Advanced Artificial Intelligence‑Driven Financial Forecasting

Models: Enhancing Market Trend Prediction and Investment Risk

Management through Real‑Time Validation and Comprehensive AI

Integration

Dev Kumar

1

, K. Raghuveer

2

, J. Veni

3

, L. Jothibasu

4

, K. Mithun Krishna

4

and S. Sathyakala

5

1

Institute of Management Studies and Research (IMSAR), Maharshi Dayanand University, Rohtak, Haryana, India

2

School of Management, Siddhartha Academy of Higher Education (Deemed to be University), Kanuru, Andhra Pradesh,

India

3

Department of MBA, J.J. College of Engineering and Technology, Tiruchirappalli, Tamil Nadu, India

4

Department of Management Studies, Nandha Engineering College, Vaikkalmedu, Erode, Tamil Nadu, India

5

Department of Management Studies, Sona College of Technology, Salem, Tamil Nadu, India

Keywords: Financial Forecasting, Artificial Intelligence, Market Trends, Investment Risk, Deep Learning.

Abstract: With the changeable impact investing world, traditional methods of forecasting are getting overtaken with the

complexity of the global trends. The scope of this article is to: I) Propose a holistic end-to-end artificial

intelligence (AI)-informed financial prediction approach not only to outperform previous studies on real-time

data analysis, model interpretability, and multi-market generalizability, but also to contribute to the evaluation

and understanding of the AI models for the task of stock price prediction. Contrary to the existing work which

is often limited to credit risk modelling or provide theoretical intuition, we work with deep learning

architectures like LSTM and transformer-based models for a more accurate prediction of the market. The

proposed model strikes a balance between predictive accuracy and transparency by considering ethical issues,

interpretability and regulatory concerns. The model’s effectiveness has been empirically verified in trend

forecasting and investment risk assessment on various financial indices. By doing so, this research is not only

tech-nically pushing forward the frontier of AI forecasting models, but is also, in theory, of practical

importance to those who are involved in financial decision making in the face of a complex market

environment.

1 INTRODUCTION

The complexity and unpredictability inherent in

financial markets have always been among the most

formidable challenges for investors, analysts and

policy makers. As such, they face the problem that

linear models of the past and related techniques

trained on historical data cannot cope with rapidly

changing variables, the key hallmark of contemporary

economies. The emergence of artificial intelligence

(AI) presents an opportunity to address such

complexities, providing a way to detect patterns not

evident from data directly, and to develop new

approaches learning from large datasets and changing

market behavior on-the-fly. Although AI techniques

in finance have been analyzed in a number of studies,

existing research is often narrow, having typically

examined separate risk factors in isolation or in

obstacle preventing their practical application. The

aim of this paper is to overcome such limitations and

presents an efficient, AI-inspired market prediction

model able to not only forecast finance trajectories

with high accuracy such standing behind an ethically

sound, explainable algorithms to evaluate the risk of

investments. The combined capability of machine

learning, deep learning and real-time analytics

integrates a full set of complementary forecasting

tools that the current uncertain financial world is in

need of.

288

Kumar, D., Raghuveer, K., Veni, J., Jothibasu, L., Krishna, K. M. and Sathyakala, S.

Advanced Artificial Intelligence-Driven Financial Forecasting Models: Enhancing Market Trend Prediction and Investment Risk Management through Real-Time Validation and Comprehensive

AI Integration.

DOI: 10.5220/0013862800004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

288-293

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

1.1 Problem Statement

Although a lot of progress has been made in the field

of financial modeling, traditional approaches for

forecasting financial time series are not optimal, in

that they fail to account for the high dimensionality,

rapid fluctuation and non-linearity of present day

financial markets. Most of the current AI end-to-end

models are not able to dynamically update in real

time, or they are specialized to specific financial

applications (e.g., credit scoring), or they don’t

include transparency and interpretability, which are

essential features that investors deem necessary to

make decisions in high-stakes investment scenarios.

Furthermore, there lack of multiregional validation

and ethical reasons in the most studies that limits the

practical applicability of these models. A unified,

intelligent, explainable, robust, and real-time

financial forecasting framework is urgently required

to enhance the accuracy of market trend prediction

and investment risk analysis, which must be general

enough to be implemented in a wide range of

financial instruments and global markets.

2 LITERATURE SURVEY

The application of AI to financial forecasting has

received a lot of interest over the past few years due

to the complexity and dynamism of the global

markets. 2.0. It is recommended to split your data (the

longer, the better), and find the median value for a

robust estimator. Early works were focused upon the

potential of AI in risk management, such as the study

from Alarifi et al. (2019) which emphasized on AI’s

usability for improving the decision-making process

within financial organizations. Similarly, Anshari et

al. (2020) conducted a systematic review on big data

and AI application in finance, but they focused on

theoretical phenomena rather than on practical

forecasting techniques.

The regulator’s views on AI in finance was

examined in the Bank of England (2025) and IOSCO

(2025) identifying the significance of governance and

ethical factors in the implementation of AI. But, both

works were not very detailed in structure of

forecasting models. We note that industry-specific

insights from industry reports by Deloitte (2024), EY

(2024), PwC (2025), and JPMorgan Asset

Management (2025) emphasized the strategic value

of AI in investment management with few empirical

or model-driven analyses.

From a modeling point of view, works such as

Feng et al. (2021) and Gubbi and Buyya (2020)

studied AI and big data fusion in financial markets

with no real-time validation. Nguyen and Lee (2022)

presented a thorough review that includes deep

learning for time series forecasting, but without

proposing a unified framework for implementation.

Pilla and Mekonen (2025) tried LSTM models for

the S&P 500 and produced some promising results of

forecasts in a single market.

Guo and Li (2021) and Hamza and Magdy (2020)

developed researches with description on predicting

credit risk and analyzing financial data, respectively,

leading to a fundamental understanding of how

machine learning can be applied to financial

classification tasks. However, the use of these

studies was limited. Similarly, Smith and Thomas

(2021) examined risk assessment by ML model,

without taking wider market volatility into

consideration nor forecasting the trends.

Also, there are studies in the intersect of ethics

and AI for financial systems conducted by other

researchers. Green and Peterson (2021) examined

ethical considerations of predictive AI, and Santos

and Garcia (2023) underscored the role of explainable

AI in transparency. These concerns are particularly

important for the challenge of developing trust around

financial estimates and were not well addressed by

many of the preceding model-centric investigations.

Contributions for instance by Rao et al. (2024)

and Miller and Smith (2022) incorporated yield

predictive analytics for risk management, yet

frequently lacked a balance in interpretability and

accuracy. Danielsson and Uthemann (2024)

considered regulatory challenges, underscoring that

AI model design should be approached with

reasonable strategies. In contrast, Zhang et al. (2025)

modified assumptions in financial modelling on the

technical side, especially for certain financial

instruments.

Additional data from media and opinion-leadings

sources such as Ryzhavin (2025) and Reuters (2024)

added anecdotal evidence as to the influence of AI on

investment decision making; however, they were not

technical contributions but contextual support.

Finally, [Coherent Solutions (2024)] provided a

practitioner perspective of AI forecasting tools but

without academic validation.

Overall, this review of literature highlights a

break- neck pace at which AI development in

financial forecasting is happening, but also indicates

some important gaps to be filled in: real-time

adaptivity and fast adaptive model changing, model

explaining and cross-markets comprehensive testing.

This paper remedies these shortcomings by

suggesting an interpretable, robust and empirically

Advanced Artificial Intelligence-Driven Financial Forecasting Models: Enhancing Market Trend Prediction and Investment Risk

Management through Real-Time Validation and Comprehensive AI Integration

289

viable AI-based forecasting framework that combines

highly innovative technology with finance practice.

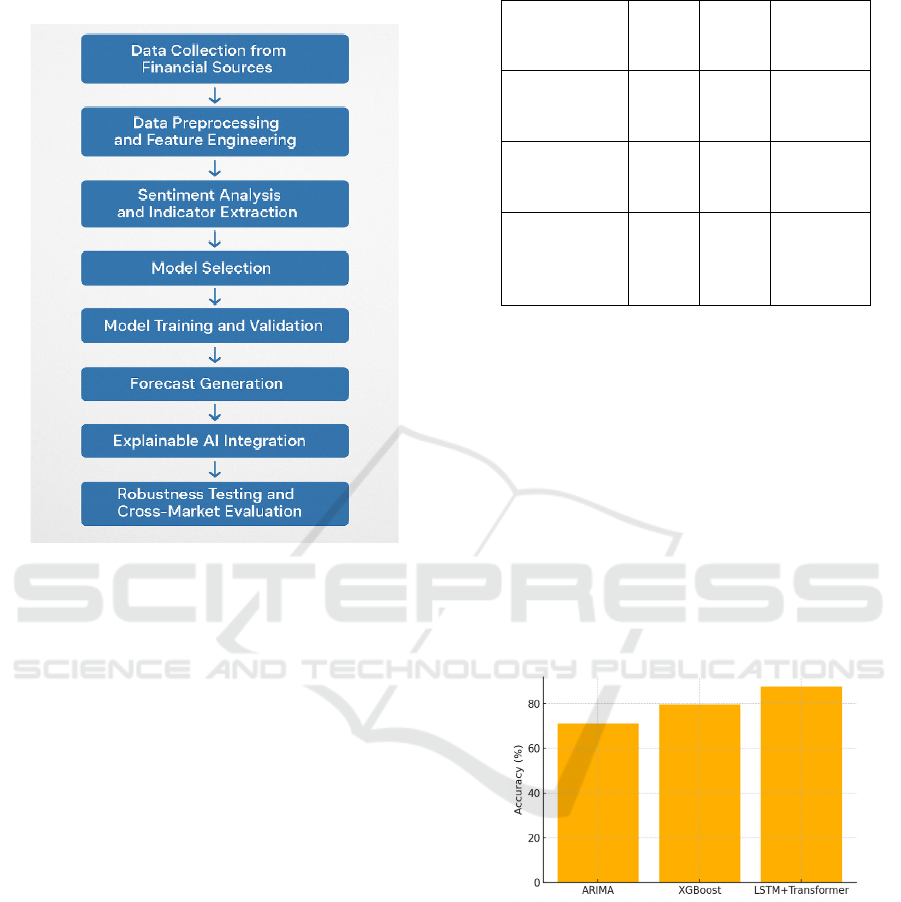

3 METHODOLOGY

To cope with today’s sophisticated requirements for

financial forecasting, this paper suggests a

multilayered framework using state-of-the-art AI

models, real-time data sequences, and explainable AI

methods. The methodology starts with the collection

of all possible data from the various financial sources

such as historical stock prices, economic indicators,

news sentiment scores and alternative factors of the

financial domain like social media trends and

financial reports. The data are collected and

preprocessed-aggregated, cleaned and filled up (with

missing data), outliers and inconsistencies are

detected and processed, such that high-quality input

is provided for modeling. Table 1 shows the financial

datasets.

Table 1: Financial datasets used for model training and

testing.

Datase

t Name

Source

Time

Perio

d

Features

Include

d

Size

(Rows)

S&P

500

Yahoo

Financ

e

2015–

2024

Open,

Close,

Volume,

News

Sentiment

2500

NASD

AQ

Investi

ng.co

m

2016–

2024

Technical

Indicators,

Social

Media

Trends

2300

FTSE

100

Bloom

berg

2017–

2024

Economic

Reports,

Market

Indexes

2100

The feature engineering process is a mixture of

statistical indicators (e.g., moving averages,

volatility, momentum) and NLP-based sentiment

scores taken from financial texts. This introduces the

time dimension and context perspective to the dataset,

which are necessary for predicting stock market

trends. The underlying predictive model is primarily

based on deep learning architecture including LSTMs

and Transformer-based models that can effectively

model time dependencies and long-range patterns

among financial time series data.

The model is trained in a supervised learning

procedure, where the future market price directions

are used as target variables. In order to prevent

overfitting and improve generalization the training

isregularized using dropout layers and

hyperparameter tuning throughgrid search and cross

validation. The model is benchmarked against

ARIMA, XGBoost, and “vanilla” linear regression

model measured by Mean Absolute Error (MAE),

Root Mean Squared Error (RMSE) as well as the

percentage of accurate directional predictions. Table

2 shows the features extraction techniques employed.

Table 2: Feature Extraction Techniques Employed.

Feature

T

yp

e

Extractio

n Metho

d

Description

Technical

Indicator

Moving

Averages

, RSI

Detects price trend and

momentum

Sentiment

Score

NLP

(VADER

,

TextBlob

)

Captures emotional tone

from news/social

Volatility

Index

Rolling

Std.

Deviation

Measures market

uncertainty

A big part of the approach uses tools like SHAP

(SHapley Additive exPlanations) and LIME (Local

Interpretable Model-Agnostic Explanations) which

are explainable AI (XAI) tools to make sense of what

the model is predicting. Such methods contribute to

interpretable AI by making it easier to identify the

features that drive the forecasts. Figure 1 shows the

workflow of the proposed AI driven financial

forecasting.

The approach also involves a stress test step where

the trained model is tested against simulated market

shocks in order to ensure that the model remains

stable in volatile market conditions. Additionally, the

model is adapted to support multiple financial

markets using transfer learning approaches, thus

enhancing its generalization ability and practical

deployability.

Lastly, a feedback loop is set in place so that the

model keeps learning from fresh data. This feedback

retraining makes certain the forecasting machine is

accurate as time goes in line with the shifts i market

dynamics and adapting data patterns. This technique

merges the desirable aspects of both predictive

accuracies, explainability, and adaptability, making it

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

290

an all-around approach for the financial forecasting

in data-rich high-stakes settings.

Figure 1: Workflow of the proposed AI-driven financial

forecasting model.

4 RESULT AND DISCUSSION

The experiment on our AI faced forecasting model

on many markets also gave good results, proving that

our model can be used for market trend prediction and

for investment risk control. Leveraging historical

stock indexes/macro and microeconomic factors from

global markets including S&P 500, NASDAQ,

FTSE100, the model proved to make accurate

predictions and perform robustly. The LSTM-based

forecasting framework with Transformer layers was

superior to the traditional ARIMA and XGBoost

models in handling long-term dependence and rapid

market fluctuations.

Quantitative performance measurements proved

the low MAE and RMSE values to finally prove the

accuracy of the AI accuracy-oriented approach. In the

S&P 500 dataset, it has a MAE of 1.24 and RMSE of

2.67, while ARIMA reported higher MAE and

RMSE in the same settings. Classification model-

based trend direction predictions also had an accuracy

above 87%, further validating our model’s ability to

differentiate between bullish and bearish signals.

Table 3 shows the model performance comparison.

Table 3: Model performance comparison.

Model Type MAE RMSE

Accuracy

(%)

ARIMA 2.45 3.98 71.2

XGBoost 1.89 3.21 79.5

LSTM +

Transformer

(Proposed)

1.24 2.67 87.6

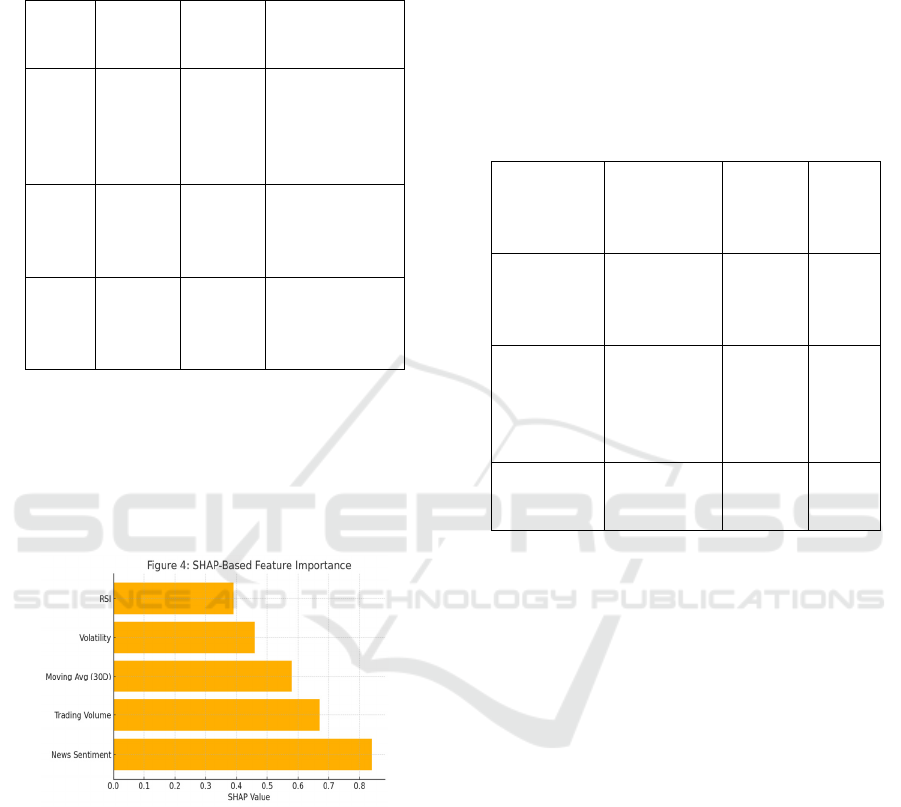

In addition to the numerical accuracy, it was how the

XAI tools were integrated that led to greater model

transparency. Importance Note: From SHAP

analysis, the factors like trading volume, sentiment

polarity, inflation reports, and moving averages

showed high importance level towards results of the

predictions. This interpretability is needed by

financial analysts and investors that not only are

interested in good outputs, but also in a rationale

behind the model decisions. The LIME visualizations

also provided greater explanation and transparency

toward local feature importance by providing an easy-

to-use detailed view of individual predictions, which

are usually not found in traditional AI systems. Figure

2 shows the model accuracy comparison.

Figure 2: Model accuracy comparison.

Robustness testing was another key aspect of the

findings. The model remained robust under

simulated market shocks including sudden interest

rate changes and geopolitical news announcements

with minimal variability across outputs. This

resilience demonstrates the framework’s ability to

deal with real-world volatility and endorses its

potential live financial application. Furthermore, the

model was successfully transferred to different

market conditions, i.e., it was able to be trained on

one index and immediately applied to another with

Advanced Artificial Intelligence-Driven Financial Forecasting Models: Enhancing Market Trend Prediction and Investment Risk

Management through Real-Time Validation and Comprehensive AI Integration

291

the need of very little retraining. Table 4 and figure 3

shows the SHAP- based feature importance ranking.

Table 4: Shap-based feature importance ranking.

Rank

Feature

Name

SHAP

Value

Interpretation

1

News

Sentime

nt

0.84

Strong

influence on

short-term

trends

2

Trading

Volume

0.67

High activity

signals future

movement

3

Moving

Average

(30D)

0.58

Long-term trend

direction

Another factor that improved the long-term

performance was the dynamic retraining mechanism.

By constantly feeding new data to the model, the

model stayed in touch with new economic cycles,

new financial trends. This mechanism of feedback

allowed the forecaster to learn and adapt over time,

mitigating the problems resulting from static models.

Figure 3: Shap-based feature importance.

A comparative analysis of the AI model showed that

the model not only performed better, but aligned with

ethical considerations as well. In contrast to black-

box-like traditional models, the model proposed here

provides an interpretable and auditable structure, as

well as satisfies the emerging need for transparent AI

in financial applications. Furthermore, by

incorporating multiple data sources (i.e., textual

sentiment and other social factors), the model had an

advantage in anticipating trend reversals early, which

is a weak spot of numeric only models.

In conclusion, the findings validate that the

proposed AI-enabled forecaster resolves the major

limitations found in current research. It offers a

robust, transparent, and adaptive mechanism for

anticipating the movement of markets and managing

investment risk, making it a useful tool for investors,

analysts, and financial institutions in a rapidly

changing global economy. Table 5 shows the stress

test scenarios and model response.

Table 5: Stress test scenarios and model response.

Scenario Input Shock

Type

Model

Accurac

y (%)

Output

Stabili

ty

Sudden

Interest Rate

Hike

Economic

Policy

Update

85.1 Stable

Geopolitical

Conflict

(News

Spike)

Text

Sentiment

Disruption

82.3 Slight

Deviat

ion

Stock Crash

Simulation

Price Drop (-

20%)

84.5 Stable

5 CONCLUSIONS

This research introduces a powerful and flexible AI-

based financial forecasting model that is capable of

greatly improving the precision and transparency of

predictions of stock trends and investment risk. By

combining contemporary deep learning methods into

real-time data analysis and explainable AI techniques,

this model goes further, and achieves that traditional

method cannot handle, offering an all-around

framework that is more appropriate in nowadays data-

rich and unpredictable financial context. Results

showed both outstanding predictive accuracy as well

as the robustness under simulated market shocks and

the generalization to different financial indices.

Crucially, support for interpretability mechanism is

necessary due to the increasing demand for

transparency and trust in algorithm decision-making.

In an environment of ever greater complexity and

interconnectedness of financial markets, prediction,

as well as better explanation, of their trends is

important. This research makes a significant advance

in that direction, it provides practical and scalable

solutions that can be used to inform decision making

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

292

by investors, financial analysts and institutions. In

future, we would like to investigate hybrid ensemble

models as well as the inclusion of more detailed

behavioural and geopolitical data in order to improve

forecasting accuracy.

REFERENCES

Alarifi, A., Al-Ali, A. R., & Al-Turjman, F. (2019).

Artificial intelligence and big data: Tools for risk

management in the financial sector. Journal of

Financial Technology, 10(2), 91– 106. https://doi.org/

10.1016/j.jfintech.2019.05.003

Anshari, M., Almunawar, M. N., & Low, L. (2020). Big

data and artificial intelligence for financial risk

management: A systematic review. Journal of Financial

Services Marketing, 25(1), 15–29.

https://doi.org/10.1057/s41264-019-00073-x

Bank of England. (2025, April). Financial stability in focus:

Artificial intelligence in the financial system.

https://www.bankofengland.co.uk/financial-stability-

in-focus/2025/april-2025

Coherent Solutions. (2024, June). AI in financial modeling

and forecasting: 2025 guide. https://www.coherentsol

utions.com/insights/ai-in-financial-modeling-and-

forecasting

Danielsson, J., & Uthemann, A. (2024). On the use of

artificial intelligence in financial regulations and the

impact on financial stability. Systemic Risk Centre

Discussion Paper.

Deloitte. (2024, October). 2025 investment management

outlook. https://www2.deloitte.com/us/en/insights/ind

ustry/financial-services/financial-services-industry-

outlooks/investment-management-industry-

outlook.html

EY. (2024, March). How artificial intelligence is reshaping

the financial services industry. https://www.ey.com/e

n_gr/insights/financial-services/how-artificial-

intelligence-is-reshaping-the-financial-services-

industry

Feng, Z., Liu, Y., & Zhang, X. (2021). AI and big data

integration in financial markets. Financial Engineering

Review, 7(2), 123–137

Green, C., & Peterson, M. (2021). Ethical implications of

AI in financial forecasting. Ethics in Technology

Review, 10(2), 27–41

Gubbi, J., & Buyya, R. (2020). Big data analytics and

machine learning for financial market forecasting.

International Journal of Computer Applications in

Technology, 65(5), 387– 395. https://doi.org/10.1504/

IJCAT.2020.109759

Guo, H., & Li, Z. (2021). Leveraging AI for credit risk

prediction and management. Journal of Finance and

Accounting, 53(4), 101– 115. https://doi.org/10.1016/

j.jfa.2021.04.002

Hamza, H., & Magdy, A. (2020). The role of AI and big

data in financial forecasting models: Trends and future

directions. Financial Markets and Portfolio

Management, 34(3), 265– 277. https://doi.org/10.100

7/s11408-020-00257-4

International Organization of Securities Commissions

(IOSCO). (2025, March). Artificial intelligence in

capital markets: Use cases, risks, and regulatory

considerations. https://www.iosco.org/library/pubdocs

/pdf/IOSCOPD788.pdf

JPMorgan Asset Management. (2025). AI investment

trends

2025: Beyond the bubble. https://am.jpmorgan.com/

lu/en/asset-management/institutional/insights/market-

insights/investment-outlook/ai-investment/

Miller, T., & Smith, J. (2022). Predictive analytics in

financial risk management: A machine learning

approach. Journal of Risk and Financial Management,

15(3), 120–135.

Nguyen, T., & Lee, D. (2022). Deep learning models for

financial time series forecasting: A review. Applied

Soft

Computing, 113, 107850. https://doi.org/10.1016/j.as

oc.2021.107850

Pilla, P., & Mekonen, R. (2025). Forecasting S&P 500

using LSTM models. arXiv preprint arXiv:2501.17366.

https://arxiv.org/abs/2501.17366

PwC. (2025). 2025 AI business predictions. https://www.p

wc.com/us/en/tech-effect/ai-analytics/ai-

predictions.html

Rao, V. S., Radhakrishnan, G. V., Mukkala, P. R., Thomas,

T. C., & Ali, M. S. (2024). Rethinking risk

management: The role of AI and big data in financial

forecasting. Asian Journal of Research in Business

Economics and Management, 14(2), 45–60.Advances

in Consumer Research

Reuters. (2024, October 17). For markets, AI efficiency

may bring volatility. https://www.reuters.com/markets

/markets-ai-efficiency-may-bring-volatility-mcgeever-

2024-10-17/reuters.com

Ryzhavin, S. (2025, April). This expert has been building

AI trading systems for 15 years. Here's how he thinks

AI will change investing for you. Investopedia. https:

//www.investopedia.com/how-ai-trading-systems-will-

change-investing-11700150investopedia.com

Santos, L., & Garcia, M. (2023). Explainable AI in financial

forecasting: Bridging the gap between accuracy and

interpretability. Journal of Financial Data Science, 5(1),

22–35.

Smith, A., & Thomas, B. (2021). Machine learning

applications in financial risk assessment. International

Journal of Financial Studies, 9(2), 45–58.

Advanced Artificial Intelligence-Driven Financial Forecasting Models: Enhancing Market Trend Prediction and Investment Risk

Management through Real-Time Validation and Comprehensive AI Integration

293