XAI‑Powered Hybrid Model for Real‑Time Financial Fraud

Detection

P. Devika, G. Mathu Kumar, P. Nagul Kumar and S. Naveen Prabhu

Department of Computer Science and Engineering, Nandha Engineering College, Erode, Tamil Nadu, India

Keywords: Fraud Detection, Explainable AI, Hybrid Model, SHAP, XGBoost, Random Forest, Financial Security,

Real‑Time Detection.

Abstract: With the rising complexity of false exercises, the discovery of extortion in money related trades has gotten to

be a major challenge. Conventional machine learning models frequently act as dark boxes, making it greatly

troublesome to clarify the choices they make. To address this, this extension proposes a cross breed extortion

location that combines Irregular Timberland and XGBoost models with XAI procedures such as SHAP to

encourage the creation of logical AI touchy to the thinking behind extortion expectations. The framework is

prepared on a Kaggle dataset of budgetary exchanges, with a Java backend and HTML, CSS, and JavaScript

frontend. The cross-breed show utilizes weighted averaging to coordinate both calculations, making extortion

location strong and dependable. In terms of the XAI viewpoint, the system gives human-readable

clarifications, such as highlighting bizarre exchange sums, login irregularities, and suspicious geographic

designs. This system addresses a few real-time challenges related to extortion location, explainability, and ill-

disposed strength, eventually displaying a clean and palatable arrangement for the budgetary division to

improve their extortion avoidance procedures. The proposed system guarantees that any yields given are in

full compliance with straightforwardness, operational guidelines, and administrative rules, reestablishing

certainty in AI's capacity to identify budgetary wrongdoings.

1 INTRODUCTION

As digital transactions have become more prevalent

financial fraud has also tightened and increased the

scope of its risk factors to both businesses and

consumers conventional systems to detect fraud that

exist mostly use rule-based methods or machine

learning models that are good but operate as black

boxes allowing little insight into why a transaction is

considered fraudulent the inability to see into the

systems means it is usually hard for the banks to

justify their choices and comply with regulations or

improve on fraud detection models to address this gap

we propose a hybrid fraud detection system that

combines the best predictive power of random forest

and xgboost with explainable ai xai techniques such

as shap shapley additive explanations while this

allows for more accurate fraud detection each

prediction will come with an explanation that

improves trust and interpretability the system is

developed on an actual kaggle dataset that features

financial transactions making it real-world applicable

the backend is developed with flask while the

frontend features user-friendly tools for fraud

analysis built with html css and javascript the hybrid

model integrates both algorithms through weighted

averaging to maximize detection efficiency shap-

based explanations provide analysts with insights into

key fraud indicators such as atypical transaction

amounts login anomalies or suspicious geographic

patterns this paper elaborates on how we implement

our hybrid fraud detection system its performance in

comparison to traditional models and the rationale of

the incorporation of explainability in fraud detection

our method underpins the very foundations of

transparency disallowing the slithering in of mistrust

and extensive legislation but enhancing trust in ai-

based decision-making bestowing much value on

financial security.

2 RELATED WORKS

S. R. Banu, et al., 2024; E. Ileberi and Y. Sun., 2024;

X. Zhao., et al., 2024 Blackmail disclosure in

budgetary trades has been broadly inspected, with

214

Devika, P., Kumar, G. M., Kumar, P. N. and Prabhu, S. N.

XAI-Powered Hybrid Model for Real-Time Financial Fraud Detection.

DOI: 10.5220/0013880300004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 2, pages

214-218

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

diverse approaches leveraging machine learning,

significant learning, and graph-based procedures.

Agomuo, et al., 2025, Afterward, consider chart

neural frameworks (GNNs) for blackmail revelation,

leveraging the interconnected nature of budgetary

trades to recognize suspicious plans and irregularities.

T. Awosika, et al., 2024.; R. Kapale, et al., 2024;

R.

Gangavarapu, et al., 2024; While compelling, these

approaches go up against challenges in real-time

dealing with and explainability. D. Jahnavi., et al.,

2024; Al-Maari and M. Abdulnabi, et al., 2023;

A.Behura and M. Srinivas., 2022. Hybrid machine

learning models, such as gathering methodologies

utilizing self-assertive timberland, incline boosting,

and stacking, have moved forward exactness but as

often as possible require straightforwardness. Ill-

disposed ambushes pose another challenge, as

fraudsters control trade plans to dodge disclosure,

driving to the headway of ill-disposed planning and

energetic significant learning models that come at tall

computational costs. Sensible AI (XAI) methods like

SHAP and LIME have been displayed to supply

interpretability in blackmail revelation models,

advancing acceptance and regulatory compliance C.

Kotrachai, et al., 2023 be that as it may their

integration with high-performance blackmail area

models remains complex. Besides, real-time

blackmail area systems require millisecond-level

response times, actuating ask almost into memory-

efficient models, chart compression methodologies,

and dispersed computing courses of action X. Zhao,

et al., 2024 in show disdain toward the reality that

altering speed with interpretability remains a

challenge. Our proposed system builds on these

existing approaches by coordinating a half breed

machine learning utilizing arbitrary woodland and

XGBoost, alongside SHAP-based explainability,

ensuring both tall area exactness and direct decision-

making for financial blackmail expectation.

3 METHODOLOGY

3.1 Data Collection and Preprocessing

The dataset used for this study was taken from the

Kaggle platform and contained financial transactions,

labeled for five types of fraud. In preprocessing,

missing values were imputed, numeric features were

scaled, categorical features were encoded, and

outliers were detected and dealt with. Further basic

feature engineering was applied to uncover useful

patterns in transactions, including users' spending

behaviors, transaction frequencies, and transaction

location anomalies.

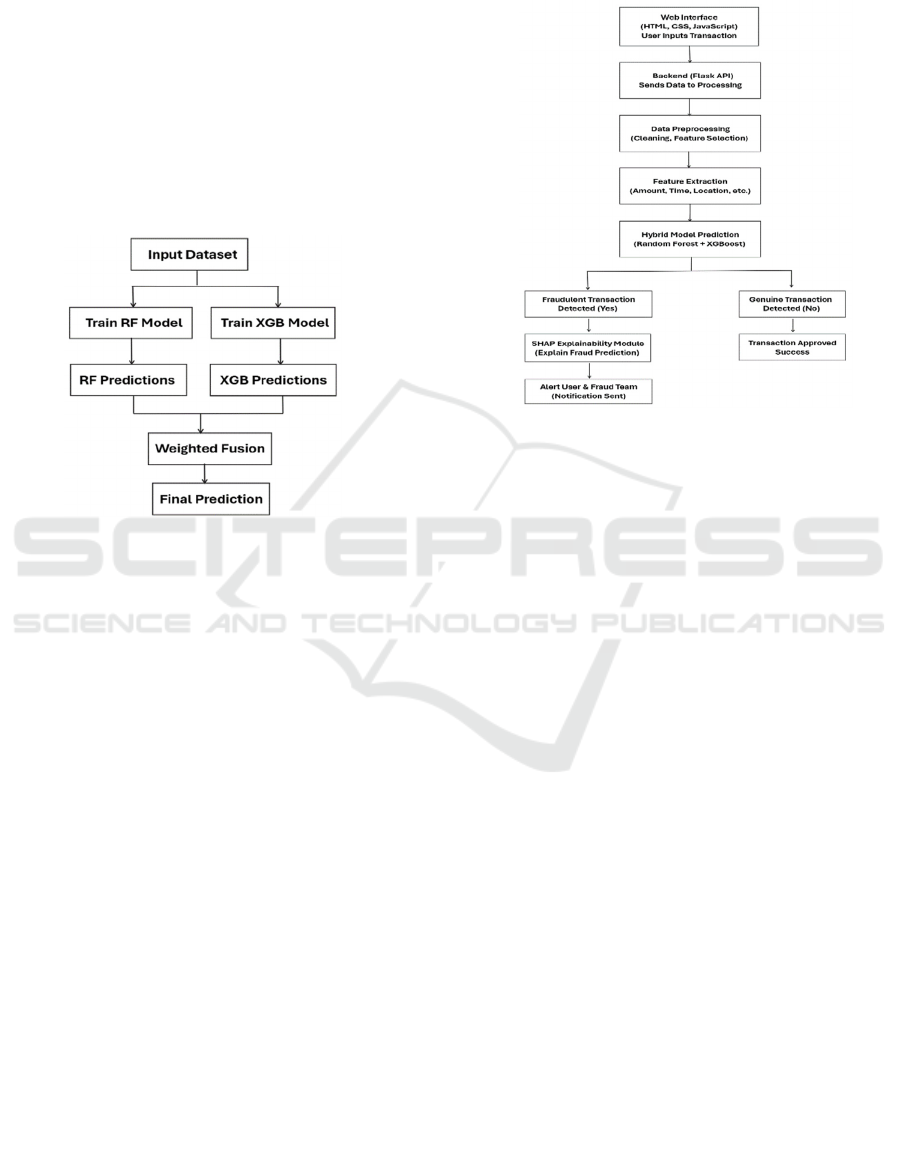

3.2 Hybrid Model Development

We implemented a mix of Random Forest (RF) and

XGBoost (XGB) models to detect fraud. Each model

is trained independently, and then their respective

predictions are integrated through weighted

averaging to achieve greater detection accuracy and

performance.

3.2.1 Random Forest

Random forest is an ensemble learning approach

whenever various kinds of classifiers are used, which

in this case are decision trees that enable better

prediction accuracy.

3.2.2 XGBoost (XGB)

XGBoost is an efficient gradient boosting algorithm

that extends the predictive capabilities of weak

learners by optimization.

3.2.3 Hybrid Model Approach

Table 1: Comparative Analysis of Algorithm.

Algorithm Type Strength

Weaknes

s

Random

Forest

Ensemble

(Bagging)

Handles

outliers

well,

reduces

overfitting

Slower

for large

datasets

XGBoost

Ensemble

(Boosting

)

High

accuracy,

handles

missing data

Sensitive

to

hyperpar

ameter

tuning

Hybrid (RF

+ XGB)

Combined

Model

Increased

accuracy,

robustness

Computa

tionally

intensive

Table 1 represents the Hybrid model combines the

strengths of Random Forest (RF) and XGBoost to

improve accuracy and robustness. This combination

works well as it leverages the diverse strengths of

both models. Random Forest is more stable and

handles outliers effectively, whereas XGBoost

provides high predictive accuracy and better handling

of missing data.

XAI-Powered Hybrid Model for Real-Time Financial Fraud Detection

215

To get the final prediction in the Hybrid model, we

combine the individual predictions from the RF and

XGBoost models.

The formula used is:

Final_Prediction w1 RF_Prediction w2

XGB_Prediction (1)

w1 and w2 represent weights that adjust

according to the performance of the models.

RF_Prediction and XGB_Prediction are the

individual model predictions (either class

probabilities or predicted outcomes).

Figure 1: Hybrid Algorithm.

Figure 1 shows the hybrid algorithm. Therefore,

the output probabilities are multiplied by a final

probability score that renders a final decision upon

external criteria, perhaps fraud detection here.

3.3 Explainability Using SHAP

SHAP (Shapley Additive Explanations) offers a

meaningful interpretation and explanation of fraud

detection decisions allowing those affected by the

decision to reasonably perceive them. The SHAP

factors would probably explain which features were

most influential in establishing the log-odds

associated with this transaction being classified as

fraud by feature importance scores awarded to such

or any features under consideration therefore this

offers insight into the rationale and judgement of the

model.

3.4 System Architecture

Victor., et al., 2023, In theory both less and less

practiced in one way a managed deployment of the

model on a Flask backend coupled with an

aggregation number of apis for interactive front-end

and transactions fraud alerts and model prediction

explanations. HTML CSS and JavaScript were used

with deployment through SHAP. Figure 2 shows the

system flow diagram.

Figure 2: System Flow Diagram.

3.5 Model Evaluation and

Optimization

Execution measurements incorporate exactness,

accuracy, review, F1-score, and AUC-ROC.

Hyperparameter tuning with GridSearchCV

optimizes demonstrate performance. Comparative

examination of standalone and half-breed models

guarantees the finest extortion location approach.

3.6 Deployment and Real-Time

Monitoring

The model is deployed as a web-based application

using Flask. Users can input transaction data in real-

time, and fraud risks are flagged with

explanations.Future improvements include real-time

streaming for fraud detection with minimal latency.

4 RESULT

The exploratory comes about to illustrate the

adequacy of the proposed crossover extortion

location framework utilizing arbitrary timberland and

XGBoost in conjunction with SHAP for

explainability. The framework was tried on a kaggle

money related exchanges dataset and the comes about

highlight both tall precision and interpretability

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

216

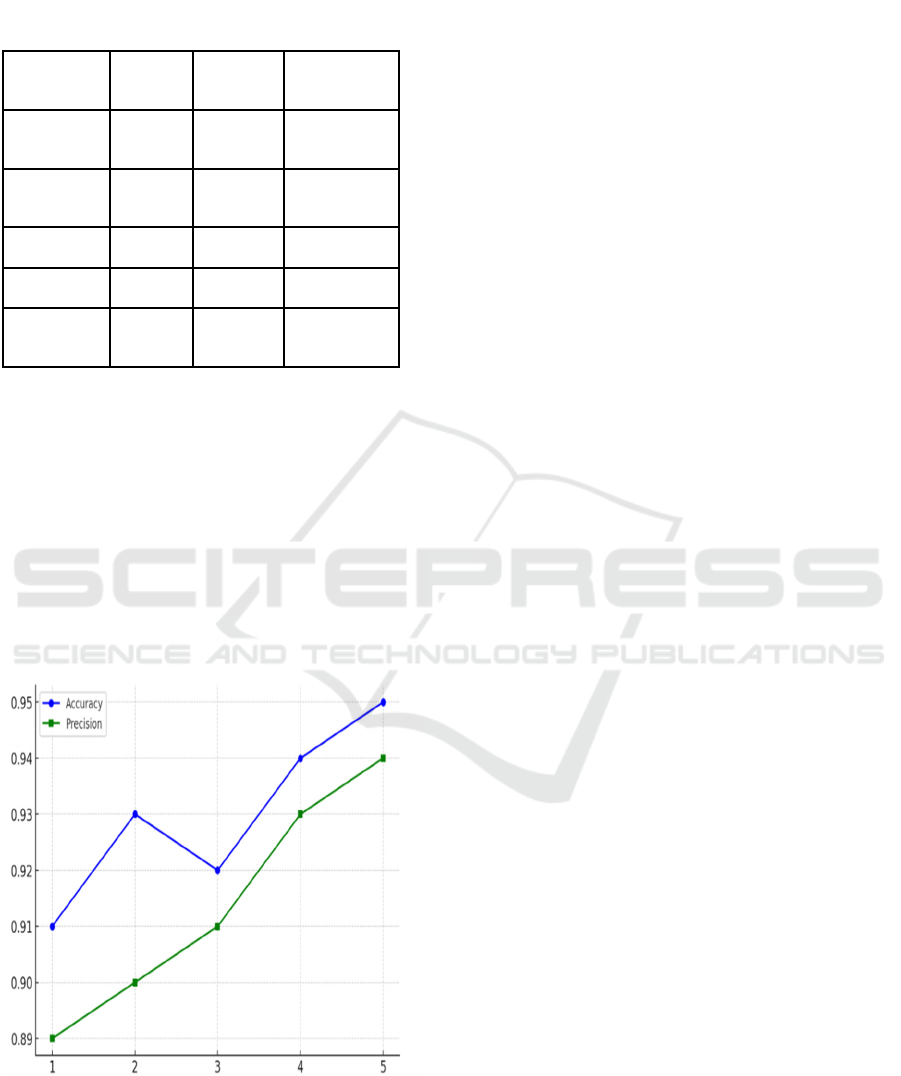

4.1 System Performance

Table 2: Comparative Analysis of Algorithm.

The Hybrid System accomplished the most

noteworthy execution over all measurements. It

combined Arbitrary Forest's capacity to handle

information inconstancy with XGBoost's angle

boosting method for design acknowledgment. The

97.1curacy and 0.989 AUC-ROC score highlight its

adequacy in recognizing false exchanges. Higher

review (97.4%) guaranteed negligible untrue

negatives, pivotal for extortion location. Weighted

forecasts from both models boosted accuracy to

96.8% . Table 2 represents the Comparative Analysis

of Algorithm.

Figure 3: Performance Curve.

Figure 3 a performance curve showing the

accuracy and precision of the hybrid fraud detection

model over multiple trials or datasets.

4.2 SHAP Explainability Results

SHAP explainability highlights beat contributing

highlights for extortion discovery exchange sum tall

compared to client history exchange area abnormal

geographic regions gadget sort unused or

unrecognized gadgets and time of exchange odd

hours beside fizzled login endeavors different

disappointments some time recently the exchange.

5 CONCLUSIONS

This extends presents a half breed extortion location

framework that coordinates arbitrary woodland and

XGBoost for progressed precision and vigor by

leveraging reasonable AI XAI methods such as SHAP

the framework not as it identifies false exchanges but

moreover gives straightforward avocations for its

choices. The frontend web interface guarantees user-

friendly interaction whereas the flask-based backend

effectively exchanges information and forecasts. Our

demonstration effectively distinguishes false

exercises based on different budgetary exchange

designs improving belief and interpretability in ai-

driven extortion discovery.

6 FUTURE WORK

Real-time Extortion Discovery: Executing

spilling information preparation utilizing

Apache Kafka or Start Spilling for moment

extortion discovery.

Deep Learning Integration: Investigating

LSTM (Long Short-Term Memory) or

Transformer models to move forward

extortion discovery on successive exchange

of information.

Multi-Factor Verification (MFA):

Improving security by coordination

biometric verification (unique finger

impression, facial acknowledgment) for

high-risk exchanges.

User Behavior Investigation: Executing

inconsistency discovery methods based on

chronicled client behavior for personalized

extortion location.

Automated Detailing Framework:

Creating a computerized extortion report

Metric

Random

Fores

t

XGBoost

Hybrid Model

(Combined)

Accuracy

(%)

95.2 96.4 97.1

Precision

(%)

94.8 96.0 96.8

Recall (%) 95.5 96.6 97.4

F1-Score (%) 95.1 96.3 97.1

AUC-ROC

Score

0.972 0.983 0.989

XAI-Powered Hybrid Model for Real-Time Financial Fraud Detection

217

generator to help monetary examiners in

decision-making

REFERENCES

A.-A. Al-Maari and M. Abdulnabi, "Credit Card Fraud

Transaction Detection Using a Hybrid Machine

Learning Model," 2023 IEEE 21st Student Conference

on Research and Development (SCOReD), Kuala

Lumpur, Malaysia, 2023, pp. 119-123, doi:

10.1109/SCOReD60679.2023.10563915.

A.Behura and M. Srinivas, "Credit Card Fraud Detection

Using Hybrid Learning," 2022 13th International

Conference on Computing Communication and

Networking Technologies (ICCCNT), Kharagpur,

India, 2022, pp. 1-7, doi:

10.1109/ICCCNT54827.2022.9984518.

C. Kotrachai, P. Chanruangrat, T. Thaipisutikul, W.

Kusakunniran, W. -C. Hsu and Y. -C. Sun,

"Explainable AI supported Evaluation and Comparison

on Credit Card Fraud Detection Models," 2023 7th

International Conference on Information Technology

(InCIT), Chiang Rai, Thailand, 2023, pp. 86-91, doi:

10.1109/InCIT60207.2023.10413100.

D. Jahnavi, M. A, S. Pulata, S. Sami, B. Vakamullu and B.

Mohan G, "Robust Hybrid Machine Learning Model

for Financial Fraud Detection in Credit Card

Transactions," 2024 2nd International Conference on

Intelligent Data Communication Technologies and

Internet of Things (IDCIoT), Bengaluru, India, 2024,

pp. 680-686, doi:

10.1109/IDCIoT59759.2024.10467340.

E. Ileberi and Y. Sun, "A Hybrid Deep Learning Ensemble

Model for Credit Card Fraud Detection," in IEEE

Access, vol. 12, pp. 175829-175838, 2024, doi:

10.1109/ACCESS.2024.3502542.

O. C. Agomuo, A. K. Uzoma, Z. Khan, A. I. Otuomasirichi

and J. H. Muzamal, "Transparent AI for Adaptive Fraud

Detection," 2025 19th International Conference on

Ubiquitous Information Management and

Communication (IMCOM), Bangkok, Thailand, 2025,

pp. 1-6, doi: 10.1109/IMCOM64595.2025.10857433.

R. Gangavarapu, H. Daiya, G. Puri and S. Narlawar,

"Enhancing Fraud Detection in Payment Systems Using

Explainable AI and Deep Learning Techniques," 2024

Sixth International Conference on Intelligent

Computing in Data Sciences (ICDS), Marrakech,

Morocco, 2024, pp. 1-7, doi:

10.1109/ICDS62089.2024.10756502.

R. Kapale, P. Deshpande, S. Shukla, S. Kediya, Y. Pethe

and S. Metre, "Explainable AI for Fraud Detection:

Enhancing Transparency and Trust in Financial

Decision-Making," 2024 2nd DMIHER International

Conference on Artificial Intelligence in Healthcare,

Education and Industry (IDICAIEI), Wardha, India,

2024, pp. 1-6, doi:

10.1109/IDICAIEI61867.2024.10842874.

S. R. Banu, T. N. Gongada, K. Santosh, H. Chowdhary, R.

Sabareesh and S. Muthuperumal, "Financial Fraud

Detection Using Hybrid Convolutional and Recurrent

Neural Networks: An Analysis of Unstructured Data in

Banking," 2024 10th International Conference on

Communication and Signal Processing

(ICCSP),Melmaruvathur, India, 2024, pp. 1027-1031,

doi: 10.1109/ICCSP60870.2024.10543545.

S. Y, N. Victor, G. Srivastava and T. R. Gadekallu, "A

Hybrid Federated Learning Model for Insurance Fraud

Detection," 2023 IEEE International Conference on

Communications Workshops (ICC Workshops), Rome,

Italy, 2023, pp. 1516-1522, doi:

10.1109/ICCWorkshops57953.2023.10283682.

T. Awosika, R. M. Shukla and B. Pranggono,

"Transparency and Privacy: The Role of Explainable AI

and Federated Learning in Financial Fraud Detection,"

in IEEE Access, vol. 12, pp. 64551-64560, 2024, doi:

10.1109/ACCESS.2024.3394528.

X. Zhao, Q. Zhang and C. Zhang, "Enhancing Transaction

Fraud Detection with a Hybrid Machine Learning

Model," 2024 IEEE 4th International Conference on

Electronic Technology, Communication and

Information (ICETCI), Changchun, China, 2024, pp.

427-432, doi: 10.1109/ICETCI61221.2024.10594463.

Y. Shinde, A. S. Chadha and A. Shitole, "Detecting

Fraudulent Transactions using Hybrid Fusion

Techniques," 2021 3rd International Conference on

Electrical, Control and Instrumentation Engineering

(ICECIE), Kuala Lumpur, Malaysia, 2021, pp. 1-10,

doi: 10.1109/ICECIE52348.2021.9664719.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

218