Impact of Environmental Accounting Information Disclosure on

Corporate Value: Evidence from China's Steel Industry

Yating Xie

a

College of International Education, South China Agricultural University, Guangzhou, China

Keywords: Steel Industry, Environmental Accounting Information Disclosure, Corporate Value.

Abstract: Against the backdrop of high-quality economic development, environmental pollution has gained increasing

attention in recent years. As a foundational industry for national development, the steel sector exerts

substantial impacts on ecological systems. Consequently, environmental accounting information disclosure

(EDI) in heavy-pollution industries-particularly the steel industry-has become a critical focus in

environmental governance research. This study examines listed steel companies in China to empirically

analyze how EDI influences corporate value. The findings reveal a significant positive correlation between

EDI quality and corporate value, indicating that high-quality environmental disclosures enhance firm

valuation. Additionally, control variables such as firm size and profitability exert notable effects on corporate

value. These results provide theoretical foundations and practical guidance for optimizing EDI practices in

the steel industry while offering policy insights for regulatory authorities.

1 INTRODUCTION

With the global advancement of sustainable

development strategies, environmental accounting

disclosure has emerged as a pivotal tool for corporate

social responsibility fulfillment and transparent

governance. By systematically disclosing

environmental resource consumption, pollution

control investments, and risk management data, firms

communicate their ecological stewardship to

investors, regulators, and the public, thereby building

trust and strengthening brand reputation. In high-

pollution industries, environmental disclosure not

only responds to regulatory mandates but also serves

as a critical bridge connecting economic performance

with environmental outcomes. While international

frameworks increasingly integrate environmental

disclosures into corporate valuation systems, the

precise mechanisms through which such disclosures

affect firm value remain debated.

China's steel industry, characterized by energy-

intensive operations and substantial emissions, offers

a unique context for investigating these dynamics. As

a pillar of the national economy, the sector faces dual

pressures: transitioning toward green production

a

https://orcid.org/0009-0000-9702-4268

while meeting stringent carbon trading policies and

ultra-low emission standards. This dual

"environmental sensitivity" and "policy dependency"

create complex strategic considerations for steel

firms. Disclosures may enhance competitive

advantages by showcasing eco-innovation yet

simultaneously trigger market concerns about short-

term profitability due to revealed compliance costs.

Theoretically, this study addresses gaps in

environmental accounting literature, particularly the

lack of consensus on EDI-value relationships in

heavy industries. By analyzing the steel sector's

supply chain structure and internalized environmental

cost mechanisms, the mechanism through which

environmental performance translates into financial

value in high-pollution environments is

systematically elucidated. Practically, the findings

hold multidimensional implications: Firms may

optimize disclosure strategies to balance

environmental accountability with economic gains;

policymakers could refine industry-specific

standards; investors might enhance ESG valuation

models to identify value signals and risks.

Xie, Y.

Impact of Environmental Accounting Information Disclosure on Corporate Value: Evidence from China’s Steel Industry.

DOI: 10.5220/0013834900004719

Paper published under CC license (CC BY-NC-ND 4.0)

In Proceedings of the 2nd International Conference on E-commerce and Modern Logistics (ICEML 2025), pages 119-123

ISBN: 978-989-758-775-7

Proceedings Copyright © 2025 by SCITEPRESS – Science and Technology Publications, Lda.

119

2 LITERATURE REVIEW

Environmental accounting disclosure and corporate

value constitute key variables in sustainable

development research for pollution-intensive

industries. EDI enables firms to demonstrate

environmental responsibility and operational

transparency through financial reports or standalone

sustainability statements. According to information

asymmetry theory, EDI reduces informational gaps

between firms and investors, fostering trust and

thereby influencing market valuation (Liu and Guo,

2025). Additionally, EDI may indirectly affect

corporate value by lowering financing costs and

improving social reputation (Kan and Li, 2025).

Corporate value — measured via return on assets

(ROA) or Tobin's Q—reflects both internal operational

efficiency and external factors like regulatory

environments. In the context of growing

environmental consciousness, firms' ecological

performance increasingly shapes their valuation (Liu

and Wang, 2025; Dong, 2025).

Existing studies present conflicting conclusions

regarding EDI-corporate value relationships. Most

scholars posit that enhanced transparency through

EDI reduces information asymmetry, bolsters

investor confidence, and elevates firm value. For

instance, Liu et al. (2025) demonstrated that ESG

transparency improves stock price convergence

through market efficiency optimization. Li and Wu

(2022) identified positive EDI-value correlations in

chemical industry studies. Similarly, Xie et al. (2022)

verified significant positive relationships between

environmental disclosures and financial performance

in the same sector.

However, minority perspectives suggest potential

negative effects. Qiu and Liu (2020) found that

financial robustness and risk controls positively

influence environmental transparency, whereas

profitability exerts inhibitory effects, necessitating

multidimensional regulatory frameworks. Low-

quality disclosures may exacerbate financing

constraints and governance inefficiencies,

particularly in firms with poor transparency (Fang

and Hu, 2023).

3 RESEARCH HYPOTHESES

Extant literature predominantly suggests that high-

quality EDI generates value-enhancing effects by

improving corporate image, reducing investor risk

perceptions, and lowering capital costs (Xiong,

2024). Nevertheless, complexities persist: Disclosure

costs may outweigh benefits, and market

responsiveness varies across industries.

For steel companies — a quintessential high-

pollution sector — stakeholders exhibit heightened

sensitivity to environmental accountability. High-

quality EDI enables firms to demonstrate pollution

control technologies and operational risks, potentially

outweighing cost concerns through enhanced investor

confidence and policy alignment.

Thus, research hypothesis 1 is proposed:

H1: Environmental accounting disclosure quality

positively correlates with corporate value among

listed steel firms.

4 RESEARCH DESIGN

4.1 Data Collection

This study analyzes Chinese steel industry listed

companies from 2018 to 2022. Data were sourced

from the CSMAR database and corporate

sustainability reports. To ensure reliability, ST/*ST

firms and entities with incomplete ESG ratings were

excluded.

4.2 Model Specification

A multivariate linear regression model tests the

hypothesis (variable definitions in Table 1).

𝑅𝑂𝐴 = 𝛽0 + 𝛽1𝐸𝐷𝐼 + 𝛽2𝑆𝑖𝑧𝑒

+ 𝛽3𝑅𝑂𝐸 + 𝛽4𝐿𝑒𝑣

+𝛽5𝐺𝑟𝑜𝑤𝑡ℎ + 𝛽6𝑃/𝐸

+𝜀

(1)

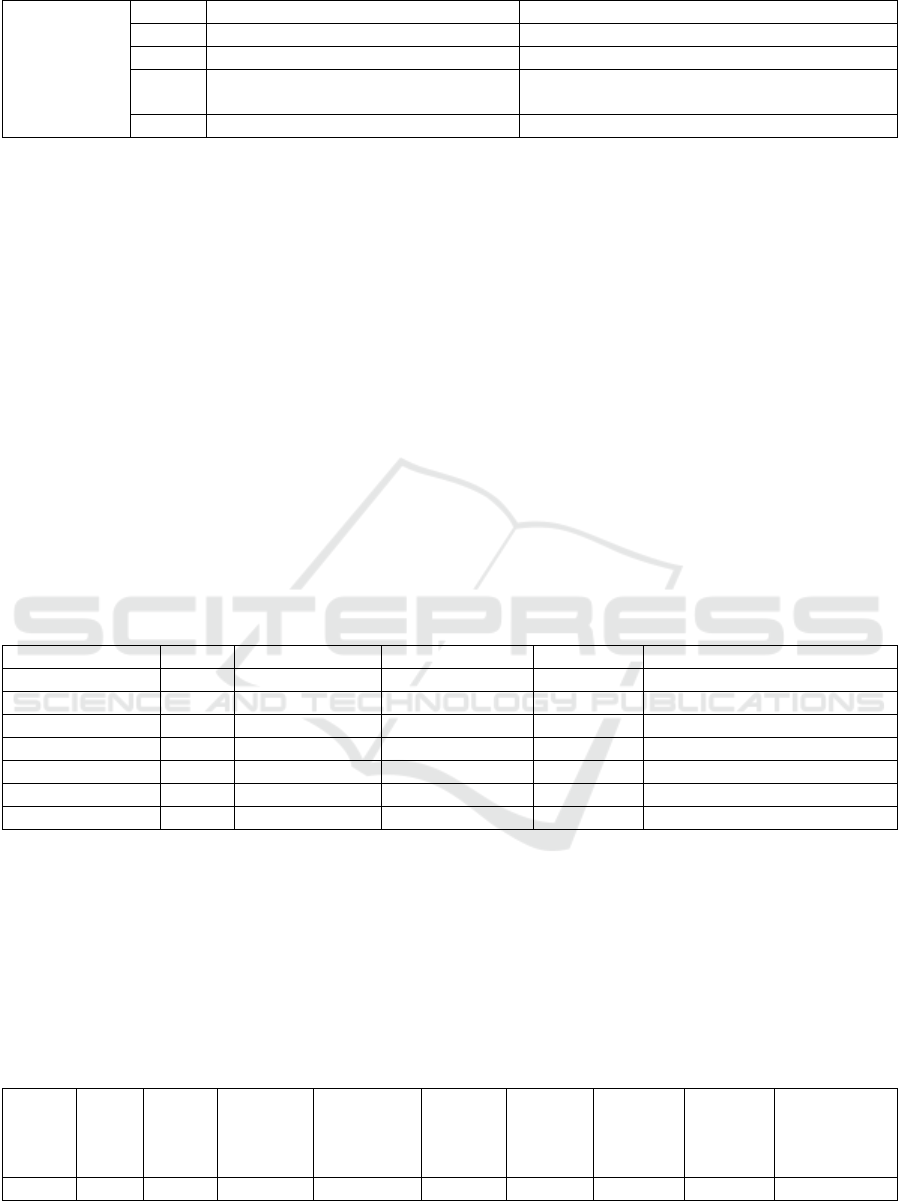

Table 1: Variable definitions

Variable

T

y

pe

Symb

ol

Variable Name Definition

Dependent

Variable

ROA Corporate Value

N

et profit divided by total assets

Independent

Variable

EDI Environmental Accounting

Information Disclosure Quality

Scores derived from the most widely use

d

environmental disclosure scoring

framework assessing content in annual

reports of listed companies

ICEML 2025 - International Conference on E-commerce and Modern Logistics

120

Control

Variables

SIZE Firm Size

N

atural lo

g

arithm of total assets

ROE Profitability Return on equity

LEV Levera

g

e Ratio Total liabilities divided b

y

total assets

GRO

WTH

Revenue Growth Rate (Current quarter revenue – Prior quarter

revenue) / Prior quarter revenue

P/E Price-to-Earnin

g

s Ratio Share price divided b

y

earnin

g

s per share

5 EMPIRICAL RESULTS AND

ANALYSIS

5.1 Descriptive Statistics

The descriptive statistics of research variables reveal

fundamental characteristics of the sample firms. The

Environmental Disclosure Index (EDI) exhibits a

mean value of 27.59 (SD = 15.05), with extreme

values ranging from 2.57 to 86.00. This indicates

pronounced heterogeneity in environmental

information disclosure quality among steel industry-

listed companies and suggests an overall suboptimal

disclosure level. Regarding financial performance

metrics, Return on Assets (ROA) shows a mean of

0.14 (SD = 0.13), with maximum and minimum

values of 0.66 and -0.21, respectively. These results

reflect significant divergence in profitability across

sample firms, likely attributable to cyclical industry

fluctuations and capacity restructuring.

Firm size (SIZE), measured as the natural

logarithm of total assets, has a mean of 24.03 (SD =

1.17). The sample spans companies with total asset

values between 21.29 and 26.71 in logarithmic terms,

encompassing medium-to-large steel enterprises and

demonstrating strong data representativeness. Among

control variables, the average debt-to-asset ratio

(LEV) of 0.520 (SD = 0.168) confirms the prevalence

of high leverage under the capital-intensive

operational model of the steel industry. Notably, the

Price-to-Earnings ratio (P/E) displays substantial

variation (-8.35 to 170.61), implying structural

discrepancies in capital market valuations of the

sector (See Table 2).

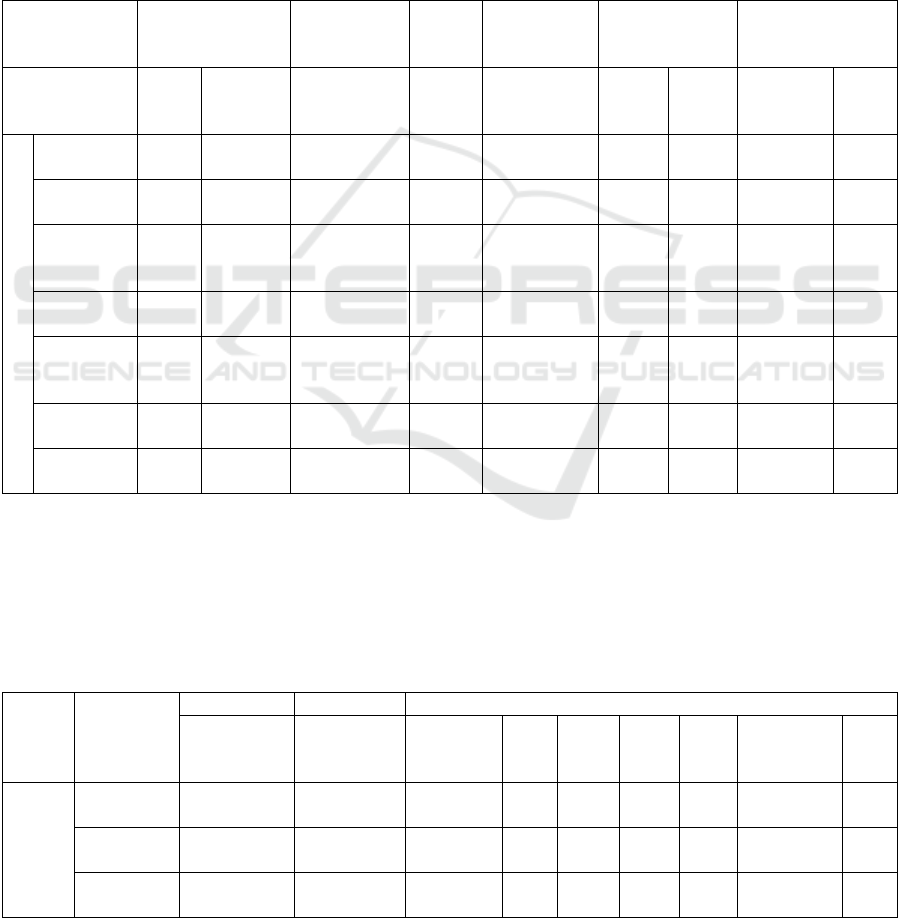

Table 2: Descriptive statistics

N

Minimu

m

Maximu

m

Mean Standard Deviation

EDI 195 2.573 86.001 27.590 15.055

ROA 195 -0.216 0.665 0.141 0.133

SIZE 195 21.292 26.710 24.031 1.165

ROE 195 -0.381 0.723 0.112 0.123

LEV 195 0.091 0.899 0.520 0.168

GROWTH 195 -0.523 0.710 0.132 0.219

P/E 195 -8.347 170.612 17.243 21.269

5.2 Regression Analysis

This study employs a multivariate linear regression

model to examine the impact of environmental

accounting information disclosure (EDI) on corporate

value (ROA). The model summary indicates strong

explanatory power, with an adjusted R² of 0.867,

suggesting that 86.7% of the variance in ROA is

accounted for by the independent variables. The F-

statistic of 211.687 (p < 0.001) confirms the model’

s overall statistical significance at the 1% level (See

Table 3).

Table 3. Statistics of the regression model

Model R R-

square

Adjusted

R-square

Error in

standard

estimation

R-

squared

change

F-

change

Degree

of

freedom

1

Degree

of

freedom

2

Significance

F-change

1 0.933 0.871 0.867 0.486 0.871 211.687 6 188 <0.001

Impact of Environmental Accounting Information Disclosure on Corporate Value: Evidence from China’s Steel Industry

121

Standardized regression coefficients (Beta

values) demonstrate that EDI exerts a significantly

positive influence on ROA (β = 0.127, t = 3.905, p <

0.001). Specifically, a one-unit increase in EDI

corresponds to an average ROA increase of 0.001

units, robustly validating Hypothesis H1 that

environmental disclosure quality positively correlates

with corporate value in the steel industry. These

findings align with information asymmetry theory

and signaling mechanisms, where high-quality

environmental disclosures reduce investor risk

perceptions, enhance market trust, and ultimately

translate into corporate value premiums.

Among control variables, profitability (ROE)

emerges as the dominant driver of ROA (β = 0.753, t

= 23.988, p < 0.001), whereas financial leverage

(LEV) exhibits a suppressive effect (β = -0.278, t = -

8.872, p < 0.001), consistent with the financial risk

transmission mechanism in capital structure theory.

Firm size (SIZE), growth (GROWTH), and P/E ratio

fail to show statistical significance (p > 0.05),

potentially due to scale economy dilution from heavy-

asset industry attributes and limited explanatory

power of valuation metrics amid cyclical volatility

(See Table 4).

Table 4: Coefficient of the regression model

Unstandardized

coefficient

Standardize

d

coefficien

t

99.0%

confidence

interval for B

Cointegration

statistic

Model B Standa

r

d error

Beta

t

Significanc

e

Lowe

r

limit

Uppe

r

limit

Toleranc

e

VIF

1 (constant) 0.20

8

0.077 2.706 0.007 0.008 0.408

EDI 0.00

1

0.000 0.127 3.905 <0.001 0.000 0.002 0.652 1.53

3

SIZE -

0.00

3

0.003 -0.025 -

0.848

0.398 -

0.012

0.006 0.788 1.26

9

ROE 0.81

7

0.034 0.753 23.98

8

<0.001 0.729 0.906 0.696 1.43

6

LEV -

0.22

1

0.025 -0.278 -

8.872

<0.001 -

0.286

-

0.156

0.699 1.43

0

GROWT

H

0.00

4

0.018 0.006 0.202 0.840 -

0.043

0.051 0.776 1.28

9

P/E 0.00

0

0.000 -0.062 -

2.209

0.028 -

0.001

0.000 0.863 1.15

8

Collinearity diagnostics reveal tolerance values

between 0.652 and 0.863, with variance inflation

factors (VIFs) all below 2.0 (maximum = 1.533), well

under the critical threshold of 10. This confirms the

absence of severe multicollinearity. While the

maximum condition index (71.608) indicates minor

intercept-related anomalies in variance proportions,

no structural interference is observed in core

explanatory variables (EDI, ROE), ensuring model

stability (See Table 5).

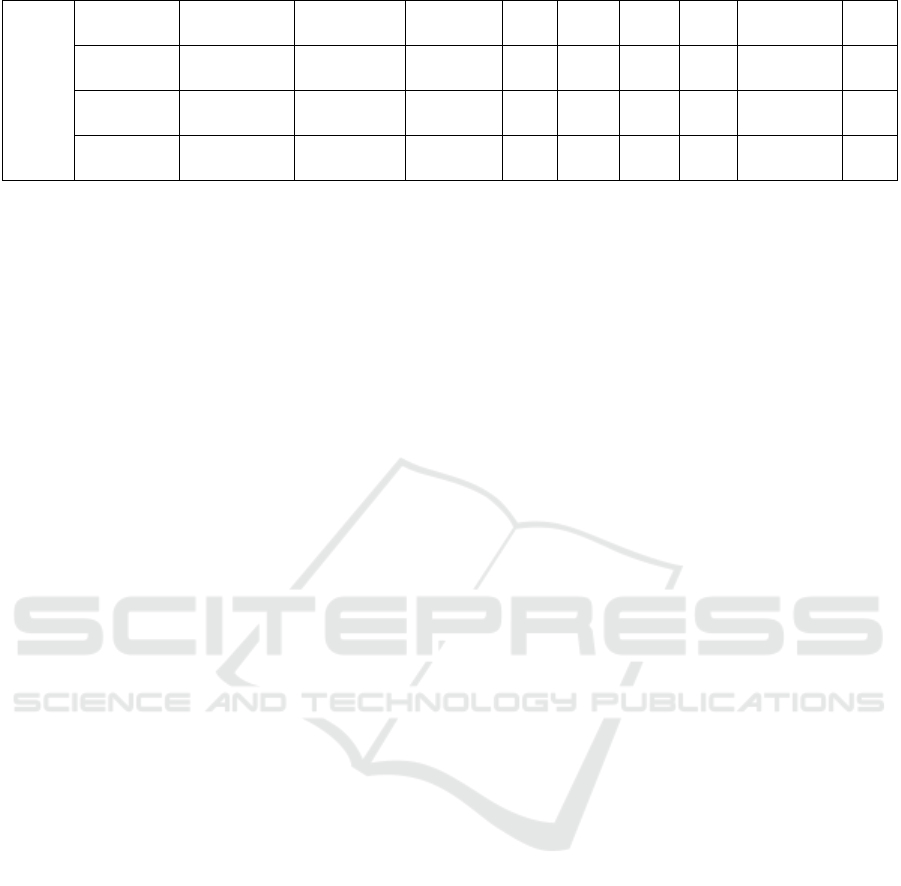

Table 5: Test of the VIF

Mode

l

Dimensio

n

Proportion of variance

Eigenvalue

s

Conditiona

l

Indicators

(

Constant

s)

ED

I

SIZ

E

RO

E

LE

V

GROWT

H

P/E

1 1 5.029 1.000 0.00 0.0

0

0.00 0.01 0.00 0.01 0.0

1

2 0.974 2.273 0.00 0.0

0

0.00 0.06 0.00 0.21 0.2

1

3 0.451 3.339 0.00 0.0

2

0.00 0.01 0.01 0.54 0.4

7

ICEML 2025 - International Conference on E-commerce and Modern Logistics

122

4 0.344 3.821 0.00 0.0

0

0.00 0.64 0.02 0.22 0.1

6

5 0.163 5.547 0.00 0.6

1

0.00 0.27 0.08 0.00 0.0

2

6 0.038 11.577 0.01 0.3

6

0.01 0.00 0.75 0.02 0.1

3

7 0.001 71.608 0.98 0.0

0

0.99 0.00 0.13 0.00 0.0

1

6 CONCLUSIONS

This study empirically validates a significant positive

correlation between environmental accounting

information disclosure (EDI) quality and corporate

value among Chinese steel industry listed companies.

The findings further reveal that firm size and

profitability exert positive moderating effects, with

larger and more profitable enterprises demonstrating

stronger marginal benefits from enhanced EDI

practices. These results underscore that in the context

of the steel industry's green transition, environmental

disclosure functions not merely as a vehicle for social

responsibility fulfillment but also as a strategic

instrument for value creation. By systematically

disclosing pollution control technologies and circular

economy achievements, firms can mitigate

stakeholders' environmental risk perceptions while

cultivating differentiated competitive advantages,

thereby aligning with policy incentives and capital

market expectations.

Notably, this research identifies two critical

limitations. First, the single-industry focus restricts

the generalizability of conclusions, necessitating

cross-validation through comparative studies across

other high-pollution sectors such as chemicals and

power generation. Second, the EDI evaluation

framework predominantly relies on annual report

content analysis, which may insufficiently capture

quantitative environmental performance. Future

investigations should prioritize the development of

multidimensional metrics integrating verified

emission data, third-party audits, and lifecycle

assessments to establish more robust disclosure

benchmarks.

Theoretical extensions could explore nonlinear

relationships between EDI and corporate value under

varying regulatory intensities, while practical

applications should focus on designing industry-

specific disclosure guidelines and dynamic incentive

mechanisms. Such advancements would strengthen

the nexus between environmental governance and

financial performance, ultimately supporting

sustainable industrial transformation.

REFERENCES

Dong, X. 2025. ESG disclosure and corporate investment

efficiency. Management and Administration, 1–19.

Fang, X. M., & Hu, D. 2023. Corporate ESG performance

and innovation: Evidence from Chinese A-share listed

firms. Economic Research Journal, 58(2), 91–106.

Kan, L. N., & Li, Q. 2025. Environmental disclosure and

corporate financial risk: A dual perspective of internal

control and external supervision. Friends of

Accounting, 1–8.

Li, Z. Y., & Wu, Y. H. 2022. Environmental accounting

disclosure and corporate value: Evidence from listed

chemical companies. Northern Economy and Trade,

2022(10), 65–68.

Liu, C. L., & Guo, C. X. 2025. ESG performance, audit

quality, and corporate inefficient investment. Journal of

Hefei University of Technology (Social Sciences

Edition), 1–15.

Liu, X. H., Wang, J. J., & Su, M. M. 2025. The impact of

corporate ESG disclosure on stock price synchronicity.

Journal of Shandong University of Finance and

Economics, 2025(2), 71–83.

Liu, Z. Y., & Wang, X. Z. 2025. Green credit policy and

financing constraints of heavy-polluting firms:

Evidence from environmental disclosure practices.

Enterprise Economy, 2025(3), 27–37.

Qiu, Y. P., & Liu, M. J. 2020. Determinants of

environmental disclosure in listed companies: Evidence

from the new energy sector. Green Finance and

Accounting, 2020(10), 45–51.

Xie, Y. Z., Tang, X. Y., & Wu, J. L. 2022. Environmental

disclosure and financial performance: Empirical

analysis of chemical industry-listed firms in China.

Journal of Hunan Agricultural University (Social

Sciences Edition), 23(4), 115–124.

Xiong, Z. X. 2024. The effect of corporate ESG

performance on debt financing costs (Doctoral

dissertation). Qilu University of Technology.

Impact of Environmental Accounting Information Disclosure on Corporate Value: Evidence from China’s Steel Industry

123