Fraud Detection in Financial Transaction Using Advanced Analytical

Techniques

S. Md Riyaz Naik, Syed Mohammad Arif, Donthala Rakesh, Shaik Khaja Peer,

Battu Sai Deepak and Kasetty Sandeep

Department of Computer Science and Engineering, Santhiram Engineering College, Nandyal‑518501, Andhra Pradesh,

India

Keywords: Financial Transactions, Fraud, Detection, Fraudulent Activity.

Abstract: Fraud detection for financial transactions is a challenging issue that is crucial to customers, merchants and

financial service providers alike. Rule based detection that is typical cannot keep up with the increasing

complexity of fraud. A need to develop robust and scalable systems that exploit state-of-the-art technology

such as Artificial Intelligence (AI), Data Analytics (DA) and Machine Learning (ML) for this purpose are the

subject of this issue statement. A primary objective is to develop models and algorithms that are able to

accurately identify fraudulent transactions while minimizing false positives. This requires analysing large

volumes of transaction data in real-time or near-real-time to identify any suspicious trends or anomalies.

Iteach8 How do you keep the model updated with latest fraud patterns? Learning and updating must continue

since system should also evolve/respond to new types of fraud when they occur. Managing imbalanced

datasets, where fraudulent transactions are uncommon in comparison to legal ones, protecting sensitive

financial data, and keeping latency low to avoid processing delays are some of the primary issues.

1 INTRODUCTION

In the financial domain, fraud is a recurring issue,

which has been threatening the safety of people,

companies and financial institutions.

The methods and sophistication of fraud evolve

with technology and the increased digitalization of

financial services. In the last decade, due to this

ongoing threat, Financial Transaction fraud detection

has taken a significant role of interest for companies

around the world.

Fraud detection in financial transactions employs

artificial intelligence, machine learning algorithms,

and advanced analytics to identify peculiar patterns

or behaviors that may indicate fraudulent activities.

By examining enormous

Banks can quickly prevent and halt fraudulent

behavior by leveraging transaction data in real time,

protecting funds, preserving trust, and maintaining

financial stability.

Sophisticated Fraud Methods: Identity theft,

account takeover and social engineering are just a

few tactics that scammers employ to circumvent

detection systems.

Data volume and Velocity: Handling the large

volume and velocity at which financial transactions

occur in real-time presents a challenge that demands

scalable algorithms and powerful infrastructure.

False positives: In order to avoid angering

genuine customers and delivering a poor user

experience, it’s important to walk the fine line

between spotting genuine fraudulent activity and

minimizing false positives.

Financial institutions are able to quickly identify

and prevent fraud by leveraging real-time

transactional information, safeguarding funds and

trust, and maintaining the integrity of the financial

system.

Advanced Fraud Techniques: Identity theft, acco

unt takeover, and social engineering are just a few o

f the strategies that scammers use to get around dete

ction systems.

Data number and Velocity: Processing and inter

preting data in realtime is difficult due to the sheer n

umber and velocity of financial transactions, necessi

tating scalable algorithms and a strong infrastructure

False Positives: To prevent upsetting real consu

mers and creating a bad user experience, it's critical

Naik, S. M. R., Arif, S. M., Rakesh, D., Peer, S. K., Deepak, B. S. and Sandeep, K.

Fraud Detection in Financial Transaction Using Advanced Analytical Techniques.

DOI: 10.5220/0013905200004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 3, pages

765-769

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

765

to strike a balance between identifying authentic fra

udulent activity and reducing false positives.

Regulatory Compliance: While maintaining

efficient fraud detection systems, financial

institutions must abide by strict regulatory standards,

such as Know Your Customer (KYC) and anti-

money laundering (AML) laws.

Cross-Channel Fraud: As omnichannel banking

and payment systems proliferate, it becomes more

difficult to identify fraud across many platforms and

channels

.

2 REVIEW OF LITERATURE

Conventional Statistical Methods: For fraud

detection, traditional statistical techniques including

Bayesian networks, decision trees, and logistic

regression have been employed.

Among the notable papers is "Detecting

fraudulent transactions in financial data sets" by Liu,

Lai, and Ma (1999). The authors of the 2002

publication "A Survey of Credit and Behavioural

Scoring: Forecasting Financial Risk of Lending to

Consumers" were Thomas and associates.

Methods of Data Mining and Machine Learning:

These methods' capacity to manage massive data sets

and spot intricate patterns has led to their rise in

popularity. Neural networks, support vector

machines, random forests, and ensemble approaches

are examples of common algorithms.

"Credit Card Fraud Detection Using Artificial

Neural Networks" by Bhattacharyya et al. (2011) is

one of the notable papers.

The study "Credit Card Fraud Detection Using

Machine Learning: A Survey" was published in 2019

by Bhattacharyya and colleagues.

Finding Anomalies:

Finding transactions that differ

from the typical conduct of authorized users is the

main goal of anomaly detection. Autoencoders,

clustering, and statistical methods are among the

techniques.

Among the notable papers is Zhang et al.'s "Fraud

detection in financial data using unsupervised

learning" (2005).

According to Phua et al. (2007), "Credit Card

Fraud Detection: A Realistic Modeling and a Novel

Learning Strategy"

Analytics of Behavior: This method looks at trends

in behavior over time to find irregularities that could

be signs of fraud. Among the methods are user

profiling, Markov models, and sequence analysis.

One of Lee and Stolfo's notable papers is

"Detecting anomalous and unknown intrusions

against programs" (2000).

"Using Behavioral Analysis to Improve Fraud

Detection" by Axelsson (2000).

Processing streams and big data: The development

of big data technologies has made it possible to detect

fraud in real time. Scalable algorithms, distributed

computing, and stream processing frameworks are

some of the methods. Notable Papers: Kantarcioglu et

al.'s "Real-time fraud detection in high-velocity data

streams" (2008). By Jajodia et al. (2016), "Big Data

and Data Mining Challenges on Scalable and High-

Performance Cyber Threat Analytics" is discussed.

Blockchain and the Identification of

Cryptocurrency Fraud: The detection of fraud in

cryptocurrency transactions has been the focus of

research since the advent of blockchain technology.

Graph analysis, transaction pattern recognition,

and smart contract auditing are some of the methods.

Prominent Articles: Bartoletti et al.'s "Bitcoin Heist:

Topological Data Analysis for Ransomware

Detection on the Bitcoin Blockchain"(2018).

By Yli-Huumo et al. (2016), "Blockchain: A

review on applications and potential challenges"

Methods of Data Mining and Machine Learning:

The use of data mining methods and machine learning

algorithms to identify fraudulent transactions is the

subject of numerous studies. Decision trees, random

forests, support vector machines, neural networks,

and clustering algorithms are some of these

techniques. Scholars frequently investigate how well

these methods categorize authentic and fraudulent

transactions according to attributes including

transaction amounts, transaction time, location, and

user behaviour

Identifying Deviations: Anomaly detection, which

searches for deviations from normal behavior, is a

widely used technique for identifying fraudulent

transactions. This could involve statistical

techniques like clustering or Gaussian mixture

models, or more sophisticated tactics like

autoencoders in neural networks. Research in this

area frequently aims to identify novel features or

feature combinations that can improve anomaly

detection systems' accuracy.

Analyzing Behavior: Users' behavior should be in

relevant to detect purposes fraud on financial

transactions. Studies in this area are generally focused

on the analysis of behaviors (such as spending

measures, transaction frequencies, or deviations from

normal behavior). Also consider behavioral

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

766

biometrics, for example mouse movements, or

keyboard dynamics, that could potentially be

considered as fraud indicators.

For some financial fields such as banking, credit

card transactions or online payment system,

researchers develop and evaluate fraud detection

schemes and algorithms. In order to efficiently detect

and prevent fraud these systems often use a variety

of methodologies, including rule-based, machine-

learning and real-time monitoring.

Privacy and Security for Data: The challenges of

security and privacy are also the focus of research

while implementing the fraud detection systems as

the information that fraud detection analysis work

with Identifiers sensitive financial information.

Ensuring that encrypted data is protected from

leakage during detection, this work even provides

encryption and secure data sharing, also privacy

preserving analytics.

Case Studies and Evaluation Metrics: The

validation of the fraud detection methods based on

empirical data is often presented by the literature.

Performance is measured using metrics such as

accuracy, precision, recall, and false positive rate as

researchers try to determine how effective different

approaches are, and what their pros and cons might

be.

Regulations within financial transaction fraud

detection, such as those required for compliance and

best practices for fraud prevention may also be

investigated. This encompasses the conversation on

Know Your Customer (KYC) regulations, anti-

money laundering (AML) mandates and other

regulatory mechanisms intended to fight financial

fraud.

3 METHODOLOGY

Research Design: Start by outlining the general

research strategy you used for your investigation.

This could be a case study, observational,

experimental, or a mix of approaches. Justify the

design's suitability for achieving the study's goals.

Data Collection: Describe the data sources you used

for your research. Transaction logs, historical

financial data, publicly accessible information, and

synthetic data created for research purposes are a few

examples of this. Explain the data collection process,

including any sample strategies used.

Describe the procedures used to preprocess the

data prior to analysis. To get rid of duplicates,

missing numbers, or outliers, data cleaning may be

necessary. Describe any feature engineering,

normalization, or transformations that were done to

get the data ready for analysis.

Feature Engineering and Selection: Explain how

pertinent features or variables are chosen for the fraud

detection model. Describe the feature selection

criteria and any expert or subject knowledge that was

taken into account. Talk about any extra features that

were created using the raw data to improve the

model's performance.

Model Creation: Describe the statistical or machine

learning methods that were applied to create the fraud

detection model. This could involve unsupervised

learning methods (like clustering, anomaly

detection), supervised learning algorithms (like

logistic regression, decision trees, and support vector

machines), or hybrid strategies. Justify the models'

selection by stating that they are appropriate for the

problem domain.

Model Evaluation: Describe the process by which

the fraud detection model's performance was

assessed. This could involve using cross-validation

methods to evaluate the model's capacity for

generalization, including holdout validation or k-fold

cross-validation. Explain the evaluation measures

that are employed, such as area under the ROC curve

(AUC), recall, accuracy, precision, and F1-score, and

talk about how to interpret them in relation to fraud

detection.

Configuration for the Experiment: Describe the

experimental setting in full, including any model

optimization or parameter tuning that was done.

Specify any hyperparameters selected for the models

and explain the process of dividing the data into

training, validation, and test sets.

Ethical Issues: Talk about any ethical issues

pertaining to the study, such as confidentiality, data

privacy, and the possible effects of false positives or

false negatives on fraud detection. Describe how

these factors were taken into account at every stage of

the study process.

Restrictions: Recognize any restrictions or limits

imposed by the approach used in your research. This

could involve restrictions on processing resources,

assumptions made in the modeling approach, or limits

of the dataset.

Reliability and Validation:

Discuss measures taken to ensure the validity and

reproducibility of the research findings. This could

be data-sharing procedures, code accessibility, or

Fraud Detection in Financial Transaction Using Advanced Analytical Techniques

767

experimental procedure to allow the study to be

repeated by other scholars.

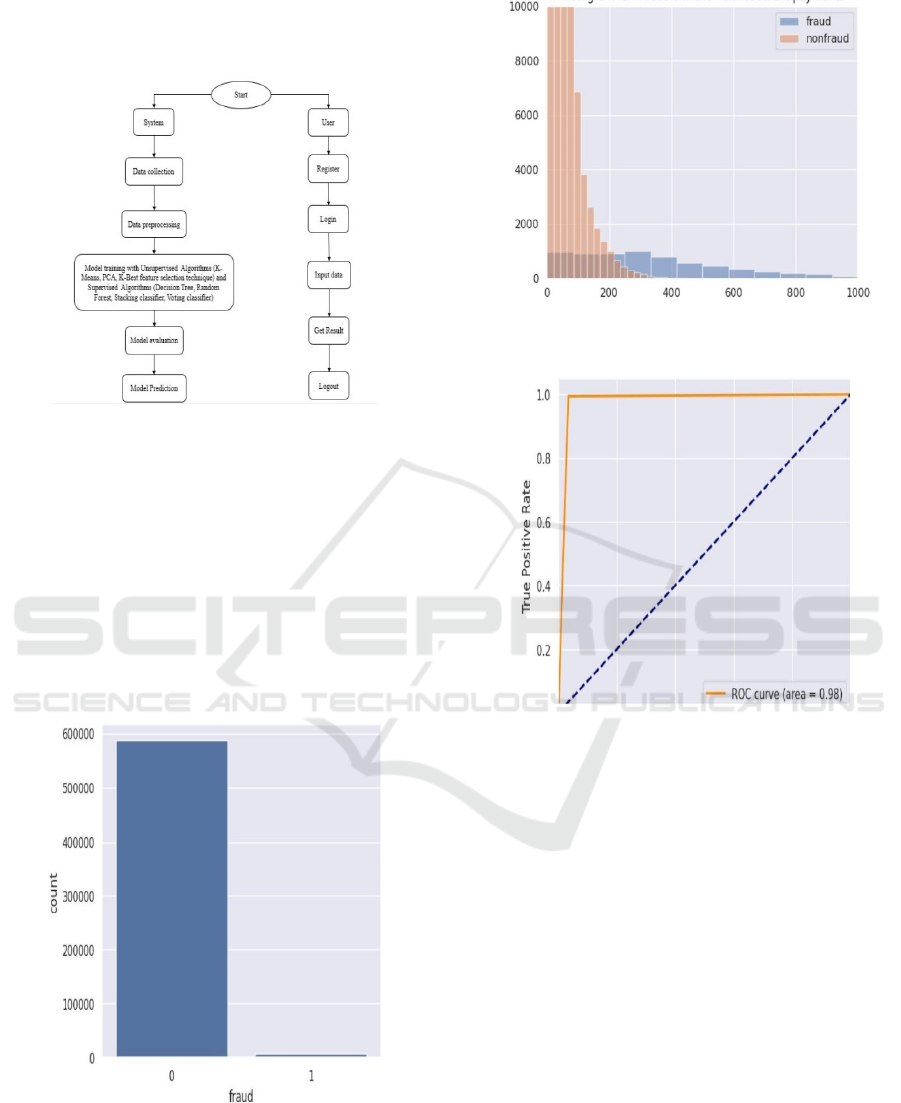

Figure 1 show the ML

System Workflow.

Figure 1: ML system workflow.

1. Gather data

2. Put data in

3. Prepare the data

4. Display the information

5. Divide the data set between testing and training.

6. Use any ML model to train the data 7. Use testing

data to assess the data.

4 EXPERIMENTAL RESULTS

Figure 2: Count of fraudulent payments.

Figure 2 show the Count of Fraudulent payments.

Figure 3: Histogram for fraudulent and non-fraudulent

payments.

Figure 4: Receiver operating characteristic (ROC) curve.

Figure 3 and 4 shows the Histogram for Fraudulent

and Non-Fraudulent Payments and Receiver Operating

characteristic (ROC) Curve respectively.

5 CONCLUSIONS

The findings of financial transaction fraud detection

highlight the vital role that data analytics and cutting-

edge technologies play in thwarting fraudulent

activity. Financial institutions can successfully spot

unusual trends and suspicious activity suggestive of

fraudulent transactions by utilizing advanced

algorithms, machine learning models, and artificial

intelligence.

Furthermore, it emphasizes the value of a multi-

pronged strategy for fraud detection that includes

behavioral analytics, predictive modeling, anomaly

detection, and real-time monitoring. Organizations

can improve their capacity to identify and stop several

forms of fraud, such as identity theft, credit card

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

768

fraud, insider trading, and money laundering, by

utilizing a combination of these strategies.

The conclusion also emphasizes how important it

is for financial institutions, regulatory organizations,

law enforcement, and other stakeholders to work

together and share information. The sector may

improve risk mitigation and fortify its collective

defenses against fraudulent activity by cultivating

relationships and sharing intelligence.

In conclusion, detecting fraud in financial

transactions is a constant task that calls for constant

creativity, teamwork, and attention to detail. In an

increasingly digital and connected world, businesses

may better protect themselves and their clients from

financial fraud by embracing cutting-edge

technologies, implementing a multi-layered strategy,

and encouraging information sharing.

REFERENCES

Alhaimer, R., Alshaheen, A., Alkhaldi, A., Malik, S., &

Lytras, M. D. (2024). Research-based evidence from

Kuwaiti higher education supports the translation of a

value-based paradigm for resilient e-learning impact in

the post-COVID-19 era. Heliyon, 10 (2).

Chaitanya, V. Lakshmi, et al. "Identification of traffic sign

boards and voice assistance system for driving." AIP

Conference Proceedings. Vol. 3028. No. 1. AIP

Publishing, 2024

Devi, M. Sharmila, et al. "Extracting and Analyzing

Features in Natural Language Processing for Deep

Learning with English Language." Journal of Research

Publication and Reviews 4.4 (2023): 497-502

In 2024, Chanane, F. Investigating Optimization

Synergies: Enhancing Rock Shear Velocity Prediction

using Neural Networks and Differential Evolution.

Knowledge and Applications in Earth Sciences,

International Journal, 6(1), 21–28.

Liu, J., and Miloud, M. O. B. (2023, April). An application

service that helps software-defined networks with

security management. Pages 129–133 of the 7th

International Conference on Cryptography, Security,

and Privacy (CSP) in 2023. IEEE.

Mahammad, Farooq Sunar, et al. "Key distribution scheme

for preventing key reinstallation attack in wireless

networks." AIP Conference Proceedings. Vol. 3028.

No. 1. AIP Publishing, 2024.

MILOUD, M. O. B., & Kim, E. Improving Cryptocurrency

Market Analysis through the Optimization of

Multivariate LSTM Networks.

Mr. Amareswara Kumar, Effective Feature Engineering

Technique for Heart Disease Prediction with Machine

Learning" in International Journal of Engineering &

Science Research, Volume 14, Issue 2, April-2024 with

ISSN 2277-2685.

Paradesi Subba Rao, "Detecting malicious Twitter bots

using machine learning" AIP Conf. Proc. 3028, 020073

(2024), https://doi.org/10.1063/5.0212693

Parumanchala Bhaskar, et al. "Incorporating Deep Learning

Techniques to Estimate the Damage of Cars During the

Accidents" AIP Conference Proceedings. Vol. 3028.

No. 1. AIP Publishing, 2024,

S. Md. Riyaz Naik, Farooq Sunar Mahammad, Mulla

Suleman. S Danish Hussain, S Waseem Akram,

Narasimha Reddy, N Naresh, "Crowd Prediction at

Various Public Places for Covid-19 Spread Prevention

Employing Linear Regres

Sunar, Mahammad Farooq, and V. Madhu Viswanatham.

"A fast approach to encrypt and decrypt of video

streams for secure channel transmission." World

Review of Science, Technology and Sustainable

Development 14.1 (2018): 11-28.

Fraud Detection in Financial Transaction Using Advanced Analytical Techniques

769