Next‑Gen Fraud Detection: Machine Learning and Encryption for

Credit Card Security

Giriharan V., Dilip Raj K. and Karthiga R.

Department of Computer Science and Engineering, St. Joseph's Institute of Technology, Chennai, Tamil Nadu, India

Keywords: Credit Card Fraud Detection, Customer Activation Prediction, Machine Learning, Django Framework, Web

Application Development.

Abstract: Today in the field of finance, it is critical to secure credit card transactions and the customer engagement

initiatives. This paper studies how machine learning is used to predict fraudulent transactions and customer

engagement, exemplifying the use of encryption algorithms in order to safeguard sensitive information. Using

cutting edge algorithms, our models achieve great accuracy in fraud detection and consumer behavior

predictions. Integrating these predictive models into the Django framework provides for an agile and scalable

web architecture, ensuring easy integration and improved usability. This approach not only strengthens the

protection of data with encryption, but also provides the foundation through which specific data sealed by the

institution can be uncovered, and thus improves the efficiency on combating fraudulent activities and retain

customers.

1 INTRODUCTION

As the digital revolution continues to accelerate,

protecting financial transactions is more important

than ever when card fraud threatens both individuals

and enterprises. The ever-evolving nature of fraud

has outpaced antifraud detection tools. To solve this

problem, the state of the art in machine learning

offers a solution. Using advanced algorithms and

data-driven techniques, machine learning models can

sift through large records of transactions to detect

suspicious activity. This not only improves the

accuracy of fraud detection, but also reduces false

alerts so legitimate transactions can be completed

without issue.” Against the backdrop of this evolving

threat, a significant innovation in protecting financial

transactions is using encryption in fraud detection

predictions supported by advanced machine learning.

In the financial services industry, credit card fouls

pose a challenge owing to the rosy figures that come

with considerable losses every year. In recent years,

the usage of credit cards has increased significantly

within the banking Sector. Nevertheless, this

increased usage of credit cards hasalso resulted in an

increase in default levels faced by financial

institutions. Credit card frauds, as defined, involve

the misuse of cardholder’s information for financial

gains, which become identifying factors for

fraudulent credit transactions. The dataset consists of

284,807 transactions of European clients, which were

scrutinized to measure the performance of the various

algorithms. The results obtained 0.02% Neural

Network technique and 100% accuracy rate, which

demonstrates this technique has the highest predictive

power and accuracy.

2 LITERATURE SURVEY

In paper, a fraud detection system for credit cards is

presented. The overall system consists of three stages.

Firstly, Luhn algorithm check for verification card

numbers and thus to differentiate legitimate from

fraudulent cards. Secondly, dynamically checking of

the expiration date of the card. Finally, the validation

of Card Verification Value (CVV) or Card

Verification Code (CVC), where digit counts fall

within an acceptable range. More, the solution

incorporates a user-friendly GUI for easier

application. With rigorous testing conducted on both

valid and fraudulent cards, our system showed better

efficiency than the distance sum model; it was also

able to capture serial numbers not detected by the

other methods relying on the Luhn algorithm.

138

V., G., K., D. R. and R., K.

Next-Gen Fraud Detection: Machine Learning and Encryption for Credit Card Security.

DOI: 10.5220/0013909300004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

138-145

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

In paper (T.P. Bhatla et al., 2013), valuable insights

into the mapping processes and current trends in the

yearly developments of machine learning

applications have been gathered for future research.

The study follows a three-phase approach. The first

phase involved compiling descriptive statistical

analysis from Scopus and Herzing's Publish or Perish,

the second phase utilized Vos Viewer for quantitative

citation analysis, and the third phase focused on

interpreting the findings. This research categorized

the studies into three clusters: machine learning

related to data mining, fraud detection, and fraud

classification. The second cluster addresses the

complexities of credit card transaction data, aiming to

enhance fraud detection systems, while the third

cluster is dedicated to improving classification

techniques for managing imbalanced data and limited

records. This area has seen rapid growth in recent

years, especially regarding the performance of fraud

classification with unbalanced data. Future research

will aim to understand how machine learning has

evolved over time for fraud detection and conduct

a comparative study across Scopus, Web of Science,

and ScienceDirect.

Paper (

Chan PK et al., 1999) is online transactions

grow in number; credit card fraud is becoming one of

the most frequent in today's world. Thereby it incurs

substantial losses. Thus, a good strategy for initial

stage of fraud detection to minimize loss that has

already been imposed by this crime. Using of

machine learning algorithms for fraud detection is a

potential solution. This paper examines the recent

developments in the application of machine learning

to detect credit card fraud. Four machine learning

models were compared in terms of accuracy.

According to the results, the Catboost algorithm

achieves the highest accuracy of 99.87%. The

analyzed data was obtained from Kaggle. In paper

(

A.C. Bahnsen et al., 20213), Logistic Regression as

well as Random Forest have been employed to

enhance the performance of fraud detection systems

and operational effectiveness.

After thorough examination of these algorithms in

the context of credit card fraud, the study

demonstrates that both models are used jointly

within Fraud Fort. Thus, this confirms the fact that the

integration between logistic regression and random

forest will result in a more reliable anti-fraud system,

thus contributing to a safer and more trustworthy

economic environment. In paper (

Dal Pozzolo et al.,

2014)

, a model is proposed that utilizes the XG Boost

classifier for detecting fraud in transactions.

Contrasting from traditional methods that are defined

using only one threshold value, our model calculates

and compares a set of multiple threshold values to

determine the optimum, thus maximizing

effectiveness and efficiency.

Paper

A.C. Bahnsen et al., proposes a technique

based on machine learning for the detection of credit

card fraud using labeled data to distinguish between

fraudulent and genuine transactions. Supervised

learning techniques were used in the experiment.

In paper (

West J, Bhattacharya M., 2016) covers

various credit card fraud detection techniques that

offer advanced protection against multiple fraud

types. We provide a comparison of these techniques

in terms of their accuracy, time efficiency, and cost-

effectiveness, while pointing out their strengths and

weaknesses to help determine the most appropriate

technique.

Paper (

Zhang, S et al., 2015) evaluates and

compares several algorithms, including Random

Forest, Decision Tree, and Artificial Neural Networks

(ANN). This research is crucial for advancing fraud

detection technologies, as it not only examines the

performance of various machine learning algorithms

but also sheds light on feature engineering. The

findings emphasize the importance of designing

scalable, resilient, and real-time solutions to address

the evolving nature of fraud strategies.

The paper centers on credit card fraud detection

by using transaction analysis, and specifically aims to

detect fraudulent items. Then the results are applied

to classify the new transactions as fraudulent or

legitimate. Detecting all fraudulent transactions with

less misclassification of unfraudulent ones is of

paramount importance. The analysis uses "neighbor

outliers" and "isolation forest" approaches to the

PCA-transformed credit card transaction data (

Van

Vlasselaer V et al., 2015).

The presented credit card fraud detection model

addresses class imbalance by synthetic minority

oversampling and the feature extraction and

representation are enhanced by sequential deep

learning methodologies. This model achieves

accuracy, detection rate and F-measure that are

greater than those of the current ones. Its utility may

have a major impact not just on online markets but

may also limit fraud and increase trust in online

purchases. The advanced feature extraction methods

employed by the model contribute to its superior

performance compared to other models (

R.J. Bolton,

D.J. Hand, et al., 2001).

3 EXISTING SYSTEM

As the credit card industry is flourishing with the

Next-Gen Fraud Detection: Machine Learning and Encryption for Credit Card Security

139

advent of Internet technology, the number of

fraudulent credit card transactions is also on the rise,

more too in view of the complexity of transaction

information. Many of the AI or machine learning

models applied for the detection of fraud have lacked

effectiveness due to redundant feature data and the

imbalanced nature of transaction datasets. Truly

speaking, better feature engineering and smart

sampling methods could help boost detection

accuracy. In this paper, we proposed thereby

embodies a compound elimination strategy to remove

correlation and redundant features, thus improving

the quality of the data. Also, a multifactor

synchronous embedding mechanism was

implemented, making each feature contributing best

towards the decision- making aspect of fraud

detection. Furthermore, SOBT eases the imbalance in

legitimate vs. fraudulent transactions, thereby

improving the model's detection capacity for fraud.

These detailed experiments shown with real-life

datasets demonstrate that this method outperforms the

existing ones in the face of limitations such as

computing intensity, risk of overfitting, and concerns

regarding scalability and implementation.

4 PROPOSED SYSTEM

A system is these, proposes to enhance the detection

of credit card fraud and the prediction of customer

activation over a platform of Django that integrates a

couple of models in machine learning. Historical data

about transactions and customer behaviors are used to

develop robust predictive models to detect fraud and

predict accurate customer activation. Industry-

standard cryptographic algorithms are used for input

and output encryption based on "lost data" and

"security data" to help reduce the risk of sensitive data

being compromised. This helps to ensure that the

data remains secure and untampered with. Django

forms the backbone of the framework and offers a

scalable platform for deploying and managing the

machine learning models. It interacts with the

database, manages the user authentication workflow,

and implements critical security practices. This has

been built on top of Django and its powerful features

for making prediction in realtime, process data at

ease and communicate with web securely. Moreover,

we framework-based application was developed to

simplify redact, utilizing dataset balancing and

algorithmic comparisons for accuracy and scalability.

Django's modular structure enables straightforward

updates and easier system maintenance.

5 METHODOLOGY

Employing the latest algorithms, it scans through all

transaction records for the most suspicious activities

with the highest precision. The algorithms, powered

by deep learning techniques, assisted with supervised

models, help the system learn and adjust to changing

fraud patterns automatically, improving detection

rates continuously. An intuitive and seamless

interface that seamlessly connects to existing

financial networks as well as real- time fraud

warnings and in depth reports to help re-. make

informed decisions. Designed with both security and

performance in mind, our algorithm fights fraud

without introducing too many false positives, creating

a secure and effective financial protection solution.

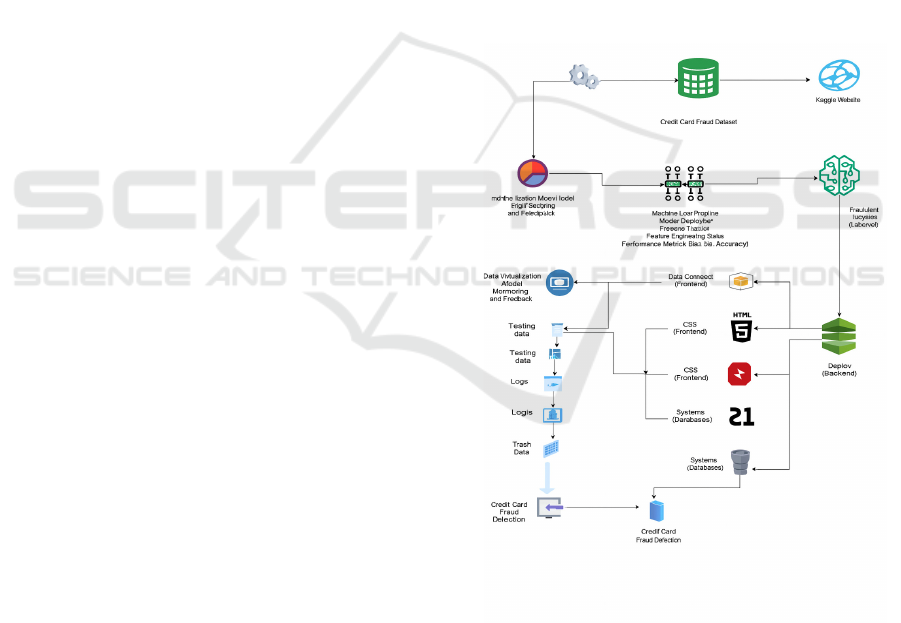

Figure 1 shows the system architecture.

5.1 System Architecture

Figure 1: System architecture.

5.2 Module Description

5.2.1 Data Pre-Processing

In most practical applications, data samples do not

fully capture population characteristics, making

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

140

validation indispensable. These methods help detect

missing and duplicate values while determining

whether data types are integers or floating-point

variables. Validation datasets are used to impartially

measure model performance during hyperparameter

tuning. As model configurations adjust based on

validation data, the risk of evaluation bias increases.

This dataset is frequently utilized to refine machine

learning models, allowing engineers to fine-tune

hyperparameters. The tasks of data collection,

preprocessing, and ensuring structural integrity

require significant time. Gaining insights into data

properties during identification aids in selecting the

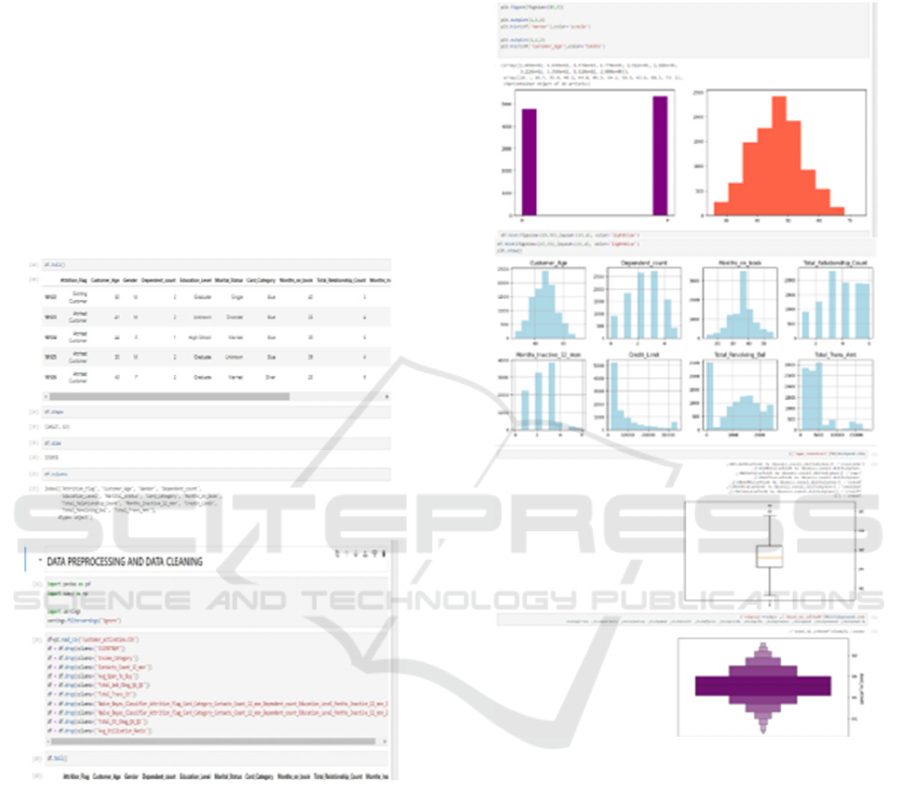

optimal algorithm for model development. Figure 2

shows the data processing steps.

Figure 2: Data processing.

5.2.2 Data Validation

Import library packages and load the dataset; analyze

variables, examine data structure, identify types, and

detect non-found entries. A verified dataset is kept for

an unbiased estimate of the model's skill and to

optimize hyperparameter tuning with the best

possible use of test and validation datasets. Data

preparation involves renaming datasets, removing

unnecessary columns, and doing variate analyses.

The cleaning methods and techniques are specific to

each dataset because every dataset is unique. The core

purpose of cleaning the data is to correct the errors or

irregularities, therefore enhancing the value for

analytics and informed decisions (figure 3).

Figure 3: Data validation.

5.2.3 Exploration Data Analysis of

Visualization

Visualizing visualizations is the natural way of

working with datasets to discover patterns, identify

errors/outliers, etc. Based on domain knowledge,

visualization in the form of plots/graphs can signify

important relationships meaningfully. Displaying

data graphically using plots and graphs may be more

stimulating than numerical figures.

In prediction outcomes, estimates are developed

with algorithms of linear equations that contain

independent variables, which can be practically

infinite in the negative and the positive direction. In

classification, the output must be mapped into

Next-Gen Fraud Detection: Machine Learning and Encryption for Credit Card Security

141

categories, and among them, logistic regression

showed the best prediction accuracy than the other

models tested.

Data visualization and exploratory data analysis are

huge areas and research beyond that suggested in the

books mentioned above. Visual representation of data

often makes patterns and trends clear, so visualization

is an important ingredient in applied statistics and

machine learning. Python plotting mastery enables us

to explore and understand datasets more effectively.

5.3 Algorithm

5.3.1 Algorithm Explanation

In the context of supervised learning where a system

is trained on labeled data inputs and then makes use

of the training to classify new data points. Datasets

may involve binary classes-for example, identifying

whether or not an email is spam, or determining

whether an individual is male or female-or multiple

classes. Some common examples of classification are

voice recognition, identification of handwritten texts,

biometric authentication, and categorizing

documents. Supervised learning algorithms are used

on labeled datasets for identifying patterns, relating

the identified patterns to new inputs, and thereby

assigning suitable labels to unseen data.

5.3.2 Adaboost Classifier

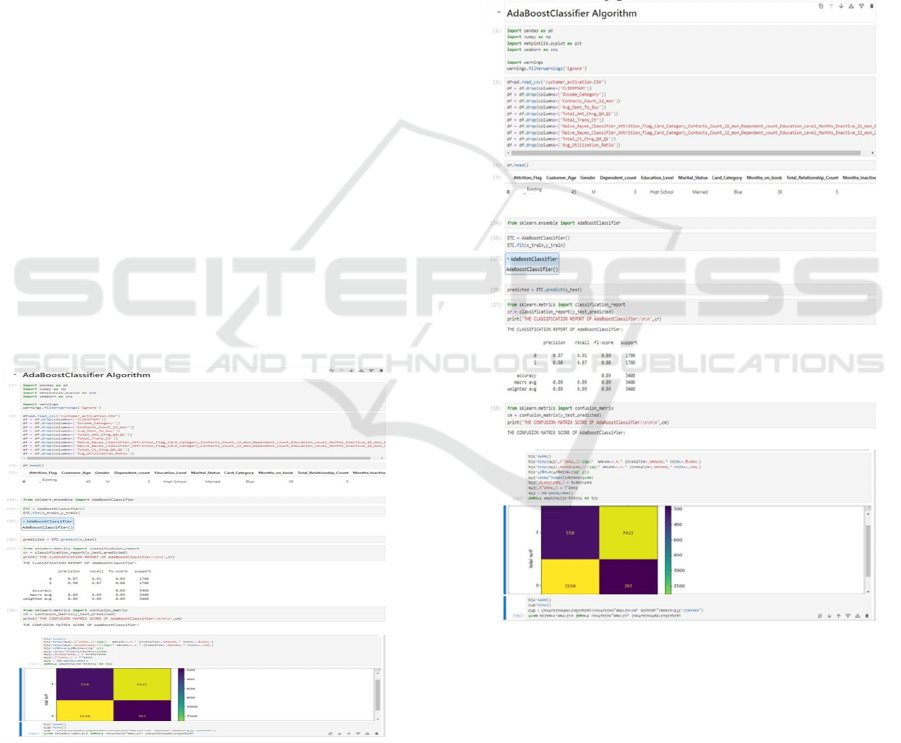

Figure 4: AdaBoost classifier.

The algorithm raises the weights of misclassified

instances, directing the next weak learners to

concentrate on these more difficult cases. Weak

learners are trained sequentially, modifying the

weights of misclassified instances. The model is

constructed at the end by aggregating the learners,

with each contributing proportionally to its accuracy,

and the ultimate prediction being based on the

weighted majority vote (figure 4).

5.3.3 Decision Tree Classifier

Decision Tree (figure 5) is a popular machine learning

algorithm for classification and regression problems.

It is depicted in the form of a tree, where every node

is a test or choice on a feature. Decision Trees are

most preferred in domains such as finance,

healthcare, and marketing for their simplicity, easy

interpretation, and capacity to solve complex

decision- making problems.

Figure 5: Decision tree classifier.

5.3.4 K N Neighbors Algorithm

It is a simple yet powerful, the query point's class is

found by the majority vote of its K nearest neighbours

(figure 6). The choice of K is a critical parameter,

as it can affect the model's overall performance is a

non-parametric algorithm, i.e., it doesn't make any

assumption about the underlying distribution of the

data.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

142

Figure 6: K N Neighbors algorithm.

The algorithm computes similarity in terms of

distance metrics, commonly Euclidean distance, but

other metrics like Manhattan or Minkowski distances

can be used based on the dataset. Since KNN doesn't

learn a model from the data, it is referred to as a lazy

learning algorithm, where the whole dataset is

retained and predictions are generated at the querying

time. KNN's simplicity and ease of implementation

are two of its strongest points. It can handle multi-

class classification problems and learn complex

decision boundaries. However, it has some

drawbacks as well, such as its computationally costly

prediction step, as it needs to compute distances to all

the training data, and its sensitivity to the curse of

dimensionality, where the performance of the model

degrades with an increase in the number of features.

By choosing an optimal K and distance metric and

applying dimensionality reduction techniques, most

of these problems can be resolved.

5.3.5 Extra Tree Classifier

It creates an ensemble of decision trees, which makes

predictions and averages out their results for better

overall performance. Extra Trees is a regular decision

tree with extra randomness added to the occasion of

building a tree. For instance, it randomizes every

split by selecting subsets of features instead of

developing the best split, which makes it more diverse

between the trees (figure 7).

Figure 7: Extra tree classifier.

The algorithm can produce better accuracy and

generalization than a single decision tree by

averaging predictions from these trees. So this Extra

Trees Classifier is very useful in cases of very large

datasets with high-dimensional features. The

algorithm reduces the complexity of determining the

best split point a randomized manner due to this

mechanism, thus accelerating training. Also it is less

prone to overfitting compared to other ensemble

learners like Random Forest, as Randomness used in

its construction reduces the chances of model

overfitting the training set and predicting accurately

Next-Gen Fraud Detection: Machine Learning and Encryption for Credit Card Security

143

on new instances. The Extra Trees Classifier is used

in various practical applications for real-time

classification that requires good accuracy and low

latency. It was able to deal with more data and

provide more accurate output making this technique

useful in a variety of sectors such as finance,

healthcare, and image processing. The algorithm is

particularly useful in cases of datasets with a high

dimensionality (many features), its randomization

mechanisms allow to control the complexity of

feature interactions while maximising accuracy and

computational efficiency.

6 CONCLUSIONS

Overall, the use of encryption models adds a better

layer of filtering for credit card fraud detection. We

are able to enhance the accuracy and safeguard of

anti-fraud technologies with latest algorithms and

strong encryption protocols. Machine learning

techniques such as deep learning and ensemble

models are powerful tools available to identify

suspicious activity by analyzing large volumes of

transactional data and recognizing abnormal patterns.

Encryption protects sensitive information at rest

during the analysis window from intrusion. This

activity further refines the accuracy of fraud detection

while promoting user confidence through top-tier

data protection practices.

6.1 Future Work

Thus, the approach is making the combination of

predictive techniques and cloud infrastructure as

effective as possible for IoT application where cloud

platforms such as AWS or Azure or Google Cloud is

thereby used to run well-trained ML models that

process large amounts of IoT data. Hosting and

training these models are available through cloud-

based services like Google AI Platform and AWS

Sage Maker. For smooth communication of IoT

device to the cloud, messaging protocols like MQTT

or HTTP can be used for exchanging data in real-

time. In addition, edge computing could be employed

to help reduce cloud- based processing dependence

by processing data near IoT devices, allowing for

rapid decision making and reducing the cloud

computational load. IoT specific lightweight models

can be rolled out on the edge for real- time

predictions. To handle the dynamic volume of data

traffic and keep the prediction models available all the

time, auto- scaling can be used in the cloud

infrastructure. Moreover both encryption and security

protocols are necessary to ensure confidentiality as

well as integrity in order to transport data across IoT

devices and cloud infrastructure. This allows for

better real-time decision-making with improved

performance, scalability, and security.

REFERENCES

[Acessed:14- SEP-2018]

A.C. Bahnsen, A. Stojanovic, D. Aouada, B.

Ottersten,”Cost sensitive credit card fraud detection

using bayes minimum risk, Machine Learning and

Applications” ICMLA 12th International Conference

on. Vol. 1, IEEE, 2013, pp. 333–338.

A.C. Bahnsen, A. Stojanovic, D. Aouada, B.

Ottersten,”Improving credit card fraud detection with

calibrated probabilities”, Proceedings of the, SIAM

International Conference on Data Mining.

Pennsylvania, USA2014, pp. 677–685.

Alex Shenfield, David Day, and Aladdin Ayesh,

"Intelligent intrusion detection system using artificial

neural networks," vol. 4, no.2, pp. 95-99, June 2018.

Antonia Nisioti, Alexios Mylonas, Paul D. Yoo, Vasilios

Katos. "From Intrusion Detection to Attacker

Attribution: A Comprehensive Survey of Unsupervised

Methods", IEEE Communications Surveys & Tutorials,

2018.

Chan PK, Fan W, Prodromidis AL, Stolfo SJ. ”Distributed

data mining in credit card fraud detection”. IEEE

Intelligent Systems and Their Applications, Nov; 14(6):

1999, pp. 67-74.

D. Stiawan, A.H. Abdullah, and M.Y. Idris, "The trends of

intrusion prevention system network, in 2010" 2nd

International Conference on Education Technology and

Computer, vol. 4, pp. 217-221, June 2010.

D.J.Weston, D.J. Hand, N.M. Adams, C.Whitrow, P.

Juszczak,” Plastic card fraud detection using peer group

analysis”, ADAC 2 (1) 2008, pp 45–62 ,

Dal Pozzolo, O. Caelen, Y.-A. Le Borgne, S. Waterschoot,

G. Bontempi,”Learned lessons in credit card fraud

detection from a practitioner” perspective, Expert Syst.

Appl. 41 (10), 2014 , pp. 4915– 4928.

ECB, “Third Report on Fraud, European Central Bank”,

February 2014.

Gómez, J. A., Arévalo, J., Paredes, R., & Nin, J, “End-to-

end neural network architecture for fraud scoring in

card payments.” Pattern Recognition Letters, 2017.

Gulshan Kumar. "The use of artificial intelligence based

techniques for intrusion detection: a review", Artificial

Intelligence Review, 09/04/2010.

Iman Sharafaldin, ArashHabibiLashkari, and Ali A.

Ghorbani, "Toward Generating a New Intrusion

Detection Dataset and intrusion Traffic

Characterization", 4th International Conference on

Information Systems Security and Privacy (ICISSP),

Portugal, January 2018.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

144

J.T. Quah, M. Sriganesh,”Real-time credit card fraud

detection using computational intelligence,” Expert

Syst. Appl. 35 (4), 2008, PP 1721– 1732.

L. Akoglu, H. Tong, D. Koutra, “Graph based anomaly

detection and description: a survey”, Data Mining and

Knowledge Discovery Available Online”,

http://dx.doi.org/ 10.1007/s10618-014-0365-y. 2014.

Liao H.-J., Lin C.-H.R., Lin Y.-C., and Tung K.-Y.

“Intrusion detection system: A comprehensive review”

Network Computing. Appl., Rev., 36 (1), pp. 16-24

,2013.[Online].Availablehttps://www.kdnuggets.com/

2016/10/beginners-guide- neuralnetworks-python-

scikit-learn.html.

Monowar H. Bhuyan, Dhruba K. Bhattacharyya, Jugal K.

Kalita. "Network Traffic Anomaly Detection and

Prevention", Springer Nature, 2017.

R.J. Bolton, D.J. Hand, et al.,”Unsupervised profiling

methods for fraud detection,” Proceedings of the VII

Conference on Credit Scoring and Credit Control, 2001,

pp. 235–255, (Edinburgh, United Kingdom).

Rosenblatt F. “The perceptron: A probabilistic model for

information storage and organization in the brain”

Psychol. Rev., 65 (6), pp. 386-408, 1958.

Singh R., Kumar H., Singla R.K., and Ketti R.R. “Internet

attacks and intrusion detection system: A review of the

literature” Online Inform. Rev., 41 (2), pp. 171-184,

2017.CrossRefView Record in ScopusGoogle Scholar.

T.P. Bhatla, V. Prabhu, A. Dua, “Understanding credit card

frauds”, Cards Bus. Rev. 1 (6), 2003, pp. 1–17.

V. Zaslavsky, A. Strizhak, “Credit card fraud detection

using selforganizing maps” Inf. Secur. 18, 2006, PP 48.

Van Vlasselaer V, Bravo C, Caelen O, Eliassi-Rad T,

Akoglu L, Snoeck M, Baesens B. “APATE: A novel

approach for automated credit card transaction fraud

detection using network-based extensions.” Decision

Support Systems. 2015, pp. 38-48.

West J, Bhattacharya M. “Payment Card Fraud Detection

Using Neural Network Committee and Clustering.

Computers & Security. 2016; 57:47- 66.

Wu J., Peng D., Li Z., Zhao L., and Ling H. “Network

intrusion detection based on a general regression neural

network optimized by an improved artificial immune

algorithm.”Rev.,10 (3), 2015. [Online] Available

https://www.ncbi.nlm.nih.gov/pubmed/25807466

[Acessed:14-SEP-2018].

Zhang G.P. “Neural networks for classification: A survey”

IEEE Trans. Syst. Man Cybern. C, Rev., 30 (4), pp.

451-462, 2000.

Zhang, S., Xiong, W., Ni, W., & Li, X. “Value of big data

to finance: observations on an internet credit Service

Company in China.” Financial Innovation, 1(1), 2015.

Next-Gen Fraud Detection: Machine Learning and Encryption for Credit Card Security

145