Deloitte Digital Audit Practice Exploration and Future Trend

Research

Mingze Xiu

a

Shoreline Community College, 98133, Shoreline, 16101 Greenwood Ave N, Shoreline, WA 98133, U.S.A.

Keywords: Digital Auditing, Deloitte, Auditing Technology, Future Trends of Auditing.

Abstract: With the rapid development of information technology, digital auditing has emerged as a significant trend

within the accounting and auditing fields. This article delves into the development path. This article provides

a detailed analysis of the application of “Argus” data analysis tools, “Spotlight” review software, and “Omni”

workflow management, demonstrating how these tools play a crucial role in processes such as risk assessment,

substantive testing, and the generation of audit reports. Meanwhile, the article also identified the problems

and challenges encountered in the implementation of digital auditing, focusing on data protection, auditing

quality control, and professional skill requirements through case studies in industries such as finance,

manufacturing, and retail. This article holds that Deloitte's exploration in the field of digital auditing has been

successful and predicts that future auditing work will encounter the rapid development of intelligent auditing

tools, the deepening of auditing data standardization, and higher requirements for the skills and qualities of

auditors.

1 INTRODUCTION

1.1 Research Background

In the wave of digital transformation, the auditing

industry is confronted with unprecedented

opportunities and challenges. According to Deloitte's

2019 report, 53% of business managers have already

begun exploring the application of Robotic Process

Automation (RPA), indicating that RPA will be

widely adopted globally within the next five years.

Meanwhile, the rapid development of emerging

technologies, such as cloud computing and big data,

has provided new tools and methods for auditing,

promoting innovation and optimization in the

auditing process.

However, despite the rapid development of

technology, the auditing industry still faces problems

such as low efficiency, high cost, and insufficient

accuracy in information collection during the initial

business activity stage. When assessing the integrity,

business condition, and professional competence of

the audited entity, traditional methods are often

constrained by time and resources, making the

a

https://orcid.org/0009-0002-7398-842X

auditing process cumbersome and inefficient. When

assessing the integrity, business condition, and

professional competence of the audited entity,

traditional methods are often constrained by time and

resources, making the auditing process cumbersome

and inefficient.

In conclusion, the research on Deloitte's practical

exploration and future trends in digital auditing holds

significant academic value and practical significance.

By studying the application of digital technology in

auditing, new ideas and methods can be developed to

transform and upgrade the auditing industry,

promoting the advancement of auditing work towards

a more efficient and intelligent direction.

1.2 Research Content and Objectives

This article takes Deloitte's exploration of digital

auditing as its research object, aiming to provide a

deep analysis and discussion of Deloitte's digital

transformation and innovative practices in the

auditing field. The auditing industry is confronted

with numerous challenges in the rapidly changing

market environment, and traditional auditing methods

are complex to meet the demands of the new era. To

240

Xiu, M.

Deloitte Digital Audit Practice Exploration and Future Trend Research.

DOI: 10.5220/0013842200004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 240-248

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

this end, Deloitte actively promotes the

implementation of digital auditing, enhancing the

efficiency and quality of auditing by improving the

application of information technology and data

analysis capabilities. The research will conduct a

detailed discussion on the concept of digital auditing,

Deloitte's practices, and its development trends, and

carry out in-depth analysis in combination with

practical cases.

The primary objective of this study is to

investigate the specific pathways through which

Deloitte's digital auditing practices contribute to its

exceptional performance in addressing emerging

risks and enhancing audit effectiveness. Against this

background, the research encompasses several

essential aspects. Firstly, the analysis of the digital

foundation of auditing provides a basis for

understanding the digital auditing framework for this

study, including the application of related

technologies such as blockchain, artificial

intelligence, and big data. Secondly, Deloitte's

exploration of digital auditing practices has set a

benchmark for the auditing industry. Through the

digital processing of data collection, analysis, and

reporting, auditing has been significantly enhanced in

terms of flexibility and accuracy. Additionally, the

case analysis section will reveal the actual effects and

benefits of Deloitte's digital auditing through an

analysis of specific projects. The comprehensive

analysis of these research contents will provide

references and lessons for the future development of

the auditing industry.

1.3 Research and Innovation

The innovation of this research mainly lies in three

aspects. Firstly, a thorough analysis of the current

application status and future development trends of

digital auditing in the industry will make the research

in related fields more systematic and professional.

Secondly, by integrating Deloitte's practical cases

with theoretical research, it provides rich empirical

data for subsequent studies. It fills the current

research gap in the academic circle regarding the

practical application of digital auditing. Furthermore,

exploring the impact of digital auditing on enhancing

audit quality and information transparency reflects

the continuous evolution of the auditing function and

its ability to respond to market demands, which holds

significant academic and practical value.

2 THE FOUNDATION OF

DIGITAL AUDIT

2.1 Digital Audit Overview

Digital auditing, as a new trend in the development of

the auditing industry, has reshaped traditional

auditing methods and processes. In terms of

definition, digital auditing is an auditing activity that

electronically acquires, analyzes, and processes a

large amount of auditing evidence through

information technology means. The proposal of this

concept marks the transformation of auditing work

from the previous manual, random sampling, and

experience-driven approach to a more refined and

automated auditing model that relies more on data

analysis and processing technologies (Xi & Li, 2016).

The establishment of the foundation for digital

auditing aims to build a technical support system that

encompasses a range of key technologies, including

cloud computing, big data, artificial intelligence, and

blockchain. Through the application of these new

technologies, auditing work has made a significant

leap forward, capable not only of efficiently handling

massive amounts of data but also of utilizing data

mining algorithms to reveal the patterns behind

complex business operations, thereby improving the

quality and efficiency of auditing. Cloud computing

technology enables the storage and processing of

audit data to no longer be constrained by local

resources. Audit project teams can collaborate

remotely, share data and audit tools, significantly

enhancing the flexibility and responsiveness of audit

work (Song, 2022). Big data technology has further

driven the evolution of auditing from sampling

auditing to comprehensive auditing, enabling every

financial transaction to be tracked and audited and

allowing risk identification and assessment to more

accurately and dynamically reflect the operational

status of enterprises. Meanwhile, the integration of

artificial intelligence technology enables auditing to

go beyond the review of historical data, allowing for

the early detection of potential risks and trends in

enterprises through predictive models (O Impacto de

Big Data na Auditoria Financeira, 2019).

As one of the pioneering international auditing

firms, Deloitte was the first to apply digital auditing

technology in active project practices. In Deloitte's

auditing methodology, it is evident that information

technology is highly integrated throughout the entire

auditing process, from planning to execution and

reporting. The Rubix platform utilizes visualization

technology to intuitively display the connections and

Deloitte Digital Audit Practice Exploration and Future Trend Research

241

key points of audit evidence, enabling auditors to

make more informed judgments.

2.2 Technology Drives the

Development of Auditing

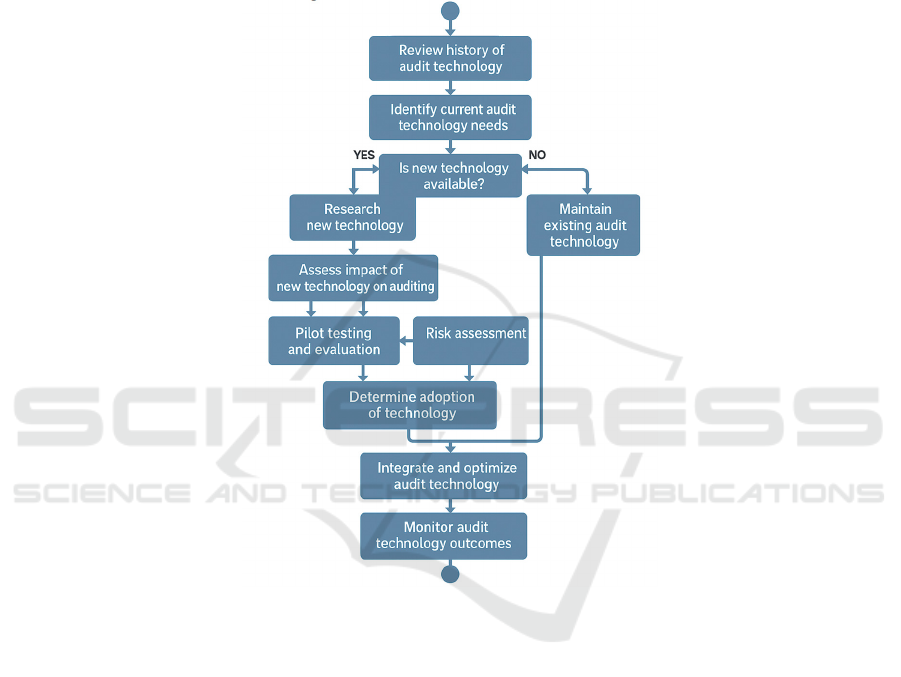

Figure 1 illustrates the entire process, ranging from a

historical review of auditing techniques to the

assessment, integration, and monitoring of the effects

of new technologies. When implementing technology

integration and optimization in the auditing process,

it is essential to fully consider how to incorporate new

technologies into the existing auditing system and

ensure that they can effectively enhance the quality

and efficiency of auditing work. When validity issues

are detected, necessary adjustment measures should

be implemented immediately to maintain the

adaptability and flexibility of the auditing technique.

Figure 1: Flowchart of the development of audit techniques.

The rapid development of technology has driven

the continuous advancement of auditing techniques.

For instance, with the application of big data and

artificial intelligence, auditing work can now achieve

larger-scale data analysis, which was unimaginable

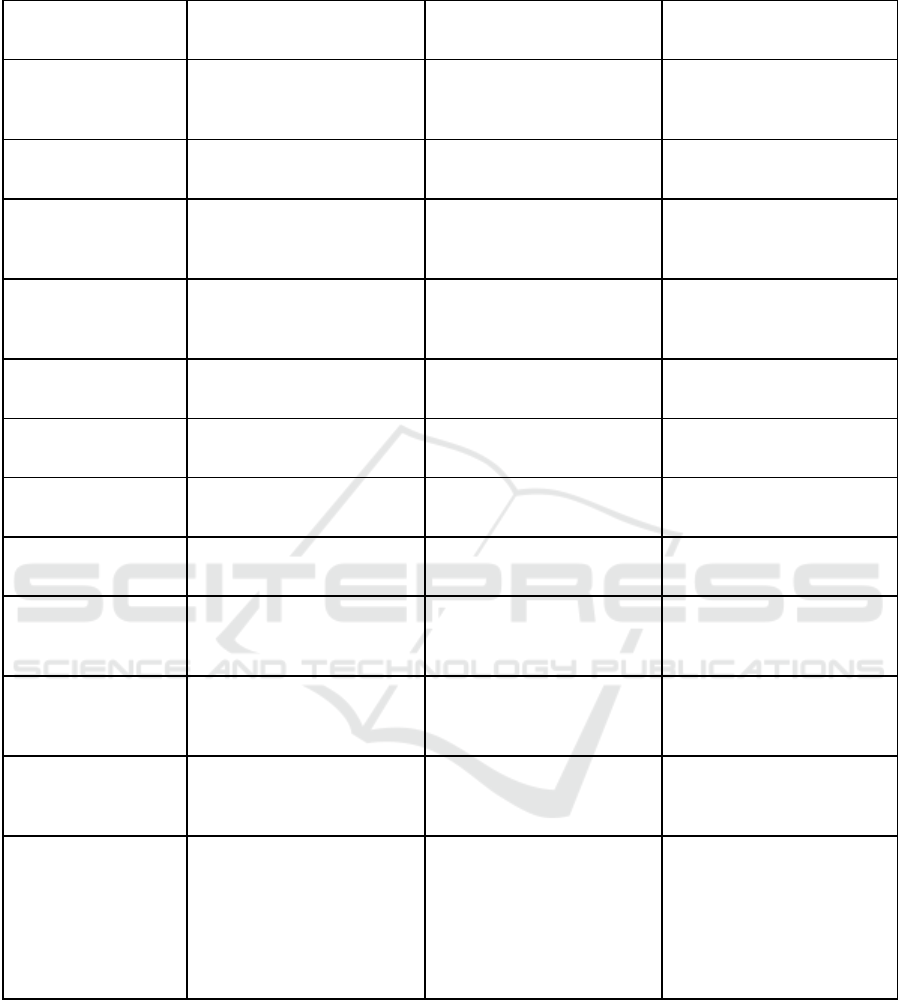

with traditional auditing methods. Table 1 shows the

significant differences between traditional auditing

and digital auditing in various elements. The

improvement in data acquisition speed, the expansion

of audit sample size, and the enhancement of data

analysis capabilities have undoubtedly brought

fundamental changes to the auditing industry (Wu et

al., 2022).

After adopting digital auditing methods, it can be

found that the reliability of audit evidence has

significantly improved. This is not only due to the

long-term stability of digital evidence storage but also

benefits from the standardization and automation of

the audit workflow. The significant reduction in the

time required for preparing financial reports enables

auditors to devote more time to higher-value

analytical work. This efficiency revolution not only

reduces the workload of auditors but also enhances

the credibility of the audit results (Liao et al., 2023).

When it comes to the process of technology

promoting the development of auditing, it is also

necessary to note that continuous skills training for

auditors is essential. The cultivation of this new skill

enables auditors to better adapt to technological

changes. Meanwhile, the mastery and application of

advanced technologies such as machine learning and

natural language processing further enhance their risk

identification capabilities and the timeliness of real-

time audit monitoring (Malsch & Stack, 2022).

ICEML 2025 - International Conference on E-commerce and Modern Logistics

242

Table 1: Comparison table of influencing factors of audit techniques.

Audit technical

elements

Traditional Audit Approaches

and Res

p

onse Strate

g

ies

Strategies for Dealing with

Di

g

ital Audit Methods

Comparison of Effectiveness

Im

p

act

Data acquisition speed

Manual collection takes

several weeks.

Automated scripts are

completed within a few hours.

Digital auditing improves

efficiency by approximately

95%.

Audit sample size

Limited sample, non-

com

p

rehensive audit

Comprehensive audit, 100%

data chec

k

Complete coverage has been

enhanced to full covera

g

e.

Data analysis ability

Simple comparison, relying

on manual experience.

Complex algorithms,

providing in-depth analysis

The depth and accuracy of the

analysis have been

significantly enhanced.

The reliability of audit

evidence

Paper documents are prone to

damage and loss.

Digital evidence preservation

has remained essentially

unchan

g

ed for a lon

g

time.

Improved reliability and

reduced file loss.

Report preparation

time

Several weeks to several

months, written by hand.

Within a few days, generate

reports automatically.

The time efficiency has been

improved by at least 80%.

Skills Requirements

for Auditors

Traditional accounting

knowledge

Data analysis, information

technolog

y

Auditors must cultivate new

skills.

Risk identification

abilit

y

Judge risks based on

experience.

Data-driven, machine learning

identifies risks.

Improvement in risk

p

rediction accurac

y

Real-time monitoring

and d

y

namic auditin

g

impracticability

Real-time data monitoring,

d

y

namic auditin

g

Enhancing the Effectiveness

and Timeliness of Auditin

g

Integration and

analysis of multi-

source data

It isn't easy and is rarely

carried out.

One-click integration, cross-

system

A more comprehensive data

perspective and deeper

analysis.

Flexibility in

responding to external

chan

g

es

Slow response and long

update cycle

Quick adaptation, real-time

update

The ability to respond to

external changes has been

si

g

nificantl

y

enhanced.

Artificial Intelligence

Audit Assistant

Non

Natural language processing,

pattern recognition

Audit quality and audit speed

have been significantly

enhanced.

The automation and

standardization of the

auditing process

The process is cumbersome,

and the standards are

inconsistent.

One-click execution of the

process, standardized

operation

Consistency and repeatability

are guaranteed.

2.3 Discussion on Deloitte's Audit

Model

In the background of the gradual popularization of

digital audit, the improvement of audit quality and

efficiency is significant. Deloitte has significantly

enhanced the accuracy and timeliness of its audits by

leveraging advanced digital tools, conducting data

analysis, implementing intelligent processes, and

conducting real-time monitoring. By applying big

data technology, Deloitte conducts in-depth analysis

of massive amounts of information to identify risk

points and achieve real-time detection of abnormal

transactions in audits. The algorithm-based auditing

Deloitte Digital Audit Practice Exploration and Future Trend Research

243

method can replace traditional manual checks, reduce

human errors, and enhance the reliability of audit

results. To this end, Deloitte has developed a machine

learning-based model. This model, through training

with historical data, optimizes risk assessment

parameters, significantly reducing blind audits in

high-risk areas and concentrating resources on key

reviews, thereby enhancing overall audit efficiency.

In the actual implementation, Deloitte introduced

RPA (Robotic Process Automation) technology to

automate repetitive data entry and analysis tasks,

resulting in a 30% reduction in audit time. Meanwhile,

through the application of blockchain technology, the

transparency and immutability of data sources have

been achieved, enhancing the credibility of

information and the reliability of the auditing process.

In addition, Deloitte attaches great importance to

enhancing the technical capabilities of its auditors,

conducting relevant technical training to enable them

to skillfully use new tools and promote human

resource optimization during the digital

transformation process.

During the writing stage of the audit report,

intelligent document generation tools can quickly

form a preliminary audit report, with data analysis

results automatically embedded, thereby improving

document production efficiency and ensuring the

accurate transmission of information. Compared with

the traditional auditing process, the report generation

time has been shortened by 40%. Meanwhile, the

adoption of data visualization technology makes the

auditing results more intuitive, helping clients

quickly grasp key issues and make prudent business

decisions accordingly.

Deloitte leverages its Rubix platform to integrate

advanced data visualization technology with auditing

practices. In this way, auditors can more intuitively

understand and interpret complex data patterns,

enhancing their insight into clients' financial

conditions. The Rubix platform features a high degree

of customization and can generate multi-dimensional

reports based on various types of data sources,

meeting audit requirements while optimizing the

delivery process.

In applying these tools and models, Deloitte

consistently prioritizes audit quality. For instance, by

using the "Argus" data analysis tool, it can

automatically identify abnormal patterns when

handling large volumes of transaction data, making

risk prediction and assessment more accurate. The

"Spotlight" auditing software offers a comprehensive

understanding of the operational processes

underlying transactions. By revealing key control

points and potential compliance risks in business

activities, it guides subsequent auditing strategies (Xi

& Li, 2016). Meanwhile, the "Omni" workflow

management platform enables Deloitte's audit teams

to collaborate more efficiently and track the progress

of audit projects in real time (Song, 2022).

3 DELOITTE DIGITAL AUDIT

PRACTICE

3.1 Deloitte Digital Audit Practice

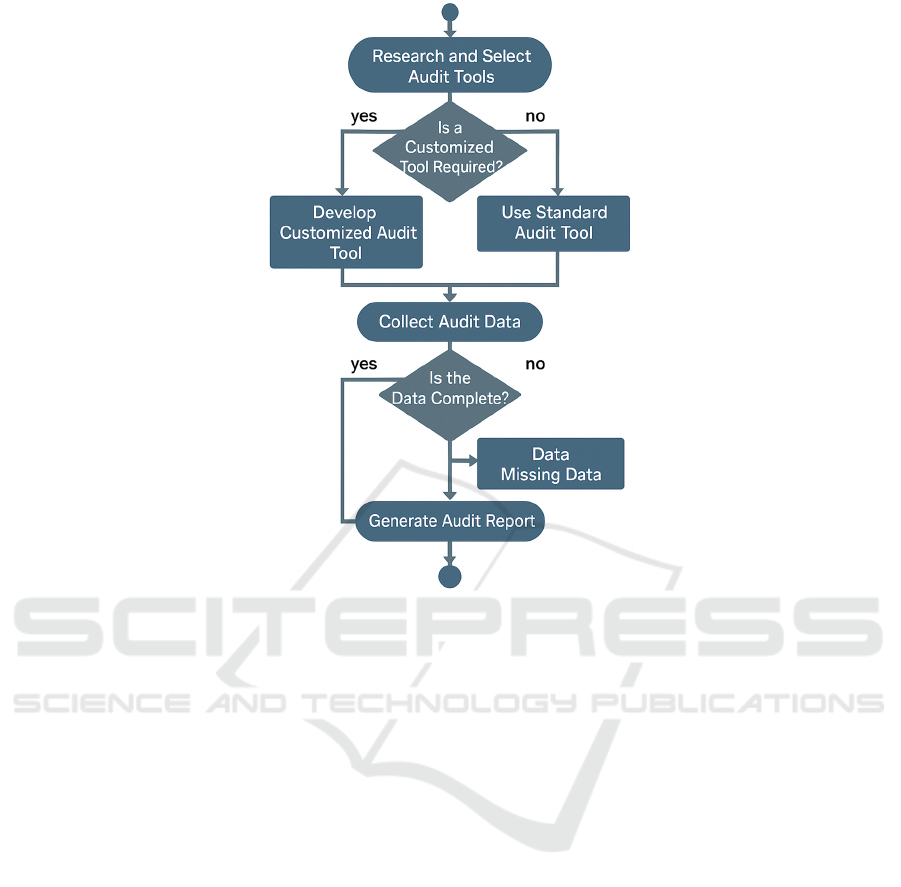

In Deloitte's digital auditing practice, the selection

and application of auditing tools are key to ensuring

the efficiency and quality of auditing. According to

the specific requirements of the auditing project, the

first decision that the auditing team faces is whether

to use standard auditing tools or to develop custom

ones. Custom-developed audit tools can better adapt

to specific audit environments and requirements, but

this also means a more significant investment of time

and resources. In response to this decision-making

issue, the research referred to Deloitte's audit tool

application flowchart and formulated the

corresponding decision-making process (see Figure

2).

After selecting the auditing tool, the next step is

to collect the data required for the audit, including,

but not limited to, financial statements, vouchers, and

transaction records. In practice, it is often

encountered that data is incomplete, which requires

auditors to communicate with the audited entity

multiple times to obtain the missing key information.

Regarding the completeness of data, the audit team

will confirm it according to specific standards and the

steps outlined in the flowchart, ensuring that all

necessary data is complete.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

244

Figure 2: Application flowchart of deloitte audit tools.

3.2 Practices of Digital Audit Processes

In Deloitte's digital auditing practice, transforming

the auditing process is a core task. It shifts from

traditional paper-based and face-to-face auditing

methods to a highly technology-reliant model of

remote analysis and electronic data processing. The

practice of digitalizing the auditing process has

reshaped key steps, including risk assessment, audit

execution, and report generation, thereby enhancing

the efficiency and quality of auditing.

During the risk assessment and control testing

stage, Deloitte relies on advanced data analysis tools,

such as Argus, to process and analyze large datasets

of clients, quickly identifying potential risks and

problem areas. Data analysis tools identify abnormal

patterns through algorithms and models, which help

detect unusual changes in business operations and

conduct multidimensional risk assessment and

monitoring of commercial banks' retail businesses,

meeting audit requirements in the context of digital

transformation (Song, 2022). By evaluating the

design and implementation effectiveness of the

internal control system, the audit team can effectively

assess the robustness of the control environment and

guide the planning and focus of future audit work.

During the substantive testing phase, auditors use

the "Spotlight" software tool to review electronic

transaction records and vouchers, enabling them to

verify the integrity, accuracy, and reasonableness of

the data and transactions. Digital auditing methods

are not merely about mapping out accounting

behaviors that have already occurred; they can also

utilize big data and intelligent technologies to predict

and assess future trends and risks (Xi & Li, 2016).

This enables the auditing work to go beyond the

analysis of historical data and instead provide clients

with more forward-looking risk management and

internal control suggestions.

During the stage of generating the audit report, the

"Omni" workflow management system ensures that

each link of the audit activity proceeds smoothly in

accordance with predetermined standards, thereby

guaranteeing the quality and consistency of the report.

In the practice of audit quality control, DD Certified

Public Accountants has clearly defined the execution

process, making the audit procedural and effectively

controlling audit risks (Zeng, 2020). Digital tools and

process practices ensure the quality of audits, taking

into account data protection and privacy regulations

while enhancing the transparency and credibility of

audit reports.

Deloitte Digital Audit Practice Exploration and Future Trend Research

245

3.3 Problems and Challenges in

Practice

In the process of implementing digital auditing

practices, Deloitte has encountered a series of

problems and challenges that involve not only

technical aspects but also management and legal

aspects. The assessment and control of the testing

phase are crucial to the quality of auditing. However,

during the process of digital transformation, auditors

are under tremendous pressure from data protection

and privacy regulations. As the auditing work

involves the collection and analysis of a large amount

of sensitive data, ensuring data security and

complying with relevant laws and regulations have

become prominent issues. For instance, the General

Data Protection Regulation (GDPR) of the European

Union has established stringent requirements for the

processing of personal data. Auditors need to design

and implement audit procedures under the premise of

compliance, which has increased the complexity of

audit work (Zhang et al., 2015).

The implementation of digital audit processes

requires the comprehensive application of various

software tools and technical methods. Deloitte may

face challenges in integrating professional knowledge

with internal tools (Anonymous, 2022). Although the

continuous innovation of auditing tools has enhanced

the efficiency of auditing work, it also requires

auditors to constantly learn and adapt to new tools,

such as Argus or Spotlight (Zhang, 2022). This not

only requires auditors to have a solid foundation in

accounting and auditing knowledge but also to

possess corresponding IT knowledge and skills to use

these tools efficiently. Data indicates that in the

combined application of big data technology and

auditing methods, auditors need to spend a

considerable amount of extra effort learning new

tools and fully understanding the profound impact

these tools have on auditing results.

3.4 Technological Innovation and

Expected Improvement

In the exploration of Deloitte's digital auditing

practices, an objective assessment of the significant

improvement in auditing efficiency is conducted

using the "auditing efficiency formula" for

calculation. This approach can accurately measure the

percentage difference in time consumption between

digital technology and traditional methods when

completing the same audit task.

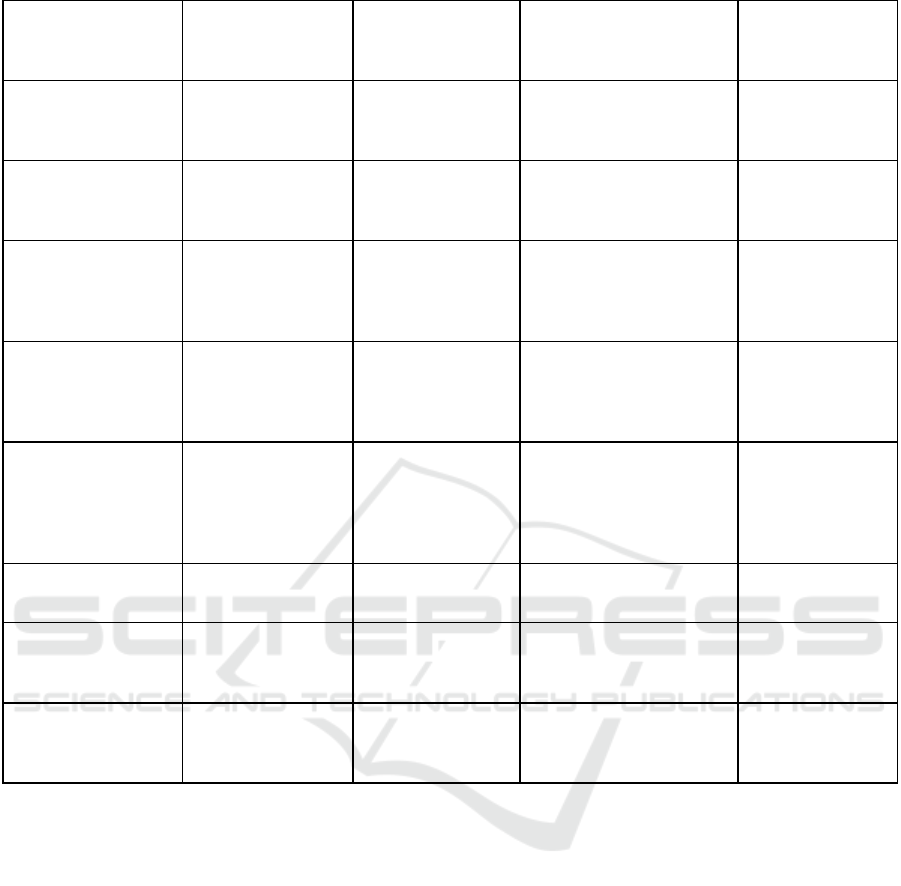

In terms of technological innovation points, Table

2 systematically categorizes the uniqueness of the

technologies employed by Deloitte in the digital

transformation process and their competitive

advantages over traditional auditing technologies.

Through multi-dimensional comparisons, this table

reflects Deloitte's technological layout and

advancement in areas such as automation,

intelligence, and data integration. For instance, in

terms of automated document processing capabilities,

Deloitte has significantly enhanced data processing

speed and notably reduced error rates by leveraging

the second-generation intelligent financial robot,

Xiao Qin Ren. Compared to manual document

processing, it is expected to achieve an efficiency

improvement of up to 60%.

Table 2: Comparison table of technological innovation points.

Innovative points of

technology

Deloitte case uses

technology

Other traditional

auditing techniques

Analysis of Comparative

Advantage

Expected

performance

improvement

Automated document

processing capability

The second-

generation intelligent

financial robot of

Xiaoqinren

Manual file

processing

Data processing for growth

rate, reducing error rate

Increase efficiency

by 60%

Intelligent Data

Extraction and

Cleaning

QinshuTong

Platform

Traditional data

extraction tools

Building a single platform

for integrating multiple

systems reduces the need

for manual intervention.

Reduce time by

70%

The automatic

generation of

financial reports

QinbaoTong

Artificially

generated financial

reports

One-click generation

reduces human errors in

typesetting.

Reduce the process

by 80%

ICEML 2025 - International Conference on E-commerce and Modern Logistics

246

Innovative points of

technology

Deloitte case uses

technology

Other traditional

auditing techniques

Analysis of Comparative

Advantage

Expected

performance

im

p

rovement

Instant feedback on

audit consultation

Intelligent financial

chatbot

Email or phone

consultation

24-hour rapid response,

providing standard answers

to common

q

uestions.

Increase

availability by 50%

High-efficiency

Document Review

Intelligent Document

Review Platform

Manual review

Quickly and accurately

extract key information and

conduct automatic reviews.

Increase speed by

90%

Data integration and

analysis

Integrated analysis

platform for

financial reports and

accounting subjects

Traditional analysis

software

Dynamic visual graphics,

supporting multi-angle

comparison

Improve decision-

making quality by

30%

Project collaborative

management

Deloitte Customer

Project

Collaboration

Platfor

m

Email and meeting

coordination

Real-time project progress

updates, secure document

storage

Increase

collaboration

efficiency by 45%

Customized solution

planning

The Artificial

Intelligence

Technology

Excellence Center

Program

Traditional

consulting services

One-stop service,

comprehensive technical

support

Reduce costs by

20%

Advanced Credit

Review Syste

m

Bank credit review

p

latfor

m

Manual credit

review

Precise risk identification

and post-loan tracking

Reduce risks by

25%

Automated physical

operations

robot arm

manual operation

Improve operational

accuracy and reduce labor

intensit

y

.

Increase production

capacity by 30%

Advertising

monitoring and

effectiveness analysis

Green Mirror System

Traditional market

research

Real-time data feedback,

optimizing advertising

strategies

Increase ROI by

20%

4 CONCLUSIONS

Based on Deloitte's practice of digital auditing, this

study focuses on the comprehensive processing of

accounting data and leverages big data technology to

transform the traditional sampling auditing approach

in auditing. By utilizing data analysis tools such as

Argus, the depth of analysis and mining of the data

set has been increased, allowing for more accurate

identification and assessment of audit risks and

responsive management of dynamic changes

throughout the audit process. Overall, Deloitte's

practice of digital auditing demonstrates that the

application of digital tools and platforms can

significantly enhance the transparency of the auditing

process, enabling internal auditors to identify risk

points more quickly and accurately in data. These

technologies not only revolutionize traditional

auditing methods but also provide new directions for

the future development of auditing work.

Audit informatization will pay more attention to

integrating professional knowledge and technology.

Although big data and artificial intelligence

technologies have brought innovations to audit work,

human professional judgment still plays an

irreplaceable role in audit activities. In terms of

professional qualities, future auditors will not only be

required to possess knowledge in traditional fields

such as accounting and auditing but also need to have

a grasp of information technology, data analysis, and

other relevant areas in order to utilize auditing tools

more effectively and analyze auditing data.

In the future, data analysis tools will achieve more

efficient data processing capabilities, supporting

comprehensive and in-depth audit analysis.

Deloitte Digital Audit Practice Exploration and Future Trend Research

247

Specifically, trained algorithms will be able to

comprehensively scan an enterprise's accounting

information and respond quickly to potential

anomalies or risks, integrating and analyzing data

from various sources to achieve comprehensive audit

coverage that encompasses all business matters. In

the face of complex data sets, data mining and pattern

recognition supported by artificial intelligence will be

able to reveal more concealed financial errors or

fraudulent behaviors. This progress will rely on high-

speed computing capabilities and optimized

algorithm models to enhance the accuracy and

reliability of audit results.

REFERENCES

Anonymous. (2022). Changing the View on Information

Systems Audits

—

From Punitive to Beneficial. Utica

University.

Liao, F. N., Han H. L., Hou F., & Long H. B. (2023). Can

artificial intelligence education help audit quality:

empirical evidence from the auditor level Luojia.

Management Review (2), 81-99

Malsch, B., & Stack, R. (2022). Auditors' Professional

Identities: A Review and Future

Directions. Accounting Perspectives.

O Impacto de Big Data na Auditoria Financeira. (2019).

Instituto Politecnico do Porto, Portugal.

Song, W. J. (2022). Exploration of Digital Audit Methods

for Retail Business of Commercial Banks under the

Background of Digital Transformation. Management

and Technology of Small and Medium sized

Enterprises (First Edition), 3.

Wu, Y. Y., Lin, Y., Lin, J., et al. (2022). Research on the

Digital Transformation of Internal Audit in Public

Hospitals - Taking KF Hospital as an Example.

Financial and accounting studies.

Xi, J. F., & Li, Q. (2016). The transformation of audit

methods - innovation brought by big data. The new

economy, (36), 75.

Zeng, W. Y. (2020). The current situation and optimization

plan of audit quality control in accounting firms -

taking DD accounting firm as an example. Modern

enterprises, 157-158.

Zhang, Y., Gao, H. Y., and Ba, Z. C. (2015). Cross type

digital resource classification method based on topic

association mining. Intelligence Theory and Practice,

38 (11), 108-114.

Zhang, J. T. (2022). Research on the Application of Big

Data in Enterprise Audit. Finance and Economics

World, 3.

ICEML 2025 - International Conference on E-commerce and Modern Logistics

248