Research on the Impact of Dynamic Pricing on Revenue Based on

Airbnb Data

Wenjia Zhang

a

School of Mathematical Sciences, Ocean University of China, Qingdao, China

Keywords: Dynamic Pricing, Linear Regression, Airbnb's Revenue.

Abstract: Airbnb, as a globally leading short-term rental platform, faces unique challenges in pricing due to the diversity

of its listings, including variations in location, amenities, and host preferences. To address these challenges,

Airbnb has introduced a calendar-based visualization tool and a machine learning-driven tool to maximize

hosts' revenue. However, the empirical impact of dynamic pricing—particularly its differential effects across

room types—remains understudied. To get figure out that, this research used linear regression to quantify the

impact of dynamic pricing on revenue and find out how it had differential effects across room types. This

study addressed two core questions: How significant is the revenue gap between dynamic pricing and fixed

pricing strategies? Does dynamic pricing exert varying impacts on revenue across different room types?

Taking Chicago as an example, the article finds that dynamic pricing can increase annual income by 30% and

shows no significant difference in the degree to which different room types affect income from dynamic

pricing.

1 INTRODUCTION

Recently, advancements in the use of dynamic pricing

have benefited multiple industries, especially driven

by digitalization and real-time data analysis

technology. In a saturated market, dynamic pricing

ensures hosts remain price-competitive, avoiding lost

bookings due to overpricing or profit erosion from

underpricing. Its flexibility and profitability

advantages make it a core strategy for many

enterprises. Despite extensive research on theoretical

research in economics, little attention has been paid

to specific quantitative research on the extent to

which dynamic pricing can improve revenue. Airbnb,

which plays an important role in short-term rental

market, adopts a dynamic pricing model of landlord's

independent selection and algorithm recommendation.

Airbnb's dynamic pricing is semi-automated, with

hosts having the final decision-making power, but

algorithmic tools have become an important tool for

increasing revenue. Its success depends on a deep

understanding of the local market, rather than simply

being driven by technology. However, detailed

regulations and algorithms of smart dynamic pricing

are not available. More research is required for the

a

https://orcid.org/0009-0005-5226-7545

definition and judgment on dynamic pricing. This

study seeks to address this gap by constructing an

original method to define dynamic pricing and

analysing data in Chicago on Airbnb to quantify the

revenue impact of dynamic pricing and explore its

heterogeneous effects across room types.

This article provides practical insights for

landlords and operators of Airbnb and has reference

significance for other industries such as shared office,

car rental, hotels, and catering. Meanwhile, it

provides theoretical implications for academic

research in Price Theory and Market Mechanism,

Algorithm and Data Science, and Sharing Economy

and Policies. With its original dynamic pricing

definition, this article breaks through traditional

dynamic pricing theory, filling academic gaps to a

certain extent, and promoting the development of

pricing theory. Besides, developing original dynamic

pricing definitions has significant commercial value

to guide business practices and enhance market

competitiveness. On the other hand, studying the

specific quantitative impact of dynamic pricing on

revenue can help support decision-making, optimize

resource allocation, conduct risk management, and

strategic value assessment.

Zhang, W.

Research on the Impact of Dynamic Pricing on Revenue Based on Airbnb Data.

DOI: 10.5220/0013852800004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 711-716

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

711

2 LITERATURE REVIEW

With the Literature Review, the author finds that

research on Airbnb is mostly focusing on travelling

tourism, such as customers' optional motivation,

development of hotel business, impact on tourist

destinations, etc. Some studies in the Economics

aspect include pricing factors and local revenues

affected by Airbnb. However, in these discussions

from an economic perspective, a key issue has been

relatively overlooked-Airbnb, as a typical

representative of the sharing economy, lacks

systematic research on the decision-making

mechanism and market impact of its hosts' dynamic

pricing strategies. For example, an empirical analysis

of short-term rental platforms.

Gallego and Ryzin studied on dynamic pricing

problem of inventory within a limited time. They

found that dynamic pricing was more valuable when

the market demand was equivocal (Gallego and

Ryzin, 1994). Victor Araman and René Caldentey

studied how to use dynamic pricing to maximise

long-term average profit (Victor Araman and René

Caldentey, 2009). Gabriel Bitran and René Caldentey

researched pricing models in revenue management

and provided the theoretical basis and practical

guidance for enterprises to formulate pricing

strategies (Gabriel Bitran and René Caldentey, 2003).

Kelly and William concluded that, in consumers'

opinion, price changes within the short term are more

unfair than those in the long term. Moreover, when

consumers get equal or more discounts in business,

the sense of price fairness and purchase satisfaction

rate is higher (Kelly and William, 2006). Georgios

Zervas, Davide Proserpio, and John W. Byers proved

that Airbnb has a great effect on hotel revenue and

different types of hotels are affected to varying

degrees (Georgios Zervas, Davide Proserpio, and

John W. Byers, 2016). Martin Falk and Miriam

Scaglione found that regulations could significantly

affect Airbnb's lease performance (Martin Falk and

Miriam Scaglione, 2024). He, Qiu, and Cheng studied

the effect on labour supply from dynamic pricing on

Uber. They analysed the data from Uber and explored

drivers' responses to dynamic pricing. The results can

be used to study Airbnb's users' response to dynamic

pricing (He, Qiu, and Cheng, 2022). Gallego and

Ryzin prepared the theoretical framework in a

changing market, and Victor Araman and René

Caldentey further extended to maximize long-term

average profits. Theoretical preparation provided

support for deeper and broader research. Later, more

factors like consumer behavior, regulations effect and

supply were taken into consideration.

The research on the impact of dynamic pricing on

Airbnb revenue mainly focuses on technical

application and strategy differences. Machine

learning is used to mimic the progress of dynamic

pricing and provides pricing suggestions. Wang

(2024) highlighted the complexity of Airbnb's

machine learning algorithms, which process

thousands of data points-including historical

bookings, seasonal trends, and competitor prices-to

generate real-time pricing recommendations. A study

on strategy differences shows dynamic pricing on

Airbnb can increase revenue. Kwok and Xie (2019)

compared pricing behaviours between single-

property and multi-property hosts, finding that multi-

property hosts adopting dynamic pricing achieve

significantly higher revenue than fixed-pricing

counterparts. However, there is no study on how

much can dynamic pricing increase revenue.

Moreover, considering that the definition of pricing

method and algorithm are non-public, how to use

limited public data to define dynamic pricing and

fixed pricing is also a worthwhile research aspect.

The author established original data filtering rules and

definition methods. By doing this, a specific number

was calculated to show how dynamic pricing affect

Airbnb's revenue.

3 METHODOLOGY

3.1 Modeling

To analyse the impact of dynamic pricing on Airbnb's

revenue, this article used linear regression to analyse

the pre-processed data. The regression model used

was:

𝑅𝑒𝑣𝑒𝑛𝑢𝑒 = 𝛽

+𝛽

×𝐷𝑦𝑛𝑎𝑚𝑖𝑐

+𝛽

× 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝛽

× 𝑅𝑜𝑜𝑚 𝑡𝑦𝑝𝑒

+𝛽

×

(

𝑅𝑜𝑜𝑚 𝑡𝑦𝑝𝑒 × 𝐷𝑦𝑛𝑎𝑚𝑖𝑐

)

+𝜖

(1)

Independent variable in this equation showed in

Table1.

In the original data, “price” represents daily price

in local currency and “reviews per month” reflects

guests' occupancy rates and feedback. This article

used a review rate of 0.78 to estimate the annual

income of each room. The review rate is from Julia's

research: about 78% of guests leave reviews of their

accommodation. This provides a revenue estimation

that is closer to the actual booking volume. Thus:

𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝐴𝑛𝑛𝑢𝑎𝑙 𝐼𝑛𝑐𝑜𝑚𝑒

= 𝑝𝑟𝑖𝑐𝑒 × 𝑟𝑒𝑣𝑖𝑒𝑤𝑠 𝑝𝑒𝑟 𝑚𝑜𝑛𝑡ℎ × 12/78

(

2

)

ICEML 2025 - International Conference on E-commerce and Modern Logistics

712

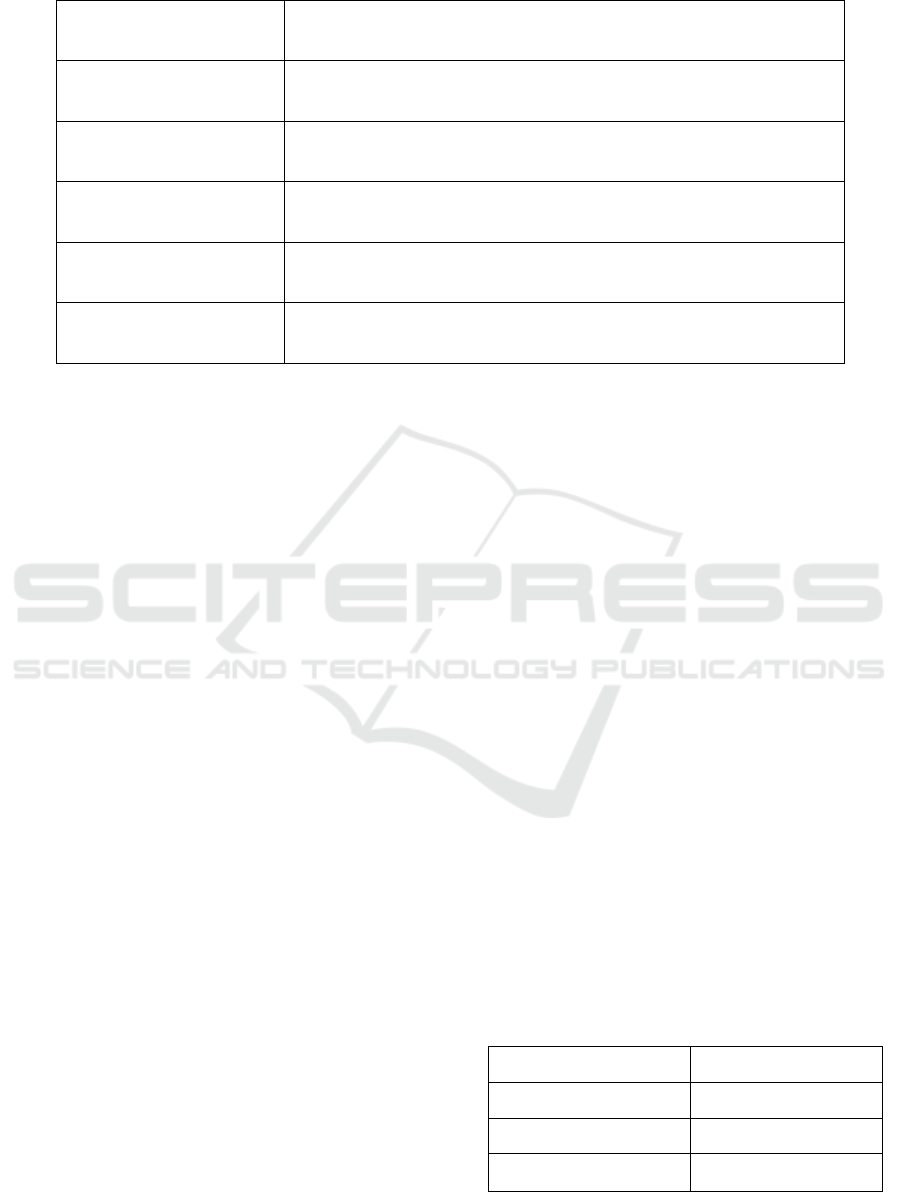

Table 1: Independent variable Meanings

Independent variable Meaning

Dynamic

Binary independent variable indicating whether dynamic pricing is used in

this room. (Dynamic price =1, Fixed price=0)

Income Estimated Annual Income.

Room type

Categorical variable representing different types of rooms. (Entire home,

Hotel room, Private room, Shared room)

Room type × dynamic

Interaction term intended to test whether the effectiveness of dynamic

pricing varies by room type.

Є The residual error.

3.2 Data Introduction

The data used in this article was downloaded from

inside Airbnb. The author chose data from Chicago,

USA, presented on the Internet. The original data

includes approximately 8700 sets, consisting of more

than 10 variables: id(user), name(user), host id,

hostname, neighbourhood (more than 80), latitude,

longitude, room type (Entire home/apt, Private room,

Shared room, Hotel room), price, minimum nights,

number of reviews, last review, reviews per month,

calculated host listings count, availability_365,

number of reviews, license. The primary variables

utilized in the data processing included Host ID,

Room type, neighbourhood, Price, and Reviews per

Month. The neighbourhood parameter denotes the

geographical community in which the rental property

is situated.

It can be concluded that this method defines the

pricing type of rooms in the same neighbourhood of

the same house host, considering that house hosts

choose the same pricing type for the same room type

in the same neighbourhood.

The following selection and processing steps were

performed on the data:

First of all, to calculate the necessary metrics, the

author selected only those Host IDs that repeat at least

four times, avoiding sample bias and making sure of

proper judgment.

Second, since a single Host ID may correspond to

multiple listings, i.e., a house host has several rooms

or houses for rent on Airbnb, the author grouped all

listings by Host ID. Listings with the same Room type

and neighbourhood under the same Host ID were

assigned to the same Room ID. Each Room ID is

considered as a single research subject. To minimize

randomness, the author filtered out Room IDs that

repeated less than three times and got 321 groups of

Room IDs in total.

Third, the author used the average price for each

Room ID as a baseline and calculated the relative

price deviation for all listings within the same group

(volatility value =

|

price − average price

|

/

average price) . The maximum volatility value's

corresponding price was selected as the

representative value for that Room ID.

Finally, among the representative values of all

groups, the author selected the top 50% with the

higher representative values to be classified as

dynamic pricing, while the remaining 50% were

classified as fixed pricing.

The author conducted the data compute

processing using MATLAB R2023a and set the

dynamic pricing and the fixed price, with the code

provided in the Appendix. The result shows that when

the representative volatility rate for a room ID

exceeds a certain threshold (= 29.55%), the group is

assigned dynamic pricing; otherwise, it is assigned

fixed pricing. Among the 321 groups of Room IDs,

161 groups were set as dynamic pricing. The

MATLAB calculation of the critical volatility rate is

displayed in Table 2.

Table 2: MATLAB operation results display

Type of variables

Dynamic room id 161 sets

Total room id 321 sets

Threshold 29.55%

Research on the Impact of Dynamic Pricing on Revenue Based on Airbnb Data

713

The above operation is based on the situation of

the data itself. After calculating the multiple

distribution ratio, the author selected the most

suitable screening criteria for this situation. For more

different data, the same definition method in this

article can be used, but setting unique standards

according to different situations is necessary.

4 RESU LT ANALYSIS

4.1 Descriptives

After data Preprocessing, there are 321 sets of room

IDs in total. Among them, 161 groups were set as

dynamic pricing and the other 160 groups were set as

fixed pricing, as shown in Table 3. Because shared

rooms were all set at fixed pricing, the author does not

analyse it here. Classifying according to different

room types, dynamic pricing increases income

compared to fixed pricing in the entire house, private

room, and hotel rooms. The analysis results show that

the entire house has the highest dynamic pricing rate

and then there is a hotel room. The entire house has

the most reviews per month, which indicates that the

occupancy rate of the entire house is relatively high,

and guests are more willing to leave reviews.

Moreover, the standard error of the entire house's

annual estimated income is the lowest, implying that

the revenue from the entire house is stable and

sustainable. It might be related to its high rate of using

dynamic pricing and show support for sustainable

revenue from dynamic pricing.

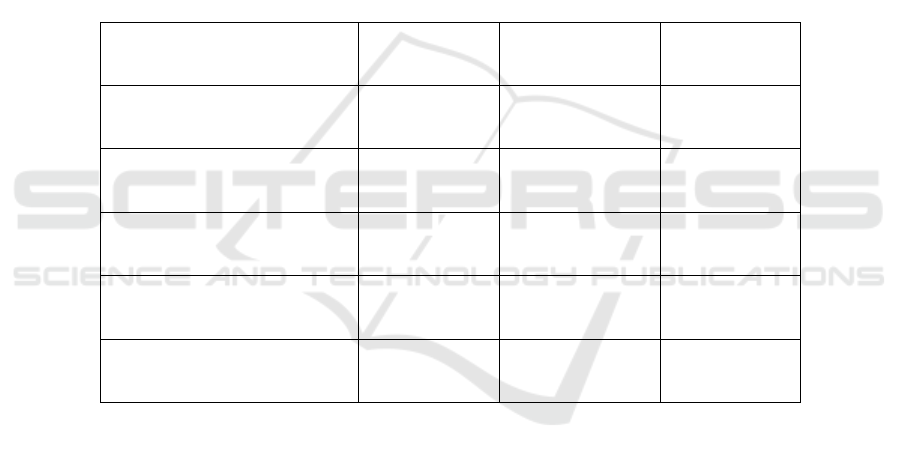

Table 3: Descriptive statistical analysis

Entire room Private room Hotel room

Average annual income of

dynamic pricing

6434$ 2312$ 5784$

Average annual income of

fixed pricing

6322$ 2245$ 5778$

Dynamic pricing rate 78.4% 36.0% 60.7%

Reviews per month 1.87 1.58 0.94

Standard error of

annual estimated Income

264.9 279.9 990.3

4.2 Regression Results

Using Fixed pricing as the control group and Entire

Home as the control group for regression analysis, the

results show that dynamic pricing can increase annual

income by more than $1,000, with a p-value less than

0.05, indicating that the increase in income due to

dynamic pricing is statistically significant. Moreover,

when Entire Home is used as the control group, the

five p-values are all greater than 0.05, suggesting that

the impact of dynamic pricing on income is not

affected by the room type. Here, can only conclude

that Private Rooms, Hotel Rooms, and Shared Rooms

are not significantly distinguished from Entire Rooms.

It is important to note that all Shared Room

listings are classified under Fixed pricing, so the

regression analysis results for Shared Room show

anomalies in terms of values (the p-value is NUM and

the others are all zeros), but this does not affect the

overall conclusion. The results of Regression 1 are

shown in Table 4.

Furthermore, to examine the difference in the

impact of dynamic pricing between Private Rooms

and Hotel Rooms, the author performed another

regression with Private Rooms as the control group.

The p-value of the Hotle Dummy and Shared Dummy

are all greater than 0.05. This shows that there is no

significant difference between these room types and

the Private Room. Meanwhile, the p-value of the

interaction terms, i.e. f_d*HD and f_d*SD, are

greater than 0.05. This shows that room type has no

significant effect on how dynamic pricing increases

avenue.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

714

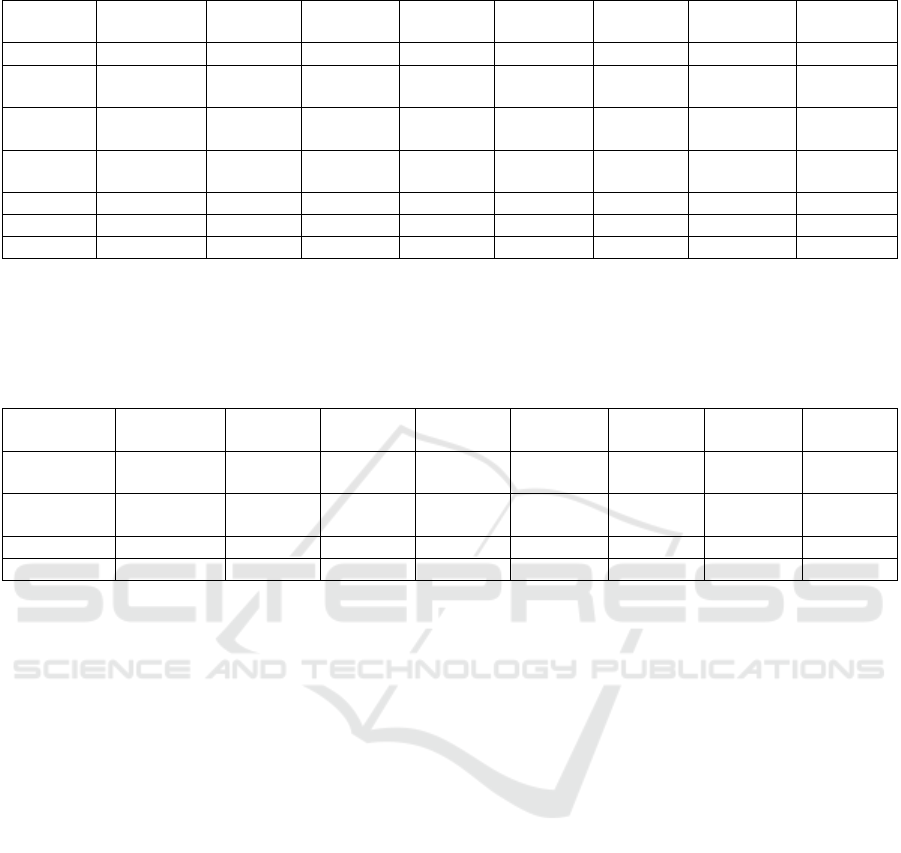

Table 4: Regression 1

Coefficients

Standard

Erro

r

t Stat P-value

Lower

𝟗𝟓%

Upper

𝟗𝟓%

LL 𝟗𝟓. 𝟎%

UL

𝟗𝟓. 𝟎%

Intercept

517138.7 265769.7 1.945815 0.051809 −4057.95 1038335

−1.2 × 10

12754095

Hotel

Dummy

440.4479 1032.579 0.426551 0.669749 −1584.53 2465.421 −47103.1 47983.95

Private

Dumm

y

−586.002 391.2381 −1.49781 0.13433 −1353.25 181.2484 −18600 17427.95

Shared

Dumm

y

−1851.6 1078.308 −1.71713 0.086101 −3966.25 263.0533 −51500.6 47797.41

f_d*HD

−2436.22 1306.753 −1.86433 0.062413 −4998.87 126.4299 −62603.6 57731.18

f_d*PD

−833.688 507.064 −1.64415 0.100294 −1828.08 160.7069 −24180.7 22513.29

f_d*SD

0 0 65535 #NUM! 0 0 0 0

The results confirm that the impact of dynamic

pricing on income remains unaffected by room type.

The outcomes of Regression 2 are shown in Table 5.

Table 5: Regression 2

Coefficients

Standard

Erro

r

t Stat P-value

Lower

𝟗𝟓%

Upper

𝟗𝟓%

LL

𝟗𝟓. 𝟎%

UL

𝟗𝟓. 𝟎%

Hotel

Dumm

y

1717.556 1606.371 1.069215 0.285094 −1432.67 4867.783 −1432.67 4867.783

Entire

Dummy

1060.904 599.2701

1.770326

0.076816 −114.315 2236.122 −114.315 2236.122

f_d*HD

−2548.14 2070.527

-1.23067

0.218582 −6608.62 1512.334 −6608.62 1512.334

f_d*ED

1300.124 791.8715

1.641837

0.100772 −252.802 2853.05 −252.802 2853.05

The f_d represents the Dynamic variable. ED

represents entire house dummy. HD represents hotel

room dummy. PD represents private room dummy.

SD represents Shared room dummy.

It is noteworthy that intrinsic price differentials

exist across distinct Room Type categories (e.g.,

Entire Home versus Private Room). Consequently,

coefficients associated with Room Type and its

interaction terms, when modelled as independent

variables, may exhibit negative values in regression

analyses.

5 CONCLUSION

In conclusion, this research investigated how

significant the revenue gap is between dynamic

pricing and fixed pricing strategies and whether

dynamic pricing exerts varying impacts on revenue

across different room types or not by linear regression.

The results demonstrate that dynamic pricing can

increase annual income by more than $1,000 in

Chicago, supporting the hypothesis that dynamic

pricing can increase annual income by 30%. Besides,

it shows that there is no significant difference in the

degree to which different room types affect income

from dynamic pricing. These findings not only

contribute to the short-term rental market but also

have an impact on economics, tourism management,

data science, and consumer behaviour. The

implications of the current study are significant for

both Airbnb and its hosts. Firstly, the research

provides evidence for the notion that dynamic pricing

is more than just a technological convenience.

Additionally, no significant difference in different

room types indicates the need for tailored dynamic

pricing algorithms.

Airbnb's dynamic pricing not only improves the

revenue management model of the tourism industry,

but also promotes the development of interactive

research between data science and economics. It

optimizes short-term rental market prices through

intelligent algorithms, while triggering policy

discussions on platform regulation and algorithm

fairness. This technology has promoted innovation in

the theory of the sharing economy and provided rich

cases for interdisciplinary research. Further attention

needs to be paid to its long-term impact on the

housing market and social equity in the future.

Research on the Impact of Dynamic Pricing on Revenue Based on Airbnb Data

715

REFERENCES

Bitran, G., & Caldentey, R., 2003. An overview of pricing

models for revenue management. Manufacturing &

Service Operations Management, 5(3), 203-229.

Chen, M. K., & Sheldon, M., 2015. Dynamic pricing in a

labor market: Surge pricing and flexible work on the

Uber platform. Working Paper.

Chen, W., Wei, Z., & Xie, K., forthcoming. Regulating

professional players in peer-to-peer markets: Evidence

from Airbnb. Management Science.

Gallego, G., & van Ryzin, G., 1994. Optimal dynamic

pricing of inventories with stochastic demand over

finite horizons. Management Science, 40(8), 999-1020.

Haws, K. L., & Bearden, W. O., 2006. Dynamic pricing and

consumer fairness perceptions. Journal of Consumer

Research, 33(3), 304-311.

Kwok, L., & Xie, K. L., 2019. Pricing strategies on Airbnb:

Are multi-unit hosts revenue pros? Tourism

Management, 72, 1-12.

Martí-Ochoa, J., Martín-Fuentes, E., & Ferrer-Rosell, B.,

2024. The voice of the guests: Analysing Airbnb

reviews as a representative source for tourism studies.

Profesional de la Información, 33(2), e330202.

Smith, H. K., & Yarger, J. L., 2024. Dynamic pricing and

revenue management in entrepreneurial supply chains.

ResearchGate. Preprint.

Wang, Y., 2024. Machine learning in Airbnb's dynamic

pricing: A multi-layered approach. Journal of Revenue

and Pricing Management, 21(3), 45-60.

Zervas, G., Proserpio, D., & Byers, J. W., 2017. The rise of

the sharing economy: Estimating the impact of Airbnb

on the hotel industry. Journal of Consumer Research,

44(3), 534-551.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

716