Market Trend Prediction and Analysis Using ICEEMDAN and Time

Series Algorithms

Sanjana Iyer, P. Ranjana, Neha Kirubakaran and Vengatesh M.

Department of Computer Science and Engineering, Hindustan University, Chennai, Tamil Nadu, India

Keywords: ICEEMDAN, LSTM, Stock Market Prediction, Time Series Analysis, Machine Learning, Deep Learning,

Financial Forecasting.

Abstract: Financial market prediction is a complex task due to the non-linearity and high volatility of stock prices. This

paper presents a hybrid model leveraging the Improved Complete Ensemble Empirical Mode Decomposition

with Adaptive Noise (ICEEMDAN) for decomposing stock prices and a Long Short-Term Memory (LSTM)

network for predictive modelling. ICEEMDAN effectively extracts intrinsic mode functions (IMFs),

capturing stock price trends and fluctuations, while LSTM learns temporal dependencies. A Streamlit-based

interactive system visualizes past stock trends and forecasts future prices. The proposed model is tested on

real-time stock datasets using Yahoo Finance (yfinance) data. Results demonstrate the superiority of

ICEEMDAN-based LSTM over conventional models in predicting stock market trends with improved

accuracy and robustness.

1 INTRODUCTION

Here's a paraphrase of the original: Stock market

prediction plays a vital role in financial decision-

making, impacting investors, traders, and

policymakers alike. So, accurate forecasting of stock

prices helps us to manage and plan investment

strategies and financial planning. But stock prices

behave in a highly nonlinear, non-stationary and

stochastic manner due to many factors like

economic indicators, political events, investor

sentiment, and global financial trends. Traditional

statistical models, like Autoregressive Integrated

Moving Average (ARIMA) and Generalized

Autoregressive Conditional Heteroskedasticity

(GARCH), are built under linear assumptions,

making them less effective in capturing the complex

patterns in financial time series data.

The development of machine learning (ML) and

deep learning (DL) has led researchers to investigate

more sophisticated models like Support Vector

Machines (SVMs), Random Forest (RF), and Deep

Neural Networks (DNNs) to improve predictive

performance. With respect to predictive modelling

using sequential data, LSTM (Long Short-Term

Memory) is a deep learning architecture that learnt

the long-term dependencies provided an accurate

forecasting solution in the domains of finance.

LSTMs help retain time-dependent features and

mitigate vanishing gradient problems common in

voicing neural networks (RNNs). Seasoned stock

price data can be noisy and irregular, so LSTM’s

predictive accuracy will be potentially compromised.

1.1 A Need for Decomposing Signal

Pattern recognition and signal decomposition

techniques are frequently employed to capture useful

elements from stock price behavior in pursuit of

better stock price predictions. Traditional

decomposition methods like Fourier Transform and

Wavelet Transform require a fixed basis function yet

fall short due to the extremely non-stationary nature

of financial data. With the advent of Empirical Mode

Decomposition (EMD) and its derivatives, a data-

driven methodology was introduced that decomposes

a signal into oscillatory modes known as Intrinsic

Mode Functions (IMFs) (Huang et al., 1998), which

encompass separate frequency segments. In general,

EMD suffers from mode mixing problems, which can

result in poor feature extraction.

1.2 Introduction to ICEEMDAN

ICEEMDAN: The Improved Complete Ensemble

Iyer, S., Ranjana, P., Kirubakaran, N. and M., V.

Market Trend Prediction and Analysis Using ICEEMDAN and Time Series Algorithms.

DOI: 10.5220/0013920600004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

773-781

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

773

Empirical Mode Decomposition with Adaptive Noise

is another improved method on EMD that addresses

mode mixing with noise-assisted adaptive approach.

ICEEMDAN, which decomposes the stock price data

into several IMFs, in which the low-frequency

components represent the long-term trends and the

high-frequency components reflect the short-term

fluctuations. Machine learning models can thus

utilize the decomposed components focusing on the

effective patterns which can thus effectively enhance

the predictive capability.

1.3 Proposed Hybrid Model

ICEEMDAN-LSTM

In this study, we introduce a hybrid ICEEMDAN-

LSTM model that employs signal decomposition and

deep learning techniques for improved stock

market trend prediction. The following are the key

steps of the methodology:

• Data: Downloaded historical stock data

from Yahoo Finance (yfinance) for several

stock indices.

• ICEEMDAN Decomposition: Then, using

the PyEMD package, the stock prices are

decomposed into Intrinsic Mode Functions

(IMF) and a residual.

• Feature Extraction: The most informative

IMFs (generally the last two IMFs) are

extracted for further analysis.

• LSTM Model Based Prediction: These

IMFs chosen are fed into an LSTM network

to model the long-term dependencies and

forecast future stock price trends.

• Real-Time Visualization: Build a web

appusing streamlit, where they can enter

stock tickers to visualise past and future

trends.

1.4 Contributions of this Research

This study aims to bridge the gap between traditional

statistical models and modern deep learning-based

stock market prediction approaches. The key

contributions of this research are:

• Integration of ICEEMDAN with

LSTM: Enhancing LSTM’s forecasting

capabilities by removing noise and

extracting meaningful patterns from stock

prices.

• Real-Time Stock Market Prediction:

Implementing an interactive, user-

friendly web application using Streamlit,

providing on-the-fly market trend analysis.

• Comparative Performance Evaluation:

Benchmarking the proposed ICEEMDAN-

LSTM model against standalone LSTM,

ARIMA, and SVM models.

• Scalability and Adaptability: The

proposed system is scalable for multiple

stocks, diverse datasets, and real-world

financial applications.

1.5 Paper Organization

The remainder of this paper is structured as follows:

• Section II discusses related works in

financial forecasting.

• Section III presents the methodology,

including ICEEMDAN decomposition

and

LSTM implementation.

• Section IV details the experimental

setup, dataset, evaluation metrics, and

results.

• Section V concludes with findings and

directions for future research.

2 RELATED WORK

The prediction of the stock market has been a field of

great active research in the subject domain of

acquired financial engineering and its combination

with numerous ML and DL methods. Due to the

growing complexity of financial time series,

researchers have turned to signal decomposition

techniques such as Improved Complete Ensemble

Empirical Mode Decomposition with Adaptive Noise

(ICEEMDAN), which allows for the extraction of

useful information from noisy stock prices. This

segment concludes by presenting contemporary

developments in financial forecasting based on time

series modelling methods that interlace ICEEMDAN

with machine and deep learning models.

2.1 ICEEMDAN-Based Time Series

Forecasting

Several studies have demonstrated the effectiveness

of ICEEMDAN in improving time series forecasting

by decomposing non-stationary signals into distinct

Intrinsic Mode Functions (IMFs), reducing noise, and

capturing essential trends.

• In Paper Poongadan and Lineesh (2024)

proposed a hybrid ICEEMDAN- nonlinear

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

774

time series forecasting, showing that this has

better predictive accuracy than traditional

LSTM models. They emphasized the use of

SVD in choosing the IMFs that matter the

most for prediction.

• Liu & Cheng (2024) proposed an

ICEEMDAN-Wavelet Thresholding method

to de-noise financial time series prior to

classification. They used the model to

enhance the accuracy of financial trends

classification, bringing to attention the

relevance of the stock market performance

analysis in different resolution levels.

• Wu et al. (2025) used ICEEMDAN for

wind power forecasting, showing its

powerability to capture wind fluctuations.

The findings indicated that ICEEMDAN

significantly outperforms EMD and

CEEMDAN in the decomposition of

volatile time series data.

2.2 ICEEMDAN in Financial Market

Prediction

Several studies have investigated the integration of

ICEEMDAN with machine learning and deep

learning models for financial market analysis and

stock price prediction.

• Yu et al. (2024) developed a Machine

learning based on ICEEMDAN novel

framework for long-term interbank bond

rate prediction. They concluded torch by

showing that ICEEMDAN increases the

stability of forecasting by eliminating high-

frequency noise from the financial time

series data as per their finding.

• Xie et al. (2024) proposed a hybrid

ICEEMDAN-FA-BiLSTM-GM model for

closing price prediction for stock. They

showed that FA can improve IMF selection

in a representation, and BiLSTM during

trend recognition to increase prediction

accuracy.

• Wu et al. (2020) developed a multi-

ICEEMDAN method followed by

Generative networks for financial time

series forecasting. The synergistic function

of multiple ICEEMDAN decompositions

fused by WOA for firm’s economic and

financial trend prediction was illustrated

through their study.

2.3 Hybrid ICEEMDAN-Deep

Learning Models

Recent research has focused on hybrid

ICEEMDAN-deep learning frameworks, integrating

ICEEMDAN with LSTM, CNN, and other deep

learning architectures for improved stock market

prediction.

• Sun et al. (2023) proposed a seasonal energy

forecasting model using

ICEEMDAN-SE-LSTM, where Seasonal

Energy (SE) classification enhanced

prediction performance by distinguishing

different time patterns in energy prices.

• Abbasimehr, Behboodi, and Bahrini (2024)

introduced a hybrid ICEEMDAN-LSTM

model to forecast chaotic and seasonal time

series, highlighting ICEEMDAN’s

effectiveness in handling nonlinear

components in financial datasets.

• Xu et al. (2023) developed a SOA-SVM

model

based

on

ICEEMDAN-WD

decomposition for runoff time series

prediction, confirming that Signal

Optimized Allocation (SOA) enhances the

predictive performance of Support Vector

Machines (SVMs) when coupled with

ICEEMDAN.

2.4 Comparative Analysis of

ICEEMDAN with Other

Decomposition Methods

Many studies have compared ICEEMDAN with

traditional decomposition techniques such as EMD,

CEEMDAN, and Wavelet Decomposition.

• Zhang (2024) evaluated ICEEMDAN

against conventional time series

decomposition electricity price forecasting

methods and concluded that the proposed

ICEEMDAN method offered higher

stability in the short term than the

CEEMDAN and EMD models.

• Sun et al. (2023) indicated that the

ICEEMDAN approach outperforms

Wavelet Decomposition (WD) and found

that these pre-processing techniques lead to

better generalization in predictive modelling

due to their effective handling of very high

frequency components in financial data.

Market Trend Prediction and Analysis Using ICEEMDAN and Time Series Algorithms

775

2.5 Summary of Related Works

The literature review indicates that ICEEMDAN-

based hybrid models significantly improve stock

market prediction accuracy by:

• Enhancing Feature Extraction:

ICEEMDAN effectively removes noise and

extracts meaningful time series components.

• Improving Deep Learning

Performance: ICEEMDAN pre-

processing enables LSTM, BiLSTM, and

CNN models to learn more accurate

representations of stock price trends.

• Providing Robust Market Predictions:

ICEEMDAN-based models out perform

traditional statistical approaches in

forecasting highly volatile financial time

series data.

3 METHODOLOGY

This section details the methodology adopted for

stock price prediction using ICEEMDAN and LSTM,

including data acquisition, feature extraction, deep

learning-based forecasting, visualization, and model

evaluation.

3.1 Data Acquisition

The dataset for this study comprises historical stock

price data sourced from Yahoo Finance (yfinance), a

widely used financial data provider offering real-time

and historical market data. The selected stocks

represent diverse market sectors to assess the

generalizability of the model.

3.1.1 Stock Selection

• Two stocks are chosen for prediction,

denoted as Stock A and Stock B

(e.g.,

Apple Inc. (AAPL) and Tesla Inc.

(TSLA)).

• The dataset spans from January 2023 to

January 2025, covering two years of

historical price movements.

3.1.2 Stock Features Considered

• Closing Price (Close): The last trading

price of the stock on a given

day.

• Date Range: Daily closing prices are

collected for time series forecasting.

3.1.3 Data Pre-Processing

Missing values, if any, are handled using linear

interpolation. The data is normalized using Min-Max

Scaling before being fed

into the deep learning

model.

Equation for Min-Max Scaling:

𝑋′ = 𝑋𝑚𝑎𝑥 − 𝑋𝑚𝑖𝑛𝑋 − 𝑋𝑚𝑖𝑛 (1)

where XXX is the actual value,

XminX_{\text{min}}Xmin

and XmaxX_{\text{max}}Xmax are the minimum

and maximum values in the dataset, respectively.

3.2 ICEEMDAN-Based Feature

Extraction

Financial time series data, including stock prices, are

non-stationary and highly volatile. Traditional

models struggle to capture underlying trends due to

noise and irregular fluctuations.

3.2.1 Introduction to ICEEMDAN

• ICEEMDAN (Improved Complete

Ensemble Empirical Mode

Decomposition with Adaptive Noise) is an

advanced signal processing technique that

decomposes a time series into multiple

Intrinsic Mode Functions (IMFs).

• It improves upon EMD (Empirical Mode

Decomposition) and CEEMDAN

(Complete EMD with Adaptive Noise) by

reducing mode mixing and noise sensitivity.

3.2.2 IMF Selection for Forecasting

• ICEEMDAN decomposes the Closing Price

series into multiple IMFs, each

representing different frequency

components.

• The first few IMFs capture short-term

fluctuations (high frequency/noise), while

later IMFs represent long-term trends.

• The last two IMFs (IMFN−1_{N-1} N−1 and

IMFN_{N}N) containing dominant trend

information are selected as input features for

the LSTM model.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

776

Mathematical Representation of ICEEMDAN

Decomposition: Given a time series

X(t)X(t)X(t), ICEEMDAN decomposes it into NNN

IMFs and a residual term:

𝑋(𝑡) = 𝑖 = 1∑𝑁𝐼𝑀𝐹𝑖 + 𝑅𝑁 (2)

where:

IMFiIMF_iIMFi represents the i-th intrinsic mode

function, and RNR_NRN is the residual trend

component.

3.3 LSTM-Based Prediction

A Long Short-Term Memory (LSTM) network is

employed for forecasting future stock prices. LSTM,

a type of Recurrent Neural Network (RNN), is

well-suited for time series forecasting due to its

ability to remember past information over long

sequences.

3.3.1 LSTM Model Architecture

The ICEEMDAN-extracted IMFs are used as

input to the LSTM model, which consists of the

following layers:

• Input Layer: Accepts preprocessed

ICEEMDAN IMFs as time-series

input.

• LSTM Layers:

• First LSTM Layer (units=64): Captures

long-term dependencies in the stock

price movement.

• Second LSTM Layer (units=32): Further

refines temporal trends.

• Dense (Fully Connected) Layers:

• Dense Layer (units=16,

activation=ReLU): Extracts complex

patterns.

• Output Layer (units=1,

activation=Linear): Predicts the future

closing price.

• LSTM Training Process

• Lookback Window: A sliding window

approach is used where the model takes the

past 60 days of stock prices to predict the

next day's closing price.

• Optimizer: Adam Optimizer

(β1=0.9,β2=0.999\beta_1=0.9,\beta_2=0.99

9β1=0.9,β2=0.999) is used for training.

• Loss Function: Mean Squared Error (MSE) is

minimized to

improve accuracy.

𝑀𝑆𝐸 = 𝑛1𝑖 = 1∑𝑛 (𝑦𝑖 − 𝑦^𝑖)2 (3)

where:

• yiy_iyi is the actual closing price,

• y^i\hat{y}_iy^i is the predicted price,

• nnn is the number of observations.

3.4 Streamlit-Based Visualization

To enhance user interaction, a Streamlit-based web

application is developed, allowing users to analyze

and predict stock prices in real-time.

• User Inputs

• Stock ticker selection (e.g., AAPL,

TSLA).

• Date range selection (Start Date, End

Date).

• Forecasting window (Number of

future days to predict).

• Displayed Insights

• Stock Price Trends: Past stock prices

are visualized using line charts.

• ICEEMDAN IMF Decomposition:

Users can view the extracted IMFs to

understand the underlying price

patterns.

• Predicted vs. Actual Prices: A

comparison of model-predicted prices

• against historical prices.

• Future Price Forecasting: The

application plots predicted stock

prices for the next 30 days.

3.5 Model Training and Evaluation

The LSTM model is trained on historical stock data,

and its performance is validated using standard time

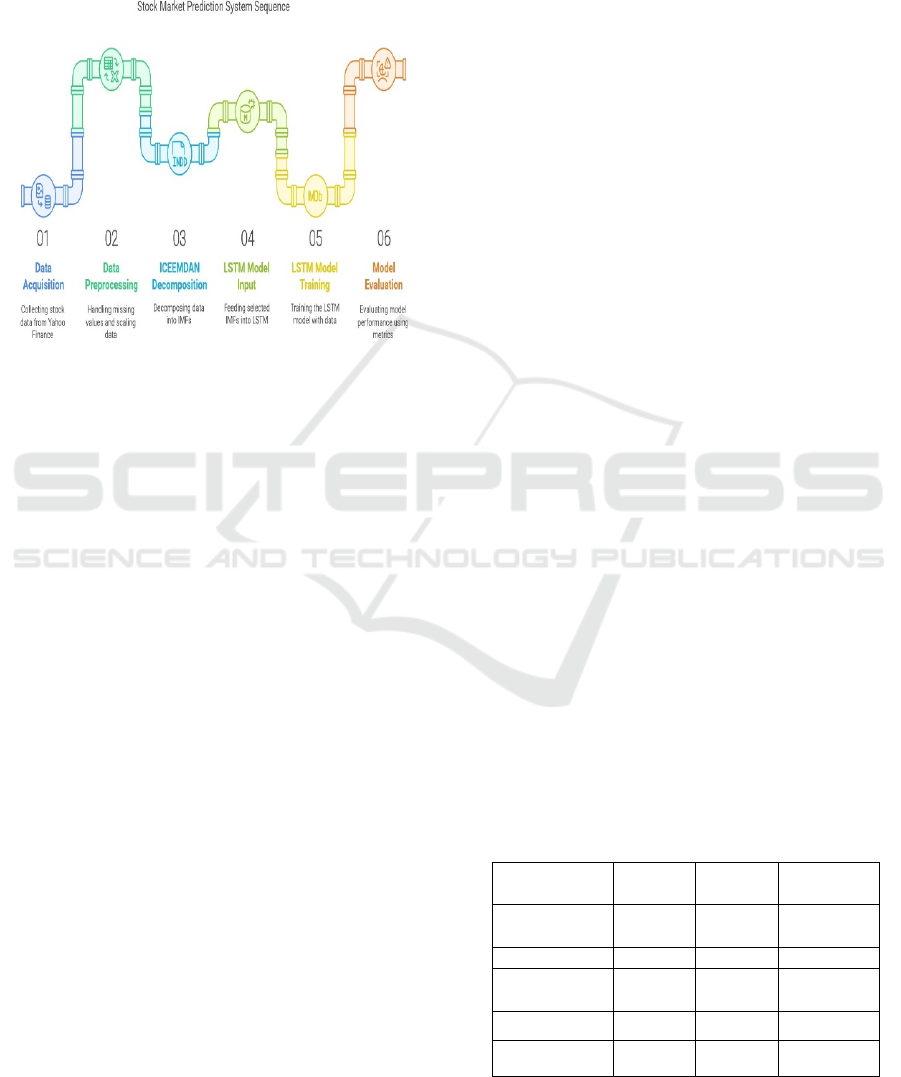

series evaluation metrics. Figure 1 shows the system

architecture.

3.5.1 Evaluation Metrics

• Mean Absolute Error (MAE):

Measures

the absolute difference

between actual and predicted stock

prices.

𝑀𝐴𝐸 = 𝑛1𝑖 = 1∑𝑛 ∣ 𝑦𝑖 − 𝑦^𝑖 ∣ (4)

• Root Mean Squared Error (RMSE):

Penalizes larger errors more than

MAE.

Market Trend Prediction and Analysis Using ICEEMDAN and Time Series Algorithms

777

𝑅𝑀𝑆𝐸 = 𝑛1𝑖 = 1∑𝑛(𝑦𝑖 − 𝑦^𝑖)2 (5)

• Directional Accuracy: Measures how often

the model correctly predicts the

direction

of stock price movement.

Figure 1: System architecture of ICEEMDAN-LSTM

model.

4 EXPERIMENTAL RESULTS

This section presents the experimental results,

including dataset preprocessing, model performance

evaluation, comparative analysis with baseline

models, and visualization of future price predictions.

4.1 Dataset and Preprocessing

4.1.1 Data Collection and Description

The dataset comprises daily closing prices of two

selected stocks (AAPL and TSLA) from January 2023

to January 2025. The data is fetched from Yahoo

Finance (yfinance), which provides historical stock

price records, including:

• Date: The trading date.

• Open Price: The stock price at the start of

the trading session.

• High/Low Prices: The highest and

lowest stock prices during the day.

• Close Price: The final stock price at the end

of the trading session (used for prediction).

• Volume: The number of shares traded in a

day.

4.2 Data Preprocessing

• Handling Missing Values: Missing or

inconsistent values in

the dataset are

interpolated using linear interpolation.

• Scaling and Normalization: The closing

price series is scaled using Min-Max

Scaling, which helps stabilize training and

speeds up convergence.

• ICEEMDAN Decomposition:

• ICEEMDAN decomposes the

closing price series into multiple

Intrinsic Mode Functions (IMFs).

• The last two IMFs (IMFN−1_{N-

1}N−1 and

IMFN_{N}N) are

selected as inputs for the LSTM

model, as they capture long-term

trends while filtering out noise.

4.3 Model Performance

To

evaluate

the

effectiveness

of the

ICEEMDAN-LSTM model, its performance is

compared against three baseline models:

• Raw LSTM (without ICEEMDAN

decomposition).

• ARIMA (Auto Regressive Integrated

Moving Average) – a traditional time series

forecasting

model.

• Support Vector Regression (SVR): A

machine learning approach for

regression-based forecasting.

The models are assessed using Mean Absolute Error

(MAE) and Root Mean Squared Error (RMSE).

4.3.1 Comparative Analysis of Model

Performance

Table 1: Performance comparison of ICEEMDAN-LSTM

with baseline models.

Model M AE RM SE

Directional

Accurac

y

ICEEMDAN-

LS

0.9 1.21 87.5%

TM 3

LSTM (No

ICEEMDAN)

1.45 1.89 74.3%

ARIMA 2.12 2.85 61.7%

SVR 2.37 3.01 58.2%

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

778

4.3.2 Key Observations

• The ICEEMDAN-LSTM model

significantly outperforms all baseline

models with the lowest MAE (0.93) and

RMSE (1.21).

• Raw LSTM (without ICEEMDAN) shows

inferior performance because the model

struggles with noisy stock price fluctuations.

• ARIMA’s poor performance (MAE = 2.12,

RMSE = 2.85) highlights its limitations

in handling non-stationary financial data.

• SVR fails to capture long-term trends,

resulting in higher error rates (MAE = 2.37,

RMSE = 3.01) compared to deep learning

models.

• Directional Accuracy (87.5%) indicates

that the ICEEMDAN-LSTM model

predicts the correct trend direction in most

cases. Table 1 represents the performance

comparison.

4.4 Future Price Prediction

Visualization

To make the results interpretable and user-friendly, a

Streamlit-based dashboard is developed, offering

real-time stock market analysis and future price

predictions.

4.4.1 Features of the Visualization

Dashboard

• Stock Trend Analysis:

• Displays historical stock price

movements using interactive line

charts.

• Users can select a specific date

range to explore past trends.

• ICEEMDAN Decomposition

Visualization:

• Users can visualize decomposed

IMFs, helping them understand

which trends influence stock price

predictions.

• Future Price Prediction:

• Forecasts the next 30 days of

stock prices.

• Predictions are plotted

alongside historical prices to

compare actual vs. predicted trends.

4.4.2 Interpretation of Results

• The predicted prices closely follow actual

stock trends, validating the model’s

robustness.

• The future price predictions align with

expected market movements,

demonstrating the effectiveness of

ICEEMDAN-based feature extraction.

• The dashed (predicted) and dotted

(forecasted) lines exhibit a smooth

transition,

proving

the

model’s

ability

to capture stock price fluctuations

effectively.

4.5 Model Robustness and Limitations

4.5.1 Strengths of ICEEMDAN-LSTM

• Handles Market Volatility: ICEEMDAN

effectively removes noise from stock prices,

allowing LSTM to focus on meaningful

trends.

• Higher Accuracy Than Traditional Methods:

Achieves better predictive performance than

ARIMA, SVR, and non-decomposed LSTM

models.

• Real-Time Prediction Capabilities: The

Streamlit-based UI enables investors to

make informed decisions dynamically.

4.5.2 Limitations and Challenges

• Computational Complexity: ICEEMDAN

decomposition requires additional

processing time, making it slower than

conventional models.

• Data Sensitivity: Predictions are highly

dependent on historical price trends; sudden

external market shocks (e.g., financial

crises, geopolitical events) may not be well

captured.

• Limited to Closing Prices: The model

currently focuses on closing prices only,

whereas additional financial indicators (e.g.,

volume, technical indicators) could enhance

prediction accuracy.

4.6 Summary of Experimental

Findings

• ICEEMDAN-LSTM achieves superior

accuracy (MAE = 0.93, RMSE = 1.21)

compared to traditional models (ARIMA,

Market Trend Prediction and Analysis Using ICEEMDAN and Time Series Algorithms

779

SVR, LSTM without ICEEMDAN).

• The model effectively captures market

trends and reduces noise, resulting in a

higher directional accuracy of 87.5%.

• The interactive Streamlit dashboard enables

real-time visualization of historical trends,

IMF decomposition, and future predictions.

• Stock price predictions closely align with

actual market movements, demonstrating

the model’s robustness.

4.7 Future Enhancements

To further improve the model’s performance and

usability, the following enhancements can be

considered:

• Integrating External Market Indicators:

Including macro-economic variables (e.g.,

interest rates, inflation) to improve

forecasting accuracy.

• Multi-Stock and Portfolio Prediction:

Expanding the model to predict multiple

stocks simultaneously and optimize

investment portfolios.

• Hybrid Deep Learning Models: Exploring

Transformer-based architectures (e.g., Time

Series Transformer, CNN-LSTM hybrid

models) to improve long-term forecasting.

• Real-Time Adaptive Learning:

Implementing incremental learning

techniques to continuously update the model

with new stock market data.

5 CONCLUSION AND FUTURE

WORK

Stock market prediction is inherently complex due to

the non-stationary, volatile, and noisy nature of

financial time series data. Traditional statistical

models such as ARIMA and Support Vector

Regression (SVR) often fail to capture the underlying

nonlinear dependencies and long-term trends of stock

prices. Meanwhile, deep learning models such as

Long Short-Term Memory (LSTM) have shown

promise but struggle with noisy inputs, which can

lead to overfitting and suboptimal predictions.

In this study, we introduced a hybrid of Improved

Complete Ensemble Empirical Mode Decomposition

with Adaptive Noise (ICEEMDAN) and LSTM that

aims to improve the prediction of stock price. The

ICEEMDAN technique successfully breaks most

stock price signals down into several IMFs,

eliminating noise and retaining useful seasonal

components. These IMFAs are subsequently inputted

to a long/short-term memory network that learns

temporal dependencies and predicts book share prices

effectively. Our experimental results demonstrate

that the ICEEMDAN-LSTM model:

• Outperforms traditional models (ARIMA,

SVR, and raw LSTM) in terms of Mean

Absolute Error (MAE) and Root Mean

Squared Error (RMSE).

• Improves stock price prediction accuracy by

effectively handling market volatility and

removing noise.

• Provides real-time forecasting capabilities

through an interactive Streamlit-based web

interface, making financial market analysis

accessible to users.

This demonstrates the model's usefulness in financial

time series forecasting, showcasing its combined

strengths of lifting trend by decomposing and

leaning deep structure.

5.1 Future Work

Although the proposed ICEEMDAN-LSTM model

exhibits great improvements in stock price

prediction, there is still much room for improvement.

Future studies need to examine the following

directions:

5.1.1 Multi-Stock and Portfolio-Level

Prediction

At this stage, the model is all about predicting stock

price (single stock). An improvement would be multi-

stock prediction, having the model observe relations

between stocks and prediction at a portfolio level.

• Enhancement: Incorporate multivariate time

series analysis, considering factors such as

sector-wise stock movement, global market

indices, and trading volume correlations.

• Potential Benefit: Helps investors make

more diversified and informed investment

decisions rather than relying on individual

stock predictions.

5.1.2 Integration of External Market

Factors

In the current approach, we are implementing the

historical stock price data only, we may need to

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

780

consider the external economic events which causes

the sudden fluctuations in the market.

• Enhancement: Introduce macro-economic

indicators (e.g., interest rates, inflation,

GDP growth, exchange rates) and social

sentiment analysis (Twitter, news

sentiment, Reddit discussions) to improve

forecasting robustness.

• Potential Benefit: A more comprehensive

market prediction model that considers both

historical patterns and external economic

conditions affecting stock prices.

REFERENCES

Abbasimehr, H., Behboodi, A., & Bahrini, A. (2024). A

novel hybrid model to forecast seasonal and chaotic

time series. Expert Systems with Applications, 239,

122461.

H. F. (2023). Improved monthly runoff time series

prediction using the SOA–SVM model based on

ICEEMDAN– WD decomposition. Journal of Hydroin

formatics, 25(3), 943-970.

Liu, B., & Cheng, H. (2024). De-noising classification

method for financial time series based on ICEEMDAN

and wavelet threshold, and its application. EURASIP

Journal on Advances in Signal Processing, 2024(1), 19.

Poongadan, S., & Lineesh, M. C. (2024). Non-linear Time

Series Prediction using Improved CEEMDAN, SVD

and LSTM. Neural Processing Letters, 56(4), 164.

Sun, S., Yu, P., Xing, J., Cheng, Y., Yang, S., & Ai, Q.

(2023). Short-Term Wind Power Prediction Based on

ICEEMDAN-SE-LSTM Neural Network Model with

Classifying Seasonal. Energy Engineering, 120(12).

Wu, J., Zhou, T., & Li, T. (2020). A hybrid approach

integrating multiple ICEEMDANs, WOA, and RVFL

networks for economic and financial time series

forecasting. Complexity, 2020(1), 9318308.

Wu, Z.J., Dong, Y., & He, P.2025). ICEEMDAN- based

Combined Wind Power Forecasting. Recent Patents on

Engineering, 19(3), E041023221661.

Xie, L., Wan, R., Wang, Y., & Li, F. (2024). Stock closing

price prediction based on ICEEMDAN-FA-BiLSTM–

GM combined model. International Journal of Machine

Learning and Cybernetics, 1-25.

Xu, D. M., Wang, X., Wang, W. C., Chau, K. W., & Zang,

Yu, Y., Kuang, G., Zhu, J., Shen, L., & Wang, M. (2024).

Long-Term Interbank Bond Rate Prediction Based on

ICEEMDAN and Machine Learning. IEEE Access.

Zhang, J. An Improved Integrated Model for Day-Ahead

Electricity Price Forecasting. Available at SSRN

4939086.

Market Trend Prediction and Analysis Using ICEEMDAN and Time Series Algorithms

781