Machine Learning Anti‑Fraud Detection Model for Internet Loans

S. Aslam Shareef, Kuruva Akhila, Benakala Likhitha, Bobbala Anusha and Gundala Likitha

Department of CSE, Ravindra College of Engineering for Women, kurnool, Andhra Pradesh, India

Keywords: Fraud Detection, Machine Learning, Online Lending, Anomaly Detection, Real‑Time Risk Assessment.

Abstract: The rise of digital lending platforms has further exacerbated fraudulent activities, making fraud detection a

prominent challenge in financial services. The proposed solution is a machine learning-based system that

detects and prevents fraud in loan applications in the case of internet-based loan services. Using supervised

learning algorithms such as Random Forest, Support Vector Machines (SVM), and Neural Networks, the

system analyses borrower profiles, transaction history, and behavioural patterns. The model learns from

historical data, allowing it to effectively separate valid applicants from potential fraudsters based on

characteristics like credit history, stable income, and loan payment records.Feature engineering techniques

and ensemble learning methods are used to improve accuracy, minimizing false positives while increasing

fraud detection performance. The real-world financial datasets are used to train and validate the system and

the high precision and recall on the detection of suspicious loan requests is achieved. Moreover, these

capabilities are accessible in real time via an APIbased integration with online lending platforms for

automated risk assessment and fraud alerts.By effectively predicting fraud, this model minimizes financial

risks for lenders and allows for better decision-making, while providing a high level of security for digital

loans. This includes adapting strategies to incorporate advanced machine learning methods, along with

responsive models that can adjust to new behaviours and patterns in fraud as it evolves.

1 INTRODUCTION

The phrase "instant access to credit" refers to the

mechanisms through which customers are

immediately approved for loans, much like online

shopping made things easier. This convenience has

indeed brought along fraudulent activities, including

identity theft, application fraud, and synthetic

identity fraud. Well, fraudsters seize the

vulnerabilities of digital lending and the lending

institutions suffer huge financial losses. Traditional

fraud detection methods based on set rules and

manual reviews are unable to keep up with complex

fraudulent behaviour. Hence, intelligent fraud

detection systems capable of rapidly responding to

new fraudulent actions are increasingly necessary as

fraudsters are constantly improving their techniques.

Machine Learning (ML) has become a very

effective tool for fraud detection at financial service.

Through the analysis of innumerable amounts of

loan application data over the past decades, the ML

algorithm is able to learn and model hidden

relationships, abnormalities, and correlations hidden

In the data that can indicate potential signs of

fraud. algorithm is able to learn and model hidden

relationships, abnormalities, and correlations hidden

in the data that can indicate potential signs of fraud.

While rule-based systems rely on predefined criteria

to flag anomalies, ML models use historical data on

previous fraud incidents to identify patterns,

continuously adapting to new threats and improving

accuracy. Various supervised learning algorithms like

Random Forest, Support Vector Machines (SVM),

Neural Networks are employed to classify loan

applications as either fraudulent or legitimate based

on the significant financial and behavioural features.

An ML-based fraud detection system highly relies

on the data quality and feature selection. Attributes

like credit history, income stability, transaction

behaviour pattern, device data, and loan repayment

history are significant in differentiating between

fraudsters and authentic borrowers. In addition,

deploying ensemble learning techniques to combine

the strengths of several models can improve

detection accuracy and reduce false positives. This

allows the model to keep pace with new and

sophisticated fraud patterns, due to advanced feature

Shareef, S. A., Akhila, K., Likhitha, B., Anusha, B. and Likitha, G.

Machine Learning Anti-Fraud Detection Model for Internet Loans.

DOI: 10.5220/0013911700004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

271-277

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

271

engineering methods used, such as anomaly

detection and behaviour profiling. The goal of the

solution in question is to combine automated

techniques for risk assessment with API-based

lending platforms so that real-time fraud detection

can take place and thus minimize the loss of funds in

case of collusion. Upon loan application, the model

immediately assesses its legitimacy and assigns a risk

score. In case a high risk of fraud is detected, alerts

can be triggered for manual review or the system can

automatically reject the application. The ML-based

fraud detection system has a significant impact in

improving the security and reliability of internet loans

by incorporating real-time decision-making

capability.

Our homework will focus on building a scalable

and efficient model for online lending fraud detection

using a machine learning approach. The paper will

also review various ML algorithms, compare their

performance on some real-world financial datasets,

and approaches to combating fraud. These insights

file additions towards more robust, precise, and agile

fraud prevention systems, enabling financial

establishments to decrease risks and foster have faith

within the arena of digital lending.

1.1 Research Methodology Research

Area

The phrase "instant access to credit" refers to the

mechanisms through which customers are

immediately approved for loans, much like online

shopping made things easier. This convenience has

indeed brought along fraudulent activities, including

identity theft, application fraud, and synthetic

identity fraud. Well, fraudsters seize the

vulnerabilities of digital lending and the lending

institutions suffer huge financial losses. Traditional

fraud detection methods based on set rules and

manual reviews are unable to keep up with complex

fraudulent behaviour. Hence, intelligent fraud

detection systems capable of rapidly responding to

new fraudulent actions are increasingly necessary as

fraudsters are constantly improving their techniques.

Machine Learning (ML) has become a very

effective tool for fraud detection at financial service.

Through the analysis of innumerable amounts of

loan application data over the past decades, the ML

algorithm is able to learn and model hidden

relationships, abnormalities, and correlations hidden

in the data that can indicate potential signs of fraud.

While rule-based systems rely on predefined criteria

to flag anomalies, ML models use historical data on

previous fraud incidents to identify patterns,

continuously adapting to new threats and improving

accuracy. Various supervised learning algorithms like

Random Forest, Support Vector Machines (SVM),

Neural Networks are employed to classify loan

applications as either fraudulent or legitimate based

on the significant financial and behavioural features.

An ML-based fraud detection system highly relies

on the data quality and feature selection. Attributes

like credit history, income stability, transaction

behaviour pattern, device data, and loan repayment

history are significant in differentiating between

fraudsters and authentic borrowers. In addition,

deploying ensemble learning techniques to combine

the strengths of several models can improve

detection accuracy and reduce false positives. This

allows the model to keep pace with new and

sophisticated fraud patterns, due to advanced feature

engineering methods used, such as anomaly

detection and behaviour profiling. The goal of the

solution in question is to combine automated

techniques for risk assessment with API-based

lending platforms so that real-time fraud detection

can take place and thus minimize the loss of funds in

case of collusion. Upon loan application, the model

immediately assesses its legitimacy and assigns a risk

score. In case a high risk of fraud is detected, alerts

can be triggered for manual review or the system can

automatically reject the application. The ML-based

fraud detection system has a significant impact in

improving the security and reliability of internet loans

by incorporating real-time decision-making

capability.

Our homework will focus on building a scalable

and efficient model for online lending fraud detection

using a machine learning approach. The paper will

also review various ML algorithms, compare their

performance on some real-world financial datasets,

and approaches to combating fraud. These insights

file additions towards more robust, precise, and agile

fraud prevention systems, enabling financial

establishments to decrease risks and foster have faith

within the arena of digital lending.

1.2 Model Selection and Training

Types of Algorithms Evaluated for Fraud Detection

Types of Machine Learning Algorithms Evaluating

for Fraud Detection Random ForestLogistic

Regression, Support vector machines (SVM),

Gradient Boosting, Neural Networks It does so by

comparing each of these models based on

performance metrics like accuracy, precision, recall,

F1score and Area Under Curve (AUCROC).

Hyperparameter tuning is performed using Grid

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

272

Search and Bayesian Optimization to enhance model

performance. Moreover, ensemble learning methods

including stacking and bagging are examined for

improving prediction accuracy by combining

multiple models.

1.3 Model Evaluation and Deployment

To assess generalizability, the trained models are

tested on an unseen test dataset. Model stability is

evaluated by using a cross-validation approach on

subsets of the data. Also, live testing is performed by

deploying the model with purchase prediction API

based fraud auditing solution to process live loan

application submissions. Automated fraud alerts and

risk scoring systems, as well as integration through

APIs with online lending platforms to support real-

time decision-making, are part of the deployment

stage. There are many more possibilities of

improvement in the future including adaptive

learning methods when the model can adapt itself

with new fraud patterns whenever new ones are

detected over time.

1.4 Research Area

Fraud Detection in Online Lending Platforms Using

Machine Learning As financial services are

increasingly digitized, fraudulent loans are a growing

concern for banks and fintech companies.

These fraudulent activities involve stealing personal

information, creating synthetic identities,

misrepresenting income, and falsifying financial

documents, all of which lead to enormous financial

losses. It focuses on creating a fraud prevention

system that utilizes AI to ensure secure and reliable

loan transactions over the internet. The research is at

the intersection of machine learning, cybersecurity,

and financial fraud detection It also covers a method

of using artificial intelligence for on-time detection of

loan applications that are potentially driven by fraud

and lowering the dependence on traditional rule

systems. Additionally, the research explores data-

driven anomaly detection techniques, behavioural

analytics, and real-time risk assessment

methodologies that can be employed to enhance the

accuracy of fraud detection systems.

The methodology is of particular relevance to

financial institutions, digital lenders, fintech startups,

and regulatory agencies. As such machine learning

models can help lenders streamline credit risk

assessment and mitigate financial losses owing to

fraudulent activities. This study has implications

across different financial industries such as personal

loans, business loans, credit card applications and

mortgage approvals.

Moreover, this study serves as a knowledge of AI

systems for financial decision models. It is essential

that machine learning models do not become opaque,

do not embed bias, and do not produce unfair

discrimination against legitimate borrowers. The

study also explores potential biases within training

data, utilizing methods like FairnessAware Machine

Learning to mitigate ethical dilemmas associated with

fraud detection. In general, the purpose of the study

is to improve fraud detection in a Digital Lending

Ecosystem by some advanced machine learning

techniques. Incorporating real-time detection models

into financial systems, this research offers a scalable

and efficient mechanism to combat fraudulent loan

applications, enhancing security and trust in the

online lending sector.

2 LITERATURE REVIEW

The task of detecting fraudulent behaviour in

financial transactions (especially in the context of

online lending) has become an area of focus of

research in the last couple of years. Goldman:

Traditional fraud detection methods involve rule-

based systems and manual reviews, which were not

effective against adaptive fraud tactics. (ML) has

proven very powerful in enhancing fraud detection,

by applying predictive analysis on data to find out

patterns, anomalies and historical data on fraud. This

literature survey will investigate some studies that

contributed to fraud detection using machine

learning techniques in online lending. Conventional

Methods for Fraud Detection.

Traditional fraud detection methods are based on

set rules and statistical methods. Such systems also

flagged fraudulent transactions if they exceeded

certain thresholds (i.e., loan amount, credit score,

number of applications, etc.). For example, research

like Bolton & Hand (2002) presented statistics-based

fraud detection techniques like Bayesian networks

and logistic regression models, which can have

practical effectiveness in some scenarios, but still

faced with a high number of false positives and the

inability to recognize new types of potential fraud.

West et al. had previously studied fraud detection in

financial transactions, which emphasized the

complexity of fraud scheme detection due to the

limitations of rule-based methods. Fraud Detection

Using Machine LearningRelated ArticlesMachine

learning algorithms have considerably changed how

we deal with fraud detection - these algorithms are

Machine Learning Anti-Fraud Detection Model for Internet Loans

273

able to learn from previous fraud cases and the

algorithms continue to evolve based on new patterns.

Ngai et al. Evolution of Computational Intelligence

Algorithms for Fraud Detection Abstract

Babuchowicz et al. Studies by Baesens et al. ML

algorithms were shown to perform better than rule-

based methods by demonstrating lower false positive

rates and higher fraud detection rates [1mQI3,3].

Many approaches to fraud detection, such as

Random Forest, Gradient Boosting Machines

(GBM), and XGBoost, use supervised learning

techniques. Bhattacharyya et al. The work in (2011)

studied the impact of ensemble learning methods and

showed that aggregating several models improves

fraud detection. Zhao et al. (2018) introduced a

framework utilizing ensemble learning for credit card

fraud detection which resulted in better precision and

2.1 Deep Learning and Anomaly

Detection in Fraud Detection

Deep learning models such as Neural Net and

Recurrent Net enable more sophisticated capturing of

hidden patterns and trends in transaction data,

making them especially useful for obtaining newer

improvements in fraud detection. Xu et al. (2019)

Used RNNs and LSTMs to detect fraud from

sequential data of financial transactions. It was shown

by their study that deep learning models have the

ability to build temporal dependences (temporal

dependencies) and can recognize behavioural

patterns from user activity, thus making them very

effective for fraud detection. Zhang et al.

Autoencoders and Generative dversarial Networks

(GANs) for unsupervised fraud detection were

performed by Wu et al. (2020) successfully tagging

latent patterns in the financial planes.Some other

relatively new techniques explored for fraud

detection are anomaly detection techniques --

Isolation Forests, Local Outlier Factor (LOF) and

OneClass SVM. Jurgovsky et al. Anomaly detection

approaches have been applied to detect fake

transactions as demonstrated by (2018) where they

concluded that their models are well suited to detect

any new fraud patterns. However, the unsupervised

learning techniques can be prone to false positives

unless they are finely tuned.

2.2 Challenges and Future Research

Directions

Even as machine learning approaches have continued

to advance in fraud detection, new challenges persist.

As fraudsters constantly refine and enhance their

processes, the detection models also need to be

dynamic and scalable. The real-time fraud detection

system has to combine big data analytics with real-

time decision-making Zhang & Zhou (2021). The

challenge of ensuring fairness while minimizing

potential biases in fraud detection models is also an

important research topic, as biased models can

discriminate against certain populations of users.

Techniques from fairness-aware machine learning

and explanations in AI (XAI) are to be more and

more common tools and should be in the fraud-proof

toolbox.

However, the literature suggests that hybrid

alternative models (e.g., supervised, unsupervised

and/or deep learning-based models) are more

effective for fraud detection. Future work should

integrate these parameters to develop real-time fraud

detection systems with reduced computational costs

and improved model interpretability to facilitate the

broader adoption of these advanced sets of techniques

in financial institutions.

3 EXISTING SYSTEM

The traditional approach to fraud detection at the

online lending platforms were rules-based systems,

manual verification of loan applications and basic

statistical models. These approaches uncover

fraudulent loan applications by pre-defined

conditions, such as credit score, transaction history,

and identity verification. They have proven to be

somewhat effective in combating fraud, but they lack

adaptability, scalability and precision and therefore

are less effective against sophisticated fraud schemes.

Rulebased filtering is perhaps the most important

mechanism for fraud detection currently in place.

Ifelse conditions are made at financial institutions to

identify suspicious applications. If a loan applicant’s

declared income doesn’t match their tax records or if

multiple loan applications come from the same IP

address, for example, the system might flag them as

potential fraud. But static rules are not flexible and

easily evaded by sophisticated fraudsters who

understand how the system works.

For fraudulent detection, a lot of financial

institutions need manual verification processes.

Human experts check documents, call the applicant’s

employer and verify personal information before

approving a loan. However, while this technique adds

an additional layer of security, it is also extremely

time-consuming, labour-intensive, and costly. In

addition, the loan process becomes time-consuming

due to manual verification, which leads to poor

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

274

customer experience and lowers operational

efficiency.

Summary Traditional fraud detection systems

employ various statistical techniques such as logistic

regression and Bayesian networks to mine historical

data and identify anomalies. After all, these models

catch fraudulent behavioural patterns based on past

events for example, inconsistencies in credit

histories or sudden changes in spending behaviour.

Yet, these models have limited fraud detection

abilities against new evolving fraud tactics and

regularly do not distinguish between genuine and

fraudulent applications for technologies with

complex underlying patterns.

Although the use of real-time fraud detection

systems is common, as these use cases often

experience challenges such as high false positive

rates, scalability concerns, and slow decisionmaking.

As a result, many authentic applicants are falsely

identified as fraudulent, resulting in their rejection or

potential delays in their loan approvals. The fantasy

world of unicorn’s nets of online loan applications,

traditional systems were unable to scale. With

evolving fraud techniques, it has become a dire need

to adapt data-driven solutions (like machine learning)

to increase fraud detection accuracy and efficiency.

4 PROPOSED SYSTEM

The presented system is about the prediction of the

fraud detection model of internet loans based on

machine learning using the algorithm which enhances

accuracy, reduces false positive and enables the

decision in real time. This system learns from past

fraud behaviour and can adapt to emerging fraud

tactics, as opposed to older rule-based systems. This

employ both supervised and unsupervised learning

models that provides a more accurate and faster

model for fraud detection in online lending systems.

The proposed system has numerous significant

characteristics, but real-time fraud detection with

machine learning classifiers like Random Forest,

XGBoost, Support Vector Machines (SVM), and

Neural Networks are extremely significant. Multiple

attributes of a loan application, transaction behaviour,

applicant profile, precedence of fraud, etc., are

analysed by these models to predispose the chances

of fraud.

Furthermore, an additional layer of anomaly

detection is added using methods such as Isolation

Forests and Autoencoders, which are helpful in

spotting unusual behaviour that deviates from typical

transaction patterns. iFinders 360 also incorporates

NLP and deep learning to review text data contained

in loan applications and supporting documentation.

Fake applicants frequently submit falsified work

history, modified financial statements or even fake

locales. Frauds can be checked through NLP based

fraud detection on the system level, where

inconsistencies can be detected, and the authenticity

of submitted details can be verified and flagged for

potential fraud cases. This further improves the

accuracy of fraud detection beyond processing

numerical and behavioural data.

4.1 Architect

One of the major advancements in the proposed

system comes from adaptive learning and continuous

updating of the model.

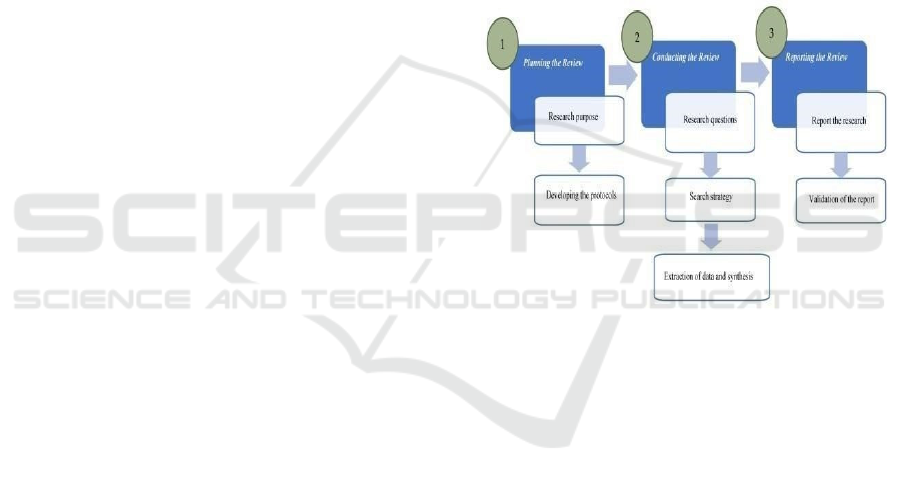

Figure 1: Planning the review.

Figure 1 shows the planning the review. This

system goes beyond static models that use past

datasets while training their models. The system will

automatically adapt and learn new fraudulent trends

through this process. Moreover, embedded

explainable AI (XAI) offers more transparency in

decision making, so, for example, it can help the

financial institutions better understand why a certain

loan application was flagged as fraudulent.

Scalability and Efficiency the proposed system

uses cloud-based deployment and big data analytics

for detecting large-scale fraud efficiently (

Dal Pozzolo

et al., 2018). Cloud infrastructure accelerates loan

application processing time, allowing companies to

approve requests more quickly without sacrificing

accuracy. Additionally, by leveraging blockchain

technology, the suggested approach ensures that all

transactions and verifications remain immutable,

greatly improving the security of the data. With such

mechanisms in place, one can considerably evaluate

Machine Learning Anti-Fraud Detection Model for Internet Loans

275

the proposed system against traditional mechanisms

with striking results towards preventing online

lending fraud effectively.

5 CONCLUSIONS

But fraud detection in online lending when

sophisticated fraud techniques are widely used

renders the traditional rule-based systems and

manual verification methods ineffective. Each of

these has disadvantages with respect to false positive

results and poor response times and not being able to

adapt to more pernicious forms of fraud. Machine

learning can be a valuable tool for prevention, with

real-time fraud detection that is more accurate and

requires less manual intervention.

The proposed approach utilizes the machine

learning algorithms, the anomaly detection

techniques, and the natural language processing to

analyse the loan applications (

Zou et al., 2020). As a

result, this system is capable of achieving a higher

detection rate and a lower false alarm rate than

classical methods by constantly learning from new

types of fraud and adjusting to new types of attacks.

Moreover, the use of explainable AI (XAI) help

increase transparency, making the decisions taken

regarding fraudulent transactions more

understandable for the financial institutions.

Cloud deployment and big data analytics also

enable the system to handle a high volume of loan

applications while ensuring scalability and real-time

fraud detection. The features of blockchain help in

securing sensitive data by preventing the

manipulation of data and also validating financial

transactions.

This cutting-edge fraud detection system not only

minimizes financial losses to online lending

platforms but also fosters greater trust among

customers and streamlines processing operations. In

summary, the developed solution not only offers

strong protection against fraud but also assists

financial institutions in optimizing their loan approval

processes, contributing to a safer and more reliable

lending landscape.

Overall, machine learning-powered fraud

detection provides a ground-breaking breakthrough

for the financial industry, as it tackles the

shortcomings of conventional approaches while

presenting a more scalable, agile, and effective

remedy to fight online loan fraud.

6 RESULTS

This is the last stage of depression detection, i.e. the

output of the proposed methodology is the overall

classification and prediction. Several different

performance metrics (accuracy, specificity, and

sensitivity) are used in this review. Three measures

were calculated: Accuracy, which quantifies the ratio

between the number of correctly diagnosed cases

(depressed or non-depressed) and the total number of

analysed cases. Figure 2 shows the RBI App

verification result screen.

The equations for these metrics are as follows:

Accuracy =

× 100% (1)

Figure 2: RBI app verification result screen.

REFERENCES

&Caelen, O. (2018). "Sequence classification for credit-

card fraud detection." Expert Systems with

Applications, 100, 234-245.

Abdallah, A., Maarof, M. A., & Zainal, A. (2016). "Fraud

detection system: A survey." Journal of Network and

Computer Applications, 68, 90-113.

Bhattacharyya, S., Jha, S., Tharakunnel, K., & Westland, J.

C. (2011). "Data mining for credit card fraud: A

comparative study." Decision Support Systems, 50(3),

602-613.

Conference on Data Science and Advanced Analytics, 1-10.

Dal Pozzolo, A., Boracchi, G., Caelen, O., Alippi, C.,

&Bontempi, G. (2018). "Credit card fraud detection and

conceptdrift adaptation with delayed supervised

information." Proceedings of the IEEE Transactions on

Neural Networks and Learning Systems, 29(8),

38963909.

Jurgovsky, J., Granitzer, M., Ziegler, K., Calabretto, S.,

Portier, P., He-Guelton, L.,

Khan, P., Sahai, A., Sharma, V., & Dey, N. (2021).

"Blockchain-based intelligent fraud detection model for

financial transactions." Future.

Le, D. M., & Huynh, P. D. (2019). "Application of deep

learning in detecting financial frauds in online

transactions." Neural Computing and Applications,

31(1), 381-390.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

276

Liu, Y., Wu, Y., & Li, M. (2018). "Financial fraud detection

model based on anomaly detection

algorithms."Proceedings of the IEEE International

Phua, C., Lee, V., Smith, K., &Gayler, R. (2010). "A

comprehensive survey of data miningbased fraud

detection research." Artificial Intelligence Review,

34(1), 114.

West, J., & Bhattacharya, M. (2016)."Intelligent financial

fraud detection: A comprehensive review." Computers

&Security, 57,47-66.

Zheng, Y., Tan, S., & Chang, E. (2019). "Anomaly

detection in financial transactions using deep learning."

IEEE Transactions on Neural Networks and Learning

Systems, 30(3), 899-912.

Zou, J., Yang, Y., & Wang, H. (2020). "Real-time fraud

detection in online financial transactions using hybrid

machine learning models." Journal of Finance and Data

Science, 6(3), 123137.

Machine Learning Anti-Fraud Detection Model for Internet Loans

277