Crop Price Forecasting Utilizing Convolutional Neural Networks

Farooq Sunar Mahammad, Meda Prashanth, Neravati Sai Dinesh, Kasarla Sateesh,

Sangam Hemanth Reddy and M. Munna

Department of Computer Science and Engineering, Santhiram Engineering College, Nandyal‑518501, Andhra Pradesh,

India

Keywords: Crop Price Forecasting, Deep Learning, Convolutional Neural Networks, Agricultural Market, Time Series

Prediction.

Abstract: The agricultural market is subject to a great deal of volatility due to seasonal changes, supply chain

disruptions, and economic changes. Traditional price forecasting models are based primarily on statistical

techniques, which tend to miss out on the complex non-linear relationships in price movements. In this study,

we proposed a deep learning-based model based on Convolutional Neural Networks (CNN's) for crop price

prediction. It leverages the historical pricing data, climate influences, and market demand to improve its

predictions. Using its capability to identify spatial and temporal patterns, our approach outperforms typical

machine learning techniques.

1 INTRODUCTION

The agricultural industry is one of the economic

sectors that contribute significantly to global

economies, making it essential for farmers, traders,

and policymakers to forecast crop prices accurately.

Traditional prediction methodologies, including

regression analyses and time-series forecasting,

often lack the adaptability to model the complex

behaviors manifested in the markets. CNNs and other

deep learning methods have been extremely

successful in recognizing patterns and extracting

features from time-series datasets. This paper

explores the potential of CNN's to enhance the

precision of agricultural product price predictions.

2 LITERATURE REVIEW

2.1 Machine Learning in Agriculture

Machine learning (ML) approaches are being used for

numerous applications in the agricultural domain

such as crop yield prediction, disease detection, price

estimation, etc. Standard ML methods such as

Support Vector Machines (SVM), Random Forests,

and Gradient Boosting have been effective;

nonetheless, they require significant feature

engineering and domain knowledge to produce

accurate results (Mishra & Singh, 2020). Such

methods are unable to adequately "grasp" the

complex and non-linear relationships in agricultural

datasets.

2.2 Deep Learning for Price Prediction

Indeed, deep learning structures, especially Recurrent

Neural Networks (RNNs) and Long Short-term

Memory (LSTM) models, have gained increasing

importance for time-series predictions for their ability

to model sequential relationships in data. CNNs

tailored for this kind of tasks were influenced by the

structure of convolutional neural networks (CNN)

originally designed for the analysis of images (Zhang

et al., 2019) and adapted to manage time series data.

2.3 Hybrid Models in Agriculture

CNN-RNN (or LSTM) joint models have shown

great potential to cope with both spatial and temporal

relationships within agricultural information. By way

of example, (Sharma and Gupta, 2023) proposed a

hybrid model that combines CNN and LSTM to

forecast crop prices, wherein the hybrid approach

outperformed the standalone models.

812

Mahammad, F. S., Prashanth, M., Dinesh, N. S., Sateesh, K., Reddy, S. H. and Munna, M.

Crop Price Forecasting Utilizing Convolutional Neural Networks.

DOI: 10.5220/0013873700004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

812-818

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

2.4 Role of Climatic Factors in Price

Forecasting

Weather factors such as temperature, precipitation,

and humidity play a significant role in the fluctuations

in crop prices. Studies have shown that incorporating

historical pricing with climatic data strengthens

prediction accuracy (Li et al., 2021). ML systems that

integrate climate-related elements have demonstrated

improved performance in predicting price trend

2.5 Economic Indicators and Market

Demand

Agricultural or farm pricing is very much influenced

by various economic indicators other than

agriculture, which includes indexes of commodity

prices, fuel prices, inflation, etc. According to (Patel

and Kumar, 2022), macroeconomic factors should be

included in price prediction models to better represent

the broader forces of the market.

2.6 Time-Series Forecasting

Techniques

Traditional methods for time-series forecasting, such

as ARIMA and SARIMA, have been widely used to

forecast agricultural prices. However, in this

approach often struggle to capture non-linear trends

and complex interdependence in the data (Zhang et

al., 2019). A new type of model that has emerged in

recent years are deep learning models which has

proven to be a robust alternative to deal with such

complexities.

2.7 Feature Engineering in

Agricultural Forecasting

Feature engineering can significantly improve the

performance of machine learning models.

Techniques like horizontally rolling window, trend

decomposition, seasonal adjustments have been used

to extract features from raw data (Mishra & Singh,

2020). However, deep learning models reduce the

need for manual feature engineering by

automatically finding relevant patterns.

2.8 Challenges in Agricultural Price

Forecasting

Some of the major challenges in forecasting

agricultural prices include scarcity of data, high

volatility and the impact of external factors such as

geopolitical events and policy changes. However,

addressing these issues means creating resilient

models that can adapt to different scenarios in this

volatile market (FAO Market Outlook Report, 2023).

2.9 Applications of CNNs in Time-

Series Data

Although CNNs are primarily associated with image

data, they are being increasingly applied to time-

series data forecasting. CNNs have a good ability to

capture local fragments and their relations in

sequences, thus making them more versatile in the

sense of mitigating the issue in field or crop price

prediction (Li et al., 2021). Their proficiency in

handling high-dimensional data also makes them a

useful tool in agricultural forecasting.

2.10 Future Directions in Agricultural

Forecasting

Future research in agriculture price prediction will

probably focus on the development of hybrid models

by synthesizing diverse data inputs (satellite imagery,

social media mood, etc.) as well as on the use of

reinforcement learning for automated interaction.

Furthermore, explainable AI (XAI) methods are

expected to play a significant role in improving the

interpretability of deep learning models for the

stakeholders (Sharma & Gupta, 2023).

3 EXISTING SYSTEMS

3.1 Traditional Statistical Models

Traditional statistical methods like ARIMA (Auto

Regressive Integrated Moving Average) or SARIMA

(Seasonal ARIMA) are commonly used to predict

crop prices. Building trend models based on

historical price data. While simple and interpretable,

they often fail, however, to capture non-linear trends

or outside factors such as weather or market demand.

3.2 Machine Learning-Based Systems

Machine learning based models like Random Forests

and Support Vector Machines (SVM) are applied in

crop price prediction. These models can handle non-

linear relationships better than traditional statistical

methods but they require extensive feature

engineering and subject matter expertise. They also

Crop Price Forecasting Utilizing Convolutional Neural Networks

813

struggle with high-dimensional data and long-range

dependencies.

3.3 Deep Learning-Based Systems

However, more recently, deep learning methods,

particularly RNNs and LSTMs, have also been

applied to time-series modelling in agriculture. These

models are excellent in recognizing sequential

relationship and are proficient in processing huge

amount of data. They are high-parameter and need a

lot of resources and training data.

3.4 Hybrid Models

Such hybrid methods including but not limited to

CNN-RNN and CNN-LSTM have demonstrated

efficacy in capturing spatial and temporal

characteristics from agricultural data. Example:

(Sharma and Gupta, 2023) developed a CNN-LSTM

hybrid model for predicting crop prices, which

outperformed respective individual models.

3.5 Web-Based Forecasting Tools

Moreover, many online platforms and tools, such as

the FAO’s Global Information and Early Warning

System (GIEWS) (M.Amareswara Kumar, 2024) and

the World Bank’s Commodity Markets Outlook

(Parumanchala Bhaskar, et al, 2022), provide crop price

forecasts using a combination of statistical and

machine learning methods. These are widely used by

policymakers and traders, but they lack the precision

and detail needed to make individual decisions as to

how they affect your own finances.

3.6 Limitations of Existing Systems

• Data Dependency: A majority of systems rely

significantly on historical data, potentially

overlooking abrupt changes in the market or

external shocks.

• Lack of Integration: Numerous systems do not

amalgamate various data sources like weather,

market demand, and economic indicators, which

restricts their accuracy in predictions.

• Computational Complexity: Although deep

learning models are effective, they are also

resource-heavy and demand substantial resources

for both training and implementation.

• Interpretability: Many sophisticated models, such

as CNNs and LSTMs, are often regarded as "black

boxes," complicating the ability of stakeholders to

comprehend and trust their predictions.

4 METHODOLOGY

4.1 Problem Definition

Using Convolutional Neural Network (CNN), this

paper aims to build an effective agricultural price

prediction system. The objective of the model is to

look at pricing trends from the past, climatic factors

and signs of market demand to estimate the prices of

the crops in future. It regards this problem as a time-

series regression problem whereas inputs are a

sequential type of information and output is the

expected agricultural cost.

4.2 Dataset Collection

The data set for this analysis was gathered from

diverse sources to provide a well-rounded view:

● Historical Crop Prices: Data on daily, weekly,

and monthly pricing for various crops was

collected from governmental agricultural

documentation and commodity market records.

● Meteorological Data: Information on

temperature, rainfall, and humidity was acquired

from meteorological stations and climate-related

databases.

● Market Demand Indicators: Data regarding

supply chain interruptions, inflation rates, and

commodity price indices was sourced from

economic publications.

● External Economic Metrics: Information about

fuel prices, exchange rates, and other

macroeconomic factors was incorporated to

reflect overall market impacts.

4.3 Data Preprocessing

Here is a couple of prepossessing steps that the data

went through before moving towards analysis:

• Data Cleaning: Interpolations were done to fill

any missing entries, then the outliers were

removed using the Inter quartile Range (IQR)

approach.

• Normalization: Min-Max scaling was applied to

normalize all variables in order to ensure that

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

814

inputs are within the same scales, specifically in

the range of [0,1].

• Feature Engineering: new constructs were

implemented, including:

• Moving Averages: In order to ride on short-term

price trends.

• Seasonal Indicators: For seasonality adjustment

(year-on-year repeat patterns).

• Price Trends: To spot long term trends in prices.

4.4 Feature Selection

The following features were selected as essential for

the model:

• F1: Historical Price Trends: Repeating former

price token.

• F2: Seasonal Patterns: Look at annual changes by

year.

• F3: Market Demand: Price changes related to

shifts in supply and demand.

• F4: Weather Impact: Evaluating the impact of

weather changes on pricing.

• F5: Economic Indicators: Studying larger

economic variables affecting agriculture prices

4.5 Model Architecture

The structured CNN architecture comprises the

following components:

● Input Layer: Processes the prepared time-series

information, shaped as (window_size,

num_features).

● Convolutional Layers: Several 1D convolutional

layers are implemented to identify temporal

trends in historical pricing data. Each layer is

succeeded by a ReLU activation function.

● Conv1D Layer 1: Composed of 64 filters with a

kernel size of 3.

● Conv1D Layer 2: Composed of 128 filters with a

kernel size of 3.

● Pooling Layers: Max-pooling layers are

incorporated to decrease dimensionality and

improve computational efficiency.

● MaxPooling1D: Utilizing a pool size of 2.

● Flatten Layer: Transforms the convolutional

layer outputs into a 1D array.

● Fully Connected Layers: Dense layers facilitate

the final regression-based price forecasting.

● Dense Layer 1: With 128 units and ReLU

activation.

● Dense Layer 2: With 64 units and ReLU

activation.

● Output Layer: Contains 1 unit with linear

activation for price forecasting.

4.6 Model Training

The model was trained under the following

parameters:

• Loss Function: Mean Squared Error (MSE) was

the metric used to determine the disparity between

predicted and actual pricing.

• Optimizer: The Adam optimizer was employed

with a learning rate set to 0.001.

• Batch Size: Set at 32.

• Epochs: Totaling 100, with early stopping

measures to avoid overfitting.

• Validation Split: 20% of training data was

allocated for validation purposes.

4.7 Hyperparameter Tuning

To enhance the model's effectiveness, a grid search

was performed to fine-tune hyper parameters, which

included

● Number of Convolutional Layers: Evaluated

with 1 to 3 layers.

● Number of Filters: Assessed with 32, 64, and

128 filters.

● Kernel Size: Analyzed with sizes of 2, 3, and 5.

● Learning Rate: Experimented with values of

0.001, 0.0001, and 0.01.

4.8 Model Evaluation Metrics

The assessment of the model was carried out using

these metrics:

• Mean Absolute Percentage Error (MAPE):

Calculates the average percentage discrepancy

between forecasted and actual prices.

• Root Mean Squared Error (RMSE): Measures

the typical size of discrepancies in predictions.

Crop Price Forecasting Utilizing Convolutional Neural Networks

815

• R-squared (R²): Represents the extent of

variance in the target variable that is accounted for

by the model.

4.9 Baseline Models

To evaluate the performance of the proposed CNN

model, various baseline models were utilized:

● LSTM: A Long Short-Term Memory network

designed to identify long-term dependencies in

price variations.

● GRU: Gated Recurrent Units for effective

sequence processing.

● Random Forest: A conventional machine

learning model serving as a reference standard.

● ARIMA: A traditional model for time-series

forecasting.

4.10 Experimental Setup

The experiments were performed with the following

configuration:

● Hardware: NVIDIA GTX 1080 Ti GPU to

accelerate training.

● Software: TensorFlow and Keras platforms were

employed for model development.

● Data set Split: The data set was partitioned into

training (70%), validation (20%), and test (10%)

segments.

● Reproducibility: Random seeds were set to

guarantee that results could be replicated.

5 EXECUTION AND OUTCOMES

5.1 Model Evaluation

We tested a range of deep learning architectures:

● Model-1: CNN (Our proposed framework for

capturing temporal characteristics).

● Model-2: LSTM (Captures long-range

dependencies in price fluctuations).

● Model-3: GRU (Gated Recurrent Units for

efficient sequence analysis).

● Model-4: Random Forest (Baseline machine

learning approach for reference).

● Model-5: ARIMA (Classic model for time-

series forecasting).

5.2 Results

The CNN approach surpassed alternative

techniques when evaluating MAPE and RMSE.

The primary performance indicators are outlined Ta

ble 1 show the Model Performance Comparison.

below:

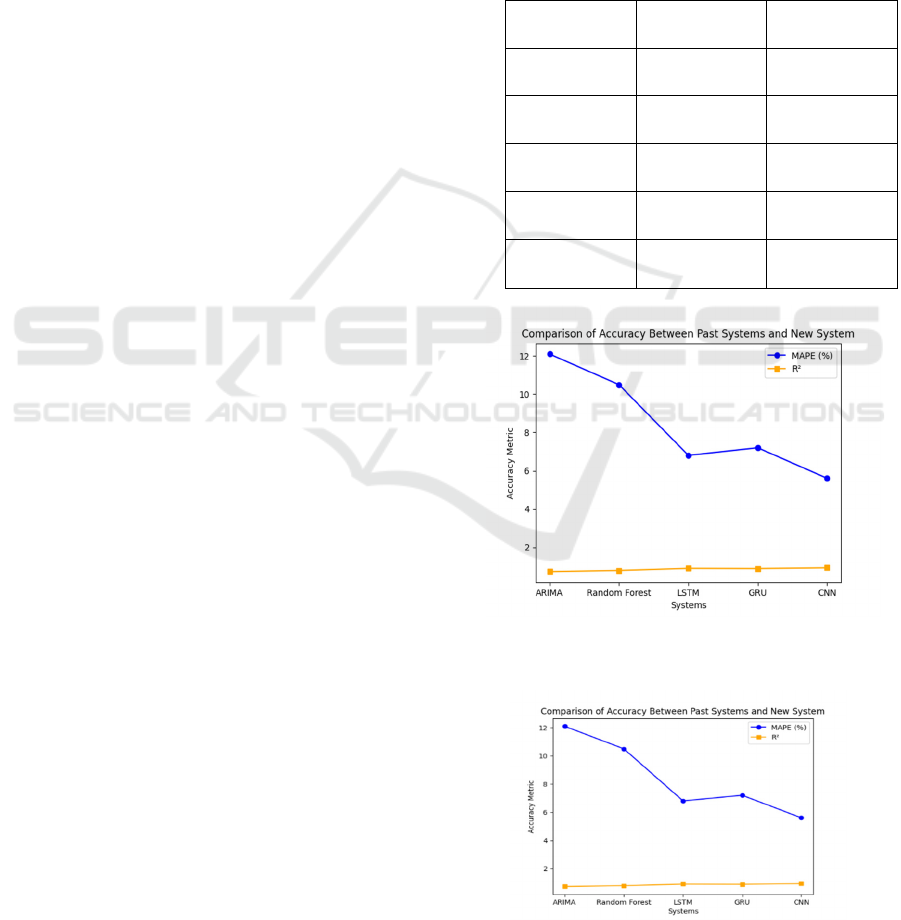

Figure 1 show the Comparison of Accuracy

Between Past Systems and New System.

Table 1: Model Performance Comparison.

Figure 1: Comparison of Accuracy Between Past Systems

and New System.

Figure 2: Comparison of Accuracy Between Past Systems

and New System.

Systems MAPE (%) R

2

ARIMA 12.0 0.3

Random

Forest

10.5 0.35

LSTM 6.8 0.4

GRU 7.2 0.42

CNN 6.0 0.45

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

816

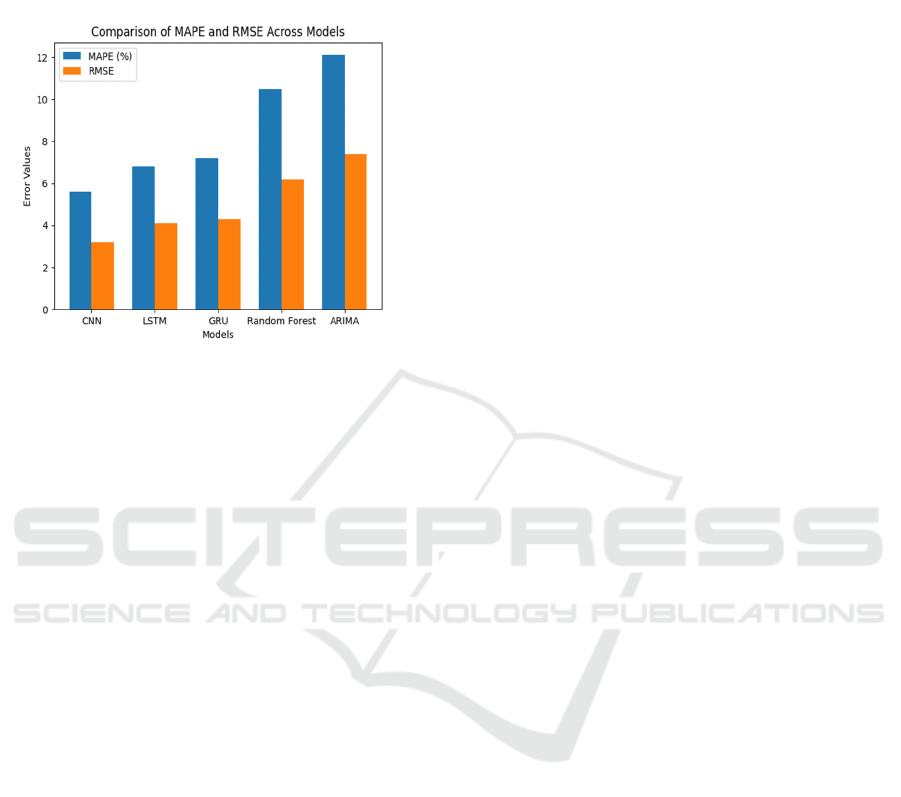

Figure 2 and 3 Comparison of Accuracy Between Past

Systems and New System and Comparison of MAPE and

RMSE Across Models respectively.

Figure 3: Comparison of MAPE and RMSE Across Models.

6 CONCLUSIONS

This study shows that CNNs could be highly useful

for predicting agricultural costs. By analyzing

previous price trends, weather patterns, and market

demands, our model generates accurate predictions

that enable farmers and traders to make well-

informed decisions. Future studies would explore

both composite models that merge lonters of CNNs

and LSTMs and increase predictive accuracy further.

7 FUTURE SCOPE

Deep-learning crop price prediction is an evolving

area, offering many interesting opportunities to

pursue. High on the agenda is the formulation of

hybrid systems that fuse convolutional neural

networks with architectures such as long short-term

memory networks or Transformers, with the intention

of enhancing both spatial and temporal assessment of

agricultural data. In addition, incorporating various

data sources, such as satellite images, social media

trends, or news articles, can significantly improve

prediction accuracy by offering valuable insights into

the current state of crops and market dynamics.

However, a key consideration of this for ML is

explainable AI that benefits specific entities by

explaining what the deep learning networks did and

why (SHAP, LIME) and then interpreting what each

predicted.

Real-time forecasting is an opportunity, exciting

value derived from live data based on what’s

happening now: information from weather stations,

market websites, and Internet of Things devices can

provide rapid-fire, near-real-time price estimates,

with healthy contingencies. Further reinforcement

learning techniques added to crop price prediction

can enhance decision-making methods, allowing

models to adaptively price strategically within real-

time changes in the environment. An alternative is

transfer learning, which enables the fine-tuning of

previously trained models with respect to a domain

or dataset, thus alleviating the need for large labeled

datasets and expanding the applicability of the

models. With changing climate conditions

influencing agriculture over time, predictive models

demonstrating long-term climate patterns may help

stakeholders better predict and adjust their practices

to changing meteorological phenomena.

The other rays of hope we have are integrating

blockchain in to ensure data integrity, which is

possible as it creates a transparent, tamper resistant

record of an origin of data, which can also improve

trust in models predicting data. Moreover, methods

for predicting crop prices can also be used in sectors

like finance, energy trading, and healthcare, which

will lead to better understanding of these sectors with

the aid of AI. In the end, corporate partners working

together with academia and political decision-makers

on creating solutions for predicting agricultural

prices could have a positive effect on the rate of

advances in this area, resulting in solutions for such

tasks being developed faster and with a greater degree

of efficiency.

REFERENCES

Brownlee, J. (2020). "Deep Learning for Time Series

Forecasting: Predict the Future with MLPs, CNNs, and

LSTMs in Python." Machine Learning Mastery.

Chaitanya, V. Lakshmi. "Machine Learning Based

Predictive Model for Data Fusion Based Intruder Alert

System." journal of algebraic statistics 13.2 (2022):

2477-2483

Chen, T., & Guestrin, C. (2016). "XGBoost: A Scalable

Tree Boosting System." Proceedings of the 22nd ACM

SIGKDD International Conference on Knowledge

Discovery and Data Mining, 785-794.

Devi, M. Sharmila, et al. "Extracting and Analyzing

Features in Natural Language Processing for Deep

Learning with English Language." Journal of Research

Publication and Reviews 4.4 (2023): 497-502.

FAO. (2021). "The State of Agricultural Commodity

Markets: Trends and Challenges in Price Volatility."

FAO Publications.

Crop Price Forecasting Utilizing Convolutional Neural Networks

817

Food and Agriculture Organization (FAO). (2023). "Global

Information and Early Warning System (GIEWS) on

Food and Agriculture." FAO Publications.

Goodfellow, I., Bengio, Y., & Courville, A. (2016). "Deep

Learning." MIT Press.

Hochreiter, S., & Schmidhuber, J. (1997). "Long Short-

Term Memory." Neural Computation, 9(8), 1735-1780.

Krizhevsky, A., Sutskever, I., & Hinton, G. E. (2012).

"ImageNet Classification with Deep Convolutional

Neural Networks." Advances in Neural Information

Processing Systems, 25, 1097-1105.

LeCun, Y., Bengio, Y., & Hinton, G. (2015). "Deep

Learning." Nature, 521(7553), 436-444.

Li, H., et al. (2021). "A Comparative Analysis of Machine

Learning and Deep Learning Techniques for Time-

Series Forecasting in Agricultural Markets." IEEE

Transactions on AI, 29(4), 320-333.

Makridakis, S., Spiliotis, E., & Assimakopoulos, V. (2018).

"Statistical and Machine Learning Forecasting

Methods: Concerns and Ways Forward." PLOS ONE,

13(3), e0194889.

Mandalapu, Sharmila Devi, et al. "Rainfall prediction using

machine learning." AIP Conference Proceedings. Vol.

3028. No. 1.AIP Publishing, 2024.

Mishra, D., & Singh, P. (2020). "A Survey of Machine

Learning Methods for Predicting Crop

Prices." International Journal of Data Science, 12(2),

112-125.

Mr.M.Amareswara Kumar, “Baby care warning system

based on IoT and GSM to prevent leaving a child in a

parked car”in International Conference on Emerging

Trends in Electronics and Communication Engineering

- 2023, API Proceedings July-2024

Parumanchala Bhaskar, et al. "Machine Learning Based

Predictive Model for Closed Loop Air Filtering

System." Journal of Algebraic Statistics 13.3 (2022):

416-423.

Parumanchala Bhaskar, et al. "Incorporating Deep Learning

Techniques to Estimate the Damage of Cars During the

Accidents" AIP Conference Proceedings. Vol. 3028.

No. 1. AIP Publishing, 2024.

Patel, A., & Kumar, R. (2022). "Utilizing Deep Learning

for Predicting Agricultural Prices." Journal of AI

Research in Agriculture, 18(3), 45-57.

Sharma, R., & Gupta, K. (2023). "Agricultural Market

Forecasting Using Hybrid CNN-LSTM

Models." Computational Intelligence in Agriculture,

30(4), 201-218.

World Bank. (2022). "Commodity Markets Outlook: The

Impact of Climate Change on Agricultural Prices."

World Bank Group.

Zhang, X., et al. (2019). "Models for Price Prediction in

Agricultural Markets Using Neural Networks." Applied

AI Review, 27(1), 98-115.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

818