The Influence of Property Listing Attributes on the Performance of

Real Estate Sales

Yi Wang

a

School of Urban Construction , Beijing City University, Beijing, China

Keywords: Property Listing, Real Estate, Regression Model.

Abstract: In recent years, due to the adjustment of the real estate market, such as policy regulations, changes in market

demand, and alterations in the business models of developers. This experiment utilized Kaggle to search for

the experimental data, processed the dataset using OLS regression, and conducted data analysis using Excel.

The influence of different property attributes and the combined effect of these attributes on the sales

performance of real estate was studied. The results show that under the condition of a single independent

variable, Square, Ladder Ratio, and Have Subway have a significant impact on real estate sales performance.

Under the condition of the co-variables, the combined effect of Subway and Ladder Ratio and the combined

effect of High and Ladder Ratio have significant impacts on the performance of real estate sales. However,

the combined effect of Low and Ladder Ratio has no significant impact on the performance of real estate sales.

This is helpful for understanding the current real estate market model and predicting its future development

trend.; it also provides a basis for decision-making for developers.

1 INTRODUCTION

In the rapidly changing real estate environment,

understanding the relationship between property

attributes and real estate sales performance is more

crucial than ever before. The property attribute serves

as a crucial factor influencing the decision-making of

home buyers, facilitating sales, and differentiating

products in a highly competitive market. With the

acceleration of urbanization and the rising demands

for residents' living standards, consumers'

considerations for housing have shifted from a single

focus on the residential function to a comprehensive

evaluation of multiple attributes such as

transportation convenience, space design, and

building quality.

In UK, the rent has risen by nearly 40% within

2023-2024 years. Changes in nature of the property

will also affect the rent. Due to the high requirements

for the property's attributes and the persistent

imbalance between the rising demand for British

properties and the decreasing supply. Many

respondents predict that rents will continue to rise in

the future. The relationship between the surrounding

environment of housing and the sales performance of

a

https://orcid.org/0009-0001-0729-1141

real estate has been extensively studied by many

experts and scholars. Analysis of the characteristics

of houses in the vicinity of the Twin Cities area is

conducted to estimate the impact of nearby

community parks, regional, state and federal parks

and natural areas, golf courses and cemeteries on the

value of houses (Soren T, 2006). These external

attributes of the properties will exert an influence on

the final sales performance by affecting the utility

evaluation of the buyers. Especially during the

current market adjustment period, the quality of the

property's attributes has become a crucial factor

determining the speed of project sales and its

premium potential. The physical attributes and

supporting facilities of the housing units have also

been the subject of numerous academic studies that

investigate their significant impact on prices (Niu,

2020). And nowadays, in order to achieve high-

quality development of the real estate sector and

create higher-quality residences. This development

direction has become a new model for the

development in the new era (Pan, 2025).

This study aims to systematically analyze the

influence mechanism of different property attributes

on the sales performance of real estate, and to

Wang, Y.

The Influence of Property Listing Attributes on the Performance of Real Estate Sales.

DOI: 10.5220/0013852400004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 691-697

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

691

investigate whether there are any interactions among

these attributes. The data was obtained from Kaggle.

The dataset was processed using OLS regression, and

the obtained data was analyzed using Excel..

2 LITERATURE REVIEW AND

RESEARCH HYPOTHESIS

2.1 Literature Review

Domestic and foreign experts and scholars have

extensively analyzed the relationship between

housing attributes and real estate sales.

Under the influence of the sharing economy, some

scholars, in their exploration of the relationship

between housing attributes and real estate sales,

started from specific platforms in order to obtain

more detailed data.For example,Wu Xiaojun and

others used Airbnb for data scraping and studied the

influencing factors of rental prices. Many variables

have a significant impact on the price of housing. The

higher the consumers' trust in landlords and

properties, the higher the house sale rate will be,

thereby promoting the performance of the real estate

market.And consumers are more likely to purchase

properties that are close to medical and educational

resources, which meets their social needs. Eg. factors

such as the degree of trust that consumer have in the

landlords and the properties, and the extent to which

the properties meet the social needs of the consumer,

etc. (Wu, 2019). This helps analyze the variables that

have the greatest impact on the sales performance of

real estate and formulating corresponding strategies.

Conducted a study to analyze the most favored

property attributes of transaction users and

investigated which location resources were most

favored by consumers. Finally, they processed these

property attributes collaboratively. And the mixed

property attributes were obtained (Piao, 2022).

The characteristics of the housing units have the

highest explanatory power for housing prices. Among

the housing attributes, the accessibility by

transportation, tourist attractions, and the supply of

nearby hotels have a significant and positive impact

on housing prices (Lai, 2022).

That currently the year-on-year decline in the

sales prices of commercial residential properties in all

major cities has continued to narrow. New real estate

sales have remained stable. It is continuing to move

in the direction of stabilizing. However, further

adjustments to real estate policies and optimization of

property attributes are still needed (Meng, 2025).

At present, in the Chinese real estate industry,

with the continuous intensification of macro-control

measures by the government and the significant

changes in the internal and external environment, the

real estate market has gradually returned to rationality.

Due to the general decrease in prices and the supply

exceeding the demand, the development of the real

estate industry has been lackluster. Therefore, this

article puts forward the following hypotheses.

House Square is a crucial factor influencing the

performance of real estate sales. Numerous studies

have shown that properties within the 80-120 square

meter range have a faster sales speed. As the size of

the house increases, the sales speed also slows down.

Therefore, the selling price increases with the

increase in building area. However, when the area

exceeds a certain limit, the sales difficulty increases,

and the growth rate of the selling price slows down

accordingly.

2.2 Research Hypothesis

The impact of completed construction area and sales

area on the average unit price of commercial housing

was analyzed using a regression model. The study

shows that both have a significant influence on the

unit price of commercial housing (Liu, 2008).

Assumption 1: Square has a significant impact on

real estate sales. Moreover, the sales price is

positively correlated with Square.

The Ladder Ratio can be understood as the

number of elevators in the same unit divided by the

number of residents on the same floor. It is also one

of the important influencing factors for real estate

sales performance. With the development of the real

estate industry in recent years, many old residential

areas have undergone renovations. Especially those

with buildings over 5 floors and without elevators.

This indirectly reflects the convenience of the

community. eg. Studied the impact of internal and

external variables of housing on its price. The housing

price reflects the expectations of the sales market.

However, during the period from 2002 to 2024, there

were relatively few studies on Ladder Ratio among

the internal variables.( Maria, 2025)

Assumption 2: The Ladder Ratio has a significant

impact on the performance of real estate sales.

Subway transportation reflects the level of

transportation convenience. Convenience in

transportation can reduce travel costs and time for

residents. Properties located close to the subway are

more attractive to consumers. Eg. The opening of the

subway can significantly increase the sales volume

and prices of real estate along the line. Studies have

ICEML 2025 - International Conference on E-commerce and Modern Logistics

692

shown that the housing prices within a 1600-meter

radius around subway stations are most significantly

affected by the subway. The closer the location, the

higher the premium; within this 1600-meter range,

the housing prices decrease as the distance

increases.(Yao, 2007)

Assumption 3: Subway has a significant impact

on real estate sales performance.

To more accurately understand the impact of

property listing attributes on the performance of real

estate sales. This experiment designed three sets of

collaborative item experiments. This experiment

conducted collaborative analyses of Layer Height

with a Ladder Ratio, Subway with a Ladder Ratio,

and Urban Area with a Ladder Ratio respectively.

The synergy between Layer Height and Ladder

Ratio will affect the consumer experience. Residents

living in the HighLayer have a higher usage rate of

the elevator. When consumers are considering

purchasing a house, they will consider the Ladder

Ratio in the Middle and High Layers. If the Ladder

Ratio in the Middle and High Layers is too small, the

living comfort will decrease, especially during peak

periods.

Assumption 4: The combined effect of Layer

Height and Ladder Ratio has a significant impact on

the performance of real estate sales.

The synergy between the Subway and Ladder

Ratio can be regarded as the relationship between

commuting efficiency and elevator waiting time.

Commuting by subway implies fast travel, but a low

Ladder Ratio would cause elevator congestion,

resulting in slower travel time. This means that a high

Ladder Ratio close to Subway is more attractive to

consumers.

Assumption 5: The synergy between Subway and

Ladder Ratio has a significant impact on the

performance of real estate sales.

3 DATA COLLECTION AND

STATISTICS

For the mutual benefit and protection of Authors and

Publishers, it is necessary that Authors provide

formal written Consent to Publish and Transfer of

Copyright before publication of the Book. The signed

Consent ensures that the publisher has the Author’s

authorization to publish the Contribution.

The copyright form is located on the authors’

reserved area. The form should be completed and

signed by one author on behalf of all the other

authors.

3.1 Data Collection

This experiment used Excel for data collection and

preprocessing. To ensure the accuracy of the data,

irrelevant variables such as community ID, user ID,

and renovation time were removed. Additionally,

missing data was deleted, and the data was filtered.

This experiment had two dependent variables, Total

Price and Unit Price. When no interaction was

involved, a double-dependent-variable experiment

was conducted. When the interaction was involved, a

single-dependent-variable experiment was conducted,

and at this time, the dependent variable was totalPrice.

The independent variables of this experiment

included 5 groups, including 2 interaction groups.

The control variables included Followers, DOM, and

Community Average.

3.2 Data Statistics

In this experiment, the variables were statistically

analyzed in terms of Number, Mean, and SD, as

shown in Table 1 and Table 2.

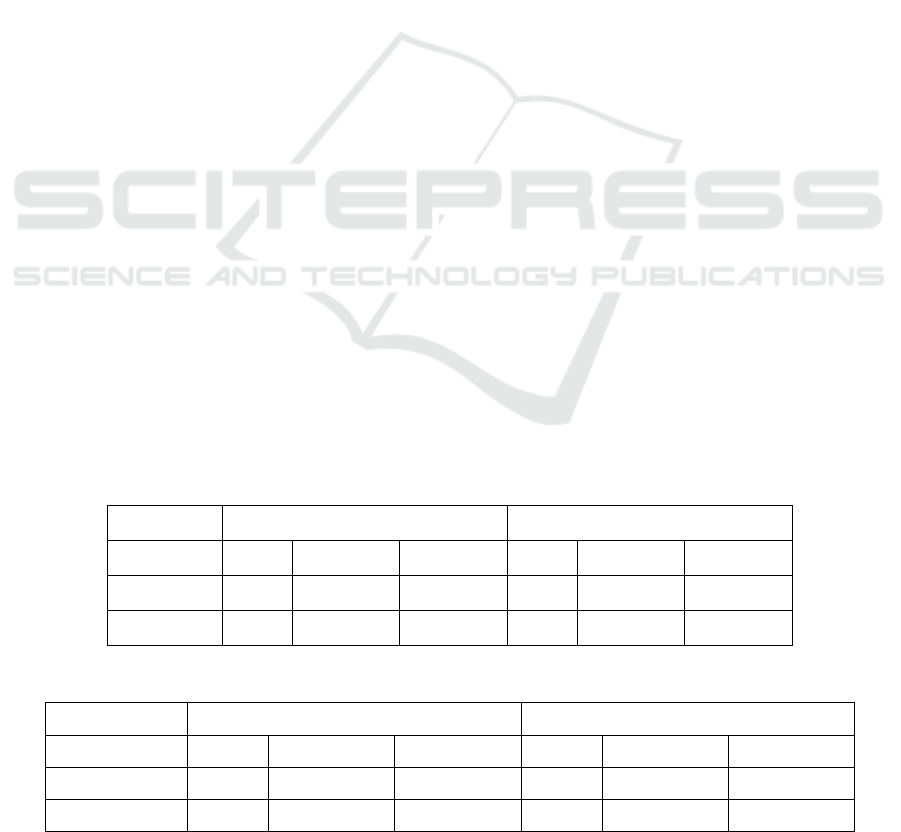

Table 1: The N, Mean, and SD of the internal factors of the property listing.

Square Ladder Ratio

N Mean SD N Mean SD

Total Price 2925 609.7649 204.0203 2925 609.7649 204.0203

Unit Price 2925 67422.96 18091.35 2925 67422.96 18091.35

Table 2: The N, Mean, and SD of the external factors of the property listing.

Have Subway Haven't Subway

N Mean SD N Mean SD

Total Price 1904 609.7649 204.0203 1021 609.8852 204.0709

Unit Price 1904 67422.96 18091.35 1021 67401.56 18069.56

The Influence of Property Listing Attributes on the Performance of Real Estate Sales

693

4 MODELLING

4.1 Identification Strategy

Identification strategy follows a typical linear

regression framework, where total price and unit-

price are the dependent variables. We define

attributes such as Square, Ladder Ratio, etc. as

independent variables to capture the impact of

property attributes on sales performance. We

controlled for the values of factors that might affect

the property attributes as well as the product

characteristics of sales performance (such as

Followers), which helps to ensure that we take into

account potential heterogeneity between different

categories.

This model is applied to the entire dataset. We

used binary variables and interaction terms to capture

the impact of different attribute characteristics on the

performance of real estate sales. The entire approach

enabled us to test the main hypotheses and

simultaneously control the influence of confounding

factors.

4.2 Result Analysis

4.2.1 The Impact of the Housing Inventory

on the Performance of Real Estate

Sales

This experiment first focused on the linear

relationships between the Square and Ladder Ratio of

the housing units and the sales performance of the real

estate. And each independent variable had a

corresponding dependent variable to accurately

reflect the relationship between the housing attributes

and the sales performance. We used the following

method to verify this relationship:

This experiment uses Equation (1) to do

regression analysis. Define the housing property type

as "Square". Table 3 presents the new results. In the

Total Price environment, the p-value of the Square is

significantly less than 0.001, and the Multiple R is

approximately 0.579, while the R Square is

approximately 0.335. It is indicated that 33.5% of the

Square data have a highly significant impact on the

Total Price, and the relationship is positive. However,

in the Unit Price environment, the Square p-value is

less than 0.05, while R Square and Multiple R are

approximately equal to 0. Although Square has a

significant impact on the Unit Price, the current

model does not explain the changes in the dependent

variable. The reasons for this result are twofold.

Firstly, the degree of change in the dependent variable

is different. The degree of change in Total Price is

much greater than that of Unit Price. Secondly, in the

Total Price model, the p-value of Square is extremely

small and it plays a dominant explanatory role. In the

Unit Price model, the p-value of Followers is lower

than that of other variables. Therefore, Followers

have a dominant explanatory power in this model, and

the explanatory power of Square will decrease.

εγγ

β

α

++

++=

DOMFollowers

SquarepriceUnitorpriceTotal

2_1_

)(

( 1 )

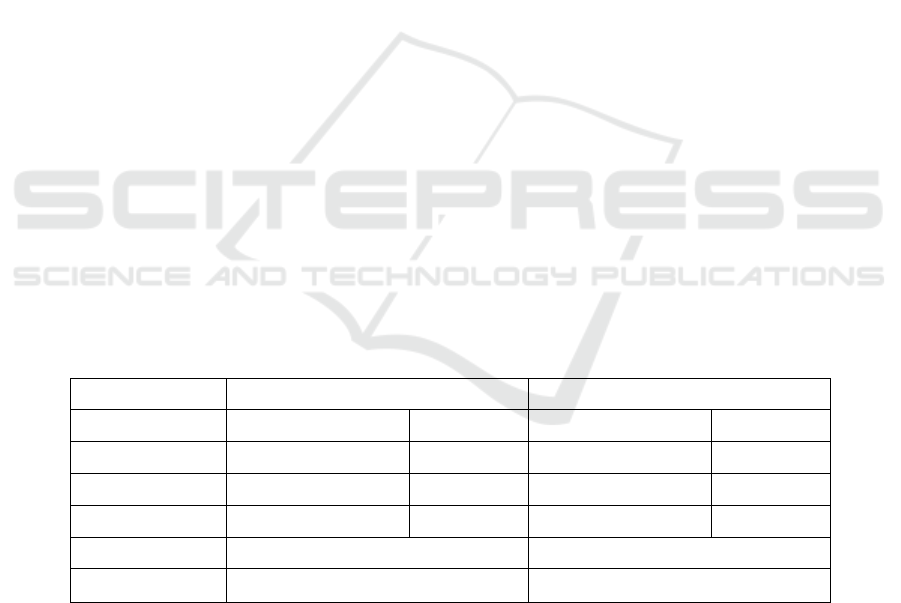

Table 3: The impact of Square on real estate sales performance.

Total Price Unit Price

Coefficients P-value Coefficients P-value

Square 6.4228 8.7E-258 -45.1631 0.0137

Followers -0.1065 0.0252 -14.4429 0.0052

DOM 0.0407 0.4110 5.7976 0.2806

Multiple R 0.5789 0.0674

R Square 0.3351 0.0045

The next experiment uses Equation (2) to do

regression analysis. Define the housing property type

as " Ladder Ratio ". Table 4 presents the new results.

In the Total Price and Unit Price environment, the p-

values of the Ladder Ratio were all less than 0.05, the

Multiple R values were all close to 1, and the R

Square values were all greater than 30%. It is

indicated that both dependent variables of the Ladder

Ratio have a significant positive correlation effect.

Moreover, the explanatory power of the independent

variables for the dependent variables is all higher than

30%.

ε

γγ

γβ

α

+

+

++

+=

AverageCommunityDOM

FollowersRatioLadder

priceUnitorpriceTotal

3_2_

1_

)(

(2)

ICEML 2025 - International Conference on E-commerce and Modern Logistics

694

Table 4: The impact of Ladder Ratio on real estate sales performance

Total Price Unit Price

Coefficients P-value Coefficients P-value

Ladder Ratio 125.9890 1.82E-16 2400.9343 0.0158

Followers -0.0469 0.2821 4.5950 0.1069

DOM -0.0292 0.5209 -11.9669 5.6426E-05

Community

Average

77.9122 0 8876.2059 0

Multiple R 0.6659 0.8353

R Square 0.4434 0.6978

4.2.2 The Influence of External Factors on

the Sales Performance of Real Estate

This experiment also investigated whether there was

a subway station nearby. These one external factors

were converted into binary values. The linear

relationship between Subway, and the sales

performance of real estate was explored.

The next experiment uses Equation (3) to do

regression analysis. Define the housing property type

as " Subway Binary " Convert Subway into binary.

Table 5 presents the new results. In both

environments, the p-value of Subway Binary was less

than 0.001, indicating a highly significant impact on

the dependent variable. However, the Multiple R and

R Square values remain relatively low. It is

speculated that this is due to the absence of important

control variables in the data.

εγ

γβ

α

+

++

+=

DOM

FollowersBinarySubway

priceUnitorpriceTotal

2_

1_

)(

(3)

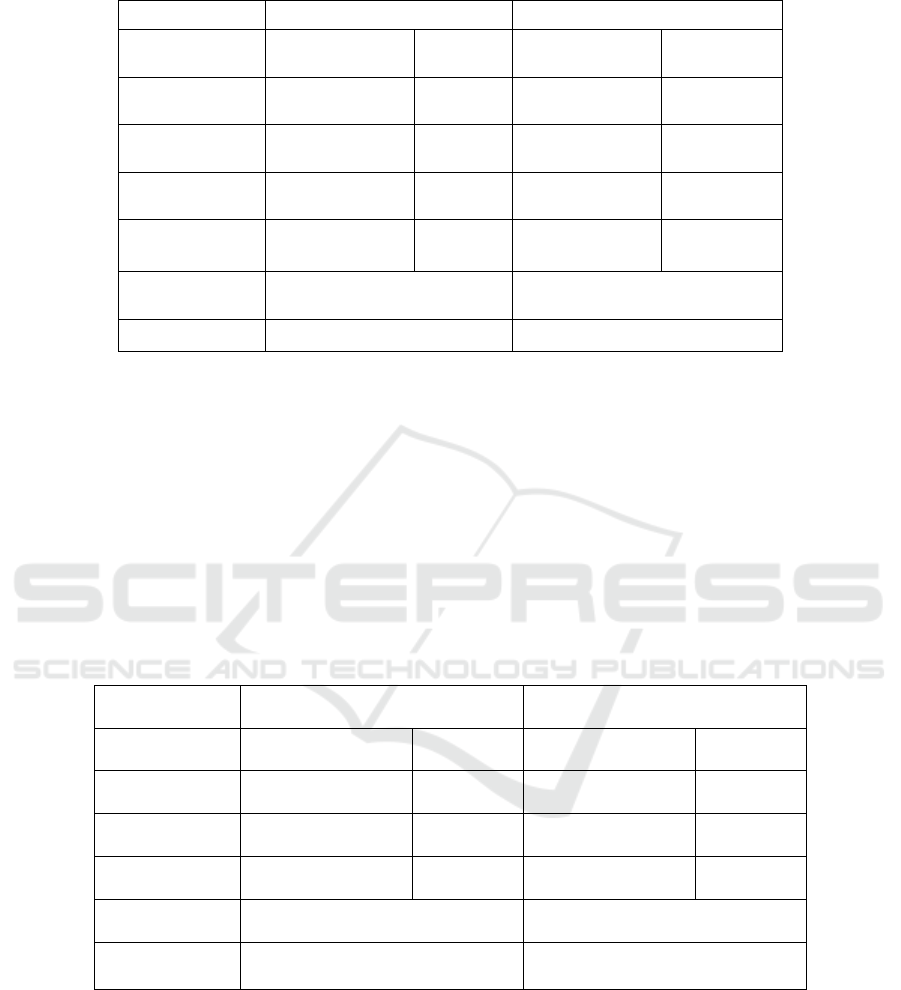

Table 5: The impact of Subway on real estate sales performance

Total Price Unit Price

Coefficients P-value Coefficients P-value

Subway Binary 39.6637 5.09E-07 5572.106 1.56E-15

Followers -0.2254 9.9E-05 -14.3938 0.0048

DOM 0.0968 0.1090 2.8644 0.5906

Multiple R 0.1179 0.1547

R Square 0.0139 0.0239

4.2.3 The Influence of Property Attributes,

Under the Interaction Effect, on the

Sales Performance of Real Estate

To further reflect the impact of property attributes on

the sales performance of real estate, this experiment

will conduct interactions among some property

attributes. We will explore how the sales performance

of real estate will change under such interactions. All

the interactive experiments were conducted in the

Total Price environment.

This experiment uses a new Equation(4) to do

regression analysis. This experiment only explored

the interaction between the High Layer and Low

Layer and the Ladder Ratio. Table 6 presents the new

results. The p-value of the High Layer * Ladder Ratio

is less than 0.05, indicating a significant impact on the

dependent variable. The p-value of the Low Layer *

The Influence of Property Listing Attributes on the Performance of Real Estate Sales

695

Ladder Ratio is greater than 0.05, indicating no

significant impact on the dependent variable. The

values of Multiple R and R Square are normal.

εγγ

β

α

++

+×

+=

DOMFollowers

RatioLadderBinaryHigh

priceUnitorpriceTotal

2_1_

1_

)(

(4)

Table 6: The impact of Layer Height * Ladder Ratio on real estate sales performance

Total Price

Coefficients P-value

High * Ladder

Ratio

35.2173 0.0138

Low * Ladder

Ratio

28.2267 0.0589

Followers -0.0615 0.1628

DOM -0.0429 0.3502

Community

Average

78.4823 0

Multiple R 0.6571

R Square 0.4317

The next experiment uses new Equation (5) to do

regression analysis. The interaction between Subway

and Ladder Ratio was explored. Table 7 presents the

new results. The p-value of the "Subway * Ladder

Ratio" is less than 0.05, indicating a significant

impact on the dependent variable. The multiple R-

value is approximately 0.657, and the interaction term

"Subway * Ladder Ratio" shows a positive

correlation effect on the dependent variable. The

square value is approximately 0.432, and the

experimental data fits well with the model.

εγ

γγ

β

α

+

++

+×

+=

AverageCommunity

DOMFollowers

RatioLadderSubway

priceUnitorpriceTotal

3_

2_1_

)(

(5)

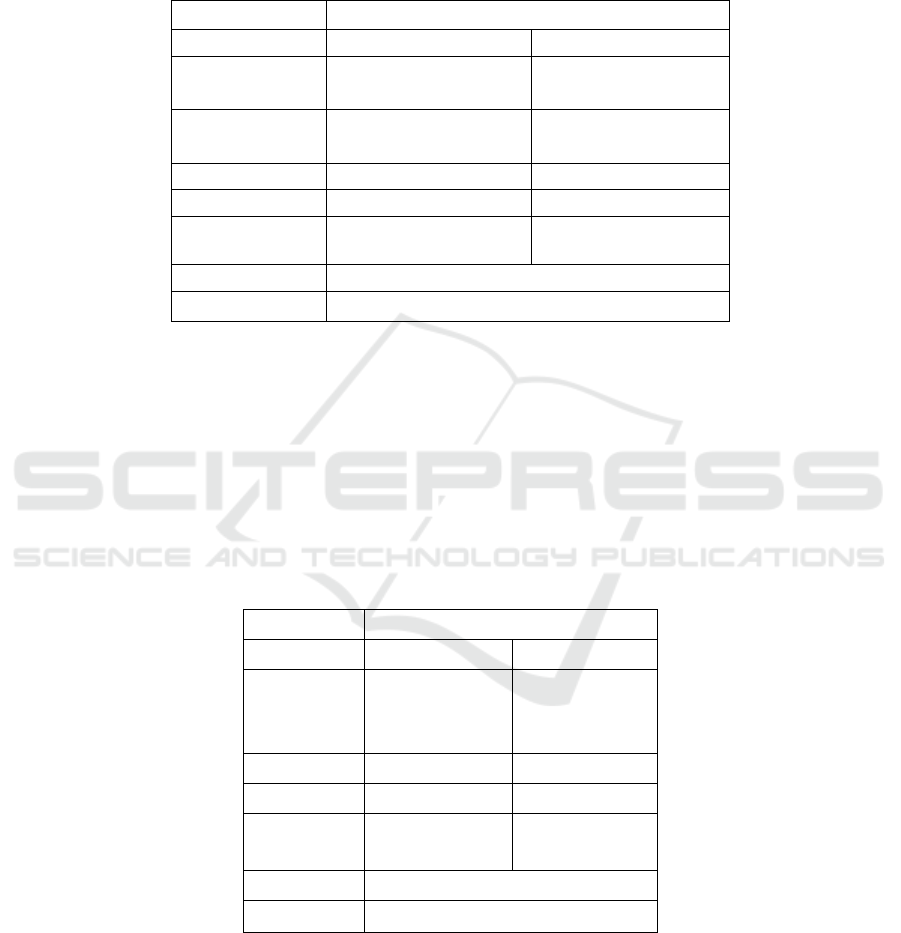

Table 7: The impact of Subway Ladder Ratio on real estate sales performance

Total Price

Coefficients P-value

Subway *

Ladder Ratio

36.1862 0.0021

Followers -0.0608 0.1669

DOM -0.0429 0.3493

Community

Average

77.5556 0

Multiple R 0.6574

R Square 0.4321

ICEML 2025 - International Conference on E-commerce and Modern Logistics

696

5 CONCLUSIONS

This article employs the OLS regression analysis

method to process the data and arrives at the

following conclusions. First Square can significantly

affect the Total Price and Unit Price. Square directly

determines the actual usable space of the house and

the living comfort. Here is one suggestion: when

targeting the group purchasing small Squares, by

optimizing the spatial layout, functional diversity can

be achieved to provide a more comfortable living

experience. However, when studying Square and Unit

Price, a phenomenon of an extremely small R Square

occurred. This study believes that the reason for this

phenomenon is that there is no simple linear

relationship between Square and Unit Price; there are

also missing variables that have masked the

relationship between Square and Unit Price.

Second The Ladder Ratio can significantly affect

the Total Price and Unit Price, and there is a linear

relationship. The reason is that a Low Ladder Ratio

indicates that more households are using the limited

elevators, which will result in longer waiting times.

The ability to attract consumers is weaker, leading to

poor performance in real estate sales. A High Ladder

Ratio means that fewer households are using the

limited elevators, and there are rarely situations of

elevator congestion. It can attract a large number of

consumers and has a faster sales speed.

Third The subway has a significant impact on the

performance of real estate sales. The subway makes

the surrounding properties more accessible and

convenient, enhancing their location advantages.

Properties along the subway line tend to have higher

values than those not along the line. However, the

experimental data shows that the R Square is lower

than 30%. This indicates that the data may be biased.

This experiment believes that this is caused by the

small sample size.

Fourth The synergy effect of High and Ladder

Ratio has a significant impact on real estate sales

performance; while the synergy effect of Low and

Ladder Ratio has no significant impact on real estate

sales performance. This experiment suggests that

people living on higher floors have a greater demand

for elevators. People living on lower floors have a

smaller demand for elevators. When encountering

peak periods, people living on high floors can

effectively solve the congestion problem and save

time with the high elevator-to-household ratio. The

sales performance brought about by the synergy

effect of High and Ladder Ratio is greater than that

brought about by the synergy effect of Low and

Ladder Ratio.

Fifth The combined effect of the "Subway and

Ladder Ratio" has a significant impact on real estate

sales performance. Properties along the subway line

and those with a high number of floors can both

enhance the convenience for the surrounding

residents; elevators facilitate the vertical movement

of residents, while the subway provides the

convenience of horizontal transportation. When these

two factors work together, they greatly improve the

convenience for residents, increase the attractiveness

of the properties, and thereby enhance the sales

performance of real estate.

REFERENCES

Anderson, S. T., & West, S. E., 2006. Open space,

residential property values, and spatial context.

Regional Science and Urban Economics, 36(6).

Guarini, M. R., Roma, A., Sabatelli, E., & Segura-de-la-Cal,

A., 2025. Intrinsic and extrinsic attributes in real estate

pricing: Insights for sustainable urban planning

strategies. Land Use Policy, 153, 107543.

La, L., Xu, F., & Han, L., 2022. Quantitative analysis of

influencing factors of Airbnb housing prices in Beijing.

Economic Geography, 42(06), 231-239.

Liu, J., 2008. Analysis of influencing factors of real estate

prices based on multiple linear regression. Journal of

Hubei University of Technology, (04), 87-90.

Meng, K., 2025. The real estate market continues to

stabilize, with new home sales remaining basically

stable. Securities Daily, A04.

Niu, R., & He, Y., 2020. Research on the influencing factors

of housing prices on shared accommodation platforms

based on feature price model. Enterprise Economics,

39(07), 27-36.

Pan, W. 2023. The real motivations, practical exploration

and reform approaches for building a new model of real

estate development. Southwest Finance, 1-13.

Pu, Y., Zhu, S., & Li, Y., 2022. Hybrid housing

recommendation method integrating user and location

resource characteristics. Computer Science, 49(S1),

733-737.

Wu, X., & Qiu, J., 2019. Research on the influencing factors

of Airbnb listing prices: Based on data from 36 Chinese

cities. Journal of Tourism Studies, 34(04), 13-28.

Yao, Y., & Su, S., 2007. The impact of rail transit on urban

commercial space and real estate value. China's

Collective Economy (Second Half of the Month), (09),

27-28.

The Influence of Property Listing Attributes on the Performance of Real Estate Sales

697