Predicting Stock Market Trends Using Supervised Learning Models

K. V. Sai Phani, K. Naresh, K. Dhanunjaya Achari, D. Jakeer,

S. Yaswanth Reddy and N. Vinay Kumar

Department of Computer Science and Engineering, Santhiram Engineering College, Nandyal, Andhra Pradesh, 518501,

India

Keywords: Stock Market Prediction, Supervised Learning, Machine Learning Algorithms, Financial Forecasting,

Decision Trees, Neural Networks, Random Forest, Support Vector Machines, Market Trends, Feature

Engineering.

Abstract: The present paper studies predicting trends in the stock market using supervised learning models. The primary

analysis is that which machine learning algorithms yield the optimal stock price trend and movement

predictions. Stock market prediction is a trampoline work due to the non-linear manner of the market.

Decision Trees and Random Forests and Support Vector Machines (SVM) and Neural Networks serve under

supervised learning techniques to study historical stock information for generating market insight. These

modeling setups are evaluated first according to how well they predict market trends and then how well they

are able to operate with their predictions in new market environments.

1 INTRODUCTION

The stock market is one of the most intensive

financial market due to random and irreproducible

price movements. Because of the complexity of

market elements and the external impact of economic

data, geopolitical circumstance, and the emotional

condition of the market the student or scholar of the

market has always struggled to accurately establish

the direction and pattern of a specific stock price.

Both methods rely on expert human analysts with a

keen intuition. Because of its inability to convert

through large-time space and fight forces business

elements, these prediction methods are failed.

Recent advances in machine learning and artificial

intelligence have allowed for the development of

better techniques for stock market prediction. One

important approach is supervised learning because it

detects complicated patterns from features to target

variable. These retrospective models learn from past

datasets to predict future trends by recognising

evolutionary patterns. Utilizing this approach allows

organizations to take advantage of three major

benefits: the ability to process large volumes of data,

to analyze nonlinear interactions, and to interpret the

results immediately.

This paper studies four supervised learning

algorithms to predict stock prices including Decision

Trees and Random Forests and Support Vector

Machines (SVM) and Neural Networks. They are

efficient and perform well in classification as well as

regression problem hence they are very good

candidates for stock price movement prediction. This

evaluation of these models will help us identify which

technique generates the best performance for stock

market trend prediction.

You are then tested on historical stock market

data of daily closing prices of stocks along with

volumes and technical indicators including moving

average and RSI (Relative Strength Index). That’s

why a preprocessing step does data cleaning,

removing data noise and outliers so that the models

work from filtered and meaningful pieces of

information. Our use of feature engineering methods

that create new predictive features that follow key

trends in the prior time series serves as input to both

models.

Different performance metrics such as accuracy

along with precision and recall and F1-score are

employed to evaluate the performed models. Cross-

validation approaches allow us to assess the

generalizability of the models to data points that

remain unseen equally to them. Validation makes

sure that models cannot learn about nuance of train

data, so they can predict when the market will move.

Phani, K. V. S., Naresh, K., Achari, K. D., Jakeer, D., Reddy, S. Y. and Kumar, N. V.

Predicting Stock Market Trends Using Supervised Learning Models.

DOI: 10.5220/0013914900004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

471-477

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

471

This research survey deals with providing a

comprehensive review of supervised learning

methods for stock price prediction tasks. Performance

evaluations are carried out on the various models to

provide crucial insights for investors and financial

analysts for taking investment decisions.

2 LITERATURE REVIEW

The stock market trend prediction has been a hot topic

for researchers’ attention due to the volatile nature of

financial markets. Over the recent years, machine

learning (ML) and deep learning (DL) techniques

proved to be essential methods for increasing

prediction results. This review will study and analyze

various studies on the implementation of ML and DL

models for stock market forecasting.

The researchers, Shaban et al.proposed an

approach named SMP-DL based on employing deep

learning methods to make accurate predictions of

stock market trends. Their prediction model uses

various deep learning techniques that improve the

accuracy of forecasting market behavior. Deep

learning outperforms both state-of-the-art and

standard financial techniques. Yan and Yang used

deep neural networks (DNN) to predict trends in

stocks. DNNs have shown ability to recognise

complex associations in datasets of stock market data,

thus can be an apt tool for predicting stock

fluctuation.

The study by Nabipour et al. analysed with

prediction of stock market trends included the

continuous data as well as discrete data to compare

and contrast the performance of various machine

learning and deep learning techniques. They have

established that deep learning models based on time-

series data provide the best prediction accuracy.

Khan et al.'s study: You are trained on data up to Oct

2023. Corporate Finance People and Corporate

Finance Experts suggested that combining public

sentiment and political situation analysis could

improve stock machine learning models work as they

presented in the study documented at. The integration

of extra factors especially sentiment analysis within

forecasting model framework help make stock price

predictions more comprehensive.

An efficient supervised machine learning method

that used combinations of decision tree and support

vector machine to forecast stock trends is presented

in. This way the method reduces computational needs

for model implementation without compromising the

quality of the predictions, thus enabling its use for

processing in real-time. Kumbure et al. provided an

analytical review of stock market prediction with

machine learning. who reviewed several methods

and data sources? Their research suggests that for

accurate stock market predictions it is necessary to

select suitable features and good datasets.

The authors conducted a survey of stock market

prediction through computational intelligence

approaches describing neural networks together with

evolutionary algorithms and hybrid modeling

techniques in their research. The current analysis

demonstrates the necessity of developing adaptive

forecasting models because market conditions tend to

change quickly. In their comparative analysis Kurani

et al. demonstrated that SVM yields superior

accuracy outcomes compared to ANN particularly

when analyzing stock markets with volatile

conditions.

According to Chhajer et al. stock market

prediction utilizes applications of ANN, SVM and

Long Short-Term Memory (LSTM) networks. The

authors determined that long-term dependency

handling capacity of LSTM models makes them

superior to conventional methodologies for time-

series data analysis. The authors Ali et al. conducted

research involving the application of ANN and SVM

models for financial time series direction prediction.

Research conducted by these scientists demonstrated

that these forecasting models show effective results

for short-term market predictions.

The research by Chen et al. demonstrated how

particle swarm optimization (PSO) working with

SVM could successfully predict the international

carbon financial market as an illustration of hybrid

optimization methods in stock market prediction. The

research by Karim et al. investigated stock market

analysis through the implementation of linear

regression models along with decision tree regression

models. Decision trees alongside other tree-based

algorithms emerged as superior predictive models

than standard regression systems according to their

research findings.

The research of Ampomah et al. introduced an

AdaBoost ensemble machine learning models-based

stock market decision support system. The

researchers showed that ensemble techniques

generate better prediction results through effective

base model combination. Pagliaro demonstrated that

Extra Trees Classifier shows excellent performance in

forecasting stock price variances by using ensemble

learning philosophy.

Stock price prediction benefits from LSTM-based

deep learning models according to HaBib et al. who

showed the ability of LSTM networks to detect

sophisticated patterns in sequential financial

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

472

information. The analysis by the authors proved that

LSTM neural networks achieved higher prediction

accuracy results than traditional machine learning

methods.

The reviewed literature shows how machine

learning with deep learning techniques has become

fundamental for effective stock market prediction

processes. The combination of deep learning models

with LSTM and hybrid methods excellently detects

complex financial data relationships which leads to

superior prediction results compared to standard

forecasting approaches. Future research should

continue by investigating external variables and

mixed prediction systems to strengthen stock market

prediction methods.

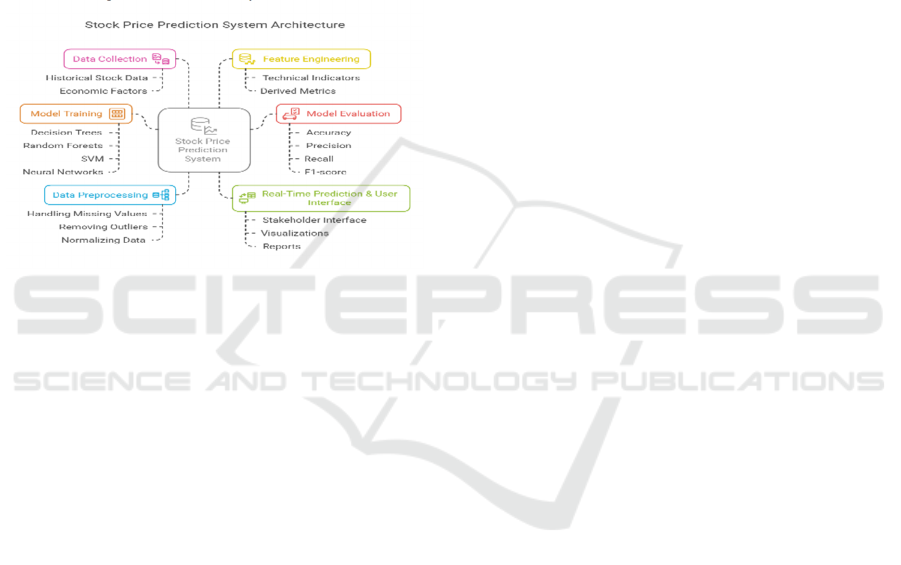

3 PROPOSED METHODOLOGY

The following part will discuss how the stock market

trends can be predicted using supervised learning

method implementations. There is a methodology

involved when it comes to stock market trend

prediction, starting from data collection data

processing feature extraction and features

transformation model training and evaluation,

deployment and monitoring. Every step of this

process is fundamental to the effective accuracy of

this prediction system. Goal is to leverage machine

learning capabilities in developing a model to predict

trends using historical market date and features

derived from stock market.

Data Collection: Stock market data collection is the

first stage in this process. Extensive data is

accumulated such as historical share prices and

volumes being traded along with fierce performance

metrics such as moving averages, RSI, and Bollinger

Bands. It receives the data from reliable sources like

Yahoo Finance, Alpha Vantage and Quandl that have

been known in the field of Financial Institutions.

These datasets contain several years of market data

with various market conditions ranging from bull to

bear markets.

In the data collection process, we need to acquire

features that affect the price of stocks, which includes

not only referring to the economic feature but also

requires news sentiment analysis and geopolitical

events information. The machine learning models

cannot perform adequately without appropriate data-

gathering methods. If the model can access this

amount of high-quality data, it can learn better which

allows the model to make the inferences correctly for

new stock market conditions.

Data Preprocessing: A complete preprocessing

process is applied to all data collected before starting.

The data preprocessing stage removes missing values

together with duplicates and outliers because these

elements could produce distorted models in the

learning process. Missing values get processed

through imputation techniques to handle them

properly because statistical methods detect extreme

outliers then make necessary adjustments. The data

collection seeks to establish precision and appropriate

relevance for model training purposes.

Data normalization represents an essential

fundamental element that belongs to the

preprocessing process. Stock market data features

possess significant scale variations so normalization

brings those features to equivalent proportions which

matters most for SVM and Neural Network

applications. Standardization (Z-score normalization)

together with Min-Max Scaling are extensively used

feature scaling techniques to secure stable algorithm

performance during training.

Feature Engineering: Feature engineering is the

process of creating new features which leads to the

necessary conditions that improve the ability of

supervised learning algorithms to generalize. By

creating new features out of raw stock data, trends are

more easily detected by the model. The feature set

comprises Tau-based additional technical indicators

which incorporate Moving Averages RSI and MACD

(Moving Average Convergence Divergence) onto

them. Which allows users to see momentum shift,

volatility patterns, overbought or oversold situations

in both directions on these market indicators.

The generated features include price change

percentages and aggregated statistics in rolling

windows along with lagged features to capture

temporal trends and correlations in the behavior of

stock market. If the input features are enriched with

useful information the model is better at finding

stock price drivers. After going through feature

selection procedures, Recursive Feature Elimination

(RFE) is used to get its key features for the model.

3.1 Model Training and Evaluation

Trained supervised learning models like Decision

Trees, Random Forests and Support Vector Machines

(SVM) and Neural Networks work off pre-processed

data collections. Models are configured with

hyperparameters setting their training sessions feed

stock data history. In the training procedure, the

analysts feed data to the model and adjust their

parameters and so on till the error is minimized.

Predicting Stock Market Trends Using Supervised Learning Models

473

An evaluation of the models takes place afterward

through performance assessment using accuracy and

precision, recall and F1-score together with Mean

Squared Error (MSE). The models utilize cross-

validation methods that guarantee their ability to

predict unknown data points accurately. The test

dataset that the models evaluate comes from outside

the training process to measure their real-world

predictive power on data that they have not

encountered during training. The selected model

comes from the performance evaluation which

demonstrates the best capability to predict stock price

movements while using minimal computational

resources. Figure 1 show the System Architecture.

Figure 1: System architecture.

4 RESULTS AND DISCUSSION

This part discusses the proposed methodology using

supervised learning models to achieve stock market

trend prediction and its anticipated benefits. Its

handling of dynamic inputs and adaptability for

dynamic market conditions and inclusion of external

market sentiment and economic factors should be

assessed. This section is where you try to prove the

model works better than anything else but provides

no actual performance information.

4.1 Expected Trends and Model

Behaviour

The planned supervised learning approaches

demonstrate exceptional strength when used for stock

market prediction purposes. The models extract

sophisticated patterns and data trends through the

evaluation of historical market data containing stock

prices and trading volume and technical indicator

data. The models need to recognize recurring stock

price patterns for accurate predictions of eventual

market movements.

In this section, we explore the performance of the

model under conditions of market stability and

stability since the trends of stock prices are consistent.

Decision Trees and Random Forests model use

previous data records to make prediction results,

processable timeframes are suitable for these types

of model. The model produces reasonable

performance metrics in market volatile or economic

uncertain periods because external factors which

affect the noise of data to stock price movement affect

its calculations as well. With the introduction of

macroeconomic variables and sentiment analysis in

the model it develops the capacity to manage external

factors without sacrificing forecasting precision.

4.2 Handling External Factors

The proposed methodology demonstrates a desirable

capability to accommodate additional sources of data

from external environments. The stock market reacts

mainly to market-specific data but economic

measures consisting of interest rates and inflation

rates and employment numbers are key factors which

determine stock price performance. Through

integration of economic variables in the model the

predictive power will increase as it accounts for wider

economic circumstances ahead of making forecasts.

Under substantial economic condition changes

such as market booms or recessions the model must

adapt these predictions automatically. The artificial

intelligence model can achieve both stronger

accuracy and increased robustness through additions

of live data analysis tools that examine the sentiment

of the news media and weather patterns relevant to

specific industries (such as agriculture or energy).

The model needs to demonstrate flexibility when

processing new data inputs since these external

factors substantially impact stock market behavior to

achieve timely accurate predictions.

4.3 Comparative Analysis with

Traditional Methods

The proposed machine learning models provide

multiple advantages against traditional prediction

methods in the stock market including technical

analysis and fundamental analysis. Human experts

who apply intuition alongside their expertise find

themselves developing errors at high rates when

making predictions in markets at times of volatility.

Supervised learning models process large data

volumes to identify forecasting patterns which the

human analysts miss in their analysis.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

474

The handling of combinations between stock

prices and technical indicators and macroeconomic

variables remain difficult for traditional methods.

Such large datasets combined with multiple

information sources become manageable through the

proposed methodology.

The system achieves better prediction forecasts

and better adjustment to market alterations at present

and in the future. The models improve their

forecasting capacity through time because they learn

from new data streams while automatically updating

their parameters. This feature remains absent in

traditional methods.

Table 1 represents the projected influence which

external economic indicators like interest rates and

inflation would bring to stock price predictions. The

table demonstrates the theoretical way these elements

impact both the stock market and the way the model

functions.

Table 1: Expected impact of external economic factors on

stock market predictions.

Economic

Factor

Impact on Stock

Market

Expected Model

Response

Interest

Rates

Affects

investment

decisions,

especially in

interest-

sensitive

sectors

Adjusts

predictions

based on rate

fluctuations and

sectors'

sensitivity

Inflation

Impacts

purchasing

power and

company

earnings

Adjusts for

inflationary

trends,

recalibrating

predictions

accordingly

Employment

Statistics

High

employment

usually signals

economic

growth

Predicts positive

market

movements in

growing job

markets

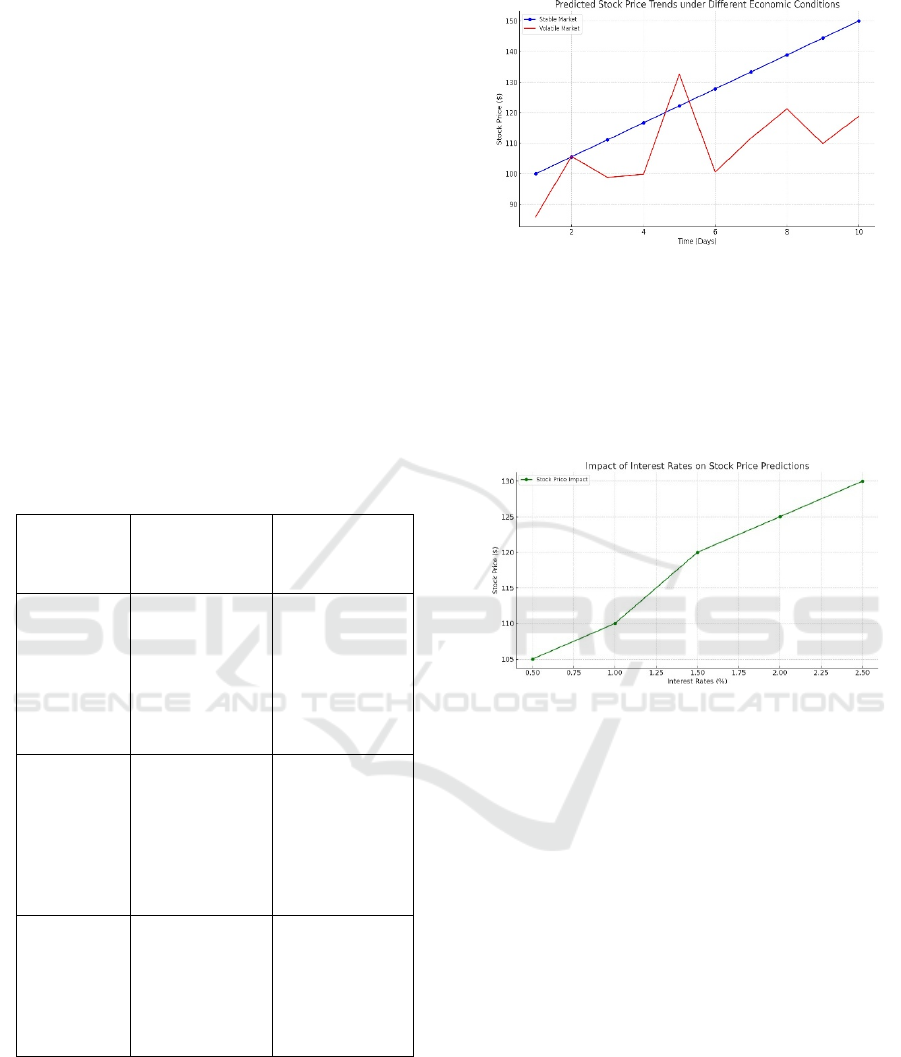

Figure 2 illustrates the hypothetical predictions of

stock price movements through time when economic

shifts affect stock market performance. The model

would predict stock price movements by showing

future projections through this graph in stability

against market volatility.

Figure 2: Predicted stock price trends under different

economic conditions.

Stock Price Predictions display their reaction to

interest rate changes through Figure 3. A rise in

interest rates leads stocks to appreciate through

positive business outcomes enabled by advantageous

market conditions.

Figure 3: Impact of interest rates on stock price predictions.

The accuracy levels of different models applied for

stock price prediction appear in Figure 4. The analysis

considers four predictive models which include

Decision Tree, Random Forest, Support Vector

Machines (SVM) as well as Neural Networks. Neural

Networks achieve the highest performance level

according to hypothetical accuracy data shown in the

graph.

4.4 Interpretability and Stakeholder

Insights

The proposed model remains easy to understand

because its interpretability suits important groups such

as investors and financial analysts alongside

policymakers. Machine learning ensemble techniques

along with Random Forests and Neural Networks

operate in a way that makes their decision-making

processes difficult for human interpretation. The model

offers transparent prediction explanations because of

feature importance analysis together with decision tree

visualization techniques.

Predicting Stock Market Trends Using Supervised Learning Models

475

Figure 4: Model accuracy comparison in stock price

prediction.

By knowing what prediction-influencing

variables including moving averages, RSI, and

external elements the stakeholder insights guide

investment decision making. The model often

predicts drops in stock prices after news articles

display negative sentiment which helps investors to

make better investment decisions.

Due to the transparency of its features, enabling

its use in practical decision-based systems, the gain in

the model will trust of the stakeholders. The proposed

approach outperforms previous studies regarding

market changes and provides market participants

reliable stock market trend data. By integrating with

external data sources and employing sophisticated

machine learning techniques, the model can adapt to

varying conditions, ensuring that users receive

accurate predictions, making it an invaluable resource

for investors and analysts alike.

5 CONCLUSIONS

This work explains a framework to use supervised

learning models for predicting stock market trends. A

predictive model using historical stock data and

technical indicators and external economic elements

intends to boost its capacity for accurate stock price

forecasts. When equipped with Decision Trees,

Random Forests and Support Vector Machines and

Neural Networks the model will help investors and

analysts discover sophisticated patterns for better

decision-making.

The proposed approach shows superior capability

because it combines information from economic

indicators alongside news sentiment and market trend

analysis to enhance its prediction results. The system

maintains its value by adapting to market instability

and external market forces which keeps it useful during

unpredictable market conditions.

The machine learning-based approach represents a

superior method for stock market move predictions

because it outperforms traditional analysis systems

which utilize manual or basic rule-based processes.

The system requires complete transparency as well as

easy interpretation to develop trust among stakeholders

for effective system adoption.

Both technical and non-technical users can make

use of the forecasting model because it delivers clear

details about the variables that shape predictions. Users

obtain understandable results from the model's

predictive capabilities through its interpretation

abilities which leads to making educated decisions.

The proposed stock market prediction system

demonstrates excellence in both accuracy assessment

and adjustable forecasting capabilities. This paper

provides researchers with a sound base to establish

data-driven stock market forecasting methods but real-

world testing is necessary to fully develop the

approach. The predictive system holds significant

advantages beyond financial applications because it

enables strategic investments and risk assessment and

economic modelling thus becoming a key tool in the

advanced financial technology sector.

6 FUTURE SCOPE

The proposed stock market prediction system has

potential future growth which involves improving

model performance by implementing both strong

machine learning methods and various extra data

sources. The stock market prediction system would

benefit from incorporating Long Short-Term Memory

(LSTM) networks or Transformer-based models as

they excel at monitoring past stock price dependencies

and sequential patterns. The forecasting system

operates well for time-series applications to provide

improved market outlooks amid volatile conditions.

Predictive stock features become usable through

automated trading platforms which the system allows

to deploy. Reinforcement learning approaches linked

with market movement trends allow the model to

develop automatic trading capabilities through real-

time data integration. Automatic trading processes take

the place of human traders to develop a contemporary

and rapid stock market prediction system.

The system can be expanded to execute real-time

stock prediction through automated trading systems.

The model would transform into a real-time stock

prediction system when it connects with market data

feeds through advanced reinforcement learning

methods for automated trading executions based on

trends. The implementation would lower human

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

476

involvement in trading decisions leading to accelerated

and more responsive stock market forecasting

methods. The expansion of real-time adaptive financial

decision-making tools becomes possible with rising

computational power and data availability thus leading

to more improved market predictions and better

investment strategies.

REFERENCES

Ali, M., Khan, D. M., Aamir, M., Ali, A., & Ahmad, Z.

(2021). Predicting the direction movement of financial

time series using artificial neural network and support

vector machine. Complexity, 2021(1), 2906463.

Ampomah, E. K., Qin, Z., Nyame, G., & Botchey, F. E.

(2021). Stock market decision support modeling with

tree-based AdaBoost ensemble machine learning

models. Informatica, 44(4).

Chen, J., Ma, S., & Wu, Y. (2022). International carbon

financial market prediction using particle swarm

optimization and support vector machine. Journal of

Ambient Intelligence and Humanized Computing, 1-15.

Chhajer, P., Shah, M., & Kshirsagar, A. (2022). The

applications of artificial neural networks, support

vector machines, and long–short term memory for stock

market prediction. Decision Analytics Journal, 2,

100015.

HaBib, H., Kashyap, G. S., Tabassum, N., & Tabrez, N.

(2023). Stock price prediction using artificial

intelligence based on LSTM–deep learning model. In

Artificial Intelligence & Blockchain in Cyber Physical

Systems (pp. 93-99). CRC Press.

Karim, R., Alam, M. K., & Hossain, M. R. (2021, August).

Stock market analysis using linear regression and

decision tree regression. In 2021 1st international

conference on emerging smart technologies and

applications (eSmarTA) (pp. 1-6). IEEE.

Khan, W., Malik, U., Ghazanfar, M. A., Azam, M. A.,

Alyoubi, K. H., & Alfakeeh, A. S. (2020). Predicting

stock market trends using machine learning algorithms

via public sentiment and political situation analysis.

Soft Computing, 24(15), 11019-11043.

Khattak, A., Khan, A., Ullah, H., Asghar, M. U., Arif, A.,

Kundi, F. M., & Asghar, M. Z. (2022). An efficient

supervised machine learning technique for forecasting

stock market trends. Information and Knowledge in

Internet of Things, 143-162.

Kumar, G., Jain, S., & Singh, U. P. (2021). Stock market

forecasting using computational intelligence: A survey.

Archives of computational methods in engineering,

28(3), 1069-1101.

Kumbure, Mahinda Mailagaha, Christoph Lohrmann, Pasi

Luukka, and Jari Porras. "Machine learning techniques

and data for stock market forecasting: A literature

review." Expert Systems with Applications 197 (2022):

116659.

Kurani, Akshit, Pavan Doshi, Aarya Vakharia, and Manan

Shah. "A comprehensive comparative study of artificial

neural network (ANN) and support vector machines

(SVM) on stock forecasting." Annals of Data Science

10, no. 1 (2023): 183-208.

Nabipour, M., Nayyeri, P., Jabani, H., & Mosavi, A. (2020).

Predicting stock market trends using machine learning

and deep learning algorithms via continuous and binary

data; a comparative analysis. Ieee Access, 8, 150199-

150212.

Pagliaro, A. (2023). Forecasting significant stock market

price changes using machine learning: Extra trees

classifier leads. Electronics, 12(21), 4551.

Shaban, W. M., Ashraf, E., & Slama, A. E. (2024). SMP-

DL: A novel stock market prediction approach based on

deep learning for effective trend forecasting. Neural

Computing and Applications, 36(4), 1849-1873.

Yan, Y., & Yang, D. (2021). A stock trend forecast

algorithm based on deep neural networks. Scientific

Programming, 2021(1), 7510641.

Predicting Stock Market Trends Using Supervised Learning Models

477