EDA: Bank Loan Default Risk Analysis

N. Ramadevi, Vasagiri Sai Kumar, Kondamadugula Dheeraj Reddy, Gandragoli Kasi Viswanath,

Natuva Komal Sai and Bachu Venkata Deepak Kumar

Department of Computer Science and Engineering (Data Science), Santhiram Engineering College, Nandyal‑518501,

Kurnool, Andhra Pradesh, India

Keywords: Data Visualization, Statistical Analysis, Credit History, Employment Status, Loan Amount, Default

Probability, Risk Analysis, EDA, Loan Default Risk, Credit Risk.

Abstract: The increasing number of debt lapse presents a large assignment to economic institutions, affecting their

profitability and lengthy-term economic stability. Debt omission occurs whilst the borrower fails to fulfill his

compensation obligations, leading to expanded hazard for banks and creditors. Identification of things

contributing to those omissions is vital to improve credit score danger evaluation and make sure greater

powerful lending practices. This takes a look at focuses on search information analysis (EDA) to research

historical mortgage records and highlight the most important pattern affecting the loan reimbursement

behavior. By analyzing borrower characteristics including income level, employment repute, credit score,

mortgage quantity, hobby rate and reimbursement history, the purpose of this take a look at is to become

aware of critical factors that determine the opportunity of mortgage urge. Using data visualization and

statistical strategies, the research default examines the relationship between various economic and

demographic variables to provide precious insights in chance. Understanding those patterns can assist banks

to make loans and manipulate financial dangers knowledgeable. Analysis curses the importance of credit score

history, as debtors with negative compensation records are more likely to default. Additionally, elements

along with high loan-to-earnings ratio, risky employment and big loan quantity contribute to debt offenses.

By identifying these essential chance indicators, economic establishments can boom their credit evaluation

shape and apply extra powerful hazard mitigation strategies. One of the major goals of this have a look at is

to help banks in developing facts-driven loan approval strategies. By leveraging insights from EDA, monetary

establishments can refine their lending standards, reduce non-acting loans, and optimize risk evaluation

fashions. This, in turn, facilitates in preserving financial balance whilst making sure that eligible borrowers

get hold of get admission to credit score.

1 INTRODUCTION

The growing number of loan defaults has grown to be

an important issue for banks and monetary

establishments global. A loan default occurs whilst a

borrower fails to fulfill the repayment duties, leading

to financial losses for the lender. As the call for loans

maintains to upward thrust, banks should carefully

assess credit hazard to minimize default charges

while ensuring that loans are granted to eligible

applicants. Effective danger control techniques are

essential to preserve economic balance and prevent

monetary disruptions resulting from high default

prices.

Exploratory Data Analysis (EDA) plays a critical

position in understanding the patterns and

developments associated with loan defaults. By

reading historical mortgage facts, financial

establishments can advantage insights into key

factors influencing default danger. Attributes which

include borrower earnings, employment status, credit

score, mortgage amount, interest price, and

compensation records offer valuable indicators of an

applicant's capacity to repay a loan. EDA enables find

hidden relationships among those variables,

permitting banks to make records-driven lending

selections.

One of the number one goals of this take a look at

is to perceive high-chance borrowers based totally on

their economic and demographic traits. Borrowers

with bad credit score history, low earnings, risky

Ramadevi, N., Kumar, V. S., Reddy, K. D., Viswanath, G. K., Sai, N. K. and Kumar, B. V. D.

EDA: Bank Loan Default Risk Analysis.

DOI: 10.5220/0013909100004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 4, pages

125-129

ISBN: 978-989-758-777-1

Proceedings Copyright © 2026 by SCITEPRESS – Science and Technology Publications, Lda.

125

employment, or high debt-to-earnings ratios are more

likely to default. By studying those patterns, banks

can put in force stricter credit score policies, improve

hazard assessment fashions, and minimize monetary

losses. This has a look at also explores how one- of-

a-kind mortgage characteristics, along with mortgage

tenure and interest quotes, effect default prices.

Data visualization techniques, such as histograms,

container plots, heatmaps, and scatter plots, are used

in this evaluation to interpret complex facts

relationships successfully. These visual

representations provide a clearer understanding of

how borrower attributes impact compensation

conduct. Additionally, correlation evaluation helps

determine the electricity of relationships between

exceptional monetary elements, helping in the

improvement of robust risk prediction fashions.

The insights from this evaluation are vital for

monetary establishments to decorate their credit score

approval procedures. By refining lending criteria,

banks can ensure that loans are granted to debtors

with a decrease chance of default. Moreover,

enforcing system mastering models primarily based

on EDA findings can similarly improve the accuracy

of default prediction structures, permitting a proactive

approach to hazard management

2 RELATED WORKS

2.1 Searching Data Analysis in Debt

Risk Evaluation (EDA)

Ch. Deepika et al. (2024) Integrate searching data

analysis (EDA) with machine learning to assess bank

loan default risks. The proposed system employs

random forest and size values for lecturers,

emphasizing transparency in credit decisions. Python

library such as pandas and

skikit-learns is used for preprocessing and model

training, receive high accuracy through modules for

data division, convenience of importance analysis and

real-time credit prediction. Framework highlights the

role of EDA in identifying repayment patterns and

reducing financial risks for institutions offering

municipal loans.

2.2 An Exploratory Data Analysis for

Loan Prediction Based on Nature of

the Clients

Previous studies in loan prediction have

predominantly employed machine learning and data

mining techniques to assess credit risk. For instance,

Goyal and Kaur (2016) explored ensemble models,

achieving 81.25% accuracy using tree algorithms,

while others utilized J48 (78.38% accuracy) and

Naive Bayes classifiers for loan approval decisions.

Research by Shaath emphasized R-based credit risk

modeling with K-nearest neighbors (KNN) for

handling missing data, and Sudhakar et al. (2016)

applied decision trees to bank datasets for risk

stratification. These works highlight the efficacy of

predictive algorithms but often overlook foundational

data exploration.

2.3 Higher-Compatibility Loan

Approval Using Prediction

Dressing Methods

F.M. Ahosanul Haq and MD. Maheedi Hasan (2024)

acquired 99% accuracy in predicting loan approval

using adbots on a dataset of 148,670 entries. Their job

compares enchanted methods (Random Forest,SVM)

and highlights the strength of the adbots in handling

unbalanced data. Feature selection and encoding

technology streamlines models, while accurate

metrics banking to automate approved procedures in

banking ecosystems.

2.4 Machine Learning for Debt

Classification

Pro. R. Yadgiri Rao et al. (2022) Propose an ML-

based debt prediction system using demographic and

financial characteristics. Their model takes advantage

of trees and logistic regression to classify applicants,

which emphasizes pre -proposing stages such as

external removal and generalization. The study

reports 85% accuracy, highlighting the role of feature

engineering in increasing the future performance for

Indian banking references.

2.5 Nervous Network and Hybrid

Models for Credit Risk Evaluation

Gopinath Mahankali and Mahip Kunagu (2021) focus

on credit risk evaluation using nervous network and

shield promoting. Their work addresses square

imbalance through smoke and receives 89%

accuracy, emphasizing the importance of variables

such as credit history and income. The study

advocates to improve default prediction in retail

banking for hybrid models.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

126

2.6 Comparative Analysis of ML

Algorithm for Loan Approval

Dr. E. Neelima et al. (2022) Compare SVM, Random

Forest and XGBost for loan approval, get 83%

accuracy with feature selection techniques. Their

structure uses the scikit- learn of the python for data

visualization and emphasizes lowering false positive

through hypermeter tuning, demonstrating practical

prevention in the rural banking sector of Andhra

Pradesh.

2.7 Naive Bayes and Ensemble

Learning for Loan Repayment

Prediction

E. Chandra Blassi and R. Rekha (2019) appoints the

methods of the contingent of Bhole Bayes and artists

to predict debt repayment capabilities. Their study

highlights the importance of credit scores and

employment status, acquiring 78% accuracy. This

task underlines the need for real -time monitoring to

update the model with developing financial trends.

2.8 Logistic Regression and Decision

Trees for Automated Loan

Processing

V. Nikhileswar et al. (2019) use logistic regression

and decision trees to automate loan eligibility checks.

By analyzing historical data from Hyderabad-based

banks, their model achieves 81% accuracy, reducing

manual processing time. The study stresses the

scalability of ML models for high-volume loan

applications in urban financial hubs.

3 METHODOLOGY

3.1 Dataset

Collect loan-related data from financial institutions or

publicly available sources. Ensure that the dataset

includes key attributes such as loan amount, applicant

income, credit score, interest rate, employment

status, repayment history, and loan tenure. Perform an

initial inspection of the dataset to check for

inconsistencies or anomalies.

3.2 Data Processing

Handle missing values using techniques such as

mean/median imputation or dropping irrelevant

records. Convert categorical variables into numerical

form using encoding techniques (e.g., one-hot

encoding or label encoding). Standardize or

normalize numerical features to ensure uniformity in

data distribution. Identify and remove duplicate

records to maintain data integrity.

3.3 Train-Test Split

Split the dataset into training and testing sets

(typically 80-20 or 70-30 split). Ensure stratified

sampling to maintain the proportion of loan defaulters

and non-defaulters in both sets. Validate the

distribution of key attributes across training and

testing datasets to avoid bias.

3.4 Training Data

Conduct Exploratory Data Analysis (EDA) on the

training dataset to identify trends and correlations.

Use univariate analysis to study the distribution of

individual features (e.g., histograms, box plots).

Perform bivariate analysis to examine relationships

between different attributes (e.g., correlation

heatmaps, scatter plots). Identify key risk indicators

affecting loan defaults, such as high debt-to-income

ratio, low credit scores, or high loan-to-value ratios.

3.5 Testing Data

Use the test dataset for validating insights obtained

from the training data. Cross-check patterns and

ensure consistency in trends observed during EDA.

Assess any significant variations or unexpected

behaviours in the data distribution.

3.6 Statistical Analysis & Visualization

Generate descriptive statistics to summarize data

characteristics, such as mean, median, standard

deviation, and skewness. Create visual

representations, including bar charts, pie charts, box

plots, and distribution curves, to better understand

data patterns. Analyze correlations between different

financial and demographic factors to determine their

impact on loan repayment.

3.7 Result Interpretation

Identify key insights from the EDA, such as common

characteristics of defaulters and successful

borrowers. Highlight significant risk factors

contributing to loan defaults and their potential

impact. Compare findings with existing financial risk

EDA: Bank Loan Default Risk Analysis

127

models or industry standards.

3.8 Visualization & Report Findings

Present the analysis results using dashboards, charts,

and visual reports for better understanding.

Summarize key observations in a structured format,

providing actionable insights for financial

institutions. Propose recommendations for mitigating

loan default risks, such as improved credit scoring

models, stricter approval criteria, or enhanced

borrower monitoring strategies.

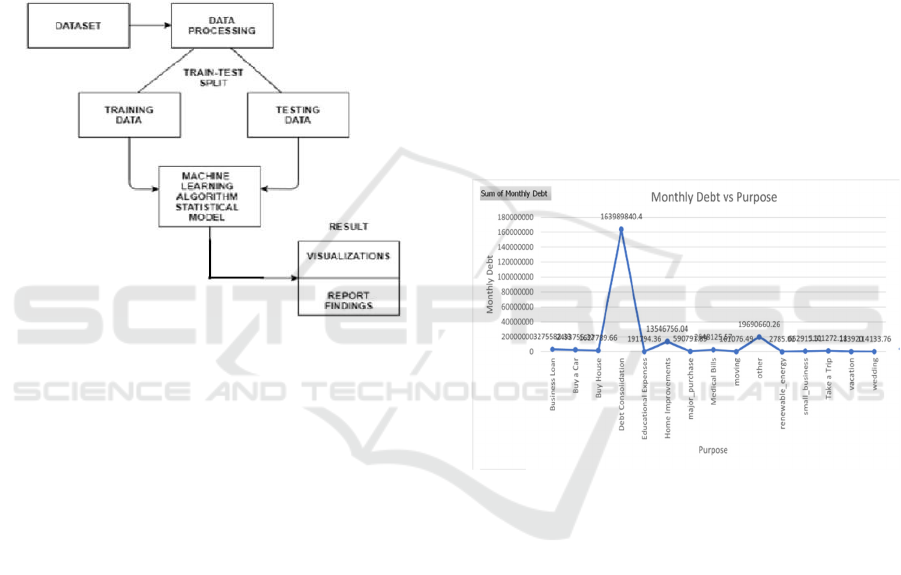

Figure 1 shows the

Methodology Flow chart.

Figure 1: Methodology Flow Chart.

4 RESULT AND EVALUATION

4.1 Loan Applicant Data Analysis

Whenever the bank makes decision to give loan to

any customers then it automatically exposes itself to

several financial risks. It is necessary for the bank to

be aware of the clients applying for the loan. This

problem motivates to do an EDA on the given dataset

and thus analyzing the nature of the customer. The

dataset that uses EDA undergoes the process of

normalization, missing value treatment, choosing

essential columns using filtering, deriving new

columns, identifying the target variables and

visualizing the data in the graphical format. Python is

used for easy and efficient processing of data. This

paper used the panda’s library available in Python to

process and extract information from the given

dataset. The processed data is converted into

appropriate graphs for better visualization of the

results and for better understanding. For obtaining the

graph Matplot library is used.

4.1.1 Monthly Debt vs Loan Purpose

• The highest monthly debt is linked to Debt

Consolidation loans, followed by home

buying.

• This suggests that people taking loans for debt

consolidation may already be financially

strained.

• Analyzing the default rates per loan purpose can

highlight high-risk loan categories.

• Debt Consolidation loans dominate,

suggesting many borrowers struggle with

existing debts.

• Home-buying loans also show high debt,

meaning property investments may be risky for

banks.

• Analyzing default rates per loan purpose can

reveal which loan types pose the highest

financial risk.

Figure 2 shows the Monthly Debt

vs Loan Purpose.

Figure 2: Monthly Debt Vs Loan Purpose.

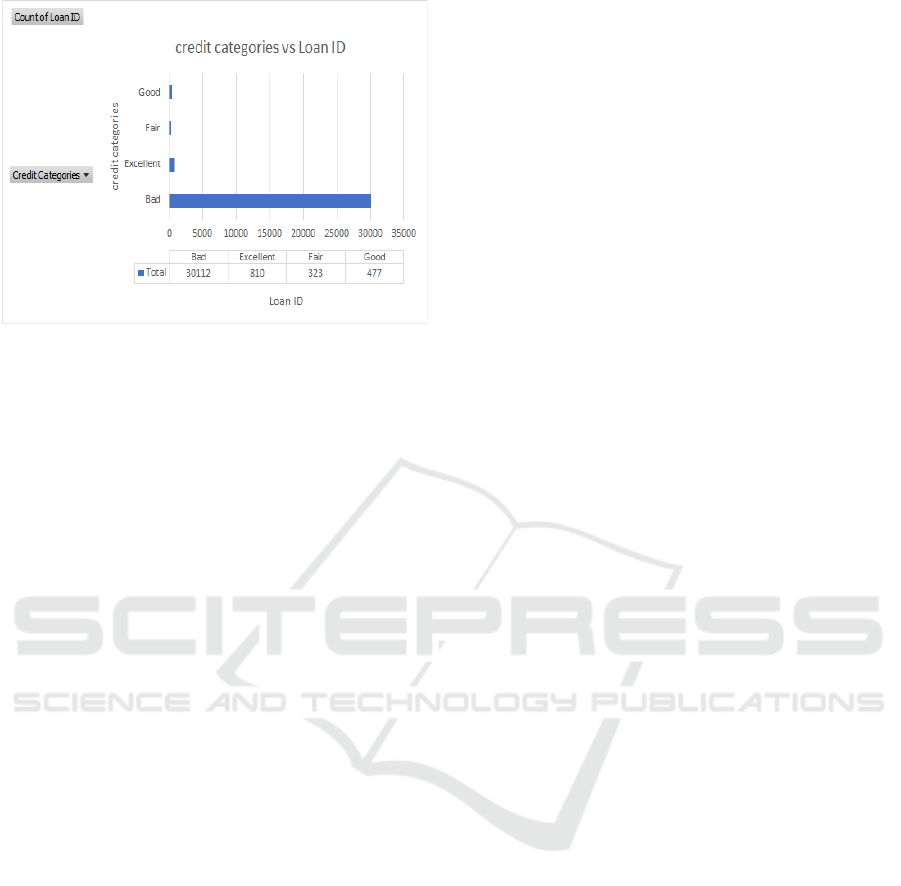

4.1.2 Credit Categories vs Loan ID

• Bad credit borrowers make up the majority,

raising concerns about high default

probability.

• The small number of Excellent and Good

credit loans suggests that banks may prefer

riskier lending strategies.

• Understanding repayment trends per credit

category can help in adjusting loan approval

criteria.

• Most loans belong to the Bad Credit category,

indicating a high-risk borrower pool.

• Very few loans are issued to those with

Excellent or Good credit.

• The high proportion of bad credit loans might

correlate with higher loan default rate.

Figure

3 shows the Credit Categories vs Loan ID.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

128

Figure 3: Credit Categories vs Loan ID.

5 CONCLUSIONS

This study systematically explores the critical factors

influencing loan default risks through Exploratory

Data Analysis (EDA), offering actionable insights to

enhance credit risk assessment frameworks. Key

findings reveal that debt consolidation and home-

buying loans are associated with higher financial

strain, as borrowers in these categories exhibit

elevated monthly debt levels and default

probabilities. The dominance of bad credit applicants

in loan approvals underscores systemic risks,

suggesting financial institutions may prioritize short-

term gains over long-term borrower stability. Sector-

specific risks, such as freelancers and full-time

workers, emerged as vulnerable groups, necessitating

tailored risk-mitigation strategies. The analysis

identifies credit history, loan-to-income ratios, and

employment stability as pivotal determinants of

repayment capacity. Visualizations like heatmaps and

box plots corroborate these patterns, demonstrating

strong correlations between poor credit scores, high

loan amounts, and default rates.

REFERENCES

Ch. Deepika, Ch. Alekhya, G. Khushi Reddy, Ch. Mounika,

S, Chaitanya Kumar,’ “Eda For Bank Loan Default

Risk Assessment” ‘, Computer Science Department,

JNTUH, Vidhya Jyothi Institute of Technology, India,

International Journal of Progressive Research in

Engineering Management and Science (IJPREMS),

Vol. 04, Issue 12, December 2024, pp: 887-893.

Dr. E. Neelima, Venkata Ayyappa Reddy Maruprolu, Sai

Prasad Penta, and Karthikeya Mallareddy “explored

Loan Approval Prediction Using Supervised Machine

Learning Algorithm” (2022) at GITAM University,

Visakhapatnam, Andhra Pradesh, India, Vol 13, Issue

04, APRIL/2022 ISSN NO:0377-9254, JES

publication.

E. Chandra Blessie and R. Rekha published “Exploring the

Machine Learning Algorithm for Prediction the Loan

Sanctioning Process” (2019) in the International

Journal of Innovative Technology and Exploring

Engineering. The research was conducted at the

Department of MCA, Nehru College of Management,

Coimbatore, Tamil Nādu, India, International Journal

of Innovative Technology and Exploring Engineering

(IJITEE) ISSN: 2278-3075 (Online), Volume-9 Issue-

1, November 2019.

F. M. Ahosanul Haque and Md. Mahedi Hassan authored

“Bank Loan Prediction Using Machine Learning

Techniques” (2024) at the Department of Computer

Science and Engineering, Daffodil International

University, Dhaka, Bangladesh, American Journal of

Industrial and Business Management, 2024, 14, 1690-

1711 https://www.scirp.org/journal/ajibm

Gopinath Mahankali and Maheep Kunagu presented

“Customer Loan Prediction Analysis” (2021) as part of

their Bachelor of Engineering requirements at the

Department of Computer Science and Engineering,

School of Computing, India, IEEE international

conference on advances in computer applications

(ICACA).

Led by Prof. R. Yadagiri Rao, with collaborators K.

Srikanth, S. Ajay Kumar, S. Srinath, Y. Sandeep

Kumar, and B. Rajesh, the project “ML-Based Loan

Prediction” (2022) was executed at the Sri Indu Institute

of Engineering & Technology, Hyderabad, India,

Journal of Education: Rabindra Bharati University Issn:

0972-7175

V. Nikhileswar, Sunil Bhutada, and Mekala Sreenivas

addressed Mitigation of “Banking and Financial

Services Involved Risks” (2019) at the Sreenidhi

Institute of Science & Technology, Hyderabad, India,

Turkish Journal of Computer and Mathematics

Education Vol.11 No03 (2020), 1073 – 108.

X.Francis Jency, V.P.Sumathi, Janani Shiva Sri developed

“An Exploratory Data Analysis for Loan Prediction

Based on Nature of the Clients “(2018). The work was

conducted at the Department of Mechanical

Engineering, international Journal of Recent

Technology and Engineering (IJRTE) ISSN: 2277-

3878 (Online), Volume-7 Issue-4s, November 2018.

EDA: Bank Loan Default Risk Analysis

129