Brand Building in the Pay-Later Era: A Study on Trust Construction

and Consumer Psychological Contracts

Lieshen Hu

1

and Ruihan Yin

2

1

Computer Science and Technology, Guangdong University of Foreign Studies South China Business College,

Guangzhou, China

2

Department of Computing, Jinan University, Shenzhen, China

Keywords: Pay-Later, Consumption Model, Consumer Psychology, Usage Preference.

Abstract: The "Pay-Later" model is an emerging consumption method that allows consumers to experience products

before completing payment through installment plans, credit services, or deferred payment options. According

to the latest data from the National Bureau of Statistics, China's online retail sales reached ¥15. 5225 trillion

in 2024, underscoring the integral role of e-commerce in modern life. With the widespread adoption of digital

payments and fintech, the Pay-Later model has rapidly gained popularity, particularly among younger

demographics. And this payment model is a product of the digital era, driven by two key factors identified

in literature: first, the expansion of internet-enabled markets has generated demand among a massive user

base; second, big data analytics has positioned Pay-Later as a strategic marketing tool, offering consumers

diversified payment choices. The authors apply methods, including Survey Methodology, Data Collection

and Analysis of preferences for the BNPL model, to this research. Through all those methods, the authors

conclude that BNPL model has an essential effect on trust construction and consumer psychological contracts.

1 INTRODUCTION

The Pay-Later model serves as a double-edged sword

for brand loyalty and consumer perception. While its

convenience and flexibility enhance satisfaction,

overconsumption may lead to negative experiences

that damage brand equity. Market tolerance for this

model also varies significantly across regions.

This study examines contemporary online

consumption patterns to decode consumer

psychological needs. At the corporate level, insights

can optimize customer-centric marketing strategies;

at the individual level, the insights empower users to

select suitable platforms while safeguarding privacy

and establishing boundaries for data rights.

2 METHOD

2.1 Survey Methodology and Data

Collection

To investigate how Pay-Later platforms affect user

retention, the authors designed a 20-item

questionnaire across seven dimensions: Demographic

profiles, Emotional bonds formed through Pay-Later

usage, Platform-consumer psychological contract

alignment, Perceived consumer responsibility, Risk

perception, Payment flexibility, Credit thresholds and

service convenience.

Launched on Wenjuanxing platform (February

25–27, 2025), the survey collected 15 valid responses

(100% retrieval rate). Reliability analysis (Table 1)

demonstrated exceptional consistency (α=0. 927),

exceeding the 0. 9 benchmark. Subscale reliability

metrics were:

Emotional bonds: α=0. 809 (near-excellent

precision)

Psychological contract alignment: α=0. 757

(acceptable)

Responsibility perception: α=0. 711 (approaching

0. 7 threshold)

Risk perception (α=0. 810) and service

convenience (α=0. 817). The above results indicate

that the scale has high reliability.

Credit thresholds (α = 0. 878) and payment flexibility

(α = 0. 821) demonstrate the highest reliability,

accurately capturing users’ perceptions of platform

mechanisms.

408

Hu, L. and Yin, R.

Brand Building in the Pay-Later Era: A Study on Trust Construction and Consumer Psychological Contracts.

DOI: 10.5220/0013846000004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 408-416

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

Table 1: Questionnaire Reliability Analysis

Dimensions

Cronbach

reliability

Anal

y

sis

Number

of items

Cronbach

reliability

Anal

y

sis

Number

of items

Emotional bonds 0.809 2 All above 0.927 20

Psychological contract alignment 0.757 3

Responsibility perception 0.711 3

Risk perception 0.810 3

Service convenience 0.821 3

Credit thresholds 0.878 3

Payment flexibility 0.817 3

To investigate trust construction and consumer

psychological contracts in the Pay-Later model, this

study designed a structured questionnaire comprising

20 items across seven dimensions: Emotional bonds,

Psychological contract expectation alignment,

Perceived responsibility, Risk perception, Payment

flexibility, Credit thresholds and Service

convenience.

The questionnaire underwent iterative

refinements through pilot testing, including the

removal of low-reliability items and ambiguous

questions reported by respondents. The final version

was distributed via the Wenjuanxing platform from

February 25 to 28, 2025, yielding 125 valid responses

(100% retrieval rate).

2.2 Respondent Profile

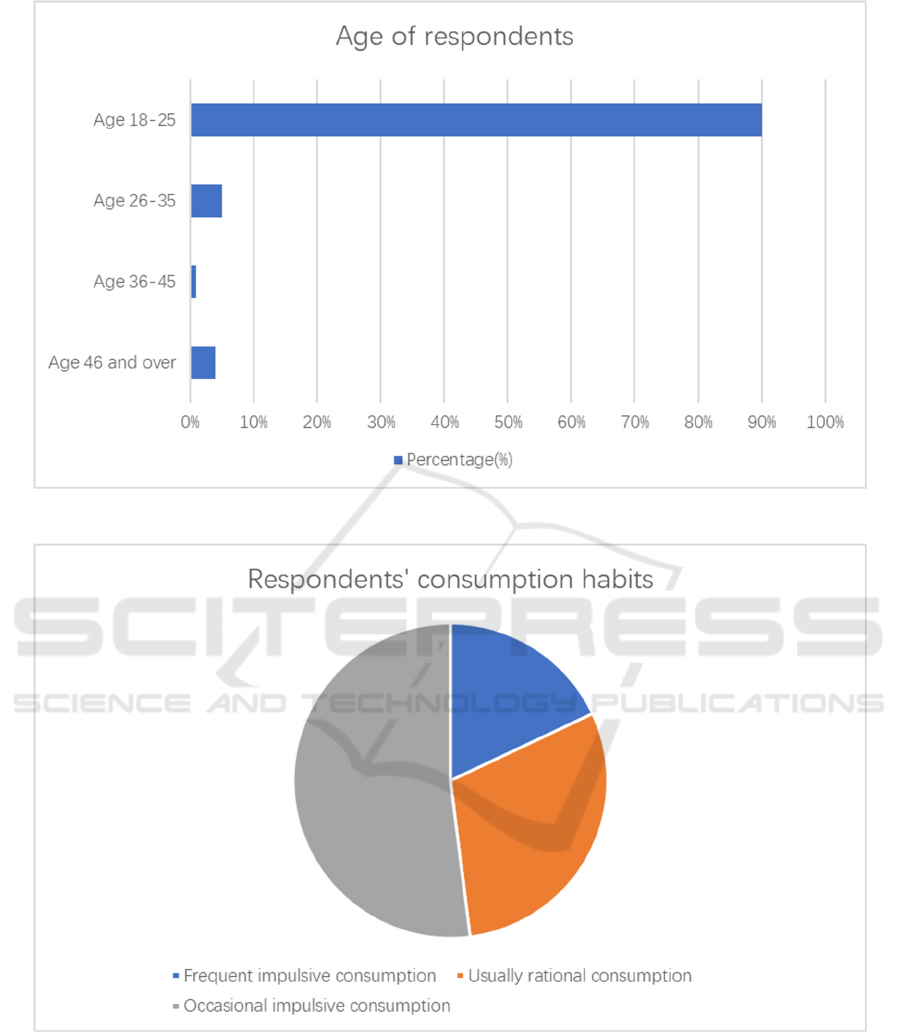

As shown in Table 1, 90% of participants belonged to

the emerging adulthood cohort (aged 18–25). Their

consumption habits (See Figure 1) revealed a

predominance of impulsive spending (70%) over

rational consumption (30%), aligning with

established behavioral trends in this demographic

(See Figure 2).

The paper adopts a four-part structure for

presentation and concludes: "We document that a

large minority of UK consumers charge BNPL to

credit cards, especially younger consumers and those

living in more deprived areas. This raises doubts on

these consumers’ ability to pay for BNPL and

prompts a regulatory question as to whether

consumers should be allowed to refinance their

unsecured debt. Further research is required. . . "

The Introduction section elaborates on the initial

emergence of the BNPL model, providing a concrete

and clear context for its subsequent development.

This approach inspires the present study to situate

BNPL within the broader internet context, integrating

the internet environment and socio-cultural

interactions to better interpret the BNPL framework.

The Institutional details section approaches the

topic from macro-level perspectives of both

enterprises and society, dividing the discussion into

three parts: product structures, Economics of BNPL,

and BNPL on credit cards. These studies establish a

preliminary framework for the subsequent research

and offer reference perspectives.

The authors begin with the macro-context of

BNPL as its entry point, followed by a preliminary

analysis of its research significance, arriving at the

same conclusion as previous literature—that the

BNPL model holds significant potential for further

investigation. Building on prior literature, we

introduce a novel perspective by leveraging our own

identity as researchers to conduct an initial

exploration and analysis of consumer psychology.

Supplemented with questionnaire data, we conclude

that BNPL, as a consumption model promoted by

platforms, plays a positive role in attracting

consumers and enhancing their platform loyalty.

Due to the limitations of the questionnaire

respondents, the study is confined to the individual

level. However, as highlighted in previous literature

and the initial discussion of research significance, this

topic holds substantial importance for both

individuals and enterprises. Future research could

employ interviews or sampling surveys to investigate

enterprises, alongside regression analysis to examine

how binding liquidity constraints are for consumers

using BNPL, the effects of BNPL on consumers,

whether BNPL is substituting for other payment

mechanisms or forms of lending, and BNPL’s

competitive effects on these established products.

This would help clarify the role of the BNPL model

in fostering enterprise-user loyalty, thereby

improving user service.

Additionally, the three research dimensions

established by prior literature—product structures,

Economics of BNPL, and BNPL on credit cards—

interpret the significance of BNPL from its origins.

Future research could extend to the midstream of the

Brand Building in the Pay-Later Era: A Study on Trust Construction and Consumer Psychological Contracts

409

value chain, such as examining the promotional phase

of BNPL models in enterprises, incorporating

dimensions like marketing, trust-building, and

reputation shaping. Alternatively, it could explore the

downstream of the value chain, introducing

dimensions such as the convenience guarantees (e. g.

, service processes, refund models) and service

quality assurances during enterprise service delivery.

These perspectives would allow for deeper

exploration at the enterprise level.

The individual-level investigation did not

extensively address the issue of power delegation.

Future research could collaborate with enterprises to

conduct follow-up interviews with consumers,

surveying their awareness of the boundaries of power

in using BNPL models and analyzing how to better

protect consumer privacy. This approach would also

mitigate the issue of some consumers' emotional

dependence on brands often stems from long-term

cumulative psychological contracts.

The formation and change of psychological

contracts are mainly mediated by organizational

behavior, individual differences of consumers,

service interaction and external environment.

Regarding corporate behavior, if the company fails to

fulfill its promises, it will directly violate the

psychological contract. Regarding individual

differences of consumers, consumers' risk

preferences, past consumption patterns, and financial

literacy will influence consumers' understanding and

expectations regarding the content of the contract.

Regarding service interaction, the service response

speed, problem-solving efficiency, and user interface

friendliness of the company's interactive process will

affect consumers' psychological contracts. Regarding

the external environment, factors such as industry

supervision, the national credit reporting system

maturity, and economic fluctuations are also

important for the importance of psychological

contracts.

Focusing on the BNPL scenario, the traditional

psychological contract theory shows a new dimension

in the BNPL scenario: its construction relies more on

technology-driven transparency and is more

susceptible to short-term experience. Studies have

found that the psychological contract has a dual effect

on trust. When the platform provides transparent

installment rules and flexible repayment options, the

consumer's psychological contract is significantly

enhanced and the stickiness of use increases. If fees

are not transparent or if data is leaked, the

psychological contract can quickly collapse. There is

also a clear differentiation in the perception of

responsibility. Some consumers regard BNPL as a

serious credit commitment and take the initiative to

fulfill the contract; the other part lacks risk

perception, reflecting the lack of a shared

responsibility mechanism in the psychological

contract.

In order to study the trust building and consumer

psychological contract research of the BNPL model,

a structured questionnaire was developed. The

questionnaire is divided into seven parts, including 20

questions, covering emotional connection,

psychological contract consistency, responsibility

perception, risk perception, repayment flexibility,

credit limits and service convenience. After a small-

scale test, the content of the questionnaire underwent

iterative validation and was revised multiple times,

such as deleting some questions with low reliability

and ambiguous questions reported by respondents

during the trial distribution process. It was released

on the Questionnaire Star platform on February 25,

2025. As of February 28, 2025, a total of 125 valid

questionnaires were collected, with a recovery rate of

100%. The situation of the respondents is shown in

Table 1. Most of the respondents who participated in

the questionnaire were people in the emerging adults

(18-25 years), accounting for 90%. The consumption

habits of the respondents are shown in Figure 1,

among which impulsive consumption (accounting for

70%) accounts for more than rational consumption

(accounting for 30%), indicating that impulsive

consumption is a common behavior among

individuals in early adulthood.

3 ANALYSIS OF PREFERENCES

FOR THE BNPL MODEL

3.1 The Understanding of the BNPL

Model Among Participants

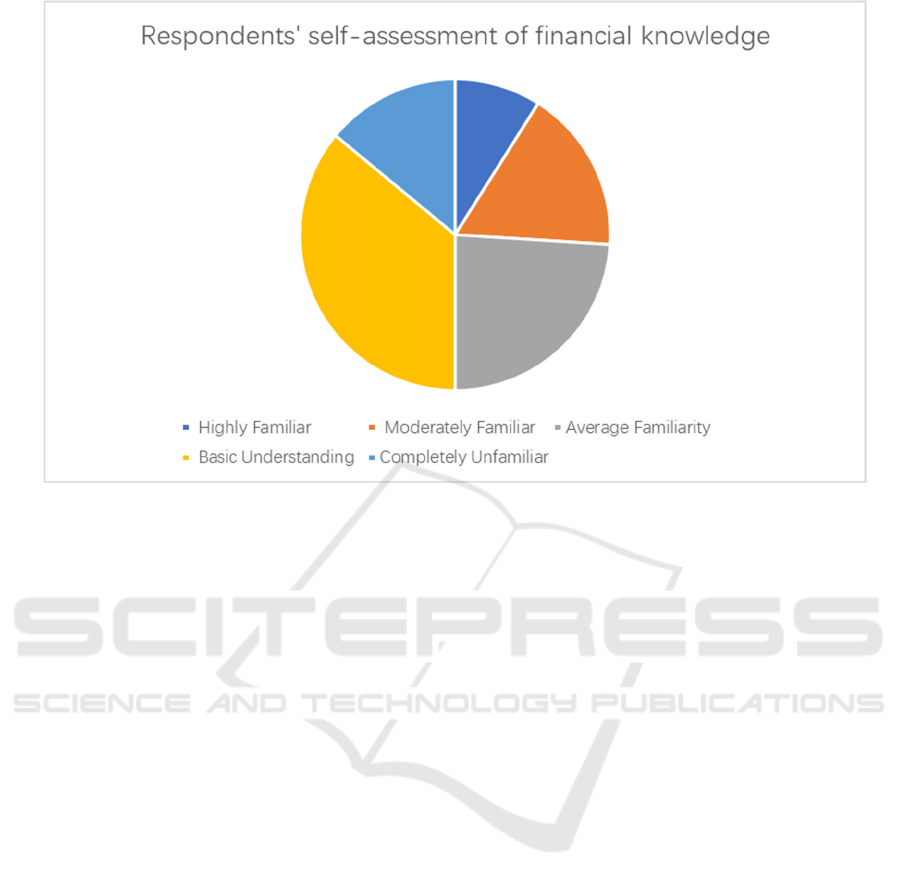

According to the questionnaire survey, 14% of the

respondents have no understanding of the credit risk

of BNPL, and 36% of the respondents have some

understanding of the credit risk of BNPL but are not

familiar with it. 9% of the respondents are very

familiar with the credit risk of BNPL, and 17% of the

respondents are relatively familiar with the credit risk

and interest rules of BNPL (See Figure 3). It can be

seen that even though almost all major platforms have

launched the BNPL model, a considerable proportion

of the respondents have a rather one-sided

understanding of the BNPL model.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

410

Figure 1: Age of respondents.

Figure 2: Respondents’ consumption habits

Brand Building in the Pay-Later Era: A Study on Trust Construction and Consumer Psychological Contracts

411

.

Figure 3: Respondents’ self-assessment of financial knowledge

3.2 Reasons for Choosing the BNPL

Model

According to the questionnaire, when investigating

the reasons for choosing the BNPL model, this article

provides six options for respondents to choose from,

namely, interest-free installments, low handling

fees/interest rates, high credit limits, high platform

security, flexible repayment periods, and others.

Among them, the proportion of high platform security

reached 44%, and the proportion of interest-free

installments reached 38. 4%, indicating that the

respondents put platform security first, indicating that

in digital payment scenarios, consumers attach great

importance to personal information protection, fund

security, and transaction reliability. In the current

consumption context, consumers tend to reduce the

immediate pressure of large-scale consumption

through interest-free installments while avoiding

interest costs.

4 TRUST BUILDING AND

CONSUMER

PSYCHOLOGICAL CONTRACT

4.1 Current Status of Trust Building

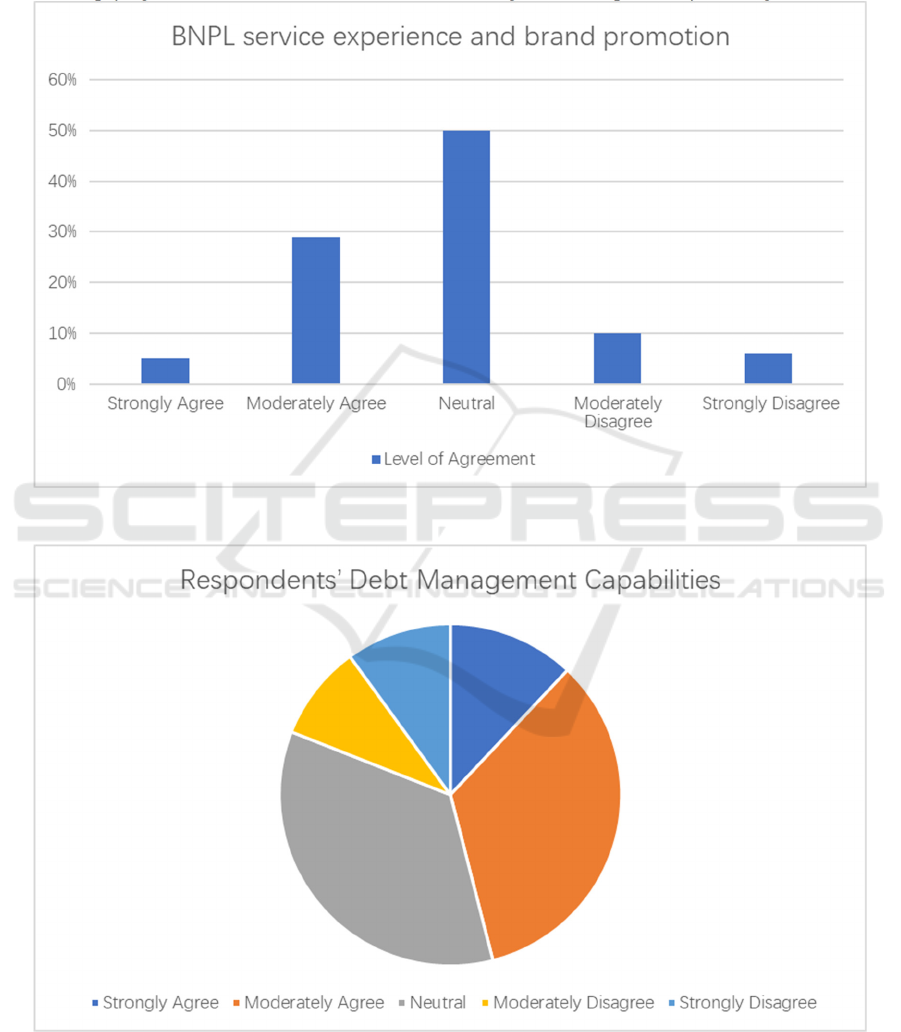

According to the survey, 34% of respondents agreed

that their actual service experience with the BNPL

service matched the brand's promotional promises,

but 16% of the respondents were still dissatisfied and

50% of the respondents were neutral. The main issues

were concentrated in opaque installment fees (20% of

the respondents disagreed that the installment fees

were in line with expectations) and hidden terms or

additional charges (22% of the respondents disagreed

that they had not encountered hidden terms or

additional charges), indicating that users have a high

level of trust in the BNPL function at this stage, but

there is a gap in user experience (See Figure 4).

50% of the respondents agreed that they were

worried about the leakage or abuse of personal

information, and only 35% of the respondents

believed that the credit review standards were

transparent and easy to understand, indicating that the

security trust of BNPL needs to be improved urgently.

44% of the respondents agreed that the BNPL

operation interface is friendly and the process is

simple, and 41% of the respondents agreed that the

BNPL approval speed met expectations, but 15% of

the respondents disagreed that the customer service

response was timely and effective, indicating that the

trust in the BNPL service at this stage depends on

process optimization.

4.2 Psychological Contract

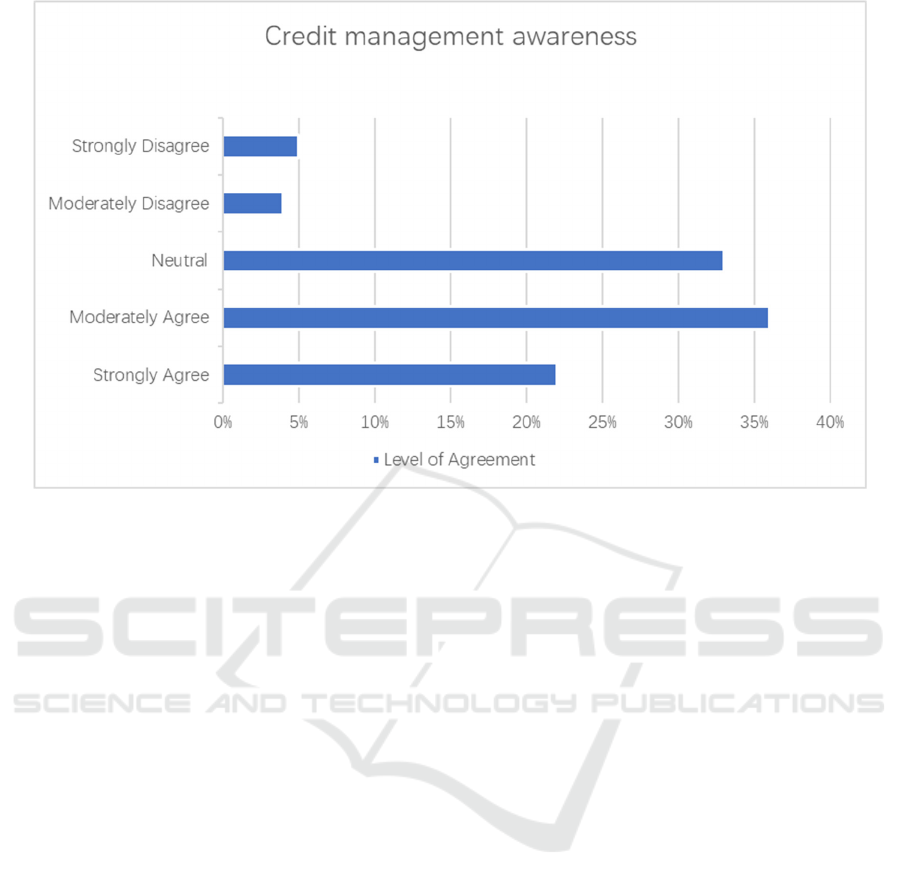

According to the questionnaire, 46% of the

respondents are clear about the repayment amount

and deadline for each period, and 58% of the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

412

respondents believe that default will affect their

personal credit records, indicating that the platform

rules are effectively communicated and the rules are

clear to users who use the BNPL. 54% of participants

prioritize repaying BNPL debts of BNPL, but 43% of

the respondents are still worried about the

accumulation of debts due to excessive consumption,

reflecting that the risk perception of users of the

BNPL is insufficient and there are differences in the

recognition of responsibility (See Figure 5 & 6).

Figure 4: Buy Now, Pay Later service experience and brand promotion.

Figure 5: Respondents’ Debt Management Capabilities

Brand Building in the Pay-Later Era: A Study on Trust Construction and Consumer Psychological Contracts

413

Figure 6: Credit management awareness

5 SUGGESTIONS FOR THE BNPL

PLATFORM

5.1 Transparency Enhancement and

Process Optimization Strategies

Regarding interactive repayment calculator, BNPL

platform can choose to embed an interactive

repayment calculator (such as slide to select the

number of installments, and display the total fee in

real time) when users choose the installment plan.

Based on prospect theory (Kahneman & Tversky,

2013), consumers exhibit heightened sensitivity to

losses. The platform must convert abstract interest

into specific amount comparison to reduce users'

neglect of hidden costs.

Regarding step-by-step disclosure process, BNPL

platforms should reference to the step-by-step prompt

rules of the EU Consumer Credit Directive, and

display key information (such as total repayment

amount, overdue fee rate) in a mandatory pop-up

window before payment, and strengthen attention

allocation through color marking (red highlights risk

items).

Regarding Simplify the refund and dispute

process, BNPL platform can learn from PayPal's one-

click dispute resolution function (Hapsari et al, 2021),

allowing users to directly freeze repayments for

disputed bills and initiate platform arbitration,

shortening the processing cycle to within 72 hours.

5.2 Data Security Reinforcement and

Transparent Credit Assessment

Mechanisms

Regarding credit score report, The BNPL platform

must open detailed dimension weights of credit

review to users and generate personalized

improvement suggestions.

Regarding Third-party security certification

disclosure, The BNPL platform must display the

compliance mark certified by the relevant country or

authoritative agency on the homepage, and pass

independent audit reports (such as publishing the

Annual Data Security Report every year to enhance

user trust)

5.3 Intuitive Interface Design and

Regulatory Transparency

Regarding cognitive load management in design, The

BNPL platform can choose to use Fitts's law to

optimize the button layout, place core functions (such

as Repayment Calendar and Expense Description) in

the hot zone (lower right side of the screen), and

highlight the entrances such as Expense Description

ICEML 2025 - International Conference on E-commerce and Modern Logistics

414

to increase the user's active consultation rate on

installment costs and default consequences.

Regarding Embedded rule prompts, The BNPL

platform must insert a 15-second video at key

operation nodes (such as before Confirm Installment)

to explain the interest calculation rules in the form of

animation.

Regarding Scenario-based risk simulation model,

After the user of the BNPL platform inputs the

monthly income and consumption plan, the system

automatically generates a dynamic curve of debt

accumulation and compares it with rational

consumption plans (Thaler, 1999).

5.4 Intelligent Consumption Limit and

Debt Management Tools, Balancing

Convenience and Risk Warning

Regarding Consumption limit, The BNPL platform

must analyze the user's historical consumption,

income fluctuations and repayment ability,

dynamically adjust the credit limit, and trigger an

early warning before exceeding the limit.

Regarding Debt consolidation, The BNPL

platform must automatically recommend a low-

interest debt consolidation plan when the user's cross-

platform installment debt exceeds the threshold, and

link third-party credit data to verify the feasibility.

Regarding self-regulation mechanism, The BNPL

platform must allow users to independently set a

cooling-off period (such as single consumption

exceeding 3, 000 yuan requires 24 hours

confirmation) or installment frequency limit (such as

maximum 2 installments per month). Use 15-point

type for the title, aligned to the center,

6 SUGGESTIONS FOR

CONSUMERS

6.1 Understanding of the Fee Rules and

Avoidance of Hidden Cost Traps

Disassemble the total cost of installments: Before

choosing installments, users of the BNPL plan should

clearly understand the total payment amount

(including interest and handling fees) shown on the

platform and use calculation tools to cross-verify

whether service fees or additional fees are charged

(Thaler & Sunstein, 2008).

6.2 Management in Credit to Avoid

Long-Term Negative Impacts

Regarding Check credit reports regularly, BNPL

users must check installment repayment records

monthly through the central bank's credit reporting

system or third-party platforms (such as Sesame

Credit) to ensure timely performance.

Regarding Prioritize repayment of high-cost

debts, such as high-interest debts, if the BNPL users

are multiple installments at the same time, prioritize

repayment of debts with high interest rates and short

terms to reduce total interest expenses.

Regarding Negotiate to repair credit, If the BNPL

users are unexpectedly overdue, immediately contact

the platform to apply for remedial measures (such as

deleting bad records after paying penalty interest) and

keep a written agreement.

6.3 Data Access Minimization and

Personal Information Safeguarding

Regarding Limit the scope of data openness, only

authorize the platform to provide necessary

information (such as blurring some fields of the ID

card number), and close non-essential permissions

such as long-term tracking of consumption records

(Acquisti, 2015).

Regarding Regularly review data permissions, the

BNPL users must check the platform's data call

records through the mobile phone system (such as

iOS privacy report, Android permission

management) every month, and revoke authorization

immediately if abnormalities are found.

With the help of decentralized data management

applications (such as My Data), the BNPL users must

selectively share consumption records to avoid

excessive collection of information by the platform.

7 CONCLUSIONS

Through the research questionnaire on the BNPL

service, the following conclusions are drawn: the trust

building of the BNPL model needs to take into

account both functional reliability and user security

perception, the stability of the psychological contract

depends on the transparency and shared responsibility

within the BNPL rules. And there is something

suggested to be given insight to. This research lays

the foundation for it.

This research found that the sustainable

development of this business model essentially relies

Brand Building in the Pay-Later Era: A Study on Trust Construction and Consumer Psychological Contracts

415

on trust relationships through research on BNPL

services. On the one hand, it is necessary to

actuarially precise repayment simulators through

precise repayment simulation tools, mandatory step-

by-step disclosure processes, and intelligent dispute

resolution mechanisms. On the other hand, it is

necessary to cryptographic transparency mechanisms

through authoritative security authentication

disclosure, encryption algorithm transparency

explanation, and user data minimization authorization

mechanisms. In the current BNPL model, the core of

brand value has shifted from traditional transaction

efficiency to dynamic maintenance of trust

relationships. This transformation reveals the

essential changes in the relationship between brands

and consumers in the digital economy. When Buy

Now Pay Later become the norm, the competitiveness

of brands no longer depends solely on their ability to

supply goods, but on their ability to transform

technological tools into trust foundation and reshape

the stickiness of psychological contracts within the

framework of risk sharing.

AUTHORS CONTRIBUTION

All the authors contributed equally and their names

were listed in alphabetical order.

REFERENCES

Dai, X. R. (2025). Buy now, pay later cannot become a

"wallet assassin". Zhejiang People's Congress, (01), 67

Gerrans, P., Baur, D. G., & Lavagna-Slater, S. (2022).

Fintech and responsibility: Buy-now-pay-later

arrangements. Australian Journal of Management,

47(3), 474–502

Guttman-Kenney, B., Firth, C., & Gathergood, J. (2023).

Buy now, pay later (BNPL)... on your credit card.

Journal of Behavioral and Experimental Finance, 37

Li, G. Y. (2023). Exploring the adoption intention of pay-

after-enjoyment services from the perspectives of Big

Five and Dark Triad personality traits [Master's thesis,

National Taichung University of Science and

Technology]

Li, T. T., & Wu, X. Y. (2024). Research on pay-after-

enjoyment purchase method based on dual-channel

mental accounting considering consumer returns.

Operations Research and Management, 33(03), 118–

124

Liu, Y., Wan, J., & Liu, X. (2017). Development status and

risk analysis of internet consumer credit: Case studies

of "Ant Huabei" and "JD Baitiao". Times Finance, (09),

290+296

Montgomery, N. V., Raju, S., Desai, K. K., & Unnava, H.

R. (2018). When good consumers turn bad:

Psychological contract breach in committed brand

relationships. Journal of Consumer Psychology, 28(3),

437–449

Yang, J., & Liu, P. G. (2007). An attempt to establish

consumer trust in mobile e-commerce. Special Zone

Economy, (4), 303–304

Yuan, C. F., & Tan, X. Y. (2022). Pay-after-enjoyment:

Global development and policy implications. China

Foreign Investment, (15), 82–84

Zhao, Y., Jiang, T. H., & Hu, H. N. (2024). On the

protection of consumer rights in the digital economy: A

"buy now, pay later" perspective. Industrial Innovation

Research, (11), 68–70

ICEML 2025 - International Conference on E-commerce and Modern Logistics

416