A Case Study on Cost Reduction and Efficiency Increase of Financial

Shared Service Centre: A Case Study of Changhong, Sichuan

Province

Tianyue Bai

Auditing, Shanghai University of International Business and Economics, Shanghai, 200126, China

Keywords: Financial Sharing Service Centre, Cost Reduction and Efficiency Increase, Path, Sichuan Changhong.

Abstract: In this paper, Sichuan Changhong is selected as a case study, from the organizational structure, information

system, business process, respectively, to explore the function of the financial sharing service centre to help

enterprises to achieve cost reduction and efficiency, and from the management cost, financial operation

efficiency, and business processing efficiency to see the specific results of the financial sharing service

centre. Through the research on the annual report data of Changhong, the paper finds that the financial

sharing service centre has a positive effect on the cost-saving and efficiency-increasing of Sichuan

Changhong, as the management cost can be reduced after stable implementation of the financial sharing

platform and the average assets managed by each financial personnel of the enterprise are gradually

increased. Taking Sichuan Changhong as an example, this paper studies how to reduce the cost and increase

the efficiency of the enterprises by the construction of the financial sharing service centre.

1 INTRODUCTION

Data has become an important new production

factor, digital technology, intelligent means have

begun to reshape the financial process and mode of

enterprises. Digital intellectualization is the

intelligentization on the basis of digitalization,

aiming to realize the overall, systematic and

intelligentized decision-making with the aid of

digital technology. The data intelligence

environment provides a new opportunity and

connotation for the construction and operation of the

financial sharing service centre (Xu, 2024). The

number intelligent financial sharing service centre

refers to the financial sharing service centre that

widely uses the number intelligent technologies such

as RPA, OCR, NLP, AI and GPT in the construction

of the financial sharing service centre to improve the

efficiency of financial sharing and promote the

financial digital transformation. The business data,

financial data, industry data, supply chain data,

contract data, tax data and other data that help

enterprises to make decisions are centralized, the

financial decision-making model is established, and

the enterprise decision-making is supported, which

solves the problems of incomplete information of

financial personnel, out of control of fund security

and passivation of management effect under the

decentralized financial management mode. With the

development of "Digital China" strategy, the

enterprise digital transformation has put forward

new challenges to the concept and mode of financial

management. The financial sharing service centre

provides a natural platform for the transformation of

enterprise financial management. The financial

sharing service has become the booster of the

enterprise financial digital transformation (Tang,

2019). Taking Sichuan Changhong as an example,

this paper studies how to reduce the cost and

increase the efficiency of the enterprises by the

construction of the financial sharing service centre.

2 LITERATURE REVIEW

Janssen and Joha (2004), Soalheira (2007), Trollius

and Wang (2016) believe that the implementation of

the financial sharing service mode can simplify the

financial work while saving the resources of the

enterprise, speed up the flow of funds, thereby

reducing the cost of the enterprise, speed up the

financial efficiency, and improve the profit

Bai, T.

A Case Study on Cost Reduction and Efficiency Increase of Financial Shared Service Centre: A Case Study of Changhong, Sichuan Province.

DOI: 10.5220/0013842400004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 255-263

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

255

proportion of the core business. Hirschfleld (1996),

Jassen et al. (2011), Casey and Totenhagen (2019)

also pointed out that the enterprise financial sharing

platform can rationally distribute the funds, assist

the enterprise to effectively expand the scope of

operation and smoothly carry out the merger

activities, so as to improve the status of competitors

in the same industry. Zhang (2018) holds that the

financial sharing service centre can transfer data and

process business with the help of information

systems such as ERPs, thus realizing the optimal

allocation of internal and external resources of the

enterprise to a certain extent, and greatly reducing

the cost of the enterprise. Yao et al. (2019) believed

that the reasonable use of the financial cloud sharing

service platform, give full play to the guidance effect

of cloud sharing on financial process reengineering,

help to integrate financial information resources and

improve the enterprise performance level. Jiang et

al. (2023) pointed out that the implementation of

intelligent finance can improve the financial

performance of enterprises by reducing the operating

cost and improving the R&D capability. Li et al.

(2025) pointed out that the key influencing factors in

the process of intelligent transformation of financial

sharing are technical characteristics, internal and

external environment, process organization and

management.

3 CASE INTRODUCTION

3.1 Overview of Sichuan Changhong

Group

Sichuan Changhong was founded in 1958, and its

predecessor was one of the key projects of 156 in

China. With the continuous development of

technology and TV, Sichuan Changhong began to

carry out diversified expansion of information

electronics, from manufacturing military products to

developing and selling military industry, household

appliances, industrial services, spare parts and other

businesses. After more than 60 years of

development, the brand value of Sichuan Changhong

has reached 203.968 billion yuan, with industrial

activities in more than 130 countries and regions,

many production bases at home and abroad, and

more than 200 branches at home. The main

businesses of Sichuan Changhong include consumer

appliances represented by intelligent household

appliances, and IT integrated services represented by

mass distribution of digital products and cloud

computing value-added services. Among them, the

sales scale of TV and refrigerator is in the leading

position in the industry, the refrigerator compressor

is the first in the world, the inverter compressor is

the first in the world, the commercial compressor is

the first in the country, and the ICT comprehensive

service and special power supply and other

businesses always maintain the leading position in

the industry. At present, the headquarters of Sichuan

Changhong Finance Sharing Service Centre is

located in Mianyang, Sichuan, with more than 470

employees in Beijing, Shanghai and other central

cities. Through years of experience, Sichuan

Changhong has accumulated rich experience in

process management and financial sharing, laying a

foundation for rapid transformation and rapid

development of enterprises.

3.2 Construction Process of Financial

Sharing Service Centre of Sichuan

Changhong Group

As shown by Table 1, the construction of the

financial sharing service centre of Sichuan

Changhong Group has gone through several stages.

In 2005, Sichuan Changhong put forward the reform

of business model and the idea of building the

financial sharing service centre, providing two

functions of management and service for the

enterprise. In December 2008, Sichuan Changhong

formally set up a financial sharing service centre to

separate from other organizations within the

enterprise group, further strengthen the application

of the sharing service concept, and start to provide

relevant consulting services for the group and collect

service fees. Since 2009, Sichuan Changhong has

deepened the financial reform, and the financial

sharing service centre has entered the development

period. In the stage, enterprises have built two

platforms and three systems of financial information

system. In 2011, the enterprise financial sharing

service centre optimized the information system,

established the customer relationship of

marketization mode, and realized independent

operation. In 2013, Sichuan Changhong changed its

original strategy and began to adopt the new three-

coordinate strategy of "intelligence, network and

coordination." The project construction of financial

cloud has been started. With the help of big data,

cloud computing, artificial intelligence and other

technologies, the business process has been re-

engineered, so that the Group has broken the

regional restrictions when processing data and

making decisions, achieved the purpose of reducing

ICEML 2025 - International Conference on E-commerce and Modern Logistics

256

cost and increasing efficiency, promoted the

financial transformation of enterprises and formed a

new management mode. In recent years, Changhong

Finance Sharing Service Centre has been deeply

cultivated in "Digital Finance," and has participated

in many pilot projects such as state-tax enterprises

and electronic vouchers of the Ministry of Finance.

Table 1: Development history of Sichuan Changhong Financial Shared Service Centre.

Year 2005 2006 to 2008 2009 to 2012 2013 to present

Period Germination period Initial period Development period Mature period

Content Put forward the

concept of financial

reform;

Establish financial

management centre

and financial service

centre.

Establish a financial

sharing service centre

(independent of the

enterprise).

Deepen the reform of

the financial sharing

service centre;

Realize market-

oriented independent

operation.

Adopt the new three-

coordinate strategy;

Start the financial

cloud construction.

3.3 Organization Model of Finance

Shared Service Centre of Sichuan

Changhong Group

After the establishment of the financial sharing

service centre in Changhong, the financial

organization structure tends to be flat. According to

the announcement of Changhong, after the

construction of the financial sharing service centre,

the number of accounting personnel of the large-

scale molecular institutions in the enterprise has

been reduced by nearly 50%, and the small-scale

molecular institutions can complete daily financial

work only by relying on the staff responsible for

cashier and document processing. With the

amalgamation of repeated similar businesses,

Sichuan Changhong has set up a special finance

department and accounting team, strengthened the

specialized division of labour, and simplified and

standardized the complex financial work. The

financial sharing service centre in Changhong,

Sichuan Province has formed the three function

distribution systems of shared finance, business

finance and strategic finance (Liu, 2023)

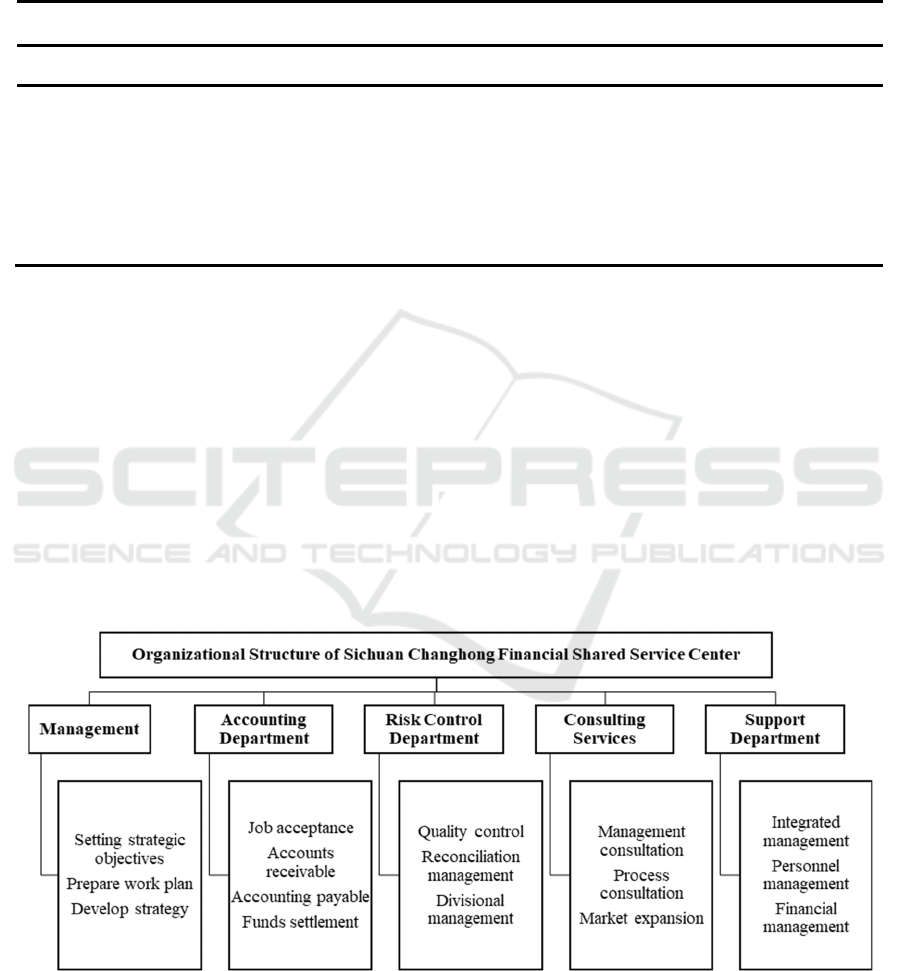

In the operation of financial sharing service

mode, Sichuan Changhong has created the

organization structure of the centre, as shown in

Figure 1.

Figure 1: Organization Chart of Sichuan Changhong Financial Shared Service Centre.

A Case Study on Cost Reduction and Efficiency Increase of Financial Shared Service Centre: A Case Study of Changhong, Sichuan Province

257

4 HOW TO REDUCE COST AND

INCREASE EFFICIENCY BY

ESTABLISHING FINANCIAL

SHARED SERVICE CENTER IN

CHANGHONG

4.1 Impact Path

After the establishment of the financial sharing

service centre in Changhong, Sichuan Province, the

similar and easy-to-standardize businesses are

processed centrally, reducing the redundant financial

organization structure, reducing the labour cost and

improving the financial processing efficiency, which

can reduce the cost and increase the efficiency to a

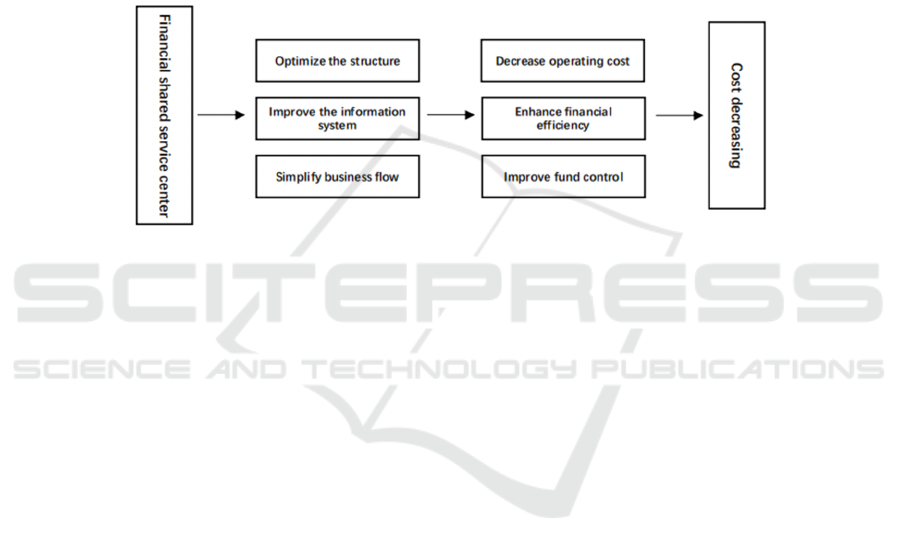

certain extent. Through analysing the concrete ways

of reducing cost and increasing efficiency of

Sichuan Changhong Financial Sharing Centre, it is

found that the influence ways are mainly reflected in

optimizing financial organization structure,

perfecting financial information system and

simplifying business processing process. Figure 2

shows the impact path of enterprise cost reduction

and efficiency improvement by the construction of

Sichuan Changhong Financial Shared Service

Centre.

Figure 2: Impact Path of Enterprise Cost Reduction and Efficiency Increase by Construction of Finance

4.1.1 Optimize Financial Organization

Structure

After the financial sharing service centre was built in

Changhong, Sichuan Province, the previous

accounting, statement registration and other

repetitive work processing processes were

consolidated and concentrated in an independent

organization. The accountants of each molecular

organization were separated from the basic business,

and the focus of work was shifted to the financial

budget, credit management and other aspects, so the

organizational structure of the enterprise was also

changed. In addition, before the construction, the

financial director of Sichuan Changhong is mainly

responsible for the overall arrangement of the

financial work of the enterprise, which is limited to

the financial aspect, and has no energy to invest in

the making of the major decisions of the enterprise.

After the establishment, the financial director is

responsible for the related work of the finance, and

can also change the role to the strategic level of the

enterprise, and clearly understand the overall

operation of the enterprise by participating in the

making of decisions, driving the performance of the

department and other aspects Sichuan Changhong

adopts the organization mode of financial sharing

service centre and financial department at the same

level (Liu, 2023). The management flexibility is

higher and the autonomy is stronger. It also indicates

that the enterprise attaches great importance to the

financial sharing service centre, and the financial

sharing centre has a high voice in the daily operation

of the group, so that the enterprise can smoothly

carry out work and strengthen the exchange and

cooperation with other departments.

After the establishment of the financial sharing

service centre in Changhong, the financial

organization structure tends to be flat, which is

beneficial to the improvement of enterprise

performance. On the one hand, the change of

organizational structure simplifies the allocation of

financial personnel, on the other hand, with the

merging of repeated business of the same kind,

Sichuan Changhong has set up a special financial

department and a verification team, strengthening

the specialized division of labour, simplifying and

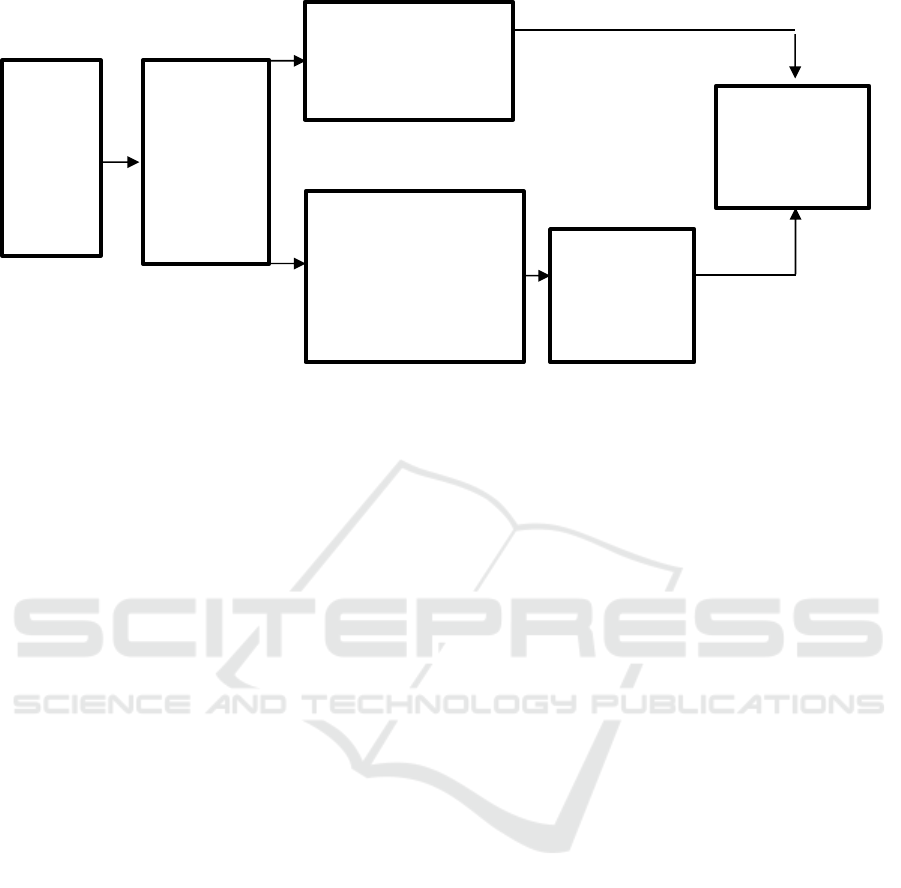

standardizing the complex financial work. Figure 3

is a path analysis diagram of the financial shared

service centre in terms of organizational structure to

make the enterprise cost-effective.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

258

Figure 3: Path Analysis of Financial Shared Service Centre for Enterprise Cost Reduction and Efficiency Improvement in

Organizational Structure.

4.1.2 Improve Financial Information System

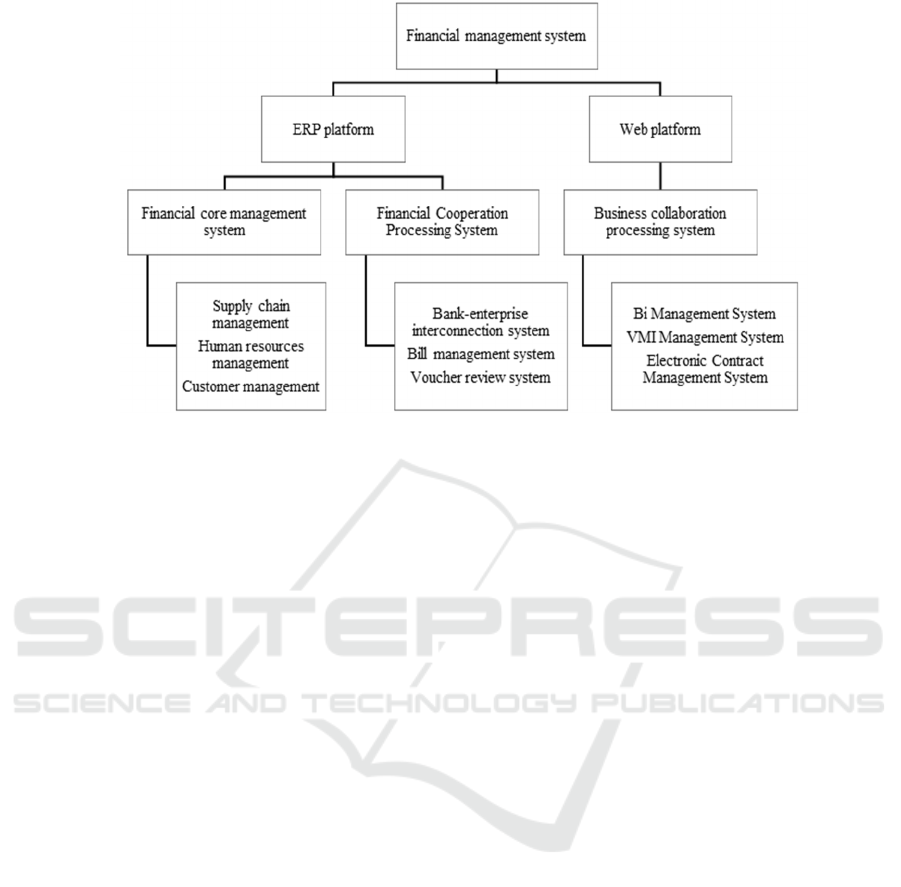

With the help of Hongxin software, Figure 4 shows

that Sichuan Changhong has set up ERP and WEB

platforms, financial core management system,

financial cooperation processing system and

business cooperation processing system.

After the establishment of the financial sharing

service centre in Changhong, Sichuan Province, the

ERP and SEI platforms were built through the

establishment of the information system to complete

the data processing related to the business activities

online, reducing the error rate of information and

strengthening the timeliness of transmission. Ye

Honglin, relevant responsible person of Sichuan

Changhong, mentioned in the interview that the

Financial Sharing Service Centre built the BI

information system, automatically extracted the

business data information of each molecular

organization, and the preparation time of the data

required for the quarterly operation analysis

meeting of enterprises was at least 10 days earlier.

At the same time, with the continuous optimization

of business process and the continuous update of

information system, the degree of accounting

automation in Sichuan Changhong increased from

40% to 90%, and the accounting error rate

decreased from 5% to 0.5%. With the help of

financial sharing centre, the depth and efficiency of

financial control have been improved. Due to the

support of business process standardization reform

and quality management process system, the degree

of enterprise financial integration is greatly

improved, which greatly improves the accuracy,

authenticity and timeliness of enterprise financial

accounting, and improves the efficiency of

accounting work by about 35%. Secondly, Sichuan

Changhong completed the automation and

informationization of enterprise accounting work

with the aid of information system, pulled out the

basic core business, released the accounting

personnel, improved the original tedious processing

process, and further improved the allocation of

human resources. At the same time, based on the

application of Sichuan Changhong information

platform, organizations with authority can complete

the reimbursement of expenses and the collection

and payment of funds online, realize the sharing of

financial data worldwide, save the labour consumed

by information transmission, and reduce the overall

operation cost of enterprises.

4.1.3 Simplify Business Processes

All links of the traditional financial management

model need manual participation, the quality of work

is easily affected by the quality of personnel, cost

efficiency and other factors, work efficiency cannot

be further improved. After the establishment of the

financial sharing service centre in Changhong,

Sichuan Province, the financial workflow is handled

by the system, which completely replaces the labour

by means of cloud collection, cloud processing, etc.

The establishment of the financial sharing service

centre has established a standardized standard

process, which makes the whole process dependable.

The accounting business is automated through the

standardization of accounting and electronic

vouchers, which improves the work efficiency,

shortens the work time and ensures the accuracy of

data accounting.

Financial

sharing

service

Flat financial

organization

structure

Simplify financial

staffing

Cost reduction

and efficiency

increase

Repeat homogeneous

financial business and

merge professional

financial department and

accounting department

Financial

business

standardization

A Case Study on Cost Reduction and Efficiency Increase of Financial Shared Service Centre: A Case Study of Changhong, Sichuan Province

259

Figure 4: Sichuan Changhong Financial Information Management System

With the help of ERP platform, CRM system,

SRM system and expense management system, the

financial sharing service centre realizes business

process reengineering, simplifies the basic processes

of enterprise purchase payment, sales collection and

expense reimbursement, and is uniformly deployed

by the financial sharing service centre. According to

the announcement of Sichuan Changhong official

website, the current business automation degree of

Sichuan Changhong reaches 96%, the time limit of

financial accounting only takes 0.5 working days,

the time limit of expense reimbursement is from the

original week to the present 20 minutes, the

operation rate of enterprise funds is greatly

improved, and the fund management efficiency is

further improved.

4.2 Effect

4.2.1 Management Cost

It can be seen from Table 2 that the total assets of

Sichuan Changhong after the establishment of the

financial sharing service centre are in a rising trend,

which can reflect the gradual expansion of the

enterprise scale. Since a large amount of personnel is

required in the initial stage of construction, the

management cost of the enterprise has increased.

After 2013, the financial sharing service centre

entered a mature period, and after stable operation,

the management cost began to decrease year by year.

Meanwhile, the ratio of the management cost to the

asset also showed a downward trend year by year.

This shows that the effect of the financial sharing

service centre in the management cost has a cushion

process, and the management cost can be reduced

after stable implementation of the financial sharing

platform. Based on the changes in the management

expenses of Sichuan Changhong Financial Shared

Service Centre, it can be found that there is a buffer

process in the cost changes after the formal

construction of the financial shared service centre.

It can be seen that during the construction of the

financial sharing service centre in Changhong, the

change trend of the proportion of management

expenses has been gradually reduced from the initial

rise. The reason for this phenomenon is that Sichuan

Changhong has set up a financial sharing service

centre, which can gather the original decentralized

business units and form a unified business

processing mode. When enterprises increase

industries, they no longer need to establish new

accounting departments, which improves the

management level of enterprises, improves the

economies of scale of enterprises, and thus achieves

the purpose of saving costs.

4.2.2 Financial Operational Efficiency

It can be seen from Table 3 that, with the continuous

expansion of the scale of Sichuan Changhong, the

ratio of total assets to financial personnel of the

enterprise presents a stable growth trend, rising from

0.39 in 2010 to 1.22 in 2023, increasing by nearly

four times, thus indicating that after the

establishment of the financial sharing service centre

in Sichuan Changhong, the increase of financial

personnel is less than the increase of total assets, and

ICEML 2025 - International Conference on E-commerce and Modern Logistics

260

the average assets managed by each financial

personnel of the enterprise are gradually increased.

It can be shown that after the establishment of the

financial sharing service centre in Changhong, the

financial work efficiency has indeed increased.

Table2: 2010-2023-Year Management Expenses and Assets of Sichuan Changhong

Time

Administrative express

(RMB 100 million)

Total assets

(RMB 100 million)

Overhead/Total Assets

2010 16.17 445.5 3.63%

2011 20.66 516.5 4.00%

2012 22.63 545.5 4.15%

2013 27.12 588.4 4.61%

2014 30.11 602.2 5.00%

2015 28.46 556.2 5.12%

2016 27.3 598.6 4.56%

2017 15.99 628.4 2.54%

2018 15.56 715.1 2.18%

2019 16.9 739.9 2.28%

2020 14.98 785.9 1.91%

2021 17.66 794 2.22%

2022 17.43 855.4 2.04%

2023 18.15 944 1.92%

Table 3: Ratio Between Total Assets and Financial Personnel of Changhong, Sichuan in 2010-2023 Years.

Time Financial personnel

Total assets

(RMB 100 million)

Total assets/

Financial personnel

2010 1154 445.5 0.39

2011 1223 516.5 0.42

2012 1273 545.5 0.43

2013 1194 588.4 0.49

2014 1180 602.2 0.51

2015 831 556.2 0.67

2016 831 598.6 0.72

2017 818 628.4 0.77

2018 991 715.1 0.72

2019 842 739.9 0.88

2020 906 785.9 0.87

2021 816 794 0.97

2022 728 855.4 1.18

2023 776 944 1.22

A Case Study on Cost Reduction and Efficiency Increase of Financial Shared Service Centre: A Case Study of Changhong, Sichuan Province

261

Table 4: Business Processing Efficiency of Sichuan Changhong Financial Shared Service Centre

Matters Changes

Length of expense reimbursement Reduced from 7 days to 20 minutes

Meeting preparation time More than 10 days in advance

Degree of automation Above 96%

Per capita orders processed per month Increased by 109.44% from 2160 to 4524

Error rate Reduced from 5 per 10,000 to 0.45 per 10,000

4.2.3

Business Processing Efficiency

As shown in the data in Table 4, after the financial

sharing service centre was constructed in

Changhong, the cost reimbursement time was

shortened from more than seven days to 20 min, and

the error rate was reduced from 0.05% to 0.0045%.

The number of business orders processed per capita

increased by 109.44% from 2160 to 4524 per month.

At the same time, the automation information

system makes the quarterly business analysis

meeting preparation time at least 10 days in advance,

and the automation degree is more than 96%. The

financial sharing service centre of enterprises

increases the speed of information transmission,

optimizes the financial work of enterprises, and

enhances the effectiveness of enterprise decision-

making.

5 CONCLUSION

Taking Sichuan Changhong as an example, this

paper deeply studies how to reduce the cost and

increase the efficiency of the enterprises by the

construction of the financial sharing service centre

of the number of intellectualized enterprises. By

analysing the construction process, organization

mode and infrastructure of the financial sharing

service centre of Sichuan Changhong Group, as well

as the concrete measures in optimizing the financial

organization structure, perfecting the financial

information system and simplifying the business

processing process, we find that the construction of

the financial sharing service centre of Sichuan

Changhong has a significant impact on the cost-

saving and efficiency improvement of Sichuan

Changhong. Sichuan Changhong has successfully

reduced the labour cost, improved the financial

processing efficiency, optimized the financial

organization structure, and perfected the information

system and business processing flow, thus realizing

the decrease of the proportion of management

expenses, and the great improvement of the financial

operation efficiency and business processing

efficiency.

The constant development of big data era

provides necessary conditions for financial

transformation. In the future, it is still necessary to

continue to deeply study the operation mechanism

and function upgrade of big data, artificial

intelligence, cloud computing and blockchain,

clarify the combination point and application section

with the financial field, construct the technology

application platform according to the characteristics

of finance, promote the future of financial

digitalization and intelligent transformation, and the

number of intelligent financial sharing service centre

will develop in the direction of technology

innovation and strategy combination (ZhuXiangyu,

2025).

REFERENCES

Casey J, Totenhagen, Melissa J, Wilmarth, Joyce Serido,

Melissa A, Curran, Soyeon Shim. 2019. Pathways

from Financial Knowledge to Relationship

Satisfaction: The Roles of Financial Behaviors,

Perceived Shared Financial Values with the Romantic

Partner, and Debt. Journal of Family and Economic

Issues, 40(3), 423-437.

Hirschfield R. 1996. Shared services save big money.

Datamation, 42(15), 76-78.

Jassen M., Rothwell, H., Seal W. 2011. Shared service

centres and professional employ- ability. Journal of

Vocational Behavior, 79(1), 241-252.

Jiang X., Wang R., Guan L., Du C. 2023. The Impact of

Intelligent Finance on Financial Performance from the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

262

Perspective of Digital Transformation. Accounting

Friends, (20), 44-51.

Jin L., Wang H. 2016. Research on the Application Effect

of Financial Shared Service Center. Friends of

Accounting, (05), 21-24.

Li J., Tian G., Xie Y., Zhang W. 2025. Research on the

Impact Path of Intelligent Financial Sharing on

Enterprise Performance: Empirical Evidence from

China Railway First Group. Accounting Monthly, 46

(04), 89-94.

Liu Y. 2023. Research on the Impact Path and Effect of

Financial Shared Service Center Construction on

Enterprise Performance (Master's Thesis, Nanjing

University of Information Science and Technology).

Master

Marijn J., Anton J. 2004. Issues in relationship

management for obtaining the benefits of a shared

service centre. Electronic Commerce.

Soalheira J. 2007. Designing a successful plan for your

shared service centre. Internation Journal of Business

Information Systems, (3), 217-230.

Tang Y., Hu X. 2019. Discussion on the Digital

Transformation of Enterprise Finance under the

Shared Service Model. Friends of Accounting, (08),

122-125.

Xu H. 2024. Construction Path and Implementation

Effectiveness of Digitalized Financial Shared Service

Center: A Case Study of Guangdong Transportation

Group. Friends of Accounting, (24), 41-47.

Yao S., Sheng Z., He Z. 2019. Research on the Impact of

Financial Process Reengineering Based on Cloud

Sharing on Enterprise Performance. Journal of Xi'an

University of Finance and Economics, 32 (05), 29-34.

Zhang Juan. 2018. Construction and Application of

Enterprise Financial Shared Services in Cloud

Computing Environment: A Case Study of Sichuan

Changhong. Accounting Friends, (21), 134-138.

Zhu X., Yuan R., Gao Y. 2025. Research Status, Hotspots

and Trends of Financial Digitalization Transformation

in China. Accounting Friends, (03), 119-126.

A Case Study on Cost Reduction and Efficiency Increase of Financial Shared Service Centre: A Case Study of Changhong, Sichuan Province

263