Integrating Diverse Analytical Models for Enhanced Fraud

Prevention in Collaborative E‑Commerce Transactions

Neeli Sritha Rayal, Guduru Sreeja Reddy, Kamsali Lasya,

Gorle Sai Sree Varshini and Kota Lakshmi Prasana

Department of Computer Science and Engineering, Ravindra College of Engineering for Women, Kurnool 518002, Andhra

Pradesh, India

Keywords: B2C e‑Commerce, Support Vector Machine (SVM), Fraudulent Transactions, e‑Commerce Platforms,

Python, Django‑ORM, Html, CSS, JavaScript. MySQL (WAMP Server).

Abstract: Traditional e-commerce transaction security systems have been designed to prevent and detect fraudulent

transactions. Arresting the attackers only with the historical order information is difficult since e-commerce

is hidden. There are many studies that aim to build technologies to prevent fraud, but they lack multi-angle

perspectives on user behavioural evolution. Consequently, fraud detection is not very effective. To do so, this

paper proposes a novel process-mining- and machine-learning-based model for user behaviour in real-time

and its application in fraud detection. The user behaviour detection is the basis model on the B2C e-commerce

platform. Second, an approach to identifying anomalies to derive meaningful aspects from event logs is

proposed. The extracted features are then fed into a Support Vector Machine (SVM)-based classification

model that identifies fraudulent activity. Through these experiments, we demonstrate the effectiveness of our

proposed approach at capturing dynamic fraudulent behaviours in an e-commerce system.

1 INTRODUCTION

In recent years, new security threats have surfaced,

despite the fact that the expansion of modern

technologies and the growth of e-commerce present

better opportunities for online businesses. According

to reports, the substantial rise in online fraud cases

costs billions of dollars annually on a global scale.

Anti-fraud systems are now essential to ensuring the

security of online transactions due to the Internet's

dynamic and dispersed nature. When addressing new

security threats, vulnerabilities are still identified by

current fraud detection systems that concentrate on

identifying unusual user behavior. The ineffective

process management of current fraud detection

systems during the trading process is a significant

problem.

The monitoring function is one of the main

problems that needs attention. Because process

capture is missing from present work, the detection

viewpoint is usually poor. To accomplish this, we

propose a process perspective where historical big

data is transformed into controllable data, and the

process of user action is captured and scrutinized in

real time. In addition, we combine a multi-

perspective detection framework for detecting

anomalous behaviours.

To overcome the limitations of the current

procedure, this study proposes an innovative hybrid

solution for anomaly detection on data flows based

on all events in a control flow that incorporates both

process mining and machine learning model benefits.

By analysing a model of an e-commerce system

business process, this approach tries to dynamically

detect changes in the users' behaviour, processes in

the transaction, and noncompliance case. It can also

analyse and detect fraudulent transactions from

multiple dimensions.

2 EXISTING SYSTEM

The machine-learning-based techniques identify

potentially risky offline or online transactions by

classifying or predicting future observations based on

previously acquired historical data. A comparison of

machine-learning algorithm-based credit card fraud

detection techniques was carried out by Xuetong Niu

Rayal, N. S., Reddy, G. S., Lasya, K., Varshini, G. S. S. and Prasana, K. L.

Integrating Diverse Analytical Models for Enhanced Fraud Prevention in Collaborative E-Commerce Transactions.

DOI: 10.5220/0013919200004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

697-702

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

697

et al. On the dataset of credit card transactions, the

majority of machine-learning models exhibit good

performance. Furthermore, after further pre-

processing, like eliminating outliers, supervised

models outperform unsupervised models by a small

margin.

The concept of identifying particular abnormal

user behaviors to detect fraud is the basis for the

widespread application layer deployment of credit

card fraud detection. Because of its greater accuracy

and coverage, the supervised learning algorithm is the

most widely used learning technique in online fraud

monitoring transactions. Recent studies have

demonstrated the effectiveness of the machine

learning approach in identifying fraudulent credit

card transactions.

2.1 Drawbacks

1) Fraud mode one: A malicious actor modifies an

order: The malicious actor may trick the victim

merchant by posing as the cashier server and sending

a phony formal payment order, order F A. By altering

the order details, including the total amount, the

malicious actor was able to obtain the order items that

do not match the payment value.

2) The mode of fraud Second, the order is

subcontracted: The victim pays the malicious actor's

order rather than his own. The bad actors pose as

buyers and sellers in order to accomplish their

objectives. Before and after the payment, the order

details are updated.

3 PROPOSED SYSTEM

The suggested system introduces a hybrid approach

to anomaly detection in data flows, which gives

details about every action embedded in a control flow

model, combining the benefits of process mining and

machine learning models. By simulating and

examining the business process of the e-commerce

system, this approach can thoroughly examine and

identify fraudulent transactions from a variety of

angles, as well as dynamically detect changes in user

behaviors, transaction processes, and noncompliance

situations. The following is a list of this paper's

significant contributions:

1) To identify the anomalies in e-commerce

transactions, a conformance checking technique

based on process mining is used.

2) To carry out thorough anomaly detection based on

Petri nets, a user behavior detection technique is

suggested.

3) To automatically classify fraudulent behaviors, an

SVM model is created by integrating multi-

perspective process mining into machine learning

techniques.

3.1 Advantages

The event log and the DPN are compared and

analyzed using the plug-in Multi-Perspective Process

Explorer and Conformance Checking to produce a

more lucid outcome. This system displays the

outcome, with various colors denoting each action.

For example, purple indicates a move on the model

only, grey indicates invisible actions, or skipped

actions, and green indicates a move on both the model

and the log. We can get the information that matches

the model and the event log in the dataflow of each

action by clicking on it. A mismatch is indicated by

the red-marked data. We identify these questionable

anomalies and utilize them as the foundation for

further machine learning model training.

4 PRELIMINARY

INVESTIGATION

The primary approach to project development begins

with the idea of creating a mail-enabled platform for

a small business that makes sending and receiving

messages simple and convenient. It includes an

address book, search engine, and some fun games.

The first activity, or preliminary investigation, starts

after it has been approved by the organization and our

project guide.

There are three components to the activity:

• Request Clarification

• Feasibility Study

• Request Approval

4.1 Request Clarification

Once the project request has passed through an

investigation and has been granted approval by the

organization and project guide, the next step is to

analyse the project request to determine exactly what

the system requires. Thus, our project is primarily

meant for those users of the company whose systems

can be connected by LAN. These days, with men

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

698

constantly on the go, everything should be ready-

made. Hence, its-development of the corresponding

portal was based on the existing wide usage of the

internet in daily life.

4.2 Request Approval

Not every project that is asked for is good or feasible.

Some organizations receive excessive project

requests by client users that make only a small

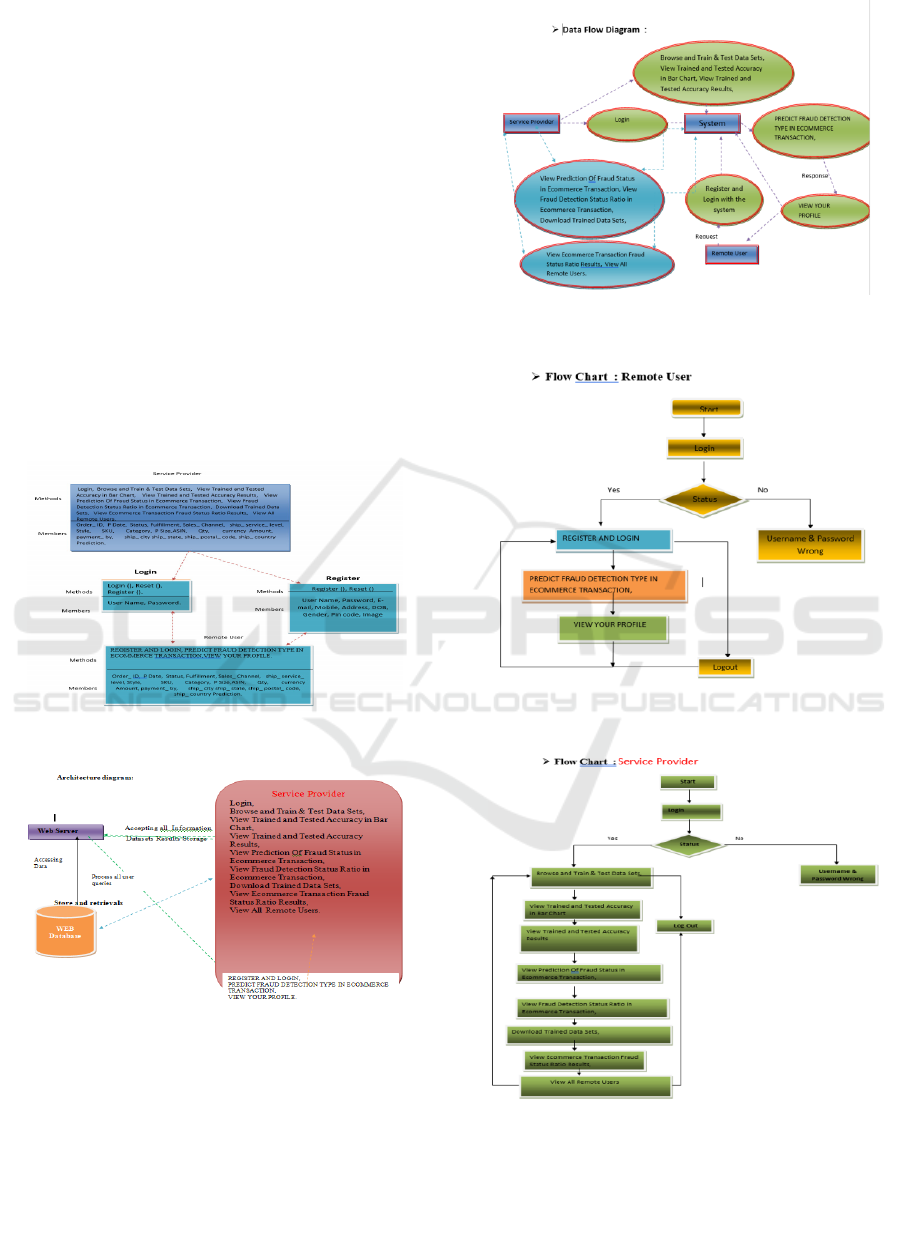

percent that are acted on. Figure 2 shows the service

provided. Such desirable and feasible projects,

however, should be scheduled. When you approve a

project request, you estimate its cost, priority,

completion time and staffing needs; that information

is then used to determine where the project request

should fall on any project lists. In reality,

development work can consider to begin after

obtaining approval of the above listed factors. Figure

1 shows the Architecture diagram.

Figure 1: Architecture diagram.

Figure 2: Service provided.

Figure 3: Data flow diagram.

Figure 4: Remote user.

Figure 5: Service provider.

Figure 3 show the Data flow diagram which the below

Figure 4 shows the Remote user and the Figure 5

illustrate the Service provider for the Request

Approval.

Integrating Diverse Analytical Models for Enhanced Fraud Prevention in Collaborative E-Commerce Transactions

699

5 IMPLEMENTATION

METHODOLOGY

5.1 Service Provider

The Service Provider must log in to this module

using a working user name and password. After

successfully logging in, he can do various activities

such as browsing and training and testing data sets.

View Results of Trained & Tested Accuracy, View

Trained & Tested Accuracy in Bar Chart, View the

Fraud Detection Status Ratio in E-Commerce

Transactions, View the Fraud prediction of Fraud

Status in E-Commerce Transactions, Get Trained

Data Sets Here E-Commerce Transactions + All

Remote Users: Fraud Status Ratio Results

5.2 View and Authorize Users

This module allows the administrator to view a list

of all registered users. There, the admin can view user

details, such as name, email, and address, and also is

able to assign users permission.

5.3 Remote User

This module consists of n present users. The user

must register before conducting any operation. The

data of the user would be stored in the database after

registration. After a successful registration, he is to

login using his password and authenticated user

name. No after successful login user will able to

REGISTER AND LOGIN, PREDICT FRAUD

DETECTION TYPE IN ECOMMERCE

TRANSACTION, VIEW YOUR PROFILE.

6 PYTHONS

Python is a high-level, interpreted, interactive and

object-oriented scripting language. Python was

designed to be readable. It has fewer syntactical

constructions than other languages, and often uses

English words as keywords while other languages

use punctuation.

• Python is Interpreted: Python is processed

at runtime by the interpreter. You do not

need to compile your program before you

can run it. Similar to PHP and PERL.

You are like Interactive Python: You could sit in

front of a Python prompt and work straight though

interpreter making your programs.

• Python is OOP: Python is defined as an

object-oriented programming, which allows

to encapsulate code into objects. Python is

Great.

7 RESULTS

Figure 6: Run project software.

Figure 7: Open dashboard.

Figure 8: Login registration form.

Figure 6 shows the run project software and Figure 7

shows the open dashboard.

Figure 8 illustrate the

Login registration form.

Figure 9 shows the view

profile details.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

700

Figure 9: View profile details.

Figure 10: Datasets in CSV format.

Figure 11: Enter datasets.

Figure 12: View result analysis.

Figure 13: View predicted fraud transaction type.

Figure 14: Fraud detection ratio in economics transaction

details.

Figure 10 shows the datasets in CSV format and

Figure 11 shows the enter datasets. Figure 12 and 13

shows the view result analysis and view predicted

fraud transaction type.

Figure 14 illustrate the Fraud

detection ratio in Economics Transaction details.

8 CONCLUSIONS

In this study, a hybrid approach is proposed through

employing formal process modelling, along with

dynamic user behaviour to capture fraudulent

transactions. We also examined the e-commerce

transaction process based on five perspectives that we

established: the control flow, the resource, the time,

the data, and user behaviour patterns. In this study, a

support vector machine (SVM) model was built to

carry out fraud transaction detection, while high-level

Petri nets were employed as a basis for process

modelling to observe abnormalities in user

behaviours. The robust testing that retrained by

ourselves in against that the proposed method is able

to accurately detect fraud in the transactions and

actions. A: The multi-perspective detection method

we proposed summed up better than the single-

perspective detection method. In future work, we will

use model checking techniques and similar deep

learning within our proposed framework to enhance

the precision. Also extending the behaviour patterns

Integrating Diverse Analytical Models for Enhanced Fraud Prevention in Collaborative E-Commerce Transactions

701

with more time features will be needed in the future

for improving the accuracy of risk identification.

Furthermore, coordinate the model, apply the

proposed methodology to more areas of malicious

behaviour, and study the construction of a standard

REFERENCES

A. Abdallah, M. A. Maarof, and A. Zainal, “Fraud detection

system: Asurvey,” J. Netw. Comput. Appl., vol. 68, pp.

90-113, Apr. 2016.

C. Rinner et al., “Process mining and conformance

checking of long running processes in the context of

melanoma surveillance,” Int. J. Env. Res. Pub. He., vol.

15, no. 12, pp. 2809, 2018.

D. Choi, and K. Lee, “Machine learning based approach to

financial fraud detection process in mobile payment

system,” IT Conv. P. (INPRA), vol. 5, no. 4, pp. 12-24,

2017.

E. A. Minastireanu, and G. Mesnita, “An Analysis of the

Most Used Machine Learning Algorithms for Online

Fraud Detection,” Info.Econ., vol. 23, no. 1, 2019.

E. Asare, L. Wang, and X. Fang, “Conformance Checking:

I. M. Mary, and M. Priyadarshini, “Online Transaction

Fraud Detection System,” in 2021 Int. Conf. Adv. C.

Inno. Tech. Engr. (ICACITE), 2021, pp. 14-16.

J. J. Stoop, “Process mining and fraud detection-A case

study on the theoretical and practical value of using

process mining for the detection of fraudulent behavior

in the procurement process,” M.S. thesis, Netherlands,

ENS: University of Twente, 2012.

L. Zheng et al., “Transaction Fraud Detection Based on

Total Order Relation and Behavior Diversity,” IEEE

Trans. Computat. Social Syst.,vol. 5, no. 3, pp. 796-

806, 2018.

M. Jans et al., “A business process mining application for

internaltransaction fraud mitigation,” Expert Syst.

Appl., vol. 38, no. 10, pp.13351-13359, 2011.

M. D. Leoni, W. M. Van Der Aalst, and B. F. V. Dongen,

“Data-and resource-aware conformance checking of

business processes,” in Int.Conf. Bus. Info. Sys.,

Springer, Berlin, Heidelberg, 2012. pp. 48-59.

M. Abdelrhim, and A. Elsayed, “The Effect of COVID-19

Spread on the e-commerce market: The case of the 5

largest e-commerce companies in the world.”

Available at SSRN 3621166, 2020, doi:10.2139/ssrn.3

621166.

P. Rao et al., “The e-commerce supply chain and

environmental sustainability: An empirical investigati

on on the online retail sector. “Cogent. Bus. Manag.,

vol. 8, no. 1, pp. 1938377, 2021.

R. Sarno et al., “Hybrid Association Rule Learning and

Process Mining for Fraud Detection,” IAENG Int. J. C.

Sci., vol. 42, no. 2,2015.

R. A. Kuscu, Y. Cicekcisoy, and U. Bozoklu, Electronic

PaymentSystems in Electronic Commerce. Turkey: IGI

Global, 2020, pp. 114–139.

S. D. Dhobe, K. K. Tighare, and S. S. Dake, “A review on

prevention of fraud in electronic payment gateway

using secret code,” Int. J. Res.Eng. Sci. Manag., vol. 3,

no. 1, pp. 602-606, Jun. 2020.

W. Chomyat and W. Premchaiswadi, “Process mining on

medicaltreatment history using conformance checking,

” in 2016 14th Int. Conf.ICT K. Eng. (ICT&KE), 2016,

pp. 77-83.

Workflow of Hospitals and Workflow of Open-Source

EMRs,” IEEE Access, vol.8, pp. 139546-139566, 2020.

X. Niu, L. Wang, and X. Yang, “A comparison study of

credit card fraud detection: Supervised versus

unsupervised,” arXiv preprintarXiv: vol. 1904, no.

10604, 2019, doi: 10.48550/arXiv.1904.10604.

Z. Li, G. Liu, and C. Jiang, “Deep Representation Learning

withFull Center Loss for Credit Card Fraud Detection,”

IEEE Trans. Computat. Social Syst., vol. 7, no. 2, pp.

569-579, 2020.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

702