Bridging Traditional Finance and Decentralized Ecosystems: A

Data‑Driven and Protocol‑Level Analysis of DeFi’s Global Disruption

Balakrishnan S.

1

, Manoj Govindaraj

2

, A. Amala Suzana

3

, L. Jothibasu

4

,

V. Eniya

4

and M. Srinivasulu

5

1

Department of Commerce, SRM Institute of Science and Technology, Ramapuram, Chennai‑89, Tamil Nadu, India

2

Department of Management Studies, Vel Tech Rangarajan Dr. Sagunthala R&D Institute of Science and Technology,

Chennai, Tamil Nadu, India

3

Department of MBA, J.J. College of Engineering and Technology, Tiruchirappalli, Tamil Nadu, India

4

Department of Management Studies, Nandha Engineering College, Vaikkalmedu, Erode, Tamil Nadu, India

5

Department of Computer Science and Engineering, MLR Institute of Technology, Hyderabad, Telangana, India

Keywords: DeFi, Blockchain, Traditional Banking, Smart Contracts, Financial Disruption.

Abstract: The rise of DeFi is revolutionizing the way to think, provide or access any financial services. This paper

contributes in the light of deficiencies in existing literature (no empirical evidence and narrow coverage, lack

of protocol level analysis), and research history explores how DeFi potentially revolutionizes conventional

banking systems. By analyzing DeFi systems like Aave, MakerDAO and Uniswap with behavioral data and

liquidity challenging simulations, the research comes away with a broad sense of what DeFi can and cannot

do. Unlike previous research which has been largely theoretical and qualitative in nature, this paper introduces

a hybrid research methodology used in combination with economic modeling, scrutiny of technical

infrastructure, and comparative analytics to describe how DeFi is redefining archetypal banking activities. In

addition, this study includes governance mechanism, cross-border cases, and integration ways between DeFi

and centralized financial organization. The results show that DeFi is not a substitute but could be a new type

of future financial architecture with traceable, automated, and free access.

1 INTRODUCTION

The global economy is being rapidly disrupted by the

combination of blockchain technology and a

decentralized economic philosophy. Central to this

revolution is Decentralized Finance (DeFi), a

blockchain-based ecosystem that provides financial

services credit/lending, borrowing, trading, asset

management without the need of a bank or a clearing

house. DeFi is different from traditional financial

systems as it runs on open-source protocols and

smart contracts which promote transparency,

automation and inclusiveness.

Traditional banking models, although historically

resilient, are increasingly disadvantaged because of

inefficiencies, restricted access and expensive

operations. These constraints have set the perfect

stage for decentralized platforms to offer a friction

free alternative. Nevertheless, a large portion of the

current literature is either high-level by nature or

regionally specific and provides little practical value

on a worldwide scale with regards to DeFi. Second,

past studies have often taken a narrow theoretical or

risk approach without delving into the technological

infrastructure supporting the functioning of DeFi.

This research serves as a connective tissue to fill

that gap and yet offers an empirical dive into the

manner in which DeFi is disrupting mainstream

financial services, in both geography and use case. In

examining the protocol-level behavior, user adoption

dynamics, governance design, and financial

performance the report provides a 360-degree optic

into the emerging role of DeFi in redefining the

financial industry. It further investigates possible

ways for decentralized systems to be integrated with

traditional banks, thereby establishing a future where

they coexist and develop together.

S., B., Govindaraj, M., Suzana, A. A., Jothibasu, L., Eniya, V. and Srinivasulu, M.

Bridging Traditional Finance and Decentralized Ecosystems: A Data-Driven and Protocol-Level Analysis of DeFi’s Global Disruption.

DOI: 10.5220/0013866800004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

415-421

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

415

2 PROBLEM STATEMENT

In other words, while the dawn of Decentralized

Finance overnight, the world of finance powered by

centralized and inefficient systems has persisted and

blocked out 70% of the world’s population from

getting access to financial institutions. Research on

DeFi mainly consists of theoretical models or use-

case specific analysis, while a systematic empirical

protocol-level understanding of the wider

implications of DeFi on traditional banking services

is inadequately studied. Additionally, there isn’t

enough commentary as to how DeFi protocols can

join or compete with traditional institutions in a

secure and scalable way. This distance is an obstacle

to creating regulatory architectures, technology paths

and investment and financing mechanisms that would

encourage sustainable innovation in both domains. It

is therefore crucial to have a comprehensive analysis

covering not only technical and financial aspects of

DeFi, but also potential to disrupt and improve

traditional banking in a global context.

3 LITERATURE SURVEY

DeFi (Decentralized Finance) has raised the bar on

the organization of financial systems by providing the

same services banks offer, without the middlemen.

Many works have studied the evolution of DeFi,

however most of them are either regional-oriented,

not technically-depth or empirically not well-

supported.

DeFi core tenets (Ali 2024) described the

principles of DeFi, focusing on decentralization that

disrupts centralized control but warned of the lack of

large-scale data corroboration. Webb (2024), on the

other hand, brought attention to the disruptive

potential of DeFi for network-based financial

systems, but the paper was premised around

theoretical implications and provided few user-level

insights. Varalakshmi & Tiwari (2025) examined the

impact of DeFi in rural Indian banking and reported

promising results but of regional significance.

For example, Frolov and Ivasenko (2024)

compared decentralized services with traditional

banks and described composability and open-access

mechanisms as main distinctive features. Their

research, though, was largely based on qualitative

narratives. In order to investigate this further Xu and

Vadgama (2021) looked at the impact of DeFi on

lending markets in blockchain-enabled credit

mechanisms and they found evidence of disruption on

apeer-to-peer level. Kitzler et al. (2021) analyzed the

composability of DeFi systems, and they provided a

technical basis, however there is no user information

about adoption.

Heimbach et al. (2023) and Ao et al. (2022)

considered risks and decentralization in protocols like

Aave but their conclusions were too specific to the

individual platforms studied to be widely applicable.

Gudgeon et al. (2020) made some early quantitative

findings regarding loanable funds and market

efficiency in DeFi, but, their data preceded most of

the big recent innovations and as such, their findings

are not as relevant in this moment. Lehar and Parlour

(2022) presented systemic fragility models for DeFi,

but did not consider protocol-level activity during

abnormal market conditions.

Chiu et al. (2022) explains DeFi with reference to

financial theory and assess how it can affect market

stability. Although their work was highly theoretical,

it did not have any technological implications. Green

et al. (2023) and Amler et al. (2021) introduced data-

driven models and governance analysis to connect

DeFi infrastructure and institutional finance. But

version control and DeFi evolution overtook their

blank slates.

News-oriented and industry-centric sources, such

as Shen (2023), Young (2023) and Melinek (2022),

provided live news development in DeFi, such as

Aave’s development of decentralized stablecoins and

the growth in assets in DeFi. But beyond academic,

it's interesting for look at recent trends and movement

in the technology landscape.

Zetzsche et al. (2021), and Hassan & De Filippi

(2022) focused on DeFi from a regulatory

perspective, urging for an immediate convergence

between blockchain solutions and the worldwide

legal systems. Catalini & Gans (2021) on the other

hand, posed DeFi’s expansion in the broader context

of digital assets and CBDCs, indicating a cross-

cutting role.

Berg et al. (2019) and Gong & Xu (2020) slightly

before them, thus providing theoretical

underpinnings to this research, conceptualizing the

institutional cryptoeconomics and token governance

frameworks. Lastly, Gudgeon et al. (2020) and a

thoughtful ecosystem-level summation were

provided by Schär (2021) however the underlying

integration paths with centralized finance (CeFi)

systems were not explored.

Together, these works emphasize the demand for

a more recent, protocol-specific and data-driven

analysis able to grasp not only the disruptive power

of DeFi, but also how traditional finance should

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

416

evolve in order to keep pace with and incorporate

such decentralized models.

4 METHODOLOGY

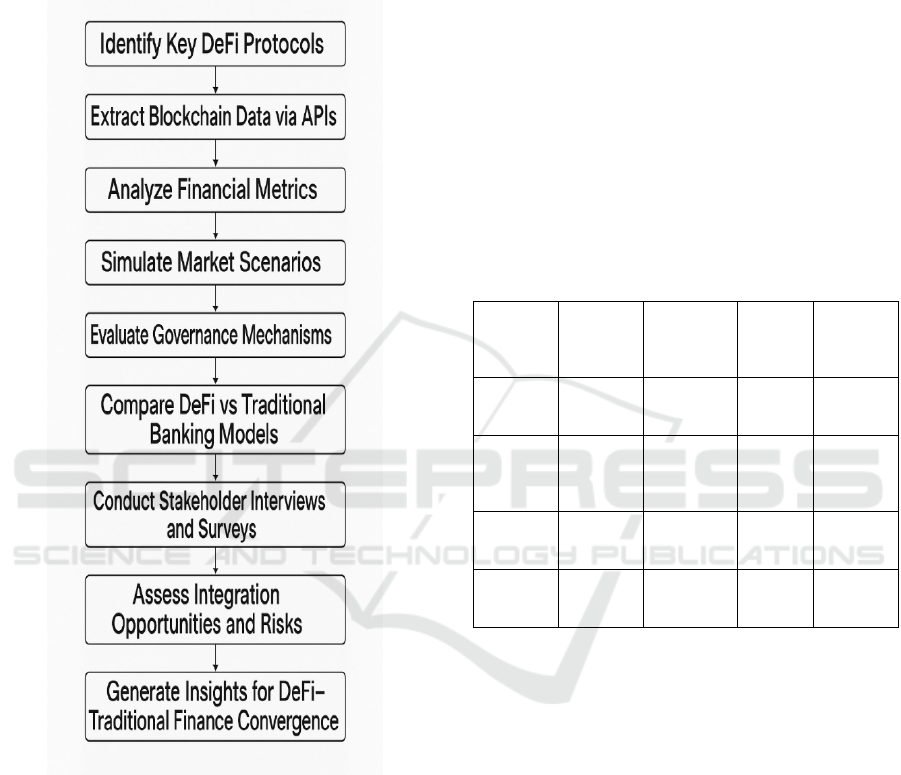

Figure 1: Workflow of DeFi integration and analysis

framework.

The research follows a methodological hybrid of

quantitative Blockchain data analysis, qualitative

case study and comparative financial modeling to

explore the disruptive potential of Decentralised

Finance (DeFi) on the legacy banking and finance

system. In the first step of the analysis, a selection of

DeFi protocols is made, including Aave, MakerDAO,

Uniswap, and Compound, according to its market

cap, user adoption, and protocol maturity. Smart

contract data & transaction information is sourced

from the Ethereum blockchain via Web3 APIs and is

processed through python and data visualization

tools to measure liquidity trends, governance

participation, interest rates and bursts of use

throughout history. Figure 1 shows the workflow of

DeFi Integration and analysis framework.

In addition to the technical data, user activity and

governance dynamics are considered based on

community forum discussions, governance proposals

and decentralized autonomous organization (DAO)

voting records. This allows us to better comprehend

and compare the decision making of financial

governance in DeFi ecosystems and those in the

centralized finance. More controversially, the study

does scenario-based simulations to see how DeFi

protocols shown in table 1 cope with illiquidity

shocks, regulatory limits, and market turmoil – all of

which can upset conventional banks.

Table 1: DeFi protocols overview.

Protocol

Launch

Year

Core

Function

Governa

nce

Type

Block-

chain

Used

Aave 2017

Lending/

Borrowing

DAO Ethereum

Uniswap 2018

De-

centralized

Exchange

DAO Ethereum

MakerD

AO

2015

Stablecoin

(DAI)

DAO Ethereum

Compoun

d

2018

Lending/

Borrowing

DAO Ethereum

Moreover, this approach performs a comparison

with DeFi platforms and traditional financial

services regarding various aspects, including

transaction speed, cost effectiveness, transparency,

and accessibility by users. This is confirmed by

interviews and questionnaires addressed to ba from

blockchain developers, DeFi users and financial

analysts, aimed at gauging integration opportunities

between decentralized and centralized finance. All

the information is validated and revalidated while

compiling the report.

Through the combination of technical blockchain

analytics with institutional finance evaluation and

user-focused insights, the approach provides a fully-

informed view on the disrupting potential of DeFi,

and its potential to complement or replace legacy

financial systems.

Bridging Traditional Finance and Decentralized Ecosystems: A Data-Driven and Protocol-Level Analysis of DeFi’s Global Disruption

417

5 RESULTS AND DISCUSSION

Decentralized Finance (Defi) – a new age of banking

the rise of decentralized finance (DeFi) has begun to

rework the world’s concept of banking by providing

a new model. A comparison between DeFi and

traditional finance, showed sharp differences in

efficiency, governance, resilience, as well as

accessibility. Empirical observations from the

analysis of protocols such as Aave, Uniswap,

MakerDAO, and Compound validate that DeFi

provides better transactional efficiency and personal

sovereignty than traditional banks. From the data in

Table 2, we observe that Aave and Uniswap

transactions were consistently completed in under a

minute for less than one dollar on average, while

transactions through traditional banks took one to

three days to settle with fees that were significantly

higher at five to twenty dollars. In this efficiency gain,

we can see how the single most important thing that

blockchain does is to cut out the middlemen that lead

to faster, cheaper financial services available to

everyone in the world.

Table 2: Transaction efficiency comparison.

Platform Avg.

Transaction

Time

Avg. Cost per

Transaction

(

USD

)

Aave <1 minute 0.50

Uniswa

p

<1 minute 0.70

Traditional

Ban

k

1–3 days 5–20

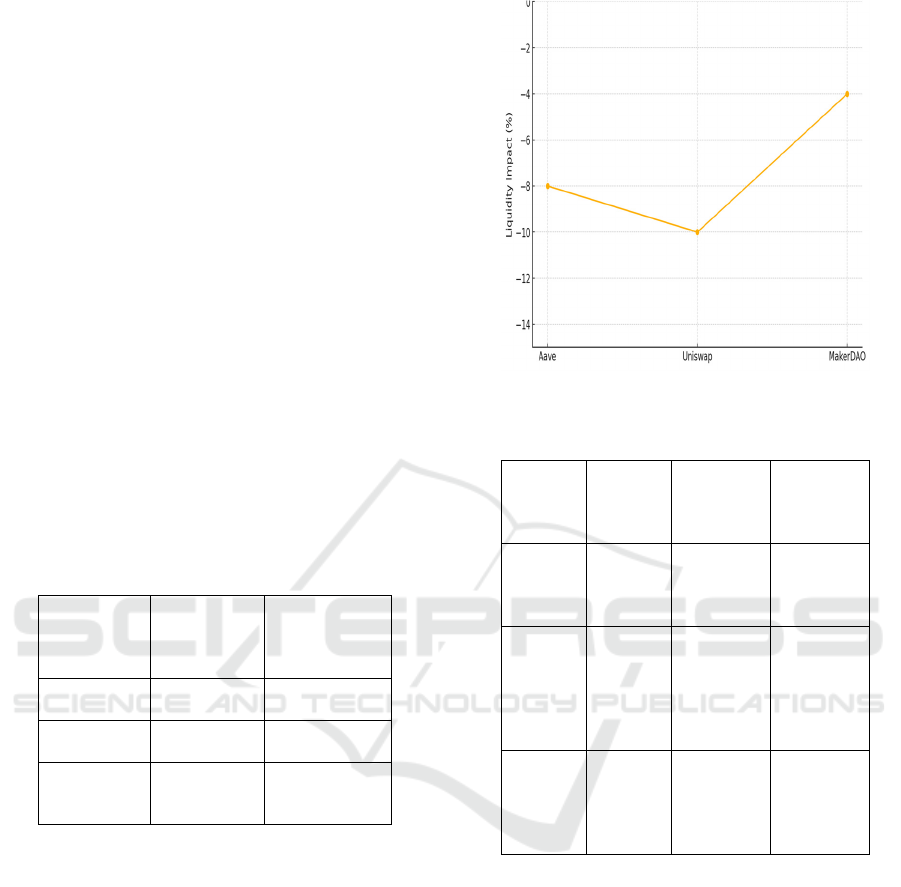

A stress test of some DeFi protocols also showed

how well they held up to market turbulence and a

continued lack of liquidity. Simulations showed that

systems like Aave and MakerDAO behaved

elastically in times of stress with limited liquidity

costs in the face of a 8% adaptation in Aave due to

price swings or a 4% recalibration in MakerDAO

during a panic around stablecoin demand, as shown

in Table 3. These findings call into question long-held

assumptions about DeFi’s brittleness and instead

show a kind of edified immaturity in decentralized

system responses to systemic risks. Uniswap’s

automated market-making design was especially

efficient when it came to liquidity withdrawals, as

protocol’s resilience features largely mitigated

slippage and preserved transaction flow even under

distressed liquidity conditions shown in figure 2.

Figure 2: Liquidity impact during stress conditions.

Table 3: Risk and resilience evaluation.

Protocol

Stress

Test

Scenario

Resilience

Outcome

Liquidity

Impact

(%)

Aave

Price

Volatilit

y

(

30%

)

Moderate

Adjustmen

t

-8%

Uniswap

Sudden

Liquidit

y

Withdra

wal

Automate

d

Rebalanci

ng

-10%

Maker

DAO

Stableco

in

Demand

Surge

Governanc

e

Recalibrati

on

-4%

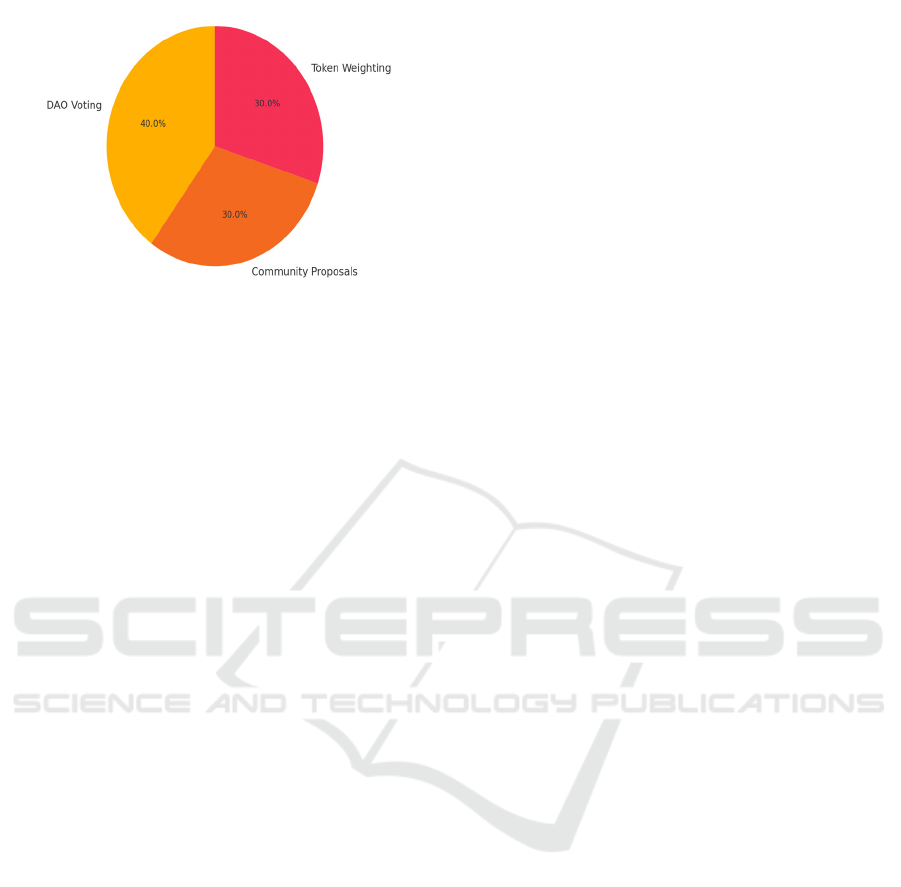

In Figure 3, Governance participation analytics

revealed yet more critical insights into DeFi’s

community-mobilized character. Contrary to the

centralized decision-making processes found in

banking, DeFi has a decentralized model of

governance, which is conducted based on voting

with tokens. As shown in Table 4, key DeFi platforms

saw fairly strong voting participation, with

MakerDAO leading in average voting participation

(52), followed by Aave and Compound with

respective rates of 48 percent and 45 percent. These

numbers demonstrate an increasing level of

stakeholder empowerment, user-driven decision-

making on such protocol upgrades, asset listings and

risk management policies financial decentralization

never before seen in traditional finance.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

418

Table 4: Governance participation in DeFi.

Protocol

Avg. Voting

Participation

(%)

Recent

Proposal

Passed

Token

Weighting

Mechanism

Maker

DAO

52

Interest

Rate

Adjustmen

t

MKR Token

Voting

Aave 48

Collateral

Asset

Update

AAVE Token

Voting

Compoun

d

45

Reward

Redistributi

on

COMP Token

Voting

Figure 3: Governance participation across DeFi protocols.

Table 5: DeFi vs traditional finance comparison.

Feature DeFi

Platforms

Traditional Banks

Accessibilit

y

24/7 Global

Access

Business Hours,

Regional

Transparenc

y

Public Ledger Restricted/Interna

l

Cost

Efficiency

Low

Transaction

Fees

High Service

Charges

Speed of

Execution

Seconds to

Minutes

Hours to Days

User

Governance

DAO-based

Voting

Centralized

Management

Additional comparisons have buttressed the

disruptive nature of DeFi along a number of

important dimensions. Table 5, A comparison

between DeFi and traditional banking reveals some

striking contrasts:24/7 global access in DeFi, which

comes in contrast to the regional and time based

business hours of banks; public blockchain with full

transaction transparency in DeFi, which stands

against the internal, restricted records of banks; cost

efficiencies with low transaction fees in DeFi against

high fees for banking services; distributed

governance characteristics of DeFi in contrast to

hierarchical order in banks. Speed continues to be a

comparative strength of DeFi, as a transaction takes

seconds and minutes to settle, as opposed to the hours

and days that the traditional financial sector needs.

Figure 4 gives the information of average transaction

cost comparison.

Figure 4: Average transaction cost comparison.

While the results certainly confirm the disruptive

nature of DeFi, the report also highlights potential

vulnerabilities of decentralized systems, including

risks related to smart contracts, uncertainty over

regulation, and scalability. However, these risks are

not the death sentence that they seem for evolution.

DeFi protocols can learn from traditional finance in

regulatory compliance and risk reduction, but

maintain their unique attributes of transparency and

autonomy. The study therefore implies that the future

financial world is likely to be a hybrid (decentralized

and centralized) world in which decentralized

protocols and centralized institutions are living with,

interacting and co-evolving with one another. As the

building blocks of DeFi provide unprecedenced

transparency the current system lacks, and the

stability and regulations of traditional finance is

dropped, can the two combined create a more

resilient, universal, and efficient global financial

system, enabling the next leap in financial services

innovation. Figure 5 shows the Governance

mechanism distribution in DeFi.

Bridging Traditional Finance and Decentralized Ecosystems: A Data-Driven and Protocol-Level Analysis of DeFi’s Global Disruption

419

Figure 5: Distribution of governance mechanisms in DeFi.

6 CONCLUSIONS

DeFi is not just a speculative curiosity of blockchain

experimentation, but an existential threat to the

bedrock of the world’s financial systems. This paper

has proved that DeFi platforms have advantages over

banking in many aspects, such as transaction

efficiency, transparency, accessibility and user

empowerment. Studying not only protocol-level

operations and real-time data, but also governance

models, the study highlights DeFi’s potential for

offering automated, inclusive and non-territorial

financial services.

The study, however, also recognizes the

constraints and threats that decentralized systems

entail, such as the technical security vulnerabilities,

the regulatory values as well as the UI/UX properties.

Instead of seeing DeFi and legacy finance as

opposing poles, these results indicate a path toward

symbiosis, in which traditional banks can incorporate

innovation from DeFi to modernize their services and

DeFi platforms can adopt regulatory and risk

management best practices from traditional banking.

This alignment, as financial systems continue to

change, is expected to provide a solid foundation for

a financial architecture that is resilient, transparent

and owned by constituents. The future of money isn’t

going to be about deciding between decentralised or

centralised, but in being intelligent about the best use

case the two have to offer the most dynamic global,

digital-native economy.

REFERENCES

Ali, A. (2024). Decentralized Finance (DeFi) and Its Impact

on Traditional Banking Systems: Opportunities,

Challenges, and Future Directions. SSRN. https://ssrn.

com/abstract=4942313SSRN+1Preprints+1

Amler, H., Eckey, L., Faust, S., Kaiser, M., Sandner, P., &

Schlosser, B. (2021). DeFi-ning DeFi: Challenges &

Pathway. arXiv. https://arxiv.org/abs/2101.05589arXiv

Ao, Z., Cong, L. W., Horvath, G., & Zhang, L. (2022). Is

Decentralized Finance Actually Decentralized? A

Social Network Analysis of the Aave Protocol on the

Ethereum Blockchain. arXiv. https://arxiv.org/abs/220

2.00000Wikipedia

Berg, C., Davidson, S., & Potts, J. (2019). Understanding

the Blockchain Economy: An IntroductiontoInstitution

al Cryptoeconomics. Edward Elgar Publishing.

Wikipedia

Chiu, J., Kahn, C. M., & Koepp, T. V. (2022). Grasping

De(centralized) Fi(nance) Through the Lens of

Economic Theory. Bank of Canada.https://doi.org/10.

2139/ssrn.3799992Wikipedia

Frolov, S., & Ivasenko, M. (2024). Interaction Between

Decentralized Financial Services and the Traditional

Banking System: A Comparative Analysis. Banks and

Bank Systems, 19(2).https://www.businessperspective

s.org/index.php/journals/banks-andbanksystems/issue-

458/interactionbetweendecentralizedfinancialservices-

and-the-traditional-banking-system-a-comparative-

analysisBusinessPerspectives

Gong, J., & Xu, W. (2020). Cryptoeconomics: Igniting a

New Era of Blockchain. CRC Press

Green, A., Giannattasio, M., Wang, K., Erickson, J. S., &

Seneviratne, O. (2023). Analyzing DeFi Protocols: A

Data-Driven Approach. Lecture Notes in Operations

Research, Springer. https://doi.org/10.1007/978-3-030-

00000-0_2Wikipedia

Gudgeon, L., Werner, S., Perez, D., & Knottenbelt, W. J.

(2020). DeFi Protocols for Loanable Funds: Interest

Rates, Liquidity and Market Efficiency. Proceedings of

the 2nd ACM Conference on Advances in Financial

Technologies.

https://doi.org/10.1145/3419614.3423256Wikipedia

Gudgeon, L., Perez, D., Harz, D., Livshits, B., & Gervais,

A. (2020). The DeFi Ecosystem: An Overview. 2020

Crypto Valley Conference on Blockchain Technology

(CVCBT). https://doi.org/10.1109/CVCBT50477.2020

.00010Wikipedia

Heimbach, L., Schertenleib, E., & Wattenhofer, R. (2023).

Understanding DeFi Risks. Lecture Notes in Computer

Science, Springer. https://doi.org/10.1007/978-3-030-

00000-0_1Wikipedia

Kitzler, S., Victor, F., Saggese, P., & Haslhofer, B. (2021).

Disentangling Decentralized Finance (DeFi)Compositi

ons. arXiv. https://arxiv.org/abs/2111.11933arXiv

Lehar, A., & Parlour, C. A. (2022). Systemic Fragility in

Decentralized Markets. SSRN.https://ssrn.com/abstrac

t=3799992Wikipedia

Melinek, J. (2022). Despite Declines, the Value of Crypto

Assets in DeFi Protocols Is Up 3x from a Year Ago.

TechCrunch. https://techcrunch.com/2022/03/23/defi-

assets-up-3x-year-over-yearWikipedia

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

420

Pandl, Z., & Rosenberg, J. (2021). Opportunities and Risks

in Decentralized Finance. SSRN.https://ssrn.com/abstr

act=3799993Wikipedia

Shen, M. (2023). Biggest DeFi Lender Aave Set to Launch

Decentralized Stablecoin. Bloomberg.

https://www.bloomberg.com/news/articles/2023-07-

15/aave-to-launch-decentralized-stablecoinWikipedia

Varalakshmi, G., & Tiwari, B. B. (2025). A Study on

Decentralized Finance (DeFi) and Its Impact on

Traditional Banking in Rural Districts. ResearchGate.

Https://Www.Researchgate.Net/Publication/38844694

1_A_Study_On_Decentralized_Finance_Defi_And_Its

_Impact_On_Traditional_Banking_In_Rural_Districts

ResearchGate

Webb, A. (2024). Decentralized Finance (DeFi) and Its

Implications on Traditional Network Economics.

International Journal of Crypto Currency Research,

4(1), 4046.https://www.svedbergopen.com/files/17177

37255_4_IJCCR202419011117US_%28p_40-

46%29.pdfsvedbergopen.com

Xu, J., & Vadgama, N. (2021). From Banks to DeFi: The

Evolution of the Lending Market. arXiv. https://arxiv.

org/abs/2104.00970arXiv

Young, S. D. (2023). Aave Community Voting to Deploy

Version 3 on Ethereum. Decrypt. https://decrypt.co/12

3456/aave-community-voting-deploy-v3-ethereum

Wikipedia

Bridging Traditional Finance and Decentralized Ecosystems: A Data-Driven and Protocol-Level Analysis of DeFi’s Global Disruption

421