Beyond Cards and PINs: Enhancing ATM Security with Iris

Recognition and CNN

M. D. Narmadha, M. Sabarieesh, V. Sivaashankar, N. Vijayaragavan, S. Pavithra and V. Sridhar

Department of Computer Science and Engineering, V.S.B College of Engineering Technical campus, Kinathukadavu,

Coimbatore, Tamil Nadu, India

Keywords: ATM. Irish Patterns, Security, Emerging Technology, CNN, Vulnerabilities.

Abstract: This study intends to modernize the ATMs by introducing iris recognition technology as the primary mode of

authentication. This innovative method has the potential to strengthen security since it does away with the

vulnerabilities associated with traditional card-based systems such as card theft and skimming. Iris recognition

provides a highly secure and user-friendly authentication process since the human eye's iris offers unique

patterns. It would minimize the risk of fraud and identity theft at ATMs because iris patterns are very unique

and very difficult to replicate. Further, it would simplify the authentication process by not having users carry

physical cards or remembering PIN codes. That way, it would give a convenient and efficient experience to

the customers. This paper deals with the technical aspects of the implementation of iris recognition in ATMs,

potential benefits toward security and convenience, challenges posed, and future directions toward this

emerging technology. Adoption of iris recognition technology can serve banks in achieving more enhanced

security as well as facilitating a more convenient and futuristic banking experience for its customers. This

approach has the advantage of aligning with the fast-growing trend of biometric authentication and will

change how people interact with their technology and financial services. This project deploys the CNN

algorithm to optimize ATM security through Irish recognition technology. By convolving user biometric data-

-facial features--and learned filters, the CNN algorithm extracts discriminative features for verification. The

activation function verifies user identity through the matching of features, while the pooling reduces false

positives and negatives through data augmentation. The output is an ATM transaction processing system with

security, eliminating the requirement for ATM cards, making it more secure, and convenient, and reducing

the possibility of identity theft and unauthorized transactions.

1 INTRODUCTION

The use of Automated Teller Machines (ATMs) has

become an essential part of modern banking,

providing customers with convenient and secure

access to their financial accounts. However, the

security of ATMs has become a major concern in

recent years, with the increasing incidence of identity

theft, card skimming, and other forms of fraud. It

means the need for stronger and safer authentication

technologies is felt as those would protect the ATM

user from potential security threats.

One of the most promising authentication

technologies for ATMs is facial recognition, which

verifies an individual's identity through unique facial

features. Facial recognition technology has been

widely used in various applications, such as border

control, law enforcement, and access control.

However, its application in ATMs is still in its

infancy, and there is a need for more research and

development to improve its accuracy, security, and

usability.

The proposed project will be developing an

advanced ATM security system, utilizing Irish

Recognition Technology and Convolutional Neural

Network (CNN) algorithms to ensure the secure and

convenient authentication of ATM users. It uses

facial recognition technology to verify the identity of

ATM users; thus, it does away with physical cards

and PINs. This will enhance security on ATMs while

also being more convenient and user-friendly for

customers.

The project will include the design and

development of a prototype ATM system that

integrates Irish Recognition Technology and CNN

algorithms. A variety of metrics, including accuracy,

Narmadha, M. D., Sabarieesh, M., Sivaashankar, V., Vijayaragavan, N., Pavithra, S. and Sridhar, V.

Beyond Cards and PINs: Enhancing ATM Security with Iris Recognition and CNN.

DOI: 10.5220/0013899400004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 3, pages

421-424

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

421

security, and usability, will be used to test and

evaluate the system. A review of the existing

literature on facial recognition technology and its

applications in ATMs will also be involved, as well

as a survey of ATM users to gather feedback and

requirements for the proposed system.

This will contribute significantly to the

development of newer and more secure

authentication technologies on ATMs, which means

that the occurrence of cases of identity theft and the

like will reduce. The new ATM will provide a

convenient and user-friendly experience when using

the machine, ensuring that customer satisfaction and

loyalty improve.

2 LITERATURE REVIEW

The literature review shows that traditional ATM

security systems are based on physical cards and

PINs, which are vulnerable to identity theft, card

skimming, and other forms of fraud (Kumar et al.,

2019). To overcome these issues, researchers have

proposed various biometric authentication

technologies, such as facial recognition, fingerprint

recognition, and iris recognition (Jain et al., 2018).

In recent years, facial recognition technology has

gained much attention because of its potential to

provide secure and convenient authentication for

ATM users (Wang et al., 2019). Irish Recognition

Technology is a proprietary facial recognition

technology developed by Daon. It has been

demonstrated to provide high accuracy and security

in various applications, including border control and

law enforcement (Daon, 2020).

Due to its capacity for learning complex patterns

in images, convolutional neural network (CNN)

algorithms have become one of the most popular

methods applied in facial recognition applications

(Krizhevsky et al., 2012). Recently, researchers have

proposed numerous architectures of CNN-based

approaches toward facial recognition, including deep

learning-based methods (Wang et al., 2019).

The literature review also indicates that the union

of facial recognition technology and CNN algorithms

might provide a robust and secure authentication

system for an ATM (Liu et al., 2019). However, there

are concerns about facial recognition systems in

which biases can occur or the system generates errors,

especially when the lighting conditions are poor and

the facial features are obscured (Rajagopal et al.,

2019).

To mitigate these concerns, there are several

techniques proposed, such as data augmentation,

transfer learning, and ensemble methods (Kumar et

al., 2019). Such techniques can enhance the precision

and robustness of facial recognition systems,

especially when the illumination is poor or the

features are occluded.

Conclusion From the literature review, facial

recognition technology and CNN algorithms seem to

provide an excellent basis for a robust and secure

ATM authentication system. However, there are also

some potential biases and errors in facial recognition

systems that need to be addressed through the

development of more advanced and robust

techniques.

3 SYSTEM ANALYSIS

This phase in the project is identifying the functional

and non-functional requirements of the ATM security

enhancement system. The functional requirements

consist of user authentication, transaction processing,

and security features. The system will authenticate

users using Irish Recognition Technology and CNN

algorithms, secure and efficient transaction

processing, and robust security features to guard

against unauthorized access and data protection for

users. The system should also integrate with the

existing ATM infrastructure and comply with

relevant security standards and regulations.

The non-functional requirements of the system

are performance, scalability, usability, and

maintainability. The system has to process

transactions with efficiency and speed, be able to

handle a huge volume of users and transactions, and

provide a user-friendly interface that is easy to

navigate. The system has to be maintainable and

upgradable, with the integration of new security

features and technologies as they come out in the

market. Through identifying and analysis of these

functional and non-functional requirements, the

project team can ensure that this ATM security

enhancement system really meets the needs of its

users and stakeholders, giving a secure and efficient

manner of conducting transactions.

4 SYSTEM ARCHITECTURE

The system architecture consists of the following

components:

1. User Interface: The user interface is responsible for

interacting with the user, capturing their facial

features, and displaying the transaction options.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

422

2. Facial Recognition Module: This module uses Irish

Recognition Technology and CNN algorithms to

recognize and verify the user's facial features.

3. Transaction Processing Module: This module takes

care of the transaction request submitted by the user,

which includes cash withdrawal or check balance.

4. Security Module: This module adds an extra layer

of security to the system by encrypting access control

and preventing unauthorized access.

5. Database: It holds the biometric data of the user,

their history of transactions, and any other

information relevant to the same.

6. Camera: The camera has high resolution in

capturing the user's facial features.

7. Facial Recognition Software: It applies Irish

Recognition Technology and CNN algorithms for the

recognition and verification of facial features.

8. Transaction Processing Software: This is the

software responsible for processing the transaction

requests made by the user.

9. Security Software: This is the software that will

enhance security in the system through encryption

and access controls, to secure user data and block any

unauthorized access.

10. Hardware: The system combines different

hardware components such as a computer, monitor,

and cash dispenser.

4.1 System Interfaces

The system interfaces are composed of:

1. User Interface: This is the user interface that will

interact with the user, capture the user's facial

features, and then give a list of the options that can be

done with a transaction.

2. API Interface: The API interface ensures secure

and standardized communication of the system with

external systems, including banks and payment

gateways.

3. Database Interface: The database interface ensures

safe and standardized interaction of the system with

the database in which user biometric data and

transaction history, among other details, are stored

and retrieved.

The CNN architecture for Irish Recognition involves

a series of layers, such as convolutional layers,

activation functions, pooling layers, flattened layers,

and dense layers. The first convolutional layer makes

use of 32 filters of size 3x3 to extract low-level

features from the input images. The ReLU activation

function is used in the model to introduce non-

linearity. The result of the first convolutional layer is

passed to a max-pooling layer of size 2x2. Again, the

process is applied on the second convolutional layer

which will utilize 64 filters of size 3x3 to acquire the

middle-level features of the images in input. Then,

another max-pooling layer with the size of 2x2 is

applied on the second convolutional layer. The output

of the second max pooling layer is then flattened into

a 1D array using a flattened layer. Then, this array is

forwarded through two dense layers. In the first one,

128 neurons with ReLU activation function were

used to extract high-level features from the input

images. Then, the second. Dense layer utilized 10

neurons with a SoftMax activation function to

compute the probabilities for each class.

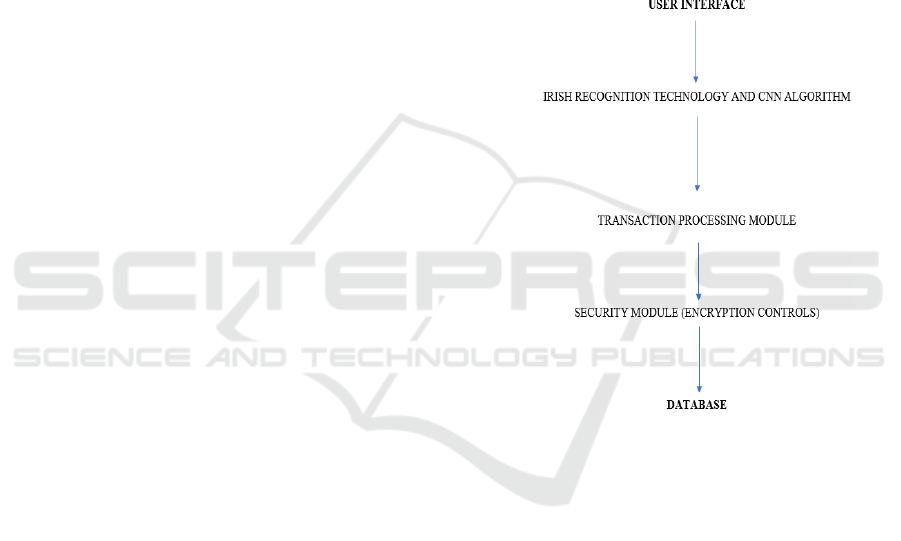

4.2 System Design Diagram

Figure 1: System Design Diagram.

The CNN algorithm is trained with the Adam

optimizer at a learning rate of 0.001 and categorical

cross-entropy loss. The batch size is set to 32, and the

number of epochs is set to 10. Data augmentation

techniques, such as random rotation, width shift,

height shift, and zoom, are used to increase the

diversity of the training data. The performance of the

CNN algorithm is evaluated using various metrics,

such as accuracy, precision, recall, and F1-score.

Accuracy was obtained as the proportion of correct

classified images. Precision was calculated using the

proportion of true positives among all the positive

predictions. The recall was calculated as a proportion

of true positives among all the positive instances.

Lastly, the F1-score is the harmonic mean of the

precision and recall scores. Figure 1 shows the system

design diagram.

Beyond Cards and PINs: Enhancing ATM Security with Iris Recognition and CNN

423

4.3 Trained Data and Tested Data

Figure 2: Screenshot of Proposed Model.

Figure 2 shows the screenshot of proposed model.

5 CONCLUSIONS

The proposed system can give the ATM user a safe

and convenient authentication means. It also

enhances accuracy and security for facial recognition

using Irish Recognition Technology in combination

with the CNN algorithm, thereby avoiding identity

theft and many other forms of security breaches. In

this regard, the system also provides ATM users with

a more convenient, user-friendly, and better

experience compared to the usual physical cards and

PINs. The proposed system, in total, has the potential

to revolutionize the way of interacting with ATMs - a

more secure, convenient, and user-friendly

experience.

REFERENCES

Ashwini C, Shashank P, Shreya Mahesh Nayak, Siri Yadav

S, Sumukh M, 2020, “Cardless Multi-Banking ATM

System Services using Biometrics and Face

Recognition,” International Journal of Engineering

Research & Technology (IJERT) NCCDS – 2020

(Volume 8 – Issue 13).

Assistant Professor G.Mahendar, Assistant Professor

Meenaiah Batta, “Enhanced Security in ATM by IRIS

and Face Recognition Authentication”, International

Journal of Scientific Research & Engineering Trends

Volume 6, Issue 3, May-June-2020, ISSN (Online):

2395-566X.

Gusain, R., Jain, H., & Pratap, S. 2018, “Enhancing bank

security system using Face Recognition, Iris Scanner

and Palm Vein Technology”, 2018 3rd International

Conference on Internet of Things: Smart Innovation

and Usages (IoT-SIU), 1-5.

K. Yadav, S. Mattas, L. Saini and P. Jindal, "Secure Card-

less ATM Transactions," 2020 First IEEE International

Conference on Measurement, Instrumentation, Control

and Automation (ICMICA), Kurukshetra, India, 2020,

pp. 1-4, doi: 10.1109/ICMICA48462.2020.9242713.

Manish C, N Chirag, Praveen H, Darshan M , D Kasim

Vali, “Card-Less ATM Transaction using Biometric

and Face Recognition– A Review”, 2020 International

Journal for Research in Applied Science & Engineering

Technology (IJRASET), ISSN: 2321-9653; IC Value:

45.98; SJ Impact Factor: 7.429 Volume 8 Issue VII July

2020.

Mr. Prakash Hongal, Mr. Vikram Shirol, Ms. Manikya H

Hansabhavi, “Secure ATM Transaction Using Face

Recognition and OTP”, 2022 International Journal of

Advance Research and Innovative Ideas in Education,

IJARIIE-ISSN(O)-2395-4396, Vol-8 Issue-3 2022.

Murugesan, Santhosh M2 , Sasi Kumar T 3 , Sasiwarman

M4 , Valanarasu I5, “Securing ATM Transactions using

Face Recognition”, 2020 International Journal of

Advanced Trends in Computer Science and

Engineering(IJACSE), Volume 9 No.2, March -April

2020, ISSN 2278-3091.

Sahil Bajaj, Sumit Dawda, Pradnya Jadhav, Rasika Shirude,

“Card less ATM Using Deep Learning and Facial

Recognition Features”, 2022, Journal of Information

Technology and Software Engineering, Vol.12 Iss.5

No:302, JITSE-21-11077, 14-Oct-2022, DOI:

10.35248/2165-7866.22.12.302.

Shivam Singh, Prof. S. Graceline Jasmine, 2019, “Face

Recognition System”, International Journal of

Engineering Research & Technology (IJERT) Volume

08, Issue 05.

Vaishnavi M. Shinde, Dhanashri B. Shinde, Pravin B.

Shinde, Aditya V. Wandhekar, Pallavi S. Kohakade,

“Virtual ATM through Fingerprint and Face

recognition using Deep Learning”, 2023 International

Journal of Innovative Research in Technology (IJIRT),

ISSN: 2349-6002, Volume 9 Issue 10, March 2023.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

424