Experimental Evaluation of Agriculture and Horticulture

Commodities Price Prediction Using Histogram Based Gradient

Boosting Algorithm

S. Saranya, Arul Murugan N., Bharanidharan K., Jeevanantham C. and Jeevak S.

Computer Science and Engineering, Mahendra Engineering College, Namakkal, Tamil Nadu, India

Keywords: Agriculture Price Forecasting, Horticulture, RF, Commodity Price Prediction, Histogram, Gradient Boost,

HGB, Random Forest.

Abstract: Accurately predicting agricultural prices are critical to achieve the sustainable and healthy growth of

agriculture, which is why agricultural price prediction is a prominent study issue in the sector. On the flip

side, it's affected by a lot of things, the most important of which are the fluctuations in agricultural commodity

prices. This paper dives into investigating the pricing patterns of important agricultural commodities among

different producers worldwide, acknowledging the potential of Deep Learning in agricultural applications.

Farmers, dealers, and lawmakers all have a critical responsibility for agricultural price prediction to enable

them to make informed decisions regarding planting, pricing, and distribution. Agriculture is a notoriously

complex and cluttered market, and typical price perspective models have proven themselves incapable. Recent

research has shown that deep learning algorithms analyzing large volumes of historical data to identify

nonlinear dependencies, significantly improves the accuracy of price predictions. We propose Histogram

based Gradient Boosting (HGB), a time series dominate based deep learning model that predicts agricultural

prices. The standard learning model Random Forest (RF) is used to cross-validate the effectiveness of the

proposed model. Along with historical pricing, the proposed model is trained on other influencing factors

such as seasonality, weather, and market demand indicators. The predictions made using the deep learning

one were more accurate and robust in comparison to more traditional models. Experimental results suggest

that this approach can improve on-farm decision-making and result in more efficient and stable market

systems.

1 INTRODUCTION

The agricultural products market is highly sensitive

to price information; large and frequent price spikes

have had a devastating effect on people's ability to

earn a living and on social stability. Apart from the

economic conditions of individual countries or areas,

Agricultural prices forecasting should also be done

with a balance between food supply and demand

across the globe (Girish Hegde et al., 2020) With the

exponential growth of the human population, the

subject of food security has become global. Accurate

forecast of commodity prices should be beneficial to

international organizations, governments, and

agribusinesses in terms of ensuring there is enough

food supply around the world, which maintains the

global food system. Therefore, it is important to

properly predict the prices of agricultural goods to

enhance the quantity-based safety of agricultural

products and promote social and economic

development (Fajar Delli Wihartiko, et al., 2021). More

variables lead to increased impermanence, and, thus,

agricultural commodity prices are more volatile,

complicated and non-stationary than general

commodity prices. Food security on a national and

international scale might be impacted by the regular

and extreme swings in the pricing of agricultural

commodities. Agrarian pricing is heavily influenced

by market forces of supply and demand, according to

the research. Prices are subject to change since

production influences both supply and demand.

Factors including the cost of labour, the cost of

growing, and the state of the global market all have

an impact on the prices of agricultural commodities

(Laveti Krishna Babu, 2024). The practice of using

scientific methods to predict, from current and

historical data, the direction and magnitude of future

730

Saranya, S., N., A. M., K., B., C., J. and S., J.

Experimental Evaluation of Agriculture and Horticulture Commodities Price Prediction Using Histogram Based Gradient Boosting Algorithm.

DOI: 10.5220/0013871900004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

730-737

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

price changes in agricultural products is known as

agricultural product forecasting. There are two main

approaches to predicting agricultural prices:

qualitative and quantitative. (Peng Chen et al., 2023.) In

qualitative analysis, all available market price data is

considered, and an overall trend in price direction is

made based on past experience; in quantitative

analysis, all available market price data is compiled,

and specific quantitative judgments about the number

or magnitude of commodity price changes are made

using specific forecasting methods.

Agricultural price forecasting primarily makes

use of quantitative analysis, which can be further

subdivided into several methods based on the

variables being considered, such as univariate and

multivariate forecasting, regression analysis (also

known as causal analysis), machine learning, time

series analysis, and combined models (M. Durga Sai

Sandeep, et al.,2025). Supply and demand, weather

patterns, government actions, market rivalry, foreign

commerce, etc. all have an impact on the pricing of

agricultural products. (Dian Dharmayanti, et Al.,2024) It

is challenging to represent and quantify prices and the

interactions between elements using simple

mathematical models since they are typically

nonlinear, dynamic, and unpredictable. While

conventional methods are simple and quick to use,

they need more a priori knowledge and assumptions

and have poor prediction impacts when dealing with

high-dimensional, nonlinear, and non-smooth data.

There are a number of drawbacks to intelligent

approaches, including their inability to handle

complicated data reliably and consistently, their high

data and computing resource requirements, and their

lack of interpretability and stability (Sourav Kumar

Purohit, et al.,2021).

A significant portion of the overall expenditure on

food production in developing countries is attributed

to inefficient supply networks, as reported by the

World Food Programme. Predictions are crucial to

the handling of these challenges. Everyone from

farmers to lawmakers may benefit from reliable

predictions of global food prices when it comes to

strategic planning and making educated decisions.

An accurate forecast may reduce price volatility by

20%, says the International Food Policy Research

Institute. Progress in AI and ML has led to an uptick

in the precision of predicting models in recent years

(Luana Gonçalves Guindani, et al.,2024). By 2030,

the global agriculture sector could reach into a $2.3

trillion market made possible by digital technologies

like AI and ML, according to the World Economic

Forum. This study covers the history of agricultural

commodity price prediction with the simple solution

methods, hybrid combination models, conventional

and intelligent prediction approaches. (Manas Kumar

Mohanty, et al., 2023) This article has anover view of

the methods that are used for forecasting the prices

of the agricultural products, it states each with their

advantages and disadvantages along with real-life

examples, and then describes the overall pathway of

growth within this area. The present research first

discusses the history of agricultural price forecasting

tools and then analyzes their currently underlying

development status.

2 RELATED WORKS

In this paper, a hybrid forecasting model based on

VMD, EEMD, and LSTM is proposed to address this

problem and solve the large prediction errors caused

by the non-linear features and the large price

fluctuations of agricultural products (Changxia Sun, et

al., 2024). This model is known by the acronym

"VMD-EEMD-LSTM". Starting from the initial time

series of agricultural commodity prices, which is

decomposed using VMD, we see a residual

component that is more complex. So, what you end

up getting from this process is called the VMFs, or

variationally mode functions. After that, the remaining

part is decomposed again using EEMD. Each

component's predictions are then derived by training

an LSTM model with all of the components. Lastly,

the most accurate price prediction is obtained by

linearly combining the forecasts for all components.

We conducted empirical experiments to assess the

VMD-EEMD-LSTM model's efficiency for one-step

and multi-step predictions using weekly pricing data

from China's wholesale agricultural marketplaces for

shiitake mushrooms, cauliflower, Chinese chives, and

pork. This study's composite model improved

predicting accuracy, as shown by the findings.

Accomplishing Sustainable Development Goal 2,

"Zero Hunger” (Anket Patil, et al.,2023), and enhancing

human health and social well-being relies on

achieving food security globally. However, the

volatility of agricultural commodity prices is just one

of several factors that influence food insecurity. This

paper dives into investigating the pricing patterns of

important agricultural commodities among different

producers worldwide, acknowledging the potential of

Machine Learning in agricultural applications. This

paper presents a Hybrid SARIMA-LSTM (HySALS)

to predict the worldwide values of agricultural

commodities based on extensive testing and

performance comparison of appropriate Machine

Learning algorithms. This study examines the

Experimental Evaluation of Agriculture and Horticulture Commodities Price Prediction Using Histogram Based Gradient Boosting

Algorithm

731

suggested method by looking at five key commodities'

price histories: wheat, millet, sorghum, maize, and

rice. Developing nations that produce a major portion

of the world's these crops or are among the top

producers globally are the primary focus of the study,

along with the average production share worldwide.

From 2005 to 2017, we use training data. From 2018

to 2022, we test the model. From 2023 to 2030, we

predict the worldwide prices of key commodities. The

goal of making these forecasts is

to provide farmers and policymakers with more

information they can use to make informed decisions

that will help in the global struggle for food security.

In support of the viability of the economy and

agricultural development, there needs to be stability in

the agricultural futures market (Tingting Zhang, et

al.,2023). Due to the complexity of changes in

agricultural futures prices, it is not easy to overcome

the restrictions that the current data preprocessing

techniques put in place for improvement of the

models’ ability to forecast. In this study, we propose

a novel VMD-SGMD-LSTM model that combines

state-of-the-art quadratic decomposition with an AI

framework. First, we use VMD to clean up the raw

futures price data, and then we let SGMD deal with

the rest of the components. Secondly, several modal

components are predicted using the LSTM model, and

then the result is achieved using the predicted values

from the different components. In addition, using data

from the Chinese agricultural futures market for

wheat, maize, and sugar, this study offers empirical

analysis in one-step, two-step, and four-step forward

forecasting scenarios, respectively. By

outperforming other benchmarked models in terms of

predictive power and resilience across several

agricultural futures, the results show that the VMD-

SGMD-LSTM hybrid model suggested here

overcomes the constraints of earlier research.

Predicting agricultural prices accurately is critical

to achieving the agricultural sector's sustainable and

healthy development, making it a popular study issue

in the sector (Feihu Sun, et al.,2023). It delves into the

many ways of forecasting, including classic,

intelligent, and combination model approaches, and

discusses the difficulties that researchers have when

trying to estimate the prices of agricultural

commodities. The findings of the study propose the

following: (1) the ARIMA and exponential smoothing

price forecasting of agricultural products will be a

developing trend for the future, and understanding the

reasons for the combination will help improve

accurate forecasting; (2) future forecasting models

will continue to incorporate structured, unstructured

data, and variables; and (3) when forecasting these

agricultural product price estimates, accuracy of

values in addition to trend forecasting accuracy will be

advantageous. This manuscript serves to progress a

future durability research agenda, as it reviews and

analyses price forecasting agricultural product

methods.

Predicting agricultural commodity prices with any

degree of accuracy is difficult because of how

complicated and unpredictable these markets are

(Kapil Choudhary, et al., 2025). Predictions made

using current models are generally inaccurate because

they do not account for non-stationary and nonlinear

trends in pricing data. A new hybrid VMD-LSTM

model is introduced to address these challenges; it

combines genetic algorithm, variationally mode

decomposition and long short-term memory (LSTM)

to enhance prediction accuracy. The proposed model

uses GA-optimized VMD, a technique for breaking

down price series into intrinsic mode functions (IMFs)

with the desirable property of sparsity, to speed up the

convergence process. Next, model and forecast each

of these IMFs separately using LSTM models that

have been optimized using GA. The final step in

generating the actual price series is to combine the

predictions of all IMFs. The VMD-LSTM is put to the

test in comparison to three other LSTM and

decomposition-based models using monthly pricing

data for maize, palm oil, and soybean oil (EEMD-

LSTM, CEEMDAN-LSTM). It is possible to measure

the efficacy using directional prediction statistics, root

mean square error and mean absolute percentage

error. As compared to the next best CEEMDAN-

LSTM, VMD-LSTM decreases RMSE by 56.93%,

MAPE by 44%, and palm oil by 21.67% and soybean

oil by 25.85%, respectively. The improved prediction

accuracy of VMD-LSTM is further supported by

TOPSIS and the Diebold-Mariano test. Farmers,

dealers, and policymakers might all benefit from the

proposed model's improved agricultural price

predicting capabilities.

3 METHODOLOGY

The research on the topic of agricultural product price

forecasting is one that is all-encompassing,

interdisciplinary, and constantly evolving. Data

sources, data types, data quality, data processing

techniques, model design techniques, and model

evaluation techniques are always evolving, which

means that the methods used to predict the values of

agricultural goods will also be improved and updated.

The employment of combination optimization

methods by predictive models has been demonstrated

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

732

to outperform models utilizing a single optimization

methodology by researchers over an extended period

of time. Combination parameter optimization

techniques have several benefits over single

parameter optimization algorithms, including their

capacity to tackle complicated optimization problems

including discrete, nonlinear, and multi-modal

functions. While the latter have difficulty with issues

like differentiability and convexity, the former

usually necessitate them. One advantage of

combination parameter optimization approaches over

single parameter optimization algorithms is their

ability to avoid local optima, which can be caused by

initial value influence and lead to slow convergence

or inferior solutions. In addition, different problems

have different needs and combination parameter

optimization techniques may respond to that. For

example, the are free to apply neighborhood

structures, multiple fitness functions and crossover

mute strategies. On the other hand, if optimization

algorithms only consider one parameter, they are

usually less flexible and reach more stable results,

which are harder to adapt or improve. Combination

parameter optimization strategies have notable

downsides including their computational complexity,

theoretical analytical reliance, and sensitivity to

parameter selections. So, in real-world applications,

one of the critical challenges is to select the right

optimization algorithms to tackle a certain problem

under a particular set of objectives to make the

required adjustments and to enhance the solution. The

introduction and widespread use of social media has

amplified the influence of public opinion on

consumers and farmers. This influence is complex

and leads to at least unreasonable planting or

purchasing behavior.

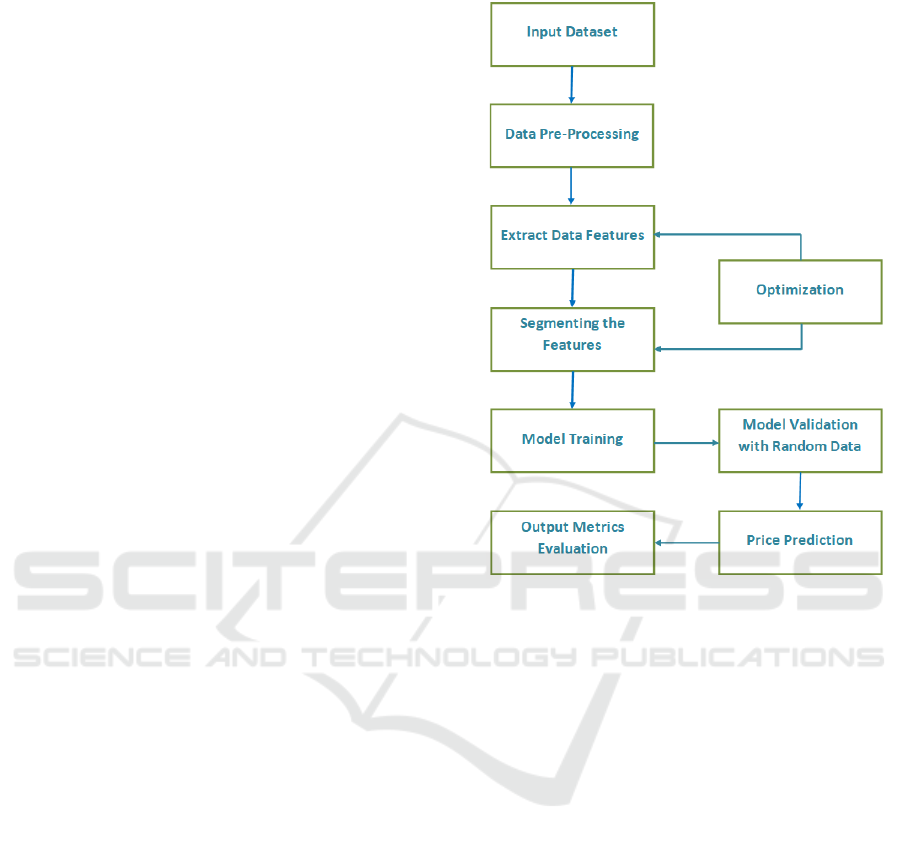

For the purpose of price forecasting and study of

price dynamics, Figure 1 shows the proposed method

flow diagram. The suggested method, Histogram

based Gradient Boosting (HGB), improves upon the

present approach, Random Forest (RF), by making it

more practical and increasing the accuracy of

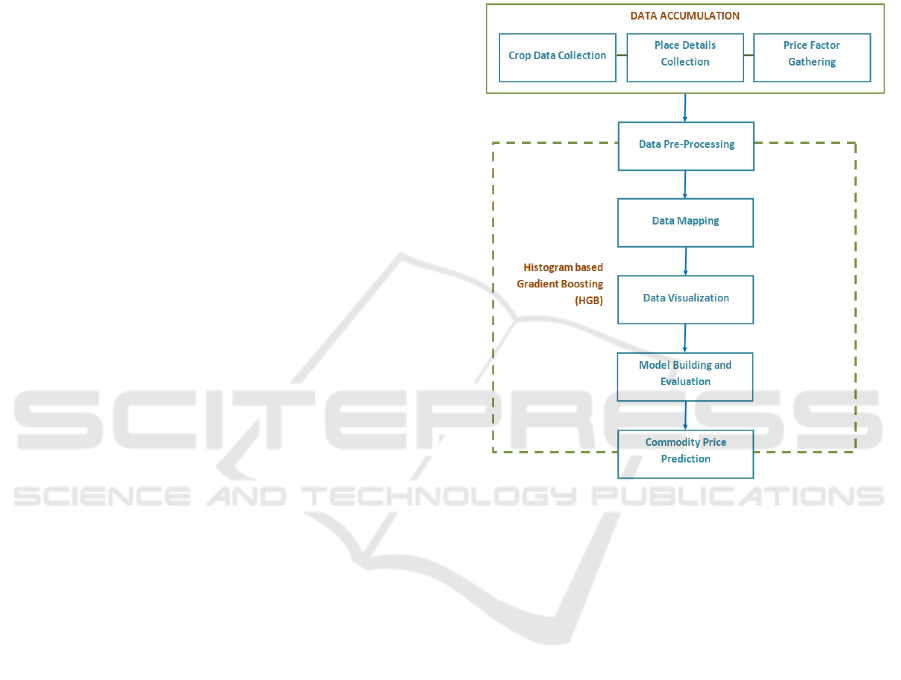

forecasts. Figure 2 of the system architecture above

shows the suggested method for price forecasting and

price dynamics analysis. We consider two types of

data in order to tackle the worldwide food security

problem that this study aims to solve: One is the Crop

data, which includes detailed information on the

commodity, nation, price (in the currency of the

country in which the crop is grown), and quantity (for

each month and year) among other factors that impact

the crop's cost on a worldwide scale. The price data is

another important part of the process since it includes

the nation, month, year, and standard currency value.

These pieces of information are utilized to convert

currency units to US dollars.

Figure 1: System Flow Diagram.

(i) Data Acquisition: To address the issue of food

security on a worldwide scale, this study draws on

two sets of data: The Crop data is one such resource;

it provides comprehensive information on the crop's

worldwide cost by month and year as well as by

product, nation, price (in currency unique to that

country), and quantity. An additional source is the

price data, which includes the following fields:

nation, month, year, and standard currency value.

These fields are utilized for currency unit conversions

to US dollars.

(ii) Data Mapping: Common characteristics, such as

nation, year, and price, are used to map the two sets

of data. More accurate and insightful analysis is

made possible by ensuring thorough and integrated

data generation.

• Data Pre-Processing: The procedures outlined

in the next section are used to pre-process the

data.

• Missing Values Handling: The dataset is filled

up with the average price for each unique set of

country and year to replace any missing values.

Experimental Evaluation of Agriculture and Horticulture Commodities Price Prediction Using Histogram Based Gradient Boosting

Algorithm

733

(iii) Data Grouping: Relevant data points are

grouped from the dataset by filtering and grouping

appropriate nations and commodities within a range.

(iv) Weight Standardization: Weight

standardization is a method for transforming different

weights into a universally accepted amount, in this

case 1 kilogram. This guarantees that all

measurements taken within the system are consistent

and uniform.

(v) Data Validation: In order to verify the accuracy

of the recorded information and the logical coherence

of the values across different features, data

consistency tests were conducted by comparing the

precision of the crop data with the accessible data.

Grey models, regression analysis, and time series

forecasting are some of the most conventional

methods for projecting agricultural prices. These

methods are effective in situations when the variables

are independent, the data is normally distributed, and

the link is either linear or simple nonlinear.

Nevertheless, these requirements are never satisfied

by practical agricultural price forecasting, which

frequently poses complicated issues such

nonlinearity, high dimensionality, and short sample

size. Intelligent forecasting methods are able to

successfully represent nonlinear interactions in price

series and have less modelling constraints and

assumptions than econometric and mathematical-

statistical approaches. Decision trees, support vector

machines, as well as plain Bayes are examples of

conventional machine learning approaches; however,

despite their simplicity, speed to train, and

robustness, these methods struggle with complicated

nonlinear interactions, require human involvement

for feature selection and extraction, and provide poor

generalization.

Feature engineering is unnecessary when deep

learning models are properly supervised, given

sufficient data quantity and quality, and allowed to

extract feature information from the original

sequence. Additionally, they excel at handling

sequences with nonlinear dependencies. Constraints

of the deep learning approach include an inability to

easily alter parameters, a high data volume required,

the risk of overfitting, and a lack of interpretability.

In real-world forecasting scenarios, many forecasting

approaches like RF can be used to solve the same

problem because of diverse modelling systems and

starting points. Various forecasting approaches offer

varying insights, each with their own set of pros and

cons. Rather than being incompatible, they work hand

in hand and complement one another. Agricultural

commodity price forecasting models sometimes have

less-than-ideal characteristics when they are first

established. To get a better prediction model in these

situations, optimizing the parameters is essential.

Parameter optimization commonly employs

techniques such as simulated annealing, particle

swarm optimization, genetic algorithms, grid search,

and cross validation.

Figure 2: Architecture Diagram.

A more scientific way would be to integrate many

valid forecasting methods into one, which is known

as the combined forecasting technique. Combination

forecasting models combine two or more models to

predict variables. They are more accurate,

comprehensive, and make better use of sample data

than individual models. This helps with synthesizing

useful information from different methods and

improves forecasting accuracy. Since the goal of the

project is to forecast food costs throughout the world,

it is necessary to convert all rates into the same

currency. The prices are converted to USD using the

currency rates of the other nations included in the data

at the specified timestamps. The following figure,

Figure 2 represents the system architecture diagram

of the proposed approach.

The annual price trends of many commodities

may be examined through data visualization. To get

a better picture of when crop prices were highest and

lowest, we may sort the price data by year and assign

each one an equal amount of weight.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

734

4 RESULTS AND DISCUSSION

The study applies ML capabilities to address the

fundamental issue of global food security that is

affected by the price of agricultural commodities.

Two significant results are achieved as a result of the

work: In the first place, an examination of the price

fluctuations of important agricultural commodities is

carried out, with a special focus on Wheat, Millet,

Sorghum, Maize, and Rice. The study sheds insight

on the patterns and shifts that have occurred in the

pricing on a worldwide basis. Particular attention is

paid to emerging countries that are either the most

prolific producers of these crops or the ones that attain

the maximum output of this crop in comparison to

other producing countries. The price dynamics study

and anticipated prices provide valuable information

to policymakers, farmers, researchers, as well as other

stakeholders in order to ensure global food security

by mitigating the effects of price-impacting variables,

fostering sustainable agriculture, and making

informed decisions. For stakeholders including

farmers, merchants, and legislators, precise

forecasting of agricultural commodity prices is

essential.

Conventional forecasting methods such as

Random Forest and the like often struggle with the

nonlinear and highly volatile nature of agricultural

price data. Deep learning algorithms have

demonstrated potential for tackling these challenges

due to their ability to capture complex patterns on the

time series. This approach introduced HGF

(Histogram based Gradient Boosting), a new deep

learning method that is particularly useful for

temporal sequence modelling and has been

successfully implemented for price predictions. Four

of the recommended models include external

variables such temperature and precipitation. When

these models were employed on potato, onion, and

tomato's pricing in major Indian markets, they

outstripped traditional statistical and machine

learning approaches, thereby underscoring the

importance of including external entities into

prediction models by realizing diminished error

metrics.

Machine learning techniques, particularly HGB

algorithm and its variants, have shown significant

potential in improving the accuracy of agricultural

commodity price forecasts. Which not only contain

external factors but also cover hybrid models helps

to better accuracy of integration forecasting and thus

can provide useful input for agriculture sector actors

to make reasonably informed decisions. For various

groups including farmers, merchants, and legislators,

accurate forecasting of agricultural prices is critically

important. Agricultural pricing data is nonlinear and

volatile, making it sometimes difficult to handle with

traditional statistical methods. Due to their ability to

capture complex patterns in time series data, deep

learning algorithms have shown promise in

addressing these challenges. Deep learning models

have exhibited potential in addressing these

challenges as a result of their ability to capture

complex regularities within time series data. Figure 3

shows the user registration page of the proposed

method. 3, requires the user or farmer to verify their

identification before visiting to the login page.

Figure 3: User Registration.

The results of the proposed method's user login,

commodity details registration, and commodity price

prediction pages are shown in Figures 4, 5, and 6,

respectively.

The accuracy ratio of the proposed scheme is

evaluated by cross-validating it with the standard

learning model called Random Forest (RF). The

accompanying figure, Figure 7, shows the output

prediction accuracy of the proposed technique HGB.

Table 1 provides a descriptive representation of the

same.

Experimental Evaluation of Agriculture and Horticulture Commodities Price Prediction Using Histogram Based Gradient Boosting

Algorithm

735

Figure 4: Login Page.

Figure 5: Commodity Details.

Figure 6: Commodity Price Prediction.

Table 1: Analysis of Commodity Price Prediction Accuracy

Between Rf and Hgb.

Epochs

RF (%)

HGB (%)

50

86.36

96.73

75

87.39

97.46

100

88.54

96.59

125

86.67

96.48

150

87.76

96.32

175

87.87

97.64

200

86.98

97.44

225

87.08

97.71

250

86.19

97.28

Figure 7: Commodity Price Prediction Accuracy.

5 CONCLUSION AND FUTURE

SCOPE

The unpredictable and multi-factorial character of

agricultural markets makes agricultural price

prediction a difficult task. In this unit, we saw how

two state-of-the-art deep learning algorithms,

Random Forests (RF) and Histogram-based Gradient

Boosting (HGB), non-traditional methods of

agricultural price forecasting, might better than more

traditional methods. Agricultural prices are affected

by complex non-linear interactions among multiple

variables such as weather patterns, supply and

demand shocks, market trends, etc.: such interactions

were captured using ensemble learning techniques.

The results showed that compared with traditional

methods, both Random Forests and Histogram-based

Gradient Boosting models were more accurate and

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

736

differential. Due to its relatively simple interpretation

through feature importance scores (rankings), RF was

particularly successful at identifying non-linear

relationships. In contrast, HGB\u2019s prediction

performance was closer to CTB, which required more

time in terms of prediction, while HGB greatly

improved the efficiency of the training speed in

handling large datasets. Given the complexity of the

data with some structured features such as historical

pricing data to unstructured features like weather and

market demand indicators, the suggested model

performed well. This showcases the algorithms'

capacity of handling the variability of continuous

information throughout different land points for

predicting prices in an agricultural setting. The

evaluations further proved that meticulous

hyperparameter tuning is necessary to achieve high

performance and the disasters showed that the

models can make accurate predictions for agricultural

prices.

In the future, research could focus on price

forecasting by incorporating climate change, quantity

of warehousing, supply to demand ratios per country,

and population dynamics as inputs to Machine

Learning models. Those elements have a large

influence on price dynamics and ultimately on food

security.

REFERENCES

Anket Patil, et al., "Forecasting Prices of Agricultural

Commodities using Machine Learning for Global Food

Security: Towards Sustainable Development Goal 2",

International Journal of Engineering Trends and

Technology, 2023.

Changxia Sun, et al., "A Study on Agricultural Commodity

Price Prediction Model Based on Secondary

Decomposition and Long Short-Term Memory

Network", Agriculture, 2024.

Dian Dharmayanti, Et Al., "Application Of Data Mining

For Predicting Horticultural Commodities Price",

Journal of Engineering Science and Technology, 2024.

Fajar Delli Wihartiko, et al., "Agricultural Price Prediction

Models: A Systematic Literature Review", Proceeding

s of the 11th Annual International Conference on

Industrial Engineering and Operations Management,

2021.

Feihu Sun, et al., "Agricultural Product Price Forecasting

Methods: A Review", Agriculture, 2023.

Girish Hegde, et al., "A Study On Agriculture Commodities

Price Prediction and Forecasting", International

Conference on Smart Technologies in Computing,

Electrical and Electronics, 2020.

Kapil Choudhary, et al., "A genetic algorithm optimized

hybrid model for agricultural price forecasting based on

VMD and LSTM network", Scientific Reports, 2025.

Laveti Krishna Babu, "Analysis of AI-ML Models for

Prices Forecasting of AgricultureandHorticultural

Commodities", International Journal of Research

Publication and Reviews, 2024.

Luana Gonçalves Guindani, et al., "Exploring current

trends in agricultural commodities forecasting methods

through text mining: Developments in statistical and

artificial intelligence methods", Heliyon, 2024.

M. Durga Sai Sandeep, et al., "AI-ML Based Price

Prediction Model for Agri-Horticultural

Commodities", International Journal of Research

Publication and Reviews, 2025.

Manas Kumar Mohanty, et al., "Agricultural commodity

price prediction model: a machine learning

framework", Neural Computing and Applications,

2023.

Peng Chen, et al., "Short-term Forecast of Agricultural

Prices Using CNN+LSTM", Proceedings of the 7th

International Conference on Intelligent Information

Processing, 2023.

Prashantha S, et al., "Agricultural Crop Commodities Price

Prediction Using Machine Learning Techniques",

International Research Journal of Innovations in

Engineering and Technology, 2020.

Sourav Kumar Purohit, et al., "Time Series Forecasting of

Price of Agricultural Products Using Hybrid Methods",

Applied Artificial Intelligence, 2021.

Tingting Zhang, et al., "Agricultural commodity futures

prices prediction based on a new hybrid forecasting

model combining quadratic decomposition technology

and LSTM model", Frontiers in Sustainable Food

Systems, 2024.

Experimental Evaluation of Agriculture and Horticulture Commodities Price Prediction Using Histogram Based Gradient Boosting

Algorithm

737