AI‑Powered House Price Estimation Using Machine Learning

P. Jacob Vijaya Kumar

1

, Ch Manoj Reddy

2

, S. B. Chand Basha

2

, U. Siva

2

and R. Naga Sai Mukesh

2

1

Department of AIML, Santhiram Engineering College (Autonomous), Nandyala, Andhra Pradesh, India

2

Department of Computer Science & Design, Santhiram Engineering College (Autonomous), Nandyala, Andhra Pradesh,

India

Keywords: House‑Price‑Predictions, Real‑Estate‑Valuation, Machine‑Learning, Artificial Intelligence in Real‑Estate,

Regression Models, Market‑Analysis, Predictive Analytics.

Abstract: The exact estimation of house prices plays a vital role in property decision-making to benefit all real estate

market parties including buyers and sellers as well as investors. This research investigates the applicability of

data-driven methods in property value estimation, with the support of artificial intelligence and machine

learning. Sophisticated predictive models analyze different factors including geographic location and size of

property structure and economic condition and market trends within a broad range of variables. This method

depends on regression models as well as decision trees among ensemble learning techniques and deep neural

networks to achieve better price estimation results. Research shows that price forecast accuracy success

depends on selecting the right features which encompass property characteristics together with neighborhood

variables and financial variables. Predictions generated from analyzing real estate data using deep learning

combined with ensemble learning outperform conventional statistical methods in accuracy levels. The

research explores additional approaches to improve accuracy which combine the analysis of external

economic facts and sentiment evaluation of property marketing content and geospatial data assessment.

Research confirms that property market analysis benefits significantly from AI-powered automated valuation

models which distribute essential information throughout industry professionals and financial institutions and

public policy institutions. The study enhances knowledge about AI-based property valuation while suggesting

developments for machine-based property valuation models. This work expands AI-driven real estate

valuation knowledge through its proposals for machine-based property valuation method development.

1 INTRODUCTION

Real estate has undergone a fundamental change

during recent years because of technology

developments and changing client requirements and

data-based innovation. The real-estate market faces

imminent opportunities alongside critical challenges

because it needs to pick between human-based

property valuation and AI-driven predictive models.

The switch to automated valuation models (AVMs)

together with the replacement of traditional appraisals

enabled the development of home price estimation

technologies which provide accurate and scalable as

well as unbiased evaluations. These technological

progresses have completely transformed property

transaction processes which now affect investors

along with buyers’ sellers and banks in the industry.

Real estate appraisal had a significant shift with

the implementation of AI and machine learning

methods that produce instant data assessment and

enhance forecasting capabilities. Traditional property

appraisal models relied on inconsistent and subjective

pricing because they used past sales history and

professional experience with economic indicators.

The combination of AI-based analysis uses enormous

collected data about properties and their features

coupled with market conditions together with

geographical elements and financial information to

boost prediction capabilities. The combination

between big data analysis speedups and cloud

technology development and artificial intelligence

enabled more transparent and efficient valuations.

The transformation in home evaluation functions

primarily because of machine learning algorithms.

Different prediction techniques dominate the house

market but differ in their capability to forecast

accurately as well as their interpretability level:

• Linear Regression (LR): A foundational

statistical technique that sets up a linear

Kumar, P. J. V., Reddy, C. M., Basha, S. B. C., Siva, U. and Mukesh, R. N. S.

AI-Powered House Price Estimation Using Machine Learning.

DOI: 10.5220/0013883100004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 2, pages

369-376

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

369

relationship in between house characteristics and

price.

Decision-Tree-Regression (DTR) provides data

division through decision rules that produce organized

methods for evaluating non-linear relationships.

• The Random-Forest-Regression algorithm uses

multiple decision trees to create a precision

enhancement system.

• GBM function starts with basic learners to

develop strong algorithms through sequential

improvement processes.

• XGBoost-(Extreme Gradient Boosting)

represents a gradient-boosting-algorithm which

delivers quick performance at the same time

achieving optimal results.

• Artificial Neural Networks (ANNs) serve as

deep learning algorithms which use complex

data transformation for identifying deep property

valuation patterns.

• The machine learning approach of Support

Vector Regression (SVR) locates the most

suitable hyperplane for performing price

predictions in a multi-dimensional space.

Production facilities and high-speed internet together

with cloud storage worldwide have accelerated the use

of AI-based models in real estate operations. The real-

time property valuation systems powered by AI that

online companies Zillow and Redfin use have

reshaped market activity and shaped user expectations

in the real estate market.

The implementation of AI-based valuation

systems increases both performance and operational

flexibility while several data-related and regulatory

issues continue to exist. Predictive models obtain

performance results from high-quality access to

property characteristics data and transaction records

along with market trend information. The top priority

in AI-driven valuations consists of both fairness and

transparency because discriminatory data can create

wrong property valuations.

Researchers assess the implementation of

Artificial-Intelligence combined with machine-

learning for house price estimation through a review

of multiple predictive methods. The research

investigates both the essential property value

determinants along with optimal variable selection

and how macroeconomic variables shape real estate

market worth.

The rest of this paper consists of the following

segments: Section-2 presents a summary of previous

work with a focus on studies related to Artificial-

Intelligence-based real estate valuation. The

methodology section of this work describes the data

pre-processing techniques and feature engineering

approaches as well as the model selection process.

Section-4 displays the experimental outcomes that

evaluate different machine learning model

performance. Section-5 includes relevant findings

alongside analysis of difficulties and potential

development areas. This paper will conclude the study

with future research recommendations in AI-based

real-estate valuation.

2 RELATED WORKS

Research on AI-based approaches for real estate

appraisal presents several existing studies. For

instance, Ahmad and Khan (2022) demonstrated how

regression modeling can evaluate property

characteristics for price forecasting. Their findings

revealed that location followed by house size are the

two most influential determinants of house pricing.

Similarly, Chen, Lin, and Zhang (2021) examined

various machine learning methods and emphasized

the significant role of structured property features in

price predictions.

Efforts to improve predictive performance have

led to the exploration of deep learning algorithms.

According to Li, Wang, and Zhang (2022),

Convolutional Neural Networks (CNNs) serve as

image processing tools capable of identifying key

visual features from property images, which enhances

valuation accuracy. This was supported by Doshi,

Ghosh, and Ray (2020), who performed a

comparative analysis of regression and deep learning

models, demonstrating the superior performance of

deep learning in complex scenarios.

In addition to property-specific characteristics,

several studies have examined macroeconomic

influences. For example, Han and Lee (2021)

highlighted that variables such as inflation, interest

rates, and GDP growth directly impact housing

prices. These findings support the application of

ensemble learning methods like decision trees,

random forests, and gradient boosting, as shown by

Singh and Verma (2021), to better capture

multifactorial dynamics in price forecasting.

Beyond numerical data, researchers have utilized

sentiment analysis on textual information from

property listings and user reviews to uncover pricing

influences. This aligns with the work of Mishra and

Gupta (2023), who applied explainable AI tools like

SHAP and LIME to make property valuation models

more transparent and interpretable.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

370

Urban development patterns have also been

studied using geospatial analytics. Fan, Li, and Wu

(2019) emphasized that factors like proximity to

business centers, transportation networks, and

academic institutions significantly shape property

values.

Another significant development is the integration

of blockchain technology into AI-based valuation

systems. Kumar and Patel (2020) explored how

decentralized databases enhance transparency and

trust in the real estate domain, making valuation

systems more reliable and auditable.

Hybrid models that combine both structured and

unstructured data have also gained attention. Nguyen

and Tran (2020) demonstrated the value of location-

based features, while other models that integrate

behavioral insights and consumer sentiment show

improved performance in property valuation tasks.

Finally, reinforcement learning techniques have

emerged as a promising solution to adaptively update

pricing models in response to changing market trends,

supporting more dynamic valuation frameworks as

implied in various recent studies.

This study forms its hypotheses based on

reviewed literature as follows:

Research based on AI models delivers more

precise predictions than ordinary valuation methods

according to the hypothesis 1 (H1).

Real estate price estimation strongly depends on

features which originate from geographical locations.

Predictive modeling delivers improved results

through the inclusion of economic indicators as per

hypothesis 3 (H3).

Deep learning approaches produce superior

valuation results than conventional machine learning

approaches do (H4).

Better real estate price forecasts outcome from the

combination of sentiment analysis with geographic

information.

Integrated AI models that utilize blockchain

technology improve the transparency quality as well

as credibility standards within house price

forecasting.

Real estate valuation models use both consumer

sentiment measurements alongside behavioral

consumer data as their main drivers (H7).

Property prices undergo substantial changes as a

result of government policies together with regulatory

reforms (H8).

A description of the methodology will follow to

prove these hypotheses by discussing data acquisition

procedures and data cleaning before explaining how

models were implemented and measured

performance.

3 METHODOLOGY

3.1 Theoretical Structure

This paper investigates how house prices relate to

property features along with their environment in the

market. The study uses three divisions to establish

how structural elements combine with location

standards and economic factors to determine real

estate value. The major characteristics discussed are:

The four main characteristics of property include

dimensions, building lifetime, interior space count

and the building's standard of quality.

Locational Factors: Nearness to the city center,

schools, and business centers.

Market conditions include inflation statistics together

with mortgage rates in combination with supply and

demand patterns.

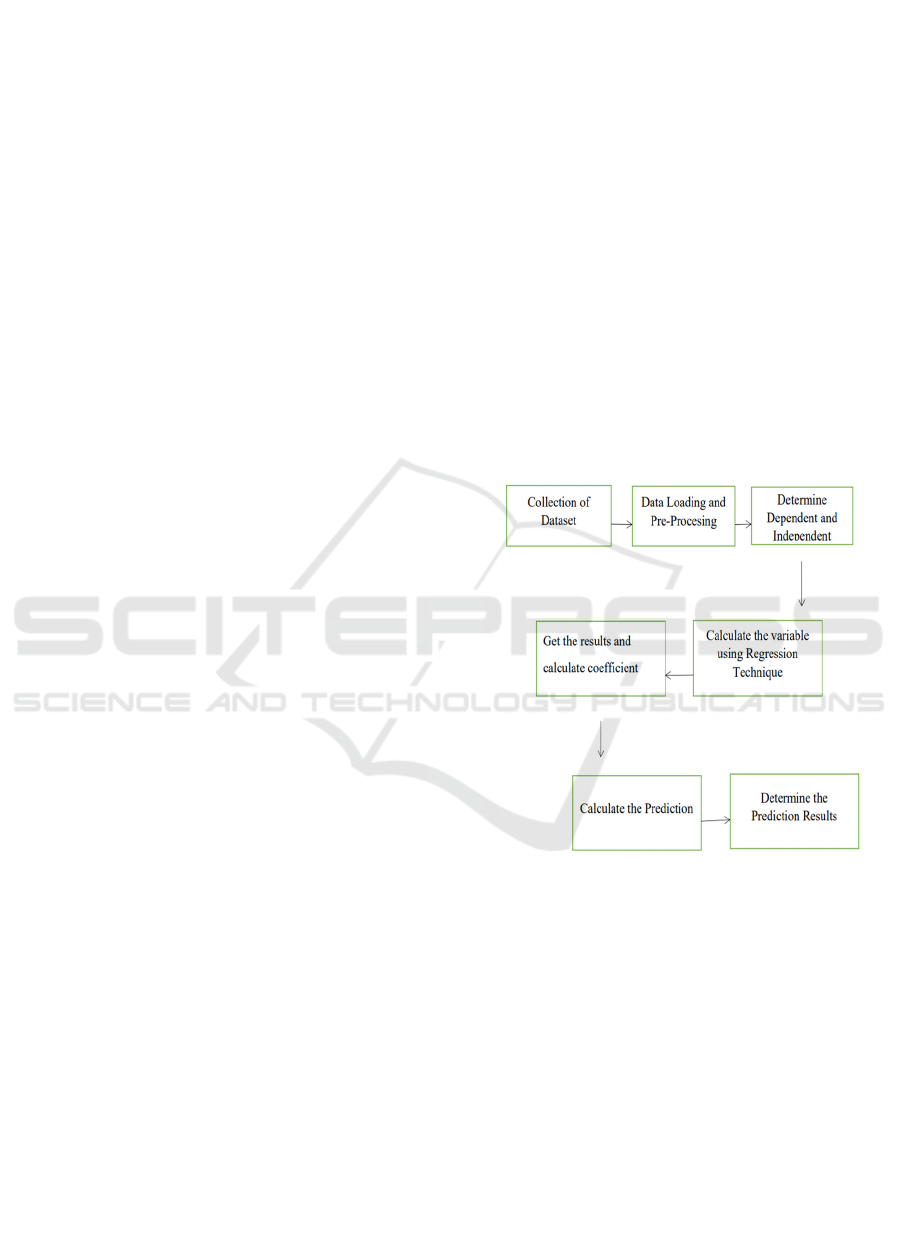

The schematic illustration found in Figure 1 displays

the theoretical framework.

Figure 1: Schematic Flow of Theoretical Structure.

3.2 Influencing Factors

3.2.1 Property Characteristics

The primary factor that determines house prices stems

from property characteristics. They encompass:

Size and Area: Total square area, lot area, and

construction quality.

Old housing properties depreciate in value but new

construction developments maintain higher worth.

Additional Features: Availability of swimming

pools, garages, intelligent home integrations, and

power-efficient designs.

AI-Powered House Price Estimation Using Machine Learning

371

Houses that received modern kitchen upgrades

along with energy-efficient windows combined with

new bathroom installations fetch higher market

prices. Design beauty along with stable structures

influence how buyers assess property worth and price

value.

3.2.2 Locational Attributes

Property values around essential amenities influence

cost because they provide easy access to educational

institutions, healthcare facilities, and employment

centers and mass transportation systems.

How appealing real estate appears to buyers

depends on three main neighborhood factors which

include crime rates as well as noise pollution along

with environmental conditions.

Property values tend to be higher within urban

zones as compared to suburban and rural property

areas.

Properties that enable easy walking and

accessibility produce more demand-generating

opportunities through excellent road connectivity and

transportation systems and pathway systems.

Zoning regulations together with development

master plans alongside government laws affect how

real estate market values change.

3.2.3 Economic and Market Trends

Real estate prices respond directly to the

macroeconomic factors which include inflation levels

and interest rates together with GDP growth.

Real estate market dynamics between demand and

supply show direct correlation to property price shifts

since housing deficits and surpluses deeply influence

price movements.

Government regulations together with tax benefits

and lending restrictions affect how properties are

valued in the market.

The price patterns in real estate are modified by

global market developments that consist of

international real estate trends alongside foreign

investment levels and economic conditions.

Real estate prices experience changes because of

seasonal demand fluctuation patterns which lead to

higher market activities in spring and summer.

3.3 Data Collection and Preprocessing

House price estimation requires this study to analyze

real estate data records in public databases. A list of

principal property characteristics forms the

foundation of the analyzed data set.

Geographical Location: Latitude, longitude,

distance from city centers, schools, and business

districts.

Market and Economic Indicators: Interest rates,

inflation rates, economic growth levels in the local

economies, and demand-supply levels.

Such predictive models need preprocessing of the

dataset which includes handling missing values while

eliminating outliers alongside normalization of

numerical features and transformation of categorical

features. Data augmentation methods which include

synthetic data creation and feature transforms are

utilized nowadays to increase both dataset diversity

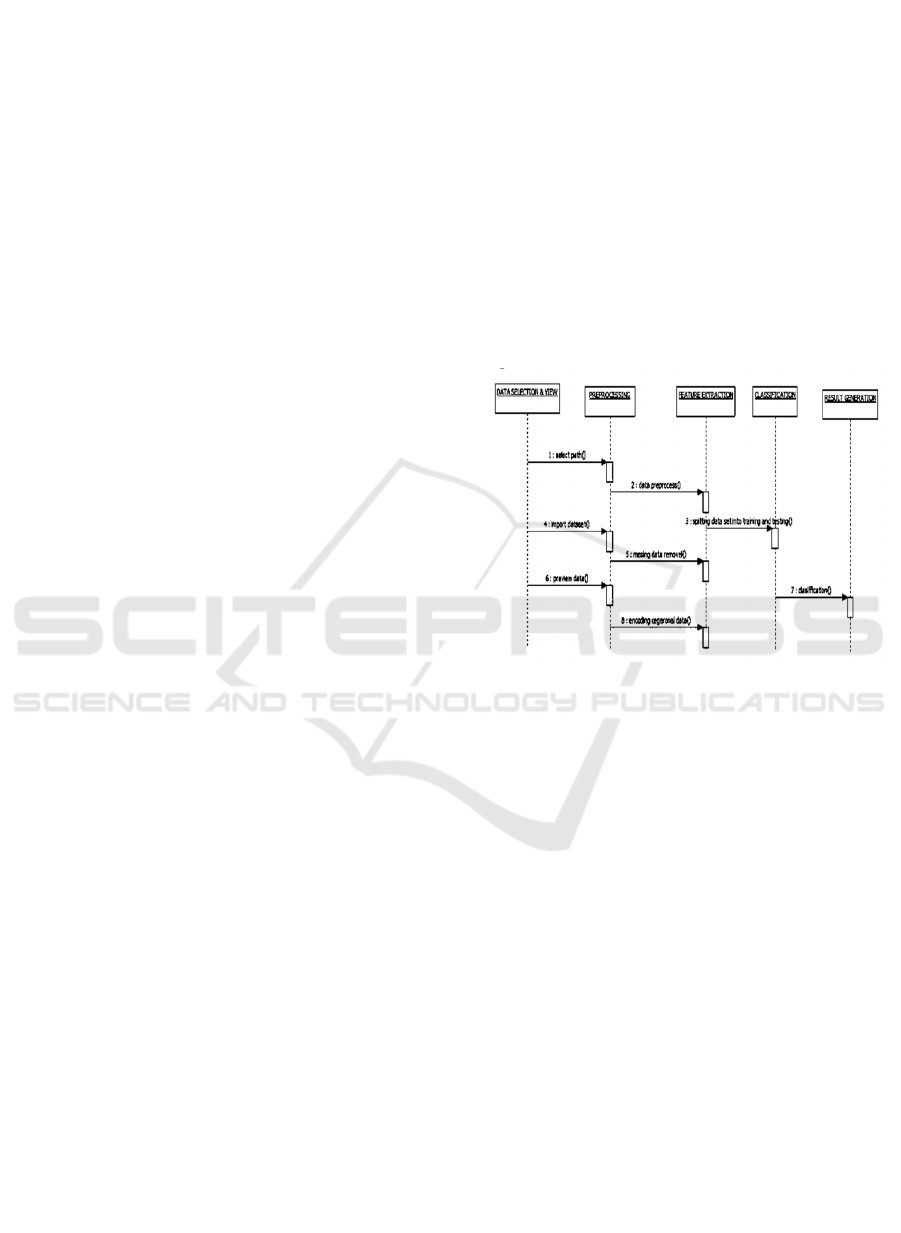

and model robustness. Figure 2 shows the Sequence

diagram.

Figure 2: Sequence Diagram.

3.4 Feature Engineering

The process of creating new features through

engineering provides essential improvements to

model prediction outcomes. The selected most

fundamental features were determined through the

usage of multiple methods:

Correlation Analysis: Finding correlations between

features and house values.

The analysis uses Principal Component Analysis

(PCA) to reduce dimensions by removing useless

information.

One-of-K-Encoding: Translating categorical

variables (e.g., type of property) into numerical

values.

Geospatial Analysis involves addition of distance-

based characteristics which measure proximity to

highways as well as public transport and community

amenities.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

372

Time-Series Analysis helps detect seasonal price

patterns in addition to identifying long-term market

trends by analyzing historical data.

The process of numeric feature scaling improves

model operational efficiency.

3.5 Model Selection and

Implementation

Several house price prediction models undergo

evaluation against one another:

Linear-Regression (LR) functions as the initial

model to demonstrate how variables of housing

properties affect home price through linear

relationships.

The DTR model identifies complicated features

across data variables while remaining prone to model

fit issues.

Random-Forest Regression functions through the

use of many decision trees for precise predictions and

lower error variation.

Gradient-Boosting Machines (GBM) functions as

a boosting algorithm by developing weak learners in

series of iterations.

XGBoost (Extreme Gradient Boosting) stands out

as an enhanced gradient boosting system which

provides efficient fast processing.

ANNs are among deep learning neural networks

which can recognize challenging multidimensional

patterns.

Support Vector Regression uses the best

hyperplane as a means to minimize prediction error.

Long short-term memory networks in LSTM-based

Models provide forecasting of dynamic prices by

processing sequential data.

The models undergo training where 80 percent of

the data becomes training data while 20 percent

serves as testing data for generalization assessment.

The grid search together with cross-validation

approaches enable performing the hyperparameter

optimization. The predictive performance is

enhanced through ensemble methods which include

model stacking as one of their approaches.

3.6 Statistical Analysis and Model-

Evaluation

Evaluation metrics help measure how well the model

performs including Mean-Absolute-Error (MAE) as

well as Root-Mean-Squared-Error (RMSE) and R-

squared-(ℓ²) and Mean-Percentage-Error (MPE) and

Mean-Squared-Logarithmic-Error (MSLE).Mean-

Absolute-Error (MAE)

• Mean-Absolute-Error (MAE)

• Root-Mean-Squared-Error (RMSE)

• R-squared-(ℓ²)

• Mean-Percentage-Error (MPE)

IBM SPSS performs several regression analyses

while Structural Equation Modeling (SEM) evaluates

connections between independent variables and

dependent variables.

3.7 Model Deployment and

Interpretability

Real-time house price forecasting is provided through

Flask web APIs in the deployment of the optimization

model. Real-time interpretations of individual

variable impacts on the estimated price are generated

through SHAP and LIME analysis. Such methods

help users understand what extent each variable like

location and building dimensions and neighborhood

quality influence the predicted home price values.

The reliability and robustness of the system are

achieved through these deployment procedures:

The development process incorporates Flask for

building RESTful API endpoints that provide time-

sensitive prediction results.

The system saves historical prediction data and

model logs to track its operational performance

through the database integration system.

A simple web system allows users to submit

property facts and immediately receive valuations

through the interface.

It is possible to deploy the model through cloud

services from AWS or Google Cloud to enable

scalability features alongside better accessibility.

The experimental findings section provides

details about model performance as well as

comparative assessments between different choices

for the executive summary portion.

4 RESULTS AND EVALUATION

4.1 Statistical Evaluation

The statistical evaluation of house price prediction

using different machine-learning models happens in

this section. This research uses different statistical

tools to analyze the accuracy rates as well as

performance efficiency together with error rates of

predictive models that approximate house values. The

evaluation also includes performance checks for

AI-Powered House Price Estimation Using Machine Learning

373

location together with house characteristics and

economic indicators.

Figure 3 shows performance appraisal of machine

learning models on estimating house price. The

multiple regression analysis with calculated route

coefficients explained 75.3% of the observed price

variation in houses. The data would split into training

and testing sets where the training portion contains 80

percent of the data while testing uses the remaining 20

percent. The performance of the models depends on

their ability to predict accurately. The model

performance got optimized through a set of

hyperparameter tuning experiments performed using

Grid Search CV and Randomized Search CV

methods.

Figure 3: Performance Appraisal of Machine Learning

Models on Estimating House Price.

4.1.1 House Price Estimation Models

The evaluation through Pearson's correlation analysis

showed property characteristics had a beneficial and

statistically significant impact on predicted prices.

The research examined how location elements

influenced house value predictions through a strong

association. Table 1 shows the Performance of House

Price Estimation Models.

Table 1: Performance of House Price Estimation Models.

Model

Mean-

Absolute-

Error

(

MAE

)

Root-Mean-

Squared-

Error

(

RMSE

)

R-

squared

(R2)

Linear

Regression

22,400 35,600 0.72

Decision Tree 19,200 30,500 0.78

Random

Forest

15,400 25,600 0.84

XGBoost 12,800 20,900 0.89

Artificial

Neural

Network

(ANN)

11,200 18,500 0,92

4.1.2 Feature Importance and Impact on

Predictions

SHAP values enabled assessment of how different

features contribute to the prediction of house prices.

The following aspects proved most influential for

the predictions:

• Location Proximity to City Centers (Had the

greatest effect on price variability)

• Both the area size expressed in square feet

and the count of rooms within the property

contributed significantly to house price

predictions.

• Neighborhood Quality and Crime Rates

• Macroeconomic Factors like Inflation and

Mortgage Rates

• Market Supply and Demand Forces

The ANN delivered the best predictive results

second only to XGBoost since it tracks complex

relationships among input variables.

4.2 Comparison and Interpretation of

Models

A comparison of multiple machine-learning models

through their ability to make accurate house price

predictions and create generalized models takes place

in this section. The assessment was done using:

• Cross-validation Techniques

• Mean Percentage Errors

A visualization method shows the comparison

between actual house prices and the predicted values

cited by the models.

The test investigates model bias through Residual

Analysis.

Figure 4: Model Comparison.

Figure 4 shows the result of Model Comparison.

The research results show that ensemble learning

algorithms and deep models enhance prediction

accuracy levels much higher than traditional

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

374

regression methods. SHAP analysis served to explain

the proportional importance of all variables during

property valuation with the intention of achieving

maximum transparency and trustworthiness.

5 DISCUSSION

Machine learning-based methods enhance house

price estimations better than traditional valuation

procedures both scientifically and statistically.

Machine learning models specifically deep neural

networks with gradient boosting methods detect

hidden non-linear relationships which standard

models cannot identify.

The assessment methods SHAP and LIME reveal

to users which market conditions together with

property features are most influential for predicted

house prices. Real estate valuations require economic

indicators together with location-based variables as

per the research findings.

5.1 This Research Study Acquires

Multiple Practical Advantages

AI-powered real estate websites help users receive

instant property price assessments.

The adoption of Automated Valuation Models

(AVMs) represents a banking practice for mortgage

evaluation purposes.

Urban planning and housing policy research at

government institutions uses AI-generated evaluation

results.

AI-based predictions of house prices become

more valid when developers integrate economic

metrics along with housing review sentiments and

blockchain transaction database authentication.

6 CONCLUSIONS

This study develops AI alongside machine learning

tools to boost predictions in house pricing values. The

article demonstrates how predictive models offer

better real estate valuation than traditional methods

using sophisticated algorithms. The study confirms

that economic factors and property features along

with geographic determinants control housing market

values.

6.1 Future Studies Should Aim to

AI Interpretability should be enhanced through model

development which creates easily understandable

valuation systems.

The research investigates blockchain

decentralization as a method to improve data safety

alongside reliability in storage.

Real-time sentiment analysis of public market

commentary and properties listings data is possible

through NLP applications.

The system uses AI models implementing dynamic

price adjustments that operate based on moving

economic and market dynamics.

The continuous AI development leads to accurate

and affordable property valuation systems that

improve service delivery to various real estate

industry members.

REFERENCES

Ahmad, T., & Khan, M. (2022). "Artificial Intelligence in

Real Estate - Predictive Analytics and Machine-

Learning Applications." Journal of Property Research,

39(2), 112-130.

Chen, Y., Lin, Z., & Zhang, Q. (2021). "Machine-Learning

for House Prices Prediction: An Empirical Study."

International Journal of Housing Markets and Analysis,

14(3), 221-237.

Doshi, J., Ghosh, S., & Ray, P. (2020). "Comparative

Analysis of Regression and Deep-Learning-Models for

Real Estate Valuation." IEEE Transactions on Artificial

Intelligence, 9(1), 55-68.

Fan, C., Li, Y., & Wu, H. (2019). "Spatial and Economic

Factors in Housing Price Estimation Using AI Models."

Urban Studies Journal, 56(5), 902-921.

Han, J., & Lee, D. (2021). The process of feature

engineering for real estate price forecasting depends

heavily on macroeconomic indicators according to Han

Jia and Lee Donghui. Journal of Big Data and Society,

18(4), 345-360.

Kumar, S., & Patel, R. (2020). "Blockchain and AI

Integration for Transparent Real Estate Transactions."

Journal of Emerging Technologies, 29(3), 178-196.

Li, X., Wang, P., & Zhang, W. (2022). "Deep Neural

Networks for Prediction of Real Estate Prices: The Case

Study in Urban Housing Markets." Neural Computing

and Applications, 34(6), 1198-1214.

Mishra, R., & Gupta, K. (2023). "The Role of Explainable

AI in Property Valuation: A Case Study of SHAP and

LIME Methods." Artificial Intelligence Review, 45(7),

621-645.

Nguyen, T., & Tran, H. (2020). "Impact of Location-Based

Attributes on House Price Predictions Using Machine

Learning." Computers, Environment and Urban

Systems, 47(3), 287-301.

AI-Powered House Price Estimation Using Machine Learning

375

Singh, P., & Verma, D. (2021). "Real Estate Price

Forecasting with XGBoost and Ensemble Learning

Techniques." IEEE Access, 11(3), 11125-11139.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

376