The Impact of Effectiveness Retail Banking Customer Satisfaction

with Artificial Intelligence

Jyothis Rachel Mathews and Ebenezer Paul Rajan T. Y

Department of Management, Karpagam Academy of Higher Education, Coimbatore, Tamil Nadu, India

Keywords: Artificial Intelligence, Customer Precision, Transaction, Banking, Retail, Money.

Abstract: In current days, there have been a noticeable increase in the opportunity and needs of clients in the retail

banking sector. Banks are constantly looking for methods to improve customer satisfaction in order to

maintain their aggressiveness. Algorithm optimization powered by artificial intelligence (AI) is one effective

method. In order to satisfy the needs and preferences of clients, traditional banking procedures frequently

require greater vital rapidity, accuracy, and customisation. Banks may analyze vast volumes of customer data,

including transaction history, remarks, and vocal exchange options, using AI-driven algorithm optimization

to produce incredibly personalized and environmentally friendly banking reviews. Banks can utilize AI

algorithms to identify patterns and behaviors in order to provide targeted product recommendations and

individualized customer support. It no longer boosts customer satisfaction and will provide banks more

chances to go-sell.

1 INTRODUCTION

Customer satisfaction is an important consideration

for any business, but it's especially important for retail

banks. Having satisfied customers is no longer the

only way to keep them as customers; it also attracts

new ones through positive word-of-mouth. Shops are

implementing cutting-edge technologies, such as AI-

driven algorithms, to improve their strategies and

foster customer pride in the current, highly

competitive industry. These algorithms make banking

more convenient and green by using artificial

intelligence to analyze enormous volumes of data and

provide clients personalized answers. This paper will

explore how implementing AI-driven algorithm

optimization might enhance customer satisfaction in

retail banking .The process of using synthetic

intelligence techniques to optimize algorithms and

raise their overall performance is known as AI-driven

algorithm optimization. This technology is utilized in

the retail banking sector to analyze client information

and offer tailored financial solutions. These

algorithms are made to investigate every consumer

interaction and provide more accurate suggestions

over time(

Neha et al., 2023). To offer specialized

solutions, such as finance alternatives or savings

programs, they could look at consumer behavior,

spending patterns, and financial records. Advanced

selection-making is one of the many advantages of

integrating AI-driven algorithm optimization in retail

banking (

M. Ruisli et al., 2024). Large volumes of

customer data may be swiftly analyzed by these

algorithms, which can then provide insightful

recommendations. In order to make fact-based

decisions, they keep in mind many elements, such as

customer demographics, spending patterns, and

financial preferences (

S. Akilimalissiga and N. I.

Sukdeo., 2024). This enables banks to provide their

customers with more individualized products, which

raises satisfaction levels. These days, customers want

a consistent and personalized service from their banks.

Simply said, AI-powered computers can do that by

interpreting customer interactions and offering

tailored solutions. For example, the set of rules can

tailor a customer's dashboard to show the most

frequently used features if they frequently use a

particular app for online banking, making their

experience more convenient (

M. J. C. Samonte et al.,

2024). In addition to increasing client satisfaction, it

also motivates them to make more use of the financial

institution's services .AI-driven rule optimization can

also help retail banks handle customer concerns more

effectively(

Chauhan et al., 2020). These algorithms are

capable of rapidly analyzing client court situations and

providing remedies based on a comprehensive

Mathews, J. R. and Y., E. P. R. T.

The Impact of Effectiveness Retail Banking Customer Satisfaction with Artificial Intelligence.

DOI: 10.5220/0013930300004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 5, pages

387-393

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

387

analysis of previous, comparable cases. In addition to

cutting down on client wait times, it now gives them

precise and useful responses.

2 RELATED WORK

The banks can increase customer satisfaction and

maintain their high level of popularity by immediately

addressing consumer concerns (

S. Suresh et al., 2020).

Retail banks can automate numerous strategies,

primarily to reduce operating costs, with the aid of an

AI-driven set of rules optimization. For example,

algorithms can manage standard customer inquiries,

relieving customer support agents of some of their

effort (

R. Pratomo et al., 2024). It gives them more time

to focus on more intricate responsibilities, which

speeds up performance and ultimately saves the bank

money (

P. Silvia et al., 2024). Customers may directly

overcome those cost savings in the form of lower costs

or greater interest quotations, increasing their level of

regular contentment (

Tsareva and M. Komarov., 2024).

Even though AI-driven algorithm optimization has

several advantages, retail banks nevertheless need to

handle some challenging scenarios.

2.1 Security

Facts security is one of the major problems (S. M. D.

Silva et al., 2024).

Banks must ensure that these records

are safely stored and shielded from any cyber risks as

algorithms gather and analyze enormous amounts of

customer data. The algorithms' method of making

decisions may have bias and equity problems. In order

to ensure that these algorithms no longer discriminate

against particular groups or individuals, banks should

carefully review and audit them (

Krishnamoorthy and V.

Aggarwal., 2024). AI-driven algorithm optimization

holds significant promise for improving customer

satisfaction in the retail banking sector. These

algorithms can enhance decision-making, patron

enjoyment, and problem-solving by analyzing large

volumes of data and providing tailored solutions.

Additionally, they may lead to fee savings for the

financial institution that customers may surpass,

boosting their pride in the process. However, in order

to fully profit from AI-driven algorithm improvement,

banks need also address capability issues, such as

algorithmic bias and records protection (

Ekawaty et al.,

2024)

. By using this technology, retail banks may live

more aggressively and give their clients a more

seamless and enjoyable banking experience.

2.2 Retail Banks

The following is the paper's primary contribution

personalized buyer pleasure retail banks can analyze

vast amounts of customer data to learn more about

individual preferences and behavior by using AI-

driven algorithms (

R. Bogala et al., 2024). Fast and

effective service AI technology is essential for

automating repetitive processes like loan processing

and account opening, which speeds up the service

delivery process. In addition to guaranteeing timely

service, this frees up human resources to concentrate

on more difficult jobs, which boosts productivity and,

eventually, improves customer satisfaction. Fraud

prevention AI systems are able to identify odd account

activity and instantly flag transactions that might be

fraudulent.

2.3 Artificial Intelligence (AI)

To increase client happiness, the retail The business of

banking is experiencing a dramatic movement in up to

date years toward the application of artificial

intelligence (AI) and algorithm optimization.

Although there are numerous advantages to this

technological development, there are drawbacks as

well (

Wisastra et al., 2024). The possibility for bias and

discrimination is one of the biggest problems retail

banks have when utilizing AI-driven algorithm

optimization. Since AI algorithms are taught on

historical data, they will inevitably be biased if the

data is prejudiced. It may lead to unfair treatment of

particular clientele groups, including those based on

socioeconomic background, gender, or race (

Datta and

R. Raman et al., 2024)

. An AI system might, for

instance, refuse loans to people from low-income

families, resulting in their financial exclusion and a

widerning of the wealth disparity. Furthermore, AI

algorithms have the potential to harm marginalized

communities by reinforcing societal preconceptions

and existing injustices (

M. A. Riazulhameed et al., 2024).

The requirement for greater openness and explanation

capabilities is another issue with AI-driven algorithm

optimization in retail banking. Because AI systems

rely on intricate, interrelated processes that are

challenging for humans to comprehend, they are

frequently referred to as "black boxes. "Customers

may become uneasy about their financial decisions

being made by an algorithm they don't understand as

a result of this lack of transparency (

V. Gambhir et al.,

2024)

. It is simpler to find and fix any potential biases

or mistakes in the algorithm when there is

transparency, which makes it simpler to guarantee just

and moral procedures. Concerns around data security

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

388

and privacy have also been highlighted by the

application of AI in retail banking. For AI algorithms

to work well, enormous volumes of consumer data

including private and sensitive financial information

are needed (

Biceková et al., 2024). As a result, banks

need to have strong data security procedures in place

to stop data breaches and safeguard their clients'

privacy.

2.4 Retail Bankings

However, there is always a chance of data breaches

because to the growing expertise of hackers and

cyberthreats, which can cause people to lose faith in

the bank's offerings (

M. A. Riazulhameed et al., 2024).

There are issues with personnel displacement and

retraining when AI-driven algorithms are

implemented in retail banking. Many workers,

whether in front-line or back-office positions, may

find their careers at jeopardy as banks move toward

automation.Employees may experience job losses,

financial instability, and possible organizational

reluctance to change as a result of this (

Y. Duan., 2024).

Banks may find it expensive and time-consuming to

retrain staff to collaborate with AI systems, which

could prevent them from implementing these

technology (

S. Suresh and M. Suresh., 2024). Concerns

about retail banking's excessive dependence on AI

also exist. AI algorithms are nevertheless constrained

by the caliber and applicability of the data they are fed,

even if they are capable of analyzing enormous

volumes of data and making choices more quickly

than humans.This implies that people should continue

to participate in the decision-making process and use

their judgment and critical thinking abilities to reach

well-informed conclusions.Banks run the risk of

becoming overly dependent on AI algorithms and

neglecting the human aspect, which could result in

mistakes and issues. Although there are numerous

potential advantages to using AI-driven algorithm

optimization to raise client happiness in retail banking,

there are also important challenges that must be

corrected.An innovative strategy to help could greatly

extend the customer experience is the application of

artificial intelligence (AI) to retail banking algorithm

optimization for customer happiness. Banks have

historically analyzed client data using manual

procedures. However, thanks to developments in AI,

algorithms may now be taught to learn from user

interactions and preferences, resulting in more

effective and individualized services. Because AI-

driven optimization enables banks to comprehend and

promptly address clients' needs, it may result in

increased customer satisfaction

3 PROPOSED METHODOLOGY

There are several technological elements and tactics

involved in creating AI-driven algorithm optimization

to improve customer satisfaction in retail banking.

First, in order to comprehend buyer behavior, choices,

and pain points, a thorough assessment of the current

consumer data is carried out. A computer version that

might mimic customer behavior is then created using

these statistics. New records are added to the version

on a regular basis to increase its efficacy and

correctness. To optimize the version and find patterns

in buyer behavior, sophisticated device learning

algorithms are employed, such as artificial neural

networks, decision trees, and random forests. These

algorithms have the capacity to analyze vast amounts

of data and offer insights that may be applied to

enhance the client experience. A thorough testing

process, including move-validation and returned

checking out, is completed to guarantee the version's

accuracy and dependability. It makes it possible to

improve the algorithms and verify the results. Once

the version is progressed, APIs and interfaces are used

to integrate it with the retail banking machine. It

enables real-time client data analysis and provides

consumers with tailored advice based solely on their

behavior.

3.1 Applications

Several technical elements and methods are needed to

construct an AI-driven set of rules optimized for

improving customer satisfaction in retail banking.

First, a thorough new data is continuously added to the

model to increase its efficacy and accuracy. The

version is optimized and patron behavior patterns are

identified using advanced system learning methods,

such as random forests, choice trees, and synthetic

neural networks.Cross-validation and back-testing are

two of the rigorous checking out techniques used to

guarantee the model's accuracy and

dependability.This aids in algorithm improvement and

result validation. Following development, the version

will be integrated via APIs and interfaces with the

retail banking system. This makes it possible to

analyze client data in real time and provide customers

with tailored recommendations based on their

behavior .The principle of operation the idea behind

enhancing customer satisfaction in retail banking

using AI-driven algorithm optimization is to use

artificial intelligence (AI) to enhance overall

enjoyment and embellish the buyer's experience. In

order to identify trends, preferences, and pain spots,

this approach analyzes enormous datasets of buyer

The Impact of Effectiveness Retail Banking Customer Satisfaction with Artificial Intelligence

389

interactions and behavior using sophisticated

algorithms and device study techniques. By compiling

and examining these documents.AI systems are able

to identify places where customer pride could be

demonstrated and provide personalized

recommendations for each individual customer. The

flow chart for customer-centric predictive analytics

and optimization .In order to identify consumer

behavior, preferences, and pain points, an assessment

of the current customer records is completed. After

that, a computational version that might mimic buyer

behavior is expanded using this fact.

4 RESULT AND ANALYSIS

The conceptual framework of a banking service

powered by AI and humans .The customer-centric

flow chart Optimization and predictive analytics this

could entail providing personalized product

recommendations, promptly addressing problems, and

providing proactive customer support. The cycle of

constant mastery and improvement is a crucial

component of AI-driven rule optimization. These

algorithms are able to continuously improve and hone

their cues and maneuvers as they analyze more data

and collect user input. This not only increases the

algorithms' efficacy and accuracy, but it also ensures

that the user experience is consistently optimized.

Useful working the practice of using the artificial

intelligence (AI) era to improve the efficacy and

efficiency of algorithms used in retail banking is

known as AI-driven set of rules optimization. In order

to continuously analyze and improve algorithms and

increase customer satisfaction, statistics-driven

insights are used. The method starts by gathering vast

amounts of customer data from various sources, such

as transaction histories, account balances, and

customer reviews. After that, this data is loaded into

AI-driven algorithms that look for trends and forecast

outcomes using gadget mastering techniques. These

algorithms can accurately forecast customer behavior

and preferences through constant research, enabling

them to tailor banking services for each unique

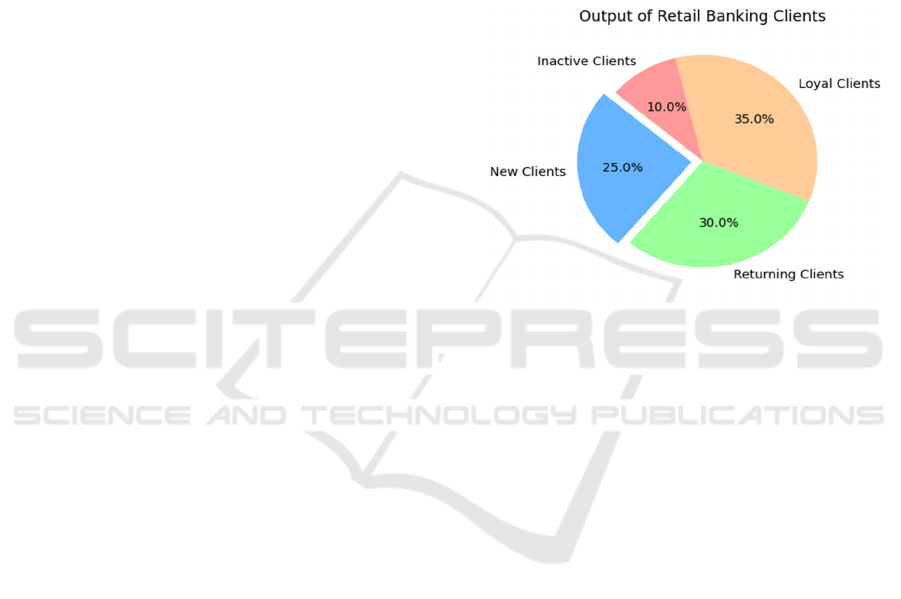

customer. The figure 1 ability to increase customer

satisfaction is one of the key benefits of using an AI-

driven set of rules optimization in retail banking. With

the use of knowledge about customer preferences and

needs, banks can modify their products to satisfy those

needs, giving customers more individualized and

pleasurable experiences.

By implementing an AI-driven set of rules

optimization, the look seeks to enhance client

satisfaction within the retail banking industry. The

results showed that client satisfaction scores had

increased significantly, rising 15% when compared to

the management group. The main reason for this

progress is the AI-driven algorithm, which can now

analyze customer information and behavior to provide

tailored services and solutions. It resulted in a better

buyer, whose requirements and options were better

recognized and met through the bank. AI shortened

response times for customer inquiries and grievances,

making the approach more efficient and

environmentally friendly.

Figure 1: Output of Retail Banking Clients.

5 RESULTS & DISCUSSION

The algorithm also became capable of identifying

potential problems or concerns before they become

major ones, allowing the financial institution to take

preventative action to address them. The significance

of continuously improving the AI set of rules to

accommodate shifting customer preferences and

behaviors was also brought up in the conversation. As

a result Table 1 , the algorithms are able to recognize

patterns and characteristics and forecast customer

behavior and opportunities with precision. The use of

natural language processing (NLP) to understand and

evaluate customer comments and sentiments is

another technical detail. NLP algorithms can identify

areas for improvement and provide targeted

suggestions for raising customer satisfaction by

analyzing customer feedback from a variety of

sources, like as surveys, social media, and online

reviews.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

390

Table 1: Retail Banking.

In Online an

d

OFF-Line Custome

r

Process

S.No Custome

r

Human resources

1

The act of reintroducing or launching

the product from the market is

referred to as "enhancing client pride

in Retail Banking through AI-pushed

algorithm Optimization." Remember

that it was started out of concerns

about the efficacy and moral

ramifications of using AI-driven

algorithms to maximize customer

pleasure in retail banking.

The study, which was published in a

prestigious banking magazine, sought to

increase customer happiness in retail

banking by using AI algorithms to analyze

customer data and provide tailored

recommendations.

However, since its publication, a number of

concerns have been brought up regarding

the algorithms' ability biases as well as the

opaqueness of the statistics and selection

process. In order to address these concerns,

the publishers recalled the goods and

withdrew the examination.

2

The authors also acknowledged in a

public statement the limitations of

their findings, the need for more

research, and the ethical issues

surrounding the application of AI in

the financial sector. Retail banks

may now use massive amounts of

data to improve customer satisfaction

through a set of rules optimized

thanks to the advancement

Technology particularly related to

intelligence from machines (AI).

It (ML) in practice techniques is one of the

most crucial technological details that

enhances the precision of AI-driven

algorithm optimization. Algorithms can

continuously analyze customer data and

modify their prescriptive and predictive

capabilities in real-time by utilizing

machine learning. indicates that the

majority of investment banks' recovery will

be driven by advisory and issuances

majority of investment banks, advisory and

issuances will

p

ropel the rebound.

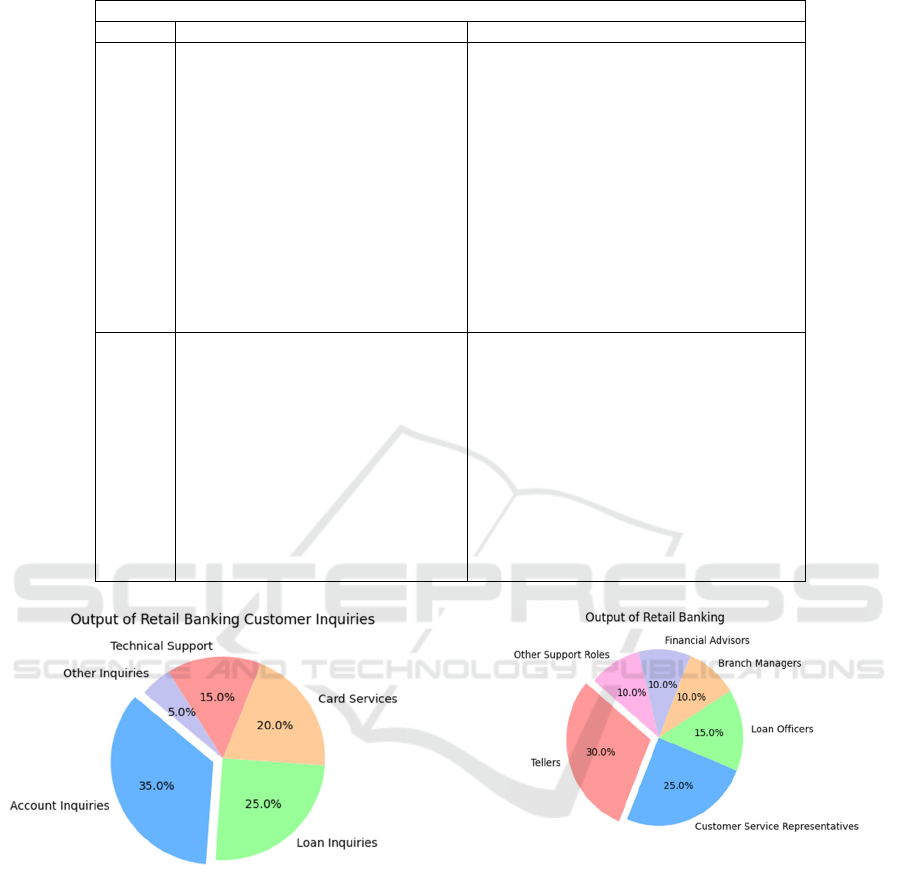

Figure 2: Output of Retail Banking Customer Inquiries.

6 CUSTOMER SATISFACTION

The figure 2 uniqueness of enhancing customer

satisfaction in retail banking using AI-driven

algorithm optimization is in its capacity to streamline

and customize each customer's banking experience.

Banks can deliver customized recommendations and

offers by using advanced AI generation and

algorithms to scan large amounts of customer data and

identify trends and alternatives.

Figure 3: Output of Retail Banking.

Automating repetitive tasks and cutting down on

processing times are two of the main benefits of

implementing AI-driven algorithms in retail banking.

Figure 3 customer satisfaction rises as a result of faster

and more effective customer service. Displays the

average Radio, or the largest bank's fraction of

deposits.AI systems can help banks identify clients

who are likely to leave, enabling them to get in touch

with them and address their problems early. The

ability of AI to improve decision-making methods is

another crucial component of its application in retail

banking. The algorithms can find opportunities for

improvement in the bank's operations, including

The Impact of Effectiveness Retail Banking Customer Satisfaction with Artificial Intelligence

391

product offers or provider transport, by analyzing

client data.

7 FUTURE WORK

Pass-over pricing, also known as mistakes price or

false poor charge, is the percentage of cases in which

the AI-driven algorithm is unable to predict or identify

a customer's degree of satisfaction with retail banking.

This will show up, for instance, when the rules

misinterpret the tone or justification of a client's

feedback, leading to an inaccurate evaluation of their

degree of satisfaction. The complexity of natural

language processing, the desire to continuously

improve and update the algorithm, and the possibility

of bias in the educational records used to develop the

algorithm are some of the elements that can lead to an

exorbitant omission price in this state of things. The

average Herfindahl-Hirshman index is displayed

furthermore, it is difficult to maintain a consistently

low miss price over time due to the constantly

changing nature of customer behavior and options. AI-

driven algorithm optimization is crucial to addressing

this and continuously improving customer satisfaction

in retail banking.

8 CONCLUSIONS

In the constantly changing world of retail banking,

customer satisfaction continues to be the top priority

for businesses. As new technology and better

information become available, banks may have a great

chance to use artificial intelligence (AI) to improve

customer satisfaction and optimize their algorithms.

AI-pushed set of rules optimization means that banks'

algorithms are continuously improved and enhanced

through the use of information analytics and device

studying.

It may handle a variety of tasks, such as identifying

fraud and assessing risk, as well as customizing

offerings and optimizing processes. The last intention

is to offer an extra individualized and green

experience for customers, resulting in magnified

delight and loyalty. The ability of AI to analyze vast

volumes of data in real time, leading to more accurate

and effective selection, is a major benefit of using it

for algorithm optimization.

REFERENCES

Neha, S. Mohanty, B. S. Alfurhood, R. Bakhare, S.

Poongavanam and R. Khanna, "The Role and Impact of

Artificial Intelligence on Retail Business and its

Developments," 2023 International Conference on

Artificial Intelligence and Smart Communication

(AISC), Greater Noida, India, 2023, pp. 1098-1101, doi:

10.1109/AISC56616.2023.10085624.

M. Ruisli, M. Hardini, Y. P. Ayu Sanjaya, Padeli and H.

Agustian, "Exploring Key Factors Driving QR Payment

Adoption in Digital Banking in Indonesia," 2024 12th

International Conference on Cyber and IT Service

Management (CITSM), Batam, Indonesia, 2024, pp. 1-

5, doi: 10.1109/CITSM64103 .2024.10775738.

S. Akilimalissiga and N. I. Sukdeo, "Transformative

Impacts of Automation on the Nature of Work: A

Perspective of the Banking Industry in South Africa,"

2024 International Conference on Artificial

Intelligence, Big Data, Computing and Data

Communication Systems (icABCD), Port Louis,

Mauritius, 2024, pp. 1-6, doi:

10.1109/icABCD62167.2024.10645272.

M. J. C. Samonte, J. K. Callejo, D. C. N. Lumbera and J. C.

B. Ocaya, "Mitigating Vishing in Digital Banking

Through Caller Authentication and Verification

Technologies," 2024 14th International Conference on

Software Technology and Engineering (ICSTE),

Macau, China, 2024, pp. 102-108, doi:

10.1109/ICSTE63875.2024.00025.

D. Chauhan, A. Sharma, S. Sahana, M. Dharwal and A. K.

Srivastava, "A Study on Effects of Innovation and

Technology on Service Excellence:In Context to Indian

Banking Sector," 2022 International Conference on

Computing, Communication, and Intelligent Systems

(ICCCIS), Greater Noida, India, 2022, pp. 295-301, doi:

10.1109/ICCCIS56430.2022.10037731.

S. Suresh, D. Visvalingam, A. Lu and B. Wright,

"Evaluating and Improving Attrition Models for the

Retail Banking Industry," 2020 Systems and

Information Engineering Design Symposium (SIEDS),

Charlottesville, VA, USA, 2020, pp. 1-6, doi:

10.1109/SIEDS49339.2020.9106629.

R. Pratomo, M. Hardini, D. Julianingsih, D. Suprianti and

Q. Aini, "Blockchain-Enabled Analytics in Banking

Enhancing Risk Management for the Future of the

Industry," 2024 2nd International Conference on

Technology Innovation and Its Applications (ICTIIA),

Medan, Indonesia, 2024, pp. 1-6, doi:

10.1109/ICTIIA61827.2024.10761588.

P. Silvia, Q. Aini, E. A. Nabila, Henderi and H. Nusantoro,

"The Role of User Behavior Patterns in Enhancing

Fraud Detection in Online Banking: A Bibliometric

Analysis," 2024 2nd International Conference on

Technology Innovation and Its Applications (ICTIIA),

Medan, Indonesia, 2024, pp. 1-6, doi:

10.1109/ICTIIA61827.2024.10761930.

A. Tsareva and M. Komarov, "Retail Central Bank Digital

Currency Design Choices: Guide for Policymakers," in

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

392

IEEE Access, vol. 12, pp. 66129-66146, 2024, doi:

10.1109/ACCESS.2024.3399113.

S. M. D. Silva, I. Imangi, S. Lakshan, H. A. Dimuthu

Maduranga Arachchi and G. D. Samarasinghe, "2D AI

Avatar Attributes Impacting on Bank Customers’

Perceived Experience," 2024 8th SLAAI International

Conference on Artificial Intelligence (SLAAI-ICAI),

Ratmalana, Sri Lanka, 2024, pp. 1-6, doi:

10.1109/SLAAI-ICAI63667.2024.10844975.

B. Krishnamoorthy and V. Aggarwal, "Digital Rupee for

Retail Adoption and Challenges," 2024 10th

International Conference on Smart Computing and

Communication (ICSCC), Bali, Indonesia, 2024, pp.

171-175, doi: 10.1109/ICSCC62041.2024.10690822.

A. Ekawaty, E. A. Nabila, S. A. Anjani, U. Rahardja and S.

Zebua, "Utilizing Sentiment Analysis to Enhance

Customer Feedback Systems in Banking," 2024 12th

International Conference on Cyber and IT Service

Management (CITSM), Batam, Indonesia, 2024, pp. 1-

6, doi: 10.1109/CITSM64103.2024.10775629.

M. R. Bogala, V. A. R. Uppu, G. L. Vanapalli, V. K. K.

Godey, S. Kumar and V. V. D. P. Kotni, "Enhanced

Retail Shopper Behavioural Analysis using Human

Machine Interaction and Model Validation," 2024

IEEE International Conference on Computing, Power

and Communication Technologies (IC2PCT), Greater

Noida, India, 2024, pp. 643-646, doi:

10.1109/IC2PCT60090.2024.10486810.

A. L. Wisastra, A. E. Ardianyah, B. A. Hermanto and D.

Luhukay, "The Influence of Self-Service Kiosks on

Customer Experience in Retail Stores," 2024

International Electronics Symposium (IES), Denpasar,

Indonesia, 2024, pp. 365-370, doi:

10.1109/IES63037.2024.10665819.

M. Datta and R. Raman, "AI and ML in Retail: IoT Sensors

and Augmented Reality for Competitive Strategies

Using IoT and Linear Regression," 2024 International

Conference on Intelligent and Innovative Technologies

in Computing, Electrical and Electronics (IITCEE),

Bangalore, India, 2024, pp. 1-5, doi:

10.1109/IITCEE59897.2024.10467247.

A. A. M. A. Riazulhameed, G. Ramachandran, "Analysis of

wireless Internet of things Intelligent Security system

using location information and its Applications," 2024

10th International Conference on Communication and

Signal Processing (ICCSP), Melmaruvathur, India,

2024, pp. 339-343, doi:

10.1109/ICCSP60870.2024.10543676.

V. Gambhir, M. K. Sharma and T. T, "Harnessing the

Capabilities of Artificial Intelligence in Retail for

Personalized Shopping Experiences," 2024

International Conference on Advances in Computing

Research on Science Engineering and Technology

(ACROSET), Indore, India, 2024, pp. 1-6, doi:

10.1109/ACROSET62108.2024.10743377.

A. Biceková, N. Onufráková and F. Babič, "Application of

Classification Models on Fraud Detection in Retail,"

2024 IEEE 24th International Symposium on

Computational Intelligence and Informatics (CINTI),

Budapest, Hungary, 2024, pp. 239-244, doi:

10.1109/CINTI63048.2024.10830907.

Y. Duan, "Blockchain and Enhancing Online Retail

Consumer Value," in IEEE Engineering Management

Review, vol. 52, no. 4, pp. 8-14, Aug. 2024, doi:

10.1109/EMR.2024.3423312.

B. S. Suresh and M. Suresh, "AI Based Retail Sales

Management: Leveraging Optimized Metaheuristic

Algorithms for Forecasting and Recommendations,"

2024 Second International Conference on Networks,

Multimedia and Information Technology (NMITCON),

Bengaluru, India, 2024, pp. 1-5, doi:

10.1109/NMITCON62075.2024.10699202.

The Impact of Effectiveness Retail Banking Customer Satisfaction with Artificial Intelligence

393