A Study on the Optimization of Aviation Manufacturing Supply

Chain Management Models Based on Green Development Principles

Yaoxuan Cheng

a

Institute of Foreign Languages, Civil Aviation University of China, Tianjin, China

Keywords: Sustainable Aviation Fuel, End-of-Life Aircraft, Green Development, Supply Chain Management, CORSIA.

Abstract: In the context of decarbonization and circular economy imperatives, this study examines how aviation

manufacturing supply chains can be optimized under green development principles by integrating sustainable

aviation fuel (SAF) and end-of-life (EOL) aircraft treatment strategies. Key findings from industry data

indicate that global SAF output remains minimal (approximately 1.3×10^9 L or ~0.3% of jet fuel demand in

2024). SAF production is constrained by high costs (often 2–8 times that of fossil kerosene) and requires

substantial new infrastructure for blending and distribution. International policies like ICAO’s CORSIA and

the EU’s SAF mandates impose strict sustainability criteria and blending targets, shaping SAF deployment

and viability. In parallel, effective EOL management can recover nearly all aircraft components: rigorous

dismantling processes allow >99% of engine parts and major airframe metals to be salvaged. For example,

recycled carbon fiber from decommissioned planes can cut energy consumption by ~98% compared to new

composites, exemplifying circular-economy benefits. These findings underscore that aligning SAF adoption

and aircraft recycling with policy frameworks (e.g., CORSIA) enables a low-carbon, resource-efficient

aviation supply chain. The study outlines how optimized supply chain models can incorporate these green

strategies to meet future environmental targets.

1 INTRODUCTION

The aviation industry faces mounting pressure to

reduce its environmental impact, aligning with global

climate commitments (International Civil Aviation

Organization [ICAO], 2022). Air traffic is projected

to roughly double in the next two decades, driving a

surge in both new aircraft deliveries and retired (end-

of-life, EOL) airframes. In this context, the principles

of green development and circular economy are

increasingly emphasized. Two key strategies have

emerged: the use of sustainable aviation fuel (SAF)

and the circular management of decommissioned

aircraft. SAF can lower the carbon intensity of flight

operations, while EOL practices focus on salvaging

materials from retired planes. SAF has drawn

significant attention as an immediate carbon-

reduction option. However, current SAF production

is extremely limited. For instance, IATA (2024)

reports that global SAF output in 2024 was only about

1.3×10^9 liters (around 0.3% of annual jet fuel

demand), well below the volumes needed for

a

https://orcid.org/0009-0009-2831-5956

meaningful decarbonization. At the same time, SAF

is much more expensive than fossil jet fuel. Techno-

economic analyses find that SAF pathways (e.g.,

HEFA, Fischer–Tropsch, Alcohol-to-Jet) often cost

several times more per liter than conventional fuel. As

a result, large investments or subsidies are needed to

expand SAF production. Integrating SAF into the fuel

supply chain also imposes technical requirements: for

example, SAF must be blended (typically ≤50%) with

conventional kerosene under ASTM standards,

necessitating new storage, metering, and certification

steps. International policies are driving SAF

deployment but also imposing strict sustainability

criteria. The ICAO CORSIA scheme (ICAO, 2022)

allows airlines to meet carbon-offset obligations with

SAF, provided it achieves a minimum life cycle GHG

reduction and avoids feedstocks from deforested or

high-carbon lands. Similarly, the European Union’s

ReFuelEU Aviation initiative (European Union

Aviation Safety Agency [EASA], 2024) mandates

rising SAF blending rates (for example, 2% by 2025,

rising to 70% by 2050). These policies aim to ensure

772

Cheng, Y.

A Study on the Optimization of Aviation Manufacturing Supply Chain Management Models Based on Green Development Principles.

DOI: 10.5220/0013860700004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 772-778

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

that SAF delivers genuine carbon benefits, but they

also elevate costs and restrict eligible feedstock

choices (e.g., excluding virgin palm oil from cleared

lands). Such regulatory trends underscore that SAF

supply chain models must not only scale up

production but also comply with sustainability

constraints. In parallel with fuel strategies, managing

aircraft at EOL is emerging as a crucial component of

sustainable aviation. Analysts note that effective EOL

treatment can confer a competitive advantage and

reduce life-cycle impacts. Practically, EOL

processing involves careful disassembly and material

recovery. Industry data indicate that more than 99%

of an aircraft’s engine components can be salvaged

and reused. Similarly, the major airframe alloys (e.g.

aluminum, steel, and titanium) and composite

materials are recovered from retired planes (de Jong,

2027). These recovered materials are recycled into

new products, exemplifying a circular economic

approach. For example, recycled carbon fiber from

decommissioned aircraft can cut manufacturing

energy use by about 98% compared to virgin

composites (Asmatulu et al., 2013). Thus, EOL

recycling conserves resources and reduces emissions,

and its importance is reflected in industry guidelines

and standards for aircraft dismantling and recycling.

Optimizing aviation supply chains to integrate SAF

and EOL processes thus requires addressing both

technological and logistical challenges.

Technologically, SAF production pathways vary in

maturity, yields, and cost (Ng et al., 2021) and

blending SAF into fuel networks demands

appropriate infrastructure and quality assurance.

Logistically, existing fuel systems must adapt: many

SAF plants lack direct pipeline connections and must

transport fuel by truck or rail. Upgrading fuel

terminals with dedicated blending tanks and testing

labs adds capital expense. Moreover, collecting

dispersed biomass feedstocks (such as used cooking

oil or agricultural residues) can be complex; studies

note that the current feedstock supply may be

insufficient for projected SAF targets. In parallel,

EOL supply chain integration involves coordination

between airlines, recyclers, and regulatory bodies to

safely recover parts and materials without disrupting

operations. Overcoming these challenges through

new coordination, equipment, and processes is

essential if the aviation supply chain is to meet green

development goals. Integrating SAF and EOL

management into these supply chains is the focus of

this study, which aims to propose optimized models

that align with green development targets. The

remainder of this paper is organized as follows.

Section 2 reviews the literature on SAF and aircraft

recycling. Section 3 examines SAF production,

supply chain integration challenges, and key policy

frameworks (including CORSIA and EU mandates),

and discusses EOL aircraft treatment within the

aviation supply chain. Finally, Section 4 concludes by

summarizing insights and outlining recommendations

for optimizing aviation manufacturing supply chain

models under green development principles.

2 SUSTAINABLE AVIATION

FUEL

Sustainable aviation fuel (SAF) has attracted growing

attention as a carbon-reduction strategy in aviation.

However, current SAF production and deployment

remain extremely limited. For example, IATA (2024)

reports that global SAF output was only ~1.3×10^9

liters in 2024 (roughly 1 million tonnes, about 0.3%

of jet fuel demand) (International Air Transport

Association [IATA], 2024). This is far below

projected needs: one industry estimate suggests on the

order of 40–50 Mt/year of SAF may be required by

mid-century to meet aviation decarbonization targets

(WEF, 2024). Investment in SAF is accelerating, but

much more capacity is needed. In the Asia-Pacific

region, for instance, the 1.4 Mt/yr Neste refinery in

Singapore is currently the world’s largest SAF plant

(ING Think, 2024), and total APAC SAF capacity is

only about 1.8 Mt/yr (600 million gallons) by 2024.

Even if all planned projects proceed, APAC capacity

might reach ~5.1 Mt/yr by 2030 (≈4% of regional jet

fuel demand). In short, SAF supply is still nascent and

outstripped by airline commitments and regulatory

targets. Economically, SAF remains much more

expensive than petroleum jet fuel. Reported

production costs (and minimum fuel selling prices,

MFSP) vary widely by technology and feedstock.

Industry sources estimate HEFA (hydro processed

esters and fatty acids) from waste oils can cost on the

order of €0.88–1.0/L ($1.0–1.1/L)(Ng et al., 2021),

whereas routes like “hydro processing of fermented

sugars” (HFS, from starch/sugar) may cost >€3.4/L

($3.9/L). In practical terms, SAF often sells for ~2–

8× the price of fossil kerosene. Recent analyses (Ng

et al., 2021) summarize MFSPs across pathways:

HEFA from oil/fat feedstock averages ≈ $1.20/L

(range ~$1.07–1.32/L), whereas Fischer–Tropsch

(FT) and Alcohol-to-Jet (ATJ) routes average

$1.76/L. In contrast, sugar-to-fuel (HFS) is far higher

($4.27/L). By comparison, conventional jet fuel

typically costs roughly $0.3–0.5/L, so SAF currently

incurs a substantial premium. These high costs imply

A Study on the Optimization of Aviation Manufacturing Supply Chain Management Models Based on Green Development Principles

773

large capital investments and/or subsidies are needed

to make SAF commercially viable. Airlines and

investors note that, despite growing offtake

agreements, producers face weak demand signals and

policy uncertainty; as one IATA statement puts it,

“governments are sending mixed signals” and

investors are “waiting for guarantees” before

committing, since SAF margins are low(International

Air Transport Association [IATA], 2024). Different

production technologies have distinct techno-

economic profiles. HEFA is the most mature and

widely deployed route: it converts triglyceride oils

(vegetable or waste) into synthetic paraffinic

kerosene (SPK). HEFA offers high product yields

(>1000 L per tonne of oil, e.g., ~1060 L/t for soybean

oil or ~1110 L/t for palm oil) and relatively low

capital cost. Ng et al. report HEFA capex on the order

of $0.34 per Liter (of annual output), far lower than

for the other pathways. Consequently, HEFA’s MFSP

($1.2/L) is the lowest of the certified routes. FT

synthesis (gasification of biomass to syngas and

Fischer-Tropsch conversion) is very capital-

intensive: roughly 50–75% of the FT production cost

is tied up in capital equipment. ATJ (fermentative

alcohol followed by catalytic conversion) has lower

capital intensity (capex 20–50% of cost) but higher

operating costs – its feedstock (e.g., cellulosic

ethanol) can contribute 15–60% of total cost. Both FT

and ATJ often have similar MFSP ($1.76/L average)

despite these differences. Sugar-to-jet (HFS) is still at

demonstration scale; it has the highest MFSP ($4.3/L)

due to low yields and high processing complexity. In

summary, HEFA has the best current economics

because of high oil yields and low capex, but it

competes with existing biodiesel markets, whereas

FT and ATJ have more expensive but potentially

feedstock-flexible pathways. Tables of production

cases show that feedstock choice strongly influences

cost. For example, FT using dedicated energy crops

or forest wood incurs a higher MFSP (e.g., $2.15/L)

than FT on municipal solid waste or agricultural

residues ($1.5–1.9/L). A similar trend holds for ATJ:

using sugars from energy crops costs more than from

crop residues. HEFA production from vegetable oils

tends to be lower cost in capital terms but can have

higher feedstock costs. Overall, SAF capital

expenditure must fall substantially, and scale-up is

required to reduce per-unit costs, as many studies

note. Ng et al. stress that route choice should balance

economic and environmental metrics, and that further

cost reductions are needed, especially for FT, ATJ,

and HFS to enable commercialization.

2.1 Supply Chain Integration

Challenges

SAF is a drop-in fuel, meaning it must be mixed with

conventional jet kerosene to meet fuel specifications.

By regulation, ASTM D7566 (the aviation fuel spec)

currently limits most SAF blends to 50% (by volume)

of the final jet fuel. This implies that SAF is

distributed through the existing petroleum jet

infrastructure. In practice, there are two general

integration models. If SAF is co-processed at an oil

refinery (for example, by hydrotreating vegetable oils

with petroleum fractions), the blended fuel meets the

normal jet-fuel spec (ASTM D1655) and simply

flows out through the refinery’s pipeline networks to

airports. If SAF is produced at a standalone bio-

refinery, the raw SAF product must be transported (by

truck, rail, or barge) to a fuel terminal for blending

with conventional jet fuel. Fuel terminals are

typically equipped with blending tanks, pumps, and

quality-control systems. The common approach is to

receive SAF and Jet A in separate tanks, meter them

into a dedicated blending tank, mix the batch, and

then certify the blend to the jet-fuel standard. The

blended product can then be delivered to airports

through the same pipelines or trucks used for ordinary

jet fuel. U.S. DOE analysis notes that “SAF produced

at a stand-alone facility… requires blending… at a

terminal,” and afterwards the SAF/Jet-A blend is

transported in the same pipelines and trucks as before.

Despite using common infrastructure, several

logistical challenges arise. First, petroleum jet and

SAF have different molecular composition (SAF is

paraffinic and typically lacks aromatic compounds).

To preserve fuel properties, the allowable blend is

capped (ASTM limits FT/HEFA SPK to 50% blends

with Jet A). In practice, most service pumps deliver

blends far lower than 50% (often 30–38%), because

higher ratios can compromise seal swell and other

fuel characteristics. Meeting fuel-spec quality at scale

requires careful quality assurance: each batch of SAF

is accompanied by an ASTM-D7566 certificate, and

each blended batch by a certificate of analysis (COA)

under ASTM D1655. Second, most SAF producers

(especially early plants) lack pipeline connections, so

they rely on trucking or rail to move fuel to terminals.

Pipeline transport of neat SAF is rare, so systems

must adapt to bring SAF to a blending point. Third,

fuel terminals may need upgrades (additional storage,

mixers, and certification labs) to handle SAF.

Although these can be done, they represent nontrivial

capital costs and coordination among stakeholders.

As one DOE review notes, SAF supply chains are still

immature and will require significant investment:

ICEML 2025 - International Conference on E-commerce and Modern Logistics

774

“Because current fuel certifications… require SAF to

be blended with conventional fuels, the SAF supply

chain also requires coordination with conventional jet

fuel industries”. Feedstock supply is another

integration hurdle. Collecting and aggregating

biomass or waste oils (used cooking oil, agricultural

residues, etc.) to feed plants is logistically complex,

especially in Asia’s dispersed geographies. For

example, plans in APAC assume massive uptake of

used cooking oil (UCO), but current UCO collection

is limited. ING research estimates that Asia’s current

UCO supply (~5 million tonnes) would only produce

~1.2 billion gallons of SAF, far short of planned

output; bridging the gap will necessitate “increasing

SAF plants [that]… rely on palm oil and palm oil mill

effluent”. Heavy reliance on palm feedstocks,

however, raises its own integration issues (see

below). In summary, SAF’s integration into the fuel

supply chain is feasible in principle via terminal

blending and existing logistics, but it demands new

coordination, equipment, and assurance processes

compared to conventional fuels.

2.2 Policy and Sustainability

Frameworks

Regulatory frameworks play a major role in SAF

economics by creating demand-pull or incentives. At

the international level, the ICAO CORSIA scheme

allows airlines to use approved SAF to meet their

offsetting obligations. CORSIA defines strict

sustainability criteria: SAF must achieve a minimum

life-cycle GHG reduction (at least 10% below

conventional jet) and must not be made from biomass

grown on recently cleared forests, peatlands,

wetlands, or other high-carbon-stock lands. In

practice, this means feedstocks that cause

deforestation or peat drainage (such as new oil-palm

plantations on rainforests) are ineligible under

CORSIA’s carbon-stock test. Correspondingly, any

SAF project claiming CORSIA benefits must be

vetted by approved sustainability schemes. In Europe,

the RED II / ReFuelEU policy compels fuel suppliers

to blend increasing shares of SAF (e.g., 2% by 2025,

climbing to 70% by 2050) (European Union Aviation

Safety Agency [EASA], 2024). SAF used in the EU

must meet RED’s sustainability and GHG-saving

criteria (generally 70–90% cut over fossil) and may

earn bonus multipliers if from residues or waste.

However, as Ng et al. point out, these policies can

have unintended consequences: RED II’s current

structure (blending mandates and credit multipliers)

may skew feedstock markets and “Favor the road and

aviation biofuel sectors” unless carefully aligned. In

particular, biofuels researchers warn that aggressive

aviation mandates could compete with food/biodiesel

markets if not managed. Overall, CORSIA and RED

II aim to ensure SAF delivers real carbon benefits, but

they also elevate costs and restrict feedstock choice.

For example, EU policy effectively excludes virgin

palm oil as an eligible feedstock (due to ILUC

concerns), and CORSIA forbids SAF from palm

plantations established after 2008 on carbon-rich

land. These regulatory criteria directly impact

economic feasibility: any fuel failing the

sustainability test will not qualify for credits or

mandates, undercutting its value.

2.3 Asia-Pacific Focus: Indonesia and

Malaysia

Southeast Asian nations are increasingly evaluating

sustainable aviation fuel (SAF) to decarbonize

growing air transport, with Indonesia and Malaysia at

the forefront of regional efforts. Indonesia has

concentrated on biojet blends derived from its vast

palm oil industry. In particular, the government and

state oil company Pertamina have developed J2.0 and

J2.4 biofuels, both based on palm oil, at the Cilacap

refinery. These domestically certified fuels exemplify

Indonesia’s initial SAF pathway, though researchers

note that Indonesia is also exploring alternative

feedstocks – notably waste cooking oil (UCO) and

sugarcane-derived biofuels – to diversify supply and

mitigate market risks (Nugroho et al., 2024).

Malaysia, by contrast, has fewer indigenous biomass

resources for aviation. Its strategy has instead focused

on forming industry partnerships and preparing for

future production. For example, Malaysia’s national

oil company Petronas signed a late-2023 agreement

with Japan’s Idemitsu to “scale-up bio-feedstock

possibilities, production cost analysis, and supply

chain security” for next-generation SAF. In short,

Indonesia leverages its palm oil sector (with an eye

toward UCO and sugarcane), whereas Malaysia is

building international coalitions and planning

infrastructure to develop SAF.

Both countries’ SAF plans must balance growth

against environmental trade-offs. Relying on palm

oil, for example, raises concerns about deforestation

and indirect land-use change (LUC). Nugroho et al.

(2024) specifically caution that new palm plantations

for biojet could trigger carbon-intensive land

conversion in Indonesia, potentially negating some of

the GHG savings of SAF. Domestic studies have f

lagged that converting peatlands or forests to oil palm

releases substantial CO₂, a risk if demand for J2 fuels

surges. In contrast, UCO feedstock offers clear

A Study on the Optimization of Aviation Manufacturing Supply Chain Management Models Based on Green Development Principles

775

sustainability advantages, since it repurposes waste

oil; however, UCO supplies are limited and

competition (for biodiesel, cooking, etc.) may cap its

impact. Sugarcane-based SAF generally shows lower

life-cycle emissions than vegetable oils, but large-

scale sugarcane expansion can also strain land and

water resources. Crucially, international certification

is a hurdle. Indonesia has certified its J-series fuels

domestically, but these certificates do not

automatically satisfy ICAO’s CORSIA standards.

Nugroho et al. (2024) highlight that Indonesia’s

current sustainability criteria and audit processes may

fall short of CORSIA requirements, meaning SAF

produced today might not earn carbon credits under

the global offsetting scheme. Aligning Indonesia’s

certification (and Malaysia’s future criteria) with

CORSIA is therefore essential to ensure that SAF

actually delivers net GHG reductions for international

f lights. In short, any expansion of bio-SAF must be

accompanied by robust land-use policies and chain-

of custody tracking so that feedstock cultivation does

not undermine climate goals.

Governments and institutions play a pivotal role

in translating potential into reality. Both Indonesia

and Malaysia have set broad climate targets

(including pledges to reach net-zero emissions by

mid-century) and have woven biofuels into their

renewable energy planning. Indonesia’s National

Energy Policy and subsequent regulations target

substantial biofuel use (e.g. high-percentage biodiesel

blending by 2025), implying future mandates could

also cover jet fuel. Nugroho et al. (2024) note that

Indonesia has issued presidential and ministerial

regulations emphasizing renewable fuels, yet

consistent SAF-specific policies are still emerging.

They recommend that Indonesia strengthen

coordination among ministries (energy, transport,

environment) and provide financial and technological

support to scale SAF production. In Malaysia,

policymaking has been more fragmented. While the

country has aggressive emissions reductions goals

and successful road-transport biofuel mandates, it has

no dedicated SAF policy to date. Instead, Malaysian

efforts have centered on leveraging state actors: for

example, Petronas and research institutes are steering

R&D, as seen in the Idemitsu collaboration. Nguyen

and Vuong (2024) argue that Malaysia (and other

ASEAN nations) needs clearer institutional backing –

such as SAF blending targets or subsidies – to attract

investment. They also highlight that Malaysia and

Singapore currently benefit from better coordination

(both have national aviation plans), whereas other

countries lag behind. At the regional level,

cooperation is deemed crucial. Nguyen and Vuong

(2024) emphasize that consistent policies across

ASEAN and joint initiatives will accelerate SAF

uptake. They point to ASEAN’s 2023 Biofuel R&D

Roadmap and energy community plans as positive

steps, but warn that translation into practice is

uneven. In essence, both studies suggest that without

ASEAN-wide harmonization – for instance, mutual

recognition of sustainability standards and pooled

research – neither Indonesia nor Malaysia can fully

realize SAF opportunities alone.

3 THE END-OF-LIFE AIRCRAFT

When aircraft reach the end-of-life (EOL) stage, they

can’t be easily recycled like normal vehicles.

According to Airbus, over the next 20 years, air traffic

will more than double. This means that demand for

new aircraft will increase rapidly. Airbus forecasts

that 42,000 new aircraft will be needed by 2043.

What’s more, 18,460 of them will be used to replace

older aircraft, which can also be viewed as EOL

aircraft. The green solution for EOL aircraft has been

a problem. First, the process for dealing with EOL

aircraft should be outlined. When an aircraft reaches

its EOL stage, it should be divided into two parts. If

the aircraft is a passenger airliner and is worth more

than its parts, it can be sold to a country with lenient

airworthiness standards, or it can be transformed into

a cargo airliner. However, if the aircraft is a cargo

airliner and it is worth more than its parts, it can only

be sold to a country with loose airworthiness

standards. In this way, the carbon emissions of EOL

aircraft will not increase. However, not all EOL

aircraft can be sold. When the value of an aircraft’s

parts exceeds the value of the aircraft itself,

dismantling should be considered. Furthermore,

according to Sainte-Beuve (2012), aircraft will be

replaced before the end of their operational life by a

new, more efficient type. This will reduce operating

costs for airlines, and the green image of EOL aircraft

treatment has gradually become a standard for global

market competitiveness based on environmental

considerations (Siles, 2011). As a result, aircraft

dismantling has become a very important stage in the

aviation supply chain. Aircraft recycling follows a

rigorous process that adheres to environmental

regulations. First, certified workers remove the

aircraft engine under the guidance of the service

manual. Furthermore, according to Airbus, more than

99% of engine parts (CFM) can be recycled. These

parts are reconditioned and re-certified so that they

can be returned to the aviation materials market

without posing safety hazards. After removing all

ICEML 2025 - International Conference on E-commerce and Modern Logistics

776

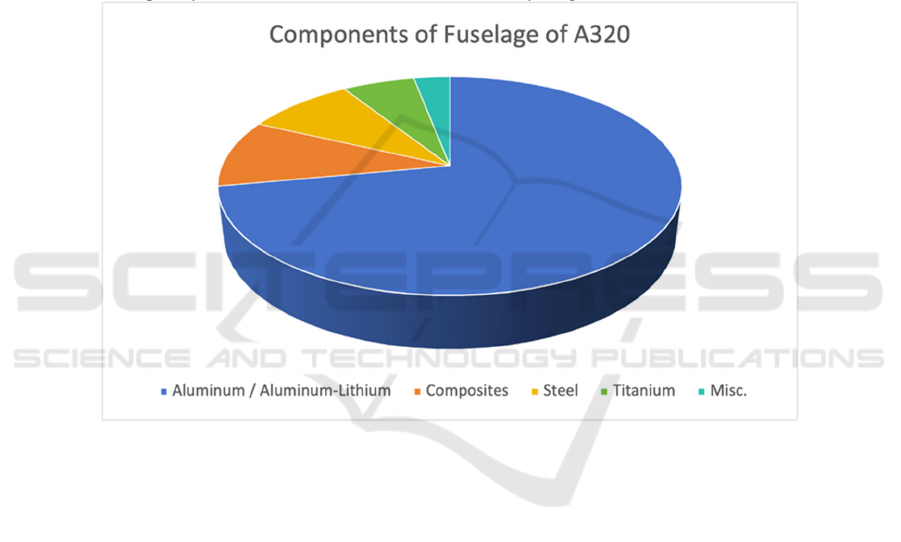

components (electrical, hydraulic systems, etc.), the

fuselage can be safely cut up. According to Airbus,

the fuselage of the A320 is primarily made of

aluminum and Al-Li alloys (72%), steel (9%), and

titanium (6%), as shown in Figure 1. All these metals

can be used as raw materials in industries beyond

aviation. Not only can the mantle be recycled, but the

recovered Fibers can also replace newly produced

Fibers (Eylem et al., 2013). According to Asmatulu

(2013), using carbon fiber as an example, recycled

fiber can reduce cost by about 30% and energy

consumption by 98% compared to producing new

fiber. This circle is a typical Open loop recycle. Many

of the materials from the EOL aircraft are suitable for

recycling. Consequently, the residual value of the

aircraft promotes the recycling of the EOL aircraft.

Additionally, the maintenance and production of the

aircraft need lots of resources and which will lead to

the release of the greenhouse gases (GHG). To reduce

the investment, raw material, labour time and carbon

emission, the recycling of parts and material from the

EOL aircraft is chosen. The third motivation for

recycling the EOL aircraft is that when those parts are

used in other projects, the total volume of waste is

reduced. Then the land that will be used as the landfill

decreased. This helps protect the safety of the land

and the underground water below that land. The

pollution of the underground water is prevented at the

source. The air, water, and land are protected due to

the recycling of the EOL aircraft.

Figure 1: Components of fuselage of A320

4 CONCLUSIONS

In conclusion, while sustainable aviation fuel (SAF)

represents a promising path for decarbonizing

aviation, significant challenges remain in scaling its

production, integrating it into existing supply chains,

and aligning it with sustainability frameworks.

Technologically, HEFA emerges as the most

economically viable SAF pathway, but its

dependence on vegetable oils and limited scalability

raises long-term concerns. Meanwhile, FT and ATJ

offer greater feedstock flexibility but face high capital

or operational costs. Despite growing commitments

from airlines and governments, SAF currently

comprises less than 1% of global jet fuel demand, and

production costs remain 2–8 times higher than

conventional kerosene, signaling an urgent need for

investment, policy consistency, and infrastructure

upgrades.

Integration into the fuel supply chain is

technically feasible but requires coordination,

logistical adaptation, and capital investment,

especially in regions lacking pipeline infrastructure.

In the Asia-Pacific region, countries like Indonesia

and Malaysia hold strategic potential due to abundant

palm-based residues; however, this opportunity is

counterbalanced by the environmental risks of

indirect land-use change. Policies such as CORSIA

and RED II provide important guardrails, but their

stringent sustainability criteria also limit eligible

feedstocks, posing a dilemma for palm-dependent

producers. To align with global standards and unlock

SAF's full potential, these nations must prioritize non-

A Study on the Optimization of Aviation Manufacturing Supply Chain Management Models Based on Green Development Principles

777

food, waste-based inputs and strengthen traceability

systems.

In addition, addressing the sustainability of

aviation must go beyond fuel. The end-of-life (EOL)

treatment of aircraft is emerging as another critical

component of the green aviation transition. Recycling

aircraft components and materials not only conserves

resource and reduces GHG emissions but also

mitigates environmental risks such as soil and

groundwater pollution. The reuse of metals and

carbon fibers exemplifies a circular economic

approach that complements SAF development.

Looking ahead, the future of sustainable aviation

lies in a multifaceted strategy: accelerating SAF

scale-up through policy and financial incentives,

ensuring environmentally robust feedstock sourcing,

improving logistics infrastructure, and promoting full

lifecycle sustainability—including aircraft

decommissioning and material recovery. Only

through such an integrated approach can the aviation

industry effectively reduce its climate impact while

maintaining operational resilience and global

competitiveness.

REFERENCES

Asmatulu, E., Overcash, M., & Twomey, J., 2013.

Recycling of aircraft: State of the art in 2011. Journal

of Industrial Engineering, (1), 960581.

de Jong, S., Hoefnagels, R., & Faaij, A., 2017. Life-cycle

analysis of greenhouse gas emissions from renewable

jet fuel production. Biotechnology for Biofuels and

Bioproducts, 10(1).

European Union Aviation Safety Agency, 2024.

Sustainable aviation fuels.

International Air Transport Association, 2024.

Disappointingly slow growth in SAF production.

International Civil Aviation Organization, 2022. CORSIA

sustainability criteria for eligible fuels.

Ng, K. S., Farooq, D., & Yang, A., 2021. Global

biorenewable development strategies for sustainable

aviation fuel production. Renewable and Sustainable

Energy Reviews, 150, 111502.

Nguyen, K. N., & Vuong, H., 2024. A case study on

sustainable aviation fuel adaptation by South East

Asian countries: Opportunities, reality, and the current

gaps. Case Studies in Chemical and Environmental

Engineering, 10, 100988.

Nugroho, D. A., Sitompul, M. R., & Widadi, N., 2024.

Sustainable aviation fuel development: case study in

Indonesia. IOP Conference Series: Earth and

Environmental Science, 1294(1), 012032.

Sainte-Beuve, D., 2012. Évaluation de différentes stratégies

de démantèlement de la carcasse d'un avion.

Siles, C., 2011. Aide à la décision pour la gestion d'un parc

d'avions en fin de vie. École Polytechnique de

Montréal.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

778