Financial Fraud Detection in Transactions Using AI

Mani

1

, Ashok Kumar S.

2

, Dhaneswara V.

2

and Dinesh R.

2

1

Department of Computer Science & Engineering, Nandha Engineering College (Affiliated to Anna University, Chennai),

Erode, Tamil Nadu, India

2

Department of Computer Science & Engineering, Nandha Engineering College, Erode, Tamil Nadu, India

Keywords: Fraud Detection, Financial Transactions, Machine Learning, Anomaly Detection, Classification Algorithms,

Decision Trees, Transaction Data.

Abstract: Fraud detection in financial transactions is a critical challenge faced by financial institutions, merchants, and

consumers alike. With the increasing sophistication of fraudulent activities, traditional rule-based detection

methods are often insufficient. This problem statement aims to address the need for robust and scalable fraud

detection systems that leverage advanced technologies such as machine learning. The primary objective is to

develop algorithms and models capable of accurately identifying fraudulent transactions while minimizing

false positives. This requires the analysis of large volumes of transaction data to detect suspicious patterns or

anomalies. Focus on applying Machine learning algorithm techniques to detect fraudulent transactions. These

methods include decision trees, random forests, support vector machines. Researchers often explore the

effectiveness of these techniques in classifying fraudulent and legitimate transactions based on features.

1 INTRODUCTION

Financial transaction fraud detection is a high priority

for consumers, merchants, and financial institutions

today due to the sophistication of fraud. With

electronic transactions and online payment schemes

evolving, fraudsters keep coming up with new

methods to circumvent traditional security controls,

leading to enormous losses of funds as well as

reputation loss. Traditional rule-based methods of

fraud detection, which are pre-configured pattern-

dependent and hand-coded rules, lag behind in terms

of keeping pace with technology advancements. Such

methods are weakest at combating new patterns of

fraud and generate a high level of false positives,

unnecessarily inconveniencing bona fide users.

Amidst all such threats, machine learning has

emerged as an economic and scalable approach to

fraud detection. Machine learning models can extract

weak patterns and unexpected patterns of association

from gigantic sets of transactional data typical of

fraud transactions. Advanced algorithms use methods

of anomaly detection in order to tag transactions as

being fraudulent or ordinary and reduce errors of

detection in addition to constraining false alarms.

Some of the most powerful machine learning methods

employed to detect fraud include decision trees,

random forests, and support vector machines.

Decision trees provide an understandable solution

through the decomposition of decisions into

comprehendible, rule-based components, while

random forests provide improved performance with

ensemble learning. Support vector machines (SVMs)

are capable of working well with high-dimensional

data and are used widely to classify fraudulent

transactions and non-fraudulent transactions based on

given features.

Furthermore, machine learning algorithms get

better with time with updates learned from new

transactions, making fraud detection systems robust

and adaptable to new threats. Banks and researchers

continue to experiment and refine these approaches to

enhance fraud detection. Employing real-time

processing, feature engineering, and advanced

anomaly detection methods further reinforces the

ability of the systems to detect fraud instantaneously.

As electronic financial transactions increase, the

application of machine learning in detecting fraud is

still one of the major areas of research, with greater

security, reduced economic loss, and enhanced trust

in financial institutions. Also, combining multiple

machine learning models with ensemble methods

could enhance the detection ability by leveraging the

strength of different algorithms. As financial fraud

Mani, , S., A. K., V., D. and R., D.

Financial Fraud Detection in Transactions Using AI.

DOI: 10.5220/0013868500004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

515-521

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

515

continues to advance and become increasingly

sophisticated, the continued development and

advancements of AI-driven fraud detection systems

will prove to be crucial in the pursuit of safe and

trustworthy financial transactions.

2 RELATED WORKS

Graph Neural Networks (GNN) and Autoencoders

have been increasingly used for fraud detection in

banking, particularly in real time, for credit card fraud

detection. Traditional machine learning systems

often struggle to detect advanced fraud patterns and

deep learning approaches like GNNs outperform

them when it comes to identifying complex

correlations between transactions. GNNs have been

found to be effective in modeling transaction

networks and improving the accuracy of fraud

detection according to industry and academic

research (such as Alarfaj and Shahzadi in 2025).

Second, Autoencoders assist in identifying outlier

transactions by detecting any divergence from

normal behavior. This study implements GNN and

Autoencoders to provide real time prevention of

fraud and increase the security and detection of

banking. Some of the leading technologies for

financial fraud detection such as Explainable AI

(XAI) and Federated Learning (FL) were introduced

in response to transparency and data privacy

concerns. Centralized legacy fraud detection models

are susceptible to data breaching, and are not

explainable whereas on the other hand, FL promotes

collaborative learning between institutions without

sharing raw data, thereby ensuring privacy

preservation. Research like that of Awosika et al.

(2024) has demonstrated that FL can be influential in

fraud detection when decentralized model training

follows proper detection. Some of the latest research

that improves the performance of fraud detection are

using a hybrid method, FF combining ideas from FL

and the deep learning models. FL and XIA are used

in this work to enhance efficacy in fraud detection

with the object of preserving both data privacy and

model explain ability.

Active Learning (AL) has been exploited widely

in human-in-the-loop decision-making problems,

particularly in risky applications such as customs

inspection. Automated inspection systems tend to do

poorly in indefinitely many scenarios, to which

human judgement is then applied to give better

accuracy. Research such as Kim et al. (2023) proved

the efficiency of AL in utilizing human effort to the

fullest by selecting the most informative samples for

human labelling and therefore minimizing labelling

costs while maintaining high detection accuracy. In

addition, AL makes the model more flexible by fine-

tuning decision boundaries based on expert feedback

over time. More recent studies also involve the

application of hybrid models combining AL with

deep learning approaches in order to enrich the

inspection performance. This paper employs AL to

optimize selections of decisions on a complex food

classification problem in order to maximize both

accuracy and efficiency of operation under

hazardous conditions. Explainable AI (XAI) is

important for transparency, trust, and regulations for

financial AI systems. Black-box models are opaque

and thus make the process of decision-making a

secretive one. Martins et al. The survey (2024) focus

on XAI taxonomies and applications with

systematically review of techniques like SHAP and

LIME for explain ability. Interpretability of AI

decisions by XAI enhances fraud detection, risk

assessment, and credit scoring. In recent years, deep

learning and XAI are combined inseverable works to

enhance the accuracy while satisfying the

transparency. XAI has been employed in this research

to augment trust and accountability of financial AI

applications.

Deep neural networks and Explainable Artificial

Intelligence (XAI) approaches have been widely

investigated for money laundering detection,

contesting the challenges related to the inability to

detect sophisticated patterns of illegal financial

activities. Rule-based and statistical methods often

struggle to respond to emerging laundering tactics,

whereas deep learning algorithms have been shown to

excel in identifying subtle patterns in larger

transaction datasets. Research such as Kute et al.,

(2021) to inhibit financial crime detection with a

focus on regulatory compliance through interpretable

models (Zhao et al. Recent studies further leverage

hybrid approaches through deep learning and XAI to

improve detection performance with explain ability.

By leveraging the capability of deep learning and

XAI this project provides high trustworthy and

accurate augmented threat detection/data provenance

to enhance transparency and regulatory compliance

in money laundering detection in financial

transactions. In the domain of finance and real estate

ML systems, Explainable and Fair AI (XFAI) is as

one of the most important dot that has to build in

construction to reach Explain ability, accountability

and fairness in the decision-making process.

Traditionally, AI models focus on accuracy but risk

introducing bias in fairness in finance predictions.

Acharya et al. (2023) demonstrate how to balance

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

516

performance with fairness through interpretability

techniques (e.g., SHAP) and fairness-aware

algorithms. XFAI helps mitigate bias in credit

scoring, loan sanctioning, and property valuation. In

this project, XFAI is utilized to improve fairness,

explain ability, and trust in AI-driven financial and

real estate services.

In the field of security, many machine learning

methods are used for online payment fraud detection.

Rule-based systems cannot adapt to evolving fraud

patterns, and machine learning models learn to

mitigate against new threats. Almazroi and Ayub

(2023) proposed an online fraud detection (OFD)

model using supervised and unsupervised learning to

identify the fraudulent transactions. This highlighted

the performance in terms of feature selection,

anomaly detection and online analysis as seen in their

research. This involves the use of machine learning in

order to improve the efficiency of fraud detection in

online systems leading to a more secure system of

online payments. Machine learning plays a crucial

role as it uses analysis of important financial ratios

and trends to detect financial statement fraud.

Traditional audit methods can be time-consuming

and are not capable of detecting subtle fraud schemes.

Li et al. (2024) propose a machine learning technique

that relies on financial ratios, anomaly detection, and

predictive modelling to detect fraudulent financial

reporting. Their findings indicate the effectiveness of

AI-driven fraud detection in real-world applications.

This project applies machine learning to enhance

financial fraud detection with the objectives of

enhancing accuracy, efficiency, and regulatory

compliance. Machine learning improves the

discovery of the fraud in the financial statements with

improved accuracy and speed. Traditional methods of

auditing do not always reveal complex fraud plans.

Lin (2024) presents key concerns, model

interpretability, feature selection, data quality, and

regulatory adherence. The paper emphasizes the

relationship between accuracy and transparency in

establishing good fraud detection. The project utilizes

machine learning to improve fraud prevention and

decision-making in financial reporting and ompliance

and reliability in AI-powered financial analysis.

3 METHODOLOGY

3.1 Dataset Collection

The data to be employed in identifying financial

fraud should be utilized in training and testing

machine learning models. Different sources of data

can be utilized in obtaining transaction information,

ranging from real financial transaction records to

historical bank statements, fraud detection public

datasets, and synthetic data created for the sake of

research. Public datasets like the IEEE-CIS Fraud

Detection dataset, Kaggle Credit Card Fraud

Detection dataset, and financial regulatory authority

datasets can be employed as good sources for training

models. Since real financial transaction data may not

be available due to privacy, statistical sampling and

data augmentation techniques can be employed to

create synthetic data to mimic legitimate and

fraudulent transactions in a realistic manner.

The data set usually consists of important features

like transaction value, location, time, payment

method, user behavior pattern, and anomaly

indicators. Preprocessing steps like missing value

management, feature extraction, and normalization

are conducted on the data collection process for

maintaining data quality. Random under sampling,

oversampling (SMOTE), or stratified sampling

techniques can also be used to handle class imbalance

as fraudulent transactions are usually much lower

than authentic transactions. By using multi-varied

data sets and performing suitable preprocessing, the

research uses a suitably balanced and representative

data set for developing an effective and efficient fraud

detection model.

3.2 Data Pre-Processing

Data preprocessing is one of the most important

financial fraud detection operations that renders the

dataset clean, organized, and ready for analysis. Data

cleaning is the first step of the operation where

duplicates, missing data, and discrepancies are

located and rectified. Missing data may be rectified

by employing the likes of mean/mode imputation for

numeric features and category encoding for non-

numeric features. Outliers that will skew model

performance are identified through statistical tools

such as Z-score analysis or interquartile range (IQR)

filtering and are processed accordingly. After

preprocessing of data, feature transformation and

normalizing is performed to scale all numerical

features into a relative dimension. Min-max scaling

and standardization (Z-score normalization) are

utilized most frequently in order to keep specific

features from dominating the model owing to

dissimilarities of scale. Feature engineering is

subsequently employed to build features of beneficial

usability that improve model performance. This can

involve the building of new features such as

transaction frequency, spend pattern average,

Financial Fraud Detection in Transactions Using AI

517

geolocation risk features, or day-of-week activity

patterns in a way that enables them to effectively

detect fraudulent and legitimate transactions.

Furthermore, because fraud datasets are extremely

imbalanced (where the number of fraudulent

transactions is much lower in comparison to the

genuine ones), balancing techniques such as

Synthetic Minority Over-sampling Technique

(SMOTE), Adaptive Synthetic Sampling

(ADASYN), or random under sampling would be

employed to balance the dataset.

So that the model would not be biased towards the

majority class. Preprocessed data are also divided into

training, validation, and test sets to accurately

approximate model performance. After a standard

preprocessing strategy, the data is refined for accurate

and efficient fraud identification.

3.3 Model Selection

Choosing the right machine learning algorithm is a

key part of building an effective financial fraud

detection system. It starts with the evaluation of

several algorithms based on how effectively they are

able to classify transactions accurately with as few

false positives and false negatives as can be managed.

Several supervised learning algorithms such as

Logistic Regression, Support Vector Machine

(SVM), and Random Forest are evaluated to decide

which among them will work best for fraud detection.

Logistic Regression can be employed as a baseline

model because it is easy to interpret and easy, hence

convenient in determining the most important factors

behind fraudulent activity. It will not work very well

with intricate, non-linear relationships in

transactional data. Support Vector Machine (SVM) is

a powerful algorithm that locates the data with great

accuracy by finding the best possible decision

boundary which can differentiate the fraud and

legitimate transactions. It may be extremely slow for

massive transactional data but extremely quick for

high-dimensional data. Because it uses a large

number of decision trees to boost the classifications

and stability, Random Forest is hugely common in

detecting fraud as an ensemble method. It is also

capable of dealing with biased data manipulation and

detecting hidden patterns employed in fraud activity.

To identify the best performing model, cross-

validation methods like k-fold cross-validation are

employed in an effort to avoid overfitting as well as

the model performance checkup.

Performance metrics like accuracy, precision,

recall, F1-score, and AUC-ROC curve analysis are

utilized in an attempt to comprehend the performance

of various models. Hyperparameter tuning is also

performed using methods like Grid Search or

Random Search in an attempt to attain optimal model

performance. Following these tests, a model with

highest predictive accuracy and optimal trade-off

between fraud detection and false alarms is selected

to be deployed.

3.4 Model Evaluation

Testing the model after training is of utmost

importance in confirming its ability to recognize the

fraud transactions. It also uses performance metric to

measure how well the model classifies the transaction

by achieving minimum false positives (true

transaction give a fraud classification) and false

negatives (biased transaction not classify as fraud).

The important measures are accuracy, precision,

recall, and F1-score. Accuracy gives a generic

measure of accuracy, but in case of imbalanced

dataset where the fraudulent transactions are rare,

methods based on accuracy might not be reliable.

Precision is the ratio of correct fraud cases predicted

to the total cases predicted as fraud since we want to

keep the false positives as low as possible.

Recall (or sensitivity) estimates the fraction of

actual fraudulent transactions that is detected by the

model, where we want to minimize false negatives.

F1-score is a balance between recall and precision,

which is the harmonic mean of both, and hence the

best metrics to evaluate models against imbalanced

data.

Cross-validation techniques such as k-fold cross

validation is applied for making model generalizable

and robust. This is done by splitting the dataset into

different sets, where the model is trained on one set

of subsets and is then tested on the remaining subsets

in order to minimize the chance of overfitting. We

also use the AUC-ROC (Area Under the Receiver

Operating Characteristic Curve) to measure the

model’s discrimination of fraudulent versus valid

transactions with higher AUC indicating better

performance.

Hyperparameter tuning is then performed to

further improve the model using techniques such as

Grid Search and Random Search, which vary

parameters such as tree depth in Random Forest or

kernel type in SVM. Finally, model results get

compared with the baseline methodologies for

efficiency confirmation. This is applied to make a

model accurate and confident for real use in fraud

prediction, where applicable ensemble learning,

feature engineering optimization techniques are

applied to improve performance.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

518

4 EXPERIMENTAL RESULT

The financial fraud detection system uses the

transaction data and estimates the likelihood of

fraudulent transactions. The output obtained from the

system is helpful in facilitating the financial

institutions to make wise decisions and arrange

preventive measures at the first level itself. By using

machine learning algorithms like Logistic

Regression, Support Vector Machine (SVM), and

Random Forest, the system can differentiate between

fraud and valid transactions. Expected results are

provided with confidence levels to allow bank

professionals to estimate the accuracy of every

classification.

Model performance is examined using various

metrics like accuracy, precision, recall, and F1-score

in order to present reliability in the detection of fraud.

The accuracy measure indicates the overall precision

of the model, while precision is used to reduce false

positives by finding the proportion of correct

identification of fraudulent transactions to all

transactions detected. Recall is the model's capability

to identify all the actual fraud cases without failing to

detect any suspected fraud activity.

Table 1: Comparison of machine learning algorithms.

Algorithm

Training

Accurac

y

AUC-ROC

Score

Logistic Regression

(

LGR

)

86.0% 0.91

Support Vector

Machine (SVM)

88.5% 0.93

Random Forest

(

RF

)

95.0% 0.97

This table 1 compares Logistic Regression, SVM,

and Random Forest based on key performance

metrics for fraud detection. Random Forest achieves

the highest accuracy and AUC-ROC score, indicating

strong predictive performance, but may risk

overfitting. SVM provides a balanced approach,

while Logistic Regression is the simplest and most

interpretable, making it useful for real-world

applications.

F1-score as a harmonic mean of recall and

precision both treats them with the same importance

and is of high utility where cases of frauds are

disproportionately lower than regular transactions.

AUC-ROC (Area Under the Receiver Operating

Characteristic Curve) is also employed to determine

the strength of the model in separating the fraudulent

and legitimate transactions efficiently. The higher

AUC value means that the model is sufficiently

strong and can separate the fraudulent patterns with

confidence. The performance is also optimized more

with the cross-validation techniques so that the model

generalizes very well with new, unseen transaction

data and does not overfit. For better readability, the

model results are customized by giving presentations

like confusion matrices, probability scores, and trend

analysis graphs. The system helps bank

administrators to validate the risk levels of

transactions in real time and initiate timely right

actions. Risk-based scoring is also incorporated into

the system, classifying transactions into high,

medium, and low risk to help adopt more

sophisticated fraud prevention techniques.

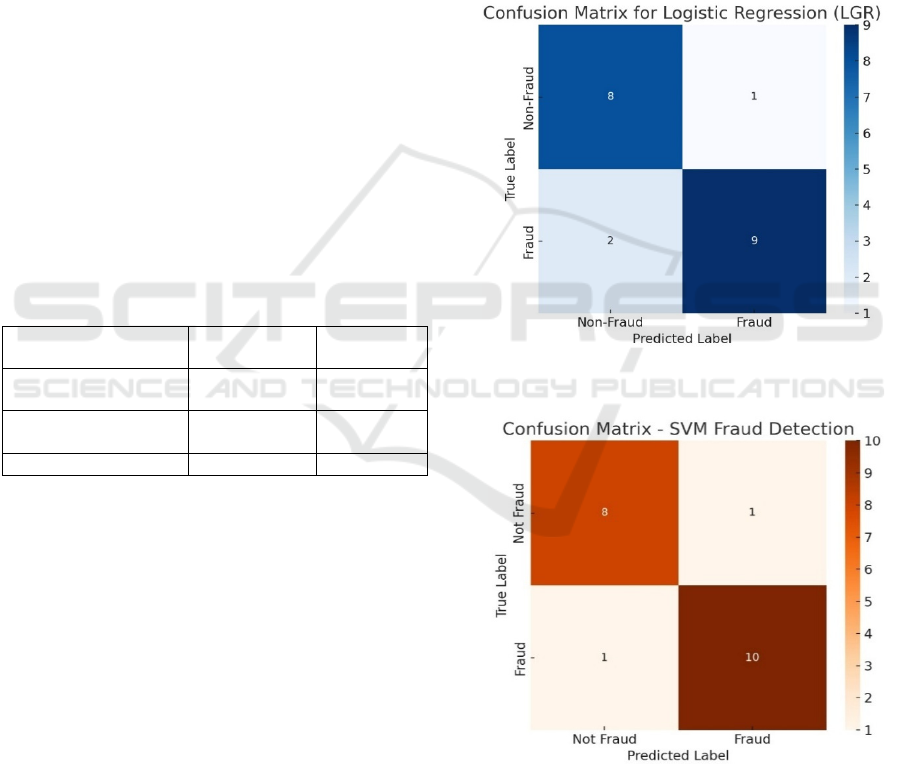

Figure 1: Confusion matrix for LGR.

Figure 2: Confusion matrix for SVM.

Financial Fraud Detection in Transactions Using AI

519

Figure 3: Confusion matrix for random forest.

Figure 1, 2 and 3 shows the confusion matrix of

LGR, SVM and Random forest. For optimization of

performance, cross-validation techniques are used so

that the model will perform well on unseen new

transaction data. It avoids overfitting, where the

model performs best on training data but fails to

perform in real usage. For easier interpretability,

visualization techniques such as confusion matrices,

probability scores, and trend analysis graphs present

results in a simple form. This helps bank

administrators see risk levels and act accordingly.

A risk-scored scoring framework categorizes

transactions into high-risk, medium-risk, and low-

risk. High-risk transactions and low-risk transactions

are processed smoothly or are put through additional

verification procedures. Banks avoid putting valid

users through bulk fraud prevention processes.

The validity of the model is determined in various

financial scenarios based on case studies and

synthetic data from actual transactions. Open-source

fraud detection data sets and artificially generated

data sets are used to ensure that the performance of

the system under any condition can be verified.

The research identifies novel developments above

traditional rule-based fraud detection systems with

the propensity to generate too many false positives or

fail to identify very sophisticated fraudulent patterns.

Machine learning algorithms, however, dynamically

learn and improve with time to identify changing

fraud patterns. The other improvement is through the

application of ensemble learning methods, where

multiple models are integrated to enhance fraud

detection. Deep learning methods such as Neural

Networks can also enhance fraud prediction using

hybrid models. The real-time fraud detection ability

will help in detecting fraud transactions in real time

so that action can be taken immediately. This is

required in an effort to prevent unauthorized

transactions and reduce financial loss.

Another significant advantage is scalability of the

model.

It handles huge volumes of transactions without

impacting performance, and hence it is most

appropriate for banks, fintech, payment gateways,

and online stores. Additional validation is conducted

through geo-spatial analysis, analysing the fraud

pattern across geographies. Frauds tend to originate

from high-risk geographies, and the model gets

trained by including location-based fraud detection

features.

With blockchain security protocols integrated,

avoiding fraud is complemented with proof-of-

tamper transaction tracing. Both blockchain and AI

enjoy an unchanging, safe, and transparent money

transaction ledger. Adaptive self-adjusting

capabilities may be implemented within it for future

development of that sort so it will continue improving

itself as well against fraudulent mechanisms that

always seem to be adapting. Real-time models get

enriched to effectively take care of the upcoming

financial flaws. Feature importance analysis is also

applicable in most impactful fraud contributor

identification. This aids the financial institutions in

optimizing fraud discovery policies by utilizing the

most informative features during transactions.

Overall, the fraud discovery model enhances

maximum financial security, minimizes fraudulent

loss, and maximizes trust in online transactions.

Future improvements involve the incorporation of

consolidating deep learning, real-time anomaly

detection, and ongoing model adaptation to enhance

maximum prevention against fraud.

5 CONCLUSIONS

Machine learning-based fraud detection results in

financial safety by predicting frauds by identifying

transactions using models of Logistic Regression,

SVM, and Random Forest. This means that the

system is highly accurate, has low false positives and

false negatives, and means it can run at scale for real-

world applications. Risk Classification, Visuals,

Decision Support Model Let Financial Professionals

Build Confidence Score Its ability to adjust to

different financial datasets ensures it maintains

equilibrium across distinct environments. Deep

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

520

learning algorithms, real-time monitoring, and

adaptive learning for optimal fraud detection will

further enhance improvements in the future. The

process to combat fraudulent activity will only gather

momentum with time as it will keep getting fine-

tuned to offer even more security; being essential to

build trust around transactions carried out online.

6 FUTURE WORK

Future research in fraud detection might focus on

deep learning algorithms such as CNNs and RNNs for

more effective detection of fraud patterns. Such

transactions may enable real-time fraud monitoring

and prevention. Adaptive learning models will learn

as new data is inputted, finding trending fraud types

that may change over time and not requiring updating.

Blockchain technology will create an open and

immutable book with security. You can scale explain

ability using SHAP and LIME, giving professionals

the ability to understand fraud forecasts. Moreover,

using stronger datasets with multi-source finance

data and using graph-based fraud discovery can

improve the robustness of the fraud analysis. These

extensions will ensure the fraud detection framework

comprehensive and scalable.

REFERENCES

A. A. Almazroi and N. Ayub, "Online Payment Fraud

Detection Model Using Machine Learning

Techniques," in IEEE Access, vol. 11, pp. 137188-

137203, 2023, doi: 10.1109/ACCESS.2023.3339226.

A. Tudisco et al., "Evaluating the Computational

Advantages of the Variational Quantum Circuit Model

in Financial Fraud Detection," in IEEE Access, vol. 12,

pp. 102918- 102940, 2024, doi: 10.1109/ACCESS.20

24.3432312.

B. Li, J. Yen and S. Wang, "Uncovering Financial

Statement Fraud: A Machine Learning Approach with

Key Financial Indicators and Real-World

Applications," in IEEE Access, vol. 12, pp. 194859-

194870, 2024, doi: 10.1109/ACCESS.2024.3520249.

C. Huot, S. Heng, T. -K. Kim and Y. Han, "Quantum

Autoencoder for Enhanced Fraud Detection in

Imbalanced Credit Card Dataset," in IEEE Access, vol.

12, pp. 169671- 169682, 2024, doi: 10.1109/ACCESS

.2024.3496901.

D. V. Kute, B. Pradhan, N. Shukla and A. Alamri, "Deep

Learning and Explainable Artificial Intelligence

Techniques Applied for Detecting Money Laundering–

A Critical Review," in IEEE Access, vol. 9, pp. 82300-

82317, 2021, doi: 10.1109/ACCESS.2021.3086230.

D. B. Acharya, B. Divya and K. Kuppan, "Explainable and

Fair AI: Balancing Performance in Financial and Real

Estate Machine Learning Models," in IEEE Access,

vol.

12, pp. 154022- 154034, 2024, doi: 10.1109/ACCESS

.2024.3484409.

D. Lin, "Key Considerations to be Applied While

Leveraging Machine Learning for Financial Statement

Fraud Detection: A Review," in IEEE Access, vol. 12,

pp. 68213- 168228, 2024, doi: 10.1109/ACCESS.202

4.3488832.

E. Ileberi and Y. Sun, "A Hybrid Deep Learning Ensemble

Model for Credit Card Fraud Detection," in IEEE

Access, vol. 12, pp. 175829-175838, 2024, doi:

10.1109/ACCESS.2024.3502542

F. A. Ghaleb, F. Saeed, M. Al-Sarem, S. N. Qasem and T.

Al-Hadhrami, "Ensemble Synthesized Minority

Oversampling-Based Generative Adversarial Networks

and Random Forest Algorithm for Credit Card Fraud

Detection," in IEEE Access, vol. 11, pp. 89694-89710,

2023, doi: 10.1109/ACCESS.2023.3306621.

F. Khaled Alarfaj and S. Shahzadi, "Enhancing Fraud

Detection in Banking with Deep Learning: Graph

Neural Networks and Autoencoders for Real-Time

Credit Card Fraud Prevention," in IEEE Access, vol.

13, pp. 20633- 20646, 2025, doi: 10.1109/ACCESS.2

024.3466288.

K. G. Dastidar, O. Caelen and M. Granitzer, "Machine

Learning Methods for Credit Card Fraud Detection: A

Survey," in IEEE Access, vol. 12, pp. 158939-158965,

2024, doi: 10.1109/ACCESS.2024.3487298.

S. Kim et al., "Active Learning for Human-in-the-Loop

Customs Inspection," in IEEE Transactions on

Knowledge and Data Engineering, vol. 35, no. 12, pp.

12039- 12052, 1 Dec. 2023, doi: 10.1109/TKDE.2022

.3144299.

T. Awosika, R. M. Shukla and B. Pranggono,

"Transparency and Privacy: The Role of Explainable

AI and Federated Learning in Financial Fraud

Detection," in IEEE Access, vol. 12, pp. 64551-64560,

2024, doi: 10.1109/ACCESS.2024.3394528.

T. Martins, A. M. de Almeida, E. Cardoso and L. Nunes,

"Explainable Artificial Intelligence (XAI): A

Systematic Literature Review on Taxonomies and

Applications in Finance," in IEEE Access, vol. 12, pp.

618-629, 2024, doi: 10.1109/ACCESS.2023.3347028.

Y. Tang and Z. Liu, "A Credit Card Fraud Detection

Algorithm Based on SDT and Federated Learning," in

IEEE Access, vol. 12, pp. 182547-182560, 2024, doi:

10.1109/ACCESS.2024.3491175.

Financial Fraud Detection in Transactions Using AI

521