Research on the Application Practice of Financial Robots Based on

RPA Technology in Tianjin Medical University

Xinyao Wang

a

School of Accounting, Shandong University of Management, 250300, Jinan, Guyunhu Street, China

Keywords: RPA Technology, Tianjin Medical University, Digitalization and Intelligence.

Abstract: In today's rapidly developing digital and intelligent era, intelligent financial robot technology (RPA) is widely

used in major enterprises and universities, promoting innovation and development in the financial field. This

article explores the application practice of RPA technology at Tianjin Medical University and deeply analyzes

its application background. By sorting out the principles of RPA technology and the characteristics of

financial management in universities, the necessity of applying RPA technology in the school is explained.

By collecting financial data from the university, the implementation process and significant effects of RPA

technology at Tianjin Medical University were revealed. The research results indicate that this technology has

provided convenience for Tianjin Medical University in the field of financial management, solved problems

such as personnel cost shortage, and greatly promoted the transformation of financial intelligence in

universities. At the same time, this article points out and proposes suggestions for certain specific issues,

which can provide certain reference value for the future development of universities.

1 INTRODUCTION

With the widespread popularization and rapid

development of education, the number and scale of

universities are constantly expanding. In its

development process, the financial business will also

continue to increase, and relatively speaking,

repetitive work accounts for a large proportion.

Traditional accounting personnel often make

mistakes and have low efficiency when completing

these large amounts of repetitive work. At the same

time, traditional financial management methods also

increase personnel costs, which to some extent hinder

the rapid and efficient development of schools. In the

field of higher education, the digital transformation of

financial management is leading a profound

transformation (Chen, 2024).

Among universities, Tianjin Medical University,

as a national "world-class discipline construction

university" and a key construction university of the

"211 Project", actively explores intelligent

transformation in the field of finance. It is one of the

first many universities to implement RPA in practice

and has had a great impact in the field of financial

management. Therefore, this article will use Tianjin

a

https://orcid.org/0009-0004-8327-3975

Medical University as a representative case for

research.

Tianjin Medical University actively promoted the

automation of financial robot processes in March

2022. By identifying and sorting out RPA as a

substitute for manual workflows, standardizing the

setting of subject attributes and project types, and

developing application scenario programs, the

university began to officially apply financial robot

RPA in May of the same year, with good results. Six

application scenarios, including self-service printing

of labor appointment documents on web pages,

integrated budget management system for financial

fund payment, bank reconciliation, project

reconciliation, sorting of scientific research

completion templates, and sorting of accounts

receivable and payable, have achieved the automation

of financial robots replacing manual processes. This

provides stable and efficient financial service

guarantees for improving work efficiency,

standardizing work standards, improving the

construction of intelligent financial systems,

deepening the digital transformation of intelligent

financial systems, and promoting the development of

the Double First Class cause.

226

Wang, X.

Research on the Application Practice of Financial Robots Based on RPA Technology in Tianjin Medical University.

DOI: 10.5220/0013842000004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 226-233

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

This article is based on the traditional financial

field of Tianjin Medical University, where the

efficiency and accuracy of personnel work are not

high, and information transmission is not timely. RPA

technology is used to implement a budget

management integrated system for financial fund

payment in financial management; Self printing of

labor appointment documents in OA office system;

Bank self-reconciliation and project self-

reconciliation; Fill in the scientific research

completion template; The practice of sorting out

accounts receivable and payable has provided

optimization solutions for the financial management

mode of universities. On this basis, the problems and

shortcomings arising from the practical process were

explored and targeted solutions were provided,

providing ideas and directions for the future practical

exploration of RPA technology in universities.

2 OVERVIEW AND

ADVANTAGES OF RPA

FINANCIAL ROBOT THEORY

RPA technology is an emerging digital intelligent tool

that simulates human thinking and behavior patterns,

simulates human operations on computers,

automatically executes rule-based repetitive tasks,

and achieves automated processing of business

processes. As shown in Figure 1, this technology has

the characteristics of high efficiency, clear rules, and

completing repetitive work. In China, rapid advances

in information technology and investment in the field

of artificial intelligence have made the role of RPA

increasingly important, and various organizations

have begun to use RPA to improve efficiency and

decision-making levels (Wang, 2024).

Figure 1: Introduction to the basic characteristics of

financial robots.

The application of RPA financial robot

technology in universities is mainly reflected in the

following advantages (Hu and Gao, 2024): Firstly, it

can improve the efficiency and accuracy of financial

data processing; RPA financial robots can work

continuously for 24 hours a day, greatly saving time

and labor costs. At the same time, it can also improve

work efficiency to a certain extent, reduce human

errors, and enhance the accuracy of data processing.

Secondly, through this technology, financial

management in universities can break down barriers

to paper-based information transmission; RPA

technology has high flexibility and scalability, and

can quickly adjust according to changes in business

needs, supporting continuous optimization and

innovation of business processes. Finally, RPA

financial robot technology can promote the digital

transformation and upgrading of finance; The

application of RPA financial robots in universities

can promote the digital and intelligent transformation

of financial management and improve financial

processing methods (Zhao, 2024).

3 THE CURRENT SITUATION

AND PROBLEMS OF

FINANCIAL MANAGEMENT

AT TIANJIN MEDICAL

UNIVERSITY

3.1 University Background

Tianjin Medical University, formerly known as

Tianjin Medical College, was established in 1951 as

a higher medical institution approved by the former

State Council after the founding of the People's

Republic of China. Professor Zhu Xianyi, a renowned

endocrinologist and medical educator, was appointed

as the first president. In June 1994, Tianjin Medical

College and Tianjin Second Medical College were

officially established to form Tianjin Medical

University. In December 1996, it became the only

national "211 Project" key construction municipal

university in Tianjin. In October 2015, it became a

jointly built university by the Tianjin Municipal

People's Government, the National Health

Commission, and the Ministry of Education. In

September 2017, it was selected as a national "world-

class discipline" construction university. In February

2022, it became the second round of "Double First

Class" construction universities.

3.2 The Specific Situation and Existing

Problems of Traditional Financial

Management

3.2.1 Specific Situation

Basic information of financial personnel: There are a

total of 20 people in the finance department. In terms

Research on the Application Practice of Financial Robots Based on RPA Technology in Tianjin Medical University

227

of personnel structure: two directors; There are seven

personnel in the accounting department, one for

project and report management, one for review, one

for cashier, and four for document preparation; There

are eleven people in the management department,

including salary management, asset management,

party and union management, internal control and

budget management, scientific research fund

management, fee management, etc. The matching

degree between the number of financial personnel and

the increasing demand for financial management is

gradually decreasing. In 2021 and 2022, the per capita

number of document making exceeded 500 per

month, and even reached a peak of 1100 per month,

which brought great pressure to accounting personnel

(Chen, 2024).

3.2.2 Eproblems

The traditional financial management model still has

significant deficiencies in the financial field of

Tianjin Medical University (Hu and Gao, 2024). This

is mainly reflected in the following three aspects:

Firstly, there are many financial and non-financial

projects in universities, and the work efficiency of

relying solely on manual mode is low. A series of

repetitive tasks consume a lot of manpower and

financial resources; Secondly, accuracy is difficult to

guarantee. Traditional financial management work is

complex and labor-intensive, and accounting

personnel are prone to errors in the face of a large

workload; Thirdly, the cost is relatively high, and

financial work requires a significant investment of

manpower to complete; The fourth issue is that

information transmission is not timely, and the

processing and feedback speed of financial

information is slow, which affects the decision-

making efficiency of the school (Yang and Chen,

2024).

4 APPLICATION PRACTICE AND

EFFECT OF RPA FINANCIAL

ROBOT IN TIANJIN MEDICAL

UNIVERSITY

4.1 Application Practice

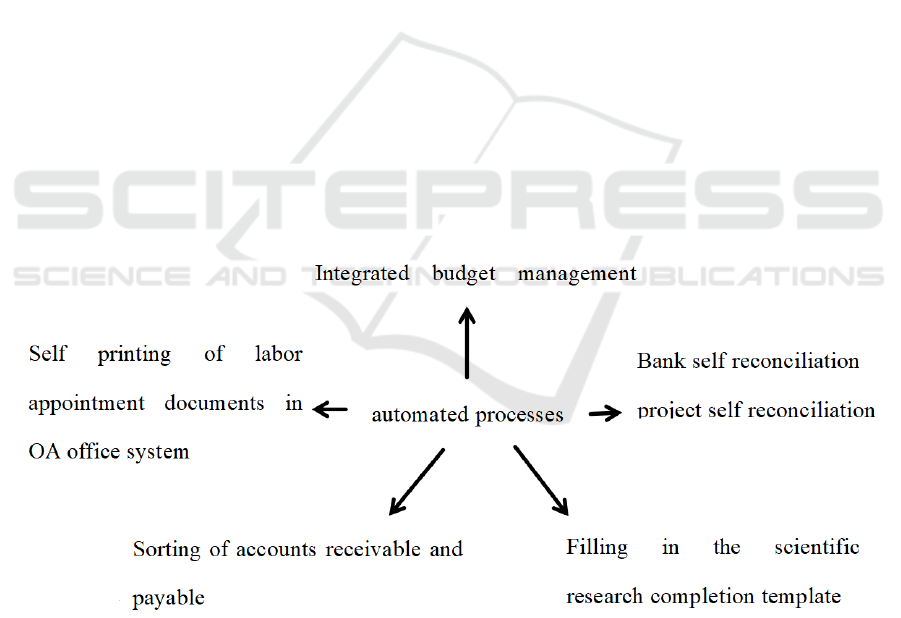

As shown in Figure 2, the application practice of RPA

financial robots in Tianjin Medical University mainly

includes: budget management integrated system for

financial fund payment; Self printing of labor

appointment documents in OA office system; Bank

self-reconciliation and project self-reconciliation; Fill

in the scientific research completion template;

Sorting of accounts receivable and payable (Tianjin

Accounting Society, 2024).

Figure 2: Overall plan and implementation of RPA financial robot at Tianjin Medical University.

4.1.1 Integrated Budget Management

System for Financial Fund Payment

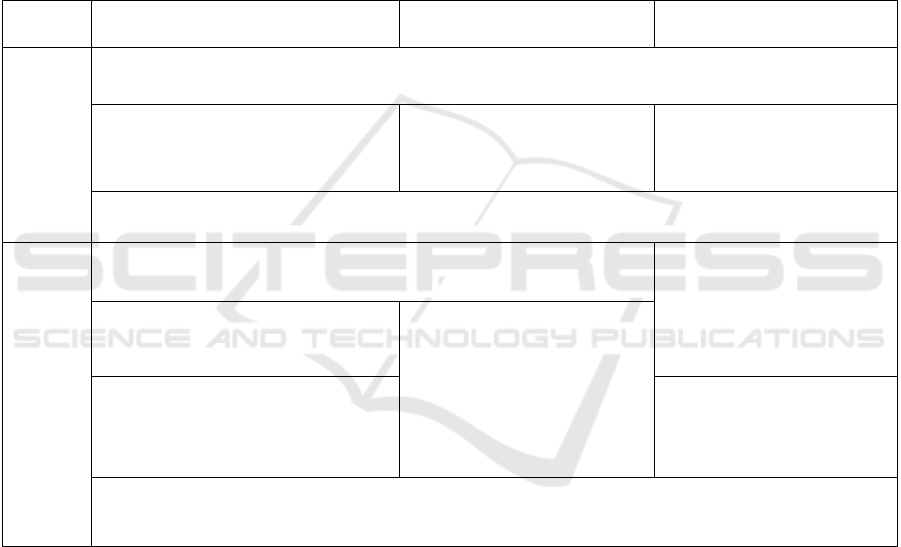

According to Table 1, under the traditional financial

model, the budget integration system of Tianjin

Medical University can be divided into two methods

for financial fund payment: Method 1 requires

cashiers to select corresponding payment indicators

and fully grasp the project types and fund types of

university, resulting in significant payment pressure.

Method 2: Although the voucher maker replaces the

cashier in selecting the corresponding payment

ICEML 2025 - International Conference on E-commerce and Modern Logistics

228

indicators, due to the large number and lack of

regularity in the coding of financial budget project

codes, the pressure is transferred to the voucher

maker, and the overall pressure and workload have

not decreased.

After applying the financial robot, the document

maker does not need to enter the financial budget

project code. After completing the document

creation, the payment information is exported from

the financial system, named as a file, and placed in a

designated folder. Click the financial robot run

button, and the financial robot will automatically

match the corresponding payment indicators based on

the project information and the pre-matching

comparison table, and automatically generate a

payment information template table. Rename it

according to the established rules and place it in the

designated folder. The cashier only needs to import

the payment information template table into the

budget management integrated system with one click.

The subsequent review and final review processes are

consistent with the above methods. Financial robots

replace financial personnel in selecting payment

indicators and entering unit payment information,

alleviating payment pressure for financial personnel.

Table 1: The budget Integration system and financial fund payment process of Tianjin Medical University under traditional

financial model.

Method 1 Method 2 Method 3

Financial

staff

Review financial documents

Financial voucher preparation (without

entering financial budget item code)

Financial voucher preparation

(enter financial budget item

code)

Financial voucher preparation

(without entering financial

budget item code)

Review financial documents

Cashier

Verify bank payment information

Financial robots organize

financial templates

Choose integrated system payment

indicators

After confirming the operation

of the bank school

interconnection system, push it

to the integrated system

Enter payment information

Import payment template into

integrated system

Subsequent review and payment process

4.1.2 Self Printing of Labor Appointment

Documents in OA Office System

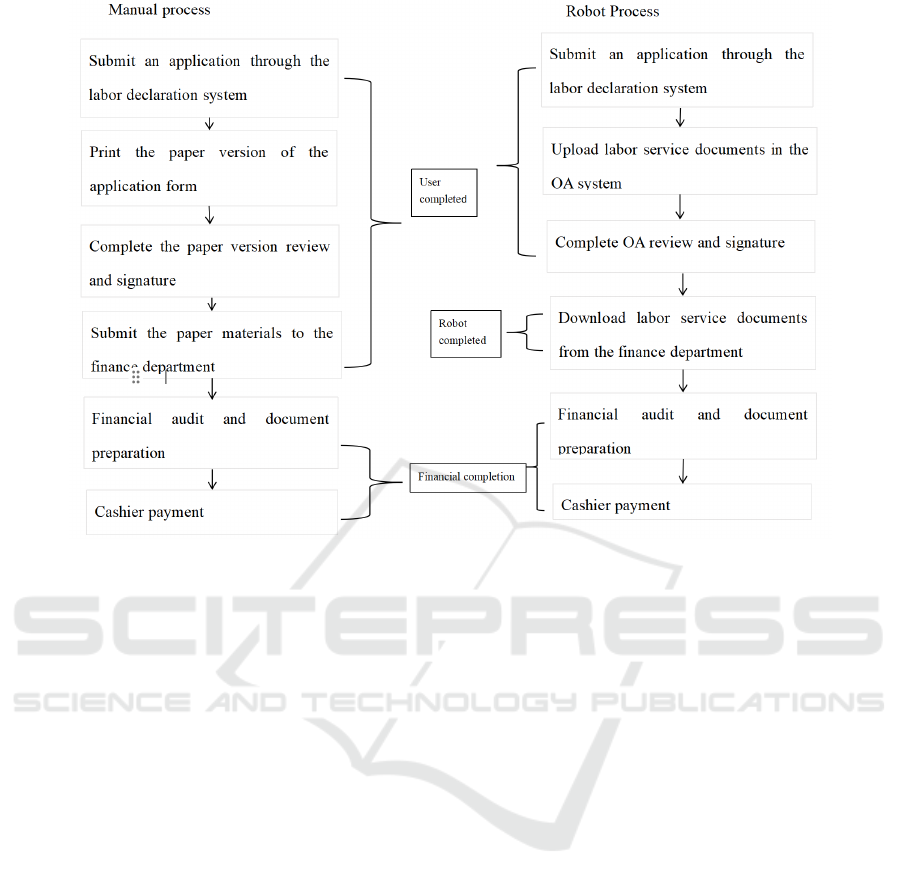

As shown in Figure 3, in both traditional manual

processes and current robot processes, there are three

stages in the labor declaration system: application,

uploading documents, and completing the review and

signing process; Next, the next step in the manual

process is to deliver the paper version of the materials

to the finance department, while the next step in the

robot process requires the finance department to

download the labor documents; The following

process is the same (financial review and voucher

preparation, cashier payment), and it is precisely from

delivery to direct download that the change greatly

improves the efficiency of appointment documents

and saves time.

Research on the Application Practice of Financial Robots Based on RPA Technology in Tianjin Medical University

229

Figure 3: Comparison of manual and robot processes for self-service document printing in OA office systems.

4.1.3 Bank and Project Self Reconciliation

The working principle of bank reconciliation is

simple, but it is time-consuming and laborious. After

applying the financial robot, the financial personnel

put the bank journal and unit journal into the

designated folder, click the financial robot run button,

and after completing the self-service reconciliation,

mark the bank statements that have not been

successfully reconciled, such as bank received but not

received by the unit, unit paid but not paid by the

bank, etc. Record the bank statements that have not

been successfully reconciled in the bank deposit

balance adjustment table, and record the entire bank

reconciliation process in the designated folder for

later query work needs.

Tianjin Medical University has a large amount of

research funds, and the sources of research funds and

types of research projects are complex. On the basis

of bank reconciliation, project funds need to be

checked against project balances, especially for

projects supported by financial funds, which need to

be checked against corresponding indicators in the

budget management integration system to avoid

project mismatches. Manual verification of project

accounts is time-consuming and inefficient. After

applying the financial robot, the financial personnel

will place the project balance table exported from the

accounting system and the financial fund statement

exported from the budget management integration

system into the designated folder, click the financial

robot run button, and according to the corresponding

relationship in the pre-set comparison table, the

financial robot will replace manual self-service to

check whether the project balance is correct and

generate reconciliation results. Financial personnel

only need to check whether there are differences in

the reconciliation results. If there are differences, they

can perform fund detail reconciliation according to

the bank statement reconciliation mode.

4.1.4 Filling in the Scientific Research

Completion Template

Every year, it is necessary to fill out a standardized

scientific research completion form. Financial

personnel need to export the income and expenditure

details of each project from the accounting system

and fill in them one by one according to the prescribed

content of the scientific research completion

template. Batch completion results in a large number

of projects and low work efficiency.

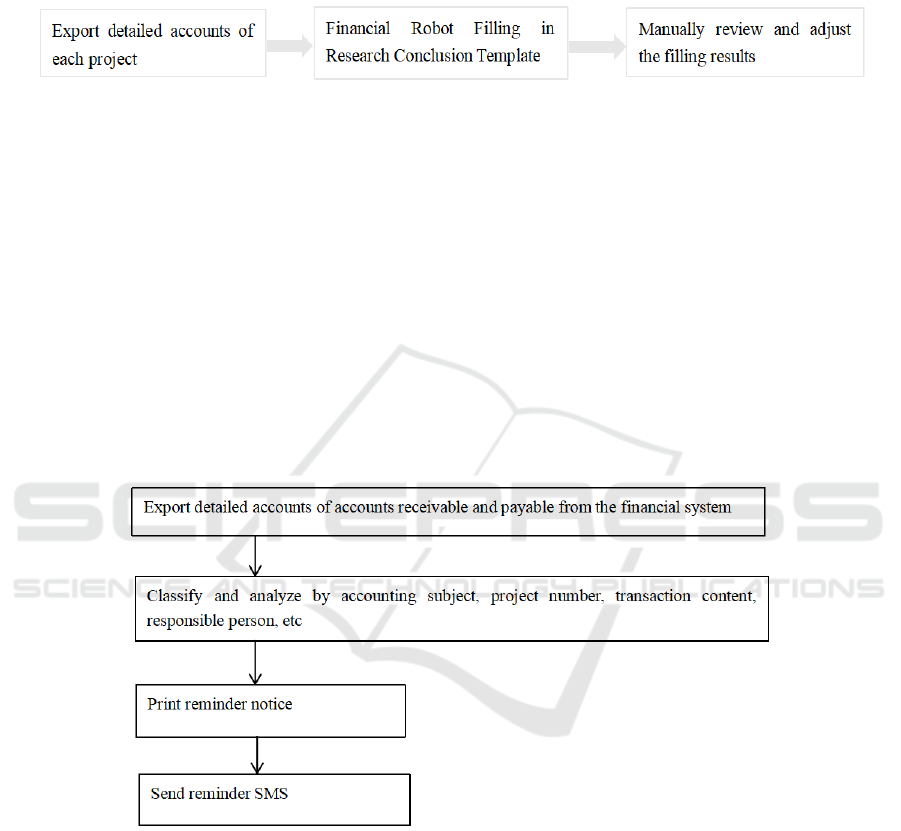

After applying the financial robot, as shown in

Figure 4, financial personnel only need to export the

income and expenditure detailed accounts of each

project from the accounting system, place them in the

ICEML 2025 - International Conference on E-commerce and Modern Logistics

230

designated folder, click the financial robot run button,

and according to the pre-set comparison table and

rules, the financial robot automatically classifies the

content of the income and expenditure detailed

accounts. The classified content is self-filled into the

scientific research conclusion template and renamed,

completely replacing manual filling of the scientific

research conclusion template (Tianjin Accounting

Society, 2024).

Figure 4: Workflow after applying financial robots.

4.1.5 Sorting of Accounts Receivable and

Payable

The process of sorting out accounts receivable and

payable: Financial personnel can query all accounts

receivable and payable through the temporary

payment port of the accounting system, classify and

analyze them according to accounting subjects,

project numbers, account contents, and project

leaders. For temporary payments that are about to

expire or have already expired, they should be

promptly reminded one by one, and payment

reminder notices should be printed. Generally, SMS

or phone communication is used, and the overall

process efficiency is relatively low (see Figure 5).

After the application of RPA financial robots at

Tianjin Medical University, the complexity of the

process for sorting accounts receivable and payable

has been greatly reduced. Just need the financial

personnel to export the incoming and outgoing funds

from the financial system with one click, place them

in the designated folder, click the run button, and the

financial robot will replace the manual analysis

process. According to the pre-set rules, the analysis

results will be filled in the designated list, and the

financial personnel can directly view the analysis

results. After verification, the financial robot will

send information in batches to each project leader.

Figure 5: Workflow for sorting accounts receivable and payable after applying financial robots.

4.2 Application Effect

After the application of RPA financial robot

technology at Tianjin Medical University, work

efficiency has significantly improved: with the help

of RPA financial robots, a large amount of tedious

manual operations by financial personnel have been

replaced, greatly improving the speed of business

processing in universities, alleviating the work

pressure of financial personnel, and enabling

financial personnel responsible for completing these

computationally repetitive tasks to engage in other

creative work, thereby effectively improving work

results (Xing and Ma, 2024);

At the same time, the accuracy of financial work

in universities has been greatly improved: through the

participation of RPA financial robots in university

financial management, many cases of careless or

erroneous data filling by financial personnel in the

past no longer exist. The digital financial

management model enables it to calculate data

according to fixed calculation methods and formats,

Research on the Application Practice of Financial Robots Based on RPA Technology in Tianjin Medical University

231

thereby significantly improving the accuracy of these

tasks;

In addition, the focus of financial work in

universities has shifted: as RPA financial robots can

complete most of the work in the finance department,

the focus of financial personnel's work will shift from

financial accounting to research work in financial

management. This transformation will provide data

support and formal judgment for the decision-making

of school management, helping to reduce the losses

caused by adopting different strategies and minimize

the possibility of risks;

Finally, this measure enhances the work value of

financial personnel in universities: freeing a large

number of financial personnel from tedious and

complex work, allowing them to devote more energy

to more valuable tasks such as financial management,

and improving the work value and career

development space of financial personnel (Gao and

Hu, 2024).

5 PROBLEMS AND

SUGGESTIONS IN THE

APPLICATION PROCESS OF

RPA FINANCIAL ROBOTS

5.1 Existing Issues

The first issue that needs to be faced is technical

problems. While technology keeps pace with the

times, there may still be some technical errors in the

financial field. In the financial work of universities,

RPA robots may also encounter system failures or

data input errors, which can have a negative impact

on the normal operation of the financial system

(Zhang and Liu, 2025).

Secondly, there are adaptation issues for

university financial personnel after changes in

business processes. With the continuous updating and

development of university financial management

models, there will be some changes and adjustments

in the workflow of RPA financial robots. If the RPA

financial robot does not adjust or update the

corresponding steps in a timely manner, it may not be

able to adapt to new work requirements (Yu, 2024).

Then, security issues need to be taken extremely

seriously: RPA financial robots pose a risk of data

leakage during application, and there is a large

amount of sensitive data in university financial data.

Once the system is hacked or poisoned, its private

data may be stolen or maliciously tampered with. At

the same time, if there are system equipment failures

that are not promptly addressed during information

storage, it can lead to data loss (Yu, 2024).

Finally, there is the issue of acceptance: some

financial personnel may have concerns about the

development and application of RPA technology

leading to their own unemployment, which may cause

a certain resistance to RPA financial robots and have

a negative impact on their work attitude and

promotion (Zhang, 2025).

5.2 Suggestion

Firstly, in terms of technology; Universities can

increase investment in technology to reduce the

frequency of erroneous programs and accelerate

updates, making it easy to implement various forms

of financial processing using RPA financial robots (Li

et al., 2024).

Secondly, in terms of personnel; Although RPA

financial robot technology brings great convenience

to financial personnel, universities also need to

advocate for deep attention to the operation of

financial robots, as well as pay attention to changes in

various financial indicators and the handling of

special businesses, in order to prevent the inability to

handle emergencies in a timely and effective manner;

Moreover, through the collaborative operation of

manual operation and RPA technology, the

acceptance of intelligent financial robots by financial

personnel can be effectively improved, enabling

interaction and cooperation between humans and

intelligent technology, and harmonious coexistence

(Gao and Hu, 2024).

Thirdly, in terms of safety management; For

confidential data and programs that have not been

automated by financial robots, their application may

lead to internal code and financial data leakage, with

high financial risks. Universities should spend

additional manpower, material resources, and

financial resources to solve the problem of financial

data leakage and maintain financial information

security (Zhao, 2024).

6 CONCLUSIONS

The high efficiency, clear rules, and repetitive work

characteristics of RPA technology have made it

widely used in the financial management model of

Tianjin Medical University. With the rapid

development of digitalization in China, intelligence

and automation are inevitable trends in the future

financial informationization construction. RPA

financial robots are a part of financial

ICEML 2025 - International Conference on E-commerce and Modern Logistics

232

informationization work and an important

development direction. Through the widespread

application of RPA technology, there will be a

qualitative leap in the financial work of universities.

There are still certain shortcomings and

limitations in the research process of this article. This

study conducted a specific analysis of various

financial indicators and operational results of Tianjin

Medical University to infer the implementation of

RPA technology in major universities. However, each

university has its unique financial situation, and

relying solely on Tianjin Medical University as a

representative for analysis does not have certain

persuasiveness and reliability. In the future, the

author can include more universities with different

types of financial situations as research objects in the

research process, and expand on the original research

direction and methods of this article. For example,

survey questionnaires and field research can be used

to further understand the actual financial situation of

universities.

REFERENCES

Chen, B. (2024). Exploration of the Application of RPA

Robots in University Settlement Work. Journal of

Wuhan Vocational and Technical College (06), 106-

110.

Gao, C. Y., & Hu, J. N. (2024). Analysis on Digital

Teaching of Finance and Accounting Majors under the

Background of RPA Promotion. Forum on Research

and Innovation Management, 2(7).

Hu, S. Y., & Gao, C. Y. (2024). Research on the Training

Mode of Accounting Professionals under the

Background of RPA. Evaluation of Educational

Research, 2 (6).

Li, Y., Qiu, J., and Xu, P. (2024). Research and Exploration

of Financial Intelligence in Higher Education: Taking

the Application of Financial RPA Robots as an

Example. Market Outlook, (06),86-88.

Tianjin Accounting Society. (2024). Excellent Case | RPA

Financial Robot Process Automation Application Case

https://mp.weixin.qq.com/s/zTMEEmks8sHy6T8qGlt7

2w.

Wang, Y. Y. (2024). Research on the Application of RPA

Technology in the Paperless Reimbursement System of

University Finance. Business Accounting, (21),106-

109.

Xing, Q., Ma, L. M. (2024). Research on the Application

Scenarios of RPA Financial Robots in University

Financial Work. Administrative assets and finance,

(23):78-80.

Yu, Y. (2024). Research on the Application of Embedded

RPA Technology in University Finance. Journal of

Texas College, 40 (06), 24-27.

Yang, L. F., & Chen, Y. M. (2024). Exploration of

Financial Intelligence and Future Financial

Management Models in Higher Education Institutions:

Based on the Perspective of RPA Technology

Application Cases. Education Finance and Accounting

Research, 35 (02), 71-80.

Zhang, X., & Liu, R. (2025). Application and Impact

Analysis of RPA based Financial Robots in University

Accounting Work. Accounting for Chinese township

enterprises, (03),11-14.

Zhao, H. (2024). Construction of Intelligent Financial

Supervision Mechanism for Colleges and Universities

Based on RPA Technology. Applied Mathematics and

Nonlinear Sciences, 9(1).

Research on the Application Practice of Financial Robots Based on RPA Technology in Tianjin Medical University

233