Advanced Machine Learning Models for Detecting Credit Card

Fraud

B. Vijaya Bhaskar Reddy

1

, Kawser Naaz Shaik

2

, Neelima Bakkanarappagari

2

,

Jaisnavi Pami Reddy Gari

2

and Jahnavi Reddy Vanna

2

1

Department of CSE, Srinivasa Ramanujan Institute of Technology (Autonomous), Andhra Pradesh, India

2

Department of CSD, Srinivasa Ramanujan Institute of Technology (Autonomous), Andhra Pradesh, India

Keywords: Bank Card Fraud Detection, Machine Learning, LSTM Networks, Convolutional Neural Networks (CNN),

Decision Trees, Random Forest, Stacking Classifier, Transaction Data, Fraud Prevention, Real‑Time

Detection.

Abstract: Issues of bank cards fraud detection still represents a huge challenge for financial institutions which

increasingly have to deal with more and more complex actions of crimineity. This work takes up this challenge

by harnessing the power of algorithms to make detection systems more efficient. We use a Kaggle dataset to

develop the following five models and compare them together: LSTM network, CNN-based neural network,

Decision Tree, Random Forest, and Stacking Classifier. CNNs are used to learn complex patterns from

transaction data, while LSTM model sequential relationships and temporal patterns. Decision Trees and

Random Forests offer strong classification through cascaded decisions, combined with ensemble learning.

Furthermore, a Stacking Classifier combines these algorithms well to possibly have better overall

performance. The objective of comparison of these methods is to compares the best method for realtime fraud

detection. It is anticipated that the outcome of the project will make a substantial contribution to making credit

card transaction systems more secure, so as to reduce financial losses and to promote consumer confidence.

1 INTRODUCTION

Credit card fraud detection is an important aspect of

the finance industry as it helps to protect both the

financial institutions and consumers from financial

losses. One of the biggest concerns is the increasing

complexity of fraud.

Requiring sophisticated detection techniques in

order to respond to the evolving threat. There are

various types of credit card fraud which range from

identity theft and account take overs to

manipulations of the transaction. The spread of such

scams has been intensified by the proliferation of

new technologies and methods used by

cybercriminals.

Fraud patterns are constantly changing, and

perpetrators use more sophisticated strategies to

subvert traditional systems. For example, criminals

have evolved to the use of machine learning and AI

to produce and commit the transaction fraud, thus

increasing the difficulty for legacy solutions to

distinguish normal from abnormal. Accordingly,

there is an increasing demand, at deployments with

ideal high security to detect in real time against new

threat.

The financial effect of credit card fraud is

massive. Banks sustain massive losses from

fraudulent activities as well as reputational harm and

loss of consumer confidence. Consumers, for their

part, can face losses of money, stress, and

inconveniences resulting from fraud. The system

costs have direct monetary value which is combined

with intangible costs as efforts to secure systems and

regulatory compliance. Following these challenge

using predictors and developing fraud prevention

system are essential elements in preventing financial

losses, improving public trust, and maintaining the

credibility of the banks’ environment the

trustworthiness of the financial environment. So,

increasing the effectiveness of fraud detection isn't

just a technical need; it's also a flat strategic necessity

for the business of finance.

290

Reddy, B. V. B., Shaik, K. N., Bakkanarappagari, N., Gari, J. P. R. and Vanna, J. R.

Advanced Machine Learning Models for Detecting Credit Card Fraud.

DOI: 10.5220/0013912000004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

290-299

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

1.1 Objective of the Study

Main goal of this investigation is to leverage cutting-

edge ML techniques to enhance the accuracy and

efficiency of detection systems. Fraud remains a

major challenge. For financial institutions because of

their increasing sophistication of fraudulent activities.

Traditional techniques for detecting cheating often

fall short in addressing these evolving threats,

necessitating the exploration of innovative solutions.

To achieve this, the study focuses on applying and

evaluating four distinct machine intelligence

algorithms: CNN, LSTM, Decision Trees, and

Random Forests. Each algorithm offers unique

strengths that can contribute to the detection of

fraudulent transactions. This study seeks to determine

the most efficient method for real-time fraud

detection by evaluating and comparing various

algorithms. The anticipated outcomes should provide

significant insights into enhancing fraud prevention

strategies. security and efficiency of credit card

transaction systems, thereby mitigating financial

losses and enhancing consumer trust.

1.2 Scope of the Study

This research work makes use of a Kaggle Dataset

Create ML models to detect the fraudulent credit card.

one of the essential elements of this work, consists of

transactions along with annotated instances of

fraudulent and non-fraudulent activities. The dataset

is comprised by multiple features types, such as, the

transaction value and the time. and user's specific

information, which is necessary for the training and

testing of the algorithms. Nevertheless, the dataset

could be inherently restricted and not balanced

between transactions of fraud and non-fraud. Such

class imbalance also creates difficulty for the

algorithms to achieve high accuracy and to reduce

both high false positives and negatives. In terms of

scale, the work covers four different machine

intelligence algorithms, CNN, LSTM, Decision Trees

and Random Forest. Every algorithm is picked to

analyse another resides of fraud detection– CNNs for

the identification of complex patterns, LSTM for the

temporal relation of events, Decision Trees &

Random Forests for reliable classification. The goal

is to compare these techniques to see which is the

best for instantaneous fraud detection.

1.3 Problem Statement

Fraud Detection Is Still A Problem Fraud detection

is still one of the key issues in the financial sector and

traditional solutions are perpetually behind the

rapidly evolving fraudulent tactics. Traditional

approaches to fraud prevention often rely on rule-

based systems, where suspicious activities are

identified by predefined criteria and rules. While

such systems are able to be configured to work

against known forms of fraud, they are by nature,

static. They miss new, sophisticated fraud scams,

much of the time that do not adhere to the

predetermined rules. Such a restriction leaves many

spaces open for fraud prevention, and the new types

of fraud cannot be discovered. Another major

challenge is that the dynamic of the Fraudsters is

always changing up their methods, in such a way that

they can conduct their scams. They are constantly

updating and refining their tactics to outpace

detection systems. drill security holes through

detection systems. They are using advanced methods

like social engineering, fictitious identities, and

advanced phishing strategies not effectively

mitigated by traditional systems. This flexibility

results in an ongoing pillow fight between the bad

guys and the detect system, one in which the bad guys

play even more of the game than the detection

systems.

Furthermore, conventional approaches generally

use a few low-quality features or models that are not

able to explain the intricate multiple aspects of fraud.

They may also suffer from undesirable high rates of

False positives increasing operational costs and

customer dissatisfaction. With the development of

fraud, more intelligent and flexible techniques are

urgently required. One potential solution is machine

intelligence, which can be used to analyse vast

amounts of transaction data and trace out subtle,

unobserved patterns that could indicate fraudulent

behaviour. Therefore, added with automatic training

in the traditional identification method mentioned

above, the integration use of the automatic training

ability of M/F and traditional identification method

would fill the gap and improve the overall detection

rate and the detection efficiency.

2 RELATED WORK

Recognizing the card transaction theft. Has

undergone evolutionary development process due to

advancement in fraudulent techniques over the years.

In the past, fraud detection started manually, and only

Rule-based systems that searched for probably

fraudulent transactions, that matched a set of pre-

defined rules were used. Such systems have some

underlying deficiencies; they were not designed to

Advanced Machine Learning Models for Detecting Credit Card Fraud

291

adapt to new types of frauds that tended to occur more

often, which resulted in increased numbers of false

positives and missed frauds (

Adil et al., 2024).

Techniques for fraud detection began with the use

of statistics and then it advanced to the use of anomaly

detection algorithms. Dynamic identification at the

more detailed level could be achieved through

statistical methods like statistical measures of

transactional behavior such as logistic regression and

statistical outlier detection (

Al Ali et al., 2024)

However, these models have the issues of high

variability and complexity of the fraud transactions

(

Alarfaj et al., 2022)

Some of the changes that characterized the

environment of fraud detection with the help of ML

methods are the following: More algorithms were

introduced, and patterns of fraud identification were

becoming more complex, due to such approaches

searching for patterns in historical data, and adapting

to new trends. These Methods that improved the

effectiveness of the fraud detection systems in

addition to reducing reliance on manual creation of

rules (

Aurna et al., 2024).

CNN and LSTM represent the latest

advancements in fraud detection technology. CNNs

excel at recognizing complex patterns and

irregularities within transaction data, while LSTM are

adept skilled at recognizing time-related

dependencies and patterns in sequences. These

advanced techniques offer promising improvements

in real-time fraud detection, as they can learn complex

relationships within the data and adapt to evolving

fraudulent tactics (

Ghaleb et al., 2024).

In summary, thanks to the continuous progress in

machine intelligence technologies, credit card fraud

detection systems have become more powerful, able

to cope with the ever-transitional nature of credit card

fraud.

Almost all types of ML algorithms are effectively

used for CC fraud detection. Supervised: Different

models like Decision Trees Classifier, Random

Forest Classifier create models and assign new

transactions as fraud or not using old transaction data.

The proposed methods utilise a hierarchical decision-

making and ensemble learning to improve both

discrimination accuracy and robustness of the

system. Deep learning algorithms, including CNN

and LSTM, have also demonstrated potential.

Because CNN model includes convolutional layers,

it can effectively find complex patterns in transaction

data.jpg (796×512). This allows them to capture the

subtle irregularities exhibited in the transaction’s

sequences, which makes them robust for smart

forensic. On the other hand, LSTM are capable of

working with sequential data and are very good at

capturing temporal dependencies, which allow them

to model the chronological order of transactions and

capturing patterns through time

Ileberi, E., & Sun, Y.

(2024).

As we could see from the past Testimonials, these

methods are tremendous help in achieving better

accuracy in detecting the fraud. For instance, CNNs

are used to identify high-precision fraudulent

patterns and LSTM are implemented to store

temporal patterns among transaction sequences.

Ensemble approaches such as the Random Forests

have been proven to enhance the detection

performance by exploiting the joint properties from a

number of decision trees

Kundu, A., Panigrahi, S., Sural,

S., & Majumdar, A. K. (2009).

In summary, ML

represents a strong move forward in fraud detection

with more accurate, efficient and adaptive solutions

than the classical ones. These methods are evolving

and their advancements will ensure even better

defenses for money exchanges and potential

consumers

CNNs which exhibit a decent performance in the

image pattern recognition part is available to use for

financial data analysis such as fraud detection. CNNs

are designed to automatically learn feature pyramids

stacked through layers by means of stacked unit of

convolution, pooling and fully connected network

across layers without any human intervention. This

configuration is especially useful in pattern

recognition and deviations.

From the norm within transactional data set,

which may indicate fraudulent activities

Mienye, I. D.,

& Jere, N. (2024). In the context of fraud detection,

CNNs use their ability to understand spatial relations

within transaction sequences or image of the

transactions data. For instance, CNNs can detect

anomaly or shift in the pattern sequences such as that

of a customer’s transactions that may point towards

fraud. This ability is attained by the network as it

operates concurrently at multiple levels of abstraction

from low to high levels of features

Le, T. T. H.,

Yeonjeong, H., Kang, H., & Kim, H. (2024).

One major use of employing CNN in fraud

identifying is that they are able to properly identify

shapes and anomalies that would otherwise not be

easily recognizable even by other complex

mathematical methods. An advantage over other

models is that CNNs can learn features by themselves

and there is no need for feature selection from the raw

images. This leads to more effective implementation

of a fraud detection system that is more accurate,

efficient in its operations and capable of expanding to

cater for even larger crowds

Shi, X., Zhang, Y., Yu, M.,

& Zhang, L. (2025).

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

292

However, CNNs also have limitations. They

demand significant computational power for training,

particularly when dealing with large datasets

Srivastava, A., Kundu, A., Sural, S., & Majumdar, A. K.

(2008).

In summary, while CNNs offer powerful pattern

recognition capabilities that can significantly improve

fraud detection systems, they should be used in

conjunction with other techniques to address their

limitations and achieve optimal performance in

detecting fraud.

LSTM is an expanded version of RNN

particularly developed to tackle the issues arising

from applying usual RNN to sequence data structure.

LSTM are especially suited to model the

dependencies in time and thus can benefit the tasks

that deal with time series data such as credit card

transaction monitoring

Xie, Y., Liu, G., Yan, C., Jiang, C.,

Zhou, M., & Li, M. (2024).

The feature of recurrent neural networks One of the

key benefits for the utilization and maintenance of

long-term dependencies is the use of conventional

RNNs sometimes face the problem of vanishing and

exploding gradients which affects the learning of long

term dependencies. LSTM resolve this problem by

their structure that is comprised of memory cells and

gates. These components also enable the network to

remember information over different sequences and

regulate the data flow within the network so that

temporal information that is relevant is retained and

other redundant information is discarded As for fraud

detection, LSTM is used to scrutinize transaction

sequences to detect an abnormal activity that can be

related to fraud. For example, the fraudulent activities

may appear to have a temporal relationship that may

not be characteristic of normal circumstances. With

LSTM, these sequential patterns are well captured

thereby making it easy to find the inherent time

sequential dependencies which other methods may

not detect. (

Xie, et al., 2023) Hence, LSTM have the

capability of processing sequences with variable

length which is more suitable for transactions which

are often random in nature. Therefore, LSTM is

useful in improving the real time fraud detection

systems due to the importance of timely and accurate

identification of fraudulent transactions based on

temporal data patterns in particular All in all, the

LSTM plays an important role in developing and

improving the performance of fraud detection

systems due to its ability to model complex temporal

data.

3 PROPOSED SYSTEM

3.1 Problem Definition

Thus, as it is apparent that more and more people are

engaging in online transactions, fraud becomes a very

important issue and a major concern for the financial

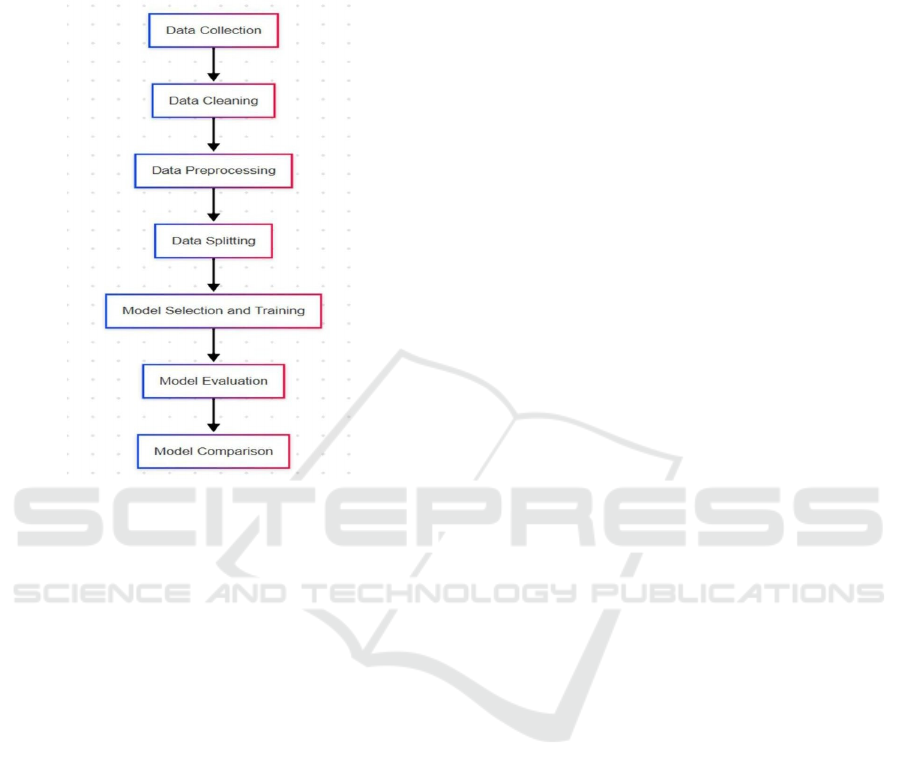

institutions. Figure 1 gives the Proposed Methodology

flowchart.

3.2 Data Collection

The dataset for fraud detection is sourced from

various reliable platforms, including banking

institutions, transaction logs, payment gateways, and

fraud investigation reports. The system collects and

analyzes both real-time and historical transaction data

to improve predictive performance.

3.2.1 Key Data Sources Include

• Bank transaction records: Capturing details like

transaction amount, time, merchant details, and

mode of payment.

• Merchant payment logs: Identifying anomalies

in merchant-side transaction behaviors.

• User behavioral data: Tracking spending

patterns, frequency of transactions, and device

usage.

• Fraudulent transaction reports: Learning from

previous fraud cases to identify emerging

fraudulent patterns.

To ensure that the dataset is representative of different

fraud scenarios, diverse sources and different

geographical regions are considered to train the

model on real-world fraud behavior.

3.3 Data Preprocessing

Raw transaction data often contains inconsistencies,

missing values, and redundant information. Before

feeding the data into the machine learning models,

rigorous preprocessing is performed to enhance data

quality and model efficiency.

3.3.1 Data Preprocessing Steps Include

• Removing duplicate transactions and irrelevant

features that do not contribute to fraud

prediction.

• Handling missing values through imputation

techniques like mean, median, or KNN-based

imputation.

• Standardizing transaction logs across different

Advanced Machine Learning Models for Detecting Credit Card Fraud

293

banks and financial services for uniformity.

• Feature extraction and transformation to

improve fraud detection accuracy, such as

deriving transaction frequency per user or

aggregating spending behavior over time.

This step ensures that the data fed into the model is

well-structured, clean, and optimized for meaningful

analysis.

3.4 Normalization

To maintain consistency across different sources and

scales of data, normalization and standardization

techniques are applied.

3.4.1 Normalization Techniques Include

• Min-Max Scaling: Used to scale numerical

values between a fixed range, ensuring that no

single feature dominates the model.

• One-hot encoding: Converts categorical

variables such as transaction type or location

into numerical form.

• Log transformations: Applied to transaction

amounts and frequencies to reduce skewness

and improve model interpretability.

These normalization techniques help in improving

model convergence and accuracy by reducing

variability and inconsistencies in the dataset.

3.5 Feature Engineering

Feature engineering is a very important process in the

ability of the fraud detection models to accurately

predict cases of fraud. High-quality features are by far

the best elements that help in class distinction

implying real from fake.

3.5.1 Key Features Engineered

• Transaction velocity features: Analyzing how

frequently a user performs transactions in a short

time span.

• Spending behavior trends: Identifying sudden

changes in spending habits that may indicate

fraud.

• Geolocation tracking: Comparing the user’s

current transaction location with historical

locations to detect anomalies.

• Device fingerprinting: Identifying if

transactions are initiated from an unknown

device or suspicious IP addresses.

These engineered features enable the model to make

more informed predictions by leveraging behavioral

and contextual data.

3.6 Model Development

The fraud detection system utilizes both machine

learning and deep learning models to achieve high

fraud detection accuracy.

3.6.1 Machine Learning Models

Implemented

• Decision Trees: Decision trees employ a decision-

making approach to identify fraud transactions

out of the genuine ones.

• Random Forest: It is an enhanced model which

works as an ensemble model and has ability to

reduce variance in the result.

• Stacking Classifier: A class of models that uses an

aggregation of several models to make the best

forecast.

f) Deep Learning Models Implemented:

• Convolutional Neural Networks (CNNs):

Extracts complex fraud patterns from

transaction data.

• Long Short-Term Memory (LSTM): Captures

sequential dependencies and anomalies in

transactional behavior.

3.6.2 Models

1. LSTM Networks (Long Short-Term Memory)

Definition:

LSTM is a sort of Recurrent Neural

Network that is specially designed to work on

sequences. It provably addresses the vanishing

gradient problem, which means that it is very

effective in learning long temporal dependencies

in time series data.

3.6.2.1 Working Mechanism

1. Input Processing: Sequential data (e.g., timeseries

transactions) is fed into the LSTM model.

2. Cell State & Memory Units: The LSTM cell

maintains an internal memory that allows it to

remember important information across long

sequences.

3. Forget Gate: Decides at which timestep which

information has to be forgotten or rather has to be

remembered.

4. Input Gate: Regulates the addition of new

information into the cell state.

5. Output Gate: He/She shows the output after the

training at each time step and transfers the related

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

294

information to the next state.

6. Training & Optimization: The network is trained

using backpropagation through time (BPTT) to

adjust weights and minimize prediction errors.

Figure 1: Flow chart for proposed methodology.

2. Convolutional Neural Networks (CNN)

Definition:

CNN are a subset of deep learning

algorithms that are used for handling data that is

arranged in a grid-based format like the image

and sequential datasets. One of the most

important ideas in CNNs is that convolution

layers learn of spatial hierarchies of features

automatically.

3.6.2.2 Working Mechanism

1.

Convolutional Layer: Applies filters to extract

spatial features from input data.

2.

Pooling Layer: Reduces dimensionality while

preserving essential information (e.g.,

MaxPooling, AveragePooling).

3.

Activation Function: Uses nonlinear functions

(ReLU, sigmoid) to introduce non-linearity.

4.

Fully Connected Layer: Connects neurons to

produce a final classification or prediction.

5.

Softmax Layer: Converts final outputs into

probability scores for classification.

6.

Backpropagation & Optimization: Weights are

updated using gradient descent and loss

minimization functions like cross-entropy.

3. Random Forest

Definition:

Random Forest is an ensemble

learning method that combines multiple decision

trees to improve classification accuracy and

reduce overfitting.

3.6.2.3 Working Mechanism

7.

Bootstrapping: Creates multiple random subsets

of training data.

8.

Decision Tree Construction: Each subset is used to

train a different decision tree.

9.

Feature Selection: A random subset of features is

considered for each tree at split points.

10.

Aggregation (Voting Mechanism): Predictions

from all trees are averaged or majority-voted to

determine the final classification.

4. Stacking Classifier

Definition:

Whereas the stacking classifier is an

ensemble learning technique that combines low

level predictors as a number of base classifiers to

enhance the predictive accuracy. It has a meta-

classifier that is used for combining the results

from different models.

3.6.2.4 Working Mechanism

1.

Base Models: Trains multiple independent models

such as Decision Trees, SVM, and Neural

Networks.

2.

Layered Learning Approach: The predictions

from these models are used as input for a

secondary model (meta- classifier).

3.

Meta-Classifier Training: The final model learns

the best way to combine predictions from base

models.

4.

Final Prediction: The meta-classifier generates

the final output by weighing the strengths of base

models.

Advantages

• Reduces bias by leveraging multiple algorithms.

• Handles complex patterns that single models

may miss.

• Improves classification accuracy and

generalization.

Advanced Machine Learning Models for Detecting Credit Card Fraud

295

4 DISCUSSION AND RESULTS

4.1 Stacking Classifier Model Results

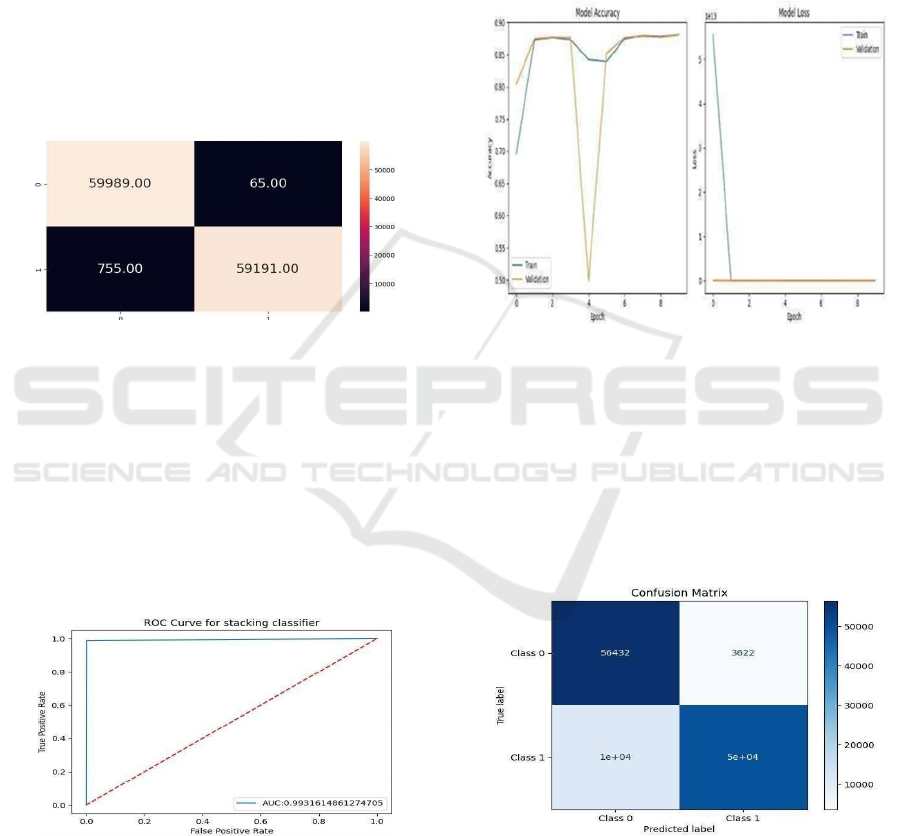

This Figure 2 shows how Stacking Classifier recall

score is calculated which is vital in determining its

ability to correctly identify the positive cases that is

fraudulent transactions as in this case. The recall

score () function calculates the measure that

represents what percentage of the actual fraudulent

cases this method identified. The recall of

0.9892236364044774 means that the model for fraud

detection is not missing many of the transactions

which are fraudulent, thus reducing the false

negatives.

Figure 2: Confusion matrix for stacking classifier.

This rather self-explanatory image presents the

confusion matrix of the Stacking Classifier. The

working of the matrix indicates the number of True

Positives, False Positives, False Negatives and True

Negatives which compare the true labels with the

predicted labels. tp = 59,989 means correctly

classified non-fraudulent transactions and tn = 59,191

means correctly classified fraudulent transactions

swhile fn = 755 and fp = 65 means the misclassified

transactions.

Figure 3: ROC curve for stacking classifier.

In Figure 3, ROC curve Receiver Operating

Characteristic curve displayed here depicts the

performance of Stacking Classifier in terms of

distinguishing between the two classes namely

fraudulent and non-fraudulent transactions. The curve

is a graph of the TPR on y-axis and FPR on the x-axis

and the AUC is used to assess the model on a general

scale. The finally calculated value of the AUC =

0.9931614861274705 means a very high model

performance as the AUC closer to 1 means that the

given model is good enough to differentiate between

fraud and genuine transactions.

4.2 CNN Model Results

Figure 4: Accuracy plot for CNN.

This Figure 4 illustrates how the accuracy and loss

of a given model change depending on the training

and validation epochs in machine learning. The

accuracy graph on the left represents performance of

the model, where training accuracy is displayed by

line of blue color while validation accuracy of the

model is displayed by line of orange color; hence the

model is able to learn effectively.

Figure 5: Confusion matrix for CNN.

Figure 5 confusion matrix provides a detailed

overview of the model's predictions for a binary

classification problem. It compares the true labels

with the predicted labels.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

296

4.3 LSTM Model Results

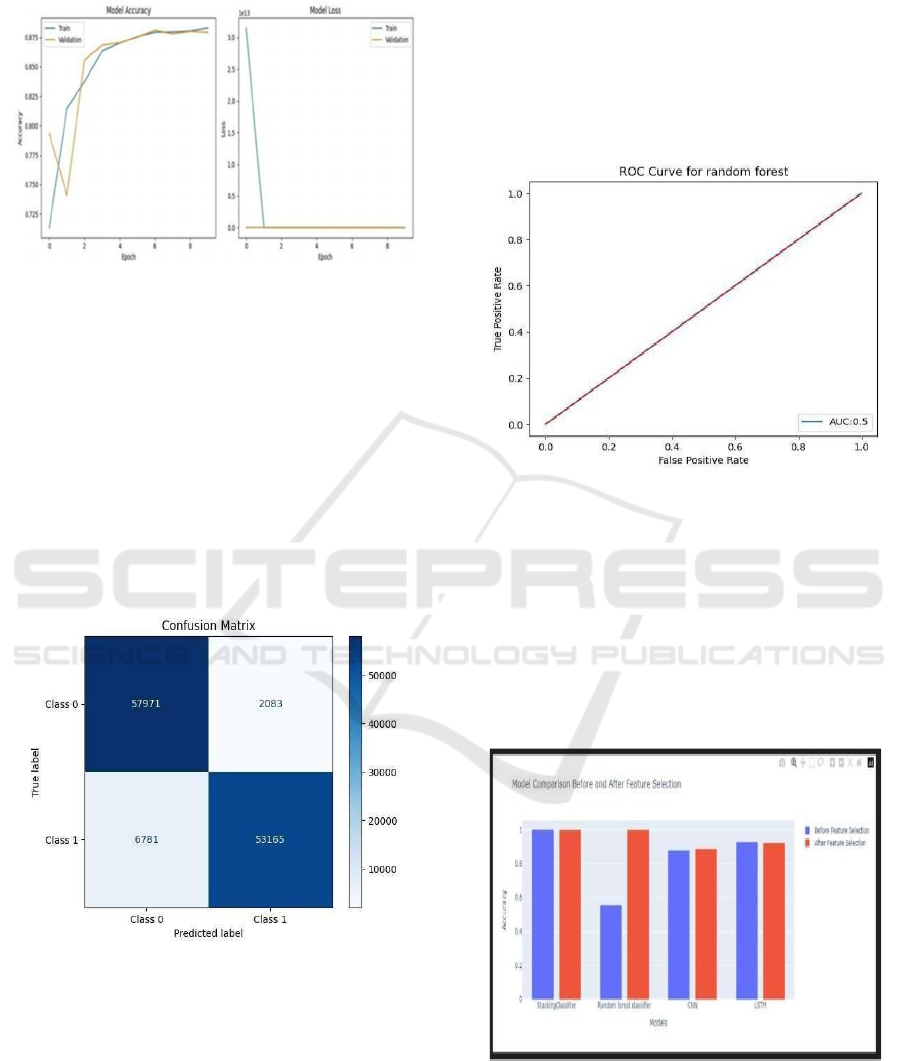

Figure 6: Accuracy Plot for LSTM.

In Figure 6, the left graph in the image is indicating

the performance of the Model Accuracy in terms of

epochs and for Training and validation data. The

Figure 2 also shows the blue line marked as ‘Train’

that represents training accuracy and the orange line

marked as ‘Valid’ for validation accuracy. There is a

slight fluctuation at the beginning of the epochs for

both validation loss and validation accuracy, but

validation accuracy remains at a high level, 0.875 at

this time. The curves indicate no over-learning of the

model as it was learned quite well and generally on

the higher clean data.

Figure 7: Confusion matrix for LSTM.

Figure 7 confusion matrix describes the ability of

the model in predicting two classes: Class 0: Non-

Fraudulent Transactions and Class 1: Fraudulent

Transactions.

•

True Negatives (TN): the number of transactions

that are non-fraudulent were 59771.

•

False Positives (FP): 2,083 transactions out of the

complete transactions that were categorized as

fraudulent were actually normal or nonfraudulent.

•

False Negatives (FN): 6,781 cases of the

fraudulent transactions were classified as

nonfraudulant.

•

[^14] True Positive (TP): Out of actual fraudulent

53,165 transactions, 53,165 of them were identified as

such.

4.4 Random Forest Model Results

Figure 8: ROC curve for random forest.

The Figure 8 involves the representation of a

graph for the Random Forest classifier that is used to

predict whether the transactions are fraudulent or not

fraudulent based on the sensitivity and specificity.

ROC plot depicts TPR or sensitivity rate, which is the

proportion of actual positives among the positive

conclusions drawn while comparing it with FPR, or

the proportion of actual negative among the negatives

concluded.

Figure 9: Accuracy comparison plot for all models.

The Figure 9 image displays a bar chart

comparing the accuracy of different models before

and after feature selection. The models are: Stacking

Classifier, Random Forest Classifier, CNN, and

Advanced Machine Learning Models for Detecting Credit Card Fraud

297

LSTM. The bars represent accuracy, with the blue

bars showing the performance before feature selection

and the red bars after feature selection, highlighting

performance improvements.

5 DISCUSSION

Among the useful features that are analyzed in the

given paper are as follows: It focuses on the

performance of various machine learning algorithms

in the given dataset. One is the best among all the

other models that is accurate with 99.7% to predict

the meaning of a goal which makes the Decision Tree

and Random Forest models to be the most appropriate

for all complex patterns. This is followed by SVC

with 74.1% and therefore the confusion matrix as an

implication of the areas that should be classified

disparagingly though the two performed badly (

Zhu et

al., 2021).

6 CONCLUSIONS

Therefore, by comparing the various models of the

machine learning one can draw a conclusion as to the

difference in classification of the results. The Decision

Tree and obtained 99.7% accuracy randomly forest

models indicating that the models are capable of

capturing complex patterns and relation that has been

established in the data set.

Altogether, it compared KNN’s effectiveness, and

though it outperformed the last two models, suggested

the optimization of the model. Based on the above

analysis this shows that selecting the correct

algorithms depend on the problem under

consideration.

7 FUTURE ENHANCEMENT

Thus, such consideration of models of ML confirms

that various approaches may lead to a distinct

classification performance. The Decision Tree and

Random Forest models had the highest accuracy of

99.7 percent and the graph thus showing that the

models are capable of capturing complex patterns and

relationship embedded in the data set.

These combined methods utilize the outcomes of

several decision trees, that makes these trees perfect

for problems when overtraining is an important

factor.

REFERENCES

Adil, M., Yinjun, Z., Jamjoom, M. M., & Ullah, Z. (2024).

OptDevNet: An Optimized Deep Event-based Network

Framework for Credit Card Fraud

Detection. IEEE Access. https://doi.org/10.1109/ACC

ESS.2024.3458944

Al Ali, A. I., S, S. R., & Khedr, A. M. (2024). Enhancing

financial distress prediction through integrated Chinese

Whisper clustering and federated learning. Journal of

Open Innovation: Technology, Market, and

Complexity, 10(3), 100344.https://doi.org/10.1016/J.J

OITMC.2024.100344

Alarfaj, F. K., Malik, I., Khan, H. U., Almusallam, N.,

Ramzan, M., & Ahmed, M. (2022). Credit Card Fraud

Detection Using State-of-the-Art Machine Learning

and Deep Learning Algorithms. IEEE Access, 10,

39700–39715. https://doi.org /10.1109/ACCESS.2022

.3166891

Aurna, N. F., Hossain, M. D., Khan, L., Taenaka, Y., &

Kadobayashi, Y. (2024). FedFusion: Adaptive Model

Fusion for Addressing Feature Discrepancies in

Federated Credit Card Fraud Detection. IEEE Access.

https://doi.org/10.1109/ACCESS.2024.3464333

Ghaleb, F. A., Saeed, F., Al-Sarem, M., Qasem, S. N., &

Al-Hadhrami, T. (2023). Ensemble Synthesized

Minority Oversampling-Based Generative Adversarial

Networks and Random Forest Algorithm for Credit

Card Fraud Detection. IEEE

Access, 11, 89694– 89710 .https: //doi.org/10.1109 /A

CCESS.2023.3306621

Hua, Z., Wang, Y., Xu, X., Zhang, B., & Liang, L. (2007).

Predicting corporate financial distress based on

integration of support vector machine and logistic

regression. Expert Systems with Applications, 33(2),

434–440.

https://doi.org/10.1016/J.ESWA.2006.05.006

Ileberi, E., & Sun, Y. (2024). Advancing Model

Performance with ADASYN and Recurrent Feature

Elimination and Cross-Validation in Machine

Learning- Assisted Credit Card Fraud Detection: A

Comparative Analysis. IEEE Access, 12, 133315–

133327.

https://doi.org/10.1109/ACCESS.2024.3457922

Kundu, A., Panigrahi, S., Sural, S., & Majumdar, A. K.

(2009). BLAST-SSAHA hybridization for credit card

fraud detection. IEEE Transactions on Dependable and

Secure Computing, 6(4), 309–315.

https://doi.org/10.1109/TDSC.2009.11

Le, T. T. H., Yeonjeong, H., Kang, H., & Kim, H. (2024).

Robust Credit Card Fraud Detection Based on Efficient

Kolmogorov-Arnold Network Models. IEEE Access.

https://doi.org/10.1109/ACCESS.2024.3485200

Mienye, I. D., & Jere, N. (2024). Deep Learning for Credit

Card Fraud Detection: A Review of Algorithms,

Challenges, and Solutions. IEEE Access, 12,

96893–96910.

https://doi.org/10.1109/ACCESS.2024.3426955

Shi, X., Zhang, Y., Yu, M., & Zhang, L. (2025). Deep

learning for enhanced risk management: a novel

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

298

approach to analyzing financial reports. PeerJ.

Computer Science, 11, e2661.https://doi.org/10.7717/

PEERJCS.2661/SUPP-4

Srivastava, A., Kundu, A., Sural, S., & Majumdar, A. K.

(2008). Credit card fraud detection using Hidden

Markov Model. IEEE Transactions on Dependable

and Secure Computing, 5(1), 37–48. https://doi.org/10

.1109/TDSC.2007.70228

Xie, Y., Liu, G., Zhou, M. C., Wei, L., Zhu, H., Zhou, R., &

Cao, L. (2023). A Spatial– Temporal Gated

Network for Credit Card Fraud Detection by Learning

Transactional Representations. IEEE Transactions on

Automation

Science and Engineering. https://doi.org/10.1109/TA

SE.2023.3335145

Xie, Y., Liu, G., Yan, C., Jiang, C., Zhou, M., & Li, M.

(2024). Learning Transactional Behavioral

Representations for Credit Card Fraud Detection. IEEE

Transactions on Neural Networks and Learning

Systems, 35(4), 5735–

5748. https://doi.org/10.1109/TN NLS.2022.3208967

Zhu, K., Zhang, N., Ding, W., & Jiang, C. (2024). An

Adaptive Heterogeneous Credit Card Fraud Detection

Model Based on Deep Reinforcement Training Subset

Selection. IEEE Transactions on Artificial

Intelligence, 5(8),4026–4041. https://doi.org/10.1109

/TAI.2024.3359568

Advanced Machine Learning Models for Detecting Credit Card Fraud

299