI transactions.

i) Precision: Accuracy is measured by precision

when it comes to positively classifying instances or

samples. The correctness formula is:

𝑃𝑟𝑒𝑐𝑖𝑠𝑖𝑜𝑛 𝑇𝑃 / 𝑇𝑃 𝐹𝑃 (1)

Figure 4: Precision comparison graph.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

424

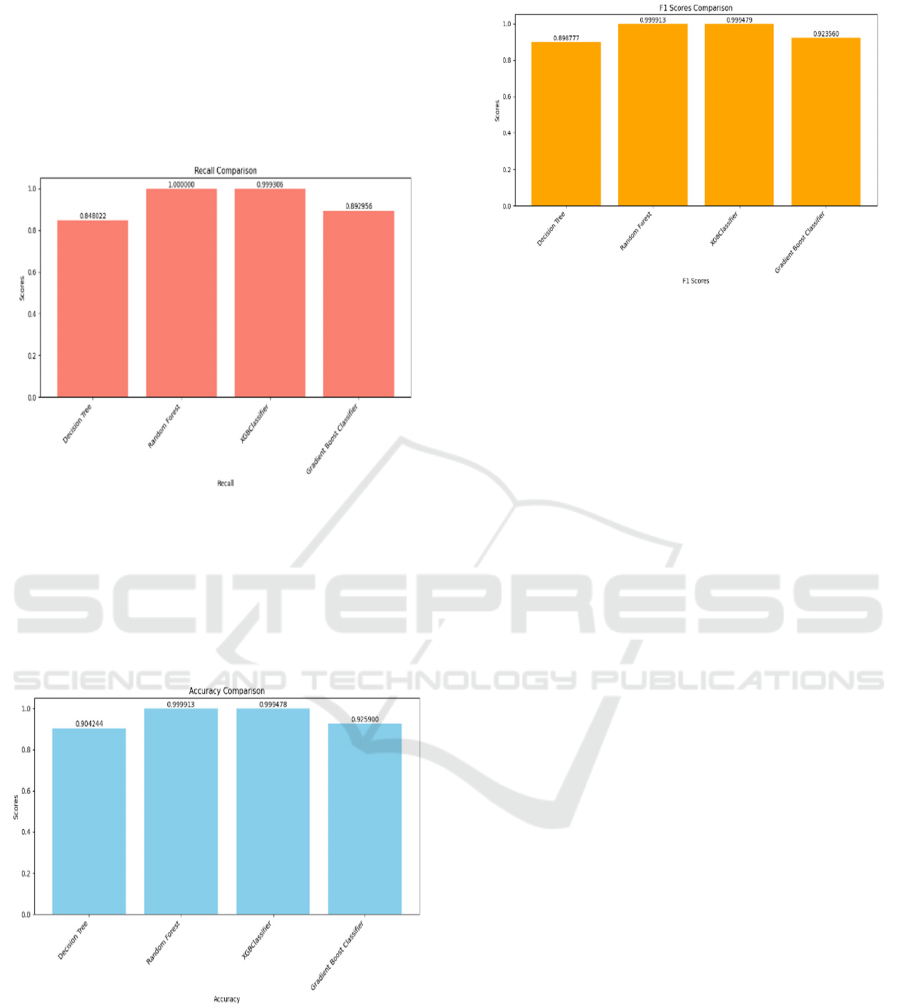

ii) Recall: The ability of a model to identify all

important instances of a class is measured by its

machine learning recall. To determine if a model

successfully captures class instances, we compare the

total number of positive observations to the number

of ones that were accurately predicted.

𝑅𝑒𝑐𝑎𝑙𝑙 𝑇𝑃 / 𝑇𝑃 𝐹𝑁

(2)

Figure 5: Recall comparison graph.

iii) Accuracy: The accuracy of a model can be

measured by looking at the percentage of valid

classification predictions.

𝐴𝑐𝑐𝑢𝑟𝑎𝑐𝑦 𝑇𝑃 𝑇𝑁 / 𝑇𝑃 𝑇𝑁 𝐹𝑃

𝐹𝑁

(3)

Figure 6: Accuracy graph.

iv) F1 Score: Use the F1 Score, a harmonic

mean of recall and accuracy, to equalise false

positives and negatives if your dataset is not uniform.

𝐹1 𝑆𝑐𝑜𝑟𝑒 2 𝑃𝑟𝑒𝑐𝑖𝑠𝑖𝑜𝑛 𝑅𝑒𝑐𝑎𝑙𝑙 /

𝑃𝑟𝑒𝑐𝑖𝑠𝑖𝑜𝑛 𝑅𝑒𝑐𝑎𝑙𝑙

(4)

Figure 7: F1 Score.

Figure 4 shows the precision comparison, Figure 5

shows the recall comparison, Figure 6 shows the

accuracy graph and figure 7 shows the F1 score.

6 CONCLUSIONS

By fixing problems with privacy and openness,

Federated Learning (FL) and Explainable AI (XAI)

revolutionise the identification of financial crime.

Model interpretability and performance are enhanced

compared to prior approaches by XGBClassifier,

Random Forest, Decision Trees, and Gradient

Boosting Machines (GBMs).

Financial organisations can better understand the

classification results provided by Random Forest

and Decision Trees, while XGBClassifier and

GBMs are able to capture complex patterns for

improved fraud detection. By eliminating the need

to share sensitive financial data, Federated Learning

(FL) enables decentralized model training.

This two-pronged approach makes the framework

more private and transparent while also enhancing

fraud detection. The findings demonstrate that

financial fraud detection systems may be enhanced by

combining XAI with FL, all while maintaining

privacy requirements. A more stable and accountable

financial system may be the result of this paradigm

shift.

7 FUTURE SCOPE

More accurate, interpretable, and private fraud

detection systems are available for future usage. To

enhance the accuracy of fraud detection, it is

recommended to combine XGBClassifier with other

Unified Payments Interface Fraud Detection Using Machine Learning

425

hybrid models such as DT, RF, and GBMs.

Transformer models and other deep learning

architectures have the potential to detect intricate

fraud patterns.

FL frameworks that have their communication

strategies fine-tuned can improve the efficiency and

accuracy of models used by financial organisations

while keeping customer data private.

By using differentiated privacy techniques,

sensitive financial data may be protected in FL,

reducing the risk of data leakage and making fraud

detection easier.

With the use of streaming data and adaptive

learning algorithms, fraud may be detected and

prevented in real-time, reducing reaction time and

financial losses. It is possible to improve the scalable

and fast XGBClassifier and GBMs for use in real-

time scenarios.

REFERENCES

UKFinance. (2022). Annual Fraud Report 2022. [Online].

Available: https://www.ukfinance.org.uk/policy-and-

guidance/reports-andpublications/annual-fraud-report-

2022

A. Abdallah, M. A. Maarof, and A. Zainal, ‘‘Fraud

detection system: A survey,’’ J. Netw. Comput. Appl.,

vol. 68, pp. 90–113, Jun. 2016.

A. Pascual, K. Marchini, and S. Miller. (2017). 2017

Identity Fraud: Securing the Connected Life. Javelin.

[Online]. Available: http://www.

javelinstrategy.com/coverage-area/2017-identity-fraud

S. Bhattacharyya, S. Jha, K. Tharakunnel, and J. C.

Westland, ‘‘Data mining for credit card fraud: A

comparative study,’’ Decis. Support Syst., vol. 50, no.

3, pp. 602–613, Feb. 2011

L. T. Rajesh, T. Das, R. M. Shukla, and S. Sengupta, ‘‘Give

and take: Federated transfer learning for industrial IoT

network intrusion detection,’’ 2023, arXiv:2310.07354.

S. Vyas, A. N. Patra, and R. M. Shukla, ‘‘Histopathological

image classification and vulnerability analysis using ,’’

2023, arXiv:2306.05980.

R. J. Bolton and D. J. Hand, ‘‘Statistical fraud detection: A

review,’’ Stat. Sci., vol. 17, no. 3, pp. 235–255, Aug.

2002.

H. van Driel, ‘‘Financial fraud, scandals, and regulation: A

conceptual framework and literature review,’’ Bus.

Hist., vol. 61, no. 8, pp. 1259–1299, Nov. 2019.

G. M. Trompeter, T. D. Carpenter, N. Desai, K. L. Jones,

and R. A. Riley, ‘‘A synthesis of fraud-related

research,’’ AUDITING, A J. Pract. Theory, vol. 32, no.

Supplement 1, pp. 287–321, May 2013.

P. Raghavan and N. E. Gayar, ‘‘Fraud detection using

machine learning and deep learning,’’ in Proc. Int.

Conf. Comput. Intell. Knowl. Economy (ICCIKE), Dec.

2019, pp. 334–339.

M. Zareapoor and P. Shamsolmoali, ‘‘Application of credit

card fraud detection: Based on bagging ensemble

classifier,’’ Proc. Comput. Sci., vol. 48, pp. 679–685,

2015.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

426