Influence of Supply Chain Geographic Proximity and Concentration

on Financial Performance of Chinese Automakers

Chengbo Li

a

School of Business, The University of Queensland, Brisbane, Australia

Keywords: Supply Chain Geographic Proximity, Supply Chain Concentration, Inventory Turnover Ratio.

Abstract: China’s automobile manufacturing industry has dominated the world’s automaking market for over a decade.

However, given the trend of globalization and the intensified competition in the industry, supply chain

network structure plays a vital role in Chinese automakers' financial performance. This paper utilized the

inventory turnover ratio to evaluate the impact of supply chain concentration and geographic proximity on

firms’ financial performance in China’s automotive manufacturing industry. To assess the impact, this

research uses data of 83 firms listed on Shanghai and Shenzhen Stock Exchanges in China’s automotive

manufacturing industry from year of 2010 to 2023. The main findings are: first, supply chain geographic

proximity is negatively related to the inventory turnover ratio; second, supply chain concentration are

negatively related to the inventory turnover ratio. Therefore, both supply chain geographic proximity and

concentration can negatively impact Chinese automakers’ financial performance. This research provides

insightful implications to firms and managers on how supply chain structure can impact financial performance.

1 INTRODUCTION

China’s automobile manufacturing industry stands

out due to its scale, quality, efficiency, and diversity.

In 2024, China produced over 31.4 million vehicles,

including 12.9 million new energy vehicles, which

accounted for approximately one-third of the world

total vehicle production and over two-thirds of the

world's electric vehicle production (Zhang, 2025).

China has maintained to be the world's largest

automobile manufacturing powerhouse for 15 years

since 2009, and for the first time in 2024 it surpassed

Japan and Germany, becoming the world's largest

automobile exporter (Chang & Bradsher, 2024).

However, given the dominant position of China’s

automobile manufacturing industry in the world, it

also faces tremendous internal and external

challenges and uncertainties, such as geopolitical

risks, environmental impacts, digital transformation,

industrial upgrading, and natural disasters. To tackle

these challenges and remain a sustainable and

competitive advantage in the global market, it is vital

to evaluate the impact of Chinese automakers’ supply

chain network structure on their financial

performance. Many studies have been conducted to

a

https://orcid.org/0009-0000-5566-5518

demonstrate supply chain factors that can influence

the financial performance of China’s automobile

manufacturing industry, including visibility,

digitalization, network complexity, inventory

management, and communication. However, as

critical structural components of supply chain

network, the influence of geographic proximity and

concentration on the financial performance of

Chinese automakers remain under-investigated.

Inventory turnover ratio is a perfect metric to measure

both the supply chain and financial performance of

firms. It not only evaluates how quickly a firm can

sell its inventory in a given period, which is closely

related to a firm’s supply chain management capacity,

but also is commonly referred to as a common metric

to measure sales efficiency, which reflects a firm’s

financial performance (Kwak, 2019). Thus, the

objective of this research is to explore and evaluate

the correlation among supply chain proximity,

concentration, and business performance based on a

firm’s inventory turnover ratio within China’s

automobile manufacturing industry. Particularly, this

paper seeks to answer two questions: First, does

supply chain proximity significantly impact China’s

automobile manufacturing firms’ financial

698

Li, C.

Influence of Supply Chain Geographic Proximity and Concentration on Financial Performance of Chinese Automakers.

DOI: 10.5220/0013852500004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 698-704

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

performance? Second, does supply chain

concentration significantly impact businesses’

financial performance within China’s automobile

manufacturing industry?

2 LITERATURE REVIEW

2.1 Impact of Supply Chain

Concentration on Financial

Performance

Supply chain concentration measures a company's

dependence on a small group of up and downstream

critical business partners. Thus, high supply chain

concentration indicates that an organization is highly

dependent on its suppliers and customers on raw

materials and sales channels. Scholars have

conducted various academic research on supply chain

concentration and its impact on business financial

performance. It is evident that supply chain

concentration is capable of influencing supply chain

resilience as it reflects a firm’s dependence on its

major trading partners (Jiang et al., 2023). Supplier

concentration generally represents the degree of a

firm’s raw material or service dependence on its

major suppliers. Therefore, high supplier

concentration, meaning a firm’s physical and

informational resources are predominantly obtained

from a few upstream suppliers, would hinder a firm’s

inventory, production, and operation when risks

occur to its suppliers. However, low supplier

concentration usually means a low level of

collaboration between the firm and suppliers, which

would increase the firm’s supply chain network the

complexity and potentially magnify the bullwhip

effect within its supply chain. Similarly, customer

concentration usually indicates the portion of a firm’s

sales revenue generated from a small group of large

customers (Chen & Xu, 2024; Jiang et al., 2023).

Hence, high customer concentration indicates that a

firm’s product sales are primarily reliant on a few

selected customers, which would become an

operational obstacle when disruption happens to

downstream major customers. Whereas, low

customer concentration usually indicates poor

customer collaboration and relationship management.

Additionally, according to Porter’s (2008) theory,

firms lose tremendous bargaining power and

competitive advantages when their operations rely

too much on a small group of suppliers or customers.

Therefore, supplier and customer concentration can

significantly influence a firm’s supply chain

resilience, which in turn affects its overall financial

performance.

2.2 Impact of Supply Chain

Geographic Proximity on Financial

Performance

Supply chain geographic proximity is also referred to

as the spatial distance between a firm and its suppliers

or customers (Cortes, 2023). It was largely considered

a major role that affects communication efficiency

between organizations. For instance, previous studies

show that companies within a proximity tend to have

a better communication channel to share information,

thereby promoting collaborations and improving

visibility (Yang & Ren, 2021). However, given the

modern technology development, especially the

development of the internet, communication between

organizations is no longer considered a major factor

that affects firms’ selection of supply chain partners

on the basis of geographic location. Despite the

communication efficiency between firms no longer

relies entirely on the distance, other factors that

associated with geographic proximity remain playing

critical roles influencing firms’ decision on suppliers

and customers selection as supply chain complexity

increases. For example, supplier selection is generally

based on consideration of cost, efficiency, time,

product quality, and variety. Therefore, companies

within a proximity would benefit from lower

transportation costs, shorter lead time, and more agile

inventory policies, which in turn enhance the overall

supply chain resilience (Lorentz et al., 2012).

Furthermore, a resilient supply chain could reduce

overall operating costs, hence, improve firm’s overall

financial performance.

2.3 China’s Auto Manufacturing

Industry Supply Chain

Characteristics

Despite the current dominant position of China’s

automobile manufacturing industry in the global

market, the industry is currently facing many

complex supply chain problems due to its rapid

development history and the current fast-paced

transition to new energy vehicles. Over recent

decades, China’s automaking sector has evolved from

a highly decentralized structure to industrial clusters

where manufactures and suppliers operate within the

same geographic regions (Cao et al., 2022; Y. Huang

et al., 2020; Sun & Abdullah, 2025). This clustering

structure offers automakers with significant

advantages, including low transportation costs and

Influence of Supply Chain Geographic Proximity and Concentration on Financial Performance of Chinese Automakers

699

low production delay risks. Thus, firms naturally

prefer to trade with businesses with who they have

already established a good relationship and within

close geographic proximity (Cao et al., 2022).

However, supply chain tension occurred with the

growing expansion of the industry. Especially when

there are hundreds of automakers and thousands of

component manufactures, not to mention the fact that

these numbers are still growing rapidly (Y. Huang et

al., 2020). The increasingly crowded supply chain

would intensify not only the competition across the

entire industry, but also the corporate decision-

making process regarding trading partner selection

and management, which in turn exacerbate the supply

chain complexity of the industry (Z. Huang et al.,

2024; Sun & Abdullah, 2025). Moreover, the trend of

new energy vehicle transition introduces additional

layers of supply chain complexity. Conventional

automakers and their suppliers have to both

collaborate with and compete against newly formed

new energy vehicle manufacturers and their

specialized suppliers due to differences in

manufacturing technology, supplier specification,

and customer segmentation (Cao et al., 2022). On one

hand, conventional automakers must cooperate with

and learn from new energy vehicle firms to achieve

their industrial upgrading and transition objectives;

on the other hand, conventional automakers face

intensifying competition from the same new energy

vehicle manufacturers for critical suppliers and

customers. Additionally, some industry clusters

centered by new energy vehicle manufacturers

established in regions that are geographically distant

from conventional automakers, creating spatial

fragmentation in China’s automotive supply chain

network which resulting in new challenges in

logistics coordination and supply chain integration

(Cao et al., 2022). Consequently, this makes the

supply chain of the whole industry even more

complex. Therefore, it is significant to investigate the

impact of supply chain distance and concentration on

automakers' financial performance.

3 METHODOLOGY

3.1 Data Collection and Processing

All data was extracted from the CSMAR (China

Stock Market and Accounting Research) database,

which is an intensive, definitive, and reliable

research-oriented platform in line with global

professional standards highlighting China’s finance

and economy while incorporating China’s exclusive

national characteristics. Therefore, data from 83 firms

listed on Shanghai and Shenzhen Stock Exchanges in

China’s automotive manufacturing industry as

samples provides a solid foundation supporting this

research to answer the above research questions. The

earliest available data of both supply chain

geographic distance index and supply chain

concentration index of China’s automobile

manufacturing industry can be tracked from 2001,

whereas firms’ financial information only started to

be disclosed from 2010. Therefore, key metrics in

each dataset, including end date, stock symbol, and

industry classification code, were used to consolidate

all necessary and meaningful data into one unified

dataset. Consequently, all the data of Chinese

automakers used in this research were based on the

combination of the above datasets, from year of 2010

to 2023.

3.2 Variable Measurements

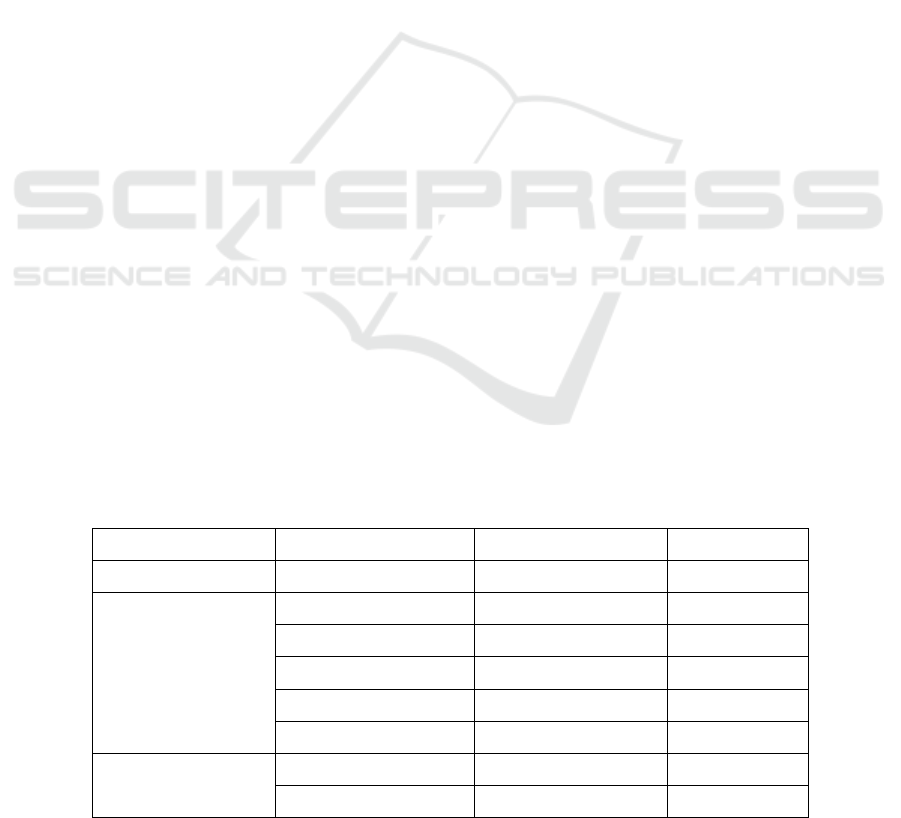

Types, abbreviations, and descriptive statistics of

variables are presented in Table 1 and Table 2.

Table 1: List of variables, abbreviations, and data sources

Type Variable Abbreviation Data Source

Dependent Variable Inventory turnover ratio ITR CSMAR

Independent

Variables

Spatial distance SD CSMAR

Major customer ratio MCR CSMAR

Major supplier ratio MSR CSMAR

Customer concentration CC CSMAR

Supplier concentration SC CSMAR

Control Variables

Close proximity CP CSMAR

Same province SP CSMAR

ICEML 2025 - International Conference on E-commerce and Modern Logistics

700

3.2.1 Dependent Variable

To evaluate the impact of supply chain metrics on

financial performance, the inventory turnover ratio

was selected as the dependent variable. It measures a

firm’s efficiency in selling out its inventory in a given

period, which in turn reflects not only a firm’s overall

supply chain management capacity but also shows its

financial performance. A high inventory turnover

ratio is always favorable to firms since it

demonstrates their high financial liquidity level and

supply chain efficiency level.

3.2.2 Independent Variable

As shown in the Table 1, independent variables used

in this research were spatial distance, major customer

ratio, major supplier ratio, customer concentration,

and supplier concentration.

Spatial distance was selected to assess the

geographic distance between a firm and its supplier or

customer, which helps to evaluate the impact of

supply chain proximity on financial performance.

Major customer ratio was calculated by dividing a

firm’s revenue from its single largest customer by its

yearly total sales. This metric quantifies the

dependence level of the firm to the largest customers.

Major supplier ratio was derived by dividing a

firm’s annual procurement from the single largest

supplier by the firm’s yearly total purchasing volume.

This variable assesses the dependence level of a firm

on the largest supplier.

Customer concentration was calculated by

dividing the revenue generated from the top five major

customers by a firm’s yearly total sales. This variable

reflects a firm’s sales channel dependence on key

customers.

Supplier concentration was derived by dividing a

firm’s annual purchases from its top five suppliers by

its total annual purchases. This variable measures a

firm’s source of goods dependence on major suppliers.

3.2.3 Control Variable

Close proximity dummy variable was constructed as

a control variable. It is assigned 1 if the distance

between a firm and its supply chain partner (supplier

or customer) is less than 300 km, and 0 otherwise.

Same province dummy variable was included as a

control variable to show whether a supply chain

partner (supplier or customer) is located in the same

province as the firm. It is 1 if they are in the same

province, and 0 otherwise.

Table 2: Descriptive statistics

Variables Obs. Mean S.D. Min. Max.

Inventory Turnover Ratio 452 5.490 3.838 1.480 39.955

Spatial Distance 452 559.432 583.062 0.706 2418.294

Major Customer Ratio 452 22.930% 15.196% 0.890% 78.210%

Major Supplier Ratio 452 14.621% 13.407% 1.780% 63.300%

Customer Concentration 452 47.376% 23.013% 4.110% 99.300%

Supplier Concentration 452 31.867% 17.777% 6.740% 89.380%

3.3 Analysis

The regression model can be specified as follow:

βββ

β

β

β

+++

++=

CCMSR

MCRSDITR

43

210

(1)

Where ITR is the dependent variable inventory

turnover ratio; SD is the spatial distance between

firms and suppliers or customers; MCR represents the

major customer ratio; MSR represents the major

supplier ratio; CC is the customer concentration; SC

is the supplier concentration; SP and CP denote

control variables same province indicator and

proximity indicator, respectively.

4 RESULTS

This section shows the results of this analysis with

interpretations. The variance inflation factor (VIF)

was employed in all regression analyses to detect

potential multicollinearity problems. As a result,

multicollinearity is not an issue in this analysis since

all regressions displayed a VIF coefficient lower than

5.

Influence of Supply Chain Geographic Proximity and Concentration on Financial Performance of Chinese Automakers

701

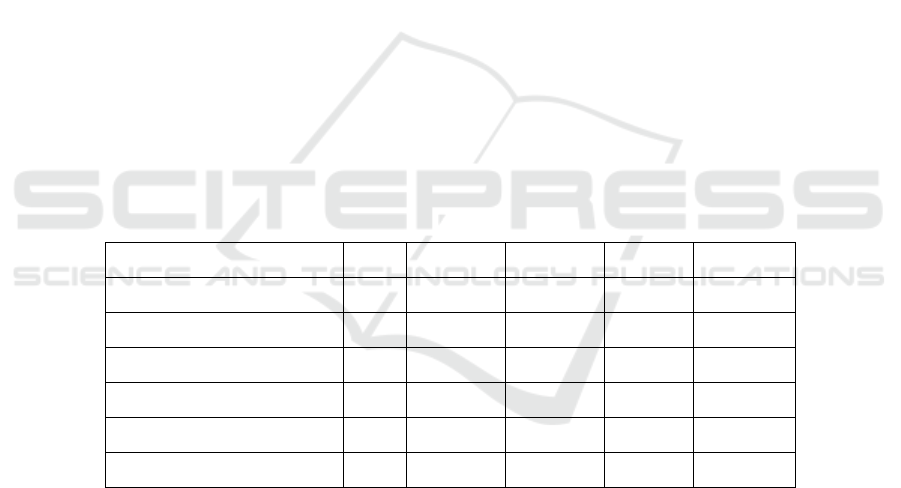

Table 3: Regression results.

Variables

Dependent Variable: Inventory Turnover Ratio

(1) (2) (3)

Intercept

8.796***

(15.487)

7.697***

(17.980)

7.275***

(17.275)

Spatial Distance

-0.001**

(-0.096)

-0.001***

(-4.532)

-0.001***

(-4.051)

Major Customer Ratio

0.062***

(

3.922

)

--- ---

Major Supplier Ratio

0.032

(1.524)

--- ---

Customer Concentration

-0.063***

(-6.086)

---

-0.023***

(-2.987)

Supplier Concentration

-0.062***

(

-3.937

)

-0.045***

(

-4.288

)

---

Same Province

1.107***

(

2.589

)

--- ---

Close Proximity

-0.818

(-1.553)

--- ---

N 452 452 452

R2 0.229 0.081 0.061

F 16.237 18.014 14.496

Note: *, **, and *** represents the significance at 10%, 5%, and 1% level, respectively. Values in parentheses are t-

statistics.

4.1 Impact of Supply Chain

Geographic Proximity on Inventory

Turnover Ratio

Table 3 shows the regression analysis results of the

impact of supply chain geographic proximity on the

inventory turnover ratio of China’s automakers.

Column 1 shows the overall impact of supply chain

geographic distance on a firm’s inventory turnover

ratio. The results indicate that the distance between

firms and their up and downstream trading partners is

negatively and significantly related to firms’

inventory turnover ratio (B = -0.001, p < 0.05). The -

0.001 coefficient denotes that each kilometer increase

in distance between a firm and its supply chain

partners, the firm’s inventory turnover ratio drops

0.001 times per year. For instance, if the distance

between a firm and its supplier increased 1000

kilometers, then based on the results, the firm’s

inventory turnover ratio would decrease for 1 time per

year. Moreover, firms and their trading partners

located within the same province can positively and

significantly impact firms’ inventory turnover ratio

(B = 1.107, p < 0.01). The coefficient of the Same

Province dummy suggests that a firm’s inventory

turnover ratio would increase 1.107 times per year

when intra-province collaboration occurred.

Furthermore, the individual impact of supplier

distance and customer distance on inventory turnover

ratio are shown in column 2 and 3, respectively. The

results confirm that supplier distance is negatively

and significantly related to a firm’s inventory

turnover ratio (B = -0.001, p < 0.01), and customer

distance is negatively and significantly related to a

firm’s inventory turnover ratio (B = -0.001, p < 0.01).

Additionally, the R

2

value of the regression model is

0.229, signifying that 22.9% of the variance in the

dependent variable can be explained by the

independent variables. This R

2

value is statistically

acceptable as the purpose of this research was to

explore the causal relationship instead of the

predictive modeling.

4.2 Impact of Supply Chain

Concentration on Inventory

Turnover Ratio

The regression results of the impact of supply chain

concentration on Chinese automakers’ inventory

turnover ratio are shown in Table 3. The overall

impact of supply chain concentration on businesses’

inventory turnover ratio can be found in column 1.

The results indicate that both up and downstream

trading partner concentration are negatively and

significantly related to firms’ inventory turnover ratio,

with a B value of -0.063 (p < 0.01) and -0.062 (p <

0.01), respectively. The coefficient of customer

concentration denotes that for every 1% increase in

the customer concentration the inventory turnover

ratio would decline 0.063 times per year. For example,

ICEML 2025 - International Conference on E-commerce and Modern Logistics

702

if a firm’s customer concentration increased 20%, its

inventory turnover ratio will decrease 1.26 times per

year. Similarly, the coefficient of supplier

concentration indicates that for every 1% higher in

the supplier concentration, the inventory turnover

ratio drops 0.062 times per year. Thus, a 20% growth

in supplier concentration would result in a 1.24 times

per year reduction in inventory turnover ratio.

Moreover, the individual impact of supplier or

customer concentration on inventory turnover ratio is

shown in column 2 or 3, respectively. The results

indicate that supplier concentration is negatively and

significantly related to inventory turnover ratio (B = -

0.045, p < 0.01), and customer concentration is also

negatively and significantly related to inventory

turnover ratio (B = -0.023, p < 0.01). Overall, the

above statistic results offer a basic answer to the

second research question.

5 CONCLUSIONS

This research evaluates the impact of supply chain

geographic proximity and concentration on the

financial performance of China’s automobile

manufacturing firms. This study utilized data from 83

firms listed on Shanghai and Shenzhen Stock

Exchanges in China’s automotive manufacturing

industry from 2010 to 2023.

First, the empirical results confirmed that the

geographic distance between automakers and their

supply trading partners can negatively impact their

inventory turnover ratio. Specifically, each kilometer

increased in supplier or customer distance reduced

inventory turnover ratio by 0.001 times per year.

Moreover, the inventory turnover ratio increased

significantly when intra-province collaboration

occurred. This indicates that the impact of geographic

proximity on inventory turnover is not a simple linear

relationship, but rather demonstrates a threshold

effect: negative impacts intensify when distance

exceeds a certain range, whereas closer proximity

within same province displays significant positive

effects. The primary drivers behind this phenomenon

includes transportation cost, transit duration, and

manufacturing lead times. These factors not only

hinder firms’ financial performance due to cost

escalations, but also result in unexpected production

schedule disruptions due to extra logistics cycles.

Therefore, to address geographic proximity

challenges, managers should prioritize intra-province

collaboration to reduce transit time and costs. For

instance, firms could invest in industrial parks to

utilize the proximity benefits.

Second, the empirical findings revealed a negative

correlation between supply chain concentration and

the inventory turnover ratio. Specifically, an increase

in supply chain concentration reduces the inventory

turnover ratio. Moreover, it is noteworthy that a

firm’s dependence on the largest customer is

negatively related to its inventory turnover ratio,

whereas its financial dependence on its largest

supplier did not show a significant relation to its

inventory turnover ratio. For firms with high supply

chain concentration, their upstream sources of

materials and downstream sales channels are highly

dependent on their major trading partners.

Consequently, firms would have minimal bargaining

power regarding price, quantity, and variety of goods

they purchase and products they sell. This

substantially impacts firms’ financial independence,

profitability, supply chain effectiveness, and product

diversity, which in turn reduces firms’ inventory

turnover ratio, supply chain resilience, and supply

chain agility. Therefore, firms should reduce reliance

on major trading partners, especially the single large

customer, and build alternative supply chain networks

for sources of materials and streams of revenue to

avoid a financial bottleneck.

This research is subject to limitations. First, the

data used in this research were extracted and

combined from multiple datasets based on the date,

stock symbol, and industry classification code. Thus,

given the availability of the primary metrics differs in

these datasets, not only was the data size significantly

reduced, but also much additional useful information

from these datasets was excluded during the data

integration phase. Hence, future research could utilize

multiple sources of information to enhance data

availability when acquiring research data. Second,

this research only focused on the impact of two

supply chain parameters on one business financial

indicator. Future research could combine other

statistical measures, including firm size, location, and

other financial ratios, to comprehensively understand

the impact of supply chain proximity and

concentration on financial performance.

REFERENCES

Cao, L., Deng, F., Zhuo, C., Jiang, Y., Li, Z., & Xu, H.,

2022. Spatial distribution patterns and influencing

factors of China's new energy vehicle industry. Journal

of Cleaner Production, 379, 134641.

Chang, A., & Bradsher, K., 2024. How China became the

world's largest car exporter. The New York Times.

Chen, R., & Xu, H., 2024. Supply chain relationships,

resilience, and export product quality: Analysis based

Influence of Supply Chain Geographic Proximity and Concentration on Financial Performance of Chinese Automakers

703

on supply chain concentration. Sustainability, 16(20),

8743.

Cortes, J. D., 2023. A review of the proximity literature:

Supply chain's missing link. Transportation Journal,

62(2), 209-248.

Huang, Y., Han, W., & Macbeth, D. K., 2020. The

complexity of collaboration in supply chain networks.

Supply Chain Management: An International Journal,

25(3), 393-410.

Huang, Z., Zhou, Y., Lin, Y., & Zhao, Y., 2024. Resilience

evaluation and enhancing for China's electric vehicle

supply chain in the presence of attacks: A complex

network analysis approach. Computers & Industrial

Engineering, 195, 110416.

Jiang, S., Yeung, A. C. L., Han, Z., & Huo, B., 2023. The

effect of customer and supplier concentrations on firm

resilience during the COVID-19 pandemic: Resource

dependence and power balancing. Journal of

Operations Management, 69(3), 497-518.

Kwak, J. K., 2019. Analysis of inventory turnover as a

performance measure in manufacturing industry.

Processes, 7(10), 760.

Lorentz, H., Töyli, J., Solakivi, T., Hälinen, H., & Ojala, L.,

2012. Effects of geographic dispersion on intra-firm

supply chain performance. Supply Chain Management:

An International Journal, 17(6), 611-626.

Porter, M. E., 2008. The five competitive forces that shape

strategy. Harvard Business Review, 86(1), 78-137.

Sun, T., & Abdullah, M. A. B., 2025. Impact of industrial

agglomeration on the upgrading of China's automobile

industry: The threshold effect of human capital and

moderating effect of government. Sustainability, 17(7),

3090.

Yang, H., & Ren, W., 2021. Research on the influence

mechanism and configuration path of network

relationship characteristics on SMEs' innovation—The

mediating effect of supply chain dynamic capability

and the moderating effect of geographical proximity.

Sustainability, 13(17), 9919.

Zhang, W., 2025. Automotive manufacturing industry in

China. Statista.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

704