Predictive Analytics and Generative AI for Customer Churn

Prediction and Proactive Retention

Anju Thomas, Tamizh Murugan T., P. Ranjana and Constance Xavier S.

Department of Computer Science and Engineering, Hindustan University, Chennai, Tamil Nadu, India

Keywords: Machine Learning, Generative AI, Telecom Communication.

Abstract: Churn prediction system is the advanced analytics and machine learning based system which predicts the

customer that might churn from the business. Thus, drawing leverage from information regarding transaction

histories, behavioral patterns, engagement levels and user feedback, the system enables businesses to take

proactive measures to retain consumers, recovering lost revenue, while ensuring the long-term sustainability

of the firm. The key processes such as data preparation, feature engineering, model building and insight

generation. Next step, Generative AI takes this model a step further, making them more accurate and frequent

in predicting potential churners, to nip the issue in the bud.

1 INTRODUCTION

Effective churn prediction models rely on robust data

representations. Thus, the performance of churn

models is enhanced through robust feature selection

techniques and text mining processes. It includes

emphasis in certain features so that only the most

relevant information reaches the model, and the best

of contemporary Natural Language Processing

techniques to bring value-added insights from text-

based inputs. One way to bridge this communication

gap is to have feedback loops and crowdsource

programs to keep your models fresh with

continuously updated data sets and user-generated

content. Models are constantly consumed, modified,

and re-consumed as output, which allows for dynamic

refinement of models.

Feedback loops are an essential part of improving

model performance which helps with updating the

results regularly so that the models can still provide

higher accuracy. Also, generalizability will help

models be accurate for new and unseen data, making

them more robust and applicable to different settings.

Overall, these techniques collectively improve the

performance and reliability of machine learning

models for churn prediction, resulting in more

effective solutions. Churn prediction models are

critically reliant on the quality of the data

representation. Improved feature engineering and

textual data mining processes can significantly

enhance the quality of these representations. This

includes creating features from existing variables,

aggregating data points, and using statistical methods

to make sure that features created are robust and

informative. Unlike general data mining, however,

textual data mining deals with unstructured text data;

it deals with unstructured text data by processing and

analyzing unstructured text data to retrieve

information. These include techniques such as NLP,

sentiment analysis, and topic modeling, which assist

us in transforming the unstructured text data into

structured features that we would feed into the

predictive model. These need to be fine ginned

constantly and continuously to stay accurate while

being able to perform specific tasks. This involves

tons of feedback loops and crowdsourcing working

in symbiosis. The internet made it easier than ever for

customers to compare products and switch between

competitors, resulting in higher churn. Delivering

product quality and personalized experiences is

critical, as product failures are a leading cause for

customer loss. Churn is also driven by dissatisfaction

with customer service and pricing concerns. This ties

to churn rates and the rise of life changes,

subscription models and the lack of data insights. This

becomes especially critical when there are too many

unsatisfied customers — companies looking to

capture the market often spend significantly more on

acquiring new customers relative to retaining

customers already on board, which in turn increases

churn and decreases profitability. The case highlights

128

Thomas, A., T., T. M., Ranjana, P. and S., C. X.

Predictive Analytics and Generative AI for Customer Churn Prediction and Proactive Retention.

DOI: 10.5220/0013878900004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 2, pages

128-134

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

important aspects for providing customer success

e.g., understanding customer needs, delivering

customer success experience, delivering on customer

service & preventing churn leveraging data analytics

and continuously iterating on product & service.

1.1 Enhancing Churn Prediction

The accuracy of churn prediction models always

depends on an effective representation of data. We

can leverage advanced textual data mining

techniques, optimizing feature engineering to derive

better representations of their data. This helps in

enhancing the efficacy and reliability of the model.

These techniques ensure that the data being fed into

the models is relevant and complete. This allows the

models to better predict client behaviour. The classic

models will help organisations to get insight about

their customers and reduce churn which eventually

boosts revenue and customer retention with the help

of advanced methodologies. Improve Data

Representation: Move towards feature engineering

and textual data mining for better susceptible data.

These include generating interaction terms, time-

based features, and using NLP techniques for

sentiment analysis and topic modeling.

We train this model on data until October 2023.

The role of feedback mechanisms is paramount here,

such as real-time updates and online learning; using

crowdsourcing to gather diverse insights and quickly

collect data.

Performance that gets better: Over time, because of

the feedback cycle, models become steadily better.

Continual learning and up-to-the-minute feedback

keep your model accurate.

Four techniques:- Generalizability: Techniques such

as cross-validation, regularization, and ensemble

methods improve the model's ability to generalize to

new, unseen data, making it more robust and

applicable.

Boosted Efficacy: We harness AutoML for

hyperparameter tuning, robustness testing, leading to

immensely superior effectiveness and reliability of

ML applications. Also, ensuring the interpretability

of the model with tools such as SHAP and LIME is

also critical.

2 LITERATURE SURVEY

It evaluates the challenges encountered in this field,

such as data protection issues, the difficulty of

integrating these technologies into existing systems,

and the relatively limited real-world testing. The

results of this work highlight the importance of these

factors for the practical use of generative AI for

consumer analytics: improving predictions and

keeping a pulse with operational needs in consumer

behavior. (Mitra Madanchian et al. 2024)

Hence, this paper is tackling the problem of

improving bank churn detection with advanced

machine learning methods. It employs Random

Forest (RF) and Light Gradient-Boosting Machine

(LGBM) classifiers, combined with the

SMOTETomek method to address class imbalance

apresenting in the dataset. The paper highlights key

challenges, such as the possibility of synthetic noise

hindering the ability of the model to learn and

generalize. Potential need for other machine learning

methods or ensemble of models to achieve better

predictive performance Through this study, we

explored the use of big data analytics, creating a

trusted algorithm that is here to ensure accurate

detection of churn towards making the banking

industry more relevant in the customer retention

perspectives. (Alin-Gabriel Văduva et al. 2024).

These approaches and algorithms were used to

adapt a generative AI-augmented knowledge base

(ChurnKB) to improve feature engineering for

customer churn modeling. It overcomes fundamental

challenges like data dependence and generative AI

difficulties for efficient generalization. The study

underlines the importance of textual data mining,

along with the combination of crowdsourcing to

enhance features and using feedback loops from

classifiers to train the sample. This research aims to

improve customer prediction by incorporating

machine learning classifiers with generative AI

techniques, creating a more accurate and

comprehensive framework to predict customer churn,

which can deeply impact customer retention

strategies across different sectors. (Maryam

Shahabikargar et al. 2024).

This paper serves an interesting research on

customer churn, where the authors developed a

customer churn prediction framework based on

integrating large language model (LLM) embeddings

by the OpenAI Text-embedding-ada-002 model with

a logistic regression classifier. The work emphasizes

the necessity of using techniques after training to

reduce difference between embeddings and

predictive outcome, and highlights scalability of

models on different datasets. In addition, it

discusses major shortcomings such as limited

generalizability of certain embedding techniques and

the incapability of the model to incorporate both

objective and subjective components of churn. The

research seeks to deliver significant information to

Predictive Analytics and Generative AI for Customer Churn Prediction and Proactive Retention

129

extend churn prediction accuracy and improve

programme usage and analysis through scrutinising

such practices as well as their respective limits.

(Meryem Chajia et al. 2024)

The models were evaluated using ACCURACY,

RECALL, F1-SCORE, and PRECISION

performance metrics, and the Random Forest

Classifier obtained an accuracy of 96.12%, which is

higher than that of Decision Trees. The limitations

include reliance on structured data, potential bias, and

the exclusion of advanced deep learning methods.

Data preprocessing, feature selection, and model

evaluation techniques play important roles in

improving churn prediction accuracy, according to

the study. They may guide future exploration of

ensemble learning, deep learning models and cost-

sensitive learning that can further refine our

prediction ability. (Aditi Chaudhary et al. 2023).

This study aims to classify customers in order to

predict churn using machine learning techniques.

The research focuses on imbalanced datasets and

mitigates it with the CTGAN (Conditional Tabular

GAN) and the SMOTE (Synthetic Minority

Oversampling Technique). (HSLR) model is

proposed based on hybrid stacking and logistic

regression (LR) as a meta-classifier, with random

forest (RF), extreme gradient boosting (XGB),

adaptive boosting (ADA), and light gradient

boosting (LGBM) as base classifiers. The

performance is measured with accuracy, precision,

recall, F1-score, MCC and ROC score, where

SMOTE generated data gives better results (94.06%

accuracy). The limitations of these methods might be

the absence of deep-learning techniques, the

potential bias from the synthesis of the datasets, and,

possibly, the requirement for real-time

implementation. Findings indicate the need for

future research to adopt techniques harnessing deep

learning capabilities, real-time churn prediction, and

ethical concerns around AI. (Nomanahmad et al.

2024)

We studied customer churn prediction using

machine learning algorithms primarily Support

Vector Machines (SVM). The study highlights factors

that might predict churn, including service quality,

pricing, customer satisfaction, and influence from

competitors. Data preprocessing, feature selection

and regression methods are carried out further for

customer attrition prediction. The SVM model

samples hyperplanes and maps data to higher-

dimensional spaces using kernel functions, enhancing

accuracy in classification. It suffers from some

limitations, such as being dependent on structured

data, inability to adjust to new data in real time, and

exclusion of deep learning models. Future studies

can leverage upon deep learning, real-time analytics

and more sophisticated feature engineering to

improve churn prediction accuracy. (RajaGopal et al.

2021).

The third paper is entitled "Analysis and Prediction of

Bank User Churn Based on Ensemble Learning

Algorithm," and envisages customer churn prediction

in a bank using the three ensemble algorithms

CatBoost, LightGBM, and Random Forest. On

quarterly user data, the model achieves 90% accuracy

and more than 80% AUC that not only useful in

customer retention but also marketing strategies

refinement for bank. Indeed, as the study indicates,

ensemble learning integrated with the proper return of

data can improve the prediction results, but issues

such as overfitting and data optimization must still be

addressed. (Yihui Deng et al. 2021).

The paper titled "Prediction of Player Churn and

Disengagement Based on User Activity Data of a

Freemium Online Strategy Game" explores

predicting player churn in "The Settlers Online" using

machine learning algorithms like random forests,

decision trees, and neural networks. By analyzing

player activity data and employing methods such as

sliding windows and quartile approaches, the

researchers achieved high accuracy, with AUC values

exceeding 0.99 and prediction accuracies over 97%.

However, the study acknowledges limitations in

generalizing the results to other games and highlights

potential biases and the need for fine-tuning labeling

approaches and feature selection. The findings are

particularly relevant for game developers seeking to

retain players in freemium games.( Karsten

Rothmeier et al. 2020)

The paper "Development of Churn Prediction

Model using XGBoost - Telecommunication Industry

in Sri Lanka" explores customer churn prediction

using machine learning algorithms like Decision

Tree, Logistic Regression, SVM, ANN, Random

Forest, AdaBoost, and XGBoost. Analyzing data

from 10,000 postpaid users, XGBoost achieved the

highest accuracy of 82.90%, improving to 83.13%

after hyperparameter tuning. The study highlights the

effectiveness of ensemble methods but notes the need

for better feature selection and data pre-processing to

address potential overfitting (Prasanth Senthan, et al.

2021).

3 PROPOSED SYSTEM

The system uses supervised machine learning

algorithms, particularly Random Forest, to predict

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

130

customer churn based on historical data, which allows

businesses to implement data-driven retention

strategies. Through detailed visualisations like

correlation heatmaps, distribution plots, and churn

reason breakdowns, the system delivers key insights

into customer behaviour and churn trends. For

additional insights and to assist with our task

classification, we used NLP techniques with the

textual field vectorized (using TF-IDF) and

classification models implemented to extract

appropriate reasons for customers not being happy.

Moreover, transformer-based models are also used

for summarizing customer feedback to create a

concise and actionable summary that helps decision-

makers formulate proactive retention strategies.

Using predictive analytics along with generative AI

we create a smart, powerful, and automated way to

retain customers by improving their engagement and

loyalty.

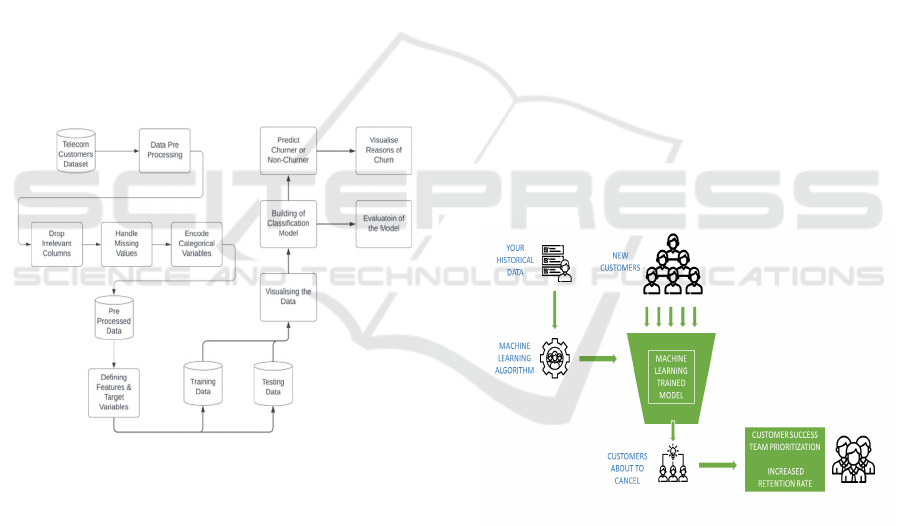

4 ARCHITECTURE DIAGRAMS

Figure 1: Overall Architecture Diagram.

The architecture diagram in figure 1 is for a simple

telecom customer churn prediction workflow. It starts

in data cleaning, such as dropping unnecessary

columns, dealing with missing data and categorical

encoding. Next, segments the data into a training and

testing with target sets and appropriate features. The

training set is analyzed in an exploratory way,

summarizing important rules, and building a strong

classifying model. Before predicting churn

likelihood, the accuracy of the model is validated

with the testing data. Lastly, charting churn triggers

helps formulate actionable steps that organizations

can take to address the issues and retain customers.

5 MODULE DESCRIPTION

Historical Customer Data Loader — this key module

collects and consolidates customer data across

different platforms (transaction histories, CRM

systems, customer interactions, social media

activities, and so on). Its primary goal is to establish

a robust dataset that captures customer interactions,

inclinations, and patterns, serving as the foundation

for predictive analytics and business intelligence.

Data ingested from different sources is the first step:

streams of structured and/or unstructured data from

multiple channels. Data cleansing and preprocessing

follows it, which involves handling missing values,

removing duplicates, and standardizing formats. The

second phase is the integration and transformation of

data: a heterogeneous set of data are integrated into a

single, uniform, structured repository; data is

featured and encoded so that its usability is optimal.

Inspired by that, and a few other various ideas for data

streaming flows, a producing pipeline would look

like this: Raw data comes from a data source (social

media, news articles, or images) It gets processed by

various rules, laws, and filters (here is where key

value-sets are applied, such as Figure ground)The

clean data is dumped into a data lake/store/warehouse

or cloud storage for scalability and quick access.

Figure 2: Workflow of Churn Prediction.

The resulting dataset fuels customer insights, churn

prediction, and personalized marketing strategies,

improving business performance as a whole.

Figure 2

illustrates the workflow of churn prediction.

Data Catalog Pre-processing Module: A system of

systematically converting raw customer data into a

formatted and structured analyzable format for

predictive analytics and AI-driven churn prediction.

First, we load the dataset, in this case using a Telco

Customer Churn dataset as the primary data source.

Predictive Analytics and Generative AI for Customer Churn Prediction and Proactive Retention

131

Processed Irrelevant Columns:Columns like

customerID are removed to reduce unwanted

attributes that do not help in predictive analysis. Data

cleaning: Missing values are an important aspect of

dataset preprocessing, and Total Charges column is

converted into a numeric format and missing data is

imputed using mean to keep the data integrity.

Handling Missing Values:

If x

i

is missing in feature X, replace it with:

𝑥

=

∑

𝑥

(1)

To prepare categorical features for machine learning,

Label Encoding is applied, ensuring compatibility

with numerical models. Example of working of label

encoding is shown in figure 3.

Figure 3: Example of Working of Label Encoding.

Furthermore, feature scaling using StandardScaler is

performed to standardize numerical values, ensuring

balanced model learning.

𝑋𝑠𝑐𝑎𝑙𝑒𝑟 =

(2)

Lastly, the data has been split into training and

testing sets for the sake of model testing. The pre-

processing pipeline encompasses crucial steps

including imputation methods for filling missing

values, feature encoding for accommodating

categorical data, scaling transformations, and data

partitioning, ultimately yielding a dataset that is

clean, consistent, and well-suited for accurate and

efficient predictive modelling. With these structured

steps, AI models can perform better at customer churn

prediction, allowing businesses to take proactive

retention measures with greater efficacy.

Churn Risk Scoring Module: a predictive

analytics engine which measures risk of customer

churn by analyzing historical data, consumer

behaviours and engagement patterns. We are

deploying methods like Feature selection, Data pre-

processing and Classification models like Random

Forest and Logistic regression, wherein Train the

module/model with available data.Churn Probability

Score (PC)

Using Logistic Regression:

Ρ(churn = 1|X) =

(

∑

)

(3)

5.1 Machine Learning Models for

Prediction (PM)

5.1.1 Random Forest (RF)

𝑓

(

𝑥

)

=

∑

ℎ

(𝑥) (4)

Following that are data clearance, missing value

filling, encoding of categorical features, feature

scaling and finally train-test dataset splitting. Then it

learns churn behaviour from the past, with the

performance metrics accuracy, precision, recall and

F1-score. In addition, AI based insights and statistical

methods (e.g., correlation analysis, feature

importance, etc.) can help further fine-tune the churn

related risk score. This scoring mechanism allows

businesses to proactively identify high-risk customers

and develop retention plans accordingly accordingly,

which in turn increases customer engagement and

reduces churn rates.

Predictive Analysis Integration: This module uses

machine learning, generative AI and advanced

analytics to forecast customer behavior and automate

retention initiatives. This facilitates customer

retention as it predicts the probability of customers

leaving based on historical behaviour, transaction

trends, and engagement metrics, allowing businesses

to design personalized retention strategies such as

targeted promotions, loyalty rewards, and proactive

customer support. Using deep learning models

(LSTMs, XGBoost, Random forest) and generative

AI, it continuously improves forecasts and adapts

strategies to real-time events. This feedback-loop

process, which is a deep learning technique, ensures

consistent improvement, thus making retention

efforts more accurate than ever. It can give businesses

higher retention, lower acquisition costs and greater

customer lifetime value (CLV).

Mathematical formulation & Algorithm

Random Forest (RF)

Prediction for Regression:

𝑦=

∑

ℎ

(𝑥)

(5)

Prediction for Classification:

𝑦 = 𝑚𝑜𝑑𝑒(

ℎ

(

𝑥

)|

𝑡 = 1,2, … , 𝑇𝑥

) (6)

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

132

Where:

T is the number of decision trees

ht(x) is the prediction from the t-th tree

6 RESULTS

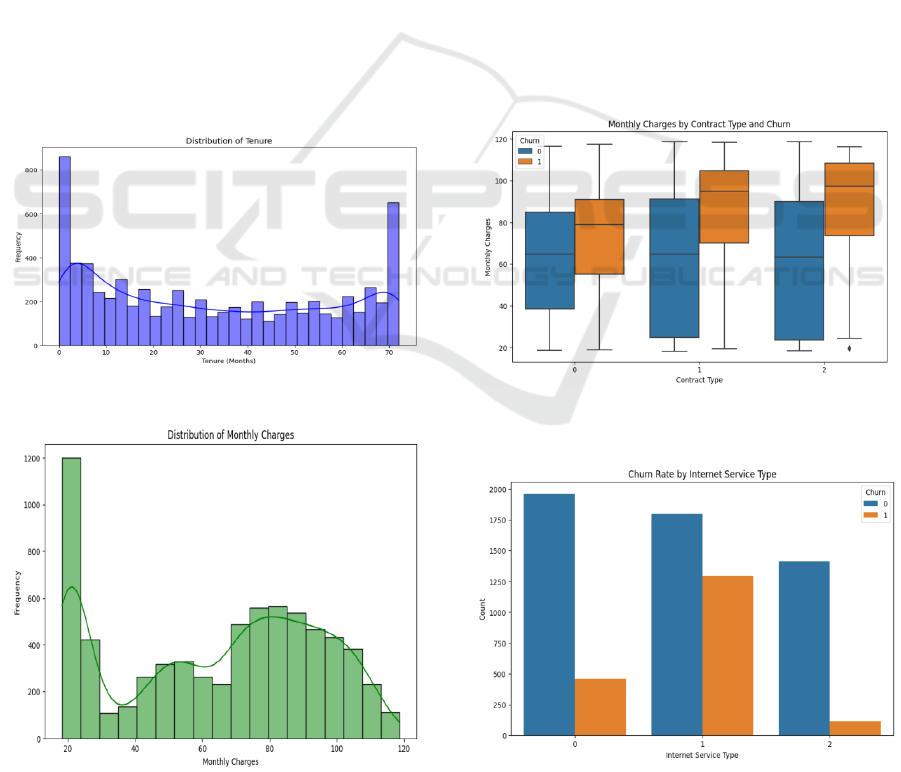

The distributions of Tenure and Monthly Charges are

shown in Figures 4 and 5 and are important

characteristics that provide crucial information about

individual instances in the dataset.

The tenure distribution is multimodal with spikes

at the start (0mo) and the upper end (70+mo). That

implies that many of these customers are either new

to the service, or have remained subscriber for some

time. The tenure distributed across intermediate

periods suggests a spreadin consumer retention.

High frequency at zero months might indicate a rate

of early contract cancellations or a very high rate of

signups. From the distribution of monthly charges,

you can see a right-skewed shape with a significant

count of charges in lower range (around 20) The

distribution slowly tapers off to larger values before

Figure 4: Distributions of Tenure.

Figure 5: Distributions of Monthly Charges.

peaking again, at around 70 to 100. By this, I mean

that, while many customers in the sample are lower-

tier customers of the company (basic plans, lower-

cost services), many customers are premium

consumers (i.e., premium or high-touch plans).

Customers with greater monthly spendings, i.e.,

those with multiple services or premium

subscriptions, occupy the right tail of the distribution.

Data Visualization − Figures 6 and 7 represent the

distributions of Monthly Charges by Contract Types

and Churn Status as well as the visual representation

of Churn Rate segmented by Internet Service Type.

Enhancing visualization of key features of dataset

provides valuable insights about the factors causing

churn behavior.

Churn analysis by contract type and monthly

charges for customers provides critical insights.

Contract Type 0 shows a diverse utilization pattern

or service packages as it has a varying price range

monthly charges. The churned and non-churned

customers are also noticabely different, Churned

customers generally tend to pay higher monthly

charges.

This tendency remains across Contract

Figure 6: Distribution of Monthly Charges by Contract

Type and Churn.

Figure 7: Distribution of Churn Rate by Internet Service

Type.

Predictive Analytics and Generative AI for Customer Churn Prediction and Proactive Retention

133

Types 1 and 2, albeit to a lesser degree. The monthly

charge data is hinting at a potential correlation

involving contract type: higher monthly charges

could lead to a higher churn rate for customers with

contract type 0 — something to consider! Churn Rate

distribution of ISPs this clearly shows that there was

a massive variation in the percentage of customers

who opted not to renew their subscription with an

ISP. Internet Service Type 0 has the most customers

while having a relatively small churn rate. Internet

Service Type 1, on the other hand, shows an

unrealistically high turnover rate, which may suggest

problems with service quality or service price.

Internet Service type 2 with lower customers has a

reasonably low churn rate too. This bimodal

distribution of churn by Internet service type is worth

investigating to understand why Internet Service

Type 1 has a higher level of churn associated with it.

7 CONCLUSIONS

This study introduces a churn prediction method that

combines feature engineering, machine learning

models, and possible deep learning advancements for

improved client retention analysis. The pipeline

consists of data preparation (missing value

imputation, label encoding, and feature scaling) and

model training with Random Forest and Logistic

Regression. The results indicate that the system:

• Outperforms simple models using feature

engineering and ensemble learning.

• Handles categorical and numerical data

efficiently, resulting in reliable predictions

even with skewed datasets.

• Provides interpretability through feature

significance analysis, which assists

organisations in identifying major churn

factors.

8 FUTURE WORK

Our churn prediction framework integrates deep

learning techniques, utilizing neural networks like

LSSTM and Transformer-based models for enhanced

sequential pattern recognition. It incorporates

sentiment analysis by leveraging NLP and the

transformers library to analyze customer feedback,

improving prediction accuracy. To optimize

performance, we implement automated

hyperparameter tuning through Grid Search or

Bayesian Optimization. Furthermore, the model is

deployed as a real-time prediction system using

Streamlit or Flask, enabling interactive and

immediate churn predictions. This comprehensive

approach empowers businesses with advanced

machine learning tools to refine customer retention

strategies, enhance decision-making, and effectively

reduce churn rates.

REFERENCES

Aditi Chaudhary, Ali Rizvi, Navneet Kumar, Ashish Kumar

Mishra, “A Novel Approach for Customer Churn

Prediction in Telecom using Machine Learning

Models”, Research Square, 2023

Alin-Gabriel Văduva, Simona-Vasilica Oprea, Andreea-

Mihaela Niculae, Adela Bâra Anca-Ioana Andreescu,

“Improving Churn Detection in the Banking Sector: A

Machine Learning Approach with Probability

Calibration Techniques”, MDPI, 2024.

Karsten Rothmeier, Nicolas Pflanzl, Joschka A. H¨

Ullmann, Mike Preuss, “Prediction of Player Churn and

Disengagement Based on User Activity Data of a

Freemium Online Strategy Game”, IEEE Transaction

on Games, 2020

Maryam Shahabikargar, Amin Beheshti, Wathiq Mansoor,

Xuyun Zhang, Jin Foo, “Generative AI-enabled

Knowledge Base Fine-tuning: Enhancing Feature

Engineering for Customer Churn”, Research Gate,

2024

Meryem Chajia, El Habib Nfaoui, “Customer Churn

Prediction Approach Based on LLM Embeddings and

Logistic Regression”, MDPI, 2024

Mitra Madanchian, “Generative AI for Consumer Behavior

Prediction: Techniques and Applications”, MDPI,

2024.

Nomanahmad Haitham Nobanee Mazharjaved Awan,

Azlan Mohdzain Ansar Naseem and Amena

Mahmoud, “Customer Personality Analysis for Churn

Prediction Using Hybrid Ensemble Models and Class

Balancing Techniques”, Institute of Electrical and

Electronics Engineers(IEEE) Access, 2024

Prasanth Senthan, RMKT Rathnayaka, Banujan

Kuhaneswaran, BTGS Kumara, “Development of

Churn Prediction Model using XGBoost –

Telecommunication Industry in Sri Lanka”, IEEE

International IoT, Electronics and Mechatronics

Conference (IEMTRONICS), 2021.

RajaGopal Kesiraju VLN P. Deeplakshmi, “Dynamic

Churn Prediction using Machine Learning Algorithms

- Predict your customer through customer behavior”,

International Conference on Computer Communication

& Informatics (ICCCI), 2021

Yihui Deng, Dingzhao Li, Lvqing Yang, Jintao Tang,

Jiangsheng Zhao, “Analysis and prediction of bank user

chum based on ensemble learning algorithm”, IEEE

International Conference on Power Electronics,

Computer Applications (ICPECA), 2021

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

134