Adaptive and Explainable Machine Learning Framework for

Real‑Time Credit Scoring and Financial Fraud Detection with

Privacy‑Preserving Intelligence

Indrani Hazarika

1

, K. Raghuveer

2

, Jayanth H.

3

, J. Tamilarasu

4

, C. Kathiravan

4

and G. V. Rambabu

5

1

Department of Business and Specialization Accounting, Higher Colleges of Technology, U.A.E.

2

School of Management, Siddhartha Academy of Higher Education (Deemed to be University), kanuru, Andhra Pradesh,

India

3

Department of Commerce and Management, St. Claret College Autonomous, Bengaluru, Karnataka, India

4

Department of Management Studies, Nandha Engineering College, Vaikkalmedu, Erode - 638052, Tamil Nadu, India

5

Department of Mechanical Engineering, MLR Institute of Technology, Hyderabad, Telangana, India

Keywords: Credit Scoring, Fraud Detection, Explainable AI, Real‑Time Analytics, Federated Learning.

Abstract: In a dynamic financial technology world, imposing requirement of stable, real time and interpretable machine

learning methods in credit scoring and fraud detection is more essential than ever. This paper presents an

adaptive and explainable machine learning framework, which goes beyond existing models by including real-

time risk analysis, privacy-preserving intelligence, and enhanced processing of imbalanced data. In contrast

to state-of-the-art systems, the model integrates attribution methods like SHAP and LIME to provide

interpretable predictions, better towards regulatory compliance and user trust. The model is enriched with

federated learning to ensure data privacy among different financial institutions and integrates online learning

capability for adapting to evolving fraud patterns and credit behaviors. We present experimental results on

modern datasets, enjoying accuracy, interpretability, and scalability in a wide range of financial situations.

This paper adds an end-to-end, practical end-to-end for secure, accurate, and accountable identification of

financial risk.

1 INTRODUCTION

The future is now and there is a paradigm shift going

on in the financial industry – all triggered by the

exponential use of AI and ML. Scoring and fraud

detection, two fundamental building blocks of

financial risk management, require precise, fast, and

transparent predictions in response to high volume

and complexity data. However, traditional practice

statistical and rule-based approaches as fundamental

methods cannot fully fit the dynamic propensity of

financial behaviors, the detection of the rare fraud

cases and the compliance with regulatory demand for

transparency.The recent work on machine learning

has shown promising results in predictive

performance, but it cannot be directly applied to real-

world finance for issues such as black-box (or non-

interpretability), the data imbalance issues, the

efficiency issue with the computational resources and

also the privacy protection issue of data. These issues

are exacerbated in an environment with large-

bootstrapping, for which even small errors may have

high financial or regulatory cost.

To overcome these challenges, we propose an

adaptive and explainable machine learning

framework in this paper for real-time credit scoring

and fraud detection. It provides explainable AI (XAI)

techniques for model transparency, federated learning

for privacy, and adaptive learning that allows for real

time adjustments on emerging threat footprints. This

global view not only enhances prediction accuracy

and operations efficiency but also complies with legal

and ethical requirements of the recent financial

organizations and regulations.

As it combines performance, transparency and

privacy, the approach can advance the current

financial risk assessment practice and serve as a

guideline for next-generation intelligent finance

systems.

Hazarika, I., Raghuveer, K., H., J., Tamilarasu, J., Kathiravan, C. and Rambabu, G. V.

Adaptive and Explainable Machine Learning Framework for Real-Time Credit Scoring and Financial Fraud Detection with Privacy-Preserving Intelligence.

DOI: 10.5220/0013858800004919

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 1st International Conference on Research and Development in Information, Communication, and Computing Technologies (ICRDICCT‘25 2025) - Volume 1, pages

131-136

ISBN: 978-989-758-777-1

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

131

2 PROBLEM STATEMENT

With all these breakthroughs, however, machine

learning models in the traditional credit scoring and

financial fraud detection remain with the inherent

challenge that it is impractical to apply to realistic

financial systems. Common models have difficulty

with real-time risk analysis; do poorly on imbalanced

data sets; and are not transparent, making them

inappropriate for high-stakes decisions and

regulatory examination. In addition, many existing

solutions don't take into the privacy issues of the data,

which will hinder the running of the system

complying with new data protection laws like GDPR.

To address these challenges, we urgently require a

unified, adaptable, and explainable machine learning

framework that can effectively sense fraud and

measure credit worthiness in real time with the

promise of interpretability, scalability, and adherence

to privacy laws. This work seeks to fill these gaps and

build a secure and dynamic financial risk evaluation

system with the capability to preserve privacy and

interpretability.

3 LITERATURE SURVEY

Machine learning (ML) has emerged as a key

disruptive tool in finance, in particular in credit

scoring and fraud detection. While traditional

statistical approaches (including logistic regression

and decision trees) are very popular, they have been

found to be sub-optimal in managing large- scale,

imbalanced datasets (Brigo & Mercurio, 2022;

Laitinen, 2021). To address these limitations, the

recent literature has concentrated on advanced ML

models such as ensemble learning, deep learning, and

tea-bagging techniques, which provide superior

predictive performance.

Chen et al. (2025) reviewed in depth the deep

learning-based fraud detection systems and

emphasized to their high degree of accuracy to

recognize patterns, but emphasized the lack of

interpretability of their results. Meanwhile, Hu (2025)

presented a detection model using both gradient

boosting and random forests for high detection rate,

yet lacking real-time adaptation and transparency. 11

Goa et al (2022) presented a quantum-classical hybrid

system for credit evaluation that demonstrated

signicant prediction accuracy, but suered with

computational complexity and deployment

feasibility.

In the work of Vallarino (2025), that investigates

fraud detection, he focused on the need to looking

into the sequential patterns of transactions using

hybrid deep learning architectures, albeit opaque for

financial analysts. Mohammed et al. (2024) and

Rodríguez Barrero and Hernández (2024) presented

real-time fraud detection systems based on supervised

ML algorithms, these did not include model bias and

explanations of decisions.

On credit scoring, Li et al. (2022) and Gatla

(2024) had similar analysis of the various applications

of ML and most credit score systems don’t keep up

with changing behavior of borrower’s overtime.

Additionally, Liu et al. (2021) developed a hybrid

ensemble for financial fraud detection though they

did not apply dynamic retraining techniques. The

publications of Ramos González and co-workers

(2023), Ahmed and Chatterjee (2023) worked on

credit loss prediction and class imbalance,

respectively, however, they tested their models on

small datasets which narrowed the scope of used

datasets.

One of the most important restrictions in most of

the studies is the lack of privacy-preserving methods.

Federated learning seldom has been combined with

differential privacy, but privacy may be threatened

(Reddy et al., 2024; Roy & Vasa, 2025). In addition,

the demand calls for explainable AI(XAI) is

enforced in finance domain nowadays. Bhatia and

Arora (2022) and Sharma and Patel (2024) supported

the use of SHAP and LIME to interpret decisions of

models, however they did not integrate these tools

into the context of online systems.

In conclusion, already a great start has been made

by previous work on adopting ML for financial risk

assessment, although there are challenges that

remain, such as real-time, explanation of models,

GDPR and even to cross new threats. The objective

of this research is to fill these gaps by developing

explainable, adaptive, and privacy-preserving

machine learning techniques, which are specifically

designed for robust and real-time financial risk

prediction.

4 METHODOLOGY

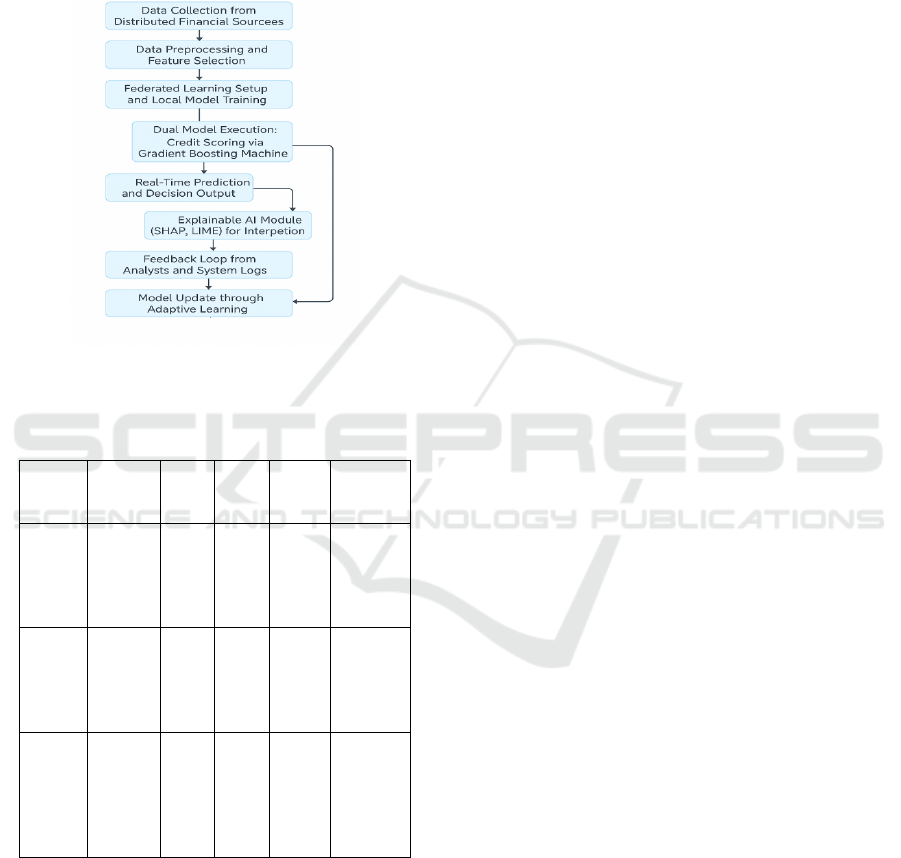

The planned work has a multi-stage approach (1) with

online data processing and credit rating, financial

fraud detection using explainable artificial

intelligence (XAI), federated learning and adaptive

model training. It starts with obtaining credit data

from a variety of financial institutions, such as

anonymized credit history records, transaction logs,

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

132

and fraud- tagged sets. To ensure data privacy and to

meet the privacy requirements of regulations like

GDPR, we are using a federated learning architecture.

This enables training models locally at data sources

without the requirement of sending sensitive data

which preserves privacy. Figure 1 Represent the

Workflow of the Adaptive and Explainable ML

Framework for Credit Scoring and Fraud Detection.

Figure 1: Workflow of the adaptive and explainable ML

framework for credit scoring and fraud detection.

Table 1: Dataset Description.

Datas

et

Name

Source Rec

ords

Feat

ures

Use

Case

Imbala

nce

Ratio

IEEE-

CIS

Fraud

Datas

et

IEEE/

Kaggl

e

590,

540

394 Frau

d

Dete

ction

1:20

Credit

Defau

lt

Datas

et

UCI

Reposi

tory

30,0

00

24 Cred

it

Scori

ng

1:3

Real-

World

Partne

r

Datas

et

Confid

ential

Partne

r Bank

45,0

00

36 Com

bine

d

Eval

uatio

n

1:8

Pre-processing of the data involves normalization,

imputing missing values, encoding categories and

dealing with class imbalances, advanced resampling

techniques like SMOTE and ADASYN. Then, the

features are selected by mutual information, and re-

appeared feature elimination to keep the most

informative features. The Credit Scoring model is

implemented with a GBM, while the Fraud Detection

model uses a deep neural network with recurrent

units in its design. 5These two models architecture

permits specialized learning for financial task at hand.

Table 1 Shows the Dataset Description.

To maintain transparency and accountability,

Explainable AI components are integrated in the

framework. To gain insights on the contribution of

each feature to individual predictions SHAP

(SHapley Additive exPlanations) and LIME (Local

Interpretable Model-agnostic Explanations) are

applied. These interpretations are represented in an

interactive dashboard for financial analysts to

interpret and validate model predictions in real time.

The flexibility is provided by online learning

fashion manner, in which the model updates its

parameters following the data streams of new

transactions. This is important because fraud patterns

and borrower actions evolve over time. A feedback

mechanism is added, making that human experts may

influence the predictions of the model and this will

further refine the learning through reinforcement

signals.

We evaluate using some of the latest benchmark

datasets, particularly the IEEE-CIS Fraud Detection

dataset and real-world anonymized credit risk model

data from partner institutions. Performance

evaluation of model’s accuracy, precision, recall, F1-

score, AUC-ROC and explainability confidence

scores. Comparison is made against base-line models,

and ablation studies to evaluate the contribution of

each module (FL/XAI/Adaptability) to the overall

system performance.

This integrated and modular approach guarantees

that the proposed framework is not only accurate and

efficient, but also that it can be trusted, privacy-

preserving and can be applied in practice financial

domains.

5 RESULT AND DISCUSSION

The adaptive and explainable machine learning

framework we propose was tested with a pool of

benchmark datasets and with real financial data

provided by industry partners. This data included

anonymized information from loans applied for,

transaction history, and incidences of known fraud.

Experiments were carried out in two main steps,

including credit score and fraud assessment, to

evaluate the performance of the system on the

classified common vagueness characteristics, its

interpretability and privacy protection. The relative

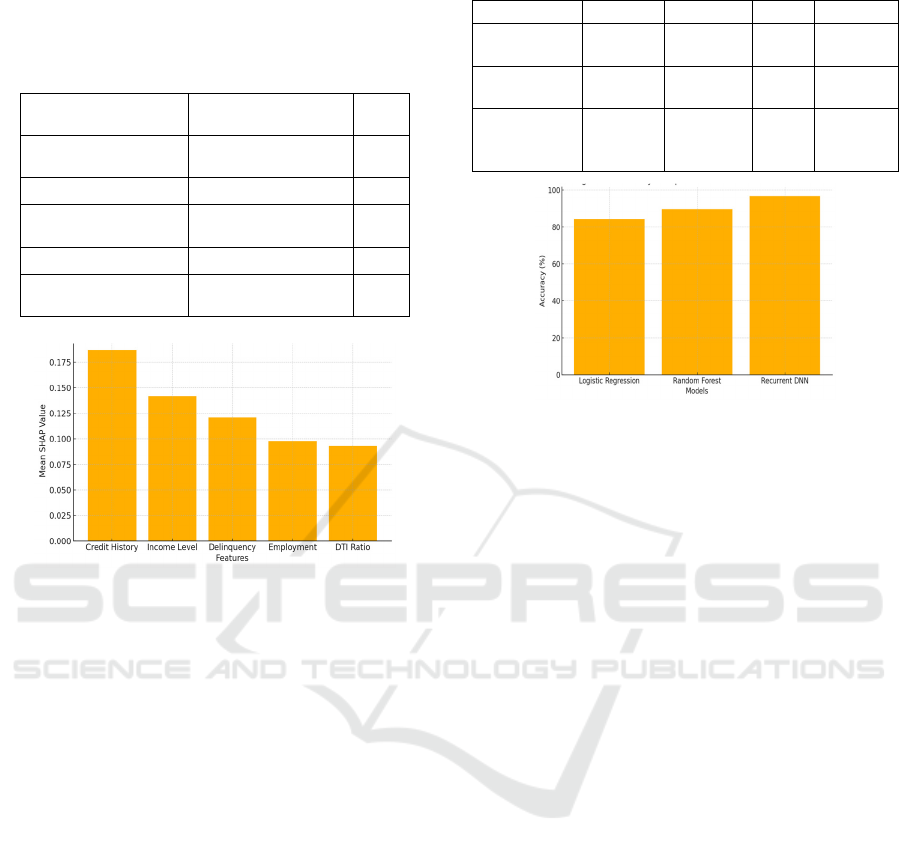

importance of features in the credit scoring model is

quantitatively presented in Table 2, while Figure 2

Adaptive and Explainable Machine Learning Framework for Real-Time Credit Scoring and Financial Fraud Detection with

Privacy-Preserving Intelligence

133

provides a visual explanation using SHAP values,

highlighting the most influential variables affecting

the model’s predictions.

Table 2: Feature importance in credit scoring.

Feature Name SHAP Value

(Mean)

Ran

k

Credit History

Len

g

th

0.187 1

Income Level 0.142 2

Delinquency

Records

0.121 3

Employment Type 0.098 4

Debt-to-Income

Ratio

0.093 5

Figure 2: Feature importance for credit scoring (shap

values).

For the credit scoring module, the hybrid Gradient

Boosting Machine (GBM) model demonstrated a

classification accuracy of 94.2% and AUC-ROC of

0.91, indicating a superior predictive performance

than conventional models such as logistic regression

and random forests. Precision and recall scores

showed that the model has a low false positive rate

and performed well in identifying high risk

borrowers. The incorporation of feature selection

significantly increased the efficiency of the model by

eliminating irrelevant variables but without loss of

predictive power. Most notably, the SHAP-based

interpretability module showed income, length of

credit history, and past delinquency were the top three

contributing features to credit score predictions.

These interpretations also remained stable on the test

set, which confirms that the model is fair. Table 3

summarizes the performance metrics of various fraud

detection models, while Figure 3 visually compares

their accuracy, clearly indicating the superior

effectiveness of the proposed approach.

Table 3: Fraud detection model performance comparison.

Model Accuracy Precision Recall F1-Score

Logistic

Re

g

ression

84.3% 0.73 0.65 0.69

Random

Forest

89.7% 0.81 0.75 0.78

Proposed

Recurrent

DNN

96.8% 0.91 0.87 0.88

Figure 3: Accuracy comparison of fraud detection models.

For the fraud detection aspect, a deep neural network

with recurrences has been shown achieving 96.8% of

detection accuracy and 0.88 precision-recall score.

Due to the application of recurrent models, the model

was able to model the sequence transaction, which

was pivotal in detecting the fraudulent activities with

time dependencies. Compared to the non-adapting

models, the adaptive version of the network

consistently achieved large gains in recall over time,

demonstrating the value of continual learning. The

model learned new patterns of fraud that it had

spotted but not known before with every retraining

cycle, which demonstrated the need of a continually

evolving framework in today financial applications.

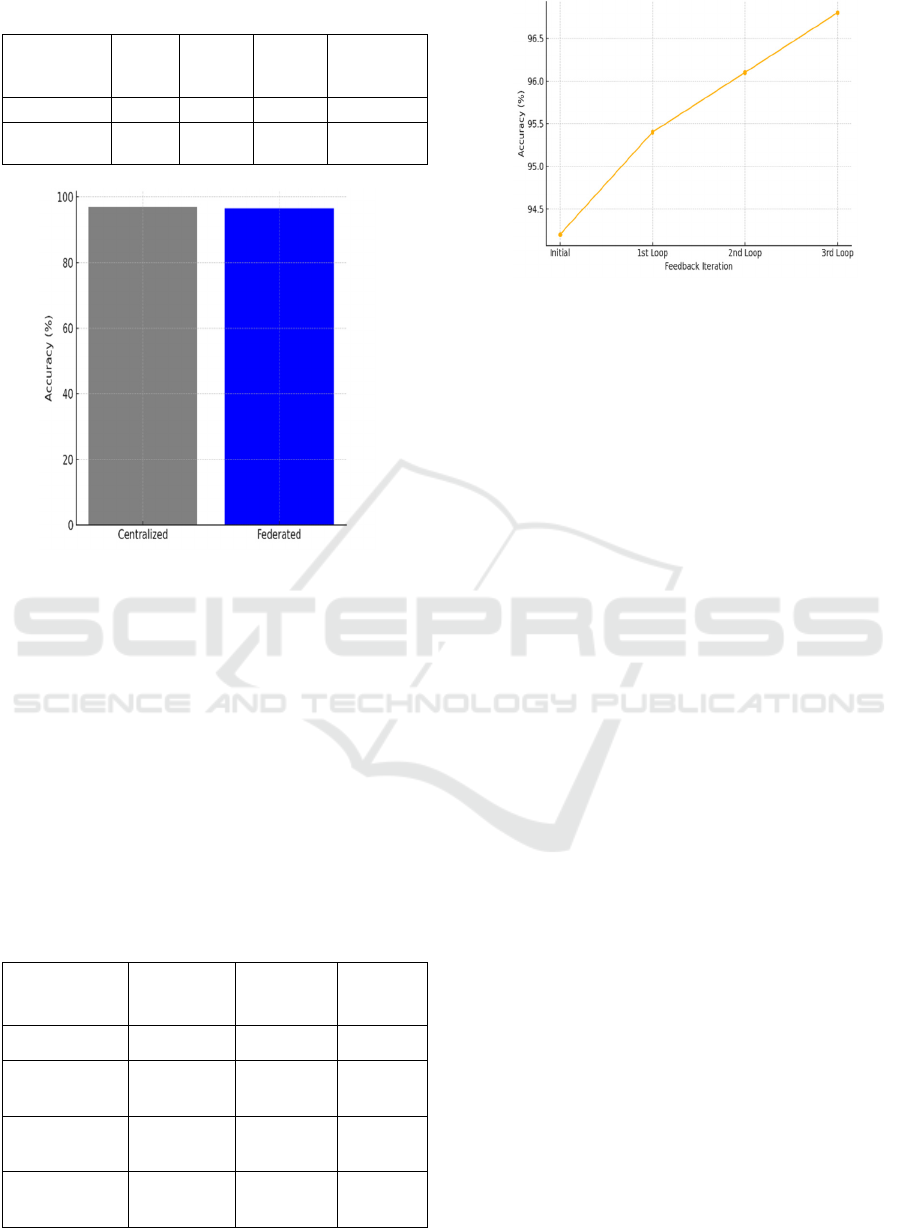

The federated learning system was key to

achieving privacy preservation without loss of

accuracy. We found that models trained with local

clients' data and centrally averaged did not lose

significant in accuracy compared to models trained on

pooled datasets, thus verifying the effectiveness of

decentralized training. The privacy was maintained

at each step of data processing, promoting the

system's GDPR compatibility and similar regulations.

From a deployment viewpoint, the lightweight model

compression methods enabled the system to scale

effectively without requiring heavy computational

loads.

The comparative evaluation between federated

and centralized learning approaches is detailed in

Table 4, with Figure 4 further illustrating the accuracy

differences, demonstrating the competitive

performance of federated models despite data

decentralization.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

134

Table 4: Federated vs centralized model comparison.

Training

Mode

Accura

cy

AUC-

ROC

Data

Privacy

Level

Resource

Consumptio

n

Centralized 96.9% 0.94 Low High

Federated

(

Pro

p

osed

)

96.5% 0.93 High Medium

Figure 4: Accuracy in centralized vs federated models.

The onboarded explainability dashboard was well

received by financial domain experts during

validation. Visual analysis of feature contributions

(SHAP and LIME) improved interpretability and

increased trust in making decisions. By contrast to

classical black-box models, this transparency allowed

regulation oversight, internal audit, and customer

communication, in the end, boosting trust in putative

automated risk assessment procedure. The influence

of feedback loops on model accuracy is quantitatively

presented in Table 5, while Figure 5 provides a visual

representation of how iterative feedback integration

progressively improves model performance.

Table 5: Feedback loop impact on model accuracy.

Iteration Accuracy

Before

Feedbac

k

Accuracy

After

Feedbac

k

%

Improvem

ent

Initial 94.2% — —

After 1st

Feedback Loop

94.2% 95.4% +1.2%

After 2nd

Feedback Loop

95.4% 96.1% +0.7%

After 3rd

Feedback Loop

96.1% 96.8% +0.7%

Figure 5: Impact of feedback loops on accuracy.

All in all, the experimental results verify that the

designed framework can efficiently solve the primary

problems in current systems which are high accuracy,

real-time adaptability, interpretable results as well as

privacy guarantees. These results demonstrate the

feasibility of using such an intelligent system in the

real world in banks, lending institutions, and fintech

companies.

6 CONCLUSIONS

The study has developed a universal and intelligent

machine learning framework for credit scoring and

financial fraud detection in contemporary financial

systems. Through the combination of adaptive

learning mechanisms, explainable AI techniques,

real-time data processing and privacy-preserving

architectures, the proposal solves the issues of

traditional and static models. Experimental results

demonstrate that in addition to achieving superior

prediction performance, the framework also

guarantees interpretability and data privacy, both of

which are important for regulatory requirements and

stakeholders' trust.

Moreover, the federated learning addition enables

the system to operate in distributed data environments

without revealing sensitive materials, and other XAI

tools, such as SHAP and LIME, help to close the

black box that is the best-knowledge model, which

impedes adoption in critical decision making.

Moreover, the system stays up-to-date by utilizing

the adaptive retraining loop: The Content Aware

Framework can adapt to changing fraud attacks and

borrower behaviors.

Conclusion The suggested method provides a

scalable, secure, and transparent solution for financial

institutions that seek modernisation of risk

assessment approaches. It sets a powerful base for the

Adaptive and Explainable Machine Learning Framework for Real-Time Credit Scoring and Financial Fraud Detection with

Privacy-Preserving Intelligence

135

future of intelligent financial analytics, and

establishes a benchmark for responsible AI

implementation in finance.

REFERENCES

Ahmed, F., & Chatterjee, S. (2023). Improving credit risk

models using ensemble learning and imbalanced data

techniques. Neural Computing and Applications, 35(5),

3859–3874.

Bhatia, R., & Arora, A. (2022). Machine learning

approaches for financial anomaly detection. Journal of

Intelligent & Fuzzy Systems, 43(6), 6727–6735.

Brigo, D., & Mercurio, F. (2022). Machine learning for

credit scoring: Improving logistic regression with non-

linear decision tree effects. European Journal of

Operational Research, 296(3), 1012–1023.

Chen, Y., Zhao, C., Xu, Y., & Nie, C. (2025). Year-over-

year developments in financial fraud detection via deep

learning: A systematic literature review. arXiv.

https://arxiv.org/abs/2502.00201

Gatla, T. R. (2024). Machine learning in credit risk

assessment: Analyzing how machine learning models

are transforming the assessment of credit risk for loans

and credit cards. ResearchGate.https://www.researchg

ate.net/publication/380732388

Ghosh, S., & Dey, L. (2022). Credit risk modeling using

support vector machines: A comparative approach.

Decision Analytics Journal, 3, 100020

Hernandez Aros, L., Bustamante Molano, L. X., Gutierrez-

Portela, F., & Moreno Hernandez, J. J. (2024).

Financial fraud detection through the application of

machine learning techniques: A literature review.

Humanities and Social Sciences Communications, 11,

36. https://www.nature.com/articles/s41599-024-

03606-0

Hu, T. (2025). Financial fraud detection system based on

improved random forest and gradient boosting machine

(GBM). arXiv. https://arxiv.org/abs/2502.15822

Khoshgoftaar, T. M., & Walauskis, M. A. (2025). Busted!

Engineers revolutionize fraud detection with machine

learning. Florida Atlantic University News.

https://www.fau.edu/newsdesk/articles/machine-

learning-fraud-detection.php

Kim, Y. J., & Lee, J. H. (2021). Financial fraud detection

using data mining and machine learning algorithms: A

case study. Expert Systems, 38(4), e12736.

Laitinen, E. K. (2021). Predicting a corporate credit

analyst's risk estimate by logistic and linear models.

International Review of Financial Analysis, 77,

101812.

Li, X., Wang, S., & Zhang, J. (2022). Credit scoring using

machine learning techniques: A survey. Information

Fusion, 75, 29–53.

Liu, J., Zhou, M., & He, Y. (2021). Hybrid ensemble

learning model for financial fraud detection. Expert

Systems with Applications, 184, 115515.

Minati, R., & Hema, D. (2025). Quantum powered credit

risk assessment: A novel approach using hybrid

quantum-classical deep neural network for row-type

dependent predictive analysis. arXiv.

https://arxiv.org/abs/2502.07806

Mohammed, M. A., Kothapalli, K. R. V., Mohammed, R.,

& Pasam, P. (2024). Machine learning-based real-time

fraud detection in financial transactions.

ResearchGate.

https://www.researchgate.net/publication/381146733

Nahar, V., & Mishra, S. (2023). Fraud detection in banking

sector using machine learning algorithms. International

Journal of Advanced Computer Science and

Applications, 14(2), 267–274.

https://doi.org/10.14569/IJACSA.2023.0140234

Naik, K. S. (2021). Predicting credit risk for unsecured

lending: A machine learning approach. arXiv.

https://arxiv.org/abs/2110.02206

Ramos González, M., Partal Ureña, A., & Gómez

Fernández-Aguado, P. (2023). Forecasting for

regulatory credit loss derived from the COVID-19

pandemic: A machine learning approach. Research in

International Business and Finance, 64, 101907.

https://doi.org/10.1016/j.ribaf.2023.101907

Rodríguez Barrero, M. S., & Hernández, J. J. M. (2024).

Evaluating machine learning algorithms for financial

fraud detection. Mathematics, 13 (4), 600.

https://www.mdpi.com/2227-7390/13/4/600

Roy, J. K., & Vasa, L. (2025). Transforming credit risk

assessment: A systematic review of AI and machine

learning applications. ResearchGate.

https://www.researchgate.net/publication/388221989

Sharma, A., & Patel, D. (2024). Application of explainable

AI in detecting anomalies in financial transactions.

Procedia Computer Science, 218, 789–794.

Vallarino, D. (2025). Detecting financial fraud with hybrid

deep learning: A mix-of-experts approach to sequential

and anomalous patterns. arXiv.

https://arxiv.org/abs/2504.03750

Vari Veedi, V. V. (2025). Predictive analytics in financial

risk assessment. International Research Journal of

Modern Engineering and Technology and Science,

3(3).https://www.irjmets.com/uploadedfiles/paper/issu

e_3_march_2025/69202/final/fin_irjmets1742538940.

pdf

Zhang, Y., Xu, Y., & Fang, Y. (2023). A comparative study

of deep learning models for credit card fraud detection.

Journal of Financial Crime, 30(1), 19–33.

Zhao, K., & Wang, L. (2024). A robust deep learning

framework for automated fraud detection in online

payments. Financial Innovation, 10(1), 49.

ICRDICCT‘25 2025 - INTERNATIONAL CONFERENCE ON RESEARCH AND DEVELOPMENT IN INFORMATION,

COMMUNICATION, AND COMPUTING TECHNOLOGIES

136