Limits and Challenges of Supply Chain Digital Collaboration: A Case

Study on Target Corporation's "Store as a Hub" Strategy

Jiayi Luo

Faculty of Engineering, University of Sydney, Sydney, Australia

Keywords: Supply Chain Digital Collaboration, Omnichannel Retailing, Operational Resilience, Financial Performance,

Strategic Adaptability.

Abstract: This study discusses the effectiveness and limitations of digital collaboration in the supply chain in

omnichannel retailing using Target's "Store as Hub" strategic model as an entry point. These utilize inventory

systems with real-time conversations, cloud platforms, and decentralized logistics. Digital transformation

increased operational resilience by reducing last-mile delivery costs by 60-70%, achieving 95% in-store order

fulfillment, and improving inventory record-keeping accuracy to 92%, but failed to deliver sustained financial

gains. The data shows that Target's operations have improved. However, revenues are still down from $109.1

billion in 2022 to $106.6 billion in 2024, and earnings per share are down 19% by the end of 2024,

underscoring the disconnect between efficiency gains and value realization. External pressures and internal

constraints exacerbate the strategic challenges. Moreover, competitors such as Amazon and Walmart

undermine Target's differentiation through superior logistics density and technology scalability. The findings

suggest that digital collaboration alone does not guarantee competitive advantage, and that success depends

on operational upgrades coordinated with dynamic pricing, customer experience design, and organizational

capacity building.

1 INTRODUCTION

Driven by both the digital economy and changes in

consumer behavior, the retail industry is accelerating

its transformation into an omnichannel model. The

rise of omnichannel retailing makes it imperative for

retailers to move toward inventory visualization,

improved fulfillment responsiveness, and a high

degree of synergy, including online and offline

channels (Hübner, Kuhn, & Wollenburg, 2016). In

response to the current dilemma, most companies

have started promoting supply chain digital

collaboration strategies to integrate multichannel

resources, improve supply chain agility, and enhance

customer experience (Gallino & Moreno, 2014).

According to Musa, Gunasekaran, and Yusuf

(2014), supply chain digital collaboration usually

refers to integrated information systems that enable

real-time linkage of key aspects such as demand

forecasting, inventory management, and order

fulfillment across multiple channels. Based on

existing research, this type of collaboration

mechanism is significantly detrimental in practice but

still controversial in terms of the actual overall

performance of the enterprise, especially the stability

and sustainability of the performance under market

uncertainty.

This paper focuses on the limits and challenges of

supply chain digital collaboration in an omnichannel

context. Specifically, will take Target, a US discount

retailer, as a case study to analyze its operational

performance after introducing the “Store as a Hub”

strategy. Specifically, this paper will take Target, an

American discount retailer, as a case study to analyze

its achievements and problems in operational

resilience and financial performance after introducing

the “Store as a Hub” strategy. Although the company

has invested heavily in its supply chain system, the

reality of its slowing financial growth and

intensifying competitive pressures reveals the

complexity of the effectiveness of synergistic

strategies.

2 LITERATURE REVIEW

The shift to omnichannel retailing has fundamentally

reshaped the supply chain structure. According to

Luo, J.

Limits and Challenges of Supply Chain Digital Collaboration: A Case Study on Target Corporation’s "Store as a Hub" Strategy.

DOI: 10.5220/0013853000004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 717-722

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

717

Hübner, Kuhn, and Wollenburg (2016), the

traditional retail model with online and offline

channels as independently functioning systems has

now proven to be unable to meet fragmented

consumer demand and increasing expectations for

speed of delivery, coolness, accuracy, and

consistency of service promptly. Therefore,

organizations must integrate and enhance their

physical and digital channels to provide a hassle-free

experience to users. However, this integrated model

puts enormous pressure on supply chain coordination,

inventory synchronization, and "last-mile delivery"

(Melacini, Perotti, Rasini & Tappia, 2018).

In this context, supply chain digital collaboration

enables dynamic collaboration of multi-channel

operational data by integrating digital technologies

such as real-time inventory visualization systems,

cloud-based order management platforms, and

intelligent scheduling algorithms (Gallino & Moreno,

2014; Musa et al., 2014). The inventory visualization

mechanism has become a key breakthrough for

improving supply chain resilience due to its cross-

node support and dynamic inventory and demand

response configuration in physical stores, regional

warehouses, and e-commerce platforms (Swink et al.,

2024). Complementary to this strategy is the

distributed fulfillment model, which Wollenburg,

Holzapfel, Hübner, and Kuhn (2018) confirmed

through empirical research that utilizing a network of

brick-and-mortar stores for end-of-line order

fulfillment has a significant advantage over the

traditional centralized warehouse model in terms of

lowering the cost of "last-mile" delivery. By

reconfiguring the decision-making mechanism of the

supply chain, these digital innovations ultimately lead

to the triple value effects of increased organizational

agility, improved risk tolerance, and optimized

customer experience.

However, while existing studies emphasize the

advantages of technological empowerment, they

overlook obvious theoretical blind spots. Recent

studies from a contingency theory perspective point

out that dynamic environmental boundaries limit the

effectiveness of digital collaboration systems:

Ivanov's (2025) simulation model shows that when

the macroeconomic volatility index exceeds a

threshold, the rigid architecture of a digital supply

chain amplifies the transmission effect of demand

contraction instead. A longitudinal study based on the

resource-based view by Paula and Jabbour (2017)

reveals that the marginal contribution of supply chain

visibility enhancement to financial performance is

attenuated by 58% when firms lack complementary

organizational capabilities, such as dynamic pricing

mechanisms and flexible production capabilities.

These findings challenge the underlying assumptions

of technological determinism, suggesting significant

weighting conditions for the value realization of

digital collaboration.

3 CASE ANALYSIS

3.1 Target’s Background

Target is one of the largest general retailers in the

U.S., with over 1,900 stores across the U.S. in a wide

range of categories, including housewares, apparel,

food, and electronics. As a traditional brick-and-

mortar retailer, Target has long relied on its store

network to attract customer traffic and build brand

loyalty. However, Target has had to revisit its

operating model with the shift in consumer preference

to e-commerce platforms and the rising demand for

an omnichannel shopping experience.

Target decided to implement the "Store as a Hub"

strategy in 2017, expanding the function of stores

from a single point of sale to a local fulfillment center.

Under this model, stores are responsible for offline

sales and picking, packing, and immediate delivery of

online orders, backed by a network of regional sorting

centers and last-mile logistics (Target Corporation,

2022). The strategy is designed to reduce fulfillment

time, improve inventory visibility, and optimize

fulfillment costs, and is at the heart of Target's

omnichannel supply chain collaboration.

Target has invested significantly in digital

infrastructure to support this strategy, including

deploying a real-time inventory management system,

a cloud-based order management platform, and

enhanced store picking capabilities. As of 2023,

stores or store-related logistics systems fulfill

approximately 95% of online orders (Target

Corporation, 2023). In addition, Target is looking to

enhance its “last-mile delivery” capabilities by

acquiring Ship to strengthen its same-day delivery

capabilities.

3.2 Target's Supply Chain Digital

Collaboration

Target's supply chain transformation is centered on its

"Store as a Hub" strategy, a digital initiative that aims

to reposition the company's more than 1,900 brick-

and-mortar stores as distribution nodes in an

integrated omnichannel logistics system. The model

no longer views stores and warehouses as separate

entities, but instead supports store picking, packing,

ICEML 2025 - International Conference on E-commerce and Modern Logistics

718

and distribution of online orders. The system's heart

is real-time inventory visibility, thanks to RFID tags,

a cloud-based order management system, and an in-

store digital interface. These technologies enable

customers and internal systems to access up-to-date

inventory levels and trigger automated order routing

based on location proximity and item availability

(Gallino & Moreno, 2014; Musa et al., 2014).

To facilitate the decentralized model, Target has

established urban sorting centers that collect

packages from neighboring stores and integrate them

through partners such as Shipt and Uber for "last-

mile" delivery. This infrastructure reduces delivery

times and improves routing efficiency. According to

Target's 2023 annual report, more than 95% of digital

orders are fulfilled through in-store inventory and

labor (Target Corporation, 2023). The company also

invested in employee training and a mobile picking

system to improve the accuracy and speed of order

fulfillment at the store level. The model embodies a

deeply embedded digital collaboration that enables

customer-facing interfaces and back-end systems to

access real-time inventory data and automatically

trigger order workflows. It aligns operational

mechanisms with strategic goals and enhances

horizontal coordination and process transparency

across the supply chain.

Target's supply chain transformation is centered

on its "Store as a Hub" strategy, a digital initiative that

aims to reposition the company's more than 1,900

brick-and-mortar stores as distribution nodes in an

integrated omnichannel logistics system. The model

no longer views stores and warehouses as separate

entities, but instead supports store picking, packing,

and distribution of online orders. The system's heart

is real-time inventory visibility, thanks to RFID tags,

a cloud-based order management system, and an in-

store digital interface. These technologies enable

customers and internal systems to access up-to-date

inventory levels and trigger automated order routing

based on location proximity and item availability

(Gallino & Moreno, 2014; Musa et al., 2014).

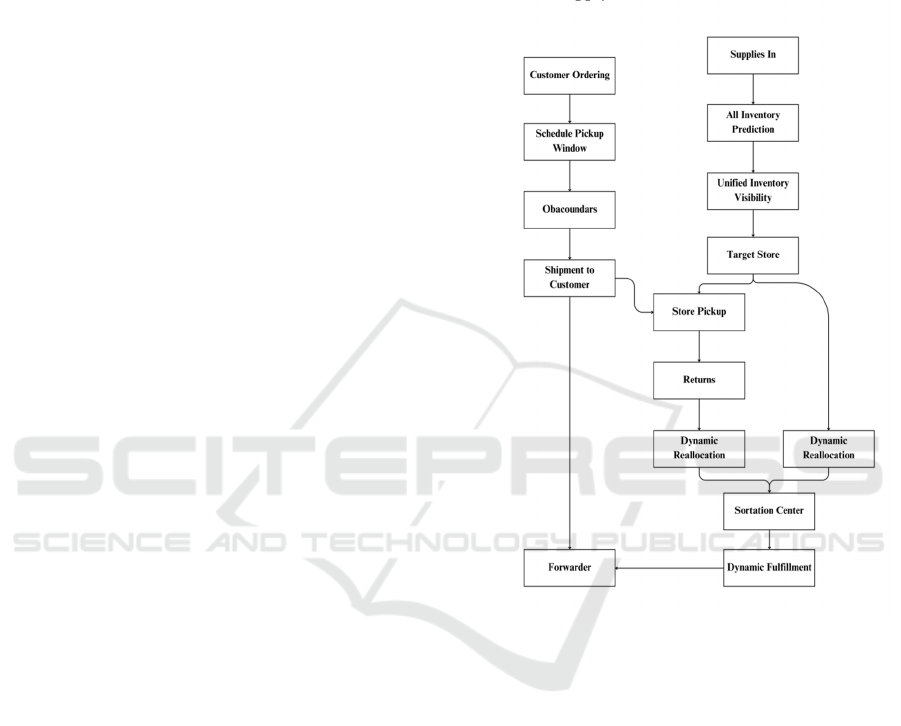

To facilitate the decentralized model, Target has

established urban sorting centers that collect

packages from neighboring stores and integrate them

through partners such as Shipt and Uber for "last-

mile" delivery, as shown in Figure 1. This

infrastructure reduces delivery times and improves

routing efficiency. According to Target's 2023 annual

report, more than 95% of digital orders are fulfilled

through in-store inventory and labor (Target

Corporation, 2023). The company also invested in

employee training and a mobile picking system to

improve the accuracy and speed of order fulfillment

at the store level. The model embodies a deeply

embedded digital collaboration that enables

customer-facing interfaces and back-end systems to

access real-time inventory data and automatically

trigger order workflows. It aligns operational

mechanisms with strategic goals and enhances

horizontal coordination and process transparency

across the supply chain.

Figure 1: Target’s store-as-a-hub fulfillment model (Picture

credit : Original).

3.3 Operational Improvement

Outcomes

The shift to a digitally coordinated store fulfillment

model has yielded significant efficiency,

responsiveness, and scalability gains. First, Target

has reduced "last mile" delivery costs by utilizing

stores geographically closer to customers rather than

centralized distribution centers. Industry data

suggests that store fulfillment, supported by real-time

digital systems, can reduce delivery costs by 30% to

40% (Melacini et al., 2018). This enhances Target's

ability to provide same-day and next-day delivery in

most U.S. metropolitan areas.

In addition to cost savings, inventory visibility

significantly improves order accuracy and reduces

out-of-stocks. Customers can view inventory at the

Limits and Challenges of Supply Chain Digital Collaboration: A Case Study on Target Corporation’s "Store as a Hub" Strategy

719

store level before placing an order, which enhances

the credibility of Target's omnichannel platform.

Store-level order fulfillment also improves flexibility

during peak holidays and major promotions. By

decentralizing order fulfillment to hundreds of

locations, Target can respond to surges in demand

without burdening centralized logistics facilities.

Overall, these improvements confirm findings in the

literature on the link between digital collaboration

and supply chain agility and customer responsiveness

(Wollenburg et al., 2018).

These improvements confirm the literature's

findings on the link between digital collaboration and

supply chain agility. Table 1 directly compares the

centralized and store-based fulfillment models.

Table 1: Centralized vs. Store-based fulfillment

comparison table

Metric

Centralized

Fulfillment

Store-

Based

Fulfillment

Average

Last-Mile Cost

$7.50 $5.10

Delivery

Time

2–3 days

Same-day

/ Next-day

Inventory

Accuracy

~83% >92%

Order

Processing

Flexibility

Medium High

Infrastructure

Investment

High

upfront

Leverages

existing stores

3.4 Continuing Challenges and

Limitations

Despite its many operational strengths, Target

struggles to translate supply chain improvements into

broader financial success. While digital collaboration

has improved distribution speeds and inventory

visibility, external economic pressures present the

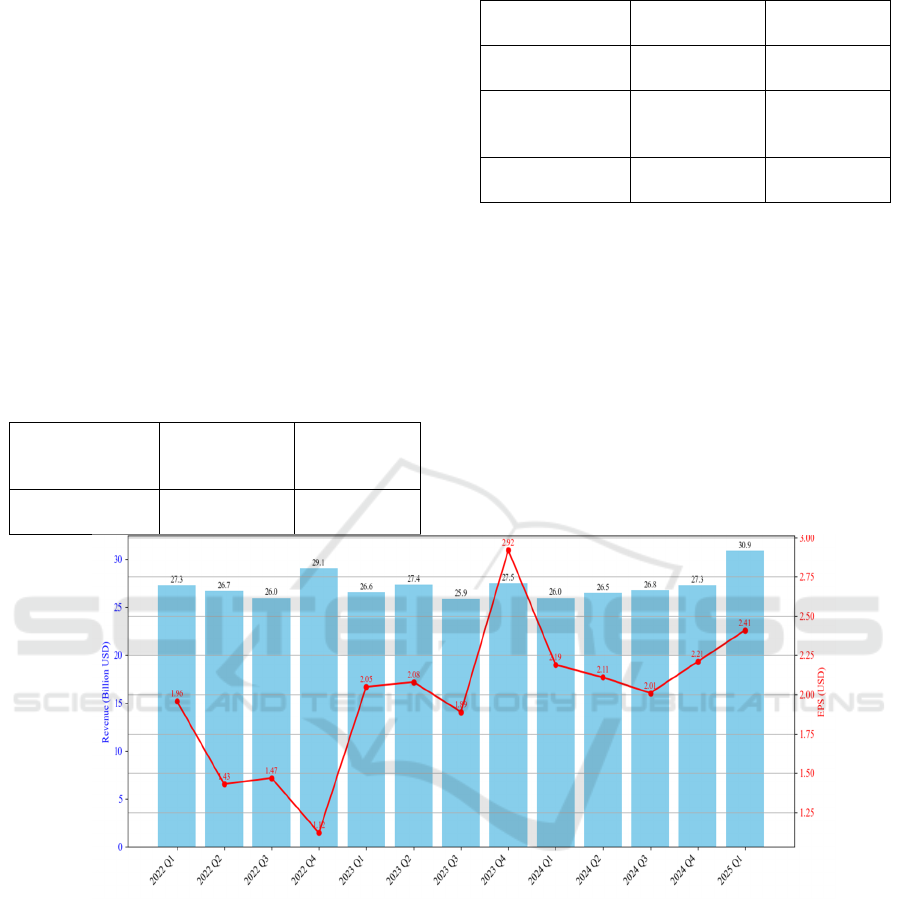

company with serious challenges. Figure 2 visualizes

the quarterly changes in Target’s revenue and

earnings per share, reinforcing the disconnect

between operational advancement and financial

outcomes.

Figure 2: Target’s Quarterly Revenue and EPS (2022 Q1–2025 Q1) (Picture credit : Original).

As shown in Figure 2, quarterly trends in revenue

and EPS illustrate the growing disconnect between

operational advancement and financial outcomes

over the FY2022-2025 period. Also, between

FY2022 and FY2024, the company's annual revenue

declined from $109.1 billion to $106.6 billion, with a

further decline of 3.15% in the first quarter of

FY2025 (Target Corporation, 2025). Earnings per

share also declined from $2.98 in the fourth quarter

of 2023 to $2.41 in the fourth quarter of 2024 (Target

Corporation, 2024). These data highlight the

limitations of digital collaboration in the face of

external market factors such as inflation, consumer

uncertainty, and declining demand for non-essential

goods. In addition to these external factors, declining

financial performance may reflect internal constraints

on companies' ability to extract value from their

digital investments. For example, the costs associated

with upgrading store infrastructure, deploying real-

time systems, and retraining employees may not be

fully offset by proportional profitability or revenue

growth gains. While digital collaboration has

operational enhancements, it must be more closely

aligned with pricing strategy, category planning, and

transformation of the long-term business model to

realize sustainable financial returns.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

720

On the other hand, competitors like Walmart and

Amazon have replicated or surpassed Target's

logistics capabilities, eroding its strategic advantage.

Walmart's dense logistics network and Amazon's

high-speed last-mile system outperform Target in

terms of coverage and responsiveness, thus eroding

the competitive differentiation of store delivery

(Syed, 2024).

Internally, stores are used for customer service

and logistics operations, bringing structural

complexity. Picking operations are labor-intensive,

and high employee turnover risks consistency and

service quality. Balancing store retail and back-of-

store logistics can lead to capacity conflicts and

increased operating costs. These organizational

pressures are consistent with previous research that

suggests digital systems must be matched with

sustainable human and process capabilities to achieve

long-term results (Paula & Jabbour, 2017).

4 DISCUSSION

This paper analyzed Target's "Store as Hub" model,

the current digital collaboration mechanisms, actual

profitability performance, and current challenges and

limitations, and provide a sample of an omnichannel

retailer's supply chain collaboration structure.

According to Target's financial statements in recent

years, Target has made significant operational

improvements, such as inventory visibility,

fulfillment timeliness, and responsiveness. However,

these strengths have not consistently translated into

improved financial performance. Against the

backdrop of high levels of digital integration, Target's

revenue is expected to decline in fiscal 2022-2024,

while earnings per share (EPS) are expected to

decline by more than 19% from the fourth quarter of

2023 to the fourth quarter of 2024. This demonstrates

the disconnect between operational capability and

value realization and shows that digital synergy alone

is insufficient to ensure the company's continued

competitiveness in the dynamic retail industry.

The importance and necessity of supply chain

agility and visibility in the context of modern retail

fulfillment systems are also confirmed by Gallino and

Moreno (2014) and Ivanov (2025). Target's

implementation of digital synergies between

inventory systems, fulfillment nodes, and last-mile

logistics is a good fit. However, it also exposes an

overlooked structural mismatch between operational

digitization and value realization. While the

assumptions in the existing literature are mainly

based on the assumption that improved visibility

equals improved performance, the Target case shows

that without relevant pricing strategies, customer

experience design, and strategic direction alignment,

digitization may only lead to improved performance.

Strategic direction alignment and digitization may

only lead to data affluence rather than profit

transformation. In addition, the increased labor

intensity, organizational complexity, and structural

burdens associated with using stores as both sales and

fulfillment nodes are parts of the equation that

existing theories have not adequately explained.

From the perspective of marketing management

practice, the "Store as Hub" model is not a universal

solution, and it is more suitable for retailers with a

dense network of stores and sophisticated information

systems with high execution capabilities. If the model

is implemented in sparsely populated areas or

retailers with a weak IT foundation in Cyber, the

marginal benefits of the model may shrink rapidly. At

the same time, the transformation of profits relies on

implementing the system and needs comprehensive

organization of staff training, suitable incentives, and

a synergistic governance system construction.

Otherwise, digital synergy may lead to management

CREEP rather than measurable customer or financial

value.

The limitations of this study still exist, so in the

future, multiple case study comparisons can be made

to explore the heterogeneity of omnichannel

fulfillment strategies further. For example, Target's

"Store as Hub" model contrasts with Amazon's

emphasis on centralized automation and high-density

logistics robotics (Amazon, 2024). There is a stark

difference. On the other hand, Walmart offers a

hybrid model that leverages its physical presence in

regional fulfillment centers and active last-mile

partnerships (Walmart, 2023). While comparing

these models raises questions about how digital

collaboration scales in low-breed environments, it

also allows for a more nuanced understanding of

which digital collaboration mechanisms perform best

under specific organizational and environmental

conditions. It can also help researchers identify

environmental enablers that influence the success of

digital fulfillment strategies.

5 CONCLUSION

The study examines the effectiveness and limitations

of digital supply chain collaboration by analyzing

Target Corporation's "Store as a Hub" model. The

findings show that while Target realized operational

improvements, such as faster order fulfillment, better

Limits and Challenges of Supply Chain Digital Collaboration: A Case Study on Target Corporation’s "Store as a Hub" Strategy

721

inventory visibility, and increased responsiveness,

these results did not directly lead to sustained

financial gains. This highlights the gap between

operational digitization and value realization,

especially considering changing consumer demands

and competitive pressures. The study also shows that

store-based fulfillment is not a one-size-fits-all

solution. Its effectiveness depends on store density,

staff capacity, and IT infrastructure. Without strong

coordination, the model can add complexity and cost.

The future of the digital supply chain requires not

only technology upgrades but also better coordination

of systems, strategies, and customer needs. Retailers

must continually adapt to a rapidly changing

marketplace, and models like Target provide valuable

lessons but must be carefully evaluated and adapted.

Future research could explore how digital

collaboration works across business models, market

conditions, and organizational structures.

REFERENCES

Amazon, 2024. Supply chain by amazon. Sell on Amazon.

Deloitte, 2024. Driverless delivery and last-mile coverage |

deloitte global. Deloitte.

Gallino, S., & Moreno, A., 2014. Integration of online and

offline channels in retail: The impact of sharing reliable

inventory availability information. Management

Science, 60(6), 1434-1451.

Hübner, A., Wollenburg, J., & Holzapfel, A., 2016. Retail

logistics in the transition from multi-channel to omni-

channel. International Journal of Physical Distribution

& Logistics Management, 46(6/7), 562-583.

Ivanov, D., 2025. What network and performance

indicators can tell us about supply chain and sourcing

resilience (and what they cannot). Journal of

Purchasing and Supply Management, 101014.

Melacini, M., Perotti, S., Rasini, M., & Tappia, E., 2018.

Efulfilment and distribution in omnichannel retailing: a

systematic literature review. International Journal of

Physical Distribution & Logistics Management, 48(4),

391-414.

Musa, A., Gunasekaran, A., & Yusuf, Y., 2014. Supply

chain product visibility: Methods, systems and impacts.

Expert Systems with Applications, 41(1), 176-194.

Paula, & Jabbour, 2017. Information systems and

sustainable supply chain management towards a more

sustainable society: Where we are and where we are

going. International Journal of Information

Management, 37(4), 241-249.

Swink, M., Sant'Ana Gallo, I., Defee, C., & Silva, A. L.,

2024. Supply chain visibility types and contextual

characteristics: A literature-based synthesis. Journal of

Business Logistics, 45(1).

Syed, 2024. Supply chain news: Walmart and amazon by

the numbers 2024.

Walmart, 2023. Product supply chain sustainability.

Walmart.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

722