Auditing Bitcoin: Ensuring Transparency and Security

C. H. Amarendra

1

, A. Sri Sai Deepak Reddy

1

,

K. Shanmukha Sai Kumar Reddy

1

and A. Phani Sridhar

2

1

Department of ACSE, School of Computing and Informatics, VFSTR Deemed to be University, Vadlamudi, Andhra

Pradesh, India

2

Department of Computer Science and Engineering, Aditya University, Aditya Nagar, Suramplame, Andhra Pradesh, India

Keywords: Black Chain, Bit Coin Audit, Cryptography.

Abstract: Bitcoin, a revolutionary cryptocurrency, has reshaped the financial landscape with its decentralized

architecture and cryptographic security. While this decentralization offers numerous advantages, it also

presents challenges in ensuring transparency and accountability within the Bitcoin ecosystem. This research

delves into the critical role of Bitcoin auditing in maintaining the integrity and security of Bitcoin transactions.

By analyzing transaction patterns, sender-receiver addresses, and other relevant data, auditors can validate the

authenticity and compliance of these transactions. This process is particularly crucial for law enforcement

agencies, as it enables them to trace the flow of funds, identify potential criminal activities, and gather

evidence for investigations and prosecutions. In this study, we examine and evaluate a dataset of Bitcoin

transactions obtained from an online source. By employing specialized forensic and blockchain analysis tools,

we meticulously scrutinize the transactions for authenticity, integrity, and adherence to regulatory standards.

Our analysis focuses on tracing the flow of funds, verifying transaction details, and identifying any anomalies

or potential risks. The broader implications of Bitcoin auditing, including its potential to enhance the overall

security and reliability of the Bitcoin ecosystem. By addressing concerns related to transparency,

accountability, and regulatory compliance, Bitcoin auditing can contribute to the long-term sustainability and

widespread adoption of this groundbreaking technology.

1 INTRODUCTION

Blockchain serves as a distributed ledger technology

facilitating secure and immutable transaction

recording across a network of interconnected nodes.

Unlike conventional centralized systems, blockchain

operates on a decentralized model. In this model, data

and transactions are stored and verified by multiple

participants within the network, rather than relying on

a single controlling entity.

The inception of blockchain dates back to 2009

with the emergence of Bitcoin, introduced by an

anonymous figure named Satoshi Nakamoto. Bitcoin,

recognized as the pioneer and foremost application of

blockchain technology, revolutionized the concept of

peer-to-peer electronic cash systems. By leveraging

blockchain, Bitcoin presented a groundbreaking

solution to the challenge of double-spending in digital

currencies, eliminating the need for intermediaries

like banks or financial institutions. This marked the

onset of a transformative era in decentralized finance.

The concept of auditing Bitcoin transactions

emerges as a vital mechanism to uphold integrity,

validate authenticity, and ensure compliance in this

decentralized financial landscape. Traditional audit

methodologies designed for centralized financial

systems must adapt to the decentralized and

cryptographically secured environment of Bitcoin.

Bitcoin audit, exploring the fundamental principles,

methodologies, and technologies involved. We delve

into the cryptographic foundations that underpin

Bitcoin's security and immutability, understanding

how these principles facilitate transaction verification

and chain of ownership validation.

At its core, Bitcoin represents a departure from

traditional financial systems governed by central

banks and intermediaries. It functions as a

decentralized electronic cash system, operating on a

peer-to-peer basis. Built upon a revolutionary

technology known as block chain. Unlike

conventional currencies, which rely on physical

forms or centralized databases, Bitcoin exists purely

Amarendra, C. H., Reddy, A. S. S. D., Reddy, K. S. S. K. and Sridhar, A. P.

Auditing Bitcoin: Ensuring Transparency and Security.

DOI: 10.5220/0013900500004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 3, pages

491-495

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

491

in the digital realm, with ownership and transactions

verified and recorded on an immutable and

transparent ledger.

The significance of Bitcoin lies not only in its role

as a digital currency but also in its underlying

principles and potential implications. Bitcoin

embodies the ideals of decentralization, censorship

resistance, and financial sovereignty, offering

individuals and communities around the globe an

alternative to traditional banking systems and fiat

currencies.

In a world marked by complexity, uncertainty, and

rapid change, the need for accountability and

transparency has never been more crucial.

Organizations, whether public or private, face a

myriad of risks and challenges that necessitate

diligent oversight and assurance mechanisms to

safeguard their operations, assets, and stakeholders'

interests. At the heart of this endeavor lies the practice

of audit a cornerstone of governance, risk

management, and compliance. Audit, in its essence, is

a systematic examination and evaluation of an

organization's financial records, operational

processes, and internal controls, conducted by

independent professionals known as auditors. Its

primary objective is to assure stakeholders regarding

the accuracy, reliability, and integrity of financial

reporting, as well as the effectiveness of internal

control systems.

In this introduction, we embark on a journey to

explore the multifaceted nature of audit, delving into

its fundamental principles, methodologies, and

overarching objectives. We uncover the role of

auditors as guardians of trust and integrity, tasked

with providing stakeholders with reliable and

unbiased insights into the organization's affairs. Audit

serves as a vital tool for enhancing transparency,

accountability, and governance within organizations.

By identifying weaknesses in internal controls,

detecting errors or fraud, and recommending remedial

actions, audit helps mitigate risks and improve

operational efficiency. Moreover, it installs

confidence among investors, creditors, regulators,

and other stakeholders, fostering trust in the

organization's financial reporting and management

practices.

The audit has unique challenges some of them are

Lack of Regulatory Framework, Complex and

Evolving Technology, Lack of Physical Evidence,

Security and Custody Risks, Global Nature and

Cross-Border Transaction (Kamau, C. G., &

Yavuzaslan, A. 2023).

An electronic coin is defined as a sequence of

digital signatures. Each transfer of ownership

involves digitally signing a hash of the preceding

transaction and the public key of the subsequent

owner. These signatures are appended to the coin,

facilitating its transfer to the next recipient

(Nakamoto, S. 2008).

Data within the block chain is decentralized,

ensuring its integrity, safety, and authenticity.

Utilizing distributed systems, decentralization, time-

series data, and asymmetric encryption, blockchain

technology enables secure storage and verification

through system-wide broadcasting (Cheng, C., &

Huang, Q. 2020).

Utilizing blockchain technology enables the

creation of a highly transparent database capable of

securely storing and updating data in real-time. The

information remains immutable, safeguarding against

tampering, while also allowing for traceability and

seamless sharing across the network (Dunn et al.,

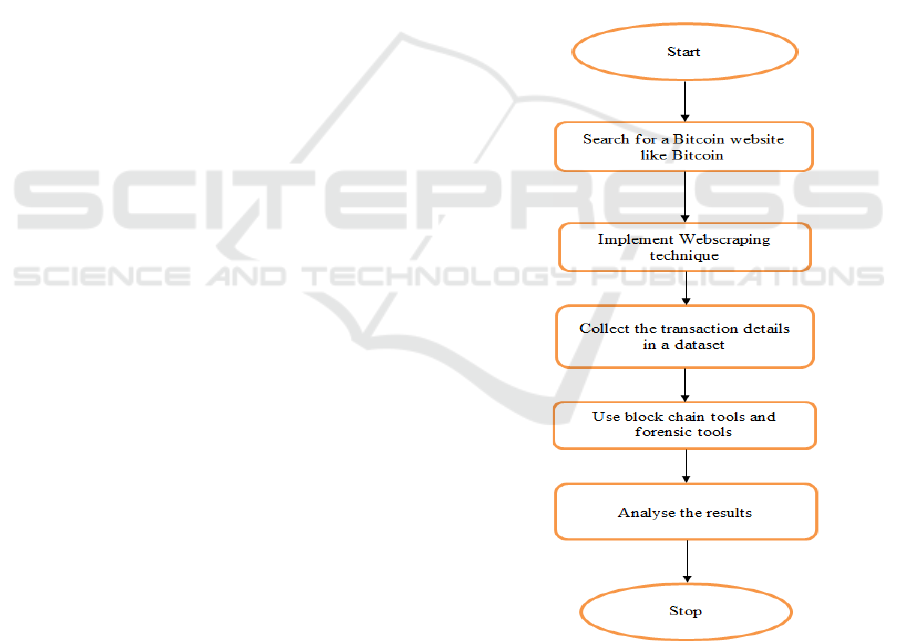

2021). Figure1 gives the bitcoin audit flowchart.

Figure 1: Flow chart of the Bitcoin audit.

There exist two main categories of block chains:

public (or permission less) and private (or

permissioned). Public block chains are openly

accessible and observable by all participants in the

network, devoid of centralized ownership or control.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

492

On the other hand, private or permissioned block

chains are confined to specific organizations or

consortia, allowing access solely to authorized parties

designated by permission (Dyball, M. C., &

Seethamraju, R. 2021).

Every transaction consists of three essential

components: the sender, transaction details, and the

recipient, all secured by encryption. These

transactions are grouped into blocks, forming the

block chain. A Bitcoin wallet, stored as a file in the

user's system, contains public and private key pairs,

facilitating transactions to and from the wallet. These

keys serve the purpose of sending and receiving

Bitcoins securely (Latifa, E. R., & Omar, A. 2017).

In pinpointing potential fraud risks, the dialogue

among key members of the engagement team may

encompass discussions about the likelihood of

significant inaccuracies arising from fraudulent

activities (Dupuis et al., 2023).

The primary advantage of a cryptocurrency,

setting it apart from traditional forms of currency, lies

in its robust security and verifiability mechanisms.

Cryptocurrency is essentially a cryptographic proof

of transaction chronology, facilitated through peer-to-

peer distributed timestamps. It's worth noting that the

original aim of blockchain development was not

solely to introduce a new currency, but rather to

establish the foundations of a decentralized cash

payment system (Procházka, D. 2018).

Auditing is a fundamental responsibility of

accountants, and in this examination, we will utilize

Bitcoin, the world's premier cryptocurrency, to

scrutinize transactions. Bitcoin operates on a unique

transaction system that utilizes a decentralized

network called the block chain. This blockchain

serves as a publicly accessible ledger, recording every

transaction ever executed. The integrity of each

transaction is safeguarded by digital signatures

associated with the sender's addresses, granting users

complete authority over sending bitcoins from their

respective Bitcoin addresses (Moore, P. 2018).

Blockchain technology itself poses a number of

opportunities for the accounting profession, including

vetting of parties to transactions, advancing real-time

accounting, incorporating artificial intelligence into

the process of auditing, and providing assurance

related to smart contracts (Dupuis et al., 2021).

2 METHODS AND MATERIAL

Understanding Bitcoin Transactions and Blockchain

Technology: The first step in conducting a Bitcoin

audit is to gain a comprehensive understanding of

how Bitcoin transactions work and the underlying

blockchain technology. This involves familiarizing

oneself with concepts such as cryptographic hashing,

digital signatures, public and private keys, blocks,

and the decentralized nature of the block chain.

• Scope definition: Define the scope of the audit,

including the specific aspects of Bitcoin transactions

and related activities to be examined. This may

include transaction validation, chain of ownership

verification, compliance with regulatory

requirements, security measures, and risk assessment.

• Data collection: Obtain the Bitcoin transaction

data from the chosen online source or website. This

may involve web scraping, API queries, or accessing

transaction data from blockchain explorers. Ensure

the integrity and completeness of the data collected

for analysis.

• Data Analysis and validation: Utilize forensic

tools and blockchain analysis tools to analyze the

Bitcoin transaction data. Verify the authenticity and

integrity of the transactions by examining transaction

details, including inputs, outputs, timestamps,

transaction amounts, and transaction fees. Use

cryptographic techniques to validate signatures and

confirm compliance with the Bitcoin protocol.

• Wallet and Transaction Audits: Auditors review

Bitcoin wallets and transactions to ensure they are

secure and legitimate. This involves verifying the

ownership of wallets, analyzing transaction history,

and confirming compliance with regulatory

requirements.

• Blockchain Analysis: Auditors leverage

blockchain analysis tools for tracking and analyzing

Bitcoin transactions. This process aids in recognizing

patterns, detecting irregularities, and verifying

adherence to anti-money laundering (AML) and

know-your-customer (KYC) regulations.

• Cryptographic Techniques: Leverage

cryptographic principles to verify the authenticity and

integrity of Bitcoin transactions. Techniques such as

digital signatures, cryptographic hashing, and public-

key cryptography are used to validate transaction data

and ensure compliance with the Bitcoin protocol.

• Data analysis Techniques: Employ data analysis

methodologies, such as statistical analysis, machine

learning algorithms, and network analysis, to

scrutinize Bitcoin transaction data. These approaches

aid auditors in recognizing patterns, detecting

irregularities, and evaluating transaction behavior

within the block chain network.

• Forensic Analysis: In case of suspected fraud or

misconduct, auditors conduct forensic analysis of

Bitcoin transactions to trace the funds, identify

Auditing Bitcoin: Ensuring Transparency and Security

493

perpetrators, and gather evidence for legal

proceedings.

• Documentation and reporting: Document

findings, observations, and recommendations in a

comprehensive audit report. Provide clear

explanations of audit procedures, findings, and

conclusions. Highlight areas of strength, weaknesses,

and opportunities for improvement, along with

actionable recommendations for remediation. Ensure

that the audit report is accurate, objective, and

tailored to the needs of stakeholders. Forensic tools

commonly used for analyzing Bitcoin transactions.

• Chainalysis Reactor: Chainalysis Reactor is a

blockchain analysis tool designed to investigate and

trace cryptocurrency transactions, including those

involving Bitcoin. It allows users to track funds

across the block chain, identify illicit activities, and

generate reports for law enforcement and regulatory

purposes.

• CipherTrace: CipherTrace offers cryptocurrency

intelligence solutions, including forensic tools for

analyzing Bitcoin transactions. Their platform

provides features for tracing funds, identifying risk

factors, and detecting money laundering activities.

CipherTrace also offers compliance solutions for

regulatory reporting and risk assessment.

• Elliptic: Elliptic specializes in blockchain

analytics and risk management solutions for

cryptocurrencies like Bitcoin. Their platform offers

tools for transaction monitoring, risk scoring, and

compliance with regulatory requirements. Elliptic

helps financial institutions, exchanges, and law

enforcement agencies identify and mitigate risks

associated with Bitcoin transactions.

• BlockSci: BlockSci is an open-source blockchain

analysis tool developed by researchers at Princeton

University. It provides a suite of tools for analyzing

and visualizing blockchain data, including Bitcoin

transactions. Block Sci allows users to trace

transaction flows, identify addresses associated with

specific entities, and analyze patterns or anomalies in

the block chain network.

These forensic tools are valuable for conducting

investigations, tracing fund flows, and identifying

illicit activities within the Bitcoin ecosystem. They

provide auditors, investigators, and regulatory

authorities with the necessary tools and insights to

ensure transparency, integrity, and compliance in the

cryptocurrency space.

3 RESULTS AND DISCUSSIONS

The results of a Bitcoin audit provide stakeholders

with assurance regarding the transparency, integrity,

and compliance of Bitcoin transactions within the

digital ecosystem. They help organizations identify

areas for improvement and mitigate risks associated

with Bitcoin transactions effectively.

The dataset obtained from an online website

known as Litecoin. We acquired this dataset using

web scraping techniques, specifically utilizing the

Beautiful Soup library. This process allowed us to

extract data from the website's HTML structure

efficiency.

The analysis of the dataset obtained in the

previous step. By utilizing various data analysis tools

and techniques, we examine the extracted data

comprehensively. This analysis involves exploring

transaction details, identifying patterns, and

uncovering insights into Litecoin transactions.

The forensic tools and blockchain analysis tools

to predict and analyze the data obtained from the

dataset. These specialized tools enable us to delve

deeper into the transaction details, trace fund flows,

identify sender and receiver addresses, and assess

compliance with regulatory standards. By leveraging

these tools, we aim to gain valuable insights into

Litecoin transactions, detect any irregularities or

anomalies, and ensure transparency and integrity

within the block chain ecosystem.

Figure 2: Analysis of Bitcoin transactions.

The Figure 2 provides the litecoin_ data. Describe

() command provides summary statistics for the

numerical columns in the Data Frame. This can help

in understanding the distribution of the data,

identifying outliers, and making informed decisions

about further analysis.

The Figure 3 explains a visualization of Litecoin

transaction data, and Figure 4 indicated the

application of a machine learning model, possibly for

predicting future Litecoin prices or identifying trends.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

494

Figure 3: Analysis of Bitcoin transactions.

Figure 4: The data analysis Litecoin transactions.

4 CONCLUSIONS

This comprehensive Bitcoin audit has demonstrated

the critical role of rigorous analysis in ensuring the

integrity and security of blockchain transactions. By

leveraging advanced forensic and blockchain analysis

tools, we have meticulously examined a dataset of

Bitcoin transactions, validating their authenticity,

integrity, and compliance with regulatory standards.

Our findings highlight the importance of robust

auditing practices in mitigating risks associated with

illicit activities and fostering a more transparent and

trustworthy digital financial ecosystem. As the

cryptocurrency landscape continues to evolve, the

need for such rigorous audits will remain paramount

in safeguarding the future of decentralized finance.

REFERENCES

Cheng, C., & Huang, Q. (2020, January). Exploration of the

application of blockchain audit. In 5th International

Conference on Economics, Management, Law and

Education (EMLE 2019) (pp. 63-68). Atlantis Press.

Dunn, R. T., Jenkins, J. G., & Sheldon, M. D. (2021).

Bitcoin and blockchain: Audit implications of the killer

Bs. Issues in Accounting Education, 36(1), 43-56.

Dupuis, D., Gleason, K. C., & Kannan, Y. H. (2021).

Bitcoin and Beyond: Crypto Asset Considerations for

Auditors. Available at SSRN 3903995.

Dupuis, D., Smith, D., Gleason, K., & Kannan, Y. (2023).

Bitcoin and Beyond: Crypto Asset Considerations for

Auditors/Forensic Accountants. Journal of Forensic

and Investigative Accounting, 15(3).

Dyball, M. C., & Seethamraju, R. (2021). The impact of

client use of blockchain technology on audit risk and

audit approach—an exploratory study. International

Journal of Auditing, 25(2), 602-615.

Kamau, C. G., & Yavuzaslan, A. (2023). CryptoAudit:

Nature, requirements and challenges of Blockchain

transaction audit. African Journal of Commercial

Studies, 3(2), 101-107.

Latifa, E. R., & Omar, A. (2017). Blockchain: Bitcoin

wallet cryptography security, challenges and

countermeasures. Journal of Internet Banking and

Commerce, 22(3), 1-29.

Moore, P. (2018). Auditing Crypto Currency Transactions:

Anomaly Detection in Bitcoin (Doctoral dissertation,

Dublin, National College of Ireland).

Nakamoto, S. (2008). Bitcoin: A peer-to-peer electronic

cash system. Available at SSRN 3440802.

Procházka, D. (2018). Accounting for bitcoin and other

cryptocurrencies under IFRS: A comparison and

assessment of competing models. The International

Journal of Digital Accounting Research, 18(24), 161-

188.

Auditing Bitcoin: Ensuring Transparency and Security

495